Professional Documents

Culture Documents

Introduction To Econometrics, Tutorial

Uploaded by

agonza70Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Introduction To Econometrics, Tutorial

Uploaded by

agonza70Copyright:

Available Formats

Quantitative Methods for Economics

Katherine Eyal

Tutorial 12

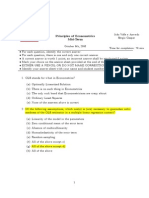

TUTORIAL 12

25 October 2010

ECO3021S

Part A: Problems

1. State with brief reason whether the following statements are true, false or uncertain:

(a) In the presence of heteroskedasticity OLS estimators are biased as well as inef-

cient.

(b) If heteroskedasticity is present, the conventional t and F tests are invalid.

(c) If a regression model is mis-specied (e.g., an important variable is omitted),

the OLS residuals will show a distinct pattern.

(d) If a regressor that has nonconstant variance is (incorrectly) omitted from a

model, the (OLS) residuals will be heteroskedastic.

2. In a regression of average wages, (W, in Rands) on the number of employees (N) for a

random sample of 30 rms, the following regression results were obtained (t-statistics

in parentheses):

W = 7.5

(N/A)

+ 0.009

(16.10)

N R

2

= 0.90

W/N = 0.008

(14.43)

+ 7.8

(76.58)

(1/N) R

2

= 0.99

(a) How do you interpret the two regressions?

(b) What is the researcher assuming in going from the rst to the second equation?

Was he worried about heteroskedasticity? How do you know?

(c) Can you relate the slopes and intercepts of the two models?

(d) Can you compare the R

2

values of the two models? Why or why not?

1

3. In 1914, the South African Robert Lehfeldt published what has become a well-known

estimate of a price elasticity of demand that relied on a double logarithmic spec-

ication. Lehfeldt reasoned that variations in weather drive uctuations in wheat

production from one year to the next, and that the price of wheat adjusts so that

buyers are willing to buy all the wheat produced. Hence, he argued, the price of

wheat observed in any year reects the demand for wheat. Consider the equation

log(price) =

0

+

1

log(wheat) + u

where price denotes the price of wheat, wheat denotes the quantity of wheat, and

1/

1

is the price elasticity of demand for wheat. Demonstrate that if the rst four

Gauss-Markov assumptions apply, the inverse of the OLS estimator of the slope in

the above equation is a consistent estimator of the price elasticity of demand for

wheat.

4. Suppose that the model

pctstck =

0

+

1

funds +

2

risktol + u

satises the rst four Gauss-Markov assumptions, where pctstck is the percentage

of a workers pension invested in the stock market, funds is the number of mutual

funds that the worker can choose from, and risktol is some measure of risk tolerance

(larger risktol means the person has a higher tolerance for risk). If funds and risktol

are positively correlated, what is the inconsistency in

1

, the slope coecient in the

simple regression of pctstck on funds?

2

Part B: Computer Exercises

1. Does the separation of corporate control from corporate ownership lead to worse

rm performance? George Stigler and Claire Friedland have addressed this question

empirically using a sample of U.S. rms. A subset of their data are in the le

EXECCOMP.DTA. The variables in the le are as follows:

ecomp Average total annual compensation in thousands of dollars for a rms

top three executives

assets Firms assets in millions of dollars

prots Firms annual prots in millions of dollars

mcontrol Dummy variable indicating management control of the rm

Consider the following equation:

profits =

0

+

1

assets +

2

mcontrol + u (1)

(a) Estimate the equation in (1). Construct a 95% condence interval for

2

.

(b) Estimate the equation in (1) but now compute the heteroskedasticity-robust

standard errors. (Use the command: reg profits assets mcontrol, robust)

Construct a 95% condence interval for

2

and compare it with the nonrobust

condence interval from part (a).

(c) Compute the Breusch-Pagan test for heteroskedasticity. Form both the F and

LM statistics and report the p values. (You can use the command hettest to

perform the LM version of the Breusch-Pagan test in Stata.)

(d) Compute the special case of the White test for heteroskedasticity. Form both

the F and LM statistics and report the p values. How does this compare to

your results from (c)? (You can use the command imtest, white to perform

the LM version of the original White test in Stata. Note that this test statistic

will be dierent from the one you compute for the special case of the White

test.)

(e) Divide all of the variables (including the intercept term) in equation (1) by the

square root of assets. Re-estimate the parameters of (1) using these data. What

are these estimates known as? These new estimates are BLUE if what is true

about the disturbances in (1)?

(f) Conduct Whites test for the disturbances in (e) being homoskedastic. What do

you conclude at the 5% level?

(g) Construct a 95% condence interval for

2

using the estimates from the regres-

sion in (e). Are you sympathetic to the claim that managerial control has no

large eect on corporate prots?

3

2. Let arr86 be a binary variable equal to unity if a man was arrested during 1986, and

zero otherwise. The population is a group of young men in California born in 1960

or 1961 who have at least one arrest prior to 1986. A linear probability model for

describing arr86 is

arr86 =

0

+

1

pcnv +

2

avgsen +

3

tottime +

4

ptime86 +

5

qemp86 + u,

where

pcnv = the proportion of prior arrests that led to a conviction

avgsen = the average sentence served from prior convictions (in months)

tottime = months spent in prison since age 18 prior to 1986

ptime86 = months spent in prison in 1986

qemp86 = the number of quarters (0 to 4) that the man was legally employed in 1986

The data set is in CRIME1.DTA.

(a) Estimate this model by OLS and verify that all tted values are strictly between

zero and one. What are the smallest and largest tted values?

(b) Estimate the equation by weighted least squares, as discussed in Section 8.5 of

Wooldridge.

(c) Use the WLS estimates to determine whether avgsen and tottime are jointly

signicant at the 5% level.

3. Use the data in WAGE1.DTA for this question.

(a) Estimate the equation

wage =

0

+

1

educ +

2

exper +

3

tenure + u.

Save the residuals and plot a histogram.

(b) Repeat part (a) but with log (wage) as the dependent variable.

(c) Would you say that Assumption MLR.6 in Wooldridge (Normality) is closer to

being satised for the level-level model or the log-level model?

4. Use the data in CHARITY.DTA for this question.

(a) Using all 4,268 observations, estimate the equation

gift =

0

+

1

mailsyear +

2

giftlast +

3

propresp + u

and interpret your results in full.

4

(b) Reestimate the equation in part (a), using the rst 2,134 observations.

(c) Find the ratio of the standard errors on

2

from parts (a) and (b). Compare

this with the result from equation (5.10) on page 175 of Wooldridge.

