Professional Documents

Culture Documents

EBI Certificates and Review Courses

Uploaded by

Karim MohamedCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

EBI Certificates and Review Courses

Uploaded by

Karim MohamedCopyright:

Available Formats

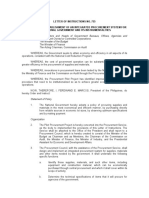

BANKING & FINANCE CERTIFICATES AND REVIEW COURSES

Year: 2012 - 2013

Banking & Finance Investement and Treasury package Certificates

Page 2

www.ebi.gov.eg

Banking & Finance

Certificates

www.ebi.gov.eg

Banking & Finance Investement and Treasury package Certificates

Credit Certificate

Certificate Hours: 255 Target Audience: This credit certificate is intended for credit department and financial institution employees, such as junior credit officers and portfolio and relationship managers. Certificate Description: The credit certificate provides participants with the fundamentals of accounting and financial statements. It also enables them to understand lending techniques for effective credit decisions as well as other techniques involving risk of trade operations from a credit perspective. Moreover, it gives the candidates perspective on the legal issues that govern the scope of credit activities. It is worth noting that EBI is applying up to date instructional methods; among them is Trial Desk, which allows participants to successfully complete the final desk based on real case studies. Certificate Objectives: Prepare a financial statement analysis Describe how to take a credit decision, through industry analysis, financial statement analysis, cash flow statement analysis, projections and lending rationales Identify the international trade services, documentary credits and letters of guarantee Identify the different financial institutions and the elements of bank risk appraisal Explain the advantages and limitations of the implementation of Basel II Explain credit risk ratings and discuss how to manage credit risk Prepare a credit facilities report Identify the role and function of credit administration Explain the banking information duties and responsibilities List the legal aspects and regulations of credit and finance Detect non-performing loans and discuss how the bank handles them Accredited by: TGIF (The Global Institute of Finance) in New York, USA Language: English CEUs: 20 For inquiries please contact Banking and Finance department Direct number: 02 - 24026943 Mr. Mohamed Youssef (Ext. 552) Mobile number: 01000019167 Email: Bankingandfinance@ebi.gov.eg

Page 4

www.ebi.gov.eg

Banking & Finance egakcap yrusaerT dna tnemetsevnI Certificates

New Trends of Internal Audit in Banks

Certificate Hours: 100 Target Audience: All employees of supervision, inspection and internal audit departments Certificate Description: Identify the fundamental determinants of the internal control system in the light of instructions issued by the Basel Unit of the Control and Supervision Sector of the Central Bank of Egypt. Certificate Objectives: List the fundamental determinants of the audit system in light of Basel Accord Explain how to inspect departments and branches of the bank using the risk approach Identify the compliance unit and the responsibilities of senior management Define check provisions and the mandatory conditions to be met in the check Explain the legal aspects of banking operations and credit Apply case studies on anti-money laundering CEUs: 8.2 Language: Arabic Banking and Finance department Direct number: 02 - 24026943 Mr. Ahmed Teleb (Ext. 570) Mobile number: 01000019167 Email: Bankingandfinance@ebi.gov.eg

For inquiries please contact

www.ebi.gov.eg

Page 5

Banking & Finance Investement and Treasury package Certificates

Principles of Banking Certificate

Certificate Hours: 100 Target Audience: This certificate is designed for undergraduates and fresh graduates aiming to join the banking field Certificate Description: The certificate provides participants with an overview of banking with an introduction to the financial and banking sector through an explanation of the roles and services provided by banks; also they will gain knowledge about the code of ethics which affects the banking sector. In the meantime, the certificate will provide participants with some basic skills in sales and customer services. Finally, the participant will learn how to write professional curriculum vitae. Certificate Objectives: Explain the development of the banking sector. List the concept and definitions of the customer service. List the different bank accounts and types of deposits. Discuss the legal aspects of commercial paper and the clearing settlements. List the various operations of retail banking. Define basic communication skills. Explain the basics for the analysis of credit and finance. Explain the concepts of SME Banking and tools of finance. Explain foreign trade operations. Demonstrate professional Writing through CV and Interview skills. Discuss Business Awareness: Written Communication, Etiquette at Workplace, and Presentation Skills. Language: English CEUs: 8.2 Banking and Finance department Direct number: 02 - 24026943 Mr. Bishoy Youssef (Ext. 557) Mobile number: 01000019167 Email: Bankingandfinance@ebi.gov.eg

