Professional Documents

Culture Documents

Important Foreclosure Cases Federal & State & Their Summaries Complements of A Grant From The Ag Settlement of California-Kamala Harris

Uploaded by

83jjmackOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Important Foreclosure Cases Federal & State & Their Summaries Complements of A Grant From The Ag Settlement of California-Kamala Harris

Uploaded by

83jjmackCopyright:

Available Formats

Global Literary MarketplaceForeclosure Fraud Defense by Grace Adams 16.

May 2013 Foreclosure cases in CA / Foreclosure Case Summaries (May 2012 May 2013) Filed under: FDCPA,Fraudulent Mortgage Lending Practices,fraudulent mortgages,fraudulent transfer,unfair bank practices,wrongful foreclosure Tags: HOLA,post-sale statutory duty admin @ 16:51 Foreclosure Case Summaries (May 2012 May 2013) State Cases: Multani v. Witkin & Neal, __ Cal. App. 4th __, 2013 WL 1818613 (May 1, 2013): HOAs pre-sale notices do not absolve them of their post-sale statutory duty to notify homeowner of a 90-day redemption period (CCP 729.050). HOAs failure to comply with 729.050 may be grounds to set aside the FC sale (remanded to trial court). In addition, no tender is required because imposing one would financially bar most potential plaintiffs, rendering 729.050 ineffectual. Therefore, a debtor is properly excused from complying with the tender requirement where the nonjudicial foreclosure is subject to a statutory right of redemption and the trustee has failed to provide the notice required under section 729.050.

West v. JP Morgan Chase Bank, N.A., 214 Cal. App. 4th 780 (2013): Homeowners compliance with trial period plan (TPP) contractually requires servicer to offer a permanent loan modification (Wigod v. Wells Fargo Bank, N.A., 673 F.3d 547, 556-57 (7th Cir. 2012)). That contractual obligation does not require express language in a TPP agreement, but is imposed through HAMP Supplemental Directive 09-01 (Apr. 6, 2009). A promissory estoppel claim is also possible in a TPP arrangement because the lender promises to offer a permanent loan modification if borrower fulfills TPP requirements. If borrower complies with the TPP, they forgo other options to their detriment, fulfilling another requirement of a PE claim. (Wigod, 673 F.3d at 566). A California unfair competition claim is also possible where lender holds out to the public that TPPs offered are HAMP compliant.

Intengan v. BAC Home Loans Servicing LP, 214 Cal. App. 4th 1047 (2013): A court may take judicial notice of the existence of a declaration from a servicer asserting compliance with the notice requirements in former CC 2923.5, but cannot take judicial notice of the contents of that declaration. Ifdisputed by the borrower, it is a matter of fact to be determined at trial whether or not a servicer actually attempted to make contact with the borrower 30 days prior to recording a notice of default. At trial, a finding of noncompliance with 2923.5 would only delay the foreclosure sale until the servicer became compliant.

Akopyan v. Wells Fargo Home Mortg., Inc.,___Cal.Rptr.3d ___, 2013 WL 1352018 (Apr. 4, 2013): Federal banking laws preempt California restrictions (Cal. Bus. & Prof. Code 10242.5) on late charges when a national bank or federal savings association is servicing a mortgage loan,even when the bank or savings association did not originate the loan.Under HOLA, the OTS meant to occupy the field, negating a claim based on wrongful late fees. (Note: the Dodd-Frank Act got rid of this field preemption for post2011 transactions). Under NBA, the OCC does not claim field preemption, but plaintiffs claim of wrongful late fees fails anyways because a states regulation of late fees significantly interferes with the banks powers under NBA.

Jolley v. Chase Home Fin., LLC., 213 Cal. App. 4th 872 (2012): Substantive information and contents of documents taken from websites, even official government websites, do not deserve judicial notice under California evidentiary rules, even where there are no factual disputes over the content or substance of the documents.

HAMP, the former California CC 2923.5 & 2923.6, and HBOR all reflect the general attitude of legislatures that banks should be required to work with borrowers to modify their loans and avoid foreclosure. As to a negligence claim, these policy considerations indicate[] that courts should not rely mechanically on the general rule that lenders owe no duty of care to their borrowers. Several recent federal cases have correctly found a duty of care arising from modification negotiations where a lender promises a modification through one channel, and then uses another to foreclose or otherwise deny a modification (dual tracking). Notably,

Jolley finds a duty of care after Ragland (below) failed to find one between a borrower and lender in a similar dual tracking scenario.

Pfeifer v. Countrywide Home Loans, 211 Cal. App. 4th 1250 (2012): Deeds of trust in FHA insured mortgages incorporate by reference HUD servicing requirements (express in the note and mortgage), which servicers must comply with before nonjudicial foreclosure. Mathews v. PHH Mortg. Corp., 283 Va.

723 (2012). One of those requirements is a face-to-face meeting between the borrower and servicer. That this meeting requirement is not expressly listed in HUDs loss mitigation measures does not render it optional or immaterial. Without this meeting (or attempt to make contact) the lender is prevented from initiating foreclosure proceedings. 24 C.F.R. 203.604. Tender is not required in these situations and where the borrower is bringing a defensive action to enjoin a foreclosure sale. A completed foreclosure sale could not be voided using this claim.