5

TUTORIAL 12 SOLUTIONS

25 October 2010

ECO3021S

Part A: Problems

1. State with brief reason whether the following statements are true, false or uncertain:

(a) In the presence of heteroskedasticity OLS estimators are biased as well as inef-

cient.

(b) If heteroskedasticity is present, the conventional t and 1 tests are invalid.

(c) If a regression model is mis-specied (e.g., an important variable is omitted),

the OLS residuals will show a distinct pattern.

(d) If a regressor that has nonconstant variance is (incorrectly) omitted from a

model, the (OLS) residuals will be heteroskedastic.

SOLUTION:

(a) False. In the presence of heteroskedasticity OLS estimators are unbiased, but

are inecient.

(b) True. If heteroskedasticity is present, the OLS standard errors are biased and

are no longer valid for constructing condence intervals and t statistics. The

usual OLS t statistics do not have / t distributions, and 1 statistics are no longer

1 distributed in the presence of heteroskedasticity.

(c) True. If there are specication errors, the residuals will exhibit noticeable

patterns.

(d) True. Often, what looks like heteroskedasticity may be due to the fact that

some important variables are omitted from the model.

2. In a regression of average wages, (\, in Rands) on the number of employees () for a

random sample of 30 rms, the following regression results were obtained (t-statistics

in parentheses):

\ = 7.5

(N=A)

+ 0.009

(16:10)

1

2

= 0.90

\, = 0.008

(14:43)

+ 7.8

(76:58)

(1,) 1

2

= 0.99

1

(a) How do you interpret the two regressions?

(b) What is the researcher assuming in going from the rst to the second equation?

Was he worried about heteroskedasticity? How do you know?

(c) Can you relate the slopes and intercepts of the two models?

(d) Can you compare the 1

2

values of the two models? Why or why not?

SOLUTION:

(a) The rst regression is an OLS estimation of the relationship between average

wages and number of employees. The results suggest that if a rm hires ten

new employees, the average wage increases by R0.09. The second regression

is weighted least squares (WLS) estimation of the relationship between average

wages and number of employees. The results suggest that if a rm hires ten

new employees, the average wage increases by R0.08.

(b) The researcher is assuming that the error variance is proportional to

2

:

Var(n

i

j ) = o

2

2

i

. He was worried about heteroskedasticity because if

Var(n

i

j ) = o

2

2

i

, the error variance is clearly non-constant. If this is a cor-

rect specication of the form of the variance, then WLS estimation (the second

equation) is more ecient than OLS (the rst equation).

(c) The intercept of the second equation is the slope coecient of the rst equation,

and the slope coecient of the second equation is the intercept of the rst

equation.

(d) You cannot compare the 1

2

values because the dependent variables are dierent

in the two models.

3. In 1914, the South African Robert Lehfeldt published what has become a well-known

estimate of a price elasticity of demand that relied on a double logarithmic spec-

ication. Lehfeldt reasoned that variations in weather drive uctuations in wheat

production from one year to the next, and that the price of wheat adjusts so that

buyers are willing to buy all the wheat produced. Hence, he argued, the price of

wheat observed in any year reects the demand for wheat. Consider the equation

log(jricc) = ,

0

+ ,

1

log(n/cat) + n

where jricc denotes the price of wheat, n/cat denotes the quantity of wheat, and

1,,

1

is the price elasticity of demand for wheat. Demonstrate that if the rst four

Gauss-Markov assumptions apply, the inverse of the OLS estimator of the slope in

the above equation is a consistent estimator of the price elasticity of demand for

wheat.

2

SOLUTION:

To show that 1,

,

1

is a consistent estimator of 1,,

1

, we have to show that

,

1

is a

consistent estimator of ,

1

. This is just the proof of Theorem 5.1 (see page 169 in

Wooldridge).

4. Suppose that the model

jct:tc/ = ,

0

+ ,

1

)n:d: + ,

2

ri:/to| + n

satises the rst four Gauss-Markov assumptions, where jct:tc/ is the percentage

of a workers pension invested in the stock market, )n:d: is the number of mutual

funds that the worker can choose from, and ri:/to| is some measure of risk tolerance

(larger ri:/to| means the person has a higher tolerance for risk). If )n:d: and ri:/to|

are positively correlated, what is the inconsistency in

,

1

, the slope coecient in the

simple regression of jct:tc/ on )n:d:?

SOLUTION:

A higher tolerance of risk means more willingness to invest in the stock market, so

,

2

0. By assumption, )n:d: and ri:/to| are positively correlated. Now we use

equation (5.5) of Wooldridge, where c

1

0 : plim(

,

1

) = ,

1

+,

2

c

1

,

1

, so

,

1

has a

positive inconsistency (asymptotic bias). This makes sense: if we omit ri:/to| from

the regression and it is positively correlated with )n:d:, some of the estimated eect

of )n:d: is actually due to the eect of ri:/to|.

Part B: Computer Exercises

1. Does the separation of corporate control from corporate ownership lead to worse

rm performance? George Stigler and Claire Friedland have addressed this question

empirically using a sample of U.S. rms. A subset of their data are in the le

EXECCOMP.DTA. The variables in the le are as follows:

ecomp Average total annual compensation in thousands of dollars for a rms

top three executives

assets Firms assets in millions of dollars

prots Firms annual prots in millions of dollars

mcontrol Dummy variable indicating management control of the rm

Consider the following equation:

jro)it: = ,

0

+ ,

1

a::ct: + ,

2

:co:tro| + n (1)

(a) Estimate the equation in (1). Construct a 95% condence interval for ,

2

.

3

(b) Estimate the equation in (1) but now compute the heteroskedasticity-robust

standard errors. (Use the command: reg profits assets mcontrol, robust)

Construct a 95% condence interval for ,

2

and compare it with the nonrobust

condence interval from part (a).

(c) Compute the Breusch-Pagan test for heteroskedasticity. Form both the 1 and

1' statistics and report the j values. (You can use the command hettest to

perform the 1' version of the Breusch-Pagan test in Stata.)

(d) Compute the special case of the White test for heteroskedasticity. Form both

the 1 and 1' statistics and report the j values. How does this compare to

your results from (c)? (You can use the command imtest, white to perform

the 1' version of the original White test in Stata. Note that this test statistic

will be dierent from the one you compute for the special case of the White

test.)

(e) Divide all of the variables (including the intercept term) in equation (1) by the

square root of assets. Re-estimate the parameters of (1) using these data. What

are these estimates known as? These new estimates are BLUE if what is true

about the disturbances in (1)?

(f) Conduct Whites test for the disturbances in (e) being homoskedastic. What do

you conclude at the 5% level?

