Professional Documents

Culture Documents

Japan Follow Up Institutional Exposures 2013 05

Uploaded by

kcousinsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Japan Follow Up Institutional Exposures 2013 05

Uploaded by

kcousinsCopyright:

Available Formats

Japan follow up Institutional Exposures

Unsubstantiated claims

Macro Economic Research May 2013

In my recent article Japan the end of the beginning I said most of the foreign security holdings via insurance companies and pension funds are currency hedged back into the Yen and this needs to be taken into account when evaluating exposure to a weaker Yen and higher inflation. The following table showed a drilled down exposure of Japanese Household Financial Assets as at December 2012 (BoJ data):

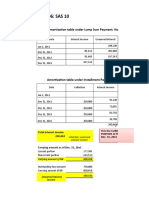

%age of Total Financial Assets Equities Investment Trusts Insurance Pension Funds Bonds/loans Cash on deposit Other Total

Japan Total 6.8 4.0 21.1 6.6 2.1 55.2 4.2 100.0

Bonds

Cash

Equities

Off shore Sec

Infn Proof Total 6.8

USA

Equities

6.8 0.8 15.3 2.2 2.1 55.2 0.2 0.3 0.6 1.3 0.7 2.3 3.1 1.6

32.8 11.8 10.8 17.3 9.5 14.6 3.2

32.8 5.5 2.9 8.5

2.9 4.4 2.3

20.4

55.7

9.4

7.0

16.4

100.0

49.7

With only 16.4% of assets invested in equities or off shore securities, I concluded that Japanese households are overwhelmingly positioned for the deflationary environment to continue. Should the BoJs target of 2% inflation within 2 years start gaining credibility, they would be very inappropriately positioned. When you consider that purchasing additional equities and offshore securities would not only lower risks of real capital loss, but also enhance yield, I expect reallocation within the $15trillion of Japanese household financial assets to be a major driver of Japanese equities and to have a significant impact on the Yen. Currency hedging in Japanese Life Insurance portfolios However an article carried by Reuters (As Japan insurers flirt with foreign bonds, yields may move more than yen 25Apr13) gives some fascinating insights as to the extent of currency hedging in institutional portfolios. This is important as in the table above I assume that foreign security holdings would provide capital protection in a weak Yen/higher inflation scenario. It appears that for the vast majority of these holdings, that is not the case. Nippon Life (the largest private sector life company with Y50tr = $500bn of assets) has Y6.64tr in hedged foreign bonds and Y2.11tr in unhedged (March 31 2013), so only 24% of foreign bond holdings are

Please refer to the disclaimer at the end

Japan follow up Institutional Exposures

Macro Economic Research May 2013

providing protection against Yen weakness. Another example, Asashi Mutual Life Insurance, the 6th largest, has just moved from fully hedged to 90% hedged as at March 31st. If we assume that foreign security holdings in the Life Assurance portfolios are 80% hedged back into Yen, the 16.4% of Household Assets protected from inflation and Yen weakness drops to under 14%. Similar hedging policies by Pension Fund managers would lower this even further to around 12.5%. The authors of the Reuters article referenced above draw the conclusion that because of the extensive hedging of foreign bond holdings, we should not expect significant Yen selling as demand grows for offshore bond holdings. My take on this is actually the reverse as the Yen weakens there will be increasing pressure to reduce the hedging on both the existing pool of assets and new flows and this could in fact be a larger number than the flow itself. As quoted in the article, Hiroshi Ozeki, GM of Finance and Investment Planning for Nippon Life says: If there is appropriate timing, we would like to boost our allocations to unhedged foreign bonds. Takahiro Ono, Asahi Mtual Life chief portfolio manager concurs: If there are clear prospects for the yen to fall further, we may consider lowering the ratio of hedged foreign bond buying a bit. I believe the past two decades of deflation and the strong Yen have also entrenched corporate attitudes and policies generally. The structure of balance sheets in the corporate sector (many companies carry massive net cash balances) and the foreign exchange hedging policies of exporters and multi-nationals will be slow to reflect the new reality, and the impact of changes here still have to impact the Yen in years to come. Conclusion Given the extent of currency hedges within institutionally managed portfolios, Japanese Household financial assets may be even more exposed to Yen weakness and inflation than I thought, with the hedging reducing inflation-robust assets from 16.4% to as low as 12.5% of total financial assets at December 31 2012. A change in hedging policy by institutional investors as existing hedge losses mount up could result in significant Yen selling.

