Professional Documents

Culture Documents

Audit Programs

Uploaded by

Na-na BucuOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Audit Programs

Uploaded by

Na-na BucuCopyright:

Available Formats

B.1.2 Audit Programs for Different Cash Accounts 1.

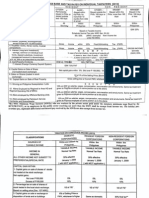

Cash in VAULT NAME OF AGENCY AUDIT PROGRAM FOR THE PERIOD ________________ CASH in VAULT ( Account Code 101 ) Account Description: This account is used to record the amount of cash collected by the Treasurer of the Philippines and the Treasurers of Local Government Units (LGUs) pending deposit. Audit Objectives: 1. To ascertain the existence or occurrence of the balance of cash in vault. 2. To determine the completeness and regularity of the account balance. 3. To determine whether the account is properly presented and adequate disclosure is made in the financial statements. Assertions: Completeness ( C ), Existence or Occurrence ( EO )), Validity/Legality or Regularity ( VR ), Presentation and Disclosure ( PD ). ASSERTIONFS

AUDIT PROCEDURES

W P Re f

TO BE DON E BY

TIME FRAME DATE DATE START COMPLE ED TED

REMAR KS

1.1 Count all cash in vault simultaneously Physically control all cash and cash items until all funds have been counted to prevent transfers by the Treasurer of counted funds to uncounted funds. See to it that the Treasurer or the Custodian of the cash is present throughout the count. EO

ASSERTIONFS

AUDIT PROCEDURES

W P Re f

TO BE DON E BY

TIME FRAME DATE DATE START COMPLE ED TED

REMAR KS

Obtain a signed receipt from the Treasurer on the return of the cash/funds to minimize the possibility, in the event of a shortage, of the Treasurer claiming that all cash was intact when presented to the auditor for counting. Verify whether all undeposited checks are payable to the order of the agency Prepare Cash Count Sheet. List the denominations of the cash and the cash items counted (examples in CA-1, CA-2 and CA-2a).

C EO RO

1.2

EO

2.1 Trace the account balance presented in the Trial Balance to the General Ledger (GL). Check that the balance matches with that of the balance appearing in the GL. 2.2 Verify the GL postings from the Cash Receipts Journal (CRJ) and General Journal (GJ). Check totals. Trace the entries in JEVs against the Report of Collections and Deposits (RCD) and source documents.

C EO C RO PD PD

2.3

3.1 Check whether the balance of the account is properly presented as Current Asset in the balance sheet and adequate disclosure is made in the financial statements. 4.1 Prepare Audit Observation Memorandum (AOM) on the noted discrepancy/ difference . 4.2 Organize working papers including indexing and cross-referencing.

PREPARED BY : Date

REVIEWED BY : Date

APPROVED BY : Date

2. Cash-Collecting Officers NAME OF AGENCY AUDIT PROGRAM FOR THE PERIOD ________________ CASH Collecting Officers ( Account Code 102 ) Account Description: The account represents amount of cash collections with Collecting Officers (CO) / Postmasters/ Telegraph Operators pending deposit. Audit Objectives: 1. To ascertain the existence or occurrence of the account Cash-Collecting Officers/Postmasters/Telegraph Operators. 2. To determine whether cash collections are completely and properly recorded as prescribed in the manual of NGAS and in accordance with existing laws, rules and regulations. 3. To determine whether the cash collections in foreign currency are properly valued in local currency at the current exchange rate as of balance sheet date.

4. To determine whether the account is properly presented and adequate disclosure is made in the financial statements. Assertions : Completeness ( C ), Existence or Occurrence ( EO ), Validity/Legality or Regularity ( VR ), Valuation and Measurement ( VM ), Presentation and Disclosure ( PD ). ASSERTIONFS W P Re f TO BE DONE BY TIME FRAME DATE STAR TED DATE COMPL ETED REMAR KS

AUDIT PROCEDURES

1.1 Obtain the list / schedule of Collecting Officers with their account balances. 1.1 Count all cash on hand simultaneously in the presence of the CO. a. Examine the cash items, see to it that fake bills and demonetized coins are not included. b. Examine checks for erasures on amount and dates, authorized check signatories, endorsements and see to it that checks are made payable to the agency. The following should be excluded from cash items. Post dated checks Sale checks and money order Chits, IOUs, vales or other forms of promissory notes

C EO C EO VM

C EO VR RO VM

c. Prepare cash count sheet. List all cash counted by denominations including cash items. d. Segregate the cash items by group, such as: checks, money orders, etc. Proceed with the listing of the cash items using the space provided in the form. In the case of checks and money orders, indicate the serial number, date, drawer, drawee and amount.

C EO C EO

ASSERTIONFS

AUDIT PROCEDURES 1.3 Obtain the signature of the CO/ custodian acknowledging that funds were counted in his presence and were returned to him intact. 1.4 Compare cash counted with collections in the Report of Collections and Deposits / Cash Receipt Record on the date of count and reconcile with with Subsidiary Ledger to establish undeposited collections. Compute the shortage or overage, if any. In case of overage, have it receipted; in case of shortage, comply with the provisions of COA Memorandum 2002-053 dated August 26, 2002. 1.5 See to it that undeposited collections are deposited not later than the next banking day and that all checks and postal money orders counted are deposited and honored by the bank. Trace the undeposited collections to the subsequent bank-validated deposit slips and bank statements. Trace the account balance from Trial Balance to GL and compare with the total of the SL balances of CO. Verify discrepancy, if any. Verify GL balance from the CRJ / CJ. Check totals/ footings.

W P Re f

TO BE DONE BY

TIME FRAME DATE STAR TED DATE COMPL ETED REMAR KS

EO

C EO VR

C EO VR

1.6

C EO VR C EO

2.1

2.2

C EO C EO VM

2.3 Test check certain number of JEVs to establish proper cut-off.

ASSERTIONFS

AUDIT PROCEDURES review/analyze accounting entries trace to CRJ and/or CJ trace to RCD and review ORs and validated deposit slips supporting the RCD prepare working papers and note differences, if any. (ex. in CA-3) 2.4 Review the authority granted to the agency in the utilization of income /receipts and deposit with AGDB. 2.5 If the agency is authorized, check if it maintains two (2) sets of books (RA and NG) and uses separate set of Official Receipts (ORs) and Cash Receipts Record (CRR) for each set of book.

W P Re f

TO BE DONE BY

TIME FRAME DATE STAR TED DATE COMPL ETED REMAR KS

VR

VR

2.6 Check whether receipts which the agency is authorized to use are recorded in the CRJ, and that NG collections are recorded in the CJ. Likewise, check whether proper OR is issued for RA and NG collections and that collections and deposits are recorded in the proper CRR. (example in CA-4) Note discrepancy, if any. 3.1 From the cash count sheet prepared, check whether all foreign currencies are converted to local currency (peso) at the current exchange rate prescribed by BSP at balance sheet date. 3.2 Check whether the BSP/ forex rate used in converting foreign currency to peso is properly disclosed in the financial statements. 4.1 Check whether the account is properly presented as Current Asset in the balance sheet.

C EO VR

C EO VM

VM PD

VM PD

ASSERTIONFS

AUDIT PROCEDURES 4.2 Prepare and issue AOM for discrepancies noted. 4.3 Organize working papers including indexing and cross-referencing. PREPARED BY : Date

W P Re f

TO BE DONE BY

TIME FRAME DATE STAR TED DATE COMPL ETED REMAR KS

REVIEWED BY : Date

APPROVED BY : Date

3. Cash - Disbursing Officers NAME OF AGENCY AUDIT PROGRAM FOR THE PERIOD ________________ CASH Disbursing Officers ( Account Code 103 )

Account Description: This account is used to record the amount of cash advances granted to designated Regular or Special Disbursing Officers/ Postmasters/ Telegraph Operators for payment of authorized official expenditures or redemption of postal money orders and telegraphic transfers subject for liquidation. Audit Objectives: 1. To ascertain the existence or occurrence of the account Cash - Disbursing Officers (DO). 2. To determine whether the grant of cash advances and the disbursements made are completely and properly recorded in accordance with existing laws, rules and regulations. 3. To determine whether the account is properly presented in the financial statements and adequate disclosure is made. Assertions: Completeness ( C ), Existence or Occurrence ( EO ), Validity/Legality or Regularity ( VR ), Presentation and Disclosure ( PD ). ASSERTIONFS TO BE DON E BY TIME FRAME DATE START ED DATE COMPLE TED

AUDIT PROCEDURES

W P Re f

REMAR KS

1.1 Obtain list/ schedule of regular and special Disbursing Officers and their account balances. 1.2 Count all cash on hand simultaneously: Physically control all cash and cash items held by the Disbursing Officers (DO) until all have been counted. This is to prevent transfers by the DO of counted funds to the uncounted funds. See to it that the DO is present throughout the count.

