Professional Documents

Culture Documents

Individual

Uploaded by

Katherine MartinOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Individual

Uploaded by

Katherine MartinCopyright:

Available Formats

Residence: individuals 7.

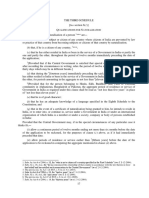

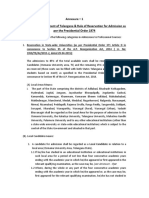

(1) For the purposes of this Act, an individual is resident in Malaysia for the basis year for a particular year of assessment if (a) (b) he is in Malaysia in that basis year for a period or periods amounting in all to one hundred and eighty-two days or more; he is in Malaysia in that basis year for a period of less than one hundred and eighty-two days and that period is linked by or to another period of one hundred and eighty-two or more consecutive days (hereinafter referred to in this paragraph as such period) throughout which he is in Malaysia in the basis year for the year of assessment immediately preceding that particular year of assessment or in that basis year for the year of assessment immediately following that particular year of assessment: Provided that any temporary absence from Malaysia (i) connected with his service in Malaysia and owing to service matters or attending conferences or seminars or study abroad; (ii) owing to ill-health involving himself or a member of his immediate family; and (iii) in respect of social visits not exceeding fourteen days in the aggregate, shall be taken to form part of such period or that period, as the case may be, if he is in Malaysia immediately prior to and after that temporary absence; (c) he is in Malaysia in that basis year for a period or periods amounting in all to ninety days or more, having been with respect to each of any three of the basis years for the four years of assessment immediately preceding that particular year of assessment either (i) resident in Malaysia within the meaning of this Act for the basis year in question; or (ii) in Malaysia for a period or periods amounting in all to ninety days or more in the basis year in question; or (d) he is resident in Malaysia within the meaning of this Act for the basis year for the year of assessment following that particular

year of assessment, having been so resident for each of the basis years for the three years of assessment immediately preceding that particular year of assessment. (1A) For the purposes of subsection (1), an individual shall be deemed to be in Malaysia for a day if he is present in Malaysia for part of that day and in ascertaining the period for which he is in Malaysia during any year, any day (within paragraphs 1(a) and (c) for which he is in Malaysia shall be taken into account whether or not that day forms part of a continuous period of days during which he is in Malaysia. Notwithstanding subsection (1), where a person who is a citizen and (a) (b) is employed in the public services or service of a statutory authority; and is not in Malaysia at any day in the basis year for that particular year of assessment by reason of (i) having and exercising his employment outside Malaysia; or (ii) attending any course of study in any institution or professional body outside Malaysia which is fullysponsored by the employer, he is deemed to be a resident for the basis year for that particular year of assessment and for any subsequent basis years when he is not in Malaysia.

(1B)

You might also like

- 1 - Notes - Resident - Individual YA2022Document2 pages1 - Notes - Resident - Individual YA2022pang jing zheNo ratings yet

- ABFT2013 T2-Residence (A)Document5 pagesABFT2013 T2-Residence (A)XindyNo ratings yet

- Employment NotificationDocument21 pagesEmployment NotificationGanesh GantaNo ratings yet

- Week 2 - Resident StatusDocument9 pagesWeek 2 - Resident Statussam_suhaimiNo ratings yet

- 31162sm DTL Finalnew-May-Nov14 Cp2Document25 pages31162sm DTL Finalnew-May-Nov14 Cp2gvcNo ratings yet

- Determination of Residence StatusDocument2 pagesDetermination of Residence StatusMah Jia YongNo ratings yet

- The All India Services (Study Leave) Regulations, 1960Document19 pagesThe All India Services (Study Leave) Regulations, 1960Rahul VcNo ratings yet

- Topic 2-Residence Status For IndividualDocument19 pagesTopic 2-Residence Status For IndividualAgnesNo ratings yet

- 1 University Roll Number L04/LLB/171440Document6 pages1 University Roll Number L04/LLB/171440Durdanta NaskarNo ratings yet

- The Direct Taxes CodeDocument3 pagesThe Direct Taxes Codeanuj91No ratings yet

- Basis of Charge Charge of Income-Tax. 4Document11 pagesBasis of Charge Charge of Income-Tax. 4poonamntpcNo ratings yet

- CCS LTC RULES PPT 20210617141434Document28 pagesCCS LTC RULES PPT 20210617141434Kumar KumarNo ratings yet

- DIRECT TAX I Bharathiar University B.com PADocument78 pagesDIRECT TAX I Bharathiar University B.com PAkalpanaNo ratings yet

- Central Civil Services (Leave Travel Concession) Rules, 1988Document7 pagesCentral Civil Services (Leave Travel Concession) Rules, 1988serekant guptaNo ratings yet

- Study Leave GR 1981Document10 pagesStudy Leave GR 1981PankajNo ratings yet

- FinalAnnexure 1 7 AP PDFDocument17 pagesFinalAnnexure 1 7 AP PDFPernapati Jhansi LakshmiNo ratings yet

- Notes TX Mys Resident StatusDocument8 pagesNotes TX Mys Resident Statusnurinatihani24No ratings yet

