Professional Documents

Culture Documents

Palacol v. Ferrer-Calleja

Uploaded by

Leidi Chua BayudanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Palacol v. Ferrer-Calleja

Uploaded by

Leidi Chua BayudanCopyright:

Available Formats

Republic of the Philippines SUPREME COURT Manila FIRST DIVISION G.R. No.

85333 February 26, 1990 CARMELITO L. PALACOL, ET AL., petitioners, vs. PURA FERRER-CALLEJA, Director of the Bureau of Labor Relations, MANILA CCBPI SALES FORCE UNION, and COCA-COLA BOTTLERS (PHILIPPINES), INC., respondents. Wellington B. Lachica for petitioners. Adolpho M. Guerzon for respondent Union.

GANCAYCO, J.: Can a special assessment be validly deducted by a labor union from the lump-sum pay of its members, granted under a collective bargaining agreement (CBA), notwithstanding a subsequent disauthorization of the same by a majority of the union members? This is the main issue for resolution in the instant petition for certiorari. As gleaned from the records of the case, the pertinent facts are as follows: On October 12, 1987, the respondent Manila CCBPI Sales Force Union (hereinafter referred to as the Union), as the collective bargaining agent of all regular salesmen, regular helpers, and relief helpers of the Manila Plant and Metro Manila Sales Office of the respondent CocaCola Bottlers (Philippines), Inc. (hereinafter referred to as the Company) concluded a new collective bargaining agreement with the latter. 1 Among the compensation benefits granted to the employees was a general salary increase to be given in lump sum including recomputation of actual commissions earned based on the new rates of increase. On the same day, the president of the Union submitted to the Company the ratification by the union members of the new CBA and

authorization for the Company to deduct union dues equivalent to P10.00 every payday or P20.00 every month and, in addition, 10% by way of special assessment, from the CBA lump-sum pay granted to the union members. The last one among the aforementioned is the subject of the instant petition. As embodied in the Board Resolution of the Union dated September 29, 1987, the purpose of the special assessment sought to be levied is "to put up a cooperative and credit union; purchase vehicles and other items needed for the benefit of the officers and the general membership; and for the payment for services rendered by union officers, consultants and others." 2 There was also an additional proviso stating that the "matter of allocation ... shall be at the discretion of our incumbent Union President." This "Authorization and CBA Ratification" was obtained by the Union through a secret referendum held in separate local membership meetings on various dates. 3 The total membership of the Union was about 800. Of this number, 672 members originally authorized the 10% special assessment, while 173 opposed the same. 4 Subsequently however, one hundred seventy (170) members of the Union submitted documents to the Company stating that although they have ratified the new CBA, they are withdrawing or disauthorizing the deduction of any amount from their CBA lump sum. Later, 185 other union members submitted similar documents expressing the same intent. These members, numbering 355 in all (170 + 185), added to the original oppositors of 173, turned the tide in favor of disauthorization for the special assessment, with a total of 528 objectors and a remainder of 272 supporters. 5 On account of the above-mentioned disauthorization, the Company, being in a quandary as to whom to remit the payment of the questioned amount, filed an action for interpleader with the Bureau of Labor Relations in order to resolve the conflicting claims of the parties concerned. Petitioners, who are regular rank-and-file employees of the Company and bona fide members of the Union, filed a motion/complaint for intervention therein in two groups of 161 and 94, respectively. They claimed to be among those union members who either did not sign any individual written authorization, or having signed one, subsequently withdrew or retracted their signatures therefrom. Petitioners assailed the 10% special assessment as a violation of

