Professional Documents

Culture Documents

Zero Based Budgeting in ISRO

Uploaded by

Vimalan ParivallalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Zero Based Budgeting in ISRO

Uploaded by

Vimalan ParivallalCopyright:

Available Formats

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

We might come closer to balancing the Budget if all of us lived closer to the Commandments and the Golden Rule. -Ronald Reagan

1.

INTRODUCTION

The Indian Space Research Organization (ISRO), have been making news for all the good reasons for many of its recent successful lunch of satellites which was celebrating its Ruby year on 10th of May 2012 with a remarkable journey of 40 years into the time space of space science and its allied technology and also reaching a milestone of 100 th space mission PSLV -C21 (Space Research Today, 2012). Space activities commenced in India in 1963 when the Thumba Equatorial Rocket Launching Station (TERLS) was set up under the stewardship of Vikram A.Sarabhai, the acknowledged father of the Indian space programme (ISRO, 2012). Initially the programme was carried out by the Department of Atomic Energy through the Indian National Committee for Space Research, which was reconstituted in 1962 for that specific purpose and subsequently transformed into the Indian Space Research Organization (ISRO). ISRO was charged with the explicit mandate to promote the development and application of space technology and space science for the socio-economic benefit of the nation (Ranjana Kaul and Ram S. Jakhu, 2010) Recognizing the critical importance of outer space as a tool for accelerating the sustainable development of the country, successive Governments have made significant financial allocations to the Department of Space (DOS) and to the ISRO for the implementation of specific programmes. The Indian Space Programme, over the years,

Christ University Page |1

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

has paved the way for creating cost-effective space infrastructure for the country in a self-reliant manner and the economic and social benefits brought in by the application of space technology to the national development have been significant. The Space Programme is poised to play a pivotal role in the national development in the coming years. Although ISRO carries many successful titles in its belt, it works with a stringent budget. To compare with that of NASA ISRO gets only about 3% of NASA annual budget (Dr K Radha Krishnan, 2010). While in the financial year the budget of ISRO was raised to $1.45 billion from $1.13 billion, the budget that of NASA was reduced to $18.448 billion from 18,724 billion (Space News, 2011).This amplifies the need of proper budget management marking the financial goals that are to be achieved and acting as a yardstick for past performance. In this research importance will be given over the study of Zero based budget, its implications with respect to ISRO Satellite Centre and its influence towards other factors that governs the financial spending. This research will be carried through investigating the pervious budgets of ISRO and their follow-ups. It will be done through carrying out a qualitative assessment through different approaches in collecting data, such as the grounded theory practice, action research or actor-network theory. Forms of the data collected can include interviews and group discussions, observation and reflection field notes, various texts, pictures, and other materials.

Christ University

Page |2

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

1.1.

Rationale for the Investigation

In 1968 an article by Peter Phyrr titled Zero-base budgeting (Phyrr P, 1970) generated a great deal of interest and prompted him to expand his concept in much greater detail in a book titled Zero-Base Budgeting (ZBB) (published in 1973 (Phyrr P, 1973). Since that time, there has been a good deal of experimenting and actual implementation of ZBB in the public sector of Indian economy. In India the government has encouraged adoption of the concept in the in several public sectors and state governments have adopted ZBB to greater or lesser degrees; Local governments, including county, city, school and hospital districts have accepted or are considering ZBB as an alternative to their current budget procedure(Singh, G.; Yadav P, 2011). The business oriented press has touted the concept as the wave of the future in budgeting (William L. Boyd 1980). A plethora of articles and news releases have appeared in the various trade journals. In the last few years, zero-base budgeting has received much acclaim but little actual evaluation. Although the practice of ZBB is slowly getting in its phase, the lack of research in the field zero based budgeting have created a void in understanding and henceforth the implementation of it in vast area of budget practice (Singh, G.; Yadav P, 2011). The purpose of this article is to review the findings of various empirical studies concerned with the applicability of zero-base budgeting in the public sector of Indian economy, with respect to ISRO/ISAC. A comment follows the review concerning the need for a rational and systematic approach to the problems of budgeting. To analysis the functional areas of ISAC it will be important to know ISROs functional areas which will be explained in this next section of this chapter.

Christ University

Page |3

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

1.2.

Outline

Chapter 1 Introduction of the study This chapter gives a brief detail on the background of the firm where the research will be carried and also elaborate the needs, of the thesis. The literature review lays the theoretical foundation on which the research will be carried. It provides evidence with help of previous carried works to support the argument. Further research and also holds the explanation of various terms pointing their importance in the research. This chapter will represent major theories of budgeting, zero based budgeting and other related literature works. Chapter 2: Industry Profile: This chapter gives the Introduction to ISRO/ISAC, its area of professional. Also the company profile: a. A brief history of the ISRO. b. Year of establishment. Initial investment, founders profile. Locations of ISRO group organizations, nature of initial business of the group. & past business performance c. Present position of the company/business group in terms of total investment, type/nature of businesses, total turnover, total number of employees, product profile, subsidiary companies under the same management, collaboration/joint ventures, performance as the major science and development organization in the country, and certifications/achievements/awards won. Chapter 3 Research Methodology This chapter describes the methodology that was used to progress and authorise the aims and objectives of this research. The research method implemented for this research comprises the research design, selection of samples, data collection methods and the data analysis procedures.

Christ University

Page |4

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

Chapter 4- Data analysis and results This chapter contains the outcomes and discoveries of the primary research carried through the qualitative research. These findings originate from the data of budgeting that will be given by ISAC for research purpose. It also provides a summary of key findings in an organized format. Chapter 5- Summary of findings This chapter lures together the findings of chapter 2 and 4. The theoretical implications of the research are discussed in this chapter relating the primary findings that is profound to heighten the structure of the research and its tenacity. Lastly an all-inclusive analysis of the collected data is presented and summarized. Chapter 6 Conclusions and Recommendations This chapter winds up the research by drawing conclusions on the aspects of zero based budgeting, financial management with concerning to ISAC.

Christ University

Page |5

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

1.3.

Literature Review

1.3.1. Budget

Firstly, a discussion on this topic with a simple definition of budget will be given. In short, budget can be defined as a quantitative economic plan made with regard to time. Therefore, for something to be characterised as a budget it must comprise the quantities of economic resources to be allocated and used, it has to be expressed in economic i.e. monetary terms, it has to be a plan not a hope or a forecast but an authoritative intention, and it must be made within a certain period of time (Harper, 1995, p. 318). Only a plan that has such characteristics can be called a budget. However, if a budget is looked upon in its wider context, it can be defined as a management tool that puts executives in control of the financial health of their company. It is an objective measure of the financial structure of companys operation and a tool that forces management to be accountable in a structured and objective way. Budgets as management tools by themselves are neither good nor bad. How managers administer budgets is the key to their value. When administered wisely, budgets facilitate planning and resource allocation and help to enumerate, itemize, dissect and examine all of the products and services that a company offers to customers (Seer, 2000, p. 187). In short and taken at its simplest level, a budget is a mathematical exercise, but in reality it is much, much more than numbers on spread sheets, which is what following text will definitely show.