The act of foreclosure, by itself, does not constitute debt collection under the FDCPA. Nor does the notification of a pending foreclosure sale constitute a debt collection activity. Simply listing the amount owed in the sale notice does not create a debt collection relationship between the lenders trustee and the borrower under the FDCPA. A trustee whose only role is to carry out the foreclosure process does not constitute a debt collector as defined by the FDCPA and it cannot be sued under that Act.

Barroso v. Ocwen Loan Servicing, 208 Cal. App. 4th 1001 (2012): In a breach of contract claim involving a permanent loan modification, express language requiring lender to send the executed agreement signed by both parties to the borrower is not a condition precedent to the formation of that contract. That interpretation would defeat both the spirit of the contract and the express language guaranteeing a HAMP modification when all the terms in the TPP are met. When a borrower signs and otherwise fulfills the demands of the contract, the contract is formed, even without lenders signature or delivery of the contract to borrower. The servicer who foreclosed on a borrower with a permanent loan modification agreement is also subject to a wrongful foreclosure claim.

Skov v. U.S. Bank Natl Assn, 207 Cal. App. 4th 690 (2012): As Intengan later confirmed, it may be appropriate to take judicial notice of the existence of a lenders declaration that it complied with notice requirements in former CC. 2923.5. It is inappropriate, however, to take judicial notice of the validity of that declaration or of the contents of that declaration, where borrower disputes those aspects. An individual borrower had a private right of action under CC 2923.5. Without one, the statute would have been meaningless. It was capable of postponing a foreclosure sale, but not voiding one.

OCC regulations, through the National Bank Act, do not preempt former CC 2923.5. Foreclosure regulations, including those associated with notice, have traditionally been left to the states, and the OCC could have expressly preempted state foreclosure law but it did not. The requirements of 2923.5 are not onerous on the banks and do not require them to enter into modification agreements with borrowers, which would create a preemption scenario.

Cadlerock Joint Venture, L.P. v. Lobel, 206 Cal. App. 4th 1531 (2012): If the lender of both the senior and junior lien on the same property assigns the junior lien to a different entity soon after its origination, that second entity and holder of the junior lien can go after the borrower for the deficiency after a foreclosure of the senior lien. In other words, this junior lien holder is not bound by the 580d antideficiency statute, or case law forbidding such conduct when the junior lien is assigned after the trustees sale of the senior lien. There is no definite time period by which to judge how quickly after origination the senior lien holder must assign the junior lien to ensure their right to sue for the deficiency, but it must be clear that the two loans were not created . . . as an artifice to evade section 580d.

Ragland v. U.S. Bank Natl Assn, 209 Cal. App. 4th 182 (2012): Summary judgment in favor of a lender is inappropriate based on borrowers inability to tender the amount due when that inability is due solely to improperly imposed late fees and assessments. Late fees and assessments could be improper when, as in this case, the lenders agents improperly instructed borrower to withhold mortgage payments.

CC 2924(g)(d) prevents foreclosure sales from happening in the seven days following either a dismissal of an action brought by the borrower, or the expiration of a TRO or court-ordered postponement. There is a private right of action implied in CC 2924(g)(d), as it would be rendered useless without one. Sec. 2924(g)(d) is not preempted by federal law. As part of a state foreclosure scheme, the statute does not deal with loan servicing and therefore falls outside of the preemption envisioned by the Home Owners Loan Act.

Wrongful foreclosure may give rise to a claim for intentional infliction of emotional distress. A claim of negligent infliction of emotional distress, however, cannot prevail without establishing a duty owed by the lender to the borrower. In arms length transactions, there is no fiduciary duty between those two parties. Even when a lenders agents advise a borrower to withhold payment, that advice falls within the scope of normal money-lender activity and does not, by itself, create a fiduciary duty that would give rise to a NIED claim.

Herrera v. Fed. Natl Mortg. Assn, 205 Cal. App. 4th 1495 (2012): Affirms California case law finding that MERS, as nominee and beneficiary of lender, has the power to assign lenders interests. That power stems from the lender signing the deed of trust over to MERS. Any assignment from MERS to a second entity does not require an agency agreement or relationship. Also, the promissory note (debt) and DOT

(security) do not have to travel together. If a lender assigns the note to a second entity, that second entity could have the power to foreclose regardless of whether it was also assigned the DOT by MERS.

CC 2932.5 requires an assignee to record the assignment of a mortgage before they sell or foreclose on the property. Sec. 2932.5 is inapplicable in the case of deeds of trust, however; there is no similar requirement demanding that the assignee of a deed of trust record the assignment before invoking their power to sell or foreclose.

Heritage Pacific Fin., LLC v. Monroy, __ Cal. App. __, 2013 WL 1779278 (Mar. 29, 2013): The assignee of a promissory note is not assigned the right to bring tort claims against the borrower on the note if that right is not explicitly part of the assignment. No California legal authority [has] held that the assignment of a promissory note automatically constituted an assignment of a lenders fraud claims. Communications made by the assignee to the borrower claiming otherwise may violate the FDCPA (if all other conditions are met). For the purposes of the FDCPA, tort claims can be considered debts.