C EO

EO

Obtain the signature of the DO acknowledging that the cash were counted in his presence and the funds were returned intact. Marked the cash items such as Suppliers invoices and ORs which had been actually examined. EO

ASSERTIONFS

AUDIT PROCEDURES

W P Re f

TO BE DON E BY

TIME FRAME DATE START ED DATE COMPLE TED

REMAR KS

1.3

Prepare Cash Count Sheet. List denominations of cash, and cash items counted. If cash items include suppliers invoices and paid payrolls, recommend that these be recognized as expense. Compare the total per count with the balance appearing in the Cashbook. Verify the difference, if any.

C EO

1.4

C EO C EO

1.5 Reconcile the cashbook / CDR balance with the SL to establish the accountability of the DO at the time of count. 1.6 For non-agency funds in the hands of the DO, obtain confirmation from those responsible for the administration of the said fund. 1.7 For non0agency funds in the hands of the DO, obtain confirmation from those responsible for the administration of the said fund. 2.1 Trace the balance to the GL/SL and ascertain if balances tally. 2.2 From the Schedule of Cash Disbursing Officers account in 1.1, compare balances with the GL/SL, TB and balance sheet (example in CA-5). 2.3 Verify details of the Schedule from Cash Disbursement Records. 2.4 Test samples of cash advances for authority/ approval and examine replenishment/ liquidation vouchers if in order.

C EO

EO RO

C EO C EO

C EO C EO VR

ASSERTIONFS

AUDIT PROCEDURES

W P Re f

TO BE DON E BY

TIME FRAME DATE START ED DATE COMPLE TED

REMAR KS

3.1

Check whether the account is properly presented as Current Asset in the balance sheet. Prepare and issue Audit Observation Memorandum for discrepancies noted (CA-5a). REVIEWED BY : Date

PD

3.2

PREPARED BY : Date

APPROVED BY : Date

4. Petty Cash Fund NAME OF AGENCY AUDIT PROGRAM FOR THE PERIOD ________________ PETTY CASH FUND ( Account Code 104 ) Account Description: This account is used to record in the books of the agency cash granted to designated Petty Cash Custodian for payment of authorized petty or miscellaneous authorized expenditures, which cannot be conveniently paid thru check. Audit Objectives: 1. To ascertain the existence or occurrence of Petty Cash Fund.

2.

To determine whether Petty Cash Funds are completely and properly recorded and utilized in accordance with existing laws, rules and regulations. 3. To determine whether the account is properly presented and adequate disclosure is made in the financial statements. Assertions: Completeness ( C ), Existence or Occurrence ( EO ), Validity/Legality or Regularity ( VR ), Presentation and Disclosure ( PD ). ASSERTIONFS TO BE DON E BY TIME FRAME DATE START ED DATE COMPLE TED REMAR KS

AUDIT PROCEDURES 1.1 Trace the balance presented in the Trial Balance to the GL. 1.2 Obtain the Cashbook/ Cash Disbursement Record (CDR) from the Petty Cash Custodian and compare the balance with the balance per GL/SL. 1.3 Check the correctness of the postings in the GL/SL from the Cashbook/ CDR. Check totals/ footings. 1.4 Trace entries from GL to Check Disbursement Journal (CkDJ) and Report of Checks Issued (RCI) (checks issued to the Petty Cash Custodian for the establishment/ replenishment of PCF) and JEVs and Cash Disbursement Journal (CDJ) for the corresponding liquidation. Note discrepancy, if any. 1.5 Examine sample replenishment of expenses for approval and adequacy of documentation. 2.1 Conduct cash count. Check whether the total cash and cash items counted agree with the petty cash fund balance in the SL/GL. 3.1 Check whether the account is properly presented as current asset in the Balance Sheet. 3.2 Prepare AOM for the discrepancies noted. 3.3 Organize working papers including indexing and cross-referencing. PREPARED BY : Date

W P Re f

C EO C EO

C EO C EO VR

C EO C EO

PD

REVIEWED BY : Date

APPROVED BY : Date

. Cash - National Treasury, Modified Disbursement System (MDS) NAME OF AGENCY AUDIT PROGRAM FOR THE PERIOD ________________ CASH National Treasury, Modified Disbursement System (MDS) ( Account Code 108 ) Account Description: This account is used to record in the Regular Agency (RA) books the receipt of Notice of Cash Allocation (NCA) from the Department of Budget and Management (DBM) and/or Notice of Transfer of Allocation (NTA) received from the Central Office/Regional Office thru which cash is withdrawn with the issuance of MDS checks. Audit Objectives: 1. To ascertain the existence or occurrence of the balance of Cash-National Treasury, MDS (net of charges against the NCA). 2. To determine the completeness and regularity of the balance of Cash - National Treasury. 3. To determine whether the account is properly presented and adequate disclosure is made in the financial statements. Assertions: Completeness ( C ), Existence or Occurrence ( EO ), Validity/Legality or Regularity (VR ) Presentation and Disclosure ( PD ). ASSERTIONFS TO BE DON E BY TIME FRAME DATE START ED DATE COMPLE TED REMAR KS

AUDIT PROCEDURES

W P Re f

1.1

Obtain and review agency prepared Bank Reconciliation Statement (BRS). check mathematical accuracy; verify the validity of outstanding checks; check ending balance per books against the SL/GL; check ending balance per books against the Bank Statement.

C EO RO

2.1

Trace the balance per TB to the GL.

C EO

ASSERTIONFS

AUDIT PROCEDURES

W P Re f

TO BE DON E BY

TIME FRAME DATE START ED DATE COMPLE TED REMAR KS

2.2

Check whether receipt of all NCAs are recorded in the Registry of Allotments and NCAs (RANCA) and covered with JEVs and posted in the GJ and GL.

C EO VR C EO

2.3 Review / test check JEVs / disbursements to ensure occurrence of transactions, accuracy of amount, completeness of supporting documents (including copy 1 of RCI, copy 2 of checks and copy 3 of ALOBS) and correctness of accounting entries in the JEVs. 2.4 Verify recording of check disbursements in the CkDJ and analyze accounting entries made. 2.5 Check totals / footings in the Ck DJ and compare with the amount posted in the GL. Take note of the discrepancy, if any.

C EO C EO C EO RO PD

2.6 Check whether the balance per GL tallies with the total amount of all unreleased checks in the Statement of Undeposited Collections (SUC) at year end. 3.1 Check whether the account is properly presented as current asset in the Balance Sheet and disclosure is properly made.

3.2 Prepare and issue AOM for discrepancies noted. 3.3 Organize working papers including indexing and cross-referencing.

PREPARED BY : Date

REVIEWED BY : Date

APPROVED BY : Date

6. Cash in Bank - Local Currency, Current Account NAME OF AGENCY AUDIT PROGRAM FOR THE PERIOD ________________ CASH in BANK Local Currency, Current Account ( Account Code 111 ) Account Description: This account is used to record deposits/withdrawals in local currency in a current account maintained with AGDB. Audit Objectives: 1. To ascertain the existence or occurrence of Cash in Bank in local currency current account. 2. To determine whether deposits and withdrawals of cash in current account are completely recorded and properly valued at the current exchange rate of the BSP in accordance with existing laws, rules and regulations. 3. To determine whether the account is properly presented and adequate disclosure on any restriction is made in the financial statements.