For inquiries please contact

Page 6

www.ebi.gov.eg

Banking & Finance egakcap yrusaerT dna tnemetsevnI Certificates

-

100 : : . : : 8.2 : 24026943 - 02 : . ( )557 01000019167 : Bankingandfinance@ebi.gov.eg :

www.ebi.gov.eg

Page 7

Banking & Finance Investement and Treasury package Certificates

Page 8

www.ebi.gov.eg

Banking & Finance egakcap yrusaerT dna tnemetsevnI Certificates

150 : : . : . . : . . . . . . . . . . . . 11 : 24026943 - 02 : . ( )551 01000019167 : Bankingandfinance@ebi.gov.eg :

www.ebi.gov.eg

Page 9

Banking & Finance Investement and Treasury package Review Courses

Page 10

www.ebi.gov.eg

Banking & Finance

Review Courses

www.ebi.gov.eg

Banking & Finance Investement and Treasury package Review Courses

Certified Management Accountant CMA Part I

Certificate Hours: 120 Target Audience: This review course is tailor-made for finance professionals at all levels, whether you want to enhance your value to your current organization or expand your career potential. Certificate Description: This review course is the advanced professional certification specifically designed to measure the accounting and financial management skills that drive business performance. Achieving the CMA credential demonstrates your mastery of financial planning, analysis, control, and decision support, as well as professional ethics. Certificate Objectives: By the end of part 1 the participants will be able to: Prepare budgeting, planning and forecasting. Define performance measurement. Make cost management. Assess internal controls. Apply professional ethics. Language: English In cooperation with IMA (Institute of Management Accountant) Schedule: Q2 Q 3 Banking and Finance department Direct number: 02 - 24026943 Mr. Mohamed Hussien (Ext. 506) Mobile number: 01000019167 Email: Bankingandfinance@ebi.gov.eg

For inquiries please contact

Page 12

www.ebi.gov.eg

Banking & Finance egakcap yrusaerT dna tnemetsevnI Review Courses

The Association of Chartered Certified Accountant (ACCA) F7 Financial Reporting

Certificate Hours: 54 Target Audience: This review course is intended for accountants and auditors who work or are aiming to work in banking (accounting and auditing department) or in the financial sector. Certificate Description: This is a review course for one section of the ACCA examination for global certification of accountants. It is designed to develop knowledge and skills in understanding and applying accounting standards and the theoretical framework in the preparation of financial statements of entities, including groups and how to analyze and interpret those financial statements. Certificate Objectives: Discuss and apply a conceptual framework for financial reporting Describe the regulatory framework for financial reporting Prepare and present financial statements that conform to international accounting standards Define and apply the consolidated financial statements Analyze and interpret financial statements Language: English In cooperation with ACCA (Association of Chartered Certified Accountant) in UK Banking and Finance department Direct number: 02 - 24026943 Mr. Mohamed Hussien (Ext. 506) Mobile number: 01000019167 Email: Bankingandfinance@ebi.gov.eg

Schedule: Q1 Q 3 For inquiries please contact

www.ebi.gov.eg

Page 13

Banking & Finance Investement and Treasury package Review Courses

The Association of Chartered Certified Accountant (ACCA) F8 - Audit and Assurance

