Professional Documents

Culture Documents

ACOS Eye On Washington Mar 2013

Uploaded by

acosurgeryOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACOS Eye On Washington Mar 2013

Uploaded by

acosurgeryCopyright:

Available Formats

An Eye

n Washington March, 2013

Quarterly Insight: The Independent Payment Advisory Board Brought to you by Jeffrey J. Kimbell & Associates OVERVIEW The Independent Payment Advisory Board (IPAB) is a 15 member government committee created under Section 3403 of the Patient Protection and Affordable Care Act of 2010 (also known as the Affordable Care act or the ACA). IPAB was championed by some Members of Congress as a way to reduce Medicare spending without having an impact on coverage or quality, but the board has been a source of political controversy from the start. Republicans and some Democrats have opposed IPAB as a rationing tool that will ultimately deny patients access to medical care as providers payments are cut. IPAB critics referred to the board as a Death Panel and Rationing Board during the health care reform debate and continue to advocate for its repeal. However, IPAB was enacted as part of the ACA, and understanding its potential impact is critical for providers in the years ahead. IPAB MISSION & MECHANICS The ACA directs IPAB to recommend savings for Medicare beginning in 2014 if the per capita growth in Medicare spending exceeds defined target growth rates in the coming year. From 2015 to 2020, the growth target is based on a measure of inflation; in subsequent years, it is based on the per capita growth in gross domestic product (GDP) plus one percentage point. The Actuary of the Centers for Medicare and Medicaid Services (CMS) is responsible for the projections of Medicare spending which may trigger IPAB. Each year, the CMS Actuary will issue a three-year projection: the determination year where the determination is made on whether IPAB is triggered, the proposal year in which IPAB submits its recommendations to Congress, and the implementation year when IPABs recommendations to reduce costs will be implemented. The CMS Actuary will also determine the size of the cuts IPAB must make to reduce Medicare spending to the targeted levels. If the spending target is breached in the determination year, then IPAB must submit recommendations to Congress by January 15 of the proposal year. If IPAB fails to submit its recommendations by January 15, the Department of Health and Human Services (HHS) Secretary is required to submit recommendations to Congress by January 25 of the proposal year. The recommendations made by IPAB move to Congress for fast-track consideration. If Congress does not act before April 1 of the proposal year, the HHS Secretary is required to implement the Board's recommendations. Overturning IPABs recommendations would require a two-thirds majority vote in both chambers of Congress. The ACA prohibits IPAB from including any recommendation that would: (1) ration health care; (2) raise revenues or increase Medicare beneficiary premiums or cost sharing; or (3) otherwise restrict benefits or modify eligibility criteria. The Board is also prohibited from recommending changes that would reduce payments to certain providers before 2020, including inpatient and outpatient hospital services, inpatient rehabilitation and psychiatric facilities, long-term care hospitals, and hospices.

1008 Upper Gulph Road Wayne, PA 19087

An Eye

n Washington March, 2013

BOARD MAKEUP IPAB is established as an independent board in the executive branch, composed of 15 full-time members appointed by the President and confirmed by the Senate. The statute sets out an array of qualifications for Board members, including expertise in health care, economics, research and technology assessment, experience with employers and third-party payers, and consumers. It requires a balance between urban and rural representation. Health care providers cannot make up a majority of the Board. Board members will be full-time federal employees, and thus cannot engage in any other business, vocation or employment. The President is required to consult with Congressional leadership in making 12 of the 15 appointments. He is to consult, concerning three appointments each, with the Majority Leader and Minority Leader of the Senate, and the Speaker and Minority Leader of the House. The IPAB Chair is appointed by the President, with advice and consent of the Senate. The IPAB Vice Chair is elected by the Board annually. Terms are for six years, and members may serve no more than two consecutive terms. IPAB members are paid at a rate prescribed for level III of the Executive Schedule, which has been frozen at $165,300 since 2010. In addition, there are three ex officio, non-voting members: the HHS Secretary, the CMS Administrator, and the Administrator of the Health Resources and Services Administration (HRSA). Currently, these posts are held by Kathleen Sebelius, Marilyn Tavenner, and Mary Wakefield, respectively. LEGISLATIVE HISTORY During the healthcare reform debate, Democrats controlled the House, the Senate and the White House, giving them large power as a party to shape the policies which would eventually become law as the ACA. IPAB was first suggested by Senator Jay Rockefeller (D-WV) essentially as strengthened version of the Medicare Payment Advisory Commission (MedPAC), a body whose recommendations have no legal authority. It was no surprise then, that in 2009 the healthcare reform bill which originated and passed in the Senate Finance Committee, of which Rockefeller was a member, included a provision creating IPAB. The Senate Health Education, Labor and Pensions (HELP) Committee also passed its own health care reform bill. These two bills were merged together to create what we now know as the ACA, which included the IPAB provision. The Senate passed the ACA on December 24, 2009, with all 60 Democrats supporting the bill to overcome a Republican filibuster. Meanwhile, the House had crafted its own version of a healthcare reform bill which did not include the IPAB provision. House Democrats did not support IPAB, because they believed Congress should and could act on its own to reduce Medicare cost growth through the regular legislative process. The House passed its bill, without an IPAB provision, on November 7, 2009. Under the regular legislative process, the House- and Senate-passed bills would then have been considered by a joint conference committee to reconcile the differences between the two pieces of legislation. However, the surprising outcome of a January 2010 special election to fill the seat recently vacated by the death of Senator Ted Kennedy (D-MA) resulted in Democrats losing their 60 seat supermajority in the Senate. Senator Scott Brown (R-MA) was sworn in on February 4, 2010, allowing Republicans to maintain a filibuster against any further healthcare reform votes in the Senate. Thus any hopes for a merged House and Senate bill were eliminated, 1008 Upper Gulph Road Wayne, PA 19087