Assertions: Completeness ( C ), Existence or Occurrence ( EO ), Rights and Obligations ( RO ), Presentation and Disclosure ( PD ). ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

1.1 Obtain Bank Statements and examine in detail the agency-prepared Bank Reconciliation Statement (BRS) Compare the ending balance per books with the balance confirmed on the Bank Confirmation form(see 1.2 below). Verify the deposits in transit and outstanding checks. Establish the mathematical accuracy of the reconciliation. Investigate old items such as checks outstanding for a long period of time and unusual items. 1.2 Confirm with the bank the balance of each depository account using the Bank Confirmation form (example in CA-9). Perform the following: Prepare confirmation requests in duplicate and have these signed by an authorized check signatory of the agency. Send both copies to the bank and request that the original be directly returned to the auditor. Send confirmation requests to all banks in which the client has an account, including those that have a zero balance at the end of the year.

C EO

C EO RO

E RO

C EO RO

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

1.2 Prepare the summary of results of confirmation and compare with SL balances (CA-10). 2.1 2.2 Trace the balance in the Trial Balance to the GL and to the corresponding SL. Obtain the Schedule of the account and trace the details of the Schedule against the SL. Examine postings in the SL against the GL. Check totals/ footings. Check whether the total of all SL balances matches with the controlling account in the GL.

C EO RO C EO C EO

2.3

C EO

2.4 Trace postings to the journals, reports and JEVs. 2.5 Check whether the account is properly presented as current asset in the Balance Sheet and any restrictions on the withdrawal of cash balances are adequately disclosed in the notes to financial statements. 3.1 Prepare and issue AOM for the discrepancies noted. (CA-11 and CA12).

C EO RO PD

PREPARED BY : Date 7.

REVIEWED BY : Date

APPROVED BY : Date

Cash in Bank - Local Currency, Savings Account NAME OF AGENCY

AUDIT PROGRAM FOR THE PERIOD ________________ CASH in BANK Local Currency, Savings Account ( Account Code 112 ) Account Description: This account is used to record deposits/withdrawals in currency, savings account maintained with AGDB. Audit Objectives: 1. To ascertain the existence or occurrence of Cash in Bank, local currency savings account. 2. To determine whether deposits and withdrawals from the savings account are authorized, completely and properly recorded. 3. To determine whether the account is properly presented and any restriction is adequately disclosed in the financial statements. Assertions: Completeness ( C ), Existence or Occurrence ( EO ), Rights and Obligations ( RO ), Presentation and Disclosure ( PD ). ASSERTIONFS local

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

1.1

Confirm bank / passbook balances. Confirm with the bank the balance of each depository account using the Bank Confirmation form and perform the following: Prepare confirmation request in duplicate and have these signed by an authorized check signatory of the agency. Send both copies to the bank, and request that the original be returned directly to the auditor. Send confirmation requests to all banks in which the client has an account, including those that have a zero balance at the end of the year.

C EO

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

1.2 Compare SL balances with results of confirmation. (example in CA-13). 1.3 Obtain BRS and review the agency prepared BRS and perform the following: compare the ending balance with the balance confirmed on the bank confirmation form; verify the validity of deposits in transit and outstanding checks; verify reconciling items such as bank charges and bank credits and errors to supporting documents; and verify old items such as checks outstanding for a long period of time and unusual items. 2.1 Trace the balance presented in the Trial Balance to the GL and to the corresponding SL for Cash in Banks account. 2.2 Obtain the Schedule of the account. Trace the details of the Schedule against the SL. Examine postings in the SL against the GL. Check totals/footings and compare the total of all SL balances with the controlling account in the GL.

C EO

C EO

C EO

C EO C EO

2.3

2.4 Trace postings to the Journals, Reports, JEV. 2.5 Check whether the interests earned are properly recorded.

C EO C EO VM

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

3.1 Check whether the balance of the account is properly presented as current asset in the Balance Sheet, and any restrictions on the withdrawal of cash balances are adequately disclosed in the notes to financial statements. 3.2 Prepare and issue AOM for discrepancies noted. 3.1 Organize working papers including indexing and cross-referencing.

RO PD

PREPARED BY :

REVIEWED BY :

APPROVED BY : Date

Date Date 8. Cash in Bank - Local Currency, Time Deposit NAME OF AGENCY AUDIT PROGRAM FOR THE PERIOD ________________

CASH in BANK Local Currency, Time Deposit ( Account Code 113 ) Account Description: This account is used to record placements in local currency of excess cash or cash not earmarked for immediate use with authorized depository banks for a specified period. Audit Objectives: 1. To ascertain the existence or occurrence of Cash in local currency, time deposits. 2. To determine whether the placement in time deposits are completely and properly recorded. 3. To determine whether placement and termination of time deposits are authorized. 4. To determine whether the account is properly presented and any restriction is adequately disclosed in the financial statements.

Assertions: Completeness ( C ), Existence or Occurrence ( EO ), Validity/Legality or Regularity ( VR ), Presentation and Disclosure ( PD ). ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

1.1 Confirm with the bank all Time Deposit placements. 1.2 1.3 Compare results of confirmation with schedule of placements (CA-14). Verify the original copies of the Certificates of Time Deposits(CTD) and check whether the certificates are in the name of the agency.

C EO RO C EO RO C EO RO VR C EO C EO C EO C EO VM C EO VM VR

1.4 Compare the CTDs with the schedule.

2.1 Check the mathematical accuracy of the schedules and reports and compare balances with SL/GL/Trial Balance. 2.2 Verify the correctness of the postings in the GL/SL from the journals and JEV. Check totals/footings. Test sample JEV and supporting documents. Verify terms of placements, particularly the rates of interests and maturity period. Test samples on the computation of interests earned from matured and preterminated placements. Obtain written authority preterminate placements. to

2.3

2.4

2.5

2.6 Prepare working paper for discrepancies noted (see CA-15, CA-15a).

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

3.1 Review the agencys authority to place cash in time deposits from the following: a. Charter, board resolutions, agency policies; b. Local Government Code, Sanggunian/Resolutions for LGUs; c. DBM and/or other duly authorized officials approval for NG. 3.2 Evaluate whether placement made is inline with the operations of the agency or necessary for the attainment of the agencys objectives. 3.3 Check whether Time Deposit placement is approved by authorized official of the agency. 3.4 Obtain written certification from management that all Time Deposits in the name of the agency are free from liens and other restrictions. Obtain and examine relevant board resolutions and verify if there are board resolutions attaching Time Deposits to loans. Check whether all restrictions related to the account including the rates of interest and maturity terms are adequately disclosed in the notes to financial statements. Check whether the account is properly presented as current asset in the Balance Sheet.

VR

EO VR

EO VR VR RO

3.5

VR RO

3.6

RO PD

4.1

PD

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

4.2

Prepare and issue Audit Observations Memorandum (AOM) for noted discrepancies (CA-16).

4.1 Organize working papers including indexing and cross-referencing.

PREPARED BY :

REVIEWED BY :

APPROVED BY :

Date Date 9. Cash in Bank - Foreign Currency, Current Account NAME OF AGENCY AUDIT PROGRAM FOR THE PERIOD ________________

Date

CASH in BANK Foreign Currency, Current Account ( Account Code 115 ) Account Description: This account is used to record foreign currency deposits/withdrawals in a current account maintained with authorized government depository banks. Audit Objectives: 1. To determine the existence or occurrence of cash in foreign currency, current account. 2. To determine whether the deposits and withdrawals in the current account are completely recorded and properly valued at the current exchange rate as of balance sheet date. 3. To determine whether the account is properly presented and adequate disclosure is made in the financial statements. Assertions: Completeness ( C ), Existence or Occurrence ( EO ), Valuation or Measurement ( VM ), Presentation and Disclosure ( PD ).