- Notification TSCAB Manager Scale I PostsDocument24 pagesNotification TSCAB Manager Scale I PostsJeshiNo ratings yet

- Residential StatusDocument9 pagesResidential Statussadhana20bbaNo ratings yet

- Eligibility To Appear For The Entrance TestDocument3 pagesEligibility To Appear For The Entrance TestBhanu K PrakashNo ratings yet

- SchedulefileDocument1 pageSchedulefileSACHIN BHARDWAJNo ratings yet

- CSARTheoryDocument5 pagesCSARTheoryismail shabbirNo ratings yet

- Definition of Local Nonlocal StatusDocument2 pagesDefinition of Local Nonlocal StatusPonna RashmithaNo ratings yet

- Leave Travel Concession: MarathiDocument18 pagesLeave Travel Concession: MarathirajnishsinghNo ratings yet

- I-Iia (E) 2012 04 27Document15 pagesI-Iia (E) 2012 04 27gsgunpNo ratings yet

- AP A Cat Eligibility CriteriaDocument3 pagesAP A Cat Eligibility CriteriaSai RevanthNo ratings yet

- Law of Taxation Law of Taxation Class Notes CompressDocument48 pagesLaw of Taxation Law of Taxation Class Notes CompressThrishul MaheshNo ratings yet

- Unit 1, Part 2Document10 pagesUnit 1, Part 2Sandip Kumar BhartiNo ratings yet

- Project On Residential StatusDocument25 pagesProject On Residential StatusAoudumbar KadamNo ratings yet

- SO SampleAgreementDocument9 pagesSO SampleAgreementMina TangNo ratings yet

- Prescribed Leave Rules, 1959Document11 pagesPrescribed Leave Rules, 1959Abdullah AbdullahNo ratings yet

- Group-A GazDocument12 pagesGroup-A Gazfansforever9125No ratings yet

- 3 - Basis of Charge, Scope of Total IncomeDocument165 pages3 - Basis of Charge, Scope of Total IncomeSaurin ThakkarNo ratings yet

- Residence in IndiaDocument7 pagesResidence in IndiaSuryaNo ratings yet

- Income Tax Act, 1961: Section - 5: Scope of Total IncomeDocument15 pagesIncome Tax Act, 1961: Section - 5: Scope of Total IncomeNisseem KrishnaNo ratings yet

- Authorisation PensionDocument2 pagesAuthorisation PensionAmit PatilNo ratings yet

- Residential Statuts 20216171446260Document23 pagesResidential Statuts 20216171446260Neha singhNo ratings yet

- GO 124 para 7Document2 pagesGO 124 para 7Diana HarpeyNo ratings yet

- Residential StatusDocument18 pagesResidential StatusShruti DoshiNo ratings yet

- I-Iia (E) 2012 04 20Document40 pagesI-Iia (E) 2012 04 20gsgunpNo ratings yet

- Residential Status and Tax IncidenceDocument4 pagesResidential Status and Tax IncidenceAshok Kumar MehetaNo ratings yet

- Principles of Taxation ProjectDocument5 pagesPrinciples of Taxation ProjectAman VenugopalNo ratings yet

- 646 G.ODocument18 pages646 G.OSurya100% (1)

- The Payment of Gratuity Act, 1972: Prof. Priyanka NagoriDocument21 pagesThe Payment of Gratuity Act, 1972: Prof. Priyanka Nagorishilpatiwari1989No ratings yet

- Taxation Chapter TwoDocument21 pagesTaxation Chapter TwoHazlina HusseinNo ratings yet

- SUBSIDIARY RULES (Vol2) PDFDocument157 pagesSUBSIDIARY RULES (Vol2) PDFdaisyNo ratings yet

- The Prescribed Leave Rules, 1959Document6 pagesThe Prescribed Leave Rules, 1959ENGR ABRAR IMTIAZNo ratings yet

- An Act To Establish A Uniform Retirement System For The Armed Forces of The Philippines, To Provide For Separation Therefrom, and For Other PurposesDocument5 pagesAn Act To Establish A Uniform Retirement System For The Armed Forces of The Philippines, To Provide For Separation Therefrom, and For Other PurposesMarius SumiraNo ratings yet

- Gazette English September 18 2015Document21 pagesGazette English September 18 2015nuwanthaNo ratings yet

- Relevant Provisions of Income-Tax Act, 1961: Section 6Document4 pagesRelevant Provisions of Income-Tax Act, 1961: Section 6ABC 123No ratings yet

- Annexures From I To IXDocument19 pagesAnnexures From I To IXSricharan SairiNo ratings yet

- Residential Status of An AssesseeDocument9 pagesResidential Status of An Assesseetanisha negiNo ratings yet

- INSPIRE FACULTY Fellowship Undertaking - July 2019 PDFDocument2 pagesINSPIRE FACULTY Fellowship Undertaking - July 2019 PDFAshish KumarNo ratings yet

- Model Answers Taxation 1. Residential Status of Assessee Under IT Act ?Document44 pagesModel Answers Taxation 1. Residential Status of Assessee Under IT Act ?Tejasvini KhemajiNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippine Congress AssembledDocument4 pagesBe It Enacted by The Senate and House of Representatives of The Philippine Congress AssembledMarius 월 SumiraNo ratings yet