Article 241(o) in relation to Article 222(b) of the Labor Code. Article 222(b) provides as follows: ART. 222. Appearances and Fees. xxx xxx xxx (b) No attorney's fees, negotiation fees or similar charges of any kind arising from any collective bargaining negotiations or conclusion of the collective agreement shall be imposed on any individual member of the contracting union; Provided, however, that attorney's fees may be charged against union funds in an amount to be agreed upon by the parties. Any contract, agreement or arrangement of any sort to the contrary shall be null and void. On the other hand, Article 241(o) mandates that: ART. 241. Rights and conditions of membership in a labor organization. xxx xxx xxx (o) Other than for mandatory activities under the Code, no special assessments, attorney's fees, negotiation fees or any other extraordinary fees may be checked off from any amount due to an employee without an individual written authorization duly signed by the employee. The authorization should specifically state the amount, purpose and beneficiary of the deduction; As authority for their contention, petitioners cited Galvadores v. Trajano, 6 wherein it was ruled that no check-offs from any amount due employees may be effected without individual written authorizations duly signed by the employees specifically stating the amount, purpose, and beneficiary of the deduction. In its answer, the Union countered that the deductions not only have the popular indorsement and approval of the general membership, but likewise complied with the legal requirements of Article 241 (n) and (o) of the Labor Code in that the board resolution of the Union imposing the questioned special assessment had been duly approved in a general membership meeting and that the collection of a special fund for labor education and research is mandated. Article 241(n) of the Labor Code states that

ART. 241. Rights and conditions of membership in a labor organization. xxx xxx xxx (n) No special assessment or other extraordinary fees may be levied upon the members of a labor organization unless authorized by a written resolution of a majority of all the members at a general membership meeting duly called for the purpose. The secretary of the organization shall record the minutes of the meeting including the list of all members present, the votes cast, the purpose of the special assessment or fees and the recipient of such assessments or fees. The record shall be attested to by the president; Med-Arbiter Manases T. Cruz ruled in favor of petitioners in an order dated February 15, 1988 whereby he directed the Company to remit the amount it had kept in trust directly to the rank-and-file personnel without delay. On appeal to the Bureau of Labor Relations, however, the order of the Med-Arbiter was reversed and set aside by the respondent-Director in a resolution dated August 19, 1988 upholding the claim of the Union that the special assessment is authorized under Article 241 (n) of the Labor Code, and that the Union has complied with the requirements therein. Hence, the instant petition. Petitioners allege that the respondent-Director committed a grave abuse of discretion amounting to lack or excess of jurisdiction when she held Article 241 (n) of the Labor Code to be the applicable provision instead of Article 222(b) in relation to Article 241(o) of the same law. According to petitioners, a cursory examination and comparison of the two provisions of Article 241 reveals that paragraph (n) cannot prevail over paragraph (o). The reason advanced is that a special assessment is not a matter of major policy affecting the entire union membership but is one which concerns the individual rights of union members. Petitioners further assert that assuming arguendo that Article 241(n) should prevail over paragraph (o), the Union has nevertheless failed to comply with the procedure to legitimize the questioned special

assessment by: (1) presenting mere minutes of local membership meetings instead of a written resolution; (2) failing to call a general membership meeting; (3) having the minutes of three (3) local membership meetings recorded by a union director, and not by the union secretary as required; (4) failing to have the list of members present included in the minutes of the meetings; and (5) failing to present a record of the votes cast. 7 Petitioners concluded their argument by citing Galvadores. After a careful review of the records of this case, We are convinced that the deduction of the 10% special assessment by the Union was not made in accordance with the requirements provided by law. Petitioners are correct in citing the ruling of this Court in Galvadores which is applicable to the instant case. The principle "that employees are protected by law from unwarranted practices that diminish their compensation without their known edge and consent" 8 is in accord with the constitutional principle of the State affording full protection to labor. 9 The respondent-Union brushed aside the defects pointed out by petitioners in the manner of compliance with the legal requirements as "insignificant technicalities." On the contrary, the failure of the Union to comply strictly with the requirements set out by the law invalidates the questioned special assessment. Substantial compliance is not enough in view of the fact that the special assessment will diminish the compensation of the union members. Their express consent is required, and this consent must be obtained in accordance with the steps outlined by law, which must be followed to the letter. No shortcuts are allowed. The applicable provisions are clear. The Union itself admits that both paragraphs (n) and (o) of Article 241 apply. Paragraph (n) refers to "levy" while paragraph (o) refers to "check-off" of a special assessment. Both provisions must be complied with. Under paragraph (n), the Union must submit to the Company a written resolution of a majority of all the members at a general membership meeting duly called for the purpose. In addition, the secretary of the organization must record the minutes of the meeting which, in turn, must include, among others, the list of all the members present as well as the votes cast. As earlier outlined by petitioners, the Union obviously failed to comply with the requirements of paragraph (n). It held local membership

