Professional Documents

Culture Documents

Advanced 5 24

Uploaded by

gon_freecs_4Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Advanced 5 24

Uploaded by

gon_freecs_4Copyright:

Available Formats

Advanced Accounting May 24, 2012 The Star Company recognizes profits on the Installment Basis.

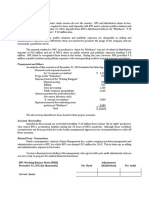

At the end of 2009, before the accounts are adjusted, the ledger shows the ff.: IAR, 2008 337,500 IAR, 2009 525,000 DGP, 2008 185,000 DGP, 2009 272,500 Regular Sales 1,500,000 Cost of Regular Sales 960,000 Each year the gross profit on Installment Sales was 8% lower than that on regular sales. In 2009, the gross profit on Installment sales was 4% higher than in 2008. 1. How much is the total realized gross profit in 2009? Sun Company which began operations on January, 2009 appropriately uses the installment method of accounting. The following data pertains to Williams operations for the year 2009. Installment Sales 180,000 Operating Expenses (before defaults and repossessions) 14,400 Regular Sales 75,000 Cash collections on Installment sales including interest of P4,800 62,400 Cost of Regular Sales 43,000 Installment receivable written off due to defaults 8,800 Cost of Installment Sales 140,000 Trade in allowance 18,000 NRV of repossessed Repossessed accounts 20,000 merchandise 10,800 Actual value of trade in merchandise 13,000 2. How much is the deferred gross profit at December 31, 2009? Moon Cars, Inc. accounts for automobile sales under the Installment Sales method. The following information relates to its past three years installment sales: Year ends 2008 Installment Sales 3,120,000 Gross profit rate based on cost 25% Balances of Installment Receivable From 2008 installment sales 859,040 From 2009 installment sales From 2010 installment sales 2009 1,440,000 33 1/3% 936,000 2010 66 2/3% 528,640 1,118,000 1,720,000

374,400

During 2010, Moon repossessed an automobile that it had sold for 256,000 in 2008. The uncollected balance of the repossessed account was 102,400. The company estimates the fair value of the repossessed item at 76,000, before any reconditioning cost. The reconditioning cost of 12,000 is needed to achieve the same gross profit for the sale of repossessed merchandise. 3. Calculate the total gross profit to be reported for 2010. 4. Calculate the total deferred gross profit at December 31, 2010 . On June 1, 2010 Meteor Company sells new car costing 1,620,000 for 2,268,000. A used car is accepted as down payment, 432,000 being allowed on the trade in. The used car can be resold for 486,000 after reconditioning cost of 64,800. The company expects to make a 20% gross profit on the sale of the used cars. During the period 270,000 was collected on the contract. 5. How much is the realized gross profit in 2010? Planet Corporation sells car on a three year installment sales contract. On December 31, 2011, the last day of Planets first year of operations, the results of operations before adjustment has Sales amounted to P1, 000,000. The Cost of installment sales is P700, 000 and operating expenses is P80, 000. The total collections during the year including interest and financing charges of P100,000 is P500,000. 6. What is the net income of Planet Corporation for the year ended December 31, 2011? Aser Computer Co. began operation at the beginning of 2011. During the year, it had cash sales of P6,875,000 and sales on installment basis of P16,500,000. Aser adds a markup on cost of 25% on cash sales and 50% on installment sales. Installment receivable at the end of 2011 is P6,600,000. 7. What is the total realized gross profit for 2011? Asteroid Company sells appliances on the installment basis. Below are information for the past three years: 2011 2010 2009 Installment Sales 750,000 600,000 400,000 Cost of sales 450,000 375,000 260,000 Collections on: 2011 installment sales 275,000 2010 installment sales 180,000 240,000 2009 installment sales 125,000 120,000 150,000 Repossessions on defaulted accounts included one made on a 2011 sale for which the unpaid balance amounted to P5,000. The depreciated value of the appliance repossessed was 2,500. 8. What is the realized gross profit in 2011 on collections of 2011 installment sales?

