Professional Documents

Culture Documents

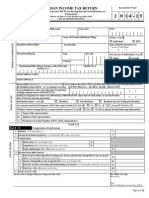

ANNUAL INCOME TAX STATEMENT

Uploaded by

Manoj SankaranarayanaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ANNUAL INCOME TAX STATEMENT

Uploaded by

Manoj SankaranarayanaCopyright:

Available Formats

ANNUAL INCOME TAX STATEMENT FOR THE FINANCIAL YEAR 2012-2013 (Assessment Year 2013-2014) Name, Designation and

Official Address of the Government Servant [ in BLOCK letters] Residential Address

Sex: PAN: 1 a 1 2 3 4 5 6 7 8 9 1 0 1 1 1 2 b c d e f g 2

Male / Female TAN: Gross Salary Income (Include Pay, DA, HRA, CCA, IR, etc.) March 2012 April May June July August September October November December January February Leave Surrender Festival Allowance / Bonus / Food Allowance / Medical Allowance etc. Pay Revision Arrears Value of prequisites u/s 17(2) (as per Form No. 12BA, wherever applicable) Profits in lieu of salary u/s 17(3) (as per Form No. 12BA, wherever applicable) Total Salary income(a+b+c+d+e+f) Deduct: The actual HRA received or House Rent actually paid in excess of 10% of the pay plus DA or 50% of pay plus DA whichever is the least in case residing in a rented building u/s 10 (13A) 2012 2012 2012 2012 2012 2012 2012 2012 2012 2013 2013 Station : Rs. Rs.

Rs.

3 4 a b c d 5 6 7 8

Balance (1-2) Deduct Entertainment Allowance [see 16 (ii)] Professional Tax paid in 2012-'13 Any other allowance exempted u/s 10 Total 4(a) + 4(b) + 4(c) Income Chargeable under the head Salaries (3-4) Add income from other sources Add income from house property Deduct interest/accured interest on HBA (maximun admissible is Rs 30,000/- (if the property is acquired or constructed on or after 01.04.99 and such acquisition or construction is completed within three years from the end of the financial year in which capital is borrowed, deductible amount is 1.50 Lakh) Gross Total income(5+6+7-8) Individual & HUF Below age of 65 years Income tax up to 2,00,000 Rs 2,00,001 - 5,00,000 Rs 5,00,001 - 10,00,000 Above Rs 10,00,001 Tax Rates Nil 10% 20% 30% Women below age of 65 years Income tax up to 2,00,000 Rs 2,00,001 - 5,00,000 Rs 5,00,001 - 10,00,000 Above Rs 10,00,001 Tax Rates Nil 10% 20% 30%

Rates of Income Tax

Education Cess: An addl. surcharge called E.C. @ 2% on the amount of income tax & surcharge (if any) in all cases shall be levied Secondary & Higher : An additional surcharge, called the Secondary & Higher E. C. on income tax at the rate of 1% of income tax Rs. Rs. B/F 1 Deductions under Chapter VI A: 0 A Under Section 80 C a GPF/PPF Contributions b LIC Premium (himself/spouse/children) not exeeding 20% of total Sum assured c GIS/FBS/SLI/PLI premium d Contribution towards LIC's Dhanaraksha Mutual Fund e Any annuity or Deferred Annuity plan f Subsciption towards NSC VIII issue g Contribution to UTI's Retirement Benefit Plan h Investment in UTI's Unit Linked Insurance Plan