meetings on separate occasions, on different dates and at various venues, contrary to the express requirement that there must be a general membership meeting. The contention of the Union that "the local membership meetings are precisely the very general meetings required by law" 10 is untenable because the law would not have specified a general membership meeting had the legislative intent been to allow local meetings in lieu of the latter. It submitted only minutes of the local membership meetings when what is required is a written resolution adopted at the general meeting. Worse still, the minutes of three of those local meetings held were recorded by a union director and not by the union secretary. The minutes submitted to the Company contained no list of the members present and no record of the votes cast. Since it is quite evident that the Union did not comply with the law at every turn, the only conclusion that may be made therefrom is that there was no valid levy of the special assessment pursuant to paragraph (n) of Article 241 of the Labor Code. Paragraph (o) on the other hand requires an individual written authorization duly signed by every employee in order that a special assessment may be validly checked-off. Even assuming that the special assessment was validly levied pursuant to paragraph (n), and granting that individual written authorizations were obtained by the Union, nevertheless there can be no valid check-off considering that the majority of the union members had already withdrawn their individual authorizations. A withdrawal of individual authorizations is equivalent to no authorization at all. Hence, the ruling in Galvadores that "no check-offs from any amounts due employees may be effected without an individual written authorization signed by the employees ... " is applicable. The Union points out, however, that said disauthorizations are not valid for being collective in form, as they are "mere bunches of randomly procured signatures, under loose sheets of paper." 11 The contention deserves no merit for the simple reason that the documents containing the disauthorizations have the signatures of the union members. The Court finds these retractions to be valid. There is nothing in the law which requires that the disauthorization must be in individual form. Moreover, it is well-settled that "all doubts in the implementation and interpretation of the provisions of the Labor Code ... shall be resolved in favor of labor." 12 And as previously stated, labor in this case refers to the union members, as employees of the Company. Their mere

desire to establish a separate bargaining unit, albeit unproven, cannot be construed against them in relation to the legality of the questioned special assessment. On the contrary, the same may even be taken to reflect their dissatisfaction with their bargaining representative, the respondent-Union, as shown by the circumstances of the instant petition, and with good reason. The Med-Arbiter correctly ruled in his Order that: The mandate of the majority rank and file have (sic) to be respected considering they are the ones directly affected and the realities of the high standards of survival nowadays. To ignore the mandate of the rank and file would enure to destabilizing industrial peace and harmony within the rank and file and the employer's fold, which we cannot countenance. Moreover, it will be recalled that precisely union dues are collected from the union members to be spent for the purposes alluded to by respondent. There is no reason shown that the regular union dues being now implemented is not sufficient for the alleged expenses. Furthermore, the rank and file have spoken in withdrawing their consent to the special assessment, believing that their regular union dues are adequate for the purposes stated by the respondent. Thus, the rank and file having spoken and, as we have earlier mentioned, their sentiments should be respected. Of the stated purposes of the special assessment, as embodied in the board resolution of the Union, only the collection of a special fund for labor and education research is mandated, as correctly pointed out by the Union. The two other purposes, namely, the purchase of vehicles and other items for the benefit of the union officers and the general membership, and the payment of services rendered by union officers, consultants and others, should be supported by the regular union dues, there being no showing that the latter are not sufficient to cover the same. The last stated purpose is contended by petitioners to fall under the coverage of Article 222 (b) of the Labor Code. The contention is impressed with merit. Article 222 (b) prohibits attorney's fees, negotiations fees and similar charges arising out of the conclusion of a collective bargaining agreement from being imposed on any individual union member. The collection of the special assessment partly for the payment for services rendered by union officers, consultants and others may not be in the category of "attorney's fees or negotiations