You might also like

- CKCFinanceLeaseQuizDocument2 pagesCKCFinanceLeaseQuizMannuelle GacudNo ratings yet

- Bus Com Handout 1 Bus CombinationDocument9 pagesBus Com Handout 1 Bus CombinationChristine RepuldaNo ratings yet

- ProblemsDocument9 pagesProblemsMark Angelo AlvarezNo ratings yet

- REVENUE RECOGNITION LONG TERM CONSTRUCTIONDocument4 pagesREVENUE RECOGNITION LONG TERM CONSTRUCTIONCee Gee BeeNo ratings yet

- B. Cost, Being The Purchase PriceDocument5 pagesB. Cost, Being The Purchase Priceaj dumpNo ratings yet

- Shenista Inc. Product Profit AnalysisDocument3 pagesShenista Inc. Product Profit Analysismohitgaba19No ratings yet

- Practice Problems Corporate LiquidationDocument2 pagesPractice Problems Corporate LiquidationAllira OrcajadaNo ratings yet

- Defined Benefit Plan-Midnight CompanyDocument2 pagesDefined Benefit Plan-Midnight CompanyDyenNo ratings yet

- Cash and Cash Equivalents: Answer: CDocument142 pagesCash and Cash Equivalents: Answer: CGarp BarrocaNo ratings yet

- Advanced Accounting PDocument4 pagesAdvanced Accounting PMaurice Agbayani100% (1)

- AFAR 01 Partnership AccountingDocument6 pagesAFAR 01 Partnership AccountingAriel DimalantaNo ratings yet

- MASTERY CLASS IN AUDITING PROBLEMS Part 1 Prob 1 9Document35 pagesMASTERY CLASS IN AUDITING PROBLEMS Part 1 Prob 1 9Mark Gelo WinchesterNo ratings yet

- Quiz - M2.5G POST-TEST May SagotDocument17 pagesQuiz - M2.5G POST-TEST May SagotJimbo ManalastasNo ratings yet

- Prelim Quiz 2Document11 pagesPrelim Quiz 2Sevastian jedd EdicNo ratings yet

- Cpa Review School of The Philippines: (P1,832,400-P598,400-P19,200-P180,000-P65,000-P73,000-P178,200)Document10 pagesCpa Review School of The Philippines: (P1,832,400-P598,400-P19,200-P180,000-P65,000-P73,000-P178,200)RIZA LUMAADNo ratings yet

- Supporting ComputationDocument5 pagesSupporting ComputationSuenNo ratings yet

- ACC5116 - Module 1Document6 pagesACC5116 - Module 1Carl Dhaniel Garcia SalenNo ratings yet

- What A ProblemDocument4 pagesWhat A ProblemEleazar SalazarNo ratings yet

- FEU Intermediate Accounting 2 Activity 04 NCA Held for SaleDocument3 pagesFEU Intermediate Accounting 2 Activity 04 NCA Held for SaleEstiloNo ratings yet

- An SME Prepared The Following Post Closing Trial Balance at YearDocument1 pageAn SME Prepared The Following Post Closing Trial Balance at YearRaca DesuNo ratings yet

- FranchisingDocument10 pagesFranchisingKRABBYPATTY PHNo ratings yet

- Accounting controls for special transactionsDocument12 pagesAccounting controls for special transactionsRNo ratings yet

- Quiz 2 - Corp Liqui and Installment SalesDocument8 pagesQuiz 2 - Corp Liqui and Installment SalesKenneth Christian WilburNo ratings yet

- This Study Resource Was: F-ACADL-01Document8 pagesThis Study Resource Was: F-ACADL-01Marjorie PalmaNo ratings yet

- HB Quiz 2018-2021Document3 pagesHB Quiz 2018-2021Allyssa Kassandra LucesNo ratings yet

- Bsa 2Document3 pagesBsa 2Gray JavierNo ratings yet

- LTCC AnswerDocument4 pagesLTCC AnswerRhina MagnawaNo ratings yet

- This Study Resource Was: National College of Business and ArtsDocument8 pagesThis Study Resource Was: National College of Business and ArtsGinoong OsoNo ratings yet

