Professional Documents

Culture Documents

Accounting FS

Uploaded by

Fazi HaiderCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting FS

Uploaded by

Fazi HaiderCopyright:

Available Formats

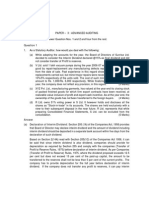

Accounting for Financial Services

Description/Objective:

The objective of this course is to equip candidates with fundamental accounting principles and concepts, tools and techniques for analysis, and application along with having knowledge about international standards for financial business concerns. The course also provides the understanding and interpretation of financial statements to assist in effective decision-making. Learning Objectives/Outcome After the successful completion of this course, participants will have: Knowledge and understanding of: o Types of accounts and accounting cycle o Accounting treatment and accounting classifications o International accounting principles and financial reporting standards o Types of business and business activities o Preparation and presentation of financial information Financial statements and its analysis Have capacity to process data, analyze and interpret the financial information and risks Course Topics 1. The Basics of Business Accounting Accounting definition and core concepts Business transactions and its classifications Accounting and its functional objectives The business entity concept and how it differs from legal entity concept Business activities: i. Operating ii. Investing iii. Financing activities The basic accounting equation Introduction to Generally Accepted Accounting Principles (GAAP) and International Accounting Standards (IFRS) Introduction to financial statements i. Balance Sheet ii. Income Statement iii. Cash Flow Statement iv. Comprehensive Income statement v. Change in equity statement 1

Elements of financial statements and their classifications How financial statements for banks are different than those of companies Financial statements and business decisions Tangible and Intangible assets Accounting for consolidation

2. Accounting for Financial Institutions Banking assets and liabilities Banking revenue and expenditure items Contingent and off balance sheet items Capital requirements for commercial banks 3. Accounting Data Processing Trial Balance, format and uses The need for adjusting accounts Time period concepts and revenue recognition principles Major types of adjusting entries i. Accruals ii. Prepayments iii. Advance receipts and payments Major types of adjusting entries i. Merchandise inventories ii. Bad debts iii. Depreciation and amortization Adjusted trial balance Preparing financial statements from adjusted trial balance Introduction to worksheet Closing process through expense and revenue summary account Post closing trial balance i. Contents ii. Uses 4. Receivables Creation of accounts receivable Collection of receivable Valuation of account Estimation of bad debts Aging of accounts receivable Writing off and recoveries 2

Notes receivables Presentation on financial statements

5. Provisioning process Importance 6. Accounting for Fixed Assets Acquisition of fixed assets Depreciation methods and their effects on financial statements Intangibles and natural resources simple accounting appreciation Typical issues related to tangible and intangible fixed assets Revaluations in fixed assets 7. Understanding Financial Statements Profit and loss statement Balance sheet Cash flow statement Statement of equity Critical elements to ascertain health of the enterprises Understanding notes attached to financial statements 8. Investments Accounting classifications i. Held for Trading ii. Available for Sale iii. Held Till Maturity Standards relating to accounting classifications Balance sheet presentation and treatment Income statement presentation and treatment 9. Analysis of Financial Statement Horizontal and vertical analysis Financial ratios including cash flow ratios (Bank financial statement analysis) Interpretations and applications of financial ratios in banking decisions

You might also like

- Information Package - KPKDocument124 pagesInformation Package - KPKFazi HaiderNo ratings yet

- 2009-10 Annual Report 2010Document9 pages2009-10 Annual Report 2010Fazi HaiderNo ratings yet

- 2008-09 Annual Report OtsukaDocument9 pages2008-09 Annual Report OtsukaFazi HaiderNo ratings yet

- ACCA F1 Study NotesDocument8 pagesACCA F1 Study Notessmillig0% (1)

- Relevent CostingDocument3 pagesRelevent CostingFazi HaiderNo ratings yet

- Adv Aud Final May08Document16 pagesAdv Aud Final May08Fazi HaiderNo ratings yet

- Agriaautos IndustriesDocument30 pagesAgriaautos IndustriesFazi HaiderNo ratings yet

- Cash Flow Projection WorksheetDocument8 pagesCash Flow Projection Worksheetpvenky_kkdNo ratings yet

- Daily ReportDocument3 pagesDaily ReportSuhail100% (1)

- Eviews HowDocument7 pagesEviews HowFazi HaiderNo ratings yet

- IAS 2 - InventoriesDocument16 pagesIAS 2 - InventoriesletmelearnthisNo ratings yet

- Master of Body Language PDFDocument10 pagesMaster of Body Language PDFreversoNo ratings yet

- ICMAP Fall 2012 Exam Strategic ManagementDocument2 pagesICMAP Fall 2012 Exam Strategic Managementsalmanahmedkhi1No ratings yet

- Research Methods in Finance SyllabusDocument3 pagesResearch Methods in Finance SyllabusFazi HaiderNo ratings yet

- Lec For Dummy VariableDocument0 pagesLec For Dummy VariableFazi HaiderNo ratings yet

- Eviews HowDocument7 pagesEviews HowFazi HaiderNo ratings yet

- Project Guidelines For M. ComDocument35 pagesProject Guidelines For M. ComMuhammad Ayyaz Iftikhar0% (1)

- Accounting Quality, Stock Price Delay and Future Stock ReturnsDocument49 pagesAccounting Quality, Stock Price Delay and Future Stock ReturnsAlan SimonNo ratings yet

- A.A.K Co. financial statements and annual reportDocument3 pagesA.A.K Co. financial statements and annual reportFazi HaiderNo ratings yet