If the assignee was assigned a second lienafter the first lien foreclosed, the second lien is extinguished and the assignee is prevented from collecting the balance of their loan due to anti-deficiency statutes. If the assignee nevertheless sends the borrower notices that they wish to collect the second lien, those notices may also violate the FDCPA as false and deceptive attempts to collect a debt.

Aurora Loan Services v. Brown, 2012 WL 6213737 (Cal. App. Div. Super. Ct. July 31, 2012): In an unlawful detainer (UD) action the only issue is whether plaintiff has the authority to possess the property. The only title issue that relates to the possession question is: can plaintiff prove acquisition of title at the trustee sale? Code Civ. Proc. 1161a. Here, defendants put the validity of the title at issue in an effort to reclassify the case from a UD to an unlimited civil action. Code Civ. Proc. 403.040. To qualify as an unlimited civil action, the value of the property in question has to exceed $25,000. Defendants argued that putting the title at issue necessarily raises the amount at stake to the value of the property, which was over $25,000. The court found that alleging improprieties surrounding title and trustee sale do not put the monetary value of the property at issue and the case cannot be reclassified as an unlimited civil action.

Personal service of a Notice to Vacate is adequately attempted under CC 1162 by going to the recipients home or business and trying to make contact. Just one attempt is adequate before a service processor resorts to posting a copy of the Notice on the property and then mailing the Notice (nail and mail). Sec. 1162(a)(3). Service does not need to be attempted at both a residence and a business to be effective. Nor is a plaintiff required to discover defendants place of business. The court, though, admits that nail and mail may not be effective if defendant refuses to attempt personal service at plaintiffs known business address.

As explained further in U.S. Bank v. Cantartzoglou (below), the plaintiff in a UD action has the burden to prove they had the right to foreclose, including perfected title. CC 1161a. Here, the beneficiary and trustee that foreclosed on the property and that were listed in the NOD and NTS were not the same beneficiary and trustee listed on the DOT. Further, Plaintiff offered no evidence that the DOT beneficiary had assigned their interest to the foreclosing beneficiary, or that the DOT beneficiary had substituted a trustee. The court did not accept as relevant a post-NOD and post-NTS recorded Corporate Assignment of Deed of Trust purportedly transferring the DOT from MERS to the foreclosing beneficiary. Without a showing that MERS had an interest in the DOT, a transfer from MERS to another beneficiary does nothing to show perfected title. In this case, the sale was declared void.

U.S. Bank v. Cantartzoglou, 2013 WL 443771 (Cal. App. Div. Super. Ct. Feb. 1, 2013): To bring a UD action a plaintiff must show that they purchased the property at a trustee sale that was compliant with both the relative statutes and the DOT. If the defendant raises questions as to the veracity of title, plaintiff has the affirmative burden to prove true title. The plaintiff must prove every aspect of the UD case, while the defendant has no burden of proof whatsoever. This differs from wrongful foreclosure actions where the homeowner plaintiff has the burden to show that something would void the sale (like an improper assignment).

Federal Cases:

Singh v. Bank of America, 2013 WL 1759863 (E.D. Cal. Apr. 23, 2013) (TRO); 2013 WL 1858436 (E.D. Cal. May 1, 2013) (PI): A preliminary injunction (and a TRO, under the same evaluation) to postpone a foreclosure sale may be appropriate under the new HBOR rule against dual tracking. If a borrower submits a complete application on a first mortgage, the servicer cannot move forward with a notice of default, notice of sale, or an actual trustee sale, while the modification application is pending. CC 2923.6(c) (2013). Here, a lenders failure to respond to a borrowers complete application signaled that negotiations were still pending and triggered 2923.6(c).

Preliminary injunction was ordered because the essential elements were met: 1) borrower was likely to prevail on the merits because lender violated the anti-dual tracking aspect of HBOR ( 2923.6(c)); 2) losing the property at the FC sale would cause irreparable harm to borrower; 3) lender is not inequitably treated the sale might only be delayed, not completely prohibited; and 4) a PI is in the publics best interest because it follows the newly enacted HBOR scheme of laws and regulations which were created to protect the public.

BofA asked that a monthly bond be set at $2,700 per month. The judge instead found a one-time $1,000 bond to be more appropriate. F.R.C.P. 65(c).

Lindberg v. Wells Fargo Bank N.A., 2013 WL 1736785 (N.D. Cal. Apr. 22, 2013): HBOR law CC 2923.6 does not apply when a borrower has failed to submit a complete application to the lender or servicer. Here, borrowers failure to timely respond (30 days) to lenders written request for further documentation prevented her from demonstrating that her application was complete. Because she would neither prevail on the merits, nor could she show that there were serious questions of fact, her motion for preliminary injunction to stop the FC sale failed.

Rex v. Chase Home Fin. LLC, __ F. Supp. 2d __, 2012 WL 5866209 (C.D. Cal Nov. 19, 2012): CCP 580e was passed as an anti-deficiency statute applying to short sales and became effective in July 2011. For sales conducted prior to that date, it may still be possible to prevent a deficiency suit after short sales involving a purchase money loan. This court found CCP 580bs anti-deficiency protections applicable in a short sale for three reasons: 1) 580bs plain language does not qualify the type of sale covered it simply says sale; 2) the legislature passed 580b to stabilize the mortgage market and state economy, goals which would be defeated if lenders could opt for a short sale instead of foreclosure and then contract out of 580b in the short sale agreement; and 3) reading 580b to apply to short sales does not render 580e superfluous. Sec. 580b applies to all modes of sale, but limits the loans involved to

purchase money loans, whereas 580e limits the type of sale to a short sale but does not limit the type of loan.