An Eye

n Washington March, 2013

and the fate of healthcare reform fell on the House to pass the bill which the Senate had passed on December 24, 2009 before Browns election. On March 21, 2010, the Democrat-controlled House passed the ACA, which contained the IPAB proposal, and President Obama signed it into law on March 23, 2010. CURRENT OUTLOOK IPABs authority to make payment reduction recommendations is somewhat limited under the ACA. Payments for inpatient and outpatient hospital services, inpatient rehabilitation and psychiatric facilities, long-term care hospitals, and hospices are protected from IPABs scrutiny until 2020, and clinical laboratories are exempt until 2016. Providers not exempt from IPAB cuts include physicians, Medicare Advantage plans, Part D prescription drug plans, skilled nursing facilities, home health agencies, dialysis centers, ambulance suppliers and providers, ambulatory surgical centers, and durable medical equipment suppliers. If IPAB is triggered, board members may focus on those areas of medicine that are high-cost, high-volume or expanding most rapidly. Given this dynamic, ophthalmic procedures and treatments could register on IPABs radar. As the U.S. population ages, the amount of cataract surgeries in America will almost certainly increase. Cataract surgery is one of the most common procedures in America, as more than 22 million Americans over the age of 40 are affected. It is unclear how granular IPABs recommendations will be, but ophthalmic procedures could conceivably be targeted as the board seeks to identify payment policies that reduce Medicare spending. However, IPABs authority is also limited in regards to how significant of a reduction they may recommend, expressed as a percentage of total Medicare funding and referred to as the applicable percent. In 2015, the applicable percent will be 0.5%, and will increase gradually until 2018, when it reaches a maximum of 1.5%. Unless a particular area grows at an extreme rate compared to others, it is likely that IPABs recommendations will be distributed across a spectrum of medical disciplines. Therefore, the impact that IPAB stands to have on the reduction of Medicare payment will not likely pose a major threat to any particular field. Currently, Medicare spending projections do not indicate that IPAB will be triggered in the next decade, rendering the agency toothless unless this scenario changes. President Obama has proposed lowering IPABs trigger from GDP + 1% to GDP + 0.5% for 2021 and later, but the idea has failed to gain traction in Congress. Regardless, there has been significant distaste of IPAB among Republican members of Congress since its inception. Recently, there have been bills introduced in both the House and Senate to repeal IPAB. These two bills, known as the Protecting Seniors' Access to Medicare Act of 2013 (S. 351 and H.R. 351, respectively), led by Senators John Cornyn (R-TX) and Orrin Hatch (R-UT) and Congressmen Phil Roe, MD (R-TN) and Allyson Schwartz (D-PA) would repeal the IPAB provision under the chief argument that it is unsuitable for unelected bureaucrats to intrude on the physician-patient relationship by influencing a physicians decision making because of reimbursement cuts made by IPAB. Republicans have also sought to defund IPAB. Beginning in 2012, the board is authorized to spend $15 million annually to conduct its affairs. The recently-passed Continuing Resolution (CR) funding the federal government through September 2013 rescinded $10 million from IPAB. Many outside stakeholders have also joined in the fight to repeal IPAB. The Healthcare Leadership Council (HLC), a coalition of executives representing all sectors within the U.S. 1008 Upper Gulph Road Wayne, PA 19087

An Eye

n Washington March, 2013

healthcare system, is coordinating a large group letter to members of Congress supporting repeal of IPAB. The letter currently has over 600 signatories from various industry, physician, and patient groups. HLC is planning to submit the letter to Congress during first week of April. Efforts to repeal and/or defund IPAB face an uphill climb, however, as Senate Democrats and the White House view the board as one of the key ACA components capable of controlling the rising cost of Medicare. Meanwhile, the Administration is planning to move forward with nominating IPAB board members in the near future, according to CMS Administrator Marilyn Tavenner in response to questions from her first confirmation hearing on April 9, 2013.