Christ University

Page |6

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

1.3.2. History of budget

The English word budget stems from the French word bougette and the Latin word bulga which was a leather bag or a large-sized purse which travellers in medieval times hung on the saddle of their horse. The treasurers bougette was the predecessor to the small leather case from which finance ministries even today in countries like Great Britain and Holland present their yearly financial plan for the state. So after being used to describe the word wallet and then state finances, the meaning of the word budget in 19th century slowly shifted to the financial plan itself, initially only for governments and then later for private and legal entities (Hofstede, 1968, p. 19). It was only then that budgets started to be considered as financial plans and not just as money bags. The use of budgets as financial planning and control tools for business enterprises is historically a rather young phenomenon. In the US, early budgetary principles in companies were mostly derived from the budget techniques in government. The other source of budgetary principles for business in the US was the Scientific Management Movement, which in the years between 1911 and 1935 conquered the US industry. Many historians agree that early budgeting systems can be seen as a logical extension of Taylors Scientific Management from the shop floor to the total enterprise. Howev er, it was not until the depression years after 1930 that budget control in US companies started to be implemented on a large-scale. Budgets with their focus on cost control simply became a perfect management tool for that period of time (ibid., p. 20). In Europe the idea of using budgets for business was firstly formulated by the French organization pioneer Henri Fayol (1841-1925). There was, however, little application in practice. Another practical stimulus came from the ideas of the Czech entrepreneur Thomas Bata (1876-1925) who introduced the so-called departmental profit-and loss- control as a tool

Christ University

Page |7

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

for decentralizing his international shoe company into a federation of independently run small businesses. Nevertheless, the main inducement for the development of budgets and their implementation in European companies came from across the Atlantic in the years following the Second World War (ibid., p. 21). Companies like Du Pont and General Motors in the U.S., Siemens in Germany, and Saint Gobain and Elctricit de France in France, which pioneered the M-form (multidivisional) organizational structure in the 1920's, first started to use budgets to support their rapid growth as they expanded into new products and markets. This was to help them to reduce the complexity of managing multiple strategies (Hope, Fraser, 1997, p. 20). The enormous diversity in the product markets served by these vertically integrated corporations required new systems and measures to coordinate dispersed and decentralized activities. In this kind of environment, budgets and ROI measure rightly played a key role in permitting central management to coordinate, motivate and evaluate the performance of their divisional managers, and perform a proper allocation of internal capital and resources (Johnson, Kaplan, 1991, p. 11). However, it is was only in the 1960's that accountants started adding to budgets other functions (like management performance evaluation and motivation) in addition to those functions for which they had originally been devised planning and control (Hope, Fraser, 1999b, p. 50). In that period, budgets became the central and most important activity within management accounting or in the words of Horngren, Foster and Datar: the most widely used accounting tool for planning and controlling organizations (2000, p. 178). This is exactly how budgets have remained to this day. The only thing that has changed in the meantime is the competitive environment in which todays companies operate and which has provoked many discussions about budgets disadvantages and their alternatives, some of which will be presented in later parts of this thesis.

Christ University

Page |8

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

1.3.3. Type of budget

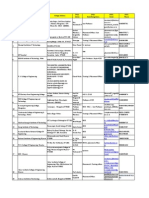

A budget is not a unitary concept but varies from organization to organization. The basic concept of budgeting involves estimating future performance, comparing actual results with the estimate, and analysing the differences between them. Factors that are relevant in determining the type or style of an organizations budget and its effects include: the type of organization, the leadership style, personalities of people affected by the budget, the method of preparation, and the desired results of the budgeting process (Cherrington, Cherrington, 1973, p. 226). In general, budgets can be classified into two primary categories (Cohen, Robbins, Young, 1994, p. 171): 1) Operating budgets Operating budgets consist of plans for all those activities that make up the normal operations of the firm. The main components of the firms operating budget include sales, production, inventory, materials, labour, overheads and R&D budgets. 2) Financial budgets Financial budgets are used to control the financial aspects of the business. In effect, these budgets reveal the influence of the operating budgets on the firms financial position and earnings potential. They include a cash budget, capital expenditures budget and pro forma balance sheet and income statement. In figure 1, all major budgets that can be used in a typical company and how they are linked and interconnected within the larger system of the master budget can be seen. This confirms what has already been said about the budgeting process that individual budgets are dependent on one another which requires that they be prepared in a hierarchical manner.

Christ University Page |9

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

Figure 1: All types of budgets involved in a typical organization

Christ University

P a g e | 10

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

Except for the usual division of companies budgets into operational and financial, budgets can also be differentiated based on expenditure authority. Using this approach, two major groups of budgets can be defined (Kemp, Dunbar, 2003, p. 3): a) Line-item budgets These are budgets where the name of each line is set, as is the amount of money that can be spent on each item. If one works within a line-item budget, one cannot overspend a specific line item and then compensate this with savings on other line (or vice versa). The authority to move money from one line item to another must be granted at a higher level. b) Block budgets These are the opposites of line-item budgets. Here a block of money is given. The details of the budget are presented but, later on, if one wants to spend more money on one item and less on another, one is free to do so. As long as the block of money is not overspent before the end of the year, the budget remains under control

Christ University

P a g e | 11

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

1.3.4. Budgeting

Budgeting may be defined quite simply as the process of compiling budgets and subsequently adhering to them as closely as possible (Maitland, 2000, p. 1). It is a process that turns managers perspectives forward. Thereby, looking to the future and planning, managers are able to anticipate and correct potential problems before they arise. This system allows managers to focus on exploiting opportunities instead of, figuratively speaking, and fighting fires. In this way the system provides sustainability to business processes within the company. It is a process of the utmost importance to management. In the words of one observer; few businesses plan to fail, but many of those that collapse failed to plan (Horngren, Foster, Datar, 2000, p. 178). The purpose of budgeting is that it gives management an idea of how well a company is meeting their income goals, whether or not expenses are in line with predicted levels, and how well controls are working. Properly used, budgeting can and should increase profits, reduce unnecessary spending, and clearly define how immediate steps can be taken to expand markets (Thomsett, 1988, p. 5). In order to achieve this, management needs to build a budgeting system, the major objectives of which are to (Viscione, 1984, p. 42): 1. Set acceptable targets for revenues and expenses. 2. Increase the likelihood that targets will be reached. 3. Provide time and opportunity to formulate and evaluate options should obstacles arise. Since budgeting as a process is very complex, it comes as no surprise that budgets are trying to fulfil numerous functions such as (Harper, 1995, p. 321, and Churchill, 1984, p. 162):

Christ University

P a g e | 12

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

a) Planning a budget establishes a plan of action that enables management to know in advance the amounts and timing of the production factors required to meet desired levels of sales. b) Controlling a budget can be used to help an organization reach its objectives by ensuring that each of the individual steps are taken as planned. c) Coordinating a budget is where all the financial components of an organization individual units, divisions, and departments - are assembled into a coherent master picture that expresses the organizations overall operational objectives and strategic goals. d) Communicating by publishing the budget, management explicitly informs its subordinates as to what exactly they must be doing and what other parts of the organization will be doing. A budget is designed to give managers a clear understanding of the companys financial goals, from expected cost savings to targeted revenues. e) Instructing a budget is often as much an executive order as an organizational plans since it lays down what must be done. It may, therefore, be regarded by subordinates as a management instruction. f) Authorising if a budget is a management instruction then conversely it is an authorisation to take budgeted action. g) Motivating in that a budget sets a target for the different members of the organization so that it can act to motivate them to try and attain their budgeted targets. h) Performance measuring - by providing a benchmark against which actual performance can be measured, a budget clearly plays a crucial role in the important task of performance measurement.