Gale v. First Franklin Loan Servs., 701 F.3d 1240 (9th Cir. 2012): The TILA provision requiring a servicer to respond to a borrowers request for information pertaining to the owner of the mortgage only applies to servicers who are also assignees of the loan. A servicer does not have the obligation to respond if it is not also an assignee. If the servicer is the original creditor, they are also not obligated. TILA 15 U.S.C. 1641(f)(2).Medrano v. Flagstar Bank, 704 F.3d 661 (9th Cir. 2012)

: RESPA provision 12 U.S.C. 2605(e) requires a servicer to timely respond to a borrowers qualified written request (QWR). A QWR must include the name and account of the borrower and either a statement that the borrower believes the account to include an error (listing the reasons for believing such), or a request for specific information described with sufficient detail. Catalan v. GMAC Mortg. Corp., 629 F.3d 676, 687 (7th Cir. 2011). Additionally, any information sought must relate to the servicing of the loan.

2605(e)(1)(A)-(B). Questions regarding anything that preceded the servicers role (like questions about the loan origination, terms, or validity) do not qualify as servicing. Notably, a request for a modification of the loan terms does not, by itself, amount to a valid QWR that triggers a response under 2605(e). A request for a modification would need to be accompanied by a finding of an error regarding the loans servicing, or by a request of information related to that servicing.

Michel v. Deutsche Bank Trust Co., 2012 WL 4363720 (E.D. Cal. Sept. 20, 2012): When a beneficiary substitutes the trustee of a DOT, that substitution may be valid where the person signing on behalf of the beneficiary does not, in fact, work for the beneficiary. In Michel, the person who signed the substitution held herself out to be a Vice President of the beneficiary. The borrowers argued that she in fact had no real relationship with the beneficiary but was instead employed by an unrelated third party. Many courts have required borrowers to demonstrate in their complaints that a signor lacked the beneficiarys authority to substitute a trustee for the claim to move forward. See Selby v. Bank of Am., Inc., 2011 WL 902182 (S.D. Cal. Mar. 14, 2011). Others, though, have found that simply alleging that the signor lacked this authority is a valid claim and a triable issue of fact.See Tang v. Bank of Am., N.A., 2012 WL 960373 (C.D. Cal. Mar. 19, 2012). The Michel court ruled this issue appropriate for adjudication in summary judgment.

If it were proved that an invalid trustee executed the foreclosure sale, that sale would be void, not voidable.

Winterbower v. Wells Fargo Bank, N.A., 2013 WL 1232997 (C.D. Cal. Mar. 27, 2013): Under HBOR provision CC 2923.6(g), servicers must re-evaluate a borrower for a loan modification when there has been a material change in the borrowers financial circumstances and the borrower submits evidence of that change. Such a re-evaluation would halt the foreclosure process because of HBORs anti dualtracking rule. In documenting changed financial circumstance, borrowers must do more than state the change in broad terms and/or list their new expenses or earnings.

Signatories to the National Mortgage Settlement (including Wells Fargo) are not liable for CC 2923.6 violations as long as they are otherwise compliant with the Settlement.

This court takes care to note that it evaluated the above issues in regards to borrowers request for a preliminary injunction stopping the FC sale. PIs set a high bar for the moving party (see Singh above) and this opinion is not conclusive . . . as to the meaning of relatively new portions of the California Civil Code, and of the meaning of the National Mortgage Settlement.

Weber Living Trust v. Wells Fargo Bank, N.A.

, 2013 WL 1196959 (N.D. Cal., Mar. 25, 2013): HBOR provision CC 2924.15 prohibits dual tracking when the property at issue is the borrowers principal residence. In an action to stop a FC sale rooted in this HBOR claim, the borrower has the burden to prove that their principal residence is the property in question.

Makreas v. First Natl Bank of N. Cal. , 856 F. Supp. 2d 1097 (N.D. Cal. 2012): If a borrower claims that an assignment or substitution of a trustee was backdated to hide the fact that it occurred after the notice of default, it would follow that the assignee or substituted trustee did not have the authority to foreclose, voiding the sale. Tamburri v. Suntrust Mortg. , 2011 WL 6294472 (N.D. Cal. Dec. 15, 2011).

Foreclosure, alone, is not considered a debt collection activity under FDCPA. If a servicer or lender went beyond the foreclosure process though, and engaged in debt collection attempts or threats, that could give rise to a FDCPA claim. A borrower should allege specific instances of debt collection attempts that are separate and distinct from foreclosure activity.

Mena v. JP Morgan Chase Bank, 2012 WL 3987475 (N.D. Cal. Sept. 7, 2012): Judicial notice may be granted to both the existence and the authenticity of certain foreclosure-related documents and government documents if they are not disputed and if they can be verified by public record. Fed. R. Ev. 201(b)(2). This differs from the Jolley courts holding in a state of California case (above) that even official government documents not in dispute do not deserve judicial notice beyond the fact that they exist.