Key Legislative and Regulatory Developments

Congress Passes FY 2013 Continuing Resolution Package Including Device User Fee Fix and Full 2013 Appropriations for FDA This week, President Obama signed a Continuing Resolution (CR) funding the federal government through the remainder of FY 2013. The package contains full FY 2013 funding for the Food and Drug Administration (FDA) and language allowing FDA to access and spend new device user fees authorized by the FDA Safety and Innovation Act (FDASIA) passed last year. The bill funds the federal government at a level equal to the spending cap for 2013 required by the Budget Control Act of 2011. This includes $2.51 billion of FY 2013 funding for FDA, an increase of $24 million from FY 2012 levels. In addition the bill contains $50 million of no-year funds to be used for food safety and human drug supply safety. These no-year funds are not tied to a given fiscal year and can be spent at any time. However, this total amount does not include the effect of the sequester. Rather, the legislation is subject to a sequestration order from the President. The FDA appropriations total in the bill would be reduced by $209 million once sequestered. Other Department of Health and Human Services (HHS) agencies and programs will be funded at FY 2012 levels, denying the department new funds requested by the Administration for programs such as federal health exchanges and fraud and abuse. The bill also rescinded $10 million from the Independent Payment Advisory Board (IPAB) and does not include new funding for the Internal Revenue Service (IRS) to implement various tax provisions of the Affordable Care Act (ACA). The bill, which originated in the House but was amended in the Senate, was passed by both chambers last week. President Obama signed the bill on Tuesday, March 26, avoiding a government shutdown. The previous bill providing funding for the federal government was set to expire on March 27, 2013. Overall, the bill should benefit the ophthalmic community, as FDAs device review process can now utilize the large increase in device user fee funding that was authorized in FDASIA last year. The full text of the bill can be found HERE.

1008 Upper Gulph Road Wayne, PA 19087

An Eye

n Washington March, 2013

Supreme Court Hears Arguments in Pay-for-Delay Case On Monday, the Supreme Court heard oral arguments of the case Federal Trade Commission v. Watson Pharmaceuticals, Inc., which is the culmination of nearly ten years worth of litigation in lower courts to determine the legality of pay-for-delay settlements. In these arrangements, a brand name drug company pays a generic company to delay its introduction of the cheaper generic version of the drug. Both branded and generic drug makers have risen in favor of the practice, while consumer groups and the American Medical Association (AMA) have voiced support for the Federal Trade Commission (FTC), which seeks to end these arrangements. During the oral arguments, Deputy Solicitor General Malcolm Stewart, prosecuting on behalf of the FTC, said that such settlements should be considered anti-competitive, and charged the drug industry to prove otherwise. However, Justice Stephen Breyer suggested that courts should consider these arrangements on a case by case basis, and not presume that they are illegal. Jeffrey L. Weinberger, who argued in defense of the drug industry, was met with skepticism from judges such as Justice Elena Kagan, who suggested that such deals present an incentive for brand name and generic companies to split profits to the detriment of consumers. Justice Samuel Alito recused himself from the case, which could create the unusual possibility of a split decision on the final ruling, which is expected in June.

House and Senate Pass FY 2014 Budget Resolutions; Senate Passes Medical Device Tax Repeal and FSA Contribution Limit Repeal Budget Amendments This month, both the House and Senate passed budget resolutions outlining how each chamber would raise and spend federal revenues in FY 2014. Budget resolutions are non-binding pieces of legislation serving as a general framework for spending but not carrying the force of law. On March 20, the House passed the House Republican Budget plan (H. Con. Res. 25) proposed by House Budget Committee Chairman Paul Ryan (R-WI) by a vote of 221-207, largely along party lines. The House Budget would eliminate the deficit by 2023 through spending reductions of $5.7 trillion over the next decade. As in past years, the proposal would also phase in a premium support model for Medicare for beneficiaries age 54 and younger, estimated to save another $129 billion. For Medicaid, the House Budget would block grant federal funds for states. The resolution also repeals most parts of the Affordable Care Act (ACA), including new taxes, insurance exchange subsidies, and the Medicaid expansion. On the revenue side, the House Budget calls for revenue neutral tax reform which lowers rates and eliminates various tax expenditures to broaden the base. The Senate passed its budget resolution (S. Con. Res. 8) crafted by Senate Budget Committee Chairwoman Patty Murray (D-WA) on March 23. During the debate, Senators overwhelmingly supported an amendment offered by Senator Amy Klobuchar (D-MN) and Senate Finance Committee Ranking Member Orrin Hatch (R-UT) to include a repeal of the 2.3% medical device excise tax in the Senate budget plan. The amendment, which did not specify how the cost of repeal would be offset, was agreed to by a vote of 79-20, with 34 Democrats voting in support of the repeal. Although this amendment is non-binding and will not result in the repeal of the 1008 Upper Gulph Road Wayne, PA 19087

An Eye

n Washington March, 2013

tax, the large amount of bipartisan support serves as an important marker that could ultimately lead to a binding vote on repeal at a later date. Additionally, an amendment offered by Senator Mike Johanns (R-NE) to include the repeal of two restrictions placed on health savings accounts (HSAs) and flexible spending arrangements (FSAs) by the Affordable Care Act (ACA) in the Senate budget was accepted by voice vote. These restrictions included Section 9003 of the ACA which prohibits individuals from purchasing overthe-counter (OTC) medications with HSA funds without a prescription from a physician and Section 9005 of the ACA which imposed an FSA contribution limit of $2,500 per year. The amendment did not specifically provide an offset for the $8 billion cost to repeal these restrictions, but it did specify that repealing these restrictions should be done in a revenueneutral way.