Christ University P a g e | 13

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

i) Decision-making it should never be assumed that a budget is set in concrete and when changing course a well-designed budget is a very useful tool in evaluating the consequences of a proposed alternative since the effect of any change can be traced throughout the entire organization. j) Delegating budgets delegate responsibility to the managers who assume authority for a specified set of resources and activities. In this way budgets emphasise even more the existing organizational structure within the company. k) Educating the educating effect of a budget is perhaps most evident when the process is introduced in a company. Operating managers learn not only the technical aspects of budgeting but also how the company functions and how their business units interact with others. l) Better management of subordinates a budget enhances the skills of operating managers not only by educating them about how the company functions, but also by giving them the opportunity to manage their subordinates in a more professional manner. The requirements that all these functions impose upon a budget make it difficult for one system to meet them all. It is precisely because these requirements differ, that role conflicts in budgeting system arise. These need to be appropriately dealt with so that dysfunctional behaviour like budget padding or other damaging budget games for the company do not appear. Since there are three major roles for any budgeting system, at least three conflicts may arise (Barrett, Fraser, 1977, p. 141)

Christ University

P a g e | 14

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

1.3.5. Types of budgeting

a. Traditional Incremental Budgeting

The traditional incremental budgeting does not analyse all planned expenditures with the same intensity. The changes from previous year's expenditures in the proposed budget for the next year which is usually increments, hence the name incremental budgeting but of course, decrements from previous years are also possible, receive the most attention. The expenditures that were already present in last year's budget will not be thoroughly analysed. According to Wildawsky and Caiden (1997, pp. 45-49) the concept of a base is central to incremental budgeting. The base is the general expectation that programs will be carried out on or close to the current level of expenditures. The budget for the next year is thus largely determined by the budget of the last year. For that reason, it is very important for an agency seeking a long-term increase in its budget to achieve the inclusion of a new project in its base, as this will then be considered as an accepted part of what will be done. The authors compare the budget with an iceberg from which the largest part of it lies below the surface outside of anybody's control. The rationale for the lack of thorough annual review is that because last year's expenditures were already justified, recurring expenditures do not need annual review given the relative stability in the overall environment of the agency. This approach also assumes that the analysts, decisionmakers and budgeters do not enough time and mental energy to analyse and justify all planned expenditures every year. By leaving large portions of the budget out of a thorough annual analysis, incremental budgeting demands less time and energy than budgeting by comprehensive analysis. Another reason is the number of long-term commitments in the budget: mandatory programs (entitlements), such as veteran's

Christ University

P a g e | 15

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

pensions, cannot simply be eliminated at will. These commitments are legally binding and must be met regardless of circumstances. Therefore, they do not need annual revision. After these long-term commitments have been paid for, there is often only a small percentage of the budget left for anybody's discretion. Another linked concept is the idea of fair share. It means not only the established base, but also the (common) expectation that an agency should receive a proportion of funds as compared to others, that must be increased or decreased over the base depending on circumstances. In any case history plays a big role, because it largely determines the base and the fair share of an agency. The advantage of incremental budgeting is that it simplifies calculations and decisionmaking, because only changes from the previous year must be considered and negotiated, thus saving considerable time and energy and decreasing conflict over expenditures, because the last year's share of the budget becomes the base and does not need thorough annual re-justification. The disadvantage of incremental budgeting is that past expenditures may not necessarily justify their continuation in the changing conditions of the future. This means a waste of the resources. The next budgeting approach -the ZBB -tries to address this problem. b. Zero-Based Budgeting (ZBB)

Hyde and Shafritz (1978, pp. 21 8-219) note that zero-based budgeting refers to the budgeting process that is first and foremost a rejection of the incremental decisionmaking model of budgeting. It demands a rejustification of the entire budget submission. It focuses on the concept of priorities, which is more than an elaboration of alternatives.

Christ University

P a g e | 16

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

It reflects a concern that the governments should do things that are the most important of all of the things they could do. In other words, the ZBB states that all programs and expenditures must be reviewed every year, the mere fact that a program or expenditure was there last year provides no justification that it should be continued in the next year. Premchand (1983, pp. 334-335) refers to (probably) the first experiment with ZBB in the Department of Agriculture in 1962 that tried to fully implement the concept. The practical experience, however, revealed some problems. The approach required excessive paper work and brought little or no change in the size or direction of the budget. As a result, the experience in 1962 failed. However, the ZBB was used in the federal level from 1977- 198 1. This time the concept was more elaborate. Premchand also gives the major features of ZBB: Examination of programs at various levels of resource allocation and performance.. Objectives have to be formulated for each agency The activities of each agency are converted into decision packages, which are developed to show performance at various resource levels such as minimum, intermediate, current, and enhancement levels, and The decision packages are then evaluated and arranged at each level of management in ranking order The ranking order enables the agencies to define the minimum effort and indicate the incremental levels of effort above the minimum of each program. Those levels are then ranked in a decreasing order and a cut-off point is established below which the items were not funded. Wildawsky and Caiden (1997, p. 270) see ZBB as manifesting vertical comprehensiveness in contrast to horizontal comprehensiveness of PPB6: Every year alternative expenditure levels from base zero are considered. PPB compares programs, while ZBB compares alternative funding levels of the same program.