CC 2932.5 does not require a foreclosing beneficiary-assignee to have recorded the assignment of the DOT prior to foreclosing. Whether or not the assignment was valid and whether the foreclosing entity had the power to foreclose may be valid claims, but there is no 2932.5 claim based on failure to record the DOT.

Barrioneuvo v. Chase Bank, 2012 WL 3235953 (N.D. Cal. Aug. 6, 2012): Tender is normally required when borrowers allege defects in the notice or procedural aspects of a foreclosure sale. If a borrower contends the validity of the foreclosure sale itself, however, tender should not be required.Tamburri v. Sunset Mortg., 2012 WL 2367881 (N.D. Cal. June 21, 2012). Some courts have also found tender unnecessary when, as here, a borrower brings an action to prevent a sale from taking place and where the harm to the borrower has not yet occurred.

If a sale is (or would be) void, rather than voidable, that situation also frees the borrower from their tender burden. In a case where a lender does not comply with CC 2923.5 notice requirements, the question becomes whether or not a notice defect which usually would trigger the tender

requirementis of a nature so as to make the sale void, thus negating the tender requirement. If the DOT does not contain language providing for a conclusive presumption of the regularity of sale, and there is defective notice, the sale is considered void. Little v. C.F.S. Serv. Corp., 188 Cal. App. 3d 1354, 1359 (1987). In this situation, tender is not required.

Tamburri v. Suntrust Mortg., 2012 WL 2367881 (N.D. Cal. June 21, 2012): To bring a RESPA 2605 claim for failure to respond to QWRs, a borrower must also allege actual damages resulting from a servicers noncompliance. The complaint must allege a specific financial harm stemming from the RESPA violation itself, rather than a broad, amorphous allegation of harm stemming from a default or foreclosure.

Requesting the identity of the loans owner(s), by itself, does not constitute a valid QWR falling under 2605 protection because it does not relate to the servicing of the loan.

Halajian v. Deutsche Bank Natl Trust Co., 2013 WL 593671 (E.D. Cal. Feb. 14, 2013): In a CC 2923.5 claim, a borrower needs to overcome a presumption that the trustee or servicer acted properly in regards to notice. The borrower needs to allege and demonstrate that notice was defective and resulted in prejudice to borrower. Knapp v. Doherty, 123 Cal. App. 4th 76, 86 n.4 (2004). Further, 2923.5 only provides a pre-sale remedy of foreclosure postponement. The statute cannot be used to un-do a foreclosure sale that has already occurred.

This court agrees with Michel (above) on the substitution/agency issue. Michel held that deciding whether a purported agent of a beneficiary (who is not an employee of that beneficiary) has the power to substitute a trustee is an issue for summary judgment and this court concurs. A borrower may allege in a complaint that a signor of a substitution was not a proper agent of the beneficiary, and discovery on that allegation is appropriate before a SJ motion is decided. Judicial notice of servicers list of corporate officers is inappropriate in cases where a servicer (like MERS, in this case) has thousands of these officers.

Harris v. Wells Fargo Bank, N.A., 2013 WL 1820003 (N.D. Cal. Apr. 30, 2013): If a borrowers default results from a lender or servicers misconduct (ex: improperly imposed late fees), tender should not be required to bring suit. (This finding is similar to the Ragland case described above).

State-law claims based on a general duty not to misrepresent material facts or not to engage in fraud in business dealings, are generally not preempted by HOLA.

DeLeon v. Wells Fargo Bank, N.A., 2011 WL 311376 at *6 (N.D. Cal. Jan. 26, 2011). Allegations that a servicer improperly instructed a borrower to withhold mortgage payments and that withholding would not result in foreclosure are such state law claims and are not preempted by HOLA.

Oral representations made by agents or employees of a servicer or lender and pertaining to the DOT (as opposed to the promissory note) may give rise to a valid breach of contract claim.

Skinner v. Green Tree Servicing, LLC, 2012 WL 6554530 (N.D. Cal. Dec. 14, 2012): CC 580b does not bar a creditor from merely contacting the borrower, asking for any unpaid debt. While the ability to sue for a deficiency is barred by 580b, the debt still theoretically exists and a creditor may ask for payment.

If the creditor asks for the debt in a manner rising to the level of harassment or making false representations to the borrower, the borrower may have valid FDCPA claims under 15 U.S.C. 1692d & 1692e. There are no bright line rules as to what type of conduct qualifies as harassment or false representation, but the language of 1692d & 1692e provide examples. In this case, repeated phone calls to borrowers home and places of employment rose to the level of a 1692d harassment claim. The creditors accusation of stealing insinuating that the borrower was committing a crime was evidence of a valid 1692e claim.

Stitt v. Citibank, 2013 WL 1787159 (N.D. Cal. Apr. 25, 2013): A fiduciary duty owed by a lender or servicer to the borrower (which does not exist in ordinary mortgage or DOT transactions) is not

necessary to establishing a fraud claim. Nor does a fraud claim require an express duty (like a duty to disclose) stated in the loan agreement. When the alleged fraud is affirmative in nature, this may constitute special circumstances forming a duty. Here, the loan servicer exacted improper fees by marking-up actual costs for services like property inspections and then refused to disclose information related to those fees. The court allowed the fraud claim to move forward.