(g) Construct a 95% condence interval for ,

2

using the estimates from the regres-

sion in (e). Are you sympathetic to the claim that managerial control has no

large eect on corporate prots?

SOLUTION:

(a)

Source | SS df MS Number of obs = 69

-------------+------------------------------ F( 2, 66) = 13.49

Model | 6843.42169 2 3421.71085 Prob > F = 0.0000

Residual | 16735.2881 66 253.564972 R-squared = 0.2902

-------------+------------------------------ Adj R-squared = 0.2687

Total | 23578.7098 68 346.745733 Root MSE = 15.924

------------------------------------------------------------------------------

profits | Coef. Std. Err. t P>|t| [95% Conf. Interval]

-------------+----------------------------------------------------------------

assets | .0274626 .0055847 4.92 0.000 .0163124 .0386128

mcontrol | -6.186284 3.844436 -1.61 0.112 -13.86195 1.48938

_cons | 8.087969 3.053642 2.65 0.010 1.991175 14.18476

------------------------------------------------------------------------------

The 95% condence interval for ,

2

is given in the Stata output: [13.86195, 1.48938] .

(You should also make sure that you can construct this CI by hand.)

4

(b)

Regression with robust standard errors Number of obs = 69

F( 2, 66) = 2.92

Prob > F = 0.0607

R-squared = 0.2902

Root MSE = 15.924

------------------------------------------------------------------------------

| Robust

profits | Coef. Std. Err. t P>|t| [95% Conf. Interval]

-------------+----------------------------------------------------------------

assets | .0274626 .0157674 1.74 0.086 -.0040181 .0589433

mcontrol | -6.186284 3.765382 -1.64 0.105 -13.70411 1.331542

_cons | 8.087969 3.796616 2.13 0.037 .5077806 15.66816

------------------------------------------------------------------------------

The 95% condence interval for ,

2

is given in the Stata output: [13.70411, 1.331542] .

(You should also make sure that you can construct this CI by hand.)

This CI is narrower than the nonrobust one from part (a).

(c) Stata commands:

reg profits assets mcontrol (This is the usual OLS regression)

predict u, resid (This saves the residuals from the regression

in a variable named n)

gen u2=u^2 (This creates the squared residuals and

saves them as n2)

reg u2 assets mcontrol (This is regression (8.14) of Wooldridge)

Stata output:

Source | SS df MS Number of obs = 69

-------------+------------------------------ F( 2, 66) = 10.77

Model | 21041422.4 2 10520711.2 Prob > F = 0.0001

Residual | 64482732.8 66 977011.104 R-squared = 0.2460

-------------+------------------------------ Adj R-squared = 0.2232

Total | 85524155.3 68 1257708.17 Root MSE = 988.44

------------------------------------------------------------------------------

u2 | Coef. Std. Err. t P>|t| [95% Conf. Interval]

-------------+----------------------------------------------------------------

assets | 1.596643 .3466613 4.61 0.000 .9045113 2.288775

mcontrol | -120.8976 238.637 -0.51 0.614 -597.3517 355.5566

_cons | -143.9968 189.5498 -0.76 0.450 -522.4451 234.4515

------------------------------------------------------------------------------

Breusch-Pagan test for heteroskedasticity (BP test):

5

1 statistic:

1 =

1

2

b u

2

,/

_

1 1

2

b u

2

_

, (: / 1)

= 10.77

This 1 statistic is easily obtained from the Stata output, as it is the 1

statistic for overall signicance of a regression.

The j value is 0.0001 indicating that we can reject the null hypothesis of

homoskedasticity.

1' statistic:

1' = : 1

2

b u

2

= 69 (0.2460)

= 16.974

The j value is less than 0.01 (the 1% critical value from the

2

distribution

with 2 degrees of freedom is 9.21), indicating that we can reject the null of

homoskedasticity.

Performing the BP test in Stata:

reg profits assets mcontrol

hettest

Breusch-Pagan / Cook-Weisberg test for heteroskedasticity

Ho: Constant variance

Variables: fitted values of profits

chi2(1) = 171.40

Prob > chi2 = 0.0000

Stata performs a dierent version of the BP test to the one discussed in Wooldridge,

but the conclusion is the same. We reject the null of homoskedasticity.

(d) Stata commands:

reg profits assets mcontrol (This is the usual OLS regression)

predict u, resid (This saves the residuals from the regression

in a variable named n)

gen u2=u^2 (This creates the squared residuals and

saves them as n2)

predict profitshat (This calculates the predicted values of prots

and saves them as jro)it:/at)

gen profitshat2=profitshat^2 (This squares the predicted values of prots

saves them as jro)it:/at2)

reg u2 profitshat profitshat2 (This is regression (8.20) of Wooldridge)

6

(Note that you do not need to recreate the squared residuals if you already did

so in (c).)

Stata output:

Source | SS df MS Number of obs = 69

-------------+------------------------------ F( 2, 66) = 10.32

Model | 20378554.1 2 10189277.1 Prob > F = 0.0001

Residual | 65145601.1 66 987054.563 R-squared = 0.2383

-------------+------------------------------ Adj R-squared = 0.2152

Total | 85524155.3 68 1257708.17 Root MSE = 993.51

------------------------------------------------------------------------------

u2 | Coef. Std. Err. t P>|t| [95% Conf. Interval]

-------------+----------------------------------------------------------------

profitshat | 70.87986 37.64392 1.88 0.064 -4.278665 146.0384

profitshat2 | -.2983731 .6413758 -0.47 0.643 -1.578921 .982175

_cons | -588.2597 348.3295 -1.69 0.096 -1283.722 107.2025

------------------------------------------------------------------------------

Special case of White test for heteroskedasticity:

1 statistic = 10.32, j value = 0.0001 (easily obtained from Stata output).

We can reject the null of homoskedasticity.

1' statistic = : 1

2

b u

2

= 69 (0.2383) = 16.443, and the j value is less

than 0.01 (the 1% critical value from the

2

distribution with 2 degrees of

freedom is 9.21). We can reject the null of homoskedasticity.

Performing the White test in Stata:

reg profits assets mcontrol

imtest, white

White's test for Ho: homoskedasticity

against Ha: unrestricted heteroskedasticity

chi2(4) = 18.05

Prob > chi2 = 0.0012

Cameron & Trivedi's decomposition of IM-test

---------------------------------------------------

Source | chi2 df p

---------------------+-----------------------------

Heteroskedasticity | 18.05 4 0.0012

Skewness | 3.69 2 0.1581

Kurtosis | 1.48 1 0.2230

---------------------+-----------------------------

Total | 23.22 7 0.0016

---------------------------------------------------

7

Stata performs the original version of the White test (equation 8.19 of Wooldridge).

