Professional Documents

Culture Documents

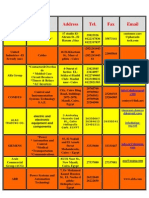

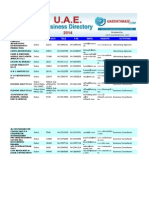

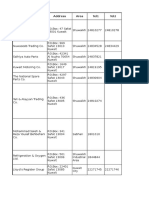

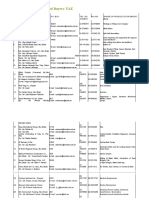

Dubai Electronics Distributors List

Uploaded by

jaheer1222Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dubai Electronics Distributors List

Uploaded by

jaheer1222Copyright:

Available Formats

15. MTC FZCO 2007 sales: $76m In the hotseat: Houssam Mobied Employees: 50 Active Accounts: 300 No.

Middle East offices outside Dubai: 2 Geographic remit: Middle East & North Africa www.mtcdubai.com PlotMO 0543, Jebel Ali Free Zone, Dubai Tel: +971 4 8037 333 Background: DRAM specialist Memory Technology Corporation Middle East (MTC) has exploited the growth in components and memory products to become one of the leading suppliers in the region. 2008 strategy: MTC is set to introduce more than 20 electronics products from its own-brand GENX and Xtreme lines this year as it bids to record 30% growth. The firm also distributes products from Micron, Samsung, Hynix, Epson and FSC. 14. Golden Systems Electronics FZCO 2007 sales: $95m In the hotseat: Ehsan Hashemi Employees: 97 Active Accounts: 450 No. Middle East offices outside Dubai: 0 Geographic remit: Middle East & North Africa www.gse.ae PO Box 111282, Dubai, UAE Tel: +971 4 397 2345 Background: GSE continues to boost its sales channels in markets such as the CIS and North Africa, as well as stepping up efforts to address the burgeoning power retail segment. 2008 strategy: Siemens broadband products and Gigabyte notebooks and PDA phones have helped GSE beat a path into lucrative retail accounts. That push is set to be assisted by the opening of a logistics and service centre in JAFZA this quarter. 13. Asbis Middle East FZCO

2007 sales: $105m In the hotseat: Hesham Tantawi Employees: 49 Active Accounts: 500 No. Middle East offices outside Dubai: 1 Geographic remit: Middle East & Africa www.asbisme.ae PO Box 17706, Warehouse VA-1, Jebel Ali Free Zone, Dubai, UAE Tel: +971 4 883 5929 Background: Once perceived as just a hard drive distributor, Asbis has massively grown its portfolio by striking deals with the likes of Dell and Toshiba, and aggressively pushing its own-brand hardware. 2008strategy: Asbis' new Saudi operation has got off to a flying start by gaining Toshiba distribution rights, and now the firm has set its sights on establishing a local presence in Qatar. Asbis aims to eventually reach sales of US$175m and employ 80 people, underscoring the extent of its ambition. 12. Empa Middle East FZCO 2007sales: $106m Inthehotseat: Rahb Hamidaddin Employees: 74 ActiveAccounts: 600 No.MiddleEastofficesoutsideDubai: 3 Geographicremit: Middle East & North Africa www.empa-me.com Jebel Ali Free Zone, South,Plot Number S-10108 Tel: +971 4 8039 500 Background: Intel distributor Empa is a powerful player in the components space, with offices in Jeddah and Riyadh as well as a presence in Cairo. The company has restructured its front office during the past year in a bid to help it improve its service levels and address smaller markets in the region. 2008strategy: Empa has recovered from a fire that destroyed its main warehouse in December and moved to a new state-of-the-art HQ in Jebel Ali. The firm is looking to increase customer breadth this year in addition to launching a value added unit. 11. eSys Technologies FZE 2007sales: $143m