CMS Clarifies Implementation of Sequester Cuts for Part A and Part B FFS Payments On March 8, the Centers for Medicare and Medicaid Services (CMS) issued a notice outlining how the agency will implement the 2% sequester cuts required by the Budget Control Act (BCA) for Medicare Part A and Part B Fee-for-Service (FFS) payments. CMS stated that, in general, Medicare FFS claims with dates-of-service or dates-of-discharge on or after April 1, 2013, will incur a 2% reduction in Medicare payment. Claims for durable medical equipment (DME), prosthetics, orthotics, and supplies, including claims under the DME Competitive Bidding Program, will be reduced by 2% based upon whether the date-of-service, or the start date for rental equipment or multi-day supplies, is on or after April 1, 2013. Furthermore, this 2% payment adjustment will be applied to all FFS claims after determining coinsurance, any applicable deductible, and any applicable Medicare Secondary Payment adjustments.

MedPAC Releases Annual Report to Congress Including Payment Reform Recommendations On March 15, the Medicare Payment Advisory Commission (MedPAC) released its March 2013 report to Congress, which urged repeal of the Sustainable Growth Rate (SGR) and recommended payment cuts to home health agencies and skilled nursing facilities (SNFs). MedPAC is statutorily required to submit an annual report to lawmakers which outlines its recommendations for payment rate adjustments to Congress through the report, including fee-for-service (FFS) Medicare; Medicare Advantage (MA), including MA special needs plans (SNPs); and Part D. Also on March 15, MedPAC Chairman Glenn Hackbarth testified regarding the panels recommendations at a House Ways and Means Committee hearing. MedPACs recommendations for Congress included the following: Increase payment rates for the inpatient and outpatient prospective payment systems in 2014 by 1%. For inpatient services, Congress should also require the Secretary of Health and Human Services (HHS) to use the difference between the statutory update and the recommended 1% update to offset increases in payment rates due to documentation and coding changes and to recover past overpayments.

1008 Upper Gulph Road Wayne, PA 19087

An Eye

n Washington March, 2013

Repeal the SGR system and replace it with a 10-year path of statutory fee-schedule updates. This path is comprised of a freeze in current payment levels for primary care and, for all other services, annual payment reductions followed by a freeze. MedPAC is offering a list of options for Congress to consider if it decides to offset the cost of repealing the SGR system within the Medicare program. For ambulatory surgical centers, MedPAC recommends no payment update for 2014 in an effort to maintain financial pressure for ASC providers to constrain costs. Additionally, MedPAC recommends that Congress requires ASCs to submit cost data, in order to more adequately inform future recommendations. MedPAC will assess this data along with quality data which was not required from ASCs until 2012 in making its future payment update recommendations for ASCs. The Ambulatory Surgical Center Association (ASCA) has come out strongly against this recommendation, suggesting that services in the ASC setting are paid at a disproportionate fraction of outpatient payment rates. MedPAC also recommends that HHS implement a value-based purchasing program for ASC services no later than 2016.Direct HHS to regularly collect data including service volume and work timeto establish more accurate work and practice expense values. Direct HHS to identify overprices fee-schedule services and reduce their relative value units (RVUs) accordingly.

The report also included status updates on MA and Part D. Additional recommendations as well as MedPACs rationale behind its recommendations are in the full report, which is available HERE.

1008 Upper Gulph Road Wayne, PA 19087

You might also like

- Restoring Quality Health Care: A Six-Point Plan for Comprehensive Reform at Lower CostFrom EverandRestoring Quality Health Care: A Six-Point Plan for Comprehensive Reform at Lower CostNo ratings yet

- ACOS Eye On Washington Apr 2013Document6 pagesACOS Eye On Washington Apr 2013acosurgeryNo ratings yet

- US Government Shutdown Explained: Causes and ImpactDocument134 pagesUS Government Shutdown Explained: Causes and ImpactDida KhalingNo ratings yet

- Why Obamacare Is Wrong for America: How the New Health Care Law Drives Up Costs, Puts Government in Charge of Your Decisions, and Threatens Your Constitutional RightsFrom EverandWhy Obamacare Is Wrong for America: How the New Health Care Law Drives Up Costs, Puts Government in Charge of Your Decisions, and Threatens Your Constitutional RightsNo ratings yet

- Medicare Policy: The Independent Payment Advisory Board: A New Approach To Controlling Medicare SpendingDocument24 pagesMedicare Policy: The Independent Payment Advisory Board: A New Approach To Controlling Medicare SpendingCatherine SnowNo ratings yet

- Health Policy Legislation Paper 1Document6 pagesHealth Policy Legislation Paper 1Emily Fitz GeraldNo ratings yet

- The Reformation of Healthcare By: Matthew Adkisson For: English 3 May 26, 2010Document5 pagesThe Reformation of Healthcare By: Matthew Adkisson For: English 3 May 26, 2010sassymurrayNo ratings yet

- Will Congress Repeal Health Care ReformDocument2 pagesWill Congress Repeal Health Care ReformTed HillNo ratings yet

- News Briefs - March 26, 2002: HB 1457 Passes Illinois HouseDocument4 pagesNews Briefs - March 26, 2002: HB 1457 Passes Illinois HouseVanessa VaileNo ratings yet

- SHARE Grantee Newsletter October 2009Document4 pagesSHARE Grantee Newsletter October 2009butle180No ratings yet