Out of State Cases:

Curtis v. US Bank Natl Assn, 50 A.3d 558 (Md. 2012): The Protecting Tenants at Foreclosure Act mandates that the purchaser of foreclosed property provide a bona fide month-to-month tenant with, at minimum, a 90-day notice to vacate. The notice is effective the day it is received by tenant, not the day of the foreclosure sale. Pre-foreclosure notices that provide tenants with advanced warning of the foreclosure and possible end to their tenancies may give the tenant actual knowledge of a foreclosure sale date, but are irrelevant to the 90-day notice required by the PTFA. Moreover, defective notices to vacate that do not comply with the PTFA do not become effective once 90 days pass. The 90-day clock can only begin when the tenant receives an effective 90-day notice.

The court also held that even a 90-day notice may not satisfy the PTFA if it is coupled with other misleading and contradictory communications. Here, the bank provided the tenant one notice to immediately vacate, quit, and surrender possession, but another notice instructed her that she did not have to vacate the property until March 2011, more than three months from the notice date. To add to the confusion, the bank filed a motion one month later asserting that it had the right to immediate possession. The court concluded the banks notice was confusing and ineffective for the purpose of the PTFA because this succession of post-sale correspondence would have left anyone perplexed.

Fontaine v. Deutsche Bank Natl Trust Co., 372 S.W.3d 257 (Tex. App. 2012): Under the PTFA, a bona fide lease must be honored by the new purchaser, unless that purchaser will be an owner-occupier (in that case, tenant still gets the 90-day notice protection). PTFA 702(a)(2)(A). A new purchaser steps into the old landlords shoes and assumes all the obligations and rights of the old landlord, including the obligation to honor the existing lease.Foreclosure Cases from 0512 to 0513[1]

This project was made possible by a grant from the Office of the Attorney General of California, from the National Mortgage Fraud Settlement, to assist California consumers.

You might also like

- Landmark Decision For Homeowners Feb. 2016 From The California Supreme Court in Yvanova v. New Century Appeal in WORD FormatDocument32 pagesLandmark Decision For Homeowners Feb. 2016 From The California Supreme Court in Yvanova v. New Century Appeal in WORD Format83jjmack100% (2)

- Huge Win For California Homeowners From The California Supreme Court Feb. 2016 in Yvanova v. New CenturyDocument33 pagesHuge Win For California Homeowners From The California Supreme Court Feb. 2016 in Yvanova v. New Century83jjmack0% (1)

- Appellant Brief - Alan Jacobs As Trustee For The New Century Liquidating TrustDocument94 pagesAppellant Brief - Alan Jacobs As Trustee For The New Century Liquidating Trust83jjmack100% (3)

- New Century Mortgage Bankruptcy Judge's Order Is Vacated by Usdc in Delaware On Appeal - Huge Win For HomeownerDocument34 pagesNew Century Mortgage Bankruptcy Judge's Order Is Vacated by Usdc in Delaware On Appeal - Huge Win For Homeowner83jjmack100% (2)

- US SUPREME COURT RULES ON THE EBIA CASE JUNE 9, 2014 - Executive Benefits Insurance Agency v. Arkison, 12-1200 - THE CASE HAD ECHOES OF ANNE NICOLE SMITH'S BANKRUTPCY (STERN V. MARSHALL)Document16 pagesUS SUPREME COURT RULES ON THE EBIA CASE JUNE 9, 2014 - Executive Benefits Insurance Agency v. Arkison, 12-1200 - THE CASE HAD ECHOES OF ANNE NICOLE SMITH'S BANKRUTPCY (STERN V. MARSHALL)83jjmack100% (1)

- Amicus Brief by The National Association of Consumer Bankruptcy Attorneys in The New Century TRS Holdings, Inc. Appeal at The Third CircuitDocument29 pagesAmicus Brief by The National Association of Consumer Bankruptcy Attorneys in The New Century TRS Holdings, Inc. Appeal at The Third Circuit83jjmack100% (1)

- FEDERAL JUDGE DENISE COTE'S 361 PAGE OPINION OF MAY 11, 2015 ON THE CASE: FHFA v. Nomura Decision 11may15Document361 pagesFEDERAL JUDGE DENISE COTE'S 361 PAGE OPINION OF MAY 11, 2015 ON THE CASE: FHFA v. Nomura Decision 11may1583jjmack100% (1)

- 2ND QTR 2014 Financials For The New Century Mortgage Bankruptcy (NCLT)Document4 pages2ND QTR 2014 Financials For The New Century Mortgage Bankruptcy (NCLT)83jjmackNo ratings yet

- Lawyer Antognini Files Reply Brief in The Yvanova v. New Century Mortgage, OCWEN, Deutsche California Appeal Case at The California Supreme Court - Filed March 2015Document35 pagesLawyer Antognini Files Reply Brief in The Yvanova v. New Century Mortgage, OCWEN, Deutsche California Appeal Case at The California Supreme Court - Filed March 201583jjmack100% (2)