Certificate Hours: 54 Target Audience: This review course is intended for accountants and auditors who work or are aiming to work in banking (accounting and auditing department) or in the financial sector. Certificate Description: This is a review course for one section of the ACCA examination for global certification of accountants. It is designed to develop knowledge and skills in understanding and applying accounting standards and the theoretical framework in the preparation of financial statements of entities, including groups and how to analyze and interpret those financial statements. Certificate Objectives: Explain the nature, purpose and scope of assurance engagements including the role of the external audit and its regulatory and ethical framework Explain the nature of internal audit and describe its role as part of overall performance management and its relationship with the external audit Demonstrate how the auditor obtains an understanding of the entity and its environment, assesses the risk of material misstatement (whether arising from fraud or other irregularities) and plans an audit of financial statements Describe and evaluate information systems and internal controls to identify and communicate control risks and their potential consequences, making appropriate recommendations Identify and describe the work and evidence required to meet the objectives of audit engagements and the application of the International Standards on Auditing Evaluate findings and modify the audit plan as necessary Explain how the conclusions from audit work are reflected in different types of audit report, explain the elements of each type of report Language: English In cooperation with ACCA (Association of Chartered Certified Accountant) in UK Banking and Finance department Direct number: 02 - 24026943 Mr. Mohamed Hussien (Ext. 506) Mobile number: 01000019167 Email: Bankingandfinance@ebi.gov.eg

Schedule: Q1 Q 3 For inquiries please contact

Page 14

www.ebi.gov.eg

Banking & Finance egakcap yrusaerT dna tnemetsevnI Review Courses

The Association of Chartered Certified Accountant (ACCA) F9 Financial Management

Certificate Hours: 54 Target Audience: This review course is intended for accountants and auditors who work or are aiming to work in banking (accounting and auditing department) or in the financial sector. Certificate Description: This is a review course for one section of the ACCA examination for global certification of accountants. It is designed to develop knowledge and skills in understanding and applying accounting standards and the theoretical framework in the preparation of financial statements of entities, including groups and how to analyze and interpret those financial statements. Certificate Objectives: Discuss the role and purpose of the financial management function Assess and discuss the impact of the economic environment on financial management Discuss and apply working capital management techniques Carry out effective investment appraisal Identify and evaluate alternative sources of business finance Explain and calculate the cost of capital and the factors which affect it Discuss and apply principles of business and asset valuations Explain and apply risk management techniques in business Language: English In cooperation with ACCA (Association of Chartered Certified Accountant) in UK Banking and Finance department Direct number: 02 - 24026943 Mr. Mohamed Hussien (Ext. 506) Mobile number: 01000019167 Email: Bankingandfinance@ebi.gov.eg

Schedule: Q1 Q 3 For inquiries please contact

www.ebi.gov.eg

Page 15

Banking & Finance Investement and Treasury package Review Courses

CFA - Chartered Financial Analyst Level I

Certificate Hours: 100 Target Audience: The CFA is a qualification for finance and investment professionals, particularly in the fields of investment management and financial analysis of stocks, bonds and their derivative assets. Certificate Description: The CFA designation was first awarded in 1963 as of August 2010. CFA Institute has more than 100,000 members around the world, including more than 90,000 CFA charter holders. Certificate Objectives: Focusing on portfolio management and financial analysis Providing the participants with general knowledge about other areas of finance Language: English In cooperation with CFA (Chartered Financial Analyst) Schedule: Q2 Q 3 Banking and Finance department Direct number: 02 - 24026943 Mr. Ahmed Teleb (Ext. 570) Mobile number: 01000019167 Email: Bankingandfinance@ebi.gov.eg

For inquiries please contact

Page 16

www.ebi.gov.eg

Banking & Finance egakcap yrusaerT dna tnemetsevnI Review Courses

CIA Certified Internal Auditor Part I: Certification Review Course According to The IIAs CIA Learning System

Certificate Hours: 54 Target Audience: Internal Auditors Certificate Description: The CIA is the only globally accepted designation for internal auditors and the standard by which internal auditing professionals demonstrate their knowledge and competence to facilitate and manage todays complex internal audit responsibilities. Certificate Objectives: Define The Internal Audit Activitys Role in Governance, Risk, and Control. Conduct the Internal Audit Engagement. Explain business analysis and information technology List business management skills Language: English In cooperation with IIA (Institute of Internal Auditors) in Florida, USA Schedule: Q2 Q4 Banking and Finance department Direct number: 02 - 24026943 Mr. Mohamed Hussien (Ext. 506) Mobile number: 01000019167 Email: Bankingandfinance@ebi.gov.eg