In the hotseat: Pavan Gupta Employees: 29 Active Accounts: 230 No. Middle East offices outside Dubai: 0 Geographicremit: Middle East & North Africa www.esysglobal.com/ae PO Box 18272, Jebel Ali Free Zone, Dubai, UAE Tel: +971 4 883 9292 Background: eSys has bounced back from its infamous split with Seagate in late 2006 to regain its footing in a competitive market. Pioneer and SimpleTech have both come on board in the Middle East to augment the company's product portfolio. 2008strategy: The components specialist still harbours ambitions to become a stronger player in finished goods distribution. Deals with laptop, printers and UPS vendors could be on the cards. Note that 30% of sales are derived from assembly. 10. Al Yousuf Digital LLC 2007sales: $150m Inthehotseat: Ahmad Qasem Employees: 57 ActiveAccounts: 400 No. Middle East offices outside Dubai: 2 Geographicremit: Middle East & North Africa www.alyousufdigital.com PO Box 25, RA13, Jebel Ali Free Zone, Dubai Tel: +971 4 881 7277 Background: Al Yousuf Digital is an established distribution name and with showrooms in Abu Dhabi, Dubai and Cairo the Epson and Viewsonic expert is well known to many of the region's dealers. 2008strategy: Having just signed Netgear for security and storage solutions, expect Al Yousuf to continue its focus on finished products as it seeks to strengthen sales into the retail channel. Increasing the fulfilment work it does for resellers working on smart home projects also remains a priority. 9. Mindware FZ LLC 2007sales: $200m Inthehotseat: Jacques Chammas Employees: 135 ActiveAccounts: 1,000

No. Middle East offices outside Dubai: 3 Geographicremit: Middle East & North Africa www.mindware.ae PO Box 55609, Dubai, UAE Tel: +971 4 391 3333 Background: Mindware has held its own in the market despite seeing a decline in ASPs for Intel CPUs and ending its hard drive agreement with Seagate midway through last year. Deals with Alcatel-Lucent, Neverfail and Xerox have reaffirmed the company's status as an influential distributor. 2008strategy: With improvements to its back-office systems now concluded and value brands flocking to its portfolio, Mindware is in a commanding position to meet its main target of profitable growth this year. 8. Logicom Dubai LLC 2007sales: $204m Inthehotseat: Nicholas Argyrides Employees: 135 ActiveAccounts: 1,200 No. Middle East offices outside Dubai: 7 Geographicremit: Middle East & North Africa www.lgcom.net Office 307, Al Kifaf Commercial Office Building Trade Centre Road, PO Box 54328, Dubai Tel: +971 4 507 8888 Background: Cyprus-listed Logicom has fought back from the credit crisis that engulfed the Intel channel two years ago to become a stronger player in the market. The company has not been distracted by changes in the Cisco distribution channel over the past year, instead reinforcing its position as the networking vendor's largest second-tier ally in the Middle East. It also survived the sharp edge of Microsoft's sword to remain the only UAE-based distributor with a regional OEM software contract. 2008strategy: With a robust structure now in place in Saudi Arabia, 2008 is poised to be a key year for Logicom's aspirations to construct a truly regional business that can offer extensive coverage of the GCC and Levant markets. Further business development in Pakistan features on the distributor's agenda, while improved solution versus product marketing also remains a major priority. 7. Comtronix LLC

2007sales: $209m In the hotseat: Ebrahimi Mahmoud Employees: 128 Active Accounts: 250 No.Middle East offices outside Dubai: 3 Geographicremit: Middle East, CIS www.comtronix.ae Umm Hurair, Old Zabeel Road, PO Box 35199, Dubai Tel: +971 4 335 3366 Background: Comtronix remains a powerful player in the components supply business, and boasts an extensive reach into the Iranian market that sets it apart from many other Middle East distributors. Even though the volume of shipments it has made is largely unchanged from last year, its revenues have climbed 7% to 8% as a result of its focus on higher value mainboards, VGAs and disk drives. It also claims to have the backing of vendor AMD, which Comtronix says is supporting a ramp-up in the firm's channel marketing and events activities. 2008strategy: The distributor is keen to extend its channel breadth this year and build on the dependable group of sub-distribution companies and resellers that it currently trades with. Efforts are also being made to ensure that the company has the credit capacity to satisfy its channel partners. It claims to already support partners with up to 90 days credit and a standard security guarantee. 6. Jumbo IT Distribution 2007sales: $250m In the hotseat: Bikas Biswas Employees: 45 ActiveAccounts: 250 No. Middle East offices outside Dubai: 1 Geographic remit: GCC www.jumbocorp.com Supra House, Umm Hureir, PO Box 3426, Dubai Tel: +971 4 336 7999 Background: Jumbo's IT distribution arm has kept a low profile during the past couple of years, but now takes its rightful place in the Power List following a prolonged period of aggressive growth.