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

1.1 Confirm bank balances by sending bank confirmations to AGDBs. 1.2 1.3 Compare SL balances with results of confirmation. Obtain Bank Statements and BRS and perform the following: Check balance per bank in the BRS against Bank Statements. Check balance per book in the BRS against GL. Verify the validity of reconciling items. Test check mathematical accuracy. Verify long outstanding reconciling items. Take note of discrepancies.

C EO C EO C EO

2.1 Trace balance to the GL and SL. 2.2 Verify postings journals and documents advice/memo). 2.3 in the GL/SL from the JEV and supporting (debit and credit Check totals/footings.

C EO VM C EO C EO VR EO VM EO VM VM PD

Obtain the BSP foreign exchange rates prevailing at transaction and balance sheet date.

2.3 Test check entries in JEV on the conversion to local currency (peso) at transaction dates. 2.5 Check whether the balance is correctly translated to peso amount using the BSP foreign exchange rate at balance sheet date.

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

2.6

Check whether foreign exchange gain/loss is properly recorded and presented in the Income Statement. Test check the correctness of the computation of interest, if deposit is interest-bearing. Take note of discrepancy. Check whether the account is properly presented in the balance sheet as current asset in the Balance Sheet.

C VM PD C

2.7

3.1

PD

3.2 Check whether the FOREX rate used in converting foreign currency deposits to peso at balance sheet date is disclosed in the notes to financial statement. 3.3 Prepare and issue Audit Observations Memorandum (AOM) for discrepancies noted.

PD

3.3 Organize working papers including indexing and cross-referencing.

PREPARED BY : Date

REVIEWED BY : Date

APPROVED BY : Date

10. Cash in Bank - Foreign Currency, Savings Account

NAME OF AGENCY AUDIT PROGRAM FOR THE PERIOD ________________ CASH in BANK Foreign Currency, Savings Account ( Account Code 116 ) Account Description: This account is used to record foreign currency deposits / withdrawals in savings account maintained with authorized government depository banks. Audit Objectives: 1. To ascertain the existence or occurrence of cash in foreign currency savings account. 2. To determine whether the foreign currency deposits and withdrawals in savings account are completely recorded and properly valued. 3. To determine whether the account is properly presented and adequately disclosed in the financial statements. Assertions: Completeness ( C ), Existence or Occurrence ( EO ), Valuation or Measurement ( VM ), Presentation and Disclosure ( PD ). ASSERTIONFS TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

AUDIT PROCEDURES

W P Re f

1.1 Confirm bank balances by sending Bank Confirmations to AGDB. 1.2 1.3 Compare SL balances with results of confirmation. Obtain Bank Statements and BRS and perform the following: Check balance per bank in the BRS against Bank Statements.

C EO C EO C EO

Check balance per book against GL. Verify the validity of reconciling items. Test check mathematical accuracy. Note long outstanding reconciling items and investigate.

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

2.1 Trace balance to the GL and SL. 2.2 Verify postings in the GL/SL from the JEVs and supporting documents (debit and credit advice/memo). Check footings 2.3 Obtain from BSP / BTr foreign exchange rates prevailing at transaction and balance sheet dates. 2.4 Test check correctness of conversion to local currency (peso) at transaction dates of entries in the JEVs. 2.5 Check if forex gain/loss is properly recorded and presented in the Income Statement Check whether the balance is correctly translated to peso amount using the BSP exchange rate as at the balance sheet date (CA-17). Test check the correctness of the computation of interest, if deposit is interest-bearing.

C EO C EO EO VM C EO VM C EO PD C EO VM PD C EO VM

2.6

2.7

2.8 Take note of deficiency, if any. 3.1 Check whether the balance of the account is properly presented as Current Asset in the Balance Sheet/ in accordance with the order of presentation in the NGAS Manual. 3.2 See if the FOREX rate used in converting foreign currency deposits to peso at balance sheet date is disclosed in the notes to financial statements.

C PD

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

3.3

Prepare and issue Audit Observations Memorandum (AOM) for the discrepancies noted.

PREPARED BY : Date

REVIEWED BY : Date

APPROVED BY : Date

11.

Cash in Bank - Foreign Currency, Time Deposit NAME OF AGENCY AUDIT PROGRAM FOR THE PERIOD ________________ CASH in BANK Foreign Currency Time Deposit ( Account Code 117 ) Account Description: This account is used to record foreign currency in time deposits maintained with authorized government depository banks. Audit Objectives: 1. To ascertain the existence or occurrence of foreign currency time deposits. 2. To determine whether the time deposits are completely recorded and properly valued. 3. To determine whether Time Deposits placements and terminations are authorized. 4. To determine whether the account is properly presented and adequately disclosed in the financial statements. Assertions: Completeness ( C ), Existence or Occurrence ( EO ), Validity/Legality or Regularity ( VR ), Valuation or Measurement ( VM ), Presentation and Disclosure ( PD ).

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

1.1 Confirm all Time Deposit placements with the bank. 1.2 Compare results of confirmation with Schedule/SL balances.

C EO RO C EO VR C EO VR RO C EO C EO

1.3 Take note of discrepancy, if any. 1.4 Verify the original copies of Certificates of Time Deposits and check that the same are in the name of the agency. 1.5 Compare CTDs with schedule. 2.1 Verify mathematical accuracy of management prepared schedules/ report and determine agreement with SL/GL/TB. Verify the correctness of the postings in the GL/SL from the JEVs. Check footings. Test check JEVs and supporting documents (such as Letter of Authorization issued to AGDBs, Debit and Credit Memo).

2.2

C EO C EO VR C EO VM C EO VM C EO VM

2.3

2.4 Obtain from BSP/BTr foreign exchange rate prevailing at transaction and balance sheet dates. 2.5 Check if upon termination of FCTDs forex differences are recognized and taken up in the books. Check whether the balance is correctly translated to peso amount using the BSP exchange rate as at the balance sheet date.

2.6

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

2.7

Verify terms of placements especially on interests.

2.8 Test check correctness of computation of interests earned from matured and preterminated placements. 2.9 Verify/ review authority to preterminate placements. 2.10 Prepare working paper. discrepancy, if any. Note

EO VR VM C EO VM VR

3.1 Review the agencys authority to place cash in foreign currency in Time Deposits from the Charter, board resolutions, agency policies, Local Government Code, Sanggunian /Resolutions for LGUs and/or other duly authorized officials approval for NG. 3.2 Evaluate if placement is in-line with the operations of the agency or necessary for the attainment of the agencys objectives. Check whether the Time Deposit placement is approved by proper official of the agency.

VR

3.3

4.1 Check whether the account is properly presented as Current Asset in the Balance Sheet. 4.2 See if adequate disclosures were made in the Notes to Financial Statements on the interest rates and maturity terms of Time Deposits and the forex rate used in translating foreign currency to peso on balance sheet date.

VR

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

4.3 Prepare summary of noted discrepancies (CA-18, CA-19 and CA-20) and issue AOM. PREPARED BY : Date REVIEWED BY : Date APPROVED BY : Date

B.2.2 Audit Programs for Different Receivable Accounts 1. Accounts Receivable Trade and Allowance for Doubtful Accounts NAME OF AGENCY AUDIT PROGRAM FOR THE PERIOD ________________ ACCOUNTS RECEIVABLE -TRADE ( Account Code 121 ) ALLOWANCE FOR DOUBTFUL ACCOUNTS ( Account Code 301 ) Account Description: The account Accounts Receivables Trade is used to record the amount due from customers/clients resulting from services rendered, trading/business transactions or sales of merchandise or property which are expected to be collected in the regular course of business or over a definite period.

Audit Objectives: 1. To determine whether receivables represent valid claims against debtors and other parties. 2. To determine whether recorded receivables are owned by the entity as of balance sheet date. 3. To determine whether all valid receivables are completely and properly recorded. 4. To determine whether the related allowance for doubtful accounts is reasonably provided.

5. To determine whether all transactions complied with the existing rules and regulations and policies of the agency. 6. To determine whether the presentation and disclosure of receivables is adequate which includes the classification of receivables into appropriate categories, reporting of receivables pledged as collateral and the related party receivables.