For inquiries please contact

www.ebi.gov.eg

Page 17

Banking & Finance Investement and Treasury package Review Courses

Certified Islamic Professional Accountant (CIPA)

Certificate Hours: 81 Target Audience: The CIPA course is intended for accountants who currently work or aim to work in the field of Islamic banking and financial institutions. Certificate Description: The CIPA certificate aims to provide a blend of theoretical concepts and practical applications to introduce the Islamic finance body of knowledge to the pool of professional accountants involved in the financial services industry, in addition to providing them with specialized knowledge in this area. Certificate Objectives: Explain the Islamic financial system List the Islamic law and Sharia standards for financial transactions Identify the objectives and concepts of financial accounting for Islamic banks and financial institutions Describe the accounting standards Identify the objectives and the principles of auditing and ethics for Islamic financial institutions Language: English / Arabic In cooperation with AAOIFI (Accounting and Auditing Organization for Islamic Financial Institution) in Bahrain

Schedule: Q2 Q4 For inquiries please contact

Banking and Finance department Direct number: 02 - 24026943 Mr. Mohamed Hussien (Ext. 506) Mobile number: 01000019167 Email: Bankingandfinance@ebi.gov.eg

Page 18

www.ebi.gov.eg

Banking & Finance egakcap yrusaerT dna tnemetsevnI Review Courses

Certified Documentary Credit Specialist (CDCS)

Certificate Hours: 108 Target Audience: This review course is intended for those who are working in the documentary credit and international trade fields and aim to become international practitioners. Certificate Description: CDCS is the professional certification that demonstrates specialist knowledge of, and ability to apply, the skills required for competent practice in documentary credits. This certificate is endorsed by the International Chamber of Commerce. Certificate Objectives: Identify documentary credit groups, types, parties, and risks. List the characteristics of documentary credits. Apply and practice documentary credit procedures. Differentiate between financial and commercial documents. Demonstrate knowledge of the international chamber of commerce rules. Language: English In cooperation with IFS (Institute of Financial Services) in UK Schedule: Q2 Banking and Finance department Direct number: 02 - 24026943 Ms. Heba Mohamed (Ext. 548) Mobile number: 01000019167 Email: Bankingandfinance@ebi.gov.eg

For inquiries please contact

www.ebi.gov.eg

Page 19

BANKING & FINANCE CERTIFICATES AND REVIEW COURSES

Year: 2012 - 2013

You might also like

- Internship Report Nepal Investment BankDocument40 pagesInternship Report Nepal Investment BankSarfraj Ansari91% (11)

- Project Report On Bank of AsiaDocument54 pagesProject Report On Bank of AsiaSeema Chapagain100% (1)

- Kanishk Tatiya - MIP - Interim ReportDocument14 pagesKanishk Tatiya - MIP - Interim ReportKanishk TatiyaNo ratings yet

- Final ReportDocument43 pagesFinal ReportAmy GreenNo ratings yet

- Banking OperationsDocument7 pagesBanking OperationsManic BashaNo ratings yet

- Chapter OneDocument13 pagesChapter OneSofonias MenberuNo ratings yet

- Chartered BankerDocument9 pagesChartered BankermothicyNo ratings yet

- Chartered Banker: The Gold Standard in Banking QualificationDocument9 pagesChartered Banker: The Gold Standard in Banking QualificationPiyal HossainNo ratings yet

- CV Karntimon - YDocument4 pagesCV Karntimon - Yichigosonix66No ratings yet

- Bank Strengthening Manual: USAID - Iraq Economic Governance IIDocument54 pagesBank Strengthening Manual: USAID - Iraq Economic Governance IIshailaja74No ratings yet

- Cib CoursesDocument10 pagesCib CoursesEnusah AbdulaiNo ratings yet

- Job Description Job Title: Branch: Reporting To: Head of Private Banking Department: Job PurposeDocument2 pagesJob Description Job Title: Branch: Reporting To: Head of Private Banking Department: Job PurposeNuwan Tharanga LiyanageNo ratings yet