fees." But there is no question that it is an exaction which falls within the category of a "similar charge," and, therefore, within the coverage of the prohibition in the aforementioned article. There is an additional proviso giving the Union President unlimited discretion to allocate the proceeds of the special assessment. Such a proviso may open the door to abuse by the officers of the Union considering that the total amount of the special assessment is quite considerable P1,027,694.33 collected from those union members who originally authorized the deduction, and P1,267,863.39 from those who did not authorize the same, or subsequently retracted their authorizations. 13 The former amount had already been remitted to the Union, while the latter is being held in trust by the Company. The Court, therefore, stakes down the questioned special assessment for being a violation of Article 241, paragraphs (n) and (o), and Article 222 (b) of the Labor Code. WHEREFORE, the instant petition is hereby GRANTED. The Order of the Director of the Bureau of Labor Relations dated August 19, 1988 is hereby REVERSED and SET ASIDE, while the order of the Med-Arbiter dated February 17, 1988 is reinstated, and the respondent Coca-Cola Bottlers (Philippines), Inc. is hereby ordered to immediately remit the amount of P1,267,863.39 to the respective union members from whom the said amount was withheld. No pronouncement as to costs. This decision is immediately executory. SO ORDERED. Narvasa, Grio-Aquino and Medialdea, JJ., concur. Cruz, J., took no part.

You might also like

- Supreme Court rules special assessment invalidDocument89 pagesSupreme Court rules special assessment invalidHimura KenshinNo ratings yet

- Supreme Court rules special assessment invalid due to union's failure to comply with legal requirementsDocument29 pagesSupreme Court rules special assessment invalid due to union's failure to comply with legal requirementsNeil Owen DeonaNo ratings yet

- Phil. 856: Special Assessment Invalid Without Individual AuthorizationDocument8 pagesPhil. 856: Special Assessment Invalid Without Individual AuthorizationGlenda Mae GemalNo ratings yet

- Labor Cases Feb13Document67 pagesLabor Cases Feb13Katrina Anne Layson YeenNo ratings yet

- Full Text Cases Art 242, 249-251Document75 pagesFull Text Cases Art 242, 249-251jeanne remojoNo ratings yet

- G.R. No. 85333Document5 pagesG.R. No. 85333Maria Celiña PerezNo ratings yet

- Palacol V Ferrer Calleja PDFDocument5 pagesPalacol V Ferrer Calleja PDFRon Russell Solivio MagbalonNo ratings yet

- Palacol Vs Ferrer DigestDocument4 pagesPalacol Vs Ferrer DigestMyrnaJoyPajoJaposNo ratings yet

- PALACOL vs. CALLEJA: Special Assessment Deduction RequirementsDocument3 pagesPALACOL vs. CALLEJA: Special Assessment Deduction Requirementspokeball001No ratings yet

- Palacol v. Ferrer-CallejaDocument9 pagesPalacol v. Ferrer-CallejaSamuel ValladoresNo ratings yet

- Palacol vs. Ferrer Calleja G.R. No. 85333Document9 pagesPalacol vs. Ferrer Calleja G.R. No. 85333Eunice KanapiNo ratings yet

- Palacol vs. CallejaDocument9 pagesPalacol vs. CallejaJesa Bayoneta100% (1)

- PALACOL vs. FERRER-CALLEJADocument2 pagesPALACOL vs. FERRER-CALLEJARaje Paul Artuz0% (1)

- Palacol Vs Ferrer-CallejaDocument9 pagesPalacol Vs Ferrer-CallejamjpjoreNo ratings yet

- Palacol v. Ferrer-CallejaDocument2 pagesPalacol v. Ferrer-CallejaShine Bautista100% (1)

- Palacol vs. Pura Ferrer-CallejaDocument2 pagesPalacol vs. Pura Ferrer-CallejabrendamanganaanNo ratings yet

- Palacol v. Ferrer-Calleja G.R. No. 85333 February 26, 1990Document2 pagesPalacol v. Ferrer-Calleja G.R. No. 85333 February 26, 1990mjpjore100% (1)

