Professional Documents

Culture Documents

Clear 2 Pay

Uploaded by

Jyoti KumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Clear 2 Pay

Uploaded by

Jyoti KumarCopyright:

Available Formats

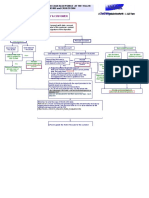

Clear2Pay is an innovative payments technology company focused on delivering globally applicable solutions for secure, timely and streamlined

payments processing . Clear2Pays Open Payment Framework (OPF) enables financial institutions to improve internal payments processing efficiencies whilst at the same time providing their clients with better payment services that are faster, with richer payments related information. Clear2Pays solutions within the Service-Oriented Architecture (SOA) based Open Payment Framework offer financial institutions the ability to process payments through a centralised payments engine that utilises a library of re-useable business services across all payment types. The bank can thus combine new services models with existing infrastructures, thereby protecting previous investments whilst gradually moving to a more modern efficient payments environment.

Different Solutions of C2P

Open Payment Solutions > Clear2Pay offers world class solutions based on the Open Payment Framework (OPF). The OPF is a library of component building blocks from which payments solutions can be derived. Built entirely on a Service Oriented Architecture (SOA), the OPF delivers common, reusable services consisting of a comprehensive data model; choreographed payment business processes and configurable services including parsing, validation, cost based routing, warehousing, security, auditing and many more. Open Test Solutions > Clear2Pay proposes the widest range of test solutions in the industry for electronic transactions in payment, transport and mobile applications. Open Card Solutions > Clear2Pay Cards delivers complete solutions for card payment services; acquiring, switching, authorisation, draft capture, fraud detection, card-holder and merchant back-office, clearing and settlement.

o o

Open Card System> Card hub solution for ATM, POS, Authorisation, Fraud, C&S, etc. Chargeback> Processor solutions for banks, card processors, issuers & acquirers

Consulting > Consulting services and expert co-sourcing based on deep domain expertise and extensive international know-how.

Open Payment Framework > The OPF is a library of component building blocks from which payments solutions can be derived. Domestic Payments > High-value RTGS and lower-value ACH payments (Fedwire, CHIPS, NACHA, BACS, CHAPS, UKFP, STEP2 & TARGET2). International Payments > Enriched payments for high volume, in-sourcing, multi-bank, correspondent banking, STP, and decision-based routing. Single Euro Payments Area (SEPA) > Full-service SDD & SCT; exception management, added value services, cost-based routing and mandate management. SEPA Direct Debits > Payment solution for the changing direct debit market under the Single Euro Payment Area. SEPA Credit Transfers > Consolidating European Credit Transfers

Electronic BillPresentment and Payment (EBPP) > Open and flexible EBPP solutions for either integrating with domestic consolidators or decisionbased routing to billers. Tax Data Service> Revolutionize the maintenance of the Tax Payment format information to pay State and Federal taxes by ACHCredit (EFT). Imaged Check Processing > Next generation check image exchange solution offering flexible scalability designed to evolve in conjunction with the industry. Consumer Remittance Payments > A complete, flexible and secure solution for international money transfer services for cash, cards and electronic transactions. eBanking > Classic electronic banking products featuring modular multichannel remote payment solutions for retail, small business and corporate customers; all highly secured and with deep functional scope. Business Payments > Optimizing payments processing for your business customers. Corporate Payment Hub > Optimised Payments Processing for Corporations. Bank Payment Hub > An umbrella payments solution offering a combination of tactical products, each introduced below, through a centralised payments infrastructure across their enterprise. Software Development Kit > Add, change and extend Open Payment Framework components to meet unique requirements.

You might also like

- IBM Banking: Our Payments Framework Solution For Financial Services Helps Simplify Payments OperationsDocument4 pagesIBM Banking: Our Payments Framework Solution For Financial Services Helps Simplify Payments OperationsIBMBankingNo ratings yet

- Bank ServDocument16 pagesBank ServaNo ratings yet

- Fis 8583-2017Document600 pagesFis 8583-2017HipHop MarocNo ratings yet

- BASE24 DR With AutoTMF and RDF WhitepaperDocument38 pagesBASE24 DR With AutoTMF and RDF WhitepaperMohan RajNo ratings yet

- IMF (FinTech Notes) Blockchain Consensus Mechanisms - A Primer For SupervisorsDocument18 pagesIMF (FinTech Notes) Blockchain Consensus Mechanisms - A Primer For SupervisorsMuning AnNo ratings yet