Contracts with vendors Acer, Lenovo, LG and HP's printing business go a long way to explaining its rapid ascent. Contrary to popular belief, Jumbo IT Distribution is not merely the supply arm of Jumbo Retail. Orders from its retail namesake accounted for just 7% to 8% - or US$20m - of its sales last year. In fact, Jumbo IT Distribution does more business with Carrefour than Jumbo Retail. 2008strategy: Expect a year of relative consolidation for Jumbo even though it aims to add another 100 accounts to its books. Its recent exploits in building the business to a meaningful size - which includes the launch of a fully-fledged operation in Kuwait - means its priority is firmly on profitability rather than top line sales growth. 5. FDC International FZE 2007sales: $328m Inthehotseat: Marissa Safe Employees: 210 ActiveAccounts: 500 No. Middle East offices outside Dubai: 3 Geographicremit: Middle East, CIS www.fdcinternational.com 5th floor, Fujairah Building, Khalid Bin Walid Road, PO Box 17453, Dubai, UAE Tel: +971 4 397 8035 Background: FDC remains a powerful components distributor with a portfolio that includes Abit, ASRock, Seagate-Maxtor, Elite, Liteon and Nvidia, as well as finished products from the likes of Lenovo. An upgrade to its IT system - which now connects all its offices - has helped FDC drive additional efficiency into its operation during the past year. Note that sales from its PC integration business, which includes its own-brand XPC lines, represent 25% of its total sales, or US$82m. 2008strategy: FDC is promising to make more investments in its back-office operations this year as it strives to keep pace with the big hitters of distribution. Although it serves more than 500 regular accounts, the company is determined to increase its reseller breadth. That objective is poised to receive a boost in the coming weeks when FDC opens a marketing and after-sales support office in KSA and appoints a well-known face to manage it. 4. Emitac Distribution LLC

2007sales: $330m In the hotseat: Amer Khreino Employees: 150 ActiveAccounts: 650 No. Middle East offices outside Dubai: 5 Geographicremit: Middle East www.emitac.ae PO Box 8391, Dubai, UAE Tel: +971 4 282 7577 Background: Emitac celebrated a strong year in 2007 as substantial growth in all its HP units, coupled with the doubling of its Acer commercial business, made a positive impact on its top and bottom line. The addition of MGE OPS power protection products and 3M solutions has given Emitac an extra edge, while a focus on developing its in-country operations appears to be paying dividends. Although not disclosing specifics, Emitac says its Jordanian and Qatari subsidiaries registered a 60% and 55% rise in annual sales respectively. 2008strategy: With a certain critical mass now achieved, Emitac is in a strong position to fulfil the needs of its vendors without compromising its profitability goals. The firm intends to launch a revamped reseller tool - ConnectED - to facilitate order management and reduce costs. Emitac is also plotting to reorganise its operations to reflect the segmentation of the dealer and retail channels. 3. Almasa IT Distribution FZCO 2007sales: $420m Inthehotseat: Frank Sheu Employees: 250 ActiveAccounts: 1,100 No. MiddleEastofficesoutsideDubai: 3 Geographicremit: Middle East & North Africa www.almasa.com PO Box 30166, Dubai, UAE Tel: +971 4 3063 100

Background: An internal restructuring saw aggressive revenue growth sacrificed in 2006, but it was a different story last year as Almasa scaled its top line to cement its position as one of the region's most powerful volume distributors. Although the company has padded out its portfolio by securing Acer, Seagate and ViewSonic rights, the secret to Almasa's success is aligning more closely with key vendor partners such as HP, Avaya and Asus. Make no mistake about it, those efforts - and its progress with establishing fully-fledged operations in Saudi Arabia and to a lesser degree Egypt - have contributed to the firm's impressive growth. 2008strategy: With 50% of its revenues now originating from outside the UAE, Almasa is aiming to reinforce its status as a pan-regional player this year. 2008 will see extra focus on markets such as Qatar and the Levant, while the company is also preparing to make its long-awaited move to a new state-of-the-art logistics facility in Jebel Ali. 2. Aptec Holdings Limited 2007 sales: $470m Inthe hotseat: Ali Baghdadi Employees: 330 Active Accounts: 2,500 No. Middle East offices outside Dubai: 4 Geographic remit: Middle East & North Africa www.apteconline.com PO Box 33550, Dubai Internet City, Dubai, UAE Tel: +971 4 3697 111 Background: Following the acquisition of Tech Data's components and enterprise business last year, Aptec has reaffirmed itself as a formidable IT distribution house. With TDME now added to the stable - and overseeing key franchises with vendors such as Cisco, Oracle and Western Digital - the Aptec group boasts over 500 employees, and almost 70% of them are in distribution functions. Enhancements to its online systems, including the automation of quote tracking and sales orders, have strengthened Aptec's relationship with partners. 2008 strategy: Having attracted an investment fund and restructured the company financially last year, Aptec is in a strong position to reach its corporate objectives this year. The signings of Adobe, ISS, NetApp and Secure Computing during the past year also indicate the direction Aptec is going. *This figure is a Channel Middle East estimate based on average distribution market growth and our calculation of the value of business inherited from Tech Data Middle