i j

1 1 1 2

Approved Mutual Fund Investments u/s 10(23D) Repayment of Housing Loan Principal towards self occupied Residential Property k Repayment of tuition fee towards any 2 children of assessee l Investment in Equity Linked Savings Scheme / Approved Infrastructure Bonds m Investment in pension Fund/Deposit of National Housing Bank under Home Loan Account Scheme n Fixed deposit on any Scheduled Bank/Housing Finance Company for not less than 5 years o Amount invested in a 5 Year Post Office Term Deposit Account p Amount invested in a Senior Citizen Savings Schekme, 2004 B U/S 80CCC - Premium paid towards IRDA approved Pension Fund C U/S 80CCD - Pension Scheme vide Notification No. F.N.5/7/2003 - ECB & PR dt. 22.12.03 D The aggregate amount of deduction u/s 80C, 80CCC & 80CCD(max. 1 Lakh) U/S 80CCF A B C D E F G H U/S 80D - Medical insurance premium (max. 15,000) U/S 80DD - Maintenance including medical treatment of Handicaped dependent U/S 80DDB - Medical treatment expense (max. 40,000) (For Senior Citizen Max. 60,000) U/S 80E - Payment of interest on loan taken for higher studies U/S 80G - Donations made to recognized funds) Rate of deduction is 50% U/S 80GG - If an assessee not in receipt of HRA incurs any expenditure on rent U/S 80 U - Disability allowance Any other allowance (specify) Aggregate of deductible amount under chapter VIA (10D+11+12A+B+C+D+E+F+G+H) Total Income (9-13) Total Income in multiples of Tens Income tax due on total income in 14 A Normal tax or tax under marginal releif (if income

1 3 1 4 1 4 1 5

A a b

1 6 1 7

exceeds 10 lakhs) Surcharge (on tax at computed at S.No 15) a b Education cess 2% (on Sl. No.15 & Sl. No.16) Secondary & Higher Education Cess 1% (on Sl. No.15 & Sl. No.16) Total tax payable (15+16+17(a)+17(b)) Less: releif u/s 89, if any (attach details) Tax Payable (18-19) Less (a)Tax deduction at source u/s 192(1) (b) Tax paid by employer on behalf of employee u/s 192(IA) on prequisites u/s 17 (2) Balance Tax Payable (20-21) Remarks: Signature of the Officer in case of G.Ps / Signature of the Head of Office in case of Non G.Ps Name : Designation :

1 8 1 9 2 0 2 1

2 2 2 3 Place: Date:

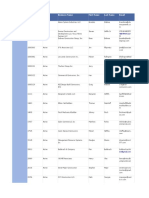

You might also like

- Tax Slab RatesDocument12 pagesTax Slab RatesTony JosephNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Income Tax (Master)Document1 pageIncome Tax (Master)nareshjangra397No ratings yet

- JSK It Returns 2011 12 AuttDocument3 pagesJSK It Returns 2011 12 AuttGobi S Gobi SNo ratings yet

- 12.TAX 4-IT FormatDocument4 pages12.TAX 4-IT FormatRagavendra RagsNo ratings yet

- INVESTMENT DECLARATIONDocument1 pageINVESTMENT DECLARATIONShishir RoyNo ratings yet

- Income Tax Rates 2011-12 Exemption Deduction Tax Calculation Income Tax Ready Reckoner FreeDocument6 pagesIncome Tax Rates 2011-12 Exemption Deduction Tax Calculation Income Tax Ready Reckoner FreevickycdNo ratings yet

- Income Tax Calculation GuideDocument17 pagesIncome Tax Calculation Guidesaravanand1983No ratings yet

- National Institute of Technology CalicutDocument7 pagesNational Institute of Technology CalicutraghuramaNo ratings yet

- Income Tax NitDocument6 pagesIncome Tax NitrensisamNo ratings yet

- Tax Declaration Form 2021 22Document4 pagesTax Declaration Form 2021 22Kasiviswanathan ChinnathambiNo ratings yet

- Income tax filing deadline reminderDocument2 pagesIncome tax filing deadline remindermakamkkumarNo ratings yet

- V. N. Hari,: Sudhakar & Kumar AssociatesDocument28 pagesV. N. Hari,: Sudhakar & Kumar AssociatesvnharicaNo ratings yet

- Modified Tax Calculator With Form-16 - Version 8.2.2 (T) For 2013-14Document28 pagesModified Tax Calculator With Form-16 - Version 8.2.2 (T) For 2013-14Bijender Pal ChoudharyNo ratings yet

- Income Tax Calculation Sheet For Financialyear 2012-2013: Shri/SmtDocument6 pagesIncome Tax Calculation Sheet For Financialyear 2012-2013: Shri/SmtDesh PremiNo ratings yet