- Global ATM Market Report: 2013 Edition - Koncept AnalyticsDocument11 pagesGlobal ATM Market Report: 2013 Edition - Koncept AnalyticsKoncept AnalyticsNo ratings yet

- Rebuilding Operating Model Credit Card CompaniesDocument4 pagesRebuilding Operating Model Credit Card CompaniesapluNo ratings yet

- Bank Settlement ProcessDocument15 pagesBank Settlement ProcessFaisal KhanNo ratings yet

- Customer Information File User Manual PDFDocument314 pagesCustomer Information File User Manual PDFFahim KaziNo ratings yet

- SWIFT Messages: Each Block Is Composed of The Following ElementsDocument10 pagesSWIFT Messages: Each Block Is Composed of The Following ElementsMAdhuNo ratings yet

- Cross Border Money TransferDocument8 pagesCross Border Money Transferintix intNo ratings yet

- Transaction Processing Rules June 2016Document289 pagesTransaction Processing Rules June 2016Armando ReyNo ratings yet

- ISO20022 MDRPart2 PaymentsInitiation 2019 2020 v1 1Document287 pagesISO20022 MDRPart2 PaymentsInitiation 2019 2020 v1 1kafihNo ratings yet

- Innovation in Banking: A Review From The Point of View of Corporate GovernanceDocument35 pagesInnovation in Banking: A Review From The Point of View of Corporate GovernanceMj PorcionculaNo ratings yet

- Union Bank PDFDocument154 pagesUnion Bank PDFRakesh Prabhakar ShrivastavaNo ratings yet

- 3D Secure 3Document30 pages3D Secure 3kominminNo ratings yet

- Verifone Vx805 DsiEMVUS Platform Integration Guide SupplementDocument60 pagesVerifone Vx805 DsiEMVUS Platform Integration Guide SupplementHammad ShaukatNo ratings yet

- DDS File Format & ArchitectureDocument14 pagesDDS File Format & ArchitectureSalmanFatehAliNo ratings yet

- National Electronic Fund TransferDocument18 pagesNational Electronic Fund TransferKuldeep KushwahaNo ratings yet

- Cheque Management System FinalDocument35 pagesCheque Management System FinalPrerna Sharma0% (1)

- Cashless+Mobile PaymentsDocument21 pagesCashless+Mobile PaymentsAnkit SajayaNo ratings yet

- Ethoca Merchant Data Provision API Integration Guide V 3.0.1 (February 13, 2019)Document13 pagesEthoca Merchant Data Provision API Integration Guide V 3.0.1 (February 13, 2019)NastasVasileNo ratings yet

- Mastercom User GuideDocument232 pagesMastercom User GuideMario Cortez EscárateNo ratings yet

- Base Files Maintenance ManualDocument1,012 pagesBase Files Maintenance ManualAdminNo ratings yet

- MDES Via Direct Service Access - International Guide 21.Q1Document69 pagesMDES Via Direct Service Access - International Guide 21.Q1karma informaticoNo ratings yet

- US Funds WireDocument1 pageUS Funds WirebaxterNo ratings yet

- Your Deposit Account Agreement: Effective May 11, 2020Document33 pagesYour Deposit Account Agreement: Effective May 11, 2020Steph BryattNo ratings yet

- General Banking TermsDocument17 pagesGeneral Banking TermsVineeth JoseNo ratings yet

- Doxim Loan OriginationDocument4 pagesDoxim Loan OriginationVincentXuNo ratings yet

- 2017 McKinsey Payments Report PDFDocument16 pages2017 McKinsey Payments Report PDFnihar shethNo ratings yet

- Features of Credit CardDocument11 pagesFeatures of Credit CardBipin ThakorNo ratings yet

- EcoBank Training Manual-V1-11-DEC-2015 PDFDocument126 pagesEcoBank Training Manual-V1-11-DEC-2015 PDFMohamed Musthafa100% (1)

- LC OracleDocument354 pagesLC OracleMyjudulNo ratings yet

- 01 - Clearing ActivtiesDocument14 pages01 - Clearing ActivtiesBarjesh_Lamba_2009No ratings yet

- Eracom HSMDocument43 pagesEracom HSMEngineerrNo ratings yet

- Real Time Gross Settlement (RTGS) System and Its Implications For Central BankingDocument16 pagesReal Time Gross Settlement (RTGS) System and Its Implications For Central BankingFahadHussainNo ratings yet

- How To Understand Payment Industry in BrazilDocument32 pagesHow To Understand Payment Industry in BrazilVictor SantosNo ratings yet

- L052-Cheque Truncation SystemDocument21 pagesL052-Cheque Truncation SystemRISHI KESHNo ratings yet