- Ohio healthcare Freedom Amendment protects patient choiceDocument9 pagesOhio healthcare Freedom Amendment protects patient choiceMike WilsonNo ratings yet

- Impact of ACA On US Health Care EcosystemDocument7 pagesImpact of ACA On US Health Care EcosystemUmme FarwahNo ratings yet

- Policy Memo 1 1Document6 pagesPolicy Memo 1 1api-488942224No ratings yet

- Health Care Reform PaperDocument6 pagesHealth Care Reform Paperchristian_barlowNo ratings yet

- HCS 455 - Policy Process - Part 1 - Health Care Reform - Week 3Document8 pagesHCS 455 - Policy Process - Part 1 - Health Care Reform - Week 3Dawn Wrightington0% (1)

- Fulfilling The Promise of Obamacare RepealDocument14 pagesFulfilling The Promise of Obamacare RepealJuniper Research GroupNo ratings yet

- Obamacare A Step BackwardsDocument2 pagesObamacare A Step BackwardsGerardFVNo ratings yet

- Impact of ACA On US Health Care Ecosystem RevisedDocument8 pagesImpact of ACA On US Health Care Ecosystem RevisedUmme FarwahNo ratings yet

- Walton Francis Testimony On USPS Health Plan 3 27 12Document14 pagesWalton Francis Testimony On USPS Health Plan 3 27 12PostalReporter.comNo ratings yet

- (Peter Ferrara) The Obamacare DisasterDocument78 pages(Peter Ferrara) The Obamacare DisasterYusuf KaripekNo ratings yet

- Governing Health The Politics of Health Policy 5th Edition Ebook PDFDocument61 pagesGoverning Health The Politics of Health Policy 5th Edition Ebook PDFevelyn.enos817100% (42)

- A Smarter Way To Pay DoctorsDocument3 pagesA Smarter Way To Pay DoctorsPeter OrszagNo ratings yet

- 2017-09-27 Letter Re: 2017 Medicare Part B Premium IncreasesDocument4 pages2017-09-27 Letter Re: 2017 Medicare Part B Premium IncreasesFedSmith Inc.No ratings yet

- The Health Care ReformDocument16 pagesThe Health Care ReformTowneMeadowNo ratings yet

- FAHP Releases 2015 Legislative Priorities Aimed at Improving Access To Affordable, Quality Health CareDocument3 pagesFAHP Releases 2015 Legislative Priorities Aimed at Improving Access To Affordable, Quality Health Careapi-157539785No ratings yet

- Research Paper On Patient Protection and Affordable Care ActDocument6 pagesResearch Paper On Patient Protection and Affordable Care Actfys1q18yNo ratings yet

- Moderate Senate Democrats Letter To McConnell, Alexander, and Hatch On Fast-Track Repeal of The Affordable Care ActDocument2 pagesModerate Senate Democrats Letter To McConnell, Alexander, and Hatch On Fast-Track Repeal of The Affordable Care ActU.S. Senator Tim KaineNo ratings yet

- Hearing AidDocument9 pagesHearing AidporternovelliNo ratings yet

- The Affordable Care ActDocument25 pagesThe Affordable Care ActTania Ballard100% (3)

- PPACA Amicus CuriaeDocument9 pagesPPACA Amicus Curiaetaosat11No ratings yet

- Share Grantee Newsletter Apr 2010Document5 pagesShare Grantee Newsletter Apr 2010butle180No ratings yet

- Round Table DraftDocument5 pagesRound Table Draftapi-240992347No ratings yet

- Republican Policy Committee: One Month Later: What America Has Found in Democrats' Government Takeover of Health CareDocument3 pagesRepublican Policy Committee: One Month Later: What America Has Found in Democrats' Government Takeover of Health CareSean HackbarthNo ratings yet

- House Subcommittee On Insurance and Banking Passes Legislation To End Balance Billing For Emergency ServicesDocument1 pageHouse Subcommittee On Insurance and Banking Passes Legislation To End Balance Billing For Emergency Servicesapi-157539785No ratings yet

- Affordable Care ActDocument9 pagesAffordable Care Actdeanna straupNo ratings yet

- CHP 14 Domestic Policy 2012Document34 pagesCHP 14 Domestic Policy 2012api-98469116No ratings yet

- FAHP Releases 2015 Legislative Priorities Aimed at Improving Access To Affordable, Quality Health CareDocument3 pagesFAHP Releases 2015 Legislative Priorities Aimed at Improving Access To Affordable, Quality Health Careapi-157539785No ratings yet

- United States Health Care Reform Progress To Date and Next StepsDocument9 pagesUnited States Health Care Reform Progress To Date and Next StepsEva MaglinteCanonNo ratings yet

- 2018-06-20 Medicaid Fraud and OverpaymentsDocument24 pages2018-06-20 Medicaid Fraud and OverpaymentsWashington ExaminerNo ratings yet

- House Hearing, 109TH Congress - A Review of The Administration's Fy2007 Health Care PrioritiesDocument153 pagesHouse Hearing, 109TH Congress - A Review of The Administration's Fy2007 Health Care PrioritiesScribd Government DocsNo ratings yet

- Medical Rights and Reform Act ExplainedDocument12 pagesMedical Rights and Reform Act Explainedpy007No ratings yet