East. 1. Redington Gulf FZE 2007sales: $795m In the hotseat: Raj Shankar Employees: 305 ActiveAccounts: 2,600 No. Middle East offices outside Dubai: 9 Geographic remit: Middle East & Africa www.redingtongulf.com Atrium Center, Office 607 & Office 306, Khaled Bin Waleed Road, Dubai, UAE Tel: +971 4 359 0555 Background: Publicly-quoted Redington continues to go from strength-to-strength and is proof that a comprehensive local in-country distribution model can work if you get all the ingredients right. The India-based company now makes the lion's share of its business from overseas sales, which means the Middle East and Africa generates more than 50% of its revenue. Redington's sales figure is based on the calendar year, but if you go by its forecasts for its current financial year - which runs from April 2007 to March 2008 - then it is on track for sales of more than US$820m, and that's merely its IT distribution vertical. It's thought that Africa sales account for around 20% of its MEA business. 2008strategy: Rivals are watching closely to see how Redington bounces back from the recent closure of HP's local PC plant in Saudi Arabia, for which it acted as the primary logistics partner. The opening of an automated distribution centre in Jebel Ali will certainly help matters, while plans to increase its brand bouquet have recently been boosted by the addition of Toshiba distribution rights in Saudi Arabia. Last year, Redington Gulf signed with APC, HP ProCurve, Kingston, Samsung's printing division and Trend Micro, and you can bet on 2008 bringing more of the same.

You might also like

- Insurance CompaniesDocument59 pagesInsurance CompaniesParag PenkerNo ratings yet

- Power CompaniesDocument3 pagesPower Companiesasu0950% (2)

- Tenant Directory: Estate Name Capital Type Legal Status Stage All S.A.O.G All AllDocument7 pagesTenant Directory: Estate Name Capital Type Legal Status Stage All S.A.O.G All AllRafay IkramNo ratings yet

- Data For Egypt CompainesDocument75 pagesData For Egypt CompainesMahmoudKhedrNo ratings yet

- 2012 Gulf Oilfield Directory Adipec Special EditionDocument1 page2012 Gulf Oilfield Directory Adipec Special EditionCaxanovaNo ratings yet

- 20180921-Dubai Companies DetailsDocument10 pages20180921-Dubai Companies Detailsbatsy4evNo ratings yet

- EgyptDocument23 pagesEgyptmel_akiNo ratings yet

- Importers and Distributors - The Saudi Arabian Furniture SectorDocument3 pagesImporters and Distributors - The Saudi Arabian Furniture Sectorabdul waleedNo ratings yet

- Saudi Exporters-Food & Food Related Products: Contact ListDocument6 pagesSaudi Exporters-Food & Food Related Products: Contact ListTalent BeaNo ratings yet

- TRADE SHOW CONTACTS SEEKING LUMBERDocument8 pagesTRADE SHOW CONTACTS SEEKING LUMBERMiracle Child67% (3)

- Abu Dhabi Job VacanciesDocument13 pagesAbu Dhabi Job Vacanciescnk20100% (1)

- Year YOUSEF M AL Employee ContactDocument1 pageYear YOUSEF M AL Employee ContactDrMohamed RifasNo ratings yet

- 100+ Names) : RECRUITMENT AGENCIES IN U.A.E. (Here Is A List ContainingDocument8 pages100+ Names) : RECRUITMENT AGENCIES IN U.A.E. (Here Is A List Containingitssajjidali5826No ratings yet

- Chambers of Commerce and IndustryDocument30 pagesChambers of Commerce and IndustryAbduRahmanMaliyekkalNo ratings yet