The test statistic is dierent to the one we computed for the special case of the

White test, but the conclusion is the same. We can reject the null of ho-

moskedasticity.

(e)

jro)it:,

p

a::ct: = ,

0

,

p

a::ct: + ,

1

a::ct:,

p

a::ct: + ,

2

:co:tro|,

p

a::ct: + n,

p

a::ct:

jro)it:,

p

a::ct: = ,

0

_

1,

p

a::ct:

_

+ ,

1

p

a::ct: + ,

2

:co:tro|,

p

a::ct: + n

Stata commands:

gen sqrtassets=assets^(1/2)

gen profits_sqrtassets = profits/sqrtassets

gen one_sqrtassets = 1/sqrtassets

gen mcontrol_sqrtassets = mcontrol/sqrtassets

reg profits_sqrtassets one_sqrtassets sqrtassets mcontrol_sqrtassets,

noconstant

Results:

Source | SS df MS Number of obs = 69

-------------+------------------------------ F( 3, 66) = 33.56

Model | 41.8974441 3 13.9658147 Prob > F = 0.0000

Residual | 27.4621735 66 .416093538 R-squared = 0.6041

-------------+------------------------------ Adj R-squared = 0.5861

Total | 69.3596176 69 1.00521185 Root MSE = .64505

------------------------------------------------------------------------------

profits_sq~s | Coef. Std. Err. t P>|t| [95% Conf. Interval]

-------------+----------------------------------------------------------------

one_sqrtas~s | 2.492719 1.708424 1.46 0.149 -.9182605 5.903698

sqrtassets | .0406921 .0068165 5.97 0.000 .0270825 .0543017

mcontrol_s~s | -2.029233 1.886417 -1.08 0.286 -5.795586 1.737119

------------------------------------------------------------------------------

These estimates are known as the weighted least squares (WLS) estimates.

The WLS estimates are BLUE if Var(n

i

j a::ct:

i

) = o

2

a::ct:

i

.

(f) Special case of the White test:

predict ustar, resid

gen ustar2 = ustar^2

predict profits_sqrtassetshat

gen profits_sqrtassetshat2 = profits_sqrtassets^2

8

reg ustar2 profits_sqrtassetshat profits_sqrtassetshat2

Source | SS df MS Number of obs = 69

-------------+------------------------------ F( 2, 66) = 94.16

Model | 47.6341764 2 23.8170882 Prob > F = 0.0000

Residual | 16.6939312 66 .252938352 R-squared = 0.7405

-------------+------------------------------ Adj R-squared = 0.7326

Total | 64.3281077 68 .946001583 Root MSE = .50293

------------------------------------------------------------------------------

ustar2 | Coef. Std. Err. t P>|t| [95% Conf. Interval]

-------------+----------------------------------------------------------------

profits_sq~t | .5869394 .2360104 2.49 0.015 .1157295 1.058149

profits_sq~2 | .3605197 .0306082 11.78 0.000 .2994084 .4216309

_cons | -.3926059 .1748171 -2.25 0.028 -.7416394 -.0435724

------------------------------------------------------------------------------

The 1 statistic = 94.16, with a j value of 0.0000. We can reject the null of

homoskedasticity. This may be because our assumed form for the error variance

is incorrect, or the model is mis-specied.

Original version of the White test:

reg profits_sqrtassets one_sqrtassets sqrtassets mcontrol_sqrtassets,

noconstant

imtest, white

White's test for Ho: homoskedasticity

against Ha: unrestricted heteroskedasticity

chi2(7) = 16.49

Prob > chi2 = 0.0210

Cameron & Trivedi's decomposition of IM-test

---------------------------------------------------

Source | chi2 df p

---------------------+-----------------------------

Heteroskedasticity | 16.49 7 0.0210

Skewness | 2.92 3 0.4039

Kurtosis | 2.13 1 0.1440

---------------------+-----------------------------

Total | 21.54 11 0.0282

---------------------------------------------------

We can reject the null of homoskedasticity at the 5% level of signicance.

(g) The 95% condence interval for ,

2

is given in the Stata output: [5.795586, 1.737119] .

(You should also make sure that you can construct this CI by hand.)

We cannot reject the null that management control has no eect on prots.

9

2. Let arr86 be a binary variable equal to unity if a man was arrested during 1986, and

zero otherwise. The population is a group of young men in California born in 1960

or 1961 who have at least one arrest prior to 1986. A linear probability model for

describing arr86 is

arr86 = ,

0

+ ,

1

jc: + ,

2

aq:c: + ,

3

totti:c + ,

4

jti:c86 + ,

5

c:j86 + n,

where

jc: = the proportion of prior arrests that led to a conviction

aq:c: = the average sentence served from prior convictions (in months)

totti:c = months spent in prison since age 18 prior to 1986

jti:c86 = months spent in prison in 1986

c:j86 = the number of quarters (0 to 4) that the man was legally employed in 1986

The data set is in CRIME1.DTA.

(a) Estimate this model by OLS and verify that all tted values are strictly between

zero and one. What are the smallest and largest tted values?

(b) Estimate the equation by weighted least squares, as discussed in Section 8.5 of

Wooldridge.

(c) Use the WLS estimates to determine whether aq:c: and totti:c are jointly

signicant at the 5% level.

SOLUTION:

You will have to rst create the arr86 variable:

gen arr86 = 0

replace arr86 = 1 if narr86 0

10

(a)

Source | SS df MS Number of obs = 2725

-------------+------------------------------ F( 5, 2719) = 27.03

Model | 25.8452455 5 5.16904909 Prob > F = 0.0000

Residual | 519.971268 2719 .191236215 R-squared = 0.0474

-------------+------------------------------ Adj R-squared = 0.0456

Total | 545.816514 2724 .20037317 Root MSE = .43731

------------------------------------------------------------------------------

arr86 | Coef. Std. Err. t P>|t| [95% Conf. Interval]

-------------+----------------------------------------------------------------

pcnv | -.1624448 .0212368 -7.65 0.000 -.2040866 -.120803

avgsen | .0061127 .006452 0.95 0.344 -.0065385 .018764

tottime | -.0022616 .0049781 -0.45 0.650 -.0120229 .0074997

ptime86 | -.0219664 .0046349 -4.74 0.000 -.0310547 -.0128781

qemp86 | -.0428294 .0054046 -7.92 0.000 -.0534268 -.0322319

_cons | .4406154 .0172329 25.57 0.000 .4068246 .4744063

------------------------------------------------------------------------------

Stata commands to get the tted values and check that they lie between zero

and one:

predict arr86hat

sum arr86hat

Variable | Obs Mean Std. Dev. Min Max

-------------+--------------------------------------------------------

arr86hat | 2725 .2770642 .0974062 .0066431 .5576897

All the tted values are between zero and one. The smallest tted value is

0.0066431 and the largest tted value is 0.5576897.