- CLASS Untold StoryDocument21 pagesCLASS Untold StoryTim McGheeNo ratings yet

- 08Document3 pages08api-597185067No ratings yet

- VRRFDocument18 pagesVRRFDan NgugiNo ratings yet

- Weekly Update 3-20-09Document3 pagesWeekly Update 3-20-09bmcauliffe100% (2)

- How Much Will Americans Sacrifice For Good Health Care?: All-Time Health Care Is A Human RightDocument4 pagesHow Much Will Americans Sacrifice For Good Health Care?: All-Time Health Care Is A Human RightVaishali MakkarNo ratings yet

- Congressman Paul RyanDocument3 pagesCongressman Paul Ryanapi-25906695No ratings yet

- The Medical Rights University of Maryland University CollegeDocument12 pagesThe Medical Rights University of Maryland University Collegepy007No ratings yet

- Congressional Budget Office: Douglas W. Elmendorf, Director U.S. Congress Washington, DC 20515Document8 pagesCongressional Budget Office: Douglas W. Elmendorf, Director U.S. Congress Washington, DC 20515Legal Insurrection100% (2)

- Keep Your Doctor Change Your SenatorDocument2 pagesKeep Your Doctor Change Your SenatorOrtmanForSenateNo ratings yet

- Research Paper FinalDocument19 pagesResearch Paper Finalapi-350383601100% (1)

- Senator Max Baucus 7-09Document5 pagesSenator Max Baucus 7-09janusvenNo ratings yet

- QUESTION # 1: Analyze Why Is It Important For Health Care Managers and Policy-Makers To Understand The Intricacies of The Health Care Delivery SystemDocument5 pagesQUESTION # 1: Analyze Why Is It Important For Health Care Managers and Policy-Makers To Understand The Intricacies of The Health Care Delivery SystemLenie ManayamNo ratings yet

- Common and Fiscal Sense To Health CareDocument2 pagesCommon and Fiscal Sense To Health Careapackof2100% (2)

- Policy PaperDocument3 pagesPolicy PaperproaceswebdevelopersNo ratings yet

- Combined WV FOIA FilesDocument902 pagesCombined WV FOIA FilesAssociation of American Physicians and SurgeonsNo ratings yet

- Health Policy AnalysisDocument8 pagesHealth Policy Analysisapi-338453738No ratings yet

- Not What The Doctors Ordered: The Sickening Impact of ObamacareDocument35 pagesNot What The Doctors Ordered: The Sickening Impact of ObamacareCitizens United Foundation100% (2)

- Hidaat Alem The Medical Rights and Reform Act of 2009 University of Maryland University CollegeDocument12 pagesHidaat Alem The Medical Rights and Reform Act of 2009 University of Maryland University Collegepy007No ratings yet

- ACOS An Eye On Washington Quarterly (SGR)Document3 pagesACOS An Eye On Washington Quarterly (SGR)acosurgeryNo ratings yet

- ACOS Eye On Washington May 2013Document3 pagesACOS Eye On Washington May 2013acosurgeryNo ratings yet

- ACOS An Eye On Washington SeptemberDocument4 pagesACOS An Eye On Washington SeptemberacosurgeryNo ratings yet

- ACOS An Eye On Washington - July 2013Document6 pagesACOS An Eye On Washington - July 2013acosurgeryNo ratings yet

- ACOS Eye On Washington May 2013Document4 pagesACOS Eye On Washington May 2013acosurgeryNo ratings yet

- ACOS An Eye On Washington Quarterly Insight (Sunshine Act)Document3 pagesACOS An Eye On Washington Quarterly Insight (Sunshine Act)CarneCapitalNo ratings yet

- Trudy Larkins Press ReleaseDocument2 pagesTrudy Larkins Press ReleaseacosurgeryNo ratings yet

- ACOS An Eye On Washington - August 2013Document4 pagesACOS An Eye On Washington - August 2013acosurgeryNo ratings yet

- ACOS Press Release Feb 24, 2012Document1 pageACOS Press Release Feb 24, 2012kyochum5805No ratings yet

- ACOS An Eye On Washington JuneDocument5 pagesACOS An Eye On Washington JuneacosurgeryNo ratings yet

- Email Not Displaying Correctly? View It in Your Browser Forward To A FriendDocument5 pagesEmail Not Displaying Correctly? View It in Your Browser Forward To A Friendkyochum5805No ratings yet

- ACOS Eye On Washington - Mar 2013Document6 pagesACOS Eye On Washington - Mar 2013acosurgeryNo ratings yet

- ACOS Eye On Washington - Apr 2013Document6 pagesACOS Eye On Washington - Apr 2013acosurgeryNo ratings yet

- ACOS First 2011 NewsletterDocument1 pageACOS First 2011 NewsletteracosurgeryNo ratings yet

- A Note From Stephen SladeDocument1 pageA Note From Stephen SladeacosurgeryNo ratings yet

- Email Not Displaying Correctly? View It in Your Browser Forward To A FriendDocument10 pagesEmail Not Displaying Correctly? View It in Your Browser Forward To A Friendkyochum5805No ratings yet