Christ University

P a g e | 17

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

MacManus (1998, pp. 257-260) refers to both advantages and disadvantages of the ZBB. The proponents like its attack on incrementalism, low-priority programs and its efforts to force government officials to engage in a more rational analysis of alternative service delivery mechanisms and levels. They also like the bottom-up rather than program budgeting top-down approach. The opponents of ZBB complain about the amount of time and resources it takes. They argue that the amount of paperwork needed for a single program's decision packages makes it improbable that all decision packages can be thoroughly analysed and ranked by the policymakers. They also note that ZBB does not consider that fact that certain programs are very unlikely to be eliminated while others have little or no chance of getting funded. There is also a lot of discussion about whether past knowledge and history should be eliminated in decision-making. Wildawsky and Caiden (1997, p. 271) are quite sceptical about eliminating the past in ZBB. They wrote: To say that a budgetary process is a historical is to conclude that the sources of error multiply while the chances of correcting mistake decrease: If history is abolished, nothing is ever settled. Old quarrels resurface as new conflicts. As mistrust grows with conflict, willingness to admit (and hence to correct) the error diminishes. Doing without the history is a little like abolishing memory -momentarily convenient, perhaps, but ultimately embarrassing. They also noted that the ZBB did not exist in its pure form in any place. When 80- 90% of the budget becomes the base and only the rest is annually reviewed that is very close to incremental budgeting. The difficulties and limitations of ZBB have resulted in creating a hybrid or target-basedbudgeting.

Christ University

P a g e | 18

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

c.

Target-Based Budgeting (TBB)

MacManus (1998, pp. 257-260) refers to this type of budgeting as incorporating the most attractive elements of the ZBB or the ranking of funding alternatives, and using costbenefit estimates for different budget parameters. TBB recognizes that certain programs are likely to be funded in most cases and therefore do not need much annual scrutiny. Under TBB each organizational unit will be asked to develop two requests. The First is activities for the target budget (funding level pre-established by the budget office). The second is the others that will be funded given additional resources. All items of the wish-list are ranked in terms of priority. The advantage of TBB is reduced paperwork, because not all programs must be presented in terms of decision packages. Since the target-base can easily be shifted, this increases its responsiveness to changing conditions and increases the ability of program managers to use their judgment in resource allocation. However, the flexibility of TBB can also be its disadvantage as it allows irresponsible managers to include their pet projects into the base to protect them from review. The incremental budgeting and ZBB are the basic budgeting approaches. The other budgeting types, line item budgeting, performance budgeting and program/mission budgeting, consider resource allocation incrementally, from base zero or use a combination of these two approaches. These other types of budgeting will be described in the following below. d. Line-Item Budgeting

The line-item budget concentrates on objects of expenditures, i.e., the items that are purchased rather on the purposes for which they are bought. They are presented to the

Christ University

P a g e | 19

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

government as a whole and also to individual agencies and organizations. This has historically been the most common budget format. The most important skills with this type of budget were those of accountants. According to MacManus (1998, p. 253) this budget type is the oldest devised in the twentieth century. The examples of classes of expenditures include personal services, supplies, travel and utilities. These classes can further be broken down into sub-classes. For example personnel services can be broken down into salaries, wages, overtime and fringe benefits. Giving separate codes to individual accounts in the budget allows further classification. The line-item budget format and incremental budgeting go hand-in-hand. Although incremental budgeting does not necessarily always use the line-item format, when the line-item format is used as the principal budget format, its accounts are most often analysed and justified incrementally. Schick (1978, pp. 49-53) notes that the line- item budget is well suited for the first of the three major functions of budgeting: control7. The control orientation deals with a relatively narrow range of objectives. MacManus (1998, p. 253) refers to advantages and disadvantages of line-item budgets. The biggest advantage of the line-item format is its simplicity. It is easy to understand and use, especially when the information is presented by organizational units such as departments or divisions, or freestanding projects. The format promotes year-to- year comparisons, especially in terms of percentages. There has been much criticism against inadequate budget structures because of these contradictory goals, but he is convinced that just because of these multiple goals the traditional budgeting is inferior for most purposes, but yet superior over all. These shortcomings of the line item budgeting have caused the emergence of other types of budgeting, especially performance and program/mission budgeting and ZBB. The

Christ University

P a g e | 20

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

description of ZBB was already given above. The remaining major budgeting types will be described next. e. Performance Budgeting

Because of conceptual confusion, it is not clear when performance budgeting started. MacManus (1998, p. 260) mentions several options ranging from the 1910s to 1949 when the Hoover Commission issued its report regarding the deficiencies of traditional control- and accounting-oriented budgeting. Hyde and Shafritz (1978, pp. 78-79) propose a general definition of performance budgeting and contrast it to program budgeting: Performance budgeting presents purpose and objectives for which funds are being allocated, examines costs of programs and activities established to meet these objectives, and identifies and analyses quantitative data measuring work performed and accomplishments. In performance budgeting, programs are linked to the various higher levels of an organization and serve as labels that encompass and structure the subordinate performance units. .Overall the performance budgeting tends to be retrospective -focusing on previous accomplishments -while program budgeting tends to be forward looking -involving policy planning and forecasts. This definition is consistent with Schick's (1978, pp. 54-59) theory of three functions of budgeting: control, management and planning. According to this theory, performance budgeting would be most suitable for the second -management -orientation of the budgeting. It would facilitate the efficient performance of fixed prescribed activities. Its focus is on the details. In performance budgeting, the work and activities are treated as an ends in themselves. Unlike in program budgeting, the work and activities relate to the functions and work of a concrete operating unit. Therefore their classification is usually

Christ University P a g e | 21

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

done along organizational lines. Thus, this classification is most useful for an administrator or manager who has to organize the daily operations of an organization. f. Program Budgeting

It seems that the essence of program budgeting can best be explained by contrasting it with the other types of budgeting. Using Schick's (1978) classification mentioned above, the program budgeting assumes the primacy of the third function a budget can have or the planning function. In the context of budgeting, planning means the determination of objectives, the evaluating of alternative courses of action and the authorization of selected programs. A planning orientation focuses on the broadest range of issues. These are governmental policies and their link to particular expenditure choices, how programs should be assessed and the criteria on the basis of which they should be created or terminated. Unlike in performance budgeting where the objective is fixed, the objective itself is a variable in program budgeting. The analysis of existing programs may lead to a statement of new objectives and a termination of old ones. Program budgeting focuses on expenditure aggregates, the details matter only when they contribute to the analysis of the total. Whereas performance budgeting used the tools of scientific management and cost accounting, program budgeting uses techniques from systems analysis and economics. In performance budgeting, the focus is on fulfilling the given objectives at least cost. In program budgeting, the focus is on allocating resources Wildawsky and Caiden (1997, p. 270) give the distinction between program budgeting and ZBB. While ZBB promotes vertical comprehensiveness, the same programs are analysed at different funding levels. Program budgeting promotes horizontal comprehensiveness when comparing different programs.

Christ University

P a g e | 22

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

g.

Planning, Programming and Budgeting System (PPBS)

In very general terms, the PPBS begin with determining national interests and threats to those interests. A strategy is then developed to encounter the threats and defend the interests. Then the programs are developed to fulfil the broad goals or missions of the strategy. The programs are structured in a manner that facilitates resource allocation between and within them. The budget is just the expression of the programs in financial terms as used by the legislature. Programming is thus the link that unites plans with budgets. Contrary to misconceptions, the goal of the PPBS is not to make decisions, but just packaging information for top-level decision-makers in the manner that they could make informed decisions. h. Missions and Mission Budgeting

There is considerably confusion about what a mission is. The DoD defines a mission as: The task, together with the purpose, that clearly indicates the action to be taken and the reason there for The NATO definition is similar: A clear, concise statement of the task of the command and its purpose. However these definitions are so general that they allow a wide range of interpretations. In general usage, a mission could thus be synonymous with task, objective or purpose. Both the military forces and the civilian sector of the government have missions. The military strategy gives major missions to the forces. However, these missions are general in nature. There could also be other, more detailed missions. The broad missions can be taken from the strategy, but at the same time, even the smallest military unit must have a clear purpose, a mission or missions.