(b) The estimated heteroskedasticity function for each observation i is

/

i

=

\

arr86

i

_

1

\

arr86

i

_

, which is strictly between zero and one because 0 <

\

arr86

i

< 1 for all i. The weights for WLS are 1,

/

i

. We transform all the

variables (including the intercept) by multiplying each variable by 1,

_

/

i

. Then

we run OLS using the transformed variables to get the WLS estimates:

Stata commands to do this easily:

gen hhat = arr86hat * (1 - arr86hat)

reg arr86 pcnv avgsen tottime ptime86 qemp86 [aw = 1/hhat]

11

(sum of wgt is 1.5961e+04)

Source | SS df MS Number of obs = 2725

-------------+------------------------------ F( 5, 2719) = 43.70

Model | 36.631818 5 7.3263636 Prob > F = 0.0000

Residual | 455.826896 2719 .167645052 R-squared = 0.0744

-------------+------------------------------ Adj R-squared = 0.0727

Total | 492.458714 2724 .180785137 Root MSE = .40944

------------------------------------------------------------------------------

arr86 | Coef. Std. Err. t P>|t| [95% Conf. Interval]

-------------+----------------------------------------------------------------

pcnv | -.1678436 .0189122 -8.87 0.000 -.2049272 -.13076

avgsen | .0053665 .0051146 1.05 0.294 -.0046624 .0153954

tottime | -.0017615 .0032514 -0.54 0.588 -.008137 .004614

ptime86 | -.0246188 .0030451 -8.08 0.000 -.0305898 -.0186479

qemp86 | -.0451885 .0054225 -8.33 0.000 -.0558212 -.0345558

_cons | .4475965 .0179922 24.88 0.000 .4123167 .4828763

------------------------------------------------------------------------------

(c) Stata command: test avgsen tottime

( 1) avgsen = 0

( 2) tottime = 0

F( 2, 2719) = 0.88

Prob > F = 0.4129

We cannot reject the null hypothesis and conclude that aq:c: and totti:c are

not jointly signicant at the 5% level of signicance.

3. Use the data in WAGE1.DTA for this question.

(a) Estimate the equation

wage = ,

0

+ ,

1

educ + ,

2

exper + ,

3

tenure + n.

Save the residuals and plot a histogram.

(b) Repeat part (a) but with log (naqc) as the dependent variable.

(c) Would you say that Assumption MLR.6 in Wooldridge (Normality) is closer to

being satised for the level-level model or the log-level model?

SOLUTION:

12

(a) reg wage educ exper tenure

predict uhat, resid

histogram uhat, normal

Source | SS df MS Number of obs = 526

-------------+------------------------------ F( 3, 522) = 76.87

Model | 2194.1116 3 731.370532 Prob > F = 0.0000

Residual | 4966.30269 522 9.51398984 R-squared = 0.3064

-------------+------------------------------ Adj R-squared = 0.3024

Total | 7160.41429 525 13.6388844 Root MSE = 3.0845

------------------------------------------------------------------------------

wage | Coef. Std. Err. t P>|t| [95% Conf. Interval]

-------------+----------------------------------------------------------------

educ | .5989651 .0512835 11.68 0.000 .4982176 .6997126

exper | .0223395 .0120568 1.85 0.064 -.0013464 .0460254

tenure | .1692687 .0216446 7.82 0.000 .1267474 .2117899

_cons | -2.872735 .7289643 -3.94 0.000 -4.304799 -1.440671

------------------------------------------------------------------------------

Use the Stata command histogram varname, normal to generate a histogram

of varname with the normal density overlaid.

13

(b)

Source | SS df MS Number of obs = 526

-------------+------------------------------ F( 3, 522) = 80.39

Model | 46.8741776 3 15.6247259 Prob > F = 0.0000

Residual | 101.455574 522 .194359337 R-squared = 0.3160

-------------+------------------------------ Adj R-squared = 0.3121

Total | 148.329751 525 .28253286 Root MSE = .44086

------------------------------------------------------------------------------

lwage | Coef. Std. Err. t P>|t| [95% Conf. Interval]

-------------+----------------------------------------------------------------

educ | .092029 .0073299 12.56 0.000 .0776292 .1064288

exper | .0041211 .0017233 2.39 0.017 .0007357 .0075065

tenure | .0220672 .0030936 7.13 0.000 .0159897 .0281448

_cons | .2843595 .1041904 2.73 0.007 .0796756 .4890435

------------------------------------------------------------------------------

(c) The residuals from the log(naqc) regression appear to be more normally dis-

tributed. Certainly the histogram in part (b) ts under its comparable normal

density better than in part (a), and the histogram for the naqc residuals is

notably skewed to the left. In the naqc regression there are some very large

residuals (roughly equal to 15) that lie almost ve estimated standard deviations

14

( o = 3.085) from the mean of the residuals, which is identically zero, of course.

Residuals far from zero does not appear to be nearly as much of a problem in

the log(naqc) regression.

4. Use the data in CHARITY.DTA for this question.

(a) Using all 4,268 observations, estimate the equation

qi)t = ,

0

+ ,

1

:ai|:jcar + ,

2

qi)t|a:t + ,

3

jrojrc:j + n

and interpret your results in full.

(b) Reestimate the equation in part (a), using the rst 2,134 observations.

(c) Find the ratio of the standard errors on

,

2

from parts (a) and (b). Compare

this with the result from equation (5.10) on page 175 of Wooldridge.