- Ccs LTC Rules 1988Document36 pagesCcs LTC Rules 1988Upendra Pratap SinghNo ratings yet

- The Child LabourDocument6 pagesThe Child LabourJithin KrishnanNo ratings yet

- Gratuity PolicyDocument4 pagesGratuity PolicySiddhraj Singh KushwahaNo ratings yet

- Balochistan Province Civil Servants Leave Rules 1981Document10 pagesBalochistan Province Civil Servants Leave Rules 1981SirajMeerNo ratings yet

- CVT / TCM Calibration Data "Write" Procedure: Applied VehiclesDocument20 pagesCVT / TCM Calibration Data "Write" Procedure: Applied VehiclesАндрей ЛозовойNo ratings yet

- Keywords:-Career Levels, Employee Competency, Job: Satisfaction, Organizational CapabilityDocument9 pagesKeywords:-Career Levels, Employee Competency, Job: Satisfaction, Organizational CapabilityInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- 9701 w19 QP 21 PDFDocument12 pages9701 w19 QP 21 PDFFaiza KhalidNo ratings yet

- Exploration of MoonDocument8 pagesExploration of MoonAryan KhannaNo ratings yet

- OD2e L4 Reading Comprehension AKDocument5 pagesOD2e L4 Reading Comprehension AKNadeen NabilNo ratings yet

- 5 Miranda Catacutan Vs PeopleDocument4 pages5 Miranda Catacutan Vs PeopleMetoi AlcruzeNo ratings yet

- Untitled PresentationDocument23 pagesUntitled Presentationapi-543394268No ratings yet

- IX Paper 2Document19 pagesIX Paper 2shradhasharma2101No ratings yet

- Product Bulletin Fisher 8580 Rotary Valve en 123032Document16 pagesProduct Bulletin Fisher 8580 Rotary Valve en 123032Rachmat MaulanaNo ratings yet

- Events ProposalsDocument19 pagesEvents ProposalsRam-tech Jackolito FernandezNo ratings yet

- browningsong 안동Document68 pagesbrowningsong 안동yooNo ratings yet

- Natural Resources of Arunachal PradeshDocument7 pagesNatural Resources of Arunachal PradeshshivarathordiviyapurNo ratings yet

- CJ1W-PRT21 PROFIBUS-DP Slave Unit: Operation ManualDocument100 pagesCJ1W-PRT21 PROFIBUS-DP Slave Unit: Operation ManualSergio Eu CaNo ratings yet

- Agricultural LocationDocument26 pagesAgricultural LocationPrince MpofuNo ratings yet

- List - of - Members As On 6 3 18 PDFDocument8 pagesList - of - Members As On 6 3 18 PDFashish jaiswal100% (1)

- Room Air Conditioner: Service ManualDocument68 pagesRoom Air Conditioner: Service Manualervin0% (1)

- Jaringan Noordin M. TopDocument38 pagesJaringan Noordin M. TopgiantoNo ratings yet

- Book - India Physical EnvironmentDocument20 pagesBook - India Physical EnvironmentScience CoachingNo ratings yet

- SDS Jojoba Wax Beads 2860Document7 pagesSDS Jojoba Wax Beads 2860swerNo ratings yet

- Hermle C42 ENDocument72 pagesHermle C42 ENKiril AngelovNo ratings yet

- Docu69346 Unity Hybrid and Unity All Flash Configuring Converged Network Adaptor PortsDocument11 pagesDocu69346 Unity Hybrid and Unity All Flash Configuring Converged Network Adaptor PortsAmir Majzoub GhadiriNo ratings yet

- QuizDocument15 pagesQuizGracie ChongNo ratings yet

- UPSC IAS Mains LAST 10 Year Papers Law OptionalDocument42 pagesUPSC IAS Mains LAST 10 Year Papers Law Optionaljooner45No ratings yet

- Nursing Process Guide: St. Anthony's College Nursing DepartmentDocument10 pagesNursing Process Guide: St. Anthony's College Nursing DepartmentAngie MandeoyaNo ratings yet

- Making A Spiritual ConfessionDocument2 pagesMaking A Spiritual ConfessionJoselito FernandezNo ratings yet

- Mca Lawsuit Details English From 2007 To Feb 2021Document2 pagesMca Lawsuit Details English From 2007 To Feb 2021api-463871923No ratings yet

- Easy Trade Manager Forex RobotDocument10 pagesEasy Trade Manager Forex RobotPinda DhanoyaNo ratings yet

- Righeimer ComplaintDocument45 pagesRigheimer ComplaintSarah BatchaNo ratings yet

- HTTP WWW - Aphref.aph - Gov.au House Committee Haa Overseasdoctors Subs Sub133Document3 pagesHTTP WWW - Aphref.aph - Gov.au House Committee Haa Overseasdoctors Subs Sub133hadia duraniNo ratings yet

- Pest Analysis PoliticalDocument4 pagesPest Analysis PoliticalAHMAD ALINo ratings yet