Professional Documents

Culture Documents

Sample Cash Flow Template

Uploaded by

Shriya SumanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sample Cash Flow Template

Uploaded by

Shriya SumanCopyright:

Available Formats

SAMPLE CASH FLOW TEMPLATE

Sample Cash Flow Template

Maize Medical Supply (MMS) is a leader in the production and sales of X-ray machines.At the end of this year, the company expects to post $35 million (M) in revenue with a cost of goods sold of $22M and SG&A expenses of $2M. They are projecting a growth of these numbers of 8%, 6%, and 2%, respectively, over the next four years. When considering their short term assets and obligations, MMS has $4M in accounts receivable, $3M in accounts payable and $5 of inventory. The company's revenue growth will be largely driven by spending $20M today on an equipment upgrade, which will also lead to a $2M increase in accounts receivable at the end of the year. The expenditure for the equipment upgrade can be depreciated using the straight line method over the next 5 years. MMS faces a 35% tax rate, a 14% discount rate and they are projected to be worth $30M at the end of our valuation horizon of 5 years. What is the value of MMS today? Information given in the problem (all dollar figures in millions)

Initial Firm Conditions Revenue COGS SG&A Accounts Receivable Inventory Accounts Payable $ 35.00 $ 22.00 $ 2.00 $ 4.00 $ 5.00 $ 3.00 Future Firm Conditions Revenue Growth 8% COGS Growth 6% SG&A Growth 2% One-time AR increase $ 2.00 Terminal Value $ 30.00 Terminal Value Year 5 Rates tax rate disc rate 35% 14%

Capital Expenditure Intitial investment $ 20.00 Expected life 5

Calculations

Annual

depreciation

during

equipment

life Time Working

Capital Change

in

WC

Time Revenue COGS SG&A Less

Dep Operating

Profit Tax NOPAT Plus

Dep Change

in

Working

Capital CAPX Free

Cash

Flow PV(FCF) PV(Terminal

Value) Total

NPV Total

NPV 0 6 1 8 2 $

4.00

2 8 0 2 $

37.80

$

(23.32) $

(2.04) $

(4.00) $

8.44

$

(2.95) $

5.49

$

4.00

$

-

$

-

$

9.49

$

7.30

3 8 0 3 $

40.82

$

(24.72) $

(2.08) $

(4.00) $

10.02

$

(3.51) $

6.52

$

4.00

$

-

$

-

$

10.52

$

7.10

4 8 0 4 $

44.09

$

(26.20) $

(2.12) $

(4.00) $

11.77

$

(4.12) $

7.65

$

4.00

$

-

$

-

$

11.65

$

6.90

5 8 AR

+

Inv

-

AP 0 WC(this

period)

-

WC(last

period) 5 $

47.62

$

(27.77) $

(2.16) $

(4.00) $

13.68

$

(4.79) $

8.89

$

4.00

$

-

$

-

$

12.89

$

6.69

$

15.58

1 $ 35.00 $ (22.00) $ (2.00) $ (4.00) $ - $ 7.00 $ - $ (2.45) $ - $ 4.55 $ 4.00 $ - $ (2.00) ($20.0) $ - $ (20.00) $ 6.55 $ (20.00) $ 5.75 $ - $ - $ -

(Last Year's Revenue) * (1 + Revenue Growth) (Last Year's COGS * (1 + COGS Growth) (Last Year's SG&A * (1 + SG&A Growth) Investment / Expected Life [if applicable] Sum of the above four items (Operating Profit) * (Tax Rate) Sum of the above two items Less INCREASES in WC from earlier calculation Sum of the above four items each year's FCF discounted to today's dollars terminal value discounted to today's dollars

$ 29.31 Summing present values of the free cash flows and the present value of the terminal value $ 29.31 Computing the NPV with help from Excel's NPV function

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- ENR Top 250 InternationalContractorsDocument77 pagesENR Top 250 InternationalContractorsIuliana FolteaNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Corpo Finals DigestDocument40 pagesCorpo Finals DigestCazzandhra BullecerNo ratings yet

- CPSE ETF - FFO PresentationDocument34 pagesCPSE ETF - FFO PresentationBhanuprakashReddyDandavoluNo ratings yet

- Virat Alloys Business Acquisition and Recapitalisation Plan of Sembule Steel Mills 22nd April 2013Document97 pagesVirat Alloys Business Acquisition and Recapitalisation Plan of Sembule Steel Mills 22nd April 2013InfiniteKnowledgeNo ratings yet