- Maulana Azad National Urdu University: CircularDocument4 pagesMaulana Azad National Urdu University: CircularDebasish BiswalNo ratings yet

- Income Tax Ready Reckoner 2011-12Document28 pagesIncome Tax Ready Reckoner 2011-12kpksscribdNo ratings yet

- Income Tax Statement Financial Year 2014-2015: Designation NameDocument1 pageIncome Tax Statement Financial Year 2014-2015: Designation NameAnandraojs JsNo ratings yet

- Investment Declaration Form - 1314 - IshitaDocument5 pagesInvestment Declaration Form - 1314 - IshitaIshita AwasthiNo ratings yet

- IT Declaration FormatDocument2 pagesIT Declaration FormatKamal VermaNo ratings yet

- DeferredDocument11 pagesDeferredShubham MaheshwariNo ratings yet

- 1 .Income Tax On Salaries - (01.06.2015)Document57 pages1 .Income Tax On Salaries - (01.06.2015)yvNo ratings yet

- FORM No. 16Document31 pagesFORM No. 16sebastianksNo ratings yet

- Income Tax Calculator FY 2013 14Document4 pagesIncome Tax Calculator FY 2013 14faiza17No ratings yet

- 2009 Tax Calculator-1Document2 pages2009 Tax Calculator-1Sandip S NagareNo ratings yet

- Tax Savings Declaration Form 2010-11Document1 pageTax Savings Declaration Form 2010-11Priyanka KhemkaNo ratings yet

- Income Tax Provision - 2010-11Document7 pagesIncome Tax Provision - 2010-11KIshore KunalNo ratings yet

- IT Calculator 14 15 Taxguru - inDocument16 pagesIT Calculator 14 15 Taxguru - inanirbanpwd76No ratings yet

- ITR-2 Indian Income Tax Return: Part A-GENDocument12 pagesITR-2 Indian Income Tax Return: Part A-GENMankamesachinNo ratings yet

- Income Tax StatementDocument2 pagesIncome Tax StatementgdNo ratings yet

- Calculate your income tax in IndiaDocument3 pagesCalculate your income tax in IndiaVasan GovindNo ratings yet

- Saving Form-Income Tax 12-13Document9 pagesSaving Form-Income Tax 12-13khaleel887No ratings yet

- Tax Calculator 2010-11Document4 pagesTax Calculator 2010-11LordEnigma18No ratings yet

- IT Declaration Form FY 2018-19Document3 pagesIT Declaration Form FY 2018-19sgshekar3050% (2)

- Salary1 2022 DisDocument45 pagesSalary1 2022 Disparinita raviNo ratings yet

- ItlpDocument12 pagesItlpNotJames BondNo ratings yet

- Income Tax Declaration Form FY 22 23 AY 23 24Document2 pagesIncome Tax Declaration Form FY 22 23 AY 23 24kishoreNo ratings yet

- Template - Restructuring-Tax Computation-BER-Salary Tracker For FY 2015-16 - CKDocument9 pagesTemplate - Restructuring-Tax Computation-BER-Salary Tracker For FY 2015-16 - CKajaykrsinghpintuNo ratings yet

- Declaration Form 12BB 2022 23Document4 pagesDeclaration Form 12BB 2022 23S S PradheepanNo ratings yet

- Withholding Tax - Bureau of Internal Revenue161116Document20 pagesWithholding Tax - Bureau of Internal Revenue161116SandyNo ratings yet

- Employee Investment Declaration Form For The Financial Year 2019-2020Document2 pagesEmployee Investment Declaration Form For The Financial Year 2019-2020Hinglaj SinghNo ratings yet

- For Individual and Other Taxpayers (Other Than Company) : IT-11GADocument9 pagesFor Individual and Other Taxpayers (Other Than Company) : IT-11GAsojol747412No ratings yet

- Section 80 CDocument5 pagesSection 80 CAmit RoyNo ratings yet

- Income Tax Calculation: Name: S. Ram Mohan ReddyDocument6 pagesIncome Tax Calculation: Name: S. Ram Mohan ReddyCA Swamyreddy MvNo ratings yet