Assertions: Existence or Occurrence ( EO ), Rights and Obligation ( RO ), Completeness ( C ), Valuation or Measurement ( VM ), Validity/Legality or Regularity ( VR ), Presentation and Disclosure ( PD ).

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

1.1

Obtain aging receivable and

schedule of accounts

a. Check totals. b. Check if the balance reconciles with the general ledger control account. c. Trace individual balances to the subsidiary ledger. d. Test the accuracy of the aging of accounts e. Check non-trade accounts erroneously included in customers accounts. f. Investigate and reclassify significant credit balances. g. Verify whether the schedule contains the following basic information: Name of debtor Address Balance of account Age of account balance Credit terms agreed upon, including limit of credit Referrals for legal action

C EO C EO C EO C EO C EO C EO VR RO VM

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

1.2 Test accuracy of balances appearing in the subsidiary ledger. Check totals in the subsidiary ledger. Trace samples to underlying records. 1.3 Confirm accuracy of individual balances by direct communication with debtors on a test basis. (See confirmation procedures.) a. Investigate exceptions reported by the debtors and discuss with concerned for proper disposition. b. If the request does not produce a reply from the customer, perform extended procedures, such as: Review collections after yearend; Check supporting documents; Discuss the account with concerned official. c Prepare a summary of confirmation results. 1.4 Review correspondence with debtors for possible adjustments.

C EO

C EO

VR EO EO VR VM C EO EO VM VR

1.5 Request the legal office for the status of accounts referred to them for collections 1.6 Take note of deficiencies, if any. Prepare and issue AOM.

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

2.1 Test propriety of cut-off: a. Examine sales recorded several days before and after the balance sheet date and ascertain whether the sales was recorded in the proper period. b. Verify subsequent collection of receivable. Investigate the nature and origin of any unusually large balances in the accounts. 2.2 Review entries in the general ledger on a test basis.

VM C EO VM

EO VR C EO VR

For debits to the account: a. Trace postings to the subsidiary ledger, JEVs, supporting billing statements, invoices or other documents. b. Regularity c. Authorization and approval d. Validity e. Accuracy f. Numerical sequence of bills and invoices For credits to the account : a. Trace postings to the JEV, Report of Collections and Deposits (RCD) and Cash Receipt Journal (CRJ)/GJ. 2.3 Take note of deficiencies, if any. Prepare and issue AOM. C EO VR

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

3.1 Perform analytical procedures, like: a. Accounts Receivable turnover. Compute the turnover of receivables and compare it with that of the preceding year and indicating averages. Obtain explanation from agency for unusually low turnover rate. b. Ratio of accounts written off to balance of accounts receivable. Compare with prior year and obtain managements 3.2 Compare a sample of shipping documents to the related invoices for orders which have been shipped but not billed. 4.1 Examine the entry recording the current years provisions and the procedures used by the client in computing the allowance for doubtful accounts. 4.2 Where provisions are made formula based on the determine by reference to the agencys procedures basis is: by the use of aged listing, the details of whether the VM

VM

C EO VR VM

Va/L R VM

a. consistent with prior years; b. appropriate to the circumstances of the business; and c. in accordance with the accounting policy. 4.3 Trace the account Bad debts expense to the general ledger.

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

4.4 Check accuracy of agencys computation of bad debts. 4.5 Evaluate the reasonableness of the basis of allowance for doubtful accounts, loss experience of prior year, data on subsequent collections, opinion of credit manager and collection lawyers, results of circularization, and other pertinent information. 4.6 Review individual balances and age of accounts and evaluate accounts that should be written off. Obtain and examine the list of debts written off during the year. Check totals and verify whether debts written off are no longer included as part of receivable

C VR VM VR VM

C EO VM C EO VM C EO VM C EO VM VR

4.7 4.8

4.9 Inquire if continuous follow up is made on debts written off and verify whether there are collections received and these are properly accounted for. 4.10 Check whether the list of debts written off is properly kept and controlled. 4.11 Take note of deficiencies, if any. Prepare and issue AOM.

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

5.1

Review the agencys legal basis like Circulars and / or Board Resolutions on provision for doubtful accounts and writing off bad debts: a. Examine proper authorization of provision for doubtful accounts; b. Examine proper authorization for all debts written off. VR VM VR VM

6.1 Review adequacy of disclosures made on provision for doubtful accounts and writing off bad debts with those required by generally accepted accounting principles. There should be disclosure on the pledging or assigning of accounts receivable. Evidence of such activities can also be obtained from a review of the minutes of board of directors meetings and inquiry from management. 6.2 Check whether the account is presented in the balance sheet as current assets. 6.1 Take note of deficiencies, if any. Prepare and issue AOM.

VR RO PD

PD

PREPARED BY : Date

REVIEWED BY : Date

APPROVED BY : Date

1. Notes Receivable NAME OF AGENCY AUDIT PROGRAM FOR THE PERIOD ________________ NOTES RECEIVABLE ( Account Code 122 ) Account Description: The account Notes Receivable is used to record the value of promissory notes, time drafts, trade acceptances and other negotiable short-term instruments from trade debtors. Audit Objectives: 1. To determine whether receivables represent valid claims against debtors and other parties. 2. To determine whether all notes receivables are owned by the entity as of balance sheet date. 3. To determine whether all valid receivables are completely and properly recorded. 4. To determine whether the related allowance for doubtful notes is reasonably provided. 5. To determine whether the presentation and disclosure of notes receivables is adequate including the reporting of any receivables pledged as collateral and the related party receivables. Assertions: Existence or Occurrence ( EO ), Rights and Obligation ( RO ), Completeness ( C ), Valuation or Measurement ( VM ), Validity/Legality or Regularity ( VR ) Presentation and Disclosure ( PD ). ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

1.1 Prepare or obtain a Schedule of the Notes Receivable as of balance sheet date.

C EO

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

1.2 Trace beginning balance appearing in the GL to prior years working paper. 1.3 Check the balances of the schedules against the GL. 1.4 Verify the correctness of postings in the SL through the General Journal (GJ) to the journal entry voucher (JEV). 1.5 Check totals in the GL and SL. 1.6 Send confirmation letters to debtors. (See confirmation procedures for the steps to be followed.) Include in each request for confirmation the following: balance of the principal, date, maker, due date, interest rate, date through which interest has been paid and collateral, if any. 2.1 Examine selected debits and credits after balance sheet date to determine whether there are unrecorded notes receivable and collections for the year under audit but which were erroneously taken up in the subsequent year.

C EO C EO C EO C EO C EO RO

C EO VM

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

2.2

Review the entries in the GL. For debits to the account: Trace postings to the subsidiary ledger, JEVs, supporting promissory notes and other documents. Examine individual source documents such as promissory notes or other documents for: C EO RO C EO Va/R L

Regularity Authorization and approval Validity Accuracy

For credits to the account: Trace postings to the JEV, Report of Collections and Deposits (RCD) and Cash Receipts Journal (CRJ)/GJ. C EO

3.1 Perform analytical procedures like notes receivable turnover. Compute the turnover of receivables and compare it with that of the preceding year indicating averages. Obtain explanation from agency for unusually low turnover rate. 3.2 Compare a sample of shipping documents to the related invoices for orders which have been shipped but not billed.

C EO VM

C EO VM

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

4.1 Examine and verify the correctness of the aging schedule of debtors balances as of balance sheet date. Note down long outstanding, dormant and unusually large balances in the accounts. Investigate the reasons. 4.2. Examine promissory notes and determine whether the terms and conditions were strictly enforced. 4.3 Review allowance provided for notes. Agencies engaged in business in in which note transactions are

C EO RO VM

C EO VR VM C EO VR VM

voluminous normally set up a separate allowance for doubtful notes. Agencies accepting only a few notes normally provide an amount in the allowance for doubtful accounts to take care of possible note losses. 4.4 For notes written off during the year, examine notes and approval of write off. Check whether complete records are maintained for notes written off and are kept by a responsible employee. C EO VR VM C EO C EO VM C EO VM VR RO

4.5

4.6 Ensure that a complete follow up of notes written off is made and collections received are properly accounted for. 4.7 Follow up subsequent collection of notes and the corresponding interest. 4.8 Examine collateral and determine their adequacy to secure the notes.