Christ University

P a g e | 23

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

1.3.6. Budgeting process

The process of budgeting generally involves an iterative cycle which moves between targets of desirable performance and estimates of feasible performance until there is, hopefully, convergence to a plan which is both feasible and acceptable (Emmanuel, Otley, Merchant, 1990, p. 31). Alternatively, if we look beyond many details and iterations of the usual budgeting process we can see that there is a simple universally applicable budgeting process, the phases of which can be described in the following manner (Finney, 1994, p. 16): 1. Budget forms and instructions are distributed to all managers. 2. The budget forms are filled out and submitted. 3. The individual budgets are transformed into appropriate budgeting/accounting terms and consolidated into one overall company budget. 4. The budget is reviewed, modified as necessary, and approved. 5. The final budget is then used throughout the year to control and measure the organization. The inevitable dependence of individual budgets on one another requires that budgets be prepared in a hierarchical manner. Figure 2 indicates a common hierarchical form of the budgeting process together with the necessary data flow between particular budgets and phases of their making. This picture shows that despite having only a few general phases, the budgeting process, due to its linearity and iteration loop, are in fact a very complex and time consuming process.

Christ University

P a g e | 24

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

Figure 2: Common hierarchical form of the budgeting process

Since it is so complex and important, the budgeting process requires lots of decision making on the particular choices that developers of budgets have at their disposal. Churchill (1984, p. 151) has provided a list of eight budget choices that managers have to be concerned with when setting up the budgeting system. Thereby, these concerns vary according to whether the company intends to use its budgets primarily for planning or for control. These budget choices are: 1. Whether it is to be prepared from the bottom-up or top-down, 2. How it is to be implemented, 3. How the budget process is linked to the strategic planning process, 4. Whether it should be a rolling budget and how often it should be revised,

Christ University

P a g e | 25

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

5. Whether performance should be evaluated against the original budget or the one relating to the actual activity level of the organization, 6. Whether compensation/bonuses should be based on budgeted performance, 7. What budget evaluation criteria should be used, and 8. What degree of ''stretch'' should be incorporated into the budget? In general, accounting theory suggests that large companies should be concerned more with operational efficiency and emphasize coordination and control aspects of budgets, while smaller innovative firms should concentrate more on the planning aspects of their budgets. Since the first budget choice about the process used to create the budget is very important, these particular methods will be elaborated on in more detail. Generally, managements choices on how to start creating budgets fall into one of three major approaches (Rasmussen, Ichors, 2000, p. 19) a. Top-down budgeting process

The top-down approach of budgeting means that upper management completes the budgeting process with minimal involvement from the management of individual operating units or departments. The levels beneath headquarters level receive the budget amounts from the top and they are expected to adhere to these given amounts. Individual operating units have very little, if any, input into the determination of the budget amounts. 2. Bottom-up b. Bottom-up budgeting process

With the bottom-up approach the budget is established at the bottom levels of the organization at the operating unit, departmental or cost/profit centre level and then

Christ University

P a g e | 26

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

brought up to the corporate level. Guidelines and targets are set at the corporate level, but specific amounts and budgeted account balances are not passed down to the individual departments. Rather, these entities are given the freedom to create their own budgets at the local level. c. Top-down/Bottom-up budgeting process

A top-down/bottom-up approach combines and balances the best elements of the two approaches. This approach allows input from lower and upper management into the model. The budget process becomes collaboration between lower and top management rather than a one-way exercise. In the combined approach, lower management submits the budget to upper management and then upper management modifies the submitted budget to reflect the operational knowledge that they have.

Christ University

P a g e | 27

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

1.4.

Zero Base Budgeting

1.4.1. Origin of the method and its main authors Modern zero-base budgeting (ZBB) methodology was developed by Peter A. Pyhrr for implementation at Texas Instruments in 1969. Pyhrr advocated a budgeting system where managers need to build each years budget from the ground up, building a case for their spending as if no baseline exists start from zero, and present their requests for appropriations in such a fashion that all funds can be allocated on the basis of cost/benefit or some similar kind of evaluative analysis. This was in total contrast to the traditional budgeting process which allowed managers to start with last years expenditures and add a percent for inflation to come up with next years budget, making them justify only those incremental increases while automatically accepting current levels of spending without question (Suver, Brown, 1977, p. 77). The focuses of zero-base budgeting process are two basic questions: Are the current activities efficient and effective? and Should current activities be eliminated or reduced to fund higher-priority or new programs? ZBB is trying to find answers to these questions by cooperating with the most management techniques; ZBB concept was not entirely new when Pyhrr introduced it at TI. The US Department of Agriculture had begun using a ground up budgeting technique in 1962, while as early as 1924, E. Hilton Young advocated re-justifying budget programs annually (Burrows, Syme, 2000, p. 227) using the decision-package ranking process. This process provides management with an operating tool to evaluate and allocate its resources effectively and efficiently, and provides the individual manager with a mechanism for identifying, evaluating, and communicating his/her activities and alternatives to higher levels of management (Pyhrr, 1977, p. 1).

Christ University

P a g e | 28

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

1.4.2. Main ideas of the method

The zero-base approach requires each organization to evaluate and review all its programs and activities systematically on the basis of performance output as well as costs, to emphasize managerial decision making first and numbers-oriented budgets second, and to increase the analysis of allocation alternatives. Although management approaches to the adoption of ZBB differ among organizations since the process must be adapted to fit the specific needs of each user, the basic steps to effective ZBB can still be identified (Pyhrr, 1976, p. 7): a. b. c. Identify decision units. Describe each decision unit as a decision package. Evaluate and rank all these packages by cost/benefit analysis to develop a budget

request and profit and loss account. d. Allocate resources accordingly.

ZBB starts with the creation of decision packages which are the building blocks of ZBB. The decision package is a document that identifies and describes a specific activity in such a manner that management can; a) evaluate it and rank it against other activities competing for the same or similar limited resources and b) decide whether to approve it or disapprove it. Each package includes a statement of the goals of the activity, the program by which the goals are to be achieved, the benefits expected from the program, the alternatives to the program, the consequences of not approving the package, and the expenditures of funds and personnel the activity requires. There are two basic types of decision packages (Pyhrr, 1970, p. 113): 1. Mutually exclusive packages identify alternative means for performing the same function. 2. Incremental packages reflect different levels of effort that may be expended on a specific function.