- LABOR RELATIONS - 2A Case Digest For Atty. Marquez PDFDocument129 pagesLABOR RELATIONS - 2A Case Digest For Atty. Marquez PDFAnne ObnamiaNo ratings yet

- 2ANotes LaborCaseDigestDocument129 pages2ANotes LaborCaseDigestsigfridmonteNo ratings yet

- 10 Palacol, Et Al. vs. Ferrer-Calleja G.R. No. 85333Document2 pages10 Palacol, Et Al. vs. Ferrer-Calleja G.R. No. 85333Monica FerilNo ratings yet

- Palacol V CallejaDocument2 pagesPalacol V CallejaAmbra Kaye AriolaNo ratings yet

- Court Rules Labor Union Failed to Validate Special Assessment DeductionDocument1 pageCourt Rules Labor Union Failed to Validate Special Assessment DeductionCAJNo ratings yet

- G.R. No. 85333 (PALACOL vs. COCA-COLA BOTTLERS (PHILIPPINES) )Document2 pagesG.R. No. 85333 (PALACOL vs. COCA-COLA BOTTLERS (PHILIPPINES) )GwylexNo ratings yet

- Case DigestDocument6 pagesCase DigestLen ZinxNo ratings yet

- Palacol v. CallejaDocument3 pagesPalacol v. CallejaChimney sweepNo ratings yet

- Abs CBN Vs Abs CBN Union DigestDocument9 pagesAbs CBN Vs Abs CBN Union DigestjelyneptNo ratings yet

- Gabriel Vs Sec of LaborDocument1 pageGabriel Vs Sec of LaborMariz GalangNo ratings yet

- 01 Gabriel vs. Sec of LaborDocument2 pages01 Gabriel vs. Sec of LaborcagrnsNo ratings yet

- Labrel Union Members Relations/ Rights and Condition of MembershipDocument5 pagesLabrel Union Members Relations/ Rights and Condition of MembershipKeikoAkustoNo ratings yet

- 55 - San Miguel Corp V SM PackagingDocument4 pages55 - San Miguel Corp V SM PackagingCelest AtasNo ratings yet

- Petitioner Vs VS: Third DivisionDocument10 pagesPetitioner Vs VS: Third DivisionPatricia RamosNo ratings yet

- Gabriel Vs Sec of LaborDocument2 pagesGabriel Vs Sec of LaborsummerwolffNo ratings yet

- Palacol v. Ferrer-CallejaDocument9 pagesPalacol v. Ferrer-CallejaDNAANo ratings yet

- Gabriel v. Secretary of Labor and Employment (2000)Document2 pagesGabriel v. Secretary of Labor and Employment (2000)Ish GuidoteNo ratings yet

- Position PaperDocument6 pagesPosition PaperLewrej De PerioNo ratings yet

- Ulp-Cert. Elect CasesDocument176 pagesUlp-Cert. Elect CasesVerdeth Marie WaganNo ratings yet

- Galvadores v Trajano arbitration fees disputeDocument3 pagesGalvadores v Trajano arbitration fees disputeMiggy CardenasNo ratings yet

- Carino Vs NLRC GR No 91086Document5 pagesCarino Vs NLRC GR No 91086Breth1979No ratings yet

- 67 - Volkschel - Labor - Union - v. - Bureau - of - LaborDocument4 pages67 - Volkschel - Labor - Union - v. - Bureau - of - LaborClarence ProtacioNo ratings yet

- Court Upholds Validity of 10% Special Assessment DeductionDocument11 pagesCourt Upholds Validity of 10% Special Assessment DeductionSamuel ValladoresNo ratings yet

- Jurisdiction of Labor Cases Involving DismissalsDocument31 pagesJurisdiction of Labor Cases Involving DismissalsjoannecatimbangNo ratings yet

- Development "Never Mentioned Journals and Ledgers" As Part of The Documentation Requirements ForDocument5 pagesDevelopment "Never Mentioned Journals and Ledgers" As Part of The Documentation Requirements ForRose Ann CalanglangNo ratings yet

- Seamen's Association v. CallejaDocument2 pagesSeamen's Association v. CallejaLv EscartinNo ratings yet