SOLUTION:

(a)

Source | SS df MS Number of obs = 4268

-------------+------------------------------ F( 3, 4264) = 129.26

Model | 80700.7052 3 26900.2351 Prob > F = 0.0000

Residual | 887399.134 4264 208.114244 R-squared = 0.0834

-------------+------------------------------ Adj R-squared = 0.0827

Total | 968099.84 4267 226.880675 Root MSE = 14.426

------------------------------------------------------------------------------

gift | Coef. Std. Err. t P>|t| [95% Conf. Interval]

-------------+----------------------------------------------------------------

mailsyear | 2.166259 .3319271 6.53 0.000 1.515509 2.817009

giftlast | .0059265 .0014324 4.14 0.000 .0031184 .0087347

propresp | 15.35861 .8745394 17.56 0.000 13.64405 17.07316

_cons | -4.551518 .8030336 -5.67 0.000 -6.125882 -2.977155

------------------------------------------------------------------------------

15

(b) Stata command: reg gift mailsyear giftlast propresp in 1/2134

Source | SS df MS Number of obs = 2134

-------------+------------------------------ F( 3, 2130) = 44.95

Model | 37014.4346 3 12338.1449 Prob > F = 0.0000

Residual | 584626.368 2130 274.472473 R-squared = 0.0595

-------------+------------------------------ Adj R-squared = 0.0582

Total | 621640.803 2133 291.439664 Root MSE = 16.567

------------------------------------------------------------------------------

gift | Coef. Std. Err. t P>|t| [95% Conf. Interval]

-------------+----------------------------------------------------------------

mailsyear | 4.975756 .9807182 5.07 0.000 3.052491 6.899021

giftlast | .0040329 .0016511 2.44 0.015 .000795 .0072708

propresp | 14.03846 1.566064 8.96 0.000 10.96729 17.10963

_cons | -10.40117 2.419694 -4.30 0.000 -15.14638 -5.655958

------------------------------------------------------------------------------

(c) The ratio of the standard error of

,

2

using 2,134 observations to that using 4,268

observations is

0.0016511

0.0014324

= 1.1527. From (5.10) we compute

_

4268

2134

= 1.4142,

which is somewhat below the ratio of the actual standard errors.

16

You might also like

- Introductory Econometrics Test BankDocument106 pagesIntroductory Econometrics Test BankMinh Hạnhx CandyNo ratings yet

- 1 Econreview-QuestionsDocument26 pages1 Econreview-QuestionsgleniaNo ratings yet

- Answers Review Questions Econometrics PDFDocument59 pagesAnswers Review Questions Econometrics PDFJohn Paul Tuohy93% (14)

- Ch25 ExercisesDocument16 pagesCh25 Exercisesamisha2562585No ratings yet

- 1 Econreview-QuestionsDocument26 pages1 Econreview-QuestionsgleniaNo ratings yet

- Chapter 4 Solutions Solution Manual Introductory Econometrics For FinanceDocument5 pagesChapter 4 Solutions Solution Manual Introductory Econometrics For FinanceNazim Uddin MahmudNo ratings yet

- Problem Set 5Document5 pagesProblem Set 5Sila KapsataNo ratings yet

- Assignment EMET8005Document3 pagesAssignment EMET8005mozNo ratings yet

- Econometrics Assignment 1Document3 pagesEconometrics Assignment 1Peter Chenza50% (2)

- Using Econometrics A Practical Guide 6th Edition Studenmund Solutions ManualDocument11 pagesUsing Econometrics A Practical Guide 6th Edition Studenmund Solutions ManualDebraChambersrimbo100% (21)

- PS2Document2 pagesPS2Toulouse18No ratings yet

- Stat 305 Final Practice - SolutionsDocument10 pagesStat 305 Final Practice - SolutionsMorgan SanchezNo ratings yet

- Using Econometrics A Practical Guide 6th Edition Studenmund Solutions ManualDocument36 pagesUsing Econometrics A Practical Guide 6th Edition Studenmund Solutions Manualdianelambkqvbvt100% (16)

- ECTX 2004: Econometrics - I: Section - I (1 Point Each)Document3 pagesECTX 2004: Econometrics - I: Section - I (1 Point Each)Ajay ChiratlaNo ratings yet

- Read Bilingual Book The Count of Monte CristoDocument2 pagesRead Bilingual Book The Count of Monte Cristoagonza70No ratings yet

- Free Online French Classes and ResourcesDocument15 pagesFree Online French Classes and Resourcesagonza70No ratings yet

- Data Mining With SPSS Modeler Theory, Exercises and Solutions (2016) by Tilo Wendler PDFDocument1,068 pagesData Mining With SPSS Modeler Theory, Exercises and Solutions (2016) by Tilo Wendler PDFvinodhknatrajanNo ratings yet

- MAS 766: Linear Models: Regression Spring 2020 Team Assignment #3 Due: Wed. Apr 8. 2020Document7 pagesMAS 766: Linear Models: Regression Spring 2020 Team Assignment #3 Due: Wed. Apr 8. 2020Aashna MehtaNo ratings yet

- Logistic Regression Quiz: Pandas Version: 1.0.5 Seaborn Version: 0.10.1 Matplotlib Version: 3.2.1 Sklearn Version: 0.23.1Document1 pageLogistic Regression Quiz: Pandas Version: 1.0.5 Seaborn Version: 0.10.1 Matplotlib Version: 3.2.1 Sklearn Version: 0.23.1AbhijitSinha0% (1)

- Mid Term UmtDocument4 pagesMid Term Umtfazalulbasit9796No ratings yet

- 1 Econreview-QuestionsDocument26 pages1 Econreview-QuestionsgleniaNo ratings yet

- Heteroscedasticity IssueDocument3 pagesHeteroscedasticity IssueShadman Sakib100% (2)

- Introduction To Econometrics, TutorialDocument19 pagesIntroduction To Econometrics, Tutorialagonza70No ratings yet

- Past Paper 2019Document7 pagesPast Paper 2019Choco CheapNo ratings yet

- Dummy Variable Regression Models 9.1:, Gujarati and PorterDocument18 pagesDummy Variable Regression Models 9.1:, Gujarati and PorterTân DươngNo ratings yet

- Exam EmpiricalMethods2SAMPLE 120323Document8 pagesExam EmpiricalMethods2SAMPLE 120323John DoeNo ratings yet

- Chapter4 SolutionsDocument5 pagesChapter4 SolutionsLan HươngNo ratings yet

- SEM 4 - 10 - BA-BSc - HONS - ECONOMICS - CC-10 - INTRODUCTORYECONOMETRI C - 10957Document3 pagesSEM 4 - 10 - BA-BSc - HONS - ECONOMICS - CC-10 - INTRODUCTORYECONOMETRI C - 10957PranjalNo ratings yet

- Chapter3 SolutionsDocument5 pagesChapter3 SolutionsAi Lian TanNo ratings yet

- Tutorial 9Document19 pagesTutorial 9Trang Nguyễn Ngọc ThiênNo ratings yet

- ps8 +fall2013Document6 pagesps8 +fall2013Patrick BensonNo ratings yet

- Econometrics Sheet 2B MR 2024Document5 pagesEconometrics Sheet 2B MR 2024rrrrokayaaashrafNo ratings yet

- Multiple Choice Sample QuestionsDocument3 pagesMultiple Choice Sample QuestionsNguyn Lại QuengNo ratings yet

- Ch26 ExercisesDocument14 pagesCh26 Exercisesamisha2562585No ratings yet

- HW1 (Practice Problem Set) - 1Document6 pagesHW1 (Practice Problem Set) - 1Beta WaysNo ratings yet