Christ University

P a g e | 29

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

Figure 3: The detailed process of decision packages sources: (ibid., p. 114):

Christ University

P a g e | 30

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

There should be at least three decision-packages for each decision-unit, though there could be as many as ten or even more. The three elementary categories of decisionpackages are presented below. More than one decision package could be presented for each category. a. Base package. This type of package meets only the most fundamental service

needs of the decision units clientele and represents the minimum level of funding needed for the units services to remain viable. There could be multiple base packages, each addressing a different way to provide the base service. This represents an important departure from incremental budgeting in that an incremental budget never considers what the absolute minimum level of funding a program can survive on is. Rather, the current level of spending is usually considered a sort of de facto minimum. b. Current service package. This type describes what it takes to continue the level of

service currently provided to the units clientele. The difference between the base package and the current service level may be expressed by multiple decision packages, with each package representing one aspect of what it takes to get from base funding to the current service level. There could also be different decision packages describing different means for achieving the same service level. c. Enhanced package. This category addresses resource required to expand service

beyond current levels. There could be any number of enhanced packages. Each manager takes his/her areas forecasted expense level for the current year, identifies the activities creating this expense, and calculates the costs for each activity. Once the manager has formulated his/her preliminary list of decision packages and has received the formalized set of assumptions about next years operations, she/he translates the packages into business-as-usual packages for the upcoming year.

Christ University P a g e | 31

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

The manager then develops his/her final set of decision packages from his/her business as- usual packages by segmenting each of them into mutually exclusive and incremental packages wherever possible and noting the discarded alternatives. When determining incremental packages, the manager must establish a minimum level of effort, which must be below the current level of operation, and then identify additional levels or increments as separate decision packages. Finally, the manager should identify all the new activities in his/her area for the upcoming year, develop the decision packages that handle them, and attach them to his/her final set. The identification and evaluation of different levels of effort represent the two most difficult aspect of the zero-base analysis, yet they are the key elements of the process. By identifying a minimum level of effort, plus additional increments as separate decision packages, each manager presents the following alternatives for top managements decision making (Pyhrr, 1976, p. 9): - eliminate the operation, - reduce the level of funding, - maintain the same level of effort, or- increase levels of funding and performance. The second important phase of ZBB is the ranking process. This technique allows management to allocate its limited resources by listing all the packages identified in order of decreasing benefit to the company. It also helps management to identify the benefits to be gained at each level of expenditure and to study the consequences of not approving additional decision packages ranked below that expenditure level. The process itself follows a hierarchical structure of the company where at each level the decision packages are reviewed, ranked and consolidated, and then forwarded to the next higher

Christ University P a g e | 32

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

organizational level for the same procedure all the way to the top. The organizations final budget equals the sum of the budgets of those decision packages accepted for funding (Pyhrr, 1977, p. 6).

Figure 4: The participative nature of the ZBB process is illustrated in the following

In order to reduce the number of packages to be reviewed in detail by successively higher levels of management and to concentrate top managements attention on the lower ranked activities, a cut-off expense line should be established at each organizational level. In this way, management can briefly review packages above the cut-off line while at the same time can devote most of the available time to decision packages below the line which are then studied in detail and ranked. The ability to achieve a list of ranked packages at any given organizational level allows management to evaluate the desirability of various expenditure levels throughout the budgeting process. Also, this

Christ University

P a g e | 33

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

ranking list provides management with a reference point to be used during the operating year to identify the activities to be reduced or expanded if allowable expenditure levels change or if the organization is over or under budget during the year (Pyhrr, 1970, p. 116). If the complete ZBB process is contemplated, it can be said that it is a top-down, bottomup approach to budgeting, which requires the participation of managers at all levels within the organizational hierarchy. To sum up, it can be said that the purpose of the ZBB process is to help management evaluate expenditures and make trade-offs among current operations, development needs, and profits for top management decision making and allocation of resources (Pyhrr, 1976, p. 6).

Christ University

P a g e | 34

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

1.4.3. Advantages and disadvantages of ZBB

Advantages of zero-base budgeting: - Properly carried out, it should result in a more efficient allocation of resources to activities and departments. - ZBB focuses attention on value for money and makes explicit the relationship between the input of resources and the output benefits. - It develops a questioning attitude and makes it easier to identify inefficient, obsolete or less cost-effective operations. - ZBB process leads to greater staff and management knowledge of the operations and activities of the organization and can increase motivation. - It is a systematic way of challenging the status quo and obliges the organization to examine alternative activities and existing costs behaviour patterns and expenditure levels. Disadvantages of zero-base budgeting: - It is a time consuming process which can generate volumes of paper work. - There is a considerable management skill required in both drawing up decision packages and in the ranking process. - ZBB might be perceived as an implied threat to existing programs. - There are considerable problems in ranking packages and there are inevitably many subjective judgements. - The thought of creating a budget from scratch causes considerable resistance if support groups and training programs are not in place.

Christ University

P a g e | 35

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

1.4.4. Practical use of ZBB

Zero-base budgeting finds its main use in areas where expenditures are not determined directly by manufacturing operations themselves in areas, that is, where the manager has the discretion to choose between different activities (and between different levels of activity) having different direct costs and benefits. These ordinarily include marketing, finance, quality control, maintenance, production planning, engineering, R&D, personnel, data processing, and so on (Pyhrr, 1970, p. 112). Due to the large amount of time that it takes to prepare ZBB, it is suggested that it should be used as a short-term (usually one year) budgeting method which could be selectively applied on a rolling basis throughout the organization. In many cases, ZBB has been used in situations where cost stabilization or control, or even cost reduction was necessary, though most of the benefits that users of ZBB reported have been achieved in reallocating funds and reassigning personnel (Dean, Cowen, 1979a, p. 56).

Christ University

P a g e | 36

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

1.5. 1.

Article reviews on ZBB Broadnax, Walter D

Zero-base budgeting: new directions for the bureaucracy? The Bureaucrat, 6:56-66, Spring 1977. Mr. Broadnax pegs taxpayer resistance to inefficient government and legislative executive branch concern over the uncontrollable portion of the Federal budget as the motivating factors behind zero base budgeting (ZBB) proposals. He gives an overview of both ZBB and sunset legislation. Potential problems in implementing ZBB in &e bureaucracy are cited. For example, although the Executive Branch can recommend that programs be discontinued, Congress controls the purse strings Mr. Broadnax also points out that ZBB was developed and tested in the private sector where maximizing profits is &e bottom line in establishing priorities. However, government workers are not motivated by the profit motive in setting priorities, and they provide services that the private sector is unable to provide. Therefore, it will not be as simple to motivate government workers to set ZBB priorities as it was in the private sector. The implementation of ZBB in Georgia, for example, resulted in no significant reallocation of resources are the other fear of ZBB opponents is increased paperwork. On the positive side, some advantages of ZBB are that it proves the quality of management information, forces management to clearly state its goals, and decreases bureaucratic ambiguity.