- 2011 - ITR2 - r6Document33 pages2011 - ITR2 - r6Bathina Srinivasa RaoNo ratings yet

- ASSESSMENT YEAR 2014 Tax Rates and DetailsDocument6 pagesASSESSMENT YEAR 2014 Tax Rates and Detailsamit2201No ratings yet

- IT Declaration 2011-12Document2 pagesIT Declaration 2011-12Vijaya Saradhi PeddiNo ratings yet

- DownloadDocument6 pagesDownloadpankhewalegNo ratings yet

- DeductionsDocument11 pagesDeductionsguest1No ratings yet

- IT Calculation for FY 2020-2021Document3 pagesIT Calculation for FY 2020-2021Sampath SanguNo ratings yet

- Investment Declaration Form 2012-13 PDFDocument1 pageInvestment Declaration Form 2012-13 PDFnovalhemantNo ratings yet

- UNIT 2 Income From SalaryDocument146 pagesUNIT 2 Income From Salaryeasy mailNo ratings yet

- Frequently Asked Questions (Faqs) Tax Deduction at Source On BOB Staff Pension PaymentsDocument4 pagesFrequently Asked Questions (Faqs) Tax Deduction at Source On BOB Staff Pension PaymentsMayur khichiNo ratings yet

- TAX STATEMENT 2015-16Document2 pagesTAX STATEMENT 2015-16JeganNo ratings yet

- Form BE2010 2Document9 pagesForm BE2010 2Teoh Zi JingNo ratings yet

- Income Tax FormatDocument2 pagesIncome Tax FormatmanmohanibcsNo ratings yet

- IT Declaration Form 2012-13Document1 pageIT Declaration Form 2012-13Suresh SharmaNo ratings yet

- Smartivity Labs Employee Tax Form GuideDocument2 pagesSmartivity Labs Employee Tax Form GuideSanjeev Kumar50% (2)

- Income Tax Calculator-1213Document6 pagesIncome Tax Calculator-1213Khalidkhattak11No ratings yet

- Commentary SanskritDocument19 pagesCommentary SanskritManoj SankaranarayanaNo ratings yet

- NumbersDocument18 pagesNumbersManoj SankaranarayanaNo ratings yet

- A Ā GasāraDocument51 pagesA Ā GasāraManoj SankaranarayanaNo ratings yet

- Ayurveda Commentaries SanskritDocument19 pagesAyurveda Commentaries SanskritManoj SankaranarayanaNo ratings yet

- Krishna Vilas AmDocument1 pageKrishna Vilas AmManoj SankaranarayanaNo ratings yet

- Ayurveda Darshanm - InnerDocument9 pagesAyurveda Darshanm - InnerManoj SankaranarayanaNo ratings yet

- DocumentDocument1 pageDocumentManoj SankaranarayanaNo ratings yet

- Vaidya Lakshana Signs of Good PhysicianDocument1 pageVaidya Lakshana Signs of Good PhysicianManoj SankaranarayanaNo ratings yet

- Dipika and TarkasamgrahaDocument845 pagesDipika and TarkasamgrahaManoj SankaranarayanaNo ratings yet

- Gandhari Keyboard WordDocument4 pagesGandhari Keyboard WordManoj SankaranarayanaNo ratings yet

- Dikshithar Won Chidambaram CaseDocument1 pageDikshithar Won Chidambaram CaseManoj SankaranarayanaNo ratings yet

- Buddhist Fort of Ancient Central TravancoreDocument1 pageBuddhist Fort of Ancient Central TravancoreManoj SankaranarayanaNo ratings yet

- Ayurveda Darshanm - InnerDocument9 pagesAyurveda Darshanm - InnerManoj SankaranarayanaNo ratings yet

- Gayati VanamaliDocument1 pageGayati VanamaliManoj SankaranarayanaNo ratings yet

- Tarkasamgraha - KshemarajaDocument1,032 pagesTarkasamgraha - KshemarajaManoj SankaranarayanaNo ratings yet