- UntitledDocument19 pagesUntitledmdnaseemchemistNo ratings yet

- Dubai Business Directory SampleDocument6 pagesDubai Business Directory SampleShehrozShafiqNo ratings yet

- JAMJOOM METAL INDUSTRIES Fabrication of Metal INDUSTRIAL GOODSDocument1 pageJAMJOOM METAL INDUSTRIES Fabrication of Metal INDUSTRIAL GOODSmeshar alsiyani100% (1)

- 2014 Dubai Exhibitions ListDocument10 pages2014 Dubai Exhibitions Listmohit1990dodwalNo ratings yet

- Logistics and Supply Chain DuabiDocument6 pagesLogistics and Supply Chain DuabiPandey AmitNo ratings yet

- 002 - UAE Business Directory 2018-2019Document1 page002 - UAE Business Directory 2018-2019Rahil Saeed 07889582701No ratings yet

- Saudia 100COM ContactsDocument28 pagesSaudia 100COM ContactsBrave Ali KhatriNo ratings yet

- UAE Trading CompaniesDocument34 pagesUAE Trading CompaniesCookie Cluver100% (1)

- Dubai Companies Addresses For Mega ProjectsDocument3 pagesDubai Companies Addresses For Mega Projectsmuhammad waqas arshadNo ratings yet

- List of CompaniesDocument3 pagesList of CompaniesChelle Sujetado De Guzman100% (1)

- Toaz - Info Uae Trading Companies PRDocument58 pagesToaz - Info Uae Trading Companies PRMaria Cristina DongalloNo ratings yet

- Gulf Food 2014Document9 pagesGulf Food 2014Micco Transport & Shipping services LLC100% (1)

- Cleaning Companies in QatarDocument10 pagesCleaning Companies in QatarklausmikaelsonwildNo ratings yet

- UaeDocument494 pagesUaeYun LINo ratings yet

- Uae Email Database SampleDocument26 pagesUae Email Database Samplejfklsdaj jsdkfjNo ratings yet

- KsaDocument3 pagesKsaJagdamba Overseas100% (1)

- Jordan Email Database SampleDocument4 pagesJordan Email Database SampleNajih ShafiqueNo ratings yet

- Compunia EuDocument10 pagesCompunia EuAbdul GhafoorNo ratings yet

- Qatar Business Directory SampleDocument1 pageQatar Business Directory SampleMuhammad SalmanNo ratings yet

- List of Top 10 Saudi CompaniesDocument2 pagesList of Top 10 Saudi CompaniesAlooly S Al-EissaNo ratings yet

- Agro Food Producfss SADocument135 pagesAgro Food Producfss SAAditya NaiduNo ratings yet

- BanksDocument5 pagesBanksNajam Saqib0% (1)

- LeadsDocument9 pagesLeadsPragatiNo ratings yet

- Qatar Doha EmailsDocument26 pagesQatar Doha EmailsPre Cadet AcademyNo ratings yet

- Contracting Companies UaeDocument1 pageContracting Companies UaeAdnan JadoonNo ratings yet

- Top 25 Pharmaceutical Companies in UAE and PakistanDocument4 pagesTop 25 Pharmaceutical Companies in UAE and PakistanIhtisham Ul Haq0% (1)

- UAE-All Companies Addresses and Contact DetailsDocument9 pagesUAE-All Companies Addresses and Contact Detailswafaa al tawilNo ratings yet

- Automotive Emails KuwaitDocument40 pagesAutomotive Emails KuwaitnazirsayyedNo ratings yet

- Gulf DetergentsDocument9 pagesGulf DetergentsAsim QaiserNo ratings yet

- UaeDocument3 pagesUaeGhulam Rabbani50% (2)

- IRAN COMPANIES CONTACT DETAILSDocument27 pagesIRAN COMPANIES CONTACT DETAILSPike Andrew100% (1)

- Expats in BahrainDocument47 pagesExpats in BahrainGarima Gupta100% (2)

- Must-check-Importers in The UAEDocument204 pagesMust-check-Importers in The UAEehsanmoodle6544No ratings yet

- Abu Dhabi Company DatabaseDocument4 pagesAbu Dhabi Company DatabaseSaurabh SrivastavaNo ratings yet

- D FirmsDocument3 pagesD FirmsMOHAMMAD SIDDIQ SALIMNo ratings yet

- UaeDocument22 pagesUaeTufail Alam100% (1)