- Dong Seung Inc Vs BLRDocument5 pagesDong Seung Inc Vs BLRwesleybooksNo ratings yet

- Gabriel v. SOLEDocument2 pagesGabriel v. SOLEEva TrinidadNo ratings yet

- Ellis v. Railway Clerks, 466 U.S. 435 (1984)Document23 pagesEllis v. Railway Clerks, 466 U.S. 435 (1984)Scribd Government DocsNo ratings yet

- Labrel GR NO 158075 and GR NO 106830Document4 pagesLabrel GR NO 158075 and GR NO 106830Joshua Bagotsay100% (1)

- 12 Gabriel, Et Al. vs. Secretary of Labor and Employment G.R. No. 115949Document2 pages12 Gabriel, Et Al. vs. Secretary of Labor and Employment G.R. No. 115949Monica FerilNo ratings yet

- Gabriel vs. Secretary of LaborDocument5 pagesGabriel vs. Secretary of LaborRaquel DoqueniaNo ratings yet

- Abs-Cbn Union vs. Abs-Cbn BroadcastingDocument8 pagesAbs-Cbn Union vs. Abs-Cbn BroadcastingHanelizan Ert RoadNo ratings yet

- LABREL - Usita MT FT Qs Compilation With Suggested AnswersDocument11 pagesLABREL - Usita MT FT Qs Compilation With Suggested AnswersMary Charlene ValmonteNo ratings yet

- Labor Relations - Case Digests 11Document7 pagesLabor Relations - Case Digests 11Macy TangNo ratings yet

- Petitioners Not Entitled to Full Backwages Despite Illegal Dismissal RulingDocument6 pagesPetitioners Not Entitled to Full Backwages Despite Illegal Dismissal RulingNxxxNo ratings yet

- Republic of the Philippines Supreme Court rules on attorney fees deductionDocument3 pagesRepublic of the Philippines Supreme Court rules on attorney fees deductionvanessa3333333No ratings yet

- 32 Galvadores v. Trajano, 144 SCRA 138Document4 pages32 Galvadores v. Trajano, 144 SCRA 138EK ANGNo ratings yet

- (G.R. No. 106518. March 11, 1999) : DecisionDocument7 pages(G.R. No. 106518. March 11, 1999) : DecisionGavin Reyes CustodioNo ratings yet

- Mendoza V Mweu DigestDocument4 pagesMendoza V Mweu DigestErika PotianNo ratings yet

- Ignacio P. Lacsina For Petitioner. William D. Dichoso For Respondent DMG, Inc. Abraham B. Drapiza For Private RespondentDocument4 pagesIgnacio P. Lacsina For Petitioner. William D. Dichoso For Respondent DMG, Inc. Abraham B. Drapiza For Private RespondentMsiNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersFrom EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersNo ratings yet

- Salaysay NG Pagpapatibay - PDFDocument1 pageSalaysay NG Pagpapatibay - PDFLeidi Chua BayudanNo ratings yet

- List of Philippine criminal law casesDocument1 pageList of Philippine criminal law casesLeidi Chua BayudanNo ratings yet

- Crim Pro Lecture Part 1 (Text)Document21 pagesCrim Pro Lecture Part 1 (Text)Leidi Chua BayudanNo ratings yet

- Lease Contract: Mr. X, of Legal Age, Married To Mrs. A, Both Filipinos, andDocument4 pagesLease Contract: Mr. X, of Legal Age, Married To Mrs. A, Both Filipinos, andLeidi Chua BayudanNo ratings yet

- Puno Opinion SeparateDocument39 pagesPuno Opinion SeparateLeidi Chua BayudanNo ratings yet

- 2019legislation - RA 11232 REVISED CORPORATION CODE 2019 PDFDocument73 pages2019legislation - RA 11232 REVISED CORPORATION CODE 2019 PDFCris Anonuevo100% (1)

- 2019legislation - RA 11232 REVISED CORPORATION CODE 2019 PDFDocument73 pages2019legislation - RA 11232 REVISED CORPORATION CODE 2019 PDFCris Anonuevo100% (1)