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

5.1 Check whether the account is presented in the balance sheet as current assets except for long-term notes. Notes receivable may either be combined with or separated from accounts receivable. See that it conforms to the provisions of the NGAS. 5.2 Review adequacy of disclosures made with those required by generally accepted accounting principles. There should be disclosure of the pledging or assigning of notes. Evidence of such activities can also be obtained from a review of the minutes of board of directors meetings and inquiry from management. 5.3 Take note of all the deficiencies. Prepare and issue AOM.

VR PD

VR RO PD

PREPARED BY : Date

REVIEWED BY : Date

APPROVED BY : Date

2.

Due from Officers and Employees

NAME OF AGENCY AUDIT PROGRAM FOR THE PERIOD ________________ DUE FROM OFFICERS and EMPLOYEES ( Account Code 123 ) Account Description: The account Due from Officers and Employees is used to record the amount of cash advances granted for official travels and other collectibles from government agencys officers and employees. Audit Objectives: 1. To determine whether the account represents valid claims of the agency. 2. To determine whether all valid accounts are completely and properly recorded. 3. To determine whether the reported balance of the account at balance sheet date is realizable. 4. To determine whether all transactions complied with the existing rules and regulations and policies of the agency. 5. To determine whether the account is properly presented and adequate disclosure is made in the financial statements. Assertions: Existence or Occurrence ( EO ), Completeness ( C ), Valuation or Measurement ( VM ), Validity/Legality or Regularity ( VR ) Presentation and Disclosure ( PD ).

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

1.1

Confirm individual balances by direct communication with officers and employees on a test basis. (See confirmation procedures for the steps to be followed.)

C EO RO

1.2 Review correspondence with officers and employees for possible adjustments. 1.3 Request the legal office for the status of accounts referred to them for collections. 1.4 1.5 1.6 Trace the account balance to the trial balance and to the general ledger (GL). Trace the beginning balance appearing in the GL to prior years working paper. Obtain aging schedule of the account Due from Officers and Employees as of balance sheet date. Check totals/footings and compare with the GL balance of the account. Check the details of schedule against the subsidiary ledgers (SL).

VR RO VR C EO C EO C EO C EO C EO C EO

1.7

1.8

1.9 Test accuracy of balances appearing in the SL of each officer and employee with advances. Foot and cross foot the subsidiary ledgers. 1.10 Verify the correctness of postings in the SL through the General Journal (GJ) to the Journal Entry Voucher (JEV). Review entries in the GL on a test basis.

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

For debits to the account, examine the individual voucher and supporting document for: regularity and validity of supporting document authorization/approval correctness of computation

For credits to the account, examine the liquidation report and its supporting documents for: 2.1 regularity and validity of supporting documents authorization and approval correctness of computation C EO VR

Compute the turn-over rate of receivables and compare it with that of the preceding year. Obtain explanation from management for unusually low turn over rate.

3.1 Examine the entry recording the current years provisions and the procedures used by the client in computing the allowance for doubtful accounts.

C EO VM

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

3.2 Where provisions are made by the use of formula based on the aging schedule, determine by reference to the details of the agencys procedures whether the basis is : a. consistent with prior years; b. appropriate to the circumstances of the business; and c. in accordance with the accounting policy. 3.3 Trace bad debts expense to the general ledger. 3.4 Check accuracy of agencys computation of bad debts 3.5 Evaluate the reasonableness of the basis of allowance for doubtful accounts, loss experience of prior year, data on subsequent collections, opinion of credit manager and collection lawyers, results of circularization, and other pertinent information. 3.6 Review individual balances and age of accounts and evaluate accounts that should be written off.

EO VR VM

C EO VM C EO VM C EO VR VM

C EO VM C EO VM C EO VM

3.7 Obtain and examine list of debts written off during the year. 3.8 Check totals and verify whether bad debts written off are no longer included as part of receivable.

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

3.9 Check whether the list of debts written off is properly kept and controlled. 3.10 Inquire if continuous follow up is made on debts written off and verify whether there are collections received and these are properly accounted for. 4.1 Review the agencys legal basis like Circulars and/or Board Resolutions and accounting manuals and policy on: Provision for doubtful accounts Writing off bad debts Liquidation of cash advances

C Va/L R C EO

VR VM

5.1 Review adequacy of disclosures made with those required by generally accepted accounting principles.

VR PD

5.2 Check whether the account is presented in the balance sheet as current assets. 5.3 Note abnormal balances which when taken together represent a significant amount and analyze if reclassification is necessary. 5.4 Verify whether the inclusion in the balance of dormant/non-moving accounts and the doubtful collectibility thereof are adequately disclosed . 5.5 Take note of deficiencies, if any. Prepare and issue AOM.

PD C EO VR PD

PREPARED BY : Date

REVIEWED BY : Date

APPROVED BY : Date

4. Loans Receivable-GOCCs (124); Loans Receivable-LGUs (125) ; Receivables-Others (126) NAME OF AGENCY AUDIT PROGRAM FOR THE PERIOD ________________ LOANS RECEIVABLE - _________ ( Account Code _____ )

Loans

Account Description: The account Loans Receivable is used to record the amount of loans due from GOCCs, LGUs and entities other than GOCCs and LGUs. . Audit Objectives: 1. 2. 3. 4. To determine whether loans receivable represents valid claims of the agency. To determine whether all loans receivable are owned by the agency as of audit date. To determine whether all valid loans receivable are completely and properly recorded. To determine whether the related allowance for doubtful accounts is reasonably provided and properly recorded. 5. To determine whether all transactions complied with the existing rules and regulations and policies of the agency. 6. To determine whether the account is properly presented in the financial statements and adequate disclosure is made.

Assertions: Existence or Occurrence ( EO ), Rights and Obligation (RO) , Completeness ( C ), Valuation or Measurement ( VM ), Validity/Legality or Regularity ( VR ) Presentation and Disclosure ( PD ). ASSERTIONFS TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

AUDIT PROCEDURES

W P Re f

1.1

Confirm individual balances by direct communication with debtors. (See confirmation procedures for the steps to be followed.)

C EO RO

1.2 Trace the FS balance to the trial balance and to the general ledger (GL). 1.3 1.4 1.5 1.6 Trace the beginning balance appearing in the GL to prior years working paper Obtain aging schedule of the account as of balance sheet date. Check totals/footings and compare with the GL /SL balances of the account. Check the details of the schedule against the subsidiary ledgers (SL).

C EO C EO C EO C EO C EO C EO

1.7 Verify the correctness of postings in the SL through the General Journal (GJ) to the Journal Entry Voucher (JEV). 2.1 Test propriety of cut-off: a. Examine sales recorded a few days before and after the balance sheet date and verify whether the sales were recorded in the proper period. b. Verify subsequent collection of receivable. Investigate the nature and origin of any unusually large balances in the accounts.

C EO VM C EO VM

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

2.2

Review entries in the general ledger on a test basis. For debits to the account: Trace postings to the subsidiary ledger, JEVs, supporting billing statements, invoices or other documents. Examine individual source documents such as billing statements, invoices or other documents for: Regularity Authorization and approval Validity Accuracy Numerical sequence of bills and invoices

For credits to the account Trace postings to the JEV, Report of Collections and Deposits (RCD) and Cash Receipt Journal (CRJ)/GJ. Compute the turn-over rate of receivables and compare it with that of the preceding year. Obtain explanation from management for unusually low turn over rate. Examine selected debits and credits after balance sheet date to determine whether there were unrecorded loans receivable and collections for the year under audit but which were erroneously taken up in the subsequent year.

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

3.1 Examine and verify the correctness of the aging schedule of debtors balances as of Balance Sheet date. Note down long outstanding, dormant and unusually large balances in the accounts. Investigate the reasons.

3.2 Examine the entry recording the current years provisions and the procedures used by the client in computing the allowance for doubtful accounts. 3.3 Where provisions are made formula based on the determine by reference to the agencys procedures basis is: by the use of aged listing, the details of whether the

a. consistent with prior years; b. appropriate to the circumstances of the business; and c. in accordance with the accounting policy. 3.4 Trace bad debts expense to the general ledger.