- Customer List As of 14O - AppliedDocument74 pagesCustomer List As of 14O - Appliednavamivb67% (3)

- PV List ENDocument4 pagesPV List ENibrahim shahNo ratings yet

- contacts 100 suppliers factories in China certified loading list of suppliers for importation: CONTACT DATABASE OF BUSINESSES AND FACTORIES IN CHINA TO EXPORT AT A GLOBAL LEVELFrom Everandcontacts 100 suppliers factories in China certified loading list of suppliers for importation: CONTACT DATABASE OF BUSINESSES AND FACTORIES IN CHINA TO EXPORT AT A GLOBAL LEVELNo ratings yet

- RedingtonDocument7 pagesRedingtonapi-3716851No ratings yet

- SWOT Analysis of Axiata Group Berhad With USPDocument23 pagesSWOT Analysis of Axiata Group Berhad With USPMalar Lokanathan50% (6)

- QEIC Tech - CGI Group Pitch - FinalDocument16 pagesQEIC Tech - CGI Group Pitch - FinalAnonymous Ht0MIJNo ratings yet

- SWOT Analysis of Haier India LTDDocument5 pagesSWOT Analysis of Haier India LTDShivani SoniNo ratings yet

- IoT For Facilities ManagementDocument2 pagesIoT For Facilities ManagementSaji Muhammed SalihNo ratings yet

- ProfileDocument9 pagesProfileNdanga Tirivepi IsaacNo ratings yet

- Vodafone: Slogan: "Make The Most of Now" LogoDocument8 pagesVodafone: Slogan: "Make The Most of Now" Logo2243059No ratings yet

- Aaqi GamesDocument3 pagesAaqi Gamesjaheer1222No ratings yet

- Dubai Duty FreeDocument68 pagesDubai Duty Freejaheer1222No ratings yet

- Dubai Healthcare Professional Licensing Guide - Final - 2Document141 pagesDubai Healthcare Professional Licensing Guide - Final - 2Fahad IqbalNo ratings yet

- Senior Retail ManagerDocument3 pagesSenior Retail Managerjaheer1222No ratings yet

- OrigDocument1 pageOrigjaheer1222No ratings yet

- Sample CVHHHHDocument4 pagesSample CVHHHHlavovNo ratings yet

- 15 08 13Document1 page15 08 13jaheer1222No ratings yet

- Dubai Job ConsultantsDocument2 pagesDubai Job Consultantsjaheer1222100% (1)

- Mega Manager Counting Machine UpdatedDocument9 pagesMega Manager Counting Machine Updatedjaheer1222No ratings yet

- LaubingerdissDocument128 pagesLaubingerdissjaheer1222No ratings yet

- Physics ThesisDocument120 pagesPhysics Thesisjaheer1222No ratings yet

- Curriculum Vitae: Mr. Mohammad Jaheer Hussain.SDocument3 pagesCurriculum Vitae: Mr. Mohammad Jaheer Hussain.Sjaheer1222No ratings yet

- Buddhist WisdomDocument255 pagesBuddhist Wisdomam_jaluNo ratings yet

- M Blaze Retail Prepaid FRCsDocument1 pageM Blaze Retail Prepaid FRCsjaheer1222No ratings yet

- Appsc GroupDocument4 pagesAppsc Groupjaheer1222No ratings yet

- Outsourcing, Offshoring, and Productivity Measurement in U.S. ManufacturingDocument36 pagesOutsourcing, Offshoring, and Productivity Measurement in U.S. Manufacturingjaheer1222No ratings yet

- Leo SchemeDocument1 pageLeo Schemejaheer1222No ratings yet

- Outsourcing, Offshoring, and Productivity Measurement in U.S. ManufacturingDocument36 pagesOutsourcing, Offshoring, and Productivity Measurement in U.S. Manufacturingjaheer1222No ratings yet

- Studies On Barrel Type CarbonizerDocument89 pagesStudies On Barrel Type Carbonizerjaheer1222100% (1)

- Studies On Barrel Type CarbonizerDocument89 pagesStudies On Barrel Type Carbonizerjaheer1222100% (1)

- Studies On Barrel Type CarbonizerDocument89 pagesStudies On Barrel Type Carbonizerjaheer1222100% (1)

- Mallik CartoonsDocument1 pageMallik Cartoonsjaheer1222No ratings yet

- Ad Fs 2.0 Step-By-Step Guide: Federation With Shibboleth 2 and The Incommon FederationDocument40 pagesAd Fs 2.0 Step-By-Step Guide: Federation With Shibboleth 2 and The Incommon FederationanditzaskcNo ratings yet