- The Didak Law Office Files Amicus Curiae in Support of Yvanova's Appeal To The California Supreme Court Case S218973 - Amicus Filed April 2015Document36 pagesThe Didak Law Office Files Amicus Curiae in Support of Yvanova's Appeal To The California Supreme Court Case S218973 - Amicus Filed April 201583jjmack100% (2)

- SLORP v. Bank of America Shellie Hill MERS Et Al - Appeal Opinion - Homeowner May Challenge A Putative Assignment's Validity On The ...Document28 pagesSLORP v. Bank of America Shellie Hill MERS Et Al - Appeal Opinion - Homeowner May Challenge A Putative Assignment's Validity On The ...83jjmack100% (1)

- In-Re-MERS V Robinson 12 June 2014Document31 pagesIn-Re-MERS V Robinson 12 June 2014Mortgage Compliance InvestigatorsNo ratings yet

- New Century Liquidating Trust Still Has Over $23 Million in Cash in Their Bankruptcy - 1ST Quarter 2014 Financial Report From Alan M Jacobs The Apptd. Bankruptcy Trustee For Nclt.Document4 pagesNew Century Liquidating Trust Still Has Over $23 Million in Cash in Their Bankruptcy - 1ST Quarter 2014 Financial Report From Alan M Jacobs The Apptd. Bankruptcy Trustee For Nclt.83jjmack100% (1)

- Examining The Consequences of Mortgage Irregularities For Financial Stability and Foreclosure MitigationDocument178 pagesExamining The Consequences of Mortgage Irregularities For Financial Stability and Foreclosure Mitigation83jjmackNo ratings yet

- United States Filed Suit Against Several Mortgage Servicers-See US v. BofA & WFBDocument8 pagesUnited States Filed Suit Against Several Mortgage Servicers-See US v. BofA & WFB83jjmackNo ratings yet

- Homeowner Helen Galope Overjoyed at Decision by Ninth Circuit Court of Appeal - March 27 2014 - This Is The Deutsche Bank Appellee Answering BriefDocument57 pagesHomeowner Helen Galope Overjoyed at Decision by Ninth Circuit Court of Appeal - March 27 2014 - This Is The Deutsche Bank Appellee Answering Brief83jjmackNo ratings yet

- In Alameda County Are Foreclosure Cases Rigged?? in Alameda County 15 Judges Have Disclosed Ownership or Stocks in Financial Firms. What About Your County?Document6 pagesIn Alameda County Are Foreclosure Cases Rigged?? in Alameda County 15 Judges Have Disclosed Ownership or Stocks in Financial Firms. What About Your County?83jjmack100% (1)

- AIG Offer To Buy Maiden Lane II SecuritiesDocument43 pagesAIG Offer To Buy Maiden Lane II Securities83jjmackNo ratings yet

- Attorney Albert Demands Retraction From Lexis Nexis About The Helen Galope Deicison Which Was Favorable For The Homeowner!!!Document7 pagesAttorney Albert Demands Retraction From Lexis Nexis About The Helen Galope Deicison Which Was Favorable For The Homeowner!!!83jjmack100% (2)

- Helen Galope's LIBOR Appeal Case - Order For Rehearing Denied To The BanksDocument1 pageHelen Galope's LIBOR Appeal Case - Order For Rehearing Denied To The Banks83jjmackNo ratings yet

- LPS COURT EXHIBIT #7 Service Providers Even Lexis NexisDocument6 pagesLPS COURT EXHIBIT #7 Service Providers Even Lexis Nexis83jjmackNo ratings yet

- FINAL Q4 2013 Hardest Hit Fund Program Performance Summary-3.18.14Document22 pagesFINAL Q4 2013 Hardest Hit Fund Program Performance Summary-3.18.1483jjmackNo ratings yet

- Bank of America Missing Documents-Ginnie Mae Halts Transfer of Servicing Rights April 2014Document2 pagesBank of America Missing Documents-Ginnie Mae Halts Transfer of Servicing Rights April 201483jjmackNo ratings yet

- Answering Brief of Appellees Barclays Bank PLC and Barclays Capital Real Estate Inc. D/B/A Homeq ServicingDocument31 pagesAnswering Brief of Appellees Barclays Bank PLC and Barclays Capital Real Estate Inc. D/B/A Homeq Servicing83jjmackNo ratings yet

- Violations of California Civil Code 1095 - Power of Attorney Law Violated-Gives Homeowner Good NewsDocument2 pagesViolations of California Civil Code 1095 - Power of Attorney Law Violated-Gives Homeowner Good News83jjmackNo ratings yet

- Analysis by Bernard Patterson On Loan ModIfications in The Helen Galope Case.Document8 pagesAnalysis by Bernard Patterson On Loan ModIfications in The Helen Galope Case.83jjmackNo ratings yet

- Appellees Petition For Rehearing in The Helen Galope Matter-Ninth CircuitDocument52 pagesAppellees Petition For Rehearing in The Helen Galope Matter-Ninth Circuit83jjmack100% (2)

- Helen Galope 3RD Amended Complaint in California Federal Court Prior To The Decision and Appeal To The Ninth Circuit Court of Appeals.Document45 pagesHelen Galope 3RD Amended Complaint in California Federal Court Prior To The Decision and Appeal To The Ninth Circuit Court of Appeals.83jjmackNo ratings yet