- Homework Chapter 12: Serial Correlation and Heteroskedasticity in Time Series RegressionsDocument2 pagesHomework Chapter 12: Serial Correlation and Heteroskedasticity in Time Series RegressionskNo ratings yet

- Midterm PrinciplesDocument8 pagesMidterm Principlesarshad_pmadNo ratings yet

- Econometrics ExamDocument8 pagesEconometrics Examprnh88No ratings yet

- PS5 SolutionDocument5 pagesPS5 SolutionGuido GilliNo ratings yet

- Multiple Choice Sample QuestionsDocument3 pagesMultiple Choice Sample QuestionsthuyvuNo ratings yet

- Aff700 1000 220401Document8 pagesAff700 1000 220401nnajichinedu20No ratings yet

- ECON 601 - Module 4 PS - Solutions - FA 19 PDFDocument11 pagesECON 601 - Module 4 PS - Solutions - FA 19 PDFTamzid IslamNo ratings yet

- ECN Exam 2006 07Document7 pagesECN Exam 2006 07targetthisNo ratings yet

- HW Iii PDFDocument8 pagesHW Iii PDFAnonymous os8J9RNo ratings yet

- Basic Econometrics 5Th Edition Gujarati Solutions Manual Full Chapter PDFDocument40 pagesBasic Econometrics 5Th Edition Gujarati Solutions Manual Full Chapter PDFJoshuaJohnsonwxog100% (13)

- ECONODocument19 pagesECONONoman Moin Ud DinNo ratings yet

- Introductory Econometrics For Finance Chris Brooks Solutions To Review - Chapter 3Document7 pagesIntroductory Econometrics For Finance Chris Brooks Solutions To Review - Chapter 3Bill Ramos100% (2)

- Multiple Choice - Chow Test Parameter StabilityDocument9 pagesMultiple Choice - Chow Test Parameter StabilityΛένια ΙωσηφίδηNo ratings yet

- Exercises Units 1,2,3Document8 pagesExercises Units 1,2,3Eduardo MuñozNo ratings yet

- Exam AFF700 211210 - SolutionsDocument11 pagesExam AFF700 211210 - Solutionsnnajichinedu20No ratings yet

- Final Assignment: 1 InstructionsDocument5 pagesFinal Assignment: 1 InstructionsLanjun ShaoNo ratings yet

- Test Your Knowledge of Linear Regression and PCA in RDocument7 pagesTest Your Knowledge of Linear Regression and PCA in RChong Jun WeiNo ratings yet

- Simple Linear RegressionDocument31 pagesSimple Linear RegressionturnernpNo ratings yet

- Appendix Nonlinear RegressionDocument5 pagesAppendix Nonlinear RegressionSanjay KumarNo ratings yet

- MS4610 - Introduction To Data Analytics Final Exam Date: November 24, 2021, Duration: 1 Hour, Max Marks: 75Document11 pagesMS4610 - Introduction To Data Analytics Final Exam Date: November 24, 2021, Duration: 1 Hour, Max Marks: 75Mohd SaudNo ratings yet

- Answers Review Questions EconometricsDocument59 pagesAnswers Review Questions EconometricsZX Lee84% (25)

- Part A Multiple Choice (10 Marks)Document16 pagesPart A Multiple Choice (10 Marks)enticoNo ratings yet

- Econometrics ProjectDocument10 pagesEconometrics ProjectCarlos Ferreira100% (1)

- Pes1ug22cs841 Sudeep G Lab1Document37 pagesPes1ug22cs841 Sudeep G Lab1nishkarshNo ratings yet

- Exercises 4,5,6,7+test CanvasDocument5 pagesExercises 4,5,6,7+test CanvasEduardo MuñozNo ratings yet

- Stat 401B Final Exam F16Document13 pagesStat 401B Final Exam F16juanEs2374pNo ratings yet

- An Introduction to Envelopes: Dimension Reduction for Efficient Estimation in Multivariate StatisticsFrom EverandAn Introduction to Envelopes: Dimension Reduction for Efficient Estimation in Multivariate StatisticsNo ratings yet

- Basic French ConversationDocument11 pagesBasic French Conversationagonza70100% (1)

- Tripartite Classification of Authority - WikipediaDocument1 pageTripartite Classification of Authority - Wikipediaagonza70No ratings yet

- The Business of Voluntourism - Do Western Do-Gooders Actually Do Harm - Volunteering - The GuardianDocument27 pagesThe Business of Voluntourism - Do Western Do-Gooders Actually Do Harm - Volunteering - The Guardianagonza70No ratings yet

- YSK A Lot of The Volunteer Abroad Companies Are Scams. - R - YouShouldKnowDocument5 pagesYSK A Lot of The Volunteer Abroad Companies Are Scams. - R - YouShouldKnowagonza70No ratings yet

- Charismatic Authority - WikipediaDocument1 pageCharismatic Authority - Wikipediaagonza70No ratings yet

- How To Learn German SmarterDocument1 pageHow To Learn German Smarteragonza70No ratings yet

- French Picture Dictionary With AudioDocument3 pagesFrench Picture Dictionary With Audioagonza70No ratings yet

- 6 French Visual Dictionaries To Take Your Vocab Study Up A NotchDocument8 pages6 French Visual Dictionaries To Take Your Vocab Study Up A Notchagonza70No ratings yet

- The 9 Best Free Online French Lessons Beyond Duolingo: April Sale! Get 40% Off + 10 Languages + 14 Day Free TrialDocument17 pagesThe 9 Best Free Online French Lessons Beyond Duolingo: April Sale! Get 40% Off + 10 Languages + 14 Day Free Trialagonza70No ratings yet

- ECON 370 Quantitative Economics With Python: Lecture 4: Python Fundamentals (Part 2)Document18 pagesECON 370 Quantitative Economics With Python: Lecture 4: Python Fundamentals (Part 2)agonza70No ratings yet

- How To Find The Perfect French Language Exchange Partner: April Sale! Get 40% Off + 10 Languages + 14 Day Free TrialDocument8 pagesHow To Find The Perfect French Language Exchange Partner: April Sale! Get 40% Off + 10 Languages + 14 Day Free Trialagonza70No ratings yet

- If You Follow His Strategies, You Will Pass The CPA ExamsDocument4 pagesIf You Follow His Strategies, You Will Pass The CPA Examsagonza70No ratings yet

- Bujinkan Kocho Dojo - Ninja and Samurai Martial ArtsDocument2 pagesBujinkan Kocho Dojo - Ninja and Samurai Martial Artsagonza70No ratings yet