Kevin Cousins is a portfolio manager at Brait Capital Management Limited. ("BraitCM"). This article is prepared by Kevin as an outside business activity. As such, BraitCM does not review or approve materials presented herein. The opinions and any recommendations expressed in this article are those of the author and do not reflect the opinions or recommendations of BraitCM. None of the information or opinions expressed in this article constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Either BraitCM or Kevin Cousins may hold or control long or short positions in the securities or instruments mentioned.

Please refer to the disclaimer at the end

You might also like

- Japan The End of The Beginning 2013 04Document8 pagesJapan The End of The Beginning 2013 04kcousinsNo ratings yet

- Index Mutual Funds: How to Simplify Your Financial Life and Beat the ProsFrom EverandIndex Mutual Funds: How to Simplify Your Financial Life and Beat the ProsNo ratings yet

- Optimal Fiscal Policy Rule For Achieving Fiscal Sustainability: A Japanese Case StudyDocument19 pagesOptimal Fiscal Policy Rule For Achieving Fiscal Sustainability: A Japanese Case StudyADBI PublicationsNo ratings yet

- Common Sense Retirement Planning: Home, Savings and InvestmentFrom EverandCommon Sense Retirement Planning: Home, Savings and InvestmentNo ratings yet

- Quantitative Monetary Easing and Risk in Financial Asset MarketsDocument55 pagesQuantitative Monetary Easing and Risk in Financial Asset Marketstocaleb4407No ratings yet

- (LGT) 20210316 - DRU - Sector RotationDocument3 pages(LGT) 20210316 - DRU - Sector RotationRuehYinn YapNo ratings yet

- Asia Maxima (Delirium) - 3Q14 20140703Document100 pagesAsia Maxima (Delirium) - 3Q14 20140703Hans WidjajaNo ratings yet

- Global Macro Commentary Jan 13Document2 pagesGlobal Macro Commentary Jan 13dpbasicNo ratings yet

- The Monarch Report 10/28/2013Document4 pagesThe Monarch Report 10/28/2013monarchadvisorygroupNo ratings yet

- GreyOwl Q4 LetterDocument6 pagesGreyOwl Q4 LetterMarko AleksicNo ratings yet

- Econ - An Afternoon With Jim Rogers - 2009!02!04 Maybank-IB ETDocument3 pagesEcon - An Afternoon With Jim Rogers - 2009!02!04 Maybank-IB ETwonderwNo ratings yet

- Global Strategic Outlook: 4th Quarter 2013Document44 pagesGlobal Strategic Outlook: 4th Quarter 2013gasepyNo ratings yet

- Data1203 All PDFDocument288 pagesData1203 All PDFlehoangthuchienNo ratings yet

- Fixed Income Markets Assignment: TanushiDocument5 pagesFixed Income Markets Assignment: TanushiTanushiNo ratings yet

- Asia Economics Comment: Don't Sweat An Early TaperDocument4 pagesAsia Economics Comment: Don't Sweat An Early TaperSwapnilNo ratings yet

- Kushagra Amrit 1882053Document10 pagesKushagra Amrit 1882053Kushagra AmritNo ratings yet

- Japanese Bonds Move 2013 05Document2 pagesJapanese Bonds Move 2013 05kcousinsNo ratings yet

- Fixed Income Markets Assignment: TanushiDocument5 pagesFixed Income Markets Assignment: TanushiTanushiNo ratings yet

- Japanese Currency Selection Funds and The Case For Long Japanese Yen ShortDocument3 pagesJapanese Currency Selection Funds and The Case For Long Japanese Yen ShortThorHollisNo ratings yet

- EdisonInsight February2013Document157 pagesEdisonInsight February2013KB7551No ratings yet