- In The Helen Galope Matter - Plaintiffs Revised Statement of Genuine IssuesDocument28 pagesIn The Helen Galope Matter - Plaintiffs Revised Statement of Genuine Issues83jjmack100% (1)

- Homeowner Helen Galope's Opening Appellant Brief in 9th Circuit Regarding The LIBOR Class Action Case.Document82 pagesHomeowner Helen Galope's Opening Appellant Brief in 9th Circuit Regarding The LIBOR Class Action Case.83jjmackNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Little Truble in DublinDocument9 pagesLittle Truble in Dublinranmnirati57% (7)

- Criminal Law 2 Case Digests ART. 114 127Document10 pagesCriminal Law 2 Case Digests ART. 114 127Gin FernandezNo ratings yet

- Philippine Enlightenment Period Lesson PlanDocument3 pagesPhilippine Enlightenment Period Lesson PlanHentiboiNo ratings yet

- ACT NO. 496 "The Land Registration Act. "Document1 pageACT NO. 496 "The Land Registration Act. "Emil Bautista100% (3)

- Indian JudiciaryDocument6 pagesIndian JudiciaryAdiba A. 130No ratings yet

- Dept List - Engineering and Architecture Program-MIST Admission 2023-FINALDocument25 pagesDept List - Engineering and Architecture Program-MIST Admission 2023-FINALSakib Md. AsifNo ratings yet

- SC takes notice of PM's development funds announcementDocument28 pagesSC takes notice of PM's development funds announcementPak ResearchNo ratings yet

- (G.R. No. 102772. October 30, 1996.) PEOPLE OF THE PHILIPPINES, Plaintiff-Appellee, v. ROGELIO DEOPANTE y CARILLO, Accused-AppellantDocument8 pages(G.R. No. 102772. October 30, 1996.) PEOPLE OF THE PHILIPPINES, Plaintiff-Appellee, v. ROGELIO DEOPANTE y CARILLO, Accused-AppellantJoy NavalesNo ratings yet

- The Cold War Imp Q&aDocument31 pagesThe Cold War Imp Q&aManas DasNo ratings yet

- Basic Commerce Clause FrameworkDocument1 pageBasic Commerce Clause FrameworkBrat WurstNo ratings yet

- Effect of An Arbitration AgreementDocument28 pagesEffect of An Arbitration AgreementUpendra UpadhyayulaNo ratings yet

- Foad Izadi Ph.D. DissertationDocument258 pagesFoad Izadi Ph.D. Dissertationizadi110No ratings yet

- Villafuerte Vs RobredoDocument1 pageVillafuerte Vs RobredoSGTNo ratings yet

- Department of History Presidency University Post Graduate SyllabusDocument64 pagesDepartment of History Presidency University Post Graduate SyllabusANUJ BISWASNo ratings yet

- Login: AO VIVODocument5 pagesLogin: AO VIVOFagner CruzNo ratings yet

- Sanders vs. Veridiano Case DigestsDocument4 pagesSanders vs. Veridiano Case DigestsBrian Balio50% (2)

- Criminal Law 1 Assign 5Document3 pagesCriminal Law 1 Assign 5monchievaleraNo ratings yet

- Court of Appeal Judgment SummarizedDocument13 pagesCourt of Appeal Judgment SummarizedEldard KafulaNo ratings yet

- G C Am7 F Gsus G C F C: Chain BreakerDocument4 pagesG C Am7 F Gsus G C F C: Chain BreakerChristine Torrepenida RasimoNo ratings yet

- Cavite - MunDocument58 pagesCavite - MunireneNo ratings yet

- Vacancy For Retired PersonnelDocument6 pagesVacancy For Retired Personnelp srivastavaNo ratings yet

- Agreements: Applies With or Without Written MillingDocument10 pagesAgreements: Applies With or Without Written MillingAngelika GacisNo ratings yet

- Moot MemorialDocument18 pagesMoot MemorialHarshit Chordia100% (1)

- 1) German UnificationDocument7 pages1) German UnificationKaiwen XueNo ratings yet

- Costs and Consequences of War in IraqDocument2 pagesCosts and Consequences of War in Iraqnatck96No ratings yet

- PEOPLE v. CARPIZO: Direct assault case on clerk in provincial auditor's office not coveredDocument8 pagesPEOPLE v. CARPIZO: Direct assault case on clerk in provincial auditor's office not coveredPRINCE LLOYD D.. DEPALUBOSNo ratings yet

- Charan Lal Sahu Vs Union of IndiaDocument20 pagesCharan Lal Sahu Vs Union of IndiaVishakaRajNo ratings yet

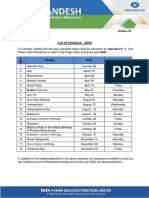

- Holiday List - 2020Document3 pagesHoliday List - 2020nitin369No ratings yet

- Abuse of ProcessDocument31 pagesAbuse of Processkenemma6No ratings yet

- Think For Bulgaria B1 P2 Unit Tests KeyDocument9 pagesThink For Bulgaria B1 P2 Unit Tests KeyKristian Hristov100% (3)