- Email Not Displaying Correctly? View It in Your Browser: Election OutcomesDocument9 pagesEmail Not Displaying Correctly? View It in Your Browser: Election Outcomeskyochum5805No ratings yet

- Coping StrategyDocument2 pagesCoping StrategyJeffson BalmoresNo ratings yet

- Executive Summary: Adult Dental Health Survey 2009Document22 pagesExecutive Summary: Adult Dental Health Survey 2009Musaab SiddiquiNo ratings yet

- Safety Data Sheet: Armohib Ci-28Document21 pagesSafety Data Sheet: Armohib Ci-28SJHEIK AbdullahNo ratings yet

- Dr. Sanjida Sultana's CVDocument4 pagesDr. Sanjida Sultana's CVHasibul Hassan ShantoNo ratings yet

- GANG FIT (Part 2)Document58 pagesGANG FIT (Part 2)John WangNo ratings yet

- VaanannanDocument53 pagesVaanannankevalNo ratings yet

- FAO, WHO - Assuring Food Safety and Quality. Guidelines.2003 PDFDocument80 pagesFAO, WHO - Assuring Food Safety and Quality. Guidelines.2003 PDFAlexandra Soares100% (1)

- Lesson 3: Health Information System How Do Health Information Systems Look Like and What Architectures Are Appropriate?Document13 pagesLesson 3: Health Information System How Do Health Information Systems Look Like and What Architectures Are Appropriate?ajengwedaNo ratings yet

- Back From The Bluez - 09 - Self ManagementDocument5 pagesBack From The Bluez - 09 - Self ManagementMelanie DovaleNo ratings yet

- PN0621 CF1 ClinicalApproachDementiaDocument5 pagesPN0621 CF1 ClinicalApproachDementiaSwayang Sudha PandaNo ratings yet

- Willingness To Pay For Improved Health Walk On The Accra-Aburi Mountains Walkway in GhanaDocument9 pagesWillingness To Pay For Improved Health Walk On The Accra-Aburi Mountains Walkway in GhanaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- 18-294 - CDG CSD Hba1c (1 X 2 M) Pull-Up (Diastika) - Ind - PrintDocument1 page18-294 - CDG CSD Hba1c (1 X 2 M) Pull-Up (Diastika) - Ind - PrintHinama ChenNo ratings yet

- Elimination Diet Guide Reveals Surprising Health Problems Caused by Food SensitivitiesDocument1 pageElimination Diet Guide Reveals Surprising Health Problems Caused by Food Sensitivitiesgianluca136No ratings yet

- Martha E. Rogers' Theory of Unitary Human BeingsDocument9 pagesMartha E. Rogers' Theory of Unitary Human BeingsCASTRO, ANDREI KARL Z.No ratings yet

- BipMED Price List May 2022Document9 pagesBipMED Price List May 2022erlinNo ratings yet

- Vitamin D and CalciumDocument33 pagesVitamin D and CalciumAkhmadRoziNo ratings yet

- Cardiovascular System Physical AssessmentDocument6 pagesCardiovascular System Physical Assessmentpulsating humNo ratings yet

- Manage URI Symptoms with Home RemediesDocument7 pagesManage URI Symptoms with Home RemediesdeepuNo ratings yet

- Mcdonalds Case Study Final ArtifactDocument10 pagesMcdonalds Case Study Final Artifactapi-340015164No ratings yet

- Akhil Kumar Ramesh Halpani: Organization Structure Training AT Sukraft Recycling PVT Ltd. (Satari, Goa)Document35 pagesAkhil Kumar Ramesh Halpani: Organization Structure Training AT Sukraft Recycling PVT Ltd. (Satari, Goa)Akhil PatelNo ratings yet

- Nursing Care PlanDocument10 pagesNursing Care PlanGinel Laquiores100% (1)

- Name: Eric P. Alim Year & Section: CMT-1Document27 pagesName: Eric P. Alim Year & Section: CMT-1Ariel BobisNo ratings yet

- NCP - HmoleDocument8 pagesNCP - HmoleChloe Opiña100% (6)

- Leila Americano Yucheng Fan Carolina Gonzalez Manci LiDocument21 pagesLeila Americano Yucheng Fan Carolina Gonzalez Manci LiKarolllinaaa100% (1)

- Epifeed LHFDocument2 pagesEpifeed LHFJoko WiwiNo ratings yet

- First Aid and Water SurvivalDocument18 pagesFirst Aid and Water Survivalmusubi purpleNo ratings yet

- Package Pricing at Mission Hospital IMB527 PDFDocument9 pagesPackage Pricing at Mission Hospital IMB527 PDFMasooma SheikhNo ratings yet

- TonsillitisDocument21 pagesTonsillitisWael ShamyNo ratings yet

- 03-Ischemic Heart Disease - 2020 OngoingDocument151 pages03-Ischemic Heart Disease - 2020 OngoingDana MohammadNo ratings yet

- PED011 Final Req 15Document3 pagesPED011 Final Req 15macabalang.yd501No ratings yet

- The Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpFrom EverandThe Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpRating: 4.5 out of 5 stars4.5/5 (11)

- Camelot's Court: Inside the Kennedy White HouseFrom EverandCamelot's Court: Inside the Kennedy White HouseRating: 4 out of 5 stars4/5 (17)