- UNIT3Document37 pagesUNIT3lokesh palNo ratings yet

- 1 - 2018 Introduction To Banking Operations UBA-Day 1 PDFDocument111 pages1 - 2018 Introduction To Banking Operations UBA-Day 1 PDFAustinNo ratings yet

- SBL Internship ReportDocument30 pagesSBL Internship ReportPrajwol ThapaNo ratings yet

- Business Analyst in Banking Domain ResumeDocument6 pagesBusiness Analyst in Banking Domain ResumeOscar BasilNo ratings yet

- Corporate BankingDocument74 pagesCorporate BankingVedant BhansaliNo ratings yet

- 1 Bank LendingDocument56 pages1 Bank Lendingparthasarathi_inNo ratings yet

- Navigating Professional Paths: A Guide to CA, MBA, UPSC, SSC, Banking, GATE, Law, and UGCFrom EverandNavigating Professional Paths: A Guide to CA, MBA, UPSC, SSC, Banking, GATE, Law, and UGCNo ratings yet

- A Project Report On The Surat PeopleDocument131 pagesA Project Report On The Surat PeopleHimanshu MistryNo ratings yet

- Q1 Module 5-Week 5-Loan Requirements of Different Banks and Non Bank InstitutionsDocument24 pagesQ1 Module 5-Week 5-Loan Requirements of Different Banks and Non Bank InstitutionsJusie ApiladoNo ratings yet

- Thesis Banking SystemDocument6 pagesThesis Banking Systemprdezlief100% (2)

- Abdulkhalek Tharwat Resume 2023Document4 pagesAbdulkhalek Tharwat Resume 2023Shohidul IslamNo ratings yet

- Eco 306 MB BankDocument11 pagesEco 306 MB BankKhánh Mai Lê NguyễnNo ratings yet

- Know Your CustomerDocument75 pagesKnow Your Customerkomal chavan100% (2)

- Contact Details: Curriculum Vitae For James SibandaDocument5 pagesContact Details: Curriculum Vitae For James SibandaNixon Gomeya ChinkhwangwaNo ratings yet

- Banking Financial Services and InsuranceDocument432 pagesBanking Financial Services and InsuranceRajesh RamachandranNo ratings yet

- Deposit Collection at BOKDocument34 pagesDeposit Collection at BOKKrishna Bahadur ThapaNo ratings yet

- KYC ProjectDocument40 pagesKYC Projectanon_292134566100% (2)

- Merchant BankingDocument20 pagesMerchant BankingDileep SinghNo ratings yet

- Compliance Functions in Banks: Back To BasicsDocument28 pagesCompliance Functions in Banks: Back To BasicsiamnehaNo ratings yet

- Banker Job DescriptionDocument2 pagesBanker Job DescriptionAnh KieuNo ratings yet

- DBF Rules Syllabus 2003 Revised 1.8.2003Document25 pagesDBF Rules Syllabus 2003 Revised 1.8.2003dharmesh_mbaNo ratings yet

- NCC Bank Term PaperDocument8 pagesNCC Bank Term Paperafmzywxfelvqoj100% (1)

- An Overview About Vietnam Joint Stock Commercial Bank For Industry and TradeDocument20 pagesAn Overview About Vietnam Joint Stock Commercial Bank For Industry and TradeTrass BineNo ratings yet

- SME Credit Assessment Course OutlineDocument7 pagesSME Credit Assessment Course OutlineZeeshankhan79No ratings yet

- 605ca47d48991df6419ac38c DCO4 BrochureDocument9 pages605ca47d48991df6419ac38c DCO4 BrochureSuman AminNo ratings yet

- CBDP FL July 2016Document3 pagesCBDP FL July 2016aNo ratings yet

- Ethiopian Institute of Financial Studies (EIFS) : Project FinanceDocument7 pagesEthiopian Institute of Financial Studies (EIFS) : Project FinanceASHENAFI GIZAWNo ratings yet

- Bank Customer ServiceDocument47 pagesBank Customer ServiceManojj21100% (1)

- Job Description Accounts Officer ExpenditureDocument2 pagesJob Description Accounts Officer ExpenditureKevinNo ratings yet