- Iq ResultDocument1 pageIq ResultFazi HaiderNo ratings yet

- Why Strategy Is Important For Business SuccessDocument18 pagesWhy Strategy Is Important For Business SuccessFazi HaiderNo ratings yet

- Atlas PakDocument86 pagesAtlas PakjawadvohraNo ratings yet

- Dummy VariablesDocument4 pagesDummy VariablesFazi HaiderNo ratings yet

- The Zakat Collection and Refund Rules 1981Document64 pagesThe Zakat Collection and Refund Rules 1981Fazi HaiderNo ratings yet

- APA Format GuideDocument4 pagesAPA Format GuidefilantropiNo ratings yet

- Companies Ordinance 1984Document439 pagesCompanies Ordinance 1984Fazi HaiderNo ratings yet

- A.A.K Co. financial statements and annual reportDocument3 pagesA.A.K Co. financial statements and annual reportFazi HaiderNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Audit-Report-Sena KaylanDocument50 pagesAudit-Report-Sena KaylanSohag AMLNo ratings yet

- Gr11 ACC P2 (ENG) June 2022 Question PaperDocument11 pagesGr11 ACC P2 (ENG) June 2022 Question Paperora masha100% (1)

- FM SimpleDocument19 pagesFM SimpleFrancine ParrochaNo ratings yet

- Sol. Man. - Chapter 4 - Nca Held For Sale & Discontinued Opns.Document10 pagesSol. Man. - Chapter 4 - Nca Held For Sale & Discontinued Opns.Crown Garcia50% (4)

- MCOM Exist Exam QuestionsDocument64 pagesMCOM Exist Exam QuestionsALI SHER HaidriNo ratings yet

- Common Loan Application Form Under Pradhan Mantri MUDRA YojanaDocument5 pagesCommon Loan Application Form Under Pradhan Mantri MUDRA YojanaPrabhaveen PrabhaNo ratings yet

- Assignment FS AnalysisDocument2 pagesAssignment FS AnalysisLorraine Anne TawataoNo ratings yet

- Accounting for Sales, Returns, Depreciation & ConsignmentsDocument25 pagesAccounting for Sales, Returns, Depreciation & Consignmentsgargee thakareNo ratings yet

- Basel III 2018Document14 pagesBasel III 2018BokulNo ratings yet

- Akun-Akun Queen ToysDocument4 pagesAkun-Akun Queen ToysAnggita Kharisma MaharaniNo ratings yet

- Preparing An Income Statement, Statement of Retained Earnings, and Balance SheetDocument5 pagesPreparing An Income Statement, Statement of Retained Earnings, and Balance SheetJames MorrisonNo ratings yet

- Financial Statements: Join PRO or PRO Plus and Get Lifetime Access To Our Premium MaterialsDocument1 pageFinancial Statements: Join PRO or PRO Plus and Get Lifetime Access To Our Premium MaterialsJazzmin Rae BarbaNo ratings yet

- Solved - A Balance Sheet, Which Is Intended To Present Fairly Th...Document2 pagesSolved - A Balance Sheet, Which Is Intended To Present Fairly Th...Iman naufalNo ratings yet

- The Statement of Cash Flows: Weygandt - Kieso - KimmelDocument40 pagesThe Statement of Cash Flows: Weygandt - Kieso - Kimmel023- TARANNUM SHIREEN GHAZINo ratings yet

- Accounting Enhancement Class Introduction To Accounting and Business Learning ObjectivesDocument5 pagesAccounting Enhancement Class Introduction To Accounting and Business Learning ObjectivesDiane GarciaNo ratings yet

- AFM QuizDocument47 pagesAFM QuizDhaya100% (1)

- Investment Banking Interview Questions: Wall Street PrepDocument50 pagesInvestment Banking Interview Questions: Wall Street PrepGaripalli Aravind100% (2)

- Trade Payables and Other Current LiabilitiesDocument54 pagesTrade Payables and Other Current Liabilitiesland YiNo ratings yet

- Hill Country SnackDocument8 pagesHill Country Snackkiller dramaNo ratings yet

- Prof. (DR.) Paresh Shah: This Photo CC By-SaDocument21 pagesProf. (DR.) Paresh Shah: This Photo CC By-SaParesh ShahNo ratings yet

- FS SimplifiedDocument52 pagesFS Simplifiedsexywanker5No ratings yet

- 04 TP FinancialDocument4 pages04 TP Financialbless erika lendroNo ratings yet

- Case Study - Comparative Financial StatementsDocument6 pagesCase Study - Comparative Financial StatementsCJNo ratings yet

- Tally Ledger & GroupDocument1 pageTally Ledger & GroupSK CreativeNo ratings yet

- Financial Statements SolutionsDocument6 pagesFinancial Statements SolutionsSyed HaseebNo ratings yet

- Measure Liquidity RatiosDocument3 pagesMeasure Liquidity RatiosSteven PangNo ratings yet

- Analysis Solutions Acc 411Document13 pagesAnalysis Solutions Acc 411dre_emNo ratings yet

- Kapco LTD: For The Year Ended 2007Document10 pagesKapco LTD: For The Year Ended 2007Zeeshan AdeelNo ratings yet

- Preparation of Financial Statements: "Sorted" Income Statement For The Year Ended 30 September 2018Document11 pagesPreparation of Financial Statements: "Sorted" Income Statement For The Year Ended 30 September 2018IlovejjcNo ratings yet

- Correction of ErrorsDocument15 pagesCorrection of ErrorsEliyah Jhonson100% (1)