3.5 Check accuracy of agencys computation of bad debts.

3.6 Evaluate the reasonableness of the basis of

allowance for doubtful accounts, loss experience of prior year, data on subsequent collections, opinion of credit manager and collection lawyers, results of circularization, and other pertinent information.

C EO Va/L R VM

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

3.7

Review individual balances and age of accounts and evaluate accounts that should be written off.

C EO RO C EO C EO RO C C EO VM VR

3.8 Obtain and examine list of debts written off during the year. 3.9 Check totals in the list and verify whether debts written off are no longer included as part of receivable. 3.10 Check whether the list of debts written off is properly kept and controlled.

3.11 Inquire if continuous follow up is made on debts written off and verify whether there are collections received and these are properly accounted for. 4.1 Review the agencys legal basis like Circulars and/or Board Resolutions on provision for doubtful accounts and writing off bad debts. Examine Memorandum of Agreement / Letter of Authority and determine whether the terms and conditions were strictly enforced.

4.2

VR

5.1 Check whether the account is presented in the balance sheet as current assets except for long-outstanding loans receivable. See that it conforms with the provisions of the NGAS. 5.2 Verify whether the inclusion in the balance of dormant/non-moving accounts and the doubtful collectibility thereof are adequately disclosed in the financial statements.

VR PD

PD

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

5.3 Take note of deficiencies, if any. Prepare and issue AOM.

PREPARED BY : Date

REVIEWED BY : Date

APPROVED BY : Date

5. Real Property Tax Receivable ; Special Education Tax Receivable

NAME OF AGENCY AUDIT PROGRAM FOR THE PERIOD ________________ REAL PROPERTY TAX RECEIVABLE ( Account Code 127) SPECIAL EDUCATION TAX RECEIVABLE ( Account Code 128 ) Account Description: The account Real Property Tax (RPT) Receivable is used to record the amount of basic real property tax due from real property owners. The account Special Education Tax (SET) Receivable is used to record the amount of additional levy on real property tax due from real property owners for the Special Education Fund.. Audit Objectives: 1. represent valid claims of the agency. 2. agency as of balance sheet date. 3. completely and properly recorded. 4. 5. To determine whether the reported balances of the accounts at balance sheet date are realizable. To determine whether the accounts are properly presented and adequately disclosed in the financial statements.. Assertions: Existence or Occurrence ( EO ), Rights and Obligation ( RO ) , Completeness ( C ), Validity/Legality or Regularity ( VR ), Valuation or Measurement ( VM ), Presentation and Disclosure ( PD ). To determine whether all valid RPT/SET receivables are To determine whether all receivables are owned by the To determine whether the RPT/SET receivables

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

1.1

Confirm individual balances on a test basis. (See confirmation procedures for the steps to be followed.) Trace the FS balance to the trial balance and to the general ledger (GL). Trace beginning balance appearing in the GL to prior years working paper.

C EO C C EO C EO C EO C EO C EO

1.2 1.3

1.4 Obtain Schedule of the account. 1.5 Check totals/footings and compare with the GL balance of the account. 1.6 Check the details of the schedule against the subsidiary ledgers (SL). 1.7 Verify the correctness of postings in the SL through the General Journal (GJ) to the Journal Entry Voucher (JEV). 1.7 Check footings and cross footings of the GL and SL. 2.1 Check whether collections after the balance sheet date are recorded in the proper period . 2.2 Examine dishonored checks for several days before and after balance sheet date to determine whether any significant adjustments are necessary at balance sheet date.

C EO C EO C EO

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

2.3 Investigate material credit balances on the schedule and consider possibility of advance payments, unrecorded receivable or erroneous entry. Review the JEV setting - up the RPT / SET receivable at the beginning of the year based on the list of taxpayers with the amount due and collectible for the year duly certified by the treasurer. See to it that the details of the list are reflected in the RPT Account Registers/Taxpayer Index Cards. 3.2 Compare the receivable set up in the current year with that of the previous year, and investigate significant fluctuations. 3.3 Select sample entries from the Assessment Roll and compute the amount of RPT/SET due for the year taking into consideration the following: Class of property Assessed value Tax rate

C EO Va/R L

C EO Va/L R

C EO

C Va/L R RO

3.3 Trace samples selected in Step 2.3 to the certified list and Real Property Tax Account Register (RPTAR)/Taxpayer Index Card and compare the RPT/SET as computed to the amounts shown in the two documents. 3.5 Obtain a listing of taxpayers who paid in advance their RPT/SET for the

C EO RO

C EO

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

current year and check that their names are not included in the certified list used as basis in setting up the receivables. 3.6 Review / verify the general ledger entries made for the current year. Trace debits to the General Journal, JEVs and supporting documents. Trace credits to the General Journal, JEVs and supporting documents, Report of Collections and Deposits and Cash Receipts Journal.

RO C EO VR RO

4.1 Obtain

delinquency report from management. Inquire into managements action on delinquent accounts. Check whether appropriate legal remedies are considered to enforce collection. Examine the aging schedule of debtors balances as of balance sheet date. Take note of long outstanding, dormant and unusually large balances in the accounts and verify reasons. years provisions and the procedures used by the client in computing the allowance for doubtful accounts.

C EO VR VM C EO VR RO VM C VR VM C EO VR VM

4.2

4.3 Examine the entry recording the current

4.4 Where provisions are made formula based on the determine by reference to the agencys procedures basis is:

by the use of aged listing, the details of whether the

a. consistent with prior years;

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

b. appropriate to the circumstances of the business; and c. in accordance with the accounting policy. 4.5 Trace bad debts expense to the general ledger. C EO C EO VM C EO VR VM

4.6 Check accuracy of agencys computation of bad debts. 4.7 Evaluate the reasonableness of the basis of allowance for doubtful accounts, loss experience of prior year, data on subsequent collections, opinion of credit manager and collection lawyers, results of circularization, and other pertinent information. Review individual balances and age of accounts and analyze accounts that should be written off. Obtain and examine listing of debts written off during the year.

4.8

4.9

4.10 Check totals in the listing and verify whether debts written off are no longer included as part of receivable. Check whether the list of debts written off is properly kept and controlled. 4.11 Inquire whether follow up is made on debts written off and verify whether collections received are properly accounted for.

C EO RO VM C EO VM C EO RO VM C EO RO VM

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

4.12 Check whether the account is presented in the balance sheet as current assets. See to it that it conforms to the provisions of the NGAS. 5.1 Review loan agreements, related confirmation replies, and other relevant documents if any portion of the account was pledged as collateral and check appropriateness of disclosure.

VR PD C EO VR RO PD

5.2 Take note of deficiencies, if any. Prepare and issue AOM.

PREPARED BY : Date

REVIEWED BY : Date

APPROVED BY : Date

6. Interest Receivable NAME OF AGENCY AUDIT PROGRAM FOR THE PERIOD ________________ INTEREST RECEIVABLE ( Account Code 129) Account Description: The account Interest Receivable is used to record the amount of interest earned and due from short term/long term investments. Audit Objectives: 1. 2. 3. 4. To determine whether interest receivable represents valid claims of the agency. To determine whether all receivables are owned by the agency as of balance sheet date. To determine whether all valid receivables are completely and properly recorded. To determine whether the related allowance for doubtful accounts is reasonably provided. 5. To determine whether the account is properly presented and disclosed in the financial statements. Assertions: Existence or Occurrence ( EO ), Rights and Obligation ( RO ) , Completeness ( C ), Valuation or Measurement ( VM ), Validity/Legality or Regularity ( VR ), Presentation and Disclosure ( PD ). ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

1.1

Confirm individual balances on a test basis. (See confirmation procedures for the steps to be followed.) Trace the beginning balance appearing in the GL to prior years working paper. as

EO RO C EO C EO

1.2

1.3 Obtain aging schedule of the account of balance sheet date.

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

1.4 Check the details of the schedule against the subsidiary ledgers (SL). 1.5 Verify the correctness of postings in the SL through the General Journal (GJ) to the Journal Entry Voucher (JEV). 1.6 Check totals of the GL, SL and schedule. 2.1 Examine selected debits and credits after balance sheet date to determine whether there are unrecorded interests receivable and collections for the year under audit but were erroneously taken up in the subsequent year. For credits to the account: Trace postings to the JEV, Report of Collections and Deposit (RCD) and Cash Receipts Journal (CRJ)/GJ. 2.2 Review the entries in the GL. For debits to the account: Trace postings to the supporting documents. SL, JEV,

C EO C EO C EO C EO VM

C EO

Examine individual source documents such as promissory notes, loan contracts, investment documents or other related documents for: Regularity Authorization and approval Validity Accuracy

C EO VR RO

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

3.1

Perform analytical procedures like accounts receivable turnover. Compute the turnover of receivables and compare it with that of the preceding year indicating averages. Obtain explanation from agency for unusually low turnover rate. Analyze the aging schedule of debtors balances as of balance sheet date. Take note of long outstanding, dormant and unusually large balances in the accounts.