- Hospital HygieneDocument29 pagesHospital HygieneManoj Sankaranarayana0% (1)

- C M/JvaraDocument6 pagesC M/JvaraManoj SankaranarayanaNo ratings yet

- Gandhari Keyboard WordDocument4 pagesGandhari Keyboard WordManoj SankaranarayanaNo ratings yet

- Manuscript AyurDocument1 pageManuscript AyurManoj SankaranarayanaNo ratings yet

- Dhara VidhiDocument1 pageDhara VidhiManoj SankaranarayanaNo ratings yet

- Mannarasala Nagaraja TempleDocument1 pageMannarasala Nagaraja TempleManoj SankaranarayanaNo ratings yet

- P.seshadiri IyerDocument1 pageP.seshadiri IyerManoj SankaranarayanaNo ratings yet

- Hari PadDocument1 pageHari PadManoj SankaranarayanaNo ratings yet

- Bhatta Tradition KeralaDocument1 pageBhatta Tradition KeralaManoj SankaranarayanaNo ratings yet

- Manuscript AyurDocument1 pageManuscript AyurManoj SankaranarayanaNo ratings yet

- God's Own CountryDocument1 pageGod's Own CountryManoj SankaranarayanaNo ratings yet

- KollurDocument1 pageKollurManoj SankaranarayanaNo ratings yet

- Rule-Extension Strategies in Ancient Indian Ritual and Linguistic TextsDocument30 pagesRule-Extension Strategies in Ancient Indian Ritual and Linguistic TextsManoj SankaranarayanaNo ratings yet

- Hari PadDocument1 pageHari PadManoj SankaranarayanaNo ratings yet

- Manoj SankaranarayanaDocument1 pageManoj SankaranarayanaManoj SankaranarayanaNo ratings yet

- Cloth RecycleDocument4 pagesCloth RecycleMuhammad Ammar KhanNo ratings yet

- UEH Mid-Term Micro Fall 2020 - B46Document4 pagesUEH Mid-Term Micro Fall 2020 - B46SƠN LƯƠNG THÁINo ratings yet

- Accounting Chapter 10Document4 pagesAccounting Chapter 1019033No ratings yet

- Myths and Realities of Eminent Domain AbuseDocument14 pagesMyths and Realities of Eminent Domain AbuseInstitute for JusticeNo ratings yet

- Licensed Contractor Report - June 2015 PDFDocument20 pagesLicensed Contractor Report - June 2015 PDFSmith GrameNo ratings yet

- Request Travel Approval Email TemplateDocument1 pageRequest Travel Approval Email TemplateM AsaduzzamanNo ratings yet

- Shoppers Paradise Realty & Development Corporation, vs. Efren P. RoqueDocument1 pageShoppers Paradise Realty & Development Corporation, vs. Efren P. RoqueEmi SicatNo ratings yet

- Terms of TradeDocument3 pagesTerms of TradePiyushJainNo ratings yet

- Weimar Republic Model AnswersDocument5 pagesWeimar Republic Model AnswersFathima KaneezNo ratings yet

- Siddharth Sheth - Review Sheet ProjectDocument2 pagesSiddharth Sheth - Review Sheet ProjectSiddharth ShethNo ratings yet

- Understanding essay questionsDocument11 pagesUnderstanding essay questionsfirstclassNo ratings yet

- Economics 2nd Edition Hubbard Test BankDocument25 pagesEconomics 2nd Edition Hubbard Test BankPeterHolmesfdns100% (48)

- National Board of Examinations: Sr. No. No. para No. Topic Query / Suggestion Amendments, To Be Read AsDocument3 pagesNational Board of Examinations: Sr. No. No. para No. Topic Query / Suggestion Amendments, To Be Read AskrishnaNo ratings yet

- Print - Udyam Registration Certificate AnnexureDocument2 pagesPrint - Udyam Registration Certificate AnnexureTrupti GhadiNo ratings yet

- Practical IFRSDocument282 pagesPractical IFRSahmadqasqas100% (1)