- Manager changes raise concerns for Japan fund investorsDocument12 pagesManager changes raise concerns for Japan fund investorsAbdullatif AlQahtaniNo ratings yet

- Pages pdf1Document4 pagesPages pdf1plato363No ratings yet

- Where Do They Stand?: PerspectiveDocument8 pagesWhere Do They Stand?: Perspectiverajesh palNo ratings yet

- Don T Let InflationDocument2 pagesDon T Let InflationJulio FalconNo ratings yet

- Global Macro Commentary July 14Document2 pagesGlobal Macro Commentary July 14dpbasicNo ratings yet

- Investment: Buffett: Buying Bonds Here Is A MistakeDocument21 pagesInvestment: Buffett: Buying Bonds Here Is A MistakeVivekNo ratings yet

- Global Macro Commentary Dec 4Document3 pagesGlobal Macro Commentary Dec 4dpbasicNo ratings yet

- Functions and Purpose Affecting StockDocument2 pagesFunctions and Purpose Affecting StockThomas KevinNo ratings yet

- To: From: Christopher M. Begg, CFA - CEO, Chief Investment Officer, and Co-Founder Date: April 24, 2012 ReDocument10 pagesTo: From: Christopher M. Begg, CFA - CEO, Chief Investment Officer, and Co-Founder Date: April 24, 2012 RepolandspringsNo ratings yet

- MF0010 - Security Analysis & Portfolio Management (Book ID: B1208)Document16 pagesMF0010 - Security Analysis & Portfolio Management (Book ID: B1208)Sudhi NanjundappaNo ratings yet

- Yen Impact On Corporates 2013 05Document2 pagesYen Impact On Corporates 2013 05kcousinsNo ratings yet

- LAM-Bank of Japan's Monetary Easing Measures Are They Powerful and ComprehensiveDocument19 pagesLAM-Bank of Japan's Monetary Easing Measures Are They Powerful and ComprehensiveLameuneNo ratings yet

- Valuation 1Document30 pagesValuation 1vv5kddfkfcNo ratings yet

- Fixed Income BulletinDocument12 pagesFixed Income BulletinfaiyazadamNo ratings yet

- Monthly Outlook GoldDocument10 pagesMonthly Outlook GoldKapil KhandelwalNo ratings yet

- Report of The Impact of Interest RatesDocument5 pagesReport of The Impact of Interest Ratesfuyuhao629No ratings yet

- Stock Market Crash Survival GuideDocument18 pagesStock Market Crash Survival GuideFlorian MlNo ratings yet

- An Investor's Guide To Inflation-Linked BondsDocument16 pagesAn Investor's Guide To Inflation-Linked BondscoolaclNo ratings yet

- Global Macro Commentary Jan 5Document2 pagesGlobal Macro Commentary Jan 5dpbasicNo ratings yet

- 10 Key Trends Changing Inv MGMTDocument50 pages10 Key Trends Changing Inv MGMTcaitlynharveyNo ratings yet

- Reasons For Holding CashDocument4 pagesReasons For Holding CashPrincee SharmaNo ratings yet

- Long-Term Investing With Stock ETFsDocument17 pagesLong-Term Investing With Stock ETFssuri92116No ratings yet

- 2 Quarter Commentary: Arket OmmentaryDocument13 pages2 Quarter Commentary: Arket OmmentaryracemizeNo ratings yet

- Fixed IncomeDocument79 pagesFixed Incomeadas_16No ratings yet

- MSN News - Oct 10, 2008 - Investors Jittery, Meltdown Reality DawnsDocument3 pagesMSN News - Oct 10, 2008 - Investors Jittery, Meltdown Reality DawnsJagannadhamNo ratings yet

- UBS CIO Monthly Extended October ReportDocument44 pagesUBS CIO Monthly Extended October ReportSid KaulNo ratings yet

- MUNI-OPIN-FEB February Muni Opinion 2012Document6 pagesMUNI-OPIN-FEB February Muni Opinion 2012Anonymous Feglbx5No ratings yet

- Thursday 1 October 2009Document6 pagesThursday 1 October 2009ZerohedgeNo ratings yet