C VR VM

C EO VR RO VM C EO VM C EO VR VM

4.2 Analyze the entry recording the current years provisions and the procedures used by the client in computing the allowance for doubtful accounts. 4.3 Where provisions are made by the use of formula based on the aged listing, determine by reference to the details of the agencys procedures whether the basis is: a. consistent with prior years; b. appropriate to the circumstances of the business; and c. in accordance with the accounting policy. Trace bad debts expense to the general ledger. Check accuracy of agencys computation of bad debts. Evaluate the reasonableness of the basis of allowance for doubtful accounts, loss experience of prior year, data on subsequent collections

C EO C VM C EO VR RO VM

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

collections, opinion of credit manager and collection lawyers, results of circularization, and other pertinent information. Review individual balances and age of accounts and evaluate accounts that should be written off. Obtain and examine list of debts written off during the year. Check totals in the list and verify whether debts written off are no longer included as part of receivable. Check whether the list of debts written off is properly kept and controlled. Inquire if continuous follow up is made on debts written off and check whether there are collections received and these are properly accounted for. 5.1 Check the propriety of the presentation of the account. See that it conforms to the provisions of the NGAS. 5.2 Check whether adequate disclosure has been made in the financial statements. 5.3 Take note of all discrepancies and prepare AOM. C EO RO C EO C EO RO C EO C EO RO C VR PD

PREPARED BY : Date

REVIEWED BY : Date

APPROVED BY : Date

7.

Due from National Government Agencies (NGAs) Due from National Treasury NAME OF AGENCY AUDIT PROGRAM FOR THE PERIOD ________________ DUE FROM NATIONAL GOVERNMENT AGENCIES ( Account Code 136) DUE FROM NATIONAL TREASURY ( Account Code 131 ) Account Description: The account Due from NGAs is used to record the amount due from departments, bureaus and other offices of the National Government (NG). Audit Objectives: 1. 2. 3. 4. 5. To determine whether all receivables represent valid claims of the agency against NGAs. To determine whether all valid receivables are completely and properly recorded. To determine whether the reported balances of the account at balance sheet date are realizable. To determine whether all transactions complied with existing rules and regulations and policies of the agency. To determine the propriety of the accounts presentation in the financial statements and the adequacy of disclosure.

Assertions: Existence or Occurrence ( EO ), Rights and Obligation ( RO ) , Completeness ( C ), Validity/Legality or Regularity ( VR ), Valuation or Measurement ( VM ), Presentation and Disclosure ( PD ). ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

1.1 Trace the beginning balance appearing in the GL to prior years working paper.

C EO

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

1.2 Obtain a schedule of receivables which should contain the following basic information: name of the agency address balance of account date reported age of the accounts balance referral for legal action, off/condonation

C EO

write C EO EO C EO C EO C EO Va/L R RO C EO VR RO C EO

1.3 Check totals in the schedule , SL and trace to GL. 1.4 Select samples from the schedule for verification.

1.5 Compare the schedule against the SL and GL. 1.6 Verify the correctness of postings in the SL through the General Journal (GJ) to the Journal Entry Voucher (JEV). 1.7 Review the liquidation documents to validate the propriety of the expenses charged vis--vis the stated purpose of the fund transfer. Verify credit balances in the accounts, if any.

2.1

2.2 Review the entries in the GL. For debits to the account: Trace posting to the subsidiary ledger, JEVs.

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

Examine individual source documents : Regularity Authorization and approval Validity Accuracy

C EO VR

For credits to the account: Trace postings to the JEV, Report of Collections and Deposits (RCD) and Cash Receipts Journal (CRJ)/GJ. 3.1 Perform analytical procedures, like: a. Accounts Receivable turnover. Compute the turnover of Due from NGAs and compare it with that of the preceding year and indicating averages. Obtain explanation from agency for unusually low turnover rate. b. Ratio of accounts written off to balance of Due from NGAs. Compare with prior year and obtain managements explanation for unusually high ratio. 4.1 Review the aging schedule of the account. 4.2 Analyze the ratio of dormant/ nonmoving accounts to total receivables. 4.3 Select samples of long outstanding or overdue accounts. C EO VM C EO VM EO

C EO C EO RO

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

Review the subsidiary details and inquire from management what actions have been taken on dormant and non-moving accounts. Assess the probability of collection and evaluate the impact on the financial position of the agency. 5.1 Check whether the account is presented in the balance sheet as current assets and that it conforms to the provisions of the NGAS. 5.2 Check whether the inclusion in the balance of dormant/non-moving accounts and the doubtful collectibility thereof are adequately disclosed.

C EO VR RO VM EO RO PD VR PD

PD

5.3 Take note of deficiencies, if any. Prepare and issue AOM.

PREPARED BY : Date

REVIEWED BY : Date

APPROVED BY : Date

8.

Due from Government-Owned and Controlled Corporations NAME OF AGENCY AUDIT PROGRAM FOR THE PERIOD ________________ DUE FROM GOVERNMENT-OWNED and CONTROLLED CORPORATIONS ( Account Code 137) Account Description: The account Due from Government Owned and Controlled Corporations (GOCCs) is used to record the amount due from GOCCs including Government Financial Institutions (GFIs). Audit Objectives: 1. To determine whether the account Due from GOCCs represents valid claim of the agency. 2. To determine whether all receivables are owned by the agency as of balance sheet date. 3. To determine whether all valid Due from GOCCs are completely and properly recorded. 4. To determine whether the reported balances of the account at balance sheet date are realizable. 5. To determine whether the account is proper presented in the financial statements and adequate disclosure is made . Assertions: Existence or Occurrence ( EO ), Rights and Obligation ( RO ) , Completeness ( C ), Validity/Legality or Regularity ( VR ), Valuation or Measurement ( VM ), Presentation and Disclosure ( PD ). ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

1.1 Prepare confirmation requests for the selected GOCCs. 1.2 Trace the FS balance to the trial balance and to the general ledgers (GL).

EO RO C EO

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f

1.3 Trace the beginning balance appearing in the GL to prior years working paper. 1.4 Secure a schedule of Due from GOCCs which should contain the following information: Name of the agency Address Balance of account Date reported Age of the accounts balance Referral for legal action, off/condonation

C EO C EO

write C EO C EO C EO C EO VR

1.5 Check footings of schedule and compare with GL balance. 1.6 Check the details of the schedule of Due from GOCCs against the SL. 1.7 Verify the correctness of postings in the SL through the General Journal (GJ) to the Journal Entry Voucher (JEV). 2.1 Examine individual source documents such as JEVs, DVs, MOA and other documents for: 2.2 Regularity Authorization and approval Validity Accuracy

Verify whether the required rules and regulations are incorporated in the Memorandum of Agreement (MOA). (COA Circular # 96-003 dated February 27, 1996.)

VR

ASSERTIONFS

AUDIT PROCEDURES

TIME FRAME TO BE DON E BY DATE START ED DATE COMPLE TED REMAR KS

W P Re f