- Receipt Voucher: Tvs Electronics LimitedDocument1 pageReceipt Voucher: Tvs Electronics LimitedKrishna SrivathsaNo ratings yet

- Zimbabwe Stock Exchange Pricelist: The Complete List of ZSE Indices Can Be Obtained From The ZSE Website: WWW - Zse.co - ZWDocument1 pageZimbabwe Stock Exchange Pricelist: The Complete List of ZSE Indices Can Be Obtained From The ZSE Website: WWW - Zse.co - ZWBen GanzwaNo ratings yet

- Dec. EarningsDocument1 pageDec. Earningsmorotasheila.smdcNo ratings yet

- Germany Vs Singapore by Andrew BaeyDocument12 pagesGermany Vs Singapore by Andrew Baeyacs1234100% (2)

- Currency and interest rate swaps explainedDocument33 pagesCurrency and interest rate swaps explainedHiral PatelNo ratings yet

- Is Pakistan Ready for Fintech GrowthDocument32 pagesIs Pakistan Ready for Fintech GrowthHaidar MustafaNo ratings yet

- Challenges Face by Least Developing Countries (LDCS)Document4 pagesChallenges Face by Least Developing Countries (LDCS)Amal nabNo ratings yet

- Real Estate Project Feasibility Study ComponentsDocument2 pagesReal Estate Project Feasibility Study ComponentsSudhakar Ganjikunta100% (1)

- Managerial Economics: Cheat SheetDocument110 pagesManagerial Economics: Cheat SheetSushmitha KanasaniNo ratings yet

- Due Amount: We're ListeningDocument2 pagesDue Amount: We're ListeningPrabhupreet SinghNo ratings yet

- DaewooDocument18 pagesDaewooapoorva498No ratings yet

- Aec 2101 Production Economics - 0Document4 pagesAec 2101 Production Economics - 0Kelvin MagiriNo ratings yet

- Book No. 13 Accountancy Financial Sybcom FinalDocument380 pagesBook No. 13 Accountancy Financial Sybcom FinalPratik DevarkarNo ratings yet

- Lumad Struggle for Land and Culture in the PhilippinesDocument10 pagesLumad Struggle for Land and Culture in the PhilippinesAlyssa Molina100% (1)

- Emirates Airlines Pilots Salary StructureDocument6 pagesEmirates Airlines Pilots Salary StructureShreyas Sinha0% (1)

- Jamaica: A Guide to the Food & RestaurantsFrom EverandJamaica: A Guide to the Food & RestaurantsRating: 4 out of 5 stars4/5 (1)

- Secrets of the Millionaire Mind: Mastering the Inner Game of WealthFrom EverandSecrets of the Millionaire Mind: Mastering the Inner Game of WealthRating: 4.5 out of 5 stars4.5/5 (197)

- Proof of Heaven: A Neurosurgeon's Journey into the AfterlifeFrom EverandProof of Heaven: A Neurosurgeon's Journey into the AfterlifeRating: 3.5 out of 5 stars3.5/5 (165)

- Coastal Alaska & the Inside Passage Adventure Travel GuideFrom EverandCoastal Alaska & the Inside Passage Adventure Travel GuideNo ratings yet

- The Game: Penetrating the Secret Society of Pickup ArtistsFrom EverandThe Game: Penetrating the Secret Society of Pickup ArtistsRating: 4 out of 5 stars4/5 (131)

- Geneva, Lausanne, Fribourg & Western Switzerland Travel AdventuresFrom EverandGeneva, Lausanne, Fribourg & Western Switzerland Travel AdventuresNo ratings yet

- Hollywood & the Best of Los Angeles Travel GuideFrom EverandHollywood & the Best of Los Angeles Travel GuideRating: 4.5 out of 5 stars4.5/5 (2)

- Aruba, Bonaire & Curacao Adventure GuideFrom EverandAruba, Bonaire & Curacao Adventure GuideRating: 5 out of 5 stars5/5 (2)

- Nassau & the Best of the Bahamas Travel GuideFrom EverandNassau & the Best of the Bahamas Travel GuideRating: 5 out of 5 stars5/5 (1)