- Process of Cash AcceptanceDocument5 pagesProcess of Cash AcceptanceJayakrishnaraj AJDNo ratings yet

- Security Rules and Procedures 30 July 2015Document227 pagesSecurity Rules and Procedures 30 July 2015BomNo ratings yet

- Tink - The Future of Payments Is OpenDocument46 pagesTink - The Future of Payments Is OpenDavid HelmanNo ratings yet

- If SwitchDocument51 pagesIf Switchxfirelove12No ratings yet

- RTGSDocument14 pagesRTGSHarshUpadhyayNo ratings yet

- Suresh Gyan Vihar University: Department of Ceit SynopsisDocument8 pagesSuresh Gyan Vihar University: Department of Ceit SynopsisAbodh KumarNo ratings yet

- Wire Remittance Domestic Best PracticesDocument10 pagesWire Remittance Domestic Best PracticesBernardo AlbaNo ratings yet

- Reference FormDocument1 pageReference Form16 ProfitsNo ratings yet

- Chapter 1 - Introduction To Digital Banking - V1.0Document17 pagesChapter 1 - Introduction To Digital Banking - V1.0prabhjinderNo ratings yet

- Smart CardDocument5 pagesSmart CardAnikesh BrahmaNo ratings yet

- Very Easy Money Transfer: E-ChequeDocument15 pagesVery Easy Money Transfer: E-ChequeKartheek AldiNo ratings yet

- Cyclos ReferenceDocument126 pagesCyclos ReferenceEnric ToledoNo ratings yet

- International - IST Switch - OmniPay - Case StudyDocument4 pagesInternational - IST Switch - OmniPay - Case StudyLuis Miguel Gonzalez SuarezNo ratings yet

- Electronic Financial Services: Technology and ManagementFrom EverandElectronic Financial Services: Technology and ManagementRating: 5 out of 5 stars5/5 (1)

- 01 - Overview & Customer Master MaintenanceDocument27 pages01 - Overview & Customer Master MaintenanceSreepada kNo ratings yet

- FDATA Open Banking in North America US VersionDocument33 pagesFDATA Open Banking in North America US VersionsdfgNo ratings yet

- State Money Transmission Laws vs. Bitcoins: Protecting Consumers or Hindering Innovation?Document30 pagesState Money Transmission Laws vs. Bitcoins: Protecting Consumers or Hindering Innovation?boyburger17No ratings yet

- Aci Card and Merchant Management Solutions Product Line Flyer FL Us 0711 4795 PDFDocument4 pagesAci Card and Merchant Management Solutions Product Line Flyer FL Us 0711 4795 PDFRazib ZoyNo ratings yet

- Atm - Screen - Flow STD Chrted BankDocument11 pagesAtm - Screen - Flow STD Chrted BankJayavant MaliNo ratings yet

- GL PL Code ChartDocument12 pagesGL PL Code ChartengrlumanNo ratings yet

- Credit Card Fraud Prevention Strategies A Complete Guide - 2021 EditionFrom EverandCredit Card Fraud Prevention Strategies A Complete Guide - 2021 EditionNo ratings yet

- Smart card management system The Ultimate Step-By-Step GuideFrom EverandSmart card management system The Ultimate Step-By-Step GuideNo ratings yet

- MVC - Defining An Application ArchitectureDocument14 pagesMVC - Defining An Application ArchitecturevishalchavannNo ratings yet

- SQL Server Execution PlanDocument17 pagesSQL Server Execution PlanJyoti KumarNo ratings yet

- ASP Net MVC PosterDocument1 pageASP Net MVC PosterJyoti KumarNo ratings yet

- SQL Server Sample QuestionsDocument15 pagesSQL Server Sample QuestionsJyoti KumarNo ratings yet

- Bhagwat Geeta (Hindi)Document127 pagesBhagwat Geeta (Hindi)Jyoti Kumar100% (6)

- EF Tutorials MVC BookDocument202 pagesEF Tutorials MVC BookwalalmNo ratings yet

- Dot Net SerializationDocument7 pagesDot Net SerializationJyoti KumarNo ratings yet

- DotNet InterviewDocument8 pagesDotNet InterviewJyoti KumarNo ratings yet

- MSC-IT 41-Min1Document10 pagesMSC-IT 41-Min1Jyoti KumarNo ratings yet

- Log 4 Net OverviewDocument8 pagesLog 4 Net Overviewcall_vipvipin725No ratings yet

- SOA Getting It RightDocument112 pagesSOA Getting It RightHumberto OliveiraNo ratings yet