- Bii 2014 OutlookDocument20 pagesBii 2014 OutlookKo NgeNo ratings yet

- When Diversification Failed: Hite AperDocument11 pagesWhen Diversification Failed: Hite Apersf_freeman5645No ratings yet

- BlackRock Midyear Investment Outlook 2014Document8 pagesBlackRock Midyear Investment Outlook 2014w24nyNo ratings yet

- InvMgtJournal 2013v3i2Document86 pagesInvMgtJournal 2013v3i2cdineshcNo ratings yet

- ICICI Prudential Mutual Fund ArticleDocument7 pagesICICI Prudential Mutual Fund ArticleNitinNo ratings yet

- Weekly Market Commentary 7-2-13Document3 pagesWeekly Market Commentary 7-2-13Stephen GierlNo ratings yet

- Empower July 2011Document74 pagesEmpower July 2011Priyanka AroraNo ratings yet

- Quarterly Fund GuideDocument72 pagesQuarterly Fund GuideJohn SmithNo ratings yet

- Global Macro Commentary Feb 4Document2 pagesGlobal Macro Commentary Feb 4dpbasicNo ratings yet

- Market Index: Measure of The Investment Performance of The Overall MarketDocument13 pagesMarket Index: Measure of The Investment Performance of The Overall MarketcabbasNo ratings yet

- CIO Note Feb 6 2018Document2 pagesCIO Note Feb 6 2018Anonymous 2LowCnVdfNo ratings yet

- Financial Instability Hypothesis - MinskyDocument10 pagesFinancial Instability Hypothesis - MinskyCervino InstituteNo ratings yet

- The True Risk StoryDocument25 pagesThe True Risk StorykcousinsNo ratings yet

- Situation Index Handbook 2014Document43 pagesSituation Index Handbook 2014kcousinsNo ratings yet

- 2011-02-28 Brait Multi Strategy Fund OverviewDocument2 pages2011-02-28 Brait Multi Strategy Fund OverviewkcousinsNo ratings yet

- Chart Review - Can We Rotate Back To EM? Macro Economic Research May 2013Document4 pagesChart Review - Can We Rotate Back To EM? Macro Economic Research May 2013kcousinsNo ratings yet

- Japanese Bonds Move 2013 05Document2 pagesJapanese Bonds Move 2013 05kcousinsNo ratings yet

- Financial Depth - The Rand's Hidden AssetDocument3 pagesFinancial Depth - The Rand's Hidden AssetkcousinsNo ratings yet

- Yen Impact On Corporates 2013 05Document2 pagesYen Impact On Corporates 2013 05kcousinsNo ratings yet

- Brait Multi Strategy Fund Overview October 2010Document2 pagesBrait Multi Strategy Fund Overview October 2010kcousinsNo ratings yet

- 2011-07-31 Brait Multi StrategyDocument2 pages2011-07-31 Brait Multi StrategykcousinsNo ratings yet

- Tim Bond v. Hugh Hendry 2009 08Document15 pagesTim Bond v. Hugh Hendry 2009 08kcousinsNo ratings yet

- Double Dip 2010 05Document3 pagesDouble Dip 2010 05kcousinsNo ratings yet

- Arm Wrestling in Commodities 2009 10Document3 pagesArm Wrestling in Commodities 2009 10kcousinsNo ratings yet

- Brait Multi Strategy Fund Overview 30 August 2009Document13 pagesBrait Multi Strategy Fund Overview 30 August 2009kcousinsNo ratings yet

- Forgotten Commies 2007 07Document9 pagesForgotten Commies 2007 07kcousinsNo ratings yet

- Buying and Selling (Part 5Document6 pagesBuying and Selling (Part 5Danica De veraNo ratings yet

- Edurev: Case Studies - (Chapter - 9) Financial Management, BST Class 12Document20 pagesEdurev: Case Studies - (Chapter - 9) Financial Management, BST Class 12Heer SirwaniNo ratings yet

- Portfolio Management Services (PMS)Document12 pagesPortfolio Management Services (PMS)Apparna BalajiNo ratings yet