- Course OutlinesDocument22 pagesCourse OutlinesOwunari Adaye-OrugbaniNo ratings yet

- Kba C. Guide English PDFDocument17 pagesKba C. Guide English PDFfelixmuyoveNo ratings yet

- Co-Operative Bank Rahul ChourasiyaDocument46 pagesCo-Operative Bank Rahul ChourasiyaNitinAgnihotriNo ratings yet

- Franklyn Banking and Finance EnglishDocument66 pagesFranklyn Banking and Finance Englishsuprnd100% (1)

- M AbassDocument5 pagesM AbassAli HassanNo ratings yet

- SCBI Brochure - Run 11Document2 pagesSCBI Brochure - Run 11Zendy PastoralNo ratings yet

- Three-Tier Financial Structure: HK$25 Million HK$100 Million HK$150 MillionDocument28 pagesThree-Tier Financial Structure: HK$25 Million HK$100 Million HK$150 MillionVishAntivirusNo ratings yet

- CFE - SNL Bank Valuation BrochureDocument5 pagesCFE - SNL Bank Valuation BrochureFahad MirNo ratings yet

- Final 1Document50 pagesFinal 1saddamitdNo ratings yet

- Thesis Paper On Dutch Bangla BankDocument5 pagesThesis Paper On Dutch Bangla Bankbrittanyeasonlowell100% (2)

- Rift Valley: UnversityDocument11 pagesRift Valley: Unversitybirook lemaNo ratings yet

- COURSE OUTLINE - Advanced Credit Adminstration - 2024Document6 pagesCOURSE OUTLINE - Advanced Credit Adminstration - 2024professionNo ratings yet

- Archana Baskota 8thsemDocument10 pagesArchana Baskota 8thsemArchana BaskotaNo ratings yet

- Job Profile:: Customer ServiceDocument3 pagesJob Profile:: Customer Serviceਖੇਤੁ ਜੁ ਮਾਂਡਿਓ ਸੂਰਮਾNo ratings yet

- 3rd Sem B, L&o 1.docx 2Document85 pages3rd Sem B, L&o 1.docx 2shree harsha cNo ratings yet

- Lesson 2 Audit of Banks Part 2 RevDocument16 pagesLesson 2 Audit of Banks Part 2 Revqrrzyz7whgNo ratings yet

- International Financial Statement AnalysisFrom EverandInternational Financial Statement AnalysisRating: 1 out of 5 stars1/5 (1)

- Mastering Trade Lines "A Guide to Building Credit and Financial Success"From EverandMastering Trade Lines "A Guide to Building Credit and Financial Success"No ratings yet

- LME301Document8 pagesLME301Karim MohamedNo ratings yet

- SCE - CFA Broch-Aug 2011-1Document4 pagesSCE - CFA Broch-Aug 2011-1Karim MohamedNo ratings yet

- Alcofan GelDocument2 pagesAlcofan GelKarim MohamedNo ratings yet

- 2013 4 24 12 33 8Document2 pages2013 4 24 12 33 8Karim MohamedNo ratings yet

- Fundamentals OF AccounthngDocument4 pagesFundamentals OF AccounthngKarim MohamedNo ratings yet

- ACCA F6 Taxation ACCA F6 Taxation: Šta Je F6 Taxation What Is F6 TaxationDocument1 pageACCA F6 Taxation ACCA F6 Taxation: Šta Je F6 Taxation What Is F6 TaxationKarim Mohamed100% (1)

- Installation/Configuration Instructions SAP GUI For Windows Setting Up SAP GUI To Print To A Local PrinterDocument2 pagesInstallation/Configuration Instructions SAP GUI For Windows Setting Up SAP GUI To Print To A Local PrinterKarim MohamedNo ratings yet

- Addis Ababa University College of Development StudiesDocument126 pagesAddis Ababa University College of Development StudieskindhunNo ratings yet

- Trust ReceiptDocument4 pagesTrust ReceiptVenz LacreNo ratings yet

- Corporate Finance 8thDocument15 pagesCorporate Finance 8thShivani Singh ChandelNo ratings yet

- Managerial Economics and Business Environment 1Document42 pagesManagerial Economics and Business Environment 1dpartha2000479750% (2)