- NFJPIA Mockboard 2011 P2Document6 pagesNFJPIA Mockboard 2011 P2ELAIZA BASHNo ratings yet

- MAS.07 Drill Balanced Scorecard and Responsibility AccountingDocument6 pagesMAS.07 Drill Balanced Scorecard and Responsibility Accountingace ender zeroNo ratings yet

- AFARDocument12 pagesAFARsino akoNo ratings yet

- Coursehero 12Document2 pagesCoursehero 12nhbNo ratings yet

- Chapter 14Document4 pagesChapter 14Richard Jay CamaNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument5 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionErwin Labayog MedinaNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument5 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionErine ContranoNo ratings yet

- Roll Forward Analysis2Document4 pagesRoll Forward Analysis2CJ alandyNo ratings yet

- AFAR - Revenue Recognition, JointDocument3 pagesAFAR - Revenue Recognition, JointJoanna Rose DeciarNo ratings yet

- Midterms Quiz 2 Answers PDFDocument7 pagesMidterms Quiz 2 Answers PDFFranz Campued100% (1)

- Sale and Leaseback Accounting QuestionsDocument28 pagesSale and Leaseback Accounting QuestionsEdrickLouise DimayugaNo ratings yet

- Budgeting Activity - DayagDocument5 pagesBudgeting Activity - DayagAlexis Kaye DayagNo ratings yet

- Construction Contract Percentage Completion QuizDocument4 pagesConstruction Contract Percentage Completion QuizJason GubatanNo ratings yet

- Cpa Review School of The Philippines ManilaDocument2 pagesCpa Review School of The Philippines ManilaJoyce Anne DugayNo ratings yet

- P2Document18 pagesP2Robert Jayson UyNo ratings yet

- CUP VI - Financial Accounting and ReportingDocument17 pagesCUP VI - Financial Accounting and ReportingRonieOlarte0% (1)

- Compute the depreciation expense for each asset for the year 2015Document5 pagesCompute the depreciation expense for each asset for the year 2015Marie Fe GullesNo ratings yet

- Assignment 4.2 Intangible Assets - ACCTG 018-ACTCY21S3 - Intermediate Accounting 2Document4 pagesAssignment 4.2 Intangible Assets - ACCTG 018-ACTCY21S3 - Intermediate Accounting 2Maxine ConstantinoNo ratings yet

- Problem 8Document1 pageProblem 8Michael ArriesgaNo ratings yet

- Gialogo, Jessie Lyn San Sebastian College - Recoletos Quiz: Required: Answer The FollowingDocument12 pagesGialogo, Jessie Lyn San Sebastian College - Recoletos Quiz: Required: Answer The FollowingMeidrick Rheeyonie Gialogo AlbaNo ratings yet

- Accounting For Taxes & Employee BenefitsDocument5 pagesAccounting For Taxes & Employee BenefitsAveryl Lei Sta.Ana100% (1)

- Standard Costing Problems and Variance AnalysisDocument4 pagesStandard Costing Problems and Variance AnalysisRoy Mitz Aggabao Bautista V100% (1)

- Mahusay Acc227 Module 4Document4 pagesMahusay Acc227 Module 4Jeth MahusayNo ratings yet

- Auditing Problem 2Document1 pageAuditing Problem 2jhobs100% (1)

- Cost Analysis and Break-Even CalculationsDocument9 pagesCost Analysis and Break-Even CalculationsErika Mae UmaliNo ratings yet

- CHAPTER-5 Advance Acctg GuerreroDocument20 pagesCHAPTER-5 Advance Acctg GuerreroKassandra EbolNo ratings yet

- Dr. Lee's patient service revenue calculation under accrual basisDocument6 pagesDr. Lee's patient service revenue calculation under accrual basisAndrea Lyn Salonga CacayNo ratings yet