- The 15 Best Websites and Apps For French Conversation PracticeDocument17 pagesThe 15 Best Websites and Apps For French Conversation Practiceagonza70No ratings yet

- Practice Speaking French Online With The Tandem AppDocument10 pagesPractice Speaking French Online With The Tandem Appagonza70No ratings yet

- Handout5 PDFDocument1 pageHandout5 PDFagonza70No ratings yet

- Stoicism (Link) : OriginsDocument6 pagesStoicism (Link) : Originsagonza70No ratings yet

- ECON 370 Quantitative Economics With PythonDocument35 pagesECON 370 Quantitative Economics With Pythonagonza70No ratings yet

- ECON 370 Quantitative Economics With PythonDocument16 pagesECON 370 Quantitative Economics With Pythonagonza70No ratings yet

- Handout3 PDFDocument1 pageHandout3 PDFagonza70No ratings yet

- Jawline Exercises - 5 Moves For Definition PDFDocument5 pagesJawline Exercises - 5 Moves For Definition PDFagonza70No ratings yet

- ECON-UA 370 Quantitative Econ With Python: Lecture 1: IntroductionDocument15 pagesECON-UA 370 Quantitative Econ With Python: Lecture 1: Introductionagonza70No ratings yet

- How Intelligent Is Bill ClintonDocument4 pagesHow Intelligent Is Bill Clintonagonza70No ratings yet

- Jawline Exercises - 5 Moves For Definition PDFDocument5 pagesJawline Exercises - 5 Moves For Definition PDFagonza70No ratings yet

- Linear Algebra DefinitionsDocument1 pageLinear Algebra Definitionsagonza70No ratings yet

- Mathispower4u PDFDocument3 pagesMathispower4u PDFagonza70No ratings yet

- Equations and Formula of Conic SectionsDocument6 pagesEquations and Formula of Conic Sectionsagonza70No ratings yet

- Functions Vs Relations Review NotesDocument7 pagesFunctions Vs Relations Review Notesagonza70No ratings yet

- To Present Facts in Definite Form: Quiz1, Short Quiz1 and Assignment1Document25 pagesTo Present Facts in Definite Form: Quiz1, Short Quiz1 and Assignment1chrisitan delarosaNo ratings yet

- Introduction To Google Earth Engine: Warren Scott February 24, 2021Document32 pagesIntroduction To Google Earth Engine: Warren Scott February 24, 2021ilmiNo ratings yet

- Chapter 6 Investigating DataDocument60 pagesChapter 6 Investigating DataJojobaby51714No ratings yet

- DNV RP-F206 Riser Integrity Management 2008-04Document66 pagesDNV RP-F206 Riser Integrity Management 2008-04vjourNo ratings yet

- Nama: Rienaldy Wienanto NIM: H4401201071 Matkul: Ekonometrika Tugas 6Document5 pagesNama: Rienaldy Wienanto NIM: H4401201071 Matkul: Ekonometrika Tugas 6Rienaldy WienantoNo ratings yet

- Human Factors That Contribute To Maritime Accidents Involving Oil TankersDocument7 pagesHuman Factors That Contribute To Maritime Accidents Involving Oil TankersAli AliyevNo ratings yet

- Impact of Exotic Pastures On Epigeic Arthropod Diversity and Contribution of Native and Exotic PlantDocument10 pagesImpact of Exotic Pastures On Epigeic Arthropod Diversity and Contribution of Native and Exotic PlantDomingas RosaNo ratings yet

- E-Cigarettes Lesson PlannersDocument19 pagesE-Cigarettes Lesson Plannersapi-544875454No ratings yet

- Chapter 04 Dimension Reduction (R)Document27 pagesChapter 04 Dimension Reduction (R)hasanNo ratings yet

- Econ 3180 Final Exam, April 15th 2013 Ryan GodwinDocument14 pagesEcon 3180 Final Exam, April 15th 2013 Ryan GodwinsehunNo ratings yet

- JRST-Inquiry-based Science Instruction - What Is It and Does It Matter - Results From A Research Synthesis Years 1984 To 2002Document24 pagesJRST-Inquiry-based Science Instruction - What Is It and Does It Matter - Results From A Research Synthesis Years 1984 To 2002Wahab AbdullahNo ratings yet

- Analysis of Variance and Contrasts: Ken Kelley's Class NotesDocument104 pagesAnalysis of Variance and Contrasts: Ken Kelley's Class Notessatyam dwivediNo ratings yet

- Echem Analyst Software ManualDocument42 pagesEchem Analyst Software ManualHsyn ZngnNo ratings yet

- IT SkillsDocument32 pagesIT SkillsUdbhav SharmaNo ratings yet

- Career TrackingDocument15 pagesCareer TrackingJEN CANTOMAYORNo ratings yet

- ALMIRA ZANDRA P - ECM-dikonversiDocument19 pagesALMIRA ZANDRA P - ECM-dikonversiMUHAMMAD NABIL ROWIYANNo ratings yet

- ProjectDocument52 pagesProjectRakesh0% (1)

- DWMDocument9 pagesDWMmanasi sawantNo ratings yet

- A. Install Relevant Package For Classification. B. Choose Classifier For Classification Problem. C. Evaluate The Performance of ClassifierDocument10 pagesA. Install Relevant Package For Classification. B. Choose Classifier For Classification Problem. C. Evaluate The Performance of ClassifierRenukaNo ratings yet

- Statistical Treatment (Part of Module 4Document56 pagesStatistical Treatment (Part of Module 4Ruby Liza CapateNo ratings yet

- Bio StatisticsDocument97 pagesBio StatisticsAME DENTAL COLLEGE RAICHUR, KARNATAKANo ratings yet

- Statistical Instruments and References Writing in ResearchDocument36 pagesStatistical Instruments and References Writing in ResearchLhoy Guisihan Asoy IdulsaNo ratings yet

- Health Insurance Nonlife Commercial Data Analysis Report 201617Document14 pagesHealth Insurance Nonlife Commercial Data Analysis Report 201617Mayank AamseekNo ratings yet

- Project Proposal Road SaftyDocument43 pagesProject Proposal Road Saftychile100% (2)

- Data Analytics Learning PlanDocument3 pagesData Analytics Learning PlanArpit GaurNo ratings yet

- Penggunaan Assosiation Rule Mining Dalam Penetapan Harga Promosi, Stok, Dan Penataan Produk Pada EtalaseDocument11 pagesPenggunaan Assosiation Rule Mining Dalam Penetapan Harga Promosi, Stok, Dan Penataan Produk Pada EtalaseifaNo ratings yet

- CH 5 RegressionDocument6 pagesCH 5 RegressionPoint BlankNo ratings yet