- Lab 2 - MPS - MUHAMMAD ABDULAH UBAIDULLAH - 394295Document8 pagesLab 2 - MPS - MUHAMMAD ABDULAH UBAIDULLAH - 394295abdullahubaid257foruNo ratings yet

- IQ 250/260 Transducer Quick Start GuideDocument2 pagesIQ 250/260 Transducer Quick Start GuideJoséEmmanuelCasasMunguíaNo ratings yet

- FC F325iT Manufacturing-System Oct2022.aspxDocument1 pageFC F325iT Manufacturing-System Oct2022.aspxKantishNo ratings yet

- Question Paper Code:: Reg. No.Document3 pagesQuestion Paper Code:: Reg. No.rfdggfyhrtyb gfhjh tjNo ratings yet

- Data Base Chapter SevenDocument38 pagesData Base Chapter SevenAmanuel DereseNo ratings yet

- AGC 200 Modbus Descriptions GuideDocument42 pagesAGC 200 Modbus Descriptions GuideAyub Anwar M-SalihNo ratings yet

- Info Uir5f3650tnfaDocument115 pagesInfo Uir5f3650tnfaCojocaru GheorgheNo ratings yet

- Digital Video Recorder: User ManualDocument186 pagesDigital Video Recorder: User ManualGéza HrinkoNo ratings yet

- Advanced I/O TechniquesDocument65 pagesAdvanced I/O Techniquesvivek srivastavNo ratings yet

- Genus Sap ImplementationDocument37 pagesGenus Sap ImplementationOrlandoNo ratings yet

- Oracle Unified Mewthod - OUMDocument27 pagesOracle Unified Mewthod - OUMSaad Mohammed El-KhoullyNo ratings yet

- Impresora EpsonDocument52 pagesImpresora EpsonHospital HerediaNo ratings yet

- Cat247 Asterix Version Number Exchange Part 20Document19 pagesCat247 Asterix Version Number Exchange Part 20Bourouiba AbdelhalimNo ratings yet

- Suitcase Fusion 7 GuideDocument108 pagesSuitcase Fusion 7 GuidenwsundmaNo ratings yet

- UM1525 STM32F0 Discovery Kit User ManualDocument31 pagesUM1525 STM32F0 Discovery Kit User ManualdcesentherNo ratings yet

- Workbook: Managing and Maintaining A Microsoft Windows Server 2003 EnvironmentDocument10 pagesWorkbook: Managing and Maintaining A Microsoft Windows Server 2003 Environmentdvl801199No ratings yet

- PDF MC68HC908GP32 PDFDocument266 pagesPDF MC68HC908GP32 PDFticocrazyNo ratings yet

- GSM Multiple Access SchemeDocument4 pagesGSM Multiple Access SchemeBilal Rao50% (2)

- Radek ResumeDocument8 pagesRadek ResumertgluchNo ratings yet

- E Commerce Notes Chapter 1-4Document16 pagesE Commerce Notes Chapter 1-4Taniya BhallaNo ratings yet

- Pgdca SyllabusDocument15 pagesPgdca SyllabusAnish MohammadNo ratings yet

- Topic-5 IC Layout (Stick Diagram) : OutlineDocument47 pagesTopic-5 IC Layout (Stick Diagram) : Outline周裕琳No ratings yet

- Sample Skill Project ReportDocument15 pagesSample Skill Project ReportstangocapNo ratings yet

- DST Tmpm370fydfg-Tde en 21751Document498 pagesDST Tmpm370fydfg-Tde en 21751trân văn tuấnNo ratings yet

- Computer Operating Systems ExplainedDocument13 pagesComputer Operating Systems ExplainedJames UddonNo ratings yet

- Infrastructure Analyst Resume SampleDocument2 pagesInfrastructure Analyst Resume Sampleresume7.comNo ratings yet

- Zivercomplus Bcom0709av05Document221 pagesZivercomplus Bcom0709av05Ahmed SoomroNo ratings yet

- Adding WebApi To ASPNET SiteDocument38 pagesAdding WebApi To ASPNET Sitesilly_rabbitzNo ratings yet

- Collision DetectionDocument8 pagesCollision DetectionRodrigo CaldeiraNo ratings yet