- Installment Sales & Long-Term ConsDocument6 pagesInstallment Sales & Long-Term ConsSirr JeyNo ratings yet

- Local Media3172437425380563588Document20 pagesLocal Media3172437425380563588Candy SchrendiNo ratings yet

- Installment Sales Methods and CalculationsDocument6 pagesInstallment Sales Methods and CalculationsApolinar Alvarez Jr.No ratings yet

- INTERMEDIATE ACCOUNTING - MIDTERM - 2019-2020 - 2nd Semester - PART1Document3 pagesINTERMEDIATE ACCOUNTING - MIDTERM - 2019-2020 - 2nd Semester - PART1Renalyn Paras100% (1)

- ACC16 - HO 2 Installment Sales 11172014Document7 pagesACC16 - HO 2 Installment Sales 11172014Marvin James Cho0% (2)

- Fa 1 - Q1Document3 pagesFa 1 - Q1gon_freecs_4No ratings yet

- Advanced Accounting Problems SolvedDocument1 pageAdvanced Accounting Problems Solvedgon_freecs_4No ratings yet

- Advanced Accounting 4 25Document2 pagesAdvanced Accounting 4 25gon_freecs_4No ratings yet

- Access 2007 TutorialsDocument34 pagesAccess 2007 Tutorialsbogsbest100% (4)

- TOS FinalsDocument1 pageTOS Finalsgon_freecs_4No ratings yet

- TOS FinalsDocument1 pageTOS Finalsgon_freecs_4No ratings yet

- Sample Cash FlowDocument1 pageSample Cash Flowgon_freecs_4No ratings yet

- Price List and Order Form 1st Sem., SY 2008-2009 Eff. June 2008 DeliveriesDocument1 pagePrice List and Order Form 1st Sem., SY 2008-2009 Eff. June 2008 Deliveriesgon_freecs_4No ratings yet

- RO15 ProDocument5 pagesRO15 Progon_freecs_4No ratings yet

- Price List and Order Form 1st Sem., SY 2008-2009 Eff. June 2008 DeliveriesDocument1 pagePrice List and Order Form 1st Sem., SY 2008-2009 Eff. June 2008 Deliveriesgon_freecs_4No ratings yet

- Price List and Order Form 1st Sem (1) - SY 2007 2008 Revised May 30 2007Document1 pagePrice List and Order Form 1st Sem (1) - SY 2007 2008 Revised May 30 2007gon_freecs_4No ratings yet

- Performance of Schools in Alphabetical Order: (October 2011 Certified Public Accountant Licensure Examination)Document18 pagesPerformance of Schools in Alphabetical Order: (October 2011 Certified Public Accountant Licensure Examination)tristan20No ratings yet

- VatDocument170 pagesVatgon_freecs_4No ratings yet

- MAS Compilation of QuestionsDocument6 pagesMAS Compilation of Questionsgon_freecs_4No ratings yet

- Full Text of The Official Result of October 2011 Certified Public Accountants Licensure ExaminationDocument17 pagesFull Text of The Official Result of October 2011 Certified Public Accountants Licensure ExaminationPaul Michael Camania JaramilloNo ratings yet

- May 2012 Certified Public Accountant Licensure ExaminationDocument1 pageMay 2012 Certified Public Accountant Licensure ExaminationPaul Michael Camania JaramilloNo ratings yet

- Full Text of The Official Result of October 2011 Certified Public Accountants Licensure ExaminationDocument17 pagesFull Text of The Official Result of October 2011 Certified Public Accountants Licensure ExaminationPaul Michael Camania JaramilloNo ratings yet

- PhotoshopDocument6 pagesPhotoshopGon FreecsNo ratings yet

- CSForm 100 Rev 2012Document2 pagesCSForm 100 Rev 2012Agnes Antonio RodriguezNo ratings yet

- VatDocument170 pagesVatgon_freecs_4No ratings yet

- A Reply - Lee Epstein, Gary KingDocument19 pagesA Reply - Lee Epstein, Gary KingAdam PeaseNo ratings yet