- Inventories - TOADocument19 pagesInventories - TOAYen86% (7)

- Soal Latihan Cash Flow Fix Dan JawabanDocument6 pagesSoal Latihan Cash Flow Fix Dan JawabanInggil Subhan100% (1)

- Finanace Assignment 1 Explanation PDFDocument1 pageFinanace Assignment 1 Explanation PDFShriya SumanNo ratings yet

- Pulsatile Drug Delivery SystemDocument14 pagesPulsatile Drug Delivery Systemapi-3741769No ratings yet

- Anti PsychoticDocument23 pagesAnti PsychoticShriya SumanNo ratings yet

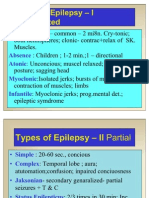

- Anti EpilepticsDocument14 pagesAnti EpilepticsShriya SumanNo ratings yet

- Argument 3Document20 pagesArgument 3Shriya SumanNo ratings yet

- Presentation 2Document28 pagesPresentation 2Shriya SumanNo ratings yet

- Internal & External Finance SourcesDocument6 pagesInternal & External Finance SourcesKarishma Satheesh Kumar0% (1)

- Diamond Model Hoffer and BCGDocument6 pagesDiamond Model Hoffer and BCGgeachyNo ratings yet

- RICS APC Requirements+Competencies 2016-17Document55 pagesRICS APC Requirements+Competencies 2016-17camelia_pirjan5776No ratings yet

- United States Court of Appeals Third CircuitDocument13 pagesUnited States Court of Appeals Third CircuitScribd Government DocsNo ratings yet

- NSCOA and The Data Dictionary (May 2011) (PDF 659KB)Document35 pagesNSCOA and The Data Dictionary (May 2011) (PDF 659KB)Rio AlexanderNo ratings yet

- Stock Market Crash in BangladeshDocument26 pagesStock Market Crash in BangladeshhrikilNo ratings yet

- Investing in Private Equity - (J.P. Morgan Asset Management)Document6 pagesInvesting in Private Equity - (J.P. Morgan Asset Management)QuantDev-MNo ratings yet

- Guide To The Secondary Market, 2015Document92 pagesGuide To The Secondary Market, 2015ed_nycNo ratings yet

- Kaveri Seed Company: IPO Fact SheetDocument4 pagesKaveri Seed Company: IPO Fact Sheetrahulrai001No ratings yet

- Solow Growth ModelDocument28 pagesSolow Growth ModelMehul GargNo ratings yet

- Prospectus of Simtex Industries LimitedDocument172 pagesProspectus of Simtex Industries LimitedMostafa Noman DeepNo ratings yet

- Family Progression MatrixDocument1 pageFamily Progression MatrixPavan KrishnamurthyNo ratings yet

- Development Planning in Bangladesh: A Scoping StudyDocument30 pagesDevelopment Planning in Bangladesh: A Scoping StudysohelalamNo ratings yet

- Skyway PlanDocument38 pagesSkyway Planrahul mehraNo ratings yet

- Valdevieso, Afrielin S. BSA - 1101 Bsa 1-Bda: Date Asset LiabilitiesDocument5 pagesValdevieso, Afrielin S. BSA - 1101 Bsa 1-Bda: Date Asset LiabilitiesAfrielin ValdeviesoNo ratings yet

- Barclays On Debt CeilingDocument13 pagesBarclays On Debt CeilingafonteveNo ratings yet

- Attachment Summary - Cash Flow Statement PDFDocument5 pagesAttachment Summary - Cash Flow Statement PDFUnmesh MitraNo ratings yet

- The Monks Investment Trust PLCDocument52 pagesThe Monks Investment Trust PLCArvinLedesmaChiongNo ratings yet

- Annual Report 2017 05 PDFDocument85 pagesAnnual Report 2017 05 PDFdewiNo ratings yet

- Private Equity AsiaDocument12 pagesPrivate Equity AsiaGiovanni Graziano100% (1)

- Chapter12 - (Applied Auditing)Document5 pagesChapter12 - (Applied Auditing)Christian Ibañez AbenirNo ratings yet

- Michael McClintock Case1Document2 pagesMichael McClintock Case1Mike MCNo ratings yet