- Bank Negara Malaysia Guidelines Related Party TransactionDocument12 pagesBank Negara Malaysia Guidelines Related Party TransactionYan QingNo ratings yet

- Auditing A Practical Approach 1st Edition Moroney Solutions ManualDocument37 pagesAuditing A Practical Approach 1st Edition Moroney Solutions ManualAmandaPrestonqajbg100% (15)

- Kacee Hargrave Kirschvink ReportDocument13 pagesKacee Hargrave Kirschvink ReportMelodyBrumbleNo ratings yet

- 12 Accountancy Lyp 2020 s1Document59 pages12 Accountancy Lyp 2020 s1Anushka JhaNo ratings yet

- Quizz On Monetary Policy and Central Bank Question OnlyDocument7 pagesQuizz On Monetary Policy and Central Bank Question OnlyVEDANT BASNYATNo ratings yet

- Cash Management - Overview Slide For TTT - 15.0 - PTJ Ao (Cmsi v1.0)Document63 pagesCash Management - Overview Slide For TTT - 15.0 - PTJ Ao (Cmsi v1.0)Siti Habsah Abdullah100% (1)

- Nigeria Fintech Census 2020: Profiling and DefiningDocument37 pagesNigeria Fintech Census 2020: Profiling and DefiningteeyNo ratings yet

- Mva EvaDocument11 pagesMva EvaRian ChiseiNo ratings yet

- ICICI Bank Summer Training ReportDocument70 pagesICICI Bank Summer Training ReportvipinkathpalNo ratings yet

- Annual Report 2014Document334 pagesAnnual Report 2014Wanderlust RiyadhNo ratings yet

- SwapsDocument13 pagesSwapsHitesh ShadijaNo ratings yet

- Acc 106 P3 LessonDocument6 pagesAcc 106 P3 LessonRowella Mae VillenaNo ratings yet

- Examination About Investment 21Document1 pageExamination About Investment 21BLACKPINKLisaRoseJisooJennieNo ratings yet

- LoanDocument4 pagesLoanRichard Chinyama Chikeji NjolombaNo ratings yet

- Analysis of Mutual Funds in IndiaDocument78 pagesAnalysis of Mutual Funds in Indiadpk1234No ratings yet

- NPO, Partnership & Co Acc A/c CalculationsDocument6 pagesNPO, Partnership & Co Acc A/c CalculationsMaulik ThakkarNo ratings yet

- Guidelines on Core Banking Solution FeaturesDocument72 pagesGuidelines on Core Banking Solution FeaturesrakhalbanglaNo ratings yet

- Brokerage and Investment BankDocument8 pagesBrokerage and Investment BankFarjana Hossain DharaNo ratings yet

- Fabm 1 q2 Week 6 PDFDocument4 pagesFabm 1 q2 Week 6 PDFA.No ratings yet

- Billing Statement: Customer Name 123 Main Street Vancouver, Wa 98661Document2 pagesBilling Statement: Customer Name 123 Main Street Vancouver, Wa 98661marcelNo ratings yet

- JPM Kolanovic CommentaryDocument8 pagesJPM Kolanovic CommentaryABAD GERONIMO RAMOS CORDOVANo ratings yet

- HDFC Bank E-Banking Customer Survey AnalysisDocument4 pagesHDFC Bank E-Banking Customer Survey AnalysisśíDDHÁŔTH śíŃǴHNo ratings yet

- Section BDocument56 pagesSection BForeclosure Fraud100% (1)

- Economic Cost vs Accounting Cost AnalysisDocument8 pagesEconomic Cost vs Accounting Cost AnalysisSrushti GhuleNo ratings yet

- Test Bank Sheet 3 - Financial Acc.1Document18 pagesTest Bank Sheet 3 - Financial Acc.1Malak El-sayedNo ratings yet

- Monzo Bank Statement 2022 05 01-2022 05 02 3891Document3 pagesMonzo Bank Statement 2022 05 01-2022 05 02 3891AlexNo ratings yet

- Loan AgreementDocument3 pagesLoan AgreementThe Pinoy ApologistNo ratings yet