- Android ExcerptsDocument20 pagesAndroid ExcerptsJyoti KumarNo ratings yet

- MD5 EncryptionDocument9 pagesMD5 EncryptionJyoti KumarNo ratings yet

- Final ThesisDocument14 pagesFinal ThesisJyll GellecanaoNo ratings yet

- Automatic Room Lighting System Using MicrocontrollerDocument60 pagesAutomatic Room Lighting System Using MicrocontrollerKaren Faye TorrecampoNo ratings yet

- Power Your Signal: Antenna SpecificationsDocument3 pagesPower Your Signal: Antenna SpecificationsMariNo ratings yet

- Sagiv Nissan CVDocument2 pagesSagiv Nissan CVSagiv NissanNo ratings yet

- Replacing The Laser Scanner Assembly HP LaserJet P3015 P3015n P3015dn P3015xDocument11 pagesReplacing The Laser Scanner Assembly HP LaserJet P3015 P3015n P3015dn P3015xGladis CarranzaNo ratings yet

- Lecture01 IntroDocument20 pagesLecture01 IntroRijy LoranceNo ratings yet

- Result Alert System Through SMS and E-MailDocument5 pagesResult Alert System Through SMS and E-MailIOSRjournalNo ratings yet

- Invotery MangementDocument9 pagesInvotery MangementSeshu naiduNo ratings yet

- 04098159Document3 pages04098159Murali GolveNo ratings yet

- Aluminium ProfileDocument23 pagesAluminium ProfileRobert CedeñoNo ratings yet

- Method of Statement For ThermographerDocument2 pagesMethod of Statement For ThermographerBabu75% (4)

- EVB Series: End-Of-Line Deflagration Flame ArrestersDocument2 pagesEVB Series: End-Of-Line Deflagration Flame Arresterstienhm_pve1553No ratings yet

- Release Note Ver 1.0Document2 pagesRelease Note Ver 1.0Nkenchor OsemekeNo ratings yet

- Study On Standard Time of Garment Sewing Based On GSD: Lihui RenDocument6 pagesStudy On Standard Time of Garment Sewing Based On GSD: Lihui RenLâm Ngọc HùngNo ratings yet

- Presented By:: Kemal Muhammet Akkaya Sr. Instrument Engineer Humod M. Al-Shammari Maintenance SuperintendentDocument54 pagesPresented By:: Kemal Muhammet Akkaya Sr. Instrument Engineer Humod M. Al-Shammari Maintenance Superintendentmaria neneng bulakNo ratings yet

- Skin Disease Detection Using Machine LearningDocument59 pagesSkin Disease Detection Using Machine LearningAnita ThapaNo ratings yet

- Exam Flashcards: by Jonathan DonadoDocument520 pagesExam Flashcards: by Jonathan Donadosolarstuff100% (1)

- Bootstrap Css Classes Desk Reference BCDocument9 pagesBootstrap Css Classes Desk Reference BCmazer38No ratings yet

- Metrology and Measurements - Lecture Notes, Study Material and Important Questions, AnswersDocument7 pagesMetrology and Measurements - Lecture Notes, Study Material and Important Questions, AnswersM.V. TVNo ratings yet

- Manual Reparacion Mitsubishi Mirage 2000 PART 2Document350 pagesManual Reparacion Mitsubishi Mirage 2000 PART 2Jeffrey Morales MenaNo ratings yet

- Manual TFA 30.3015Document43 pagesManual TFA 30.3015Carlos Ernesto NataliNo ratings yet

- TR 101290v010201pDocument175 pagesTR 101290v010201pAndreas_HBNo ratings yet

- Yuens CatalogueDocument23 pagesYuens CatalogueDora PopNo ratings yet

- Aw2.9bk6 12ax1 ManualDocument63 pagesAw2.9bk6 12ax1 ManualjassimNo ratings yet

- Spare Parts Catalogue: Bajaj Auto LimitedDocument44 pagesSpare Parts Catalogue: Bajaj Auto LimitedRahul KhadeNo ratings yet

- ITIL TestsDocument54 pagesITIL TestssokzgrejfrutaNo ratings yet

- Read This FirstDocument21 pagesRead This FirstNíkolas BorgesNo ratings yet

- 290-01 (Industrial Control Trainer)Document1 page290-01 (Industrial Control Trainer)HadiWaluyo100% (1)

- X1 Using VA01 With Digital Call Panel Quick Start ProgrammingDocument4 pagesX1 Using VA01 With Digital Call Panel Quick Start ProgrammingMos CraciunNo ratings yet