- Criminal Procedure Part 1-2Document16 pagesCriminal Procedure Part 1-2Leidi Chua BayudanNo ratings yet

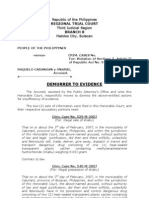

- Demand Letter: 4321 DEF Street Barangay Moon Ville, Pasig CityDocument1 pageDemand Letter: 4321 DEF Street Barangay Moon Ville, Pasig CityLeidi Chua BayudanNo ratings yet

- Lease Contract: Mr. X, of Legal Age, Married To Mrs. A, Both Filipinos, andDocument4 pagesLease Contract: Mr. X, of Legal Age, Married To Mrs. A, Both Filipinos, andLeidi Chua BayudanNo ratings yet

- 2019legislation - Revised Corporation Code Comparative Matrix - As of March 22 2019 PDFDocument121 pages2019legislation - Revised Corporation Code Comparative Matrix - As of March 22 2019 PDFJohn Lloyd MacuñatNo ratings yet

- Dvisio NsDocument3 pagesDvisio NsShikago BolNo ratings yet

- Demand Letter: 4321 DEF Street Barangay Moon Ville, Pasig CityDocument1 pageDemand Letter: 4321 DEF Street Barangay Moon Ville, Pasig CityLeidi Chua BayudanNo ratings yet

- Service and Support Coverage - Apple SupportDocument1 pageService and Support Coverage - Apple SupportLeidi Chua BayudanNo ratings yet

- Certification Presiding Judgelexecutive Certification VacanciesDocument1 pageCertification Presiding Judgelexecutive Certification VacanciesLeidi Chua Bayudan100% (1)

- Medical Act of 1959 regulates Philippine medical education & practiceDocument6 pagesMedical Act of 1959 regulates Philippine medical education & practicePatricia Anne CollantesNo ratings yet

- CULPEPPER CARROLL PLLC v. COLE - FindLaw PDFDocument7 pagesCULPEPPER CARROLL PLLC v. COLE - FindLaw PDFLeidi Chua BayudanNo ratings yet

- CH 8 SIFEx Qu Ac AnswersDocument5 pagesCH 8 SIFEx Qu Ac AnswersgetoNo ratings yet

- CULPEPPER CARROLL PLLC v. COLE - FindLaw PDFDocument7 pagesCULPEPPER CARROLL PLLC v. COLE - FindLaw PDFLeidi Chua BayudanNo ratings yet

- Supreme Court Denies Admission to Murderer Turned Law StudentDocument10 pagesSupreme Court Denies Admission to Murderer Turned Law StudentLeidi Chua BayudanNo ratings yet

- Philippine Supreme Court Affirms Tax on Interest Payments by National Development CompanyDocument124 pagesPhilippine Supreme Court Affirms Tax on Interest Payments by National Development CompanyLeidi Chua BayudanNo ratings yet

- CULPEPPER CARROLL PLLC v. COLE - FindLaw PDFDocument7 pagesCULPEPPER CARROLL PLLC v. COLE - FindLaw PDFLeidi Chua BayudanNo ratings yet

- Duration of PenaltiesDocument1 pageDuration of Penaltiesroyax1No ratings yet

- TaxrevDocument891 pagesTaxrevLeidi Chua BayudanNo ratings yet

- Violations1 PDFDocument6 pagesViolations1 PDFLeidi Chua BayudanNo ratings yet

- SC rules against military officers in Amparo caseDocument4 pagesSC rules against military officers in Amparo caseLeidi Chua BayudanNo ratings yet

- BP22 Related Case Laws on Worthless ChecksDocument12 pagesBP22 Related Case Laws on Worthless ChecksLeidi Chua BayudanNo ratings yet

- 2016 Bar Q CivilDocument6 pages2016 Bar Q CivilLeidi Chua BayudanNo ratings yet