- PADINIDocument8 pagesPADINIAnonymous 5DJQq2vghPNo ratings yet

- Management: Fifteenth Edition, Global EditionDocument46 pagesManagement: Fifteenth Edition, Global EditionAnna Maria TabetNo ratings yet

- Investment Banking Using ExcelDocument2 pagesInvestment Banking Using Excelrex_pprNo ratings yet

- Eo - 359-1989 PS-DBMDocument3 pagesEo - 359-1989 PS-DBMKing Gerazol GentuyaNo ratings yet

- MN5005NI Transnational Business Management: Submitted To: Sinja Poudel Ma'am Submitted byDocument29 pagesMN5005NI Transnational Business Management: Submitted To: Sinja Poudel Ma'am Submitted byHARSHANA SHRESTHA BA (Hons) in Business AdministrationNo ratings yet

- Bijmolt Et Al (2021)Document11 pagesBijmolt Et Al (2021)hafidzah fauziaNo ratings yet

- BNMDocument47 pagesBNMHyun爱纶星No ratings yet

- Chief Financial Officer Job DescriptionDocument8 pagesChief Financial Officer Job Descriptionfinancemanagement702No ratings yet

- IBISWorld - Database & Directory Publishing in The US - 2019Document31 pagesIBISWorld - Database & Directory Publishing in The US - 2019uwybkpeyawxubbhxjyNo ratings yet

- Topaz ManualDocument37 pagesTopaz ManualbookerNo ratings yet

- SAP Global Implementation Conceptual-Design-Of-Finance and ControllingDocument172 pagesSAP Global Implementation Conceptual-Design-Of-Finance and Controllingprakhar31No ratings yet

- Guidance Note On Recovery-Private SectorDocument161 pagesGuidance Note On Recovery-Private SectorJuan M. Nava DavilaNo ratings yet

- Chapter 5Document42 pagesChapter 5Aamrh AmrnNo ratings yet

- Questions For Assignment 2078 (NOU, BBS 1st Yr, Account and Taxation, Account Part)Document4 pagesQuestions For Assignment 2078 (NOU, BBS 1st Yr, Account and Taxation, Account Part)rishi dhungel100% (1)

- Ahmad FA - Chapter4Document1 pageAhmad FA - Chapter4ahmadfaNo ratings yet

- 27815rmc No. 03-2006 - Annex BDocument2 pages27815rmc No. 03-2006 - Annex BClarineRamosNo ratings yet

- Becg m-4Document25 pagesBecg m-4CH ANIL VARMANo ratings yet

- HW 2-SolnDocument9 pagesHW 2-SolnZhaohui ChenNo ratings yet

- Loan Agreement TemplateDocument2 pagesLoan Agreement TemplateElla Probinsiyana VlogNo ratings yet

- White Revolution in IndiaDocument57 pagesWhite Revolution in IndiaPiyush Gaur0% (3)

- Induction Acknowledgement-1Document3 pagesInduction Acknowledgement-1aal.majeed14No ratings yet

- (Routledge International Studies in Money and Banking) Dirk H. Ehnts - Modern Monetary Theory and European Macroeconomics-Routledge (2016)Document223 pages(Routledge International Studies in Money and Banking) Dirk H. Ehnts - Modern Monetary Theory and European Macroeconomics-Routledge (2016)Felippe RochaNo ratings yet

- FINAL REPORT 2-1 Final FinalDocument24 pagesFINAL REPORT 2-1 Final FinalDecoy1 Decoy1No ratings yet

- Strategic Elements of Competitive Advantage Session 5-6: by Dr. Jitarani Udgata Ph.D. IIFT-DDocument41 pagesStrategic Elements of Competitive Advantage Session 5-6: by Dr. Jitarani Udgata Ph.D. IIFT-Dcastro dasNo ratings yet

- Project On Ibrahim Fibers LTDDocument53 pagesProject On Ibrahim Fibers LTDumarfaro100% (1)

- Microeconomics PS #1Document2 pagesMicroeconomics PS #1Kanav AyriNo ratings yet