- Tso C139Document5 pagesTso C139Russell GouldenNo ratings yet

- Contemporary Management Education: Piet NaudéDocument147 pagesContemporary Management Education: Piet Naudérolorot958No ratings yet

- In - Gov.uidai ADHARDocument1 pageIn - Gov.uidai ADHARvamsiNo ratings yet

- G.R. No. 172242Document2 pagesG.R. No. 172242Eap Bustillo67% (3)

- Sarva Shiksha Abhiyan, GOI, 2013-14: HighlightsDocument10 pagesSarva Shiksha Abhiyan, GOI, 2013-14: Highlightsprakash messiNo ratings yet

- Forex Risk ManagementDocument114 pagesForex Risk ManagementManish Mandola100% (1)

- Symphonological Bioethical Theory: Gladys L. Husted and James H. HustedDocument13 pagesSymphonological Bioethical Theory: Gladys L. Husted and James H. HustedYuvi Rociandel Luardo100% (1)

- GUBAnt BanwnaDocument36 pagesGUBAnt BanwnaMarc Philip100% (1)

- General Math Second Quarter Exam ReviewDocument5 pagesGeneral Math Second Quarter Exam ReviewAgnes Ramo100% (1)

- TRANSGENDER ISSUES AT UiTM SHAH ALAMDocument15 pagesTRANSGENDER ISSUES AT UiTM SHAH ALAMJuliano Mer-KhamisNo ratings yet

- Financial Management Introduction Lecture#1Document12 pagesFinancial Management Introduction Lecture#1Rameez Ramzan AliNo ratings yet

- Power Plant Cooling IBDocument11 pagesPower Plant Cooling IBSujeet GhorpadeNo ratings yet

- Admissions and ConfessionsDocument46 pagesAdmissions and ConfessionsAlexis Anne P. ArejolaNo ratings yet

- 1.1.a New Attitude For A New YearDocument8 pages1.1.a New Attitude For A New YearMatthew LopezNo ratings yet

- Group 2 - Liham Na Sinulat Sa Taong 2070 - SanggunianDocument5 pagesGroup 2 - Liham Na Sinulat Sa Taong 2070 - SanggunianDominador RomuloNo ratings yet

- Who Gsap 2017Document56 pagesWho Gsap 2017Mirzania Mahya FathiaNo ratings yet

- 1 CBT Sample Questionnaires-1Document101 pages1 CBT Sample Questionnaires-1Mhee FaustinaNo ratings yet

- Artisan Professionnel Program Finds MUA InfluencersDocument7 pagesArtisan Professionnel Program Finds MUA InfluencersWilliam SuriadyNo ratings yet

- The Project Saboteur1Document28 pagesThe Project Saboteur1pharezeNo ratings yet

- Taste of IndiaDocument8 pagesTaste of IndiaDiki RasaptaNo ratings yet

- FREE MEMORY MAPS FOR ECONOMICS CHAPTERSDocument37 pagesFREE MEMORY MAPS FOR ECONOMICS CHAPTERSRonit GuravNo ratings yet

- Axis Priority SalaryDocument5 pagesAxis Priority SalarymanojNo ratings yet

- The Landmarks of MartinismDocument7 pagesThe Landmarks of Martinismcarlos incognitosNo ratings yet

- Mba Dissertation Employee RetentionDocument8 pagesMba Dissertation Employee RetentionCustomPaperWritingUK100% (1)

- Joseph Stalin: Revisionist BiographyDocument21 pagesJoseph Stalin: Revisionist BiographyStefanoCzarnyNo ratings yet

- Career Lesson Plan Cheat SheetDocument2 pagesCareer Lesson Plan Cheat Sheetapi-278760277No ratings yet

- Amazon InvoiceDocument1 pageAmazon InvoiceChandra BhushanNo ratings yet

- DiphtheriaDocument30 pagesDiphtheriaBinayaNo ratings yet

- HCB 0207 Insurance Ad Risk ManagementDocument2 pagesHCB 0207 Insurance Ad Risk Managementcollostero6No ratings yet