Christ University

P a g e | 37

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

2.

Pyhrr, Peter A

Zero-base budgeting: where to use it and how to begin. S.A.M. Advanced Management Journal, v. 41, no. 3:4-14, Summer 1976. Zero-base budgeting is primarily a management tool rather than an accounting method. It is applicable in discretionary programs where dost benefit analysis can be applied. From identifying decision units to allocating resources on the basis of cost-benefit it analysis applied to each decision unit. ZBB necessitates a task force of operating and financial managers which must design the process to fit the organization, work with managers at all levels involved with the process, and finally evaluate and revise the ZBB process.

3.

Stonich, Paul J

Zero base planning--a management tool. Managerial Planning, July/Aug. 1976: 1-4. Zero-base planning is a tool that helps cost centre managers analyse operations and allocate funds better. Steps involved include the proper identification and analysis. Of decision units, allocation of critical resources to appropriate activities, and preparation of detailed budgets. Implementation must include designing the system to meet each organization's individual needs, opening communication lines .among managers involved in the decision unit process, and providing adequate training to managers. Aero-base planning through a task force that can be responsible for the steps involved in successfully implementing the new method. Since the concept of zero-base is threatening too many managers, In addition, it is probably best to administer.

Christ University

P a g e | 38

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

4.

Stonich, Paul J. and Frederick W. Harvey

The new look for budgeting: zero-base planning. Today's Manager, May/June 1976, p. 13-16. Zero-base planning is different in both conceptual and procedural ways from usual budgeting methods. ZBB starts from no base and treats discrete functions or activities just as it would a brand new operation. It requires consideration of the organization's purpose, facilitates the identification of alternative means of accomplishing the purpose, and requires the identification of different increments of service. The article targets the decision unit increments aspect of ZBB: activities and costs over the preceding level. A matching process of services and dollars provides alternatives at various spending

5.

Anthony Bobert N

Zero-base budgeting is a fraud. Wall Street Journal, April 27, 1977 The author says that the name, zero-base budgeting, is a fraud. The one attempt to apply ZBB (state of Georgia) did not result in an analysis of the budget from zero, with a justification for every dollar requested. Within the first budget cycle, the zero benchmark was replaced by 80%. Attention was focused only on the increment over 80% of current spending levels. No one person can annually review all yet, if the job is delegated the ZBB idea of comparing priorities is lost. Compared with current Federal incremental budget procedures, zero-base budgeting has nothing of substance to offer, are not good, and the good parts are not new. The author says that Federal agency experience as far back as the 1960's shows that ranking decision packages according to priority, does not work. Honest agency heads admit that program priority is influenced by the amount of funds likely to be available, rather than the other way around.

Christ University

P a g e | 39

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

Mr Anthony recommends zero-base review, in which outside experts go into an agency and carefully examine its reason for being, its methods of operation, and its costs. It is time consuming and traumatic and should be done about every five years, not annually.

6.

Carter, Jimmy.

Nation's budgeting and answers negative concerns about the concept. ZBB Business, 65:24-26, January 1977. Jimmy Carter discusses the positive aspects of zero-base Jimmy Carter tells why he will use zero-base budgeting. In contrast to the traditional budgeting approach of incrementing the new on the old, zero-base budgeting demands a total justification of everything from zero. Each function of an organization, regardless of whether it is 50 years old or a brand new proposal is analyzed annually. ZBB draws on systems analysis, problem-solving, cost benefit analysis, and program management techniques. Mr Carter discusses the benefits of implementing ZBB in Georgia where it resulted in a 50 per cent reduction in administrative costs. He states that he will require zero-base budgeting for all Federal departments, bureaus, and boards, by executive order.

7.

Dooskin, Herbert P.

Zero-base budgeting: a plus for government. National Civic Review, 66:118-121, 144, March 1977. Mr Dooskin defines zero-base budgeting (ZBB) and details its functions. and support activities typical of government. ZBB assumes that any budgeting above zero requires justification, and subjects all programs to the level of scrutiny usually reserved for new programs. This encourages executives to set priorities and to find the most effective and inexpensive method of executing particular programs done or ZBB does not overcome

Christ University P a g e | 40

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

work, and supervisors are reluctant to lay of unnecessary staff. Also, ZBB takes a great deal of time, efficient, government or reduce costs in and of itself, but it may help. He says that ZBB is particularly appropriate in service ZBB is not without pitfalls .Overall policy planning must be Fear of supervisors' scrutiny is not easily Mr Dooskin concludes that ZBB is a tool that cannot bring about

8.

Hayward, John T.

Buzz words galore. Government Executive, v.8, no. 9:19-21, Sept. 1976. The author voices his opinion on Carter's buzzword, zero-base budgeting. The concept seems new, but continuing fundings in Washington already undergo five stages of review before getting into the budget--authorization, appropriation, apportionment, obligation and expenditure processes unrelated to the state budgeting process, where lead to an eventually sensible process. ZBB has been used up to now, year to come will decide the future of the nation. Congressional input into the budget process--and this will Hardware not buzzwords, with the change of the Federal fiscal ZBB will only add to the paperwork,

9.

McGinnis, James F.

Pluses and minuses of zero-base budgeting Administrative Management Sept. 1976: 22-23 91. Zero-base budgeting is the process of carefully analyzing budgets top to bottom. There is no automatic carry forward of funds--all expenditures must be justified for the forthcoming fiscal year. The budgeting process begins at the lowest levels of management and works upward, depending on careful orchestration and special reports. Budget reviewers make decisions based on a knowledgeable overview of a segment of an

Christ University P a g e | 41

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

organization as it relates to the whole. In the process, managers see the basic interrelationships within the company. The keys to properly implementing zero-base budgeting are: 1. Unqualified support of top management; 2. Effective design of the process; and 3. Effective management of the budgeting. Among the minuses are that the adoption involves an extensive manual, additional cost factors, and initial disruption of normal operations. But on the plus side, managers will be forced to identify in efficient and obsolete operations.

10.

Rehfuss, John.

Zero-base budgeting: the experience to date. Public Personnel Management, 6:181187, May-June 1977. Mr. Rehfuss offers a history and a definition of zero-base budgeting (ZBB). He emphasizes decision packages, gives a short comparison between ZBB and PPBs, and describes private and government implementations of ZBB. The article discusses the pros and cons of ZBB as well. provides high level managers detailed information on lower level activities and on lower level management performers. It suggests how funding levels may be manipulated, to seek alternatives, consider cost reductions, axil become more ZBB Lower level managers are forced knowledgeable about both their functions and their organizational interrelationships. In addition, involvement with the budget process adds to lower level managers' knowledge of government functions. One of the most significant advantages of ZBB is that it establishes a financial planning phase prior to budget preparation, dragging and resistance when programs are endangered. Also, many agencies are hampered by federally earmarked funds which work against ZBB prioritizing. People also complain that the budget preparation cycle is too short for effective implementation of ZBB.