- Nine Black Robes: Inside the Supreme Court's Drive to the Right and Its Historic ConsequencesFrom EverandNine Black Robes: Inside the Supreme Court's Drive to the Right and Its Historic ConsequencesNo ratings yet

- The Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VoteFrom EverandThe Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VoteRating: 4.5 out of 5 stars4.5/5 (16)

- The Deep State: How an Army of Bureaucrats Protected Barack Obama and Is Working to Destroy the Trump AgendaFrom EverandThe Deep State: How an Army of Bureaucrats Protected Barack Obama and Is Working to Destroy the Trump AgendaRating: 4.5 out of 5 stars4.5/5 (4)

- Commander In Chief: FDR's Battle with Churchill, 1943From EverandCommander In Chief: FDR's Battle with Churchill, 1943Rating: 4 out of 5 stars4/5 (16)

- We've Got Issues: How You Can Stand Strong for America's Soul and SanityFrom EverandWe've Got Issues: How You Can Stand Strong for America's Soul and SanityNo ratings yet

- Thomas Jefferson: Author of AmericaFrom EverandThomas Jefferson: Author of AmericaRating: 4 out of 5 stars4/5 (107)

- Game Change: Obama and the Clintons, McCain and Palin, and the Race of a LifetimeFrom EverandGame Change: Obama and the Clintons, McCain and Palin, and the Race of a LifetimeRating: 4 out of 5 stars4/5 (572)

- The Courage to Be Free: Florida's Blueprint for America's RevivalFrom EverandThe Courage to Be Free: Florida's Blueprint for America's RevivalNo ratings yet

- Power Grab: The Liberal Scheme to Undermine Trump, the GOP, and Our RepublicFrom EverandPower Grab: The Liberal Scheme to Undermine Trump, the GOP, and Our RepublicNo ratings yet

- Reading the Constitution: Why I Chose Pragmatism, not TextualismFrom EverandReading the Constitution: Why I Chose Pragmatism, not TextualismNo ratings yet

- Witch Hunt: The Story of the Greatest Mass Delusion in American Political HistoryFrom EverandWitch Hunt: The Story of the Greatest Mass Delusion in American Political HistoryRating: 4 out of 5 stars4/5 (6)

- Stonewalled: My Fight for Truth Against the Forces of Obstruction, Intimidation, and Harassment in Obama's WashingtonFrom EverandStonewalled: My Fight for Truth Against the Forces of Obstruction, Intimidation, and Harassment in Obama's WashingtonRating: 4.5 out of 5 stars4.5/5 (21)

- Blood Money: Why the Powerful Turn a Blind Eye While China Kills AmericansFrom EverandBlood Money: Why the Powerful Turn a Blind Eye While China Kills AmericansRating: 4.5 out of 5 stars4.5/5 (10)

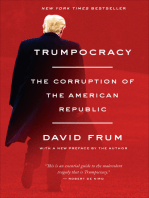

- Trumpocracy: The Corruption of the American RepublicFrom EverandTrumpocracy: The Corruption of the American RepublicRating: 4 out of 5 stars4/5 (68)

- The Quiet Man: The Indispensable Presidency of George H.W. BushFrom EverandThe Quiet Man: The Indispensable Presidency of George H.W. BushRating: 4 out of 5 stars4/5 (1)

- The Last Republicans: Inside the Extraordinary Relationship Between George H.W. Bush and George W. BushFrom EverandThe Last Republicans: Inside the Extraordinary Relationship Between George H.W. Bush and George W. BushRating: 4 out of 5 stars4/5 (6)

- The Great Gasbag: An A–Z Study Guide to Surviving Trump WorldFrom EverandThe Great Gasbag: An A–Z Study Guide to Surviving Trump WorldRating: 3.5 out of 5 stars3.5/5 (9)

- An Ordinary Man: The Surprising Life and Historic Presidency of Gerald R. FordFrom EverandAn Ordinary Man: The Surprising Life and Historic Presidency of Gerald R. FordRating: 4 out of 5 stars4/5 (5)

- Profiles in Ignorance: How America's Politicians Got Dumb and DumberFrom EverandProfiles in Ignorance: How America's Politicians Got Dumb and DumberRating: 4.5 out of 5 stars4.5/5 (80)

- The Magnificent Medills: The McCormick-Patterson Dynasty: America's Royal Family of Journalism During a Century of Turbulent SplendorFrom EverandThe Magnificent Medills: The McCormick-Patterson Dynasty: America's Royal Family of Journalism During a Century of Turbulent SplendorNo ratings yet

- The Science of Liberty: Democracy, Reason, and the Laws of NatureFrom EverandThe Science of Liberty: Democracy, Reason, and the Laws of NatureNo ratings yet

- Crimes and Cover-ups in American Politics: 1776-1963From EverandCrimes and Cover-ups in American Politics: 1776-1963Rating: 4.5 out of 5 stars4.5/5 (26)

- The Invisible Bridge: The Fall of Nixon and the Rise of ReaganFrom EverandThe Invisible Bridge: The Fall of Nixon and the Rise of ReaganRating: 4.5 out of 5 stars4.5/5 (32)