Christ University

P a g e | 42

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

11.

Havemann, Joel.

Taking up the tools to tame the bureaucracy: zero-base budgeting. National Journal, 9:514-517, April 2, 1977. James T. McIntyre, Office of Management and Budget deputy director, hopes that Federal zero-base budgeting (ZBB) guidelines will be ready in time for Federal agencies to use as they prepare theirfiscal1979 budgets. For each program (decision unit) agencies must establish a minimum budget level, below which the program would be without value. This would constitute one decision package. Taking the same program, the agency must identify add-ons that would lift the program above its current level. This would constitute another decision package. Decisions packages would be ranked in order of importance. Agencies have the option to examine in depth only the lower ranked packages. Federal agencies fear that OMB will use ZBB to slash programs to meet President Carter's goal of a balanced budget in fiscal 1981. They also fear that their existing budgeting systems will be obliterated, that ZBB will become an exercise in paperwork, and that the public may react badly if popular programs are ranked low. The article also compares ZBB with PPB and IBO and includes a case study.

12.

Lynch, Thomas.

A context for zero-base budgeting. The Bureaucrat, 6:3-11, Spring 1977. In this introductory article, Mr Lynch gives a short definition and history of zero-base budgeting (ZBB) and introduces the other authors. He points out that ZBB could repeat many mistakes of the Federal implementation of planning-programming budgeting (PPB). Facing the Carter administration been a trend towards Federal centralization of social programs traditionally funded locally, through entitlement;. ZBB is an Executive

Christ University

P a g e | 43

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

Branch tool addressed to the appropriations stage and cannot be applied to uncontrollable expenditures which may be controlled at the authorization stage, through some form of sunset legislation. Congressman Jack Brooks, Chairman of the Government Operations Committee has urged President Carter to postpone mediate Executive Branch introduction of ZBB. If the recession can be stopped, growth of 'uncontrollable programs will slow down, enabling the Carter administration to apply ZBB to future Federal programs. The article sets ZBB in the context of the economic conditions a by-product of; the recession has. The article also includes references to other sources on ZBB. .

13.

Minmier, George Samuel.

An evaluation of the zero-base budgeting system in governmental institutions. Atlanta, Ga., Georgia State University, School of Business Administration, 1975 HJ2053.G4M55 264 p Mr. Minmier compares various budgetary procedures and discusses the historical development of zero-based budgeting (ZBB). He details Georgia's initial attempts in zero-base budgeting, from 1973 to 1975. The focus on ZBB procedural changes as the system evolved. The author includes an analysis of Georgia's experience and its implications for the future. The book also contains tables, exhibits, and a bibliography.

14.

Scheiring, Michael J.

Zero-base budgeting in New Jersey. State Government, v. 49, no.3:174-179, Summer 1976. By order of Governor Brendan Byrne's memorandum of July 22, 1974, the state of New Jersey adopted zero-base budgeting for all departments and agencies. deficit projected

Christ University P a g e | 44

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

for Fi 1976. The time for budget reform seemed ripe. This was done in the face of an impending $450 million New Jersey 's ZBB system followed the prescribed basic steps of making decision packages, evaluating and ranking the decision packages, and fin all y allocating the resources accordingly. Forms were developed to facilitate each step.

15.

MacFarlane, John A.

Zero-base budgeting in action- - there's nothing to it.'' CA Magazine, 109:28-32, Dec. 1976. In the face of severe financial difficulties, McMaster University decided t o t r y zerobase budgeting to help relieve the forecasted $2.7 million deficit for FY 1975-76. Expected savings were to be effected in at least one of two ways: 1) finding less costly alternative ways to do things, or 2) shutting down operations that were ranked a t the lowest priority. In addition to the usual evaluation functions of decision packages,'' McMaster identified an alternative that caused policy effects to be evaluated as well. The results of using ZBB involved changes in staffing, changes in the structure of accounting records and increased knowledge of the operation of the University as a whole. McMaster University achieved its goal of a balanced budget ahead of schedule. While ZBB was found to have borne problems, McMaster planned to use the system again.

Christ University

P a g e | 45

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

2. 2.1.

PROFILE OF ISRO/ISAC

Background of ISRO

It is not the purpose of this research to dwell on the details of rocket science or into technical aspects of ISRO. The beginnings, however, need to be noted to understand the management of the programme during analysis of ones financial administration.

2.1.1. History of ISRO

The Indian government created a dedicated institutional framework for its national space program. This framework includes: the Department of Space (DOS), the administrative agency responsible for the Indian space program; the Indian Space Research Organization (ISRO), the primary operational entity responsible for Indian space activities; and the Antrix Corporation, a government-owned organization responsible for marketing Indias space products and services.10From the inception of its space program in 1962, India has favoured an evolutionary technology development process Mistry, D. (1998). The experience of India, over the past 40 plus years, in developing and operating a space program focused on providing direct societal benefits offers a number of lessons as developing countries across the globe become increasingly involved in space activities. For a space program to be successful in the context of a developing nation, that program must provide tangible benefits to that country and its people and be tied to broader development objectives (Christensen, et al., 2009). The benefits from space activities have now become widely known in the country. In fact there is worldwide recognition of the importance of space activities not only for the developed nations but in particular for the developing countries. Such recognition, even at well-informed levels, did not exist in the country when India formally organized its modest space effort

Christ University

P a g e | 46

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013

through the establishment of the Indian National Committee for Space Research (INCOSPAR) in 1962. In November 1963 the first sounding rocket was launched from the Thumba Rocket Launching Station (TERLS) near Trivandrum. The founders of the Indian space programme recognized the potential for the immense benefits from space technology even in the early 1960s, when humanity was just ushering in the space era. Early ideas about possible space applications of relevance to India can be found in a number of writings and speeches by Dr Sarabhai, a selection of which have been brought out in a publication by the Indian Space Research Organization (ISRO, 1979). The early ideas were mainly cantered on the utilization of satellites for television and developmental education, meteorology, and remote sensing for natural resources management. The programme also included development and launch of sounding rockets for space science research. Though international cooperation dominated in the early years, careful stress was placed on self-reliance. Nuclei of trained manpower were formed at laboratories that were then part of INCOSPAR but were constituted into ISRO in 1969 (Rajan, YS, 1988).

2.2.

The Aim and Vision of ISRO

Though here is no precise mission and vision statement for ISRO, it is widely proclaimed that the following addressed by Dr. Vikram Sarabhai is accepted as its Vision (Joshi, P. (Ed.). 1992). There are some who question the relevance of space activities in a developing nation. To us, there is no ambiguity of purpose. We do not have the fantasy of competing with the economically advanced nations in the exploration of the moon or the planets or manned space-flight. But we are convinced that if we are to play a meaningful role nationally, and in the community of nations, we must be second to none in the

Christ University

P a g e | 47

Zero Based Budgeting: A critical analysis on budgeting practice of ISRO Satellite Centre (ISAC)

2013