- Rule 8 Section 1-In General - Every Pleading Shall Contain in A Methodical and Logical Form, PlainDocument1 pageRule 8 Section 1-In General - Every Pleading Shall Contain in A Methodical and Logical Form, PlainLeidi Chua BayudanNo ratings yet

- Heirs of Eugenio Lopez v. EnriquezDocument11 pagesHeirs of Eugenio Lopez v. EnriquezLeidi Chua BayudanNo ratings yet

- Police Organization and Administration With Police Planning: (Review Examination)Document11 pagesPolice Organization and Administration With Police Planning: (Review Examination)Jen PaezNo ratings yet

- MIRATHDocument105 pagesMIRATHasifali.qadriNo ratings yet

- 004 Page 84 Sps Santos vs. CADocument2 pages004 Page 84 Sps Santos vs. CAocpgensan ocpgensanNo ratings yet

- PA RAP (Rules of Procedure) Superior Court Citations Downloaded March 19, 2007Document171 pagesPA RAP (Rules of Procedure) Superior Court Citations Downloaded March 19, 2007Stan J. CaterboneNo ratings yet

- Iglesia Ni Cristo v. Court of Appeals, G.R. No. 119673, July 26, 1996Document10 pagesIglesia Ni Cristo v. Court of Appeals, G.R. No. 119673, July 26, 1996Paul Romualdez TanNo ratings yet

- MJ Estate Motion To Compel RobsonDocument17 pagesMJ Estate Motion To Compel RobsonIvy100% (4)

- The Hercules Industries V SOLEDocument2 pagesThe Hercules Industries V SOLEArvin Robert100% (1)

- Fort Bonifacio Development Corporation vs. Fong 754 SCRA 544, March 25, 2015Document8 pagesFort Bonifacio Development Corporation vs. Fong 754 SCRA 544, March 25, 2015Eunice AmbrocioNo ratings yet

- Ravi Gangal - RD - 130101095Document5 pagesRavi Gangal - RD - 130101095Meghna SinghNo ratings yet

- MMDA v. Concerned Residents of Manila BayDocument2 pagesMMDA v. Concerned Residents of Manila BayDan AbaniaNo ratings yet

- Government Contracts: Umakanth VarottilDocument16 pagesGovernment Contracts: Umakanth VarottilAadhitya NarayananNo ratings yet

- SSG Election DatabaseDocument34 pagesSSG Election DatabaseAdrian ReyesNo ratings yet

- RPC 2 Questionnaire With AnswersDocument17 pagesRPC 2 Questionnaire With AnswersJohn Mark Paracad67% (3)

- The Advancement of Learning by Bacon, Francis, 1561-1626Document114 pagesThe Advancement of Learning by Bacon, Francis, 1561-1626Gutenberg.orgNo ratings yet

- 1-Utak v. ComelecDocument30 pages1-Utak v. ComelecNHYNo ratings yet

- ACCESS MCLE 29th Lecture SeriesDocument2 pagesACCESS MCLE 29th Lecture SeriesAlex CanataNo ratings yet

- Leigh Ravenscroft V CaRT, Particulars of ClaimDocument5 pagesLeigh Ravenscroft V CaRT, Particulars of ClaimNigel MooreNo ratings yet

- Civrev (Property) Assignment 1Document49 pagesCivrev (Property) Assignment 1Jf ManejaNo ratings yet

- 000 01 PubCorp DigestsDocument44 pages000 01 PubCorp DigestsannamariepagtabunanNo ratings yet

- Bucks County League of Women Voters Guide: Primary Election 2015Document101 pagesBucks County League of Women Voters Guide: Primary Election 2015BucksLocalNews.comNo ratings yet

- Revised Attestation FORMDocument7 pagesRevised Attestation FORMPrabhu SakinalaNo ratings yet

- United States Court of Appeals, Ninth CircuitDocument4 pagesUnited States Court of Appeals, Ninth CircuitScribd Government DocsNo ratings yet

- Adoption DeedDocument2 pagesAdoption DeedNirmal86% (7)

- Demurrer To EvidenceDocument6 pagesDemurrer To EvidenceR.A. Gregorio88% (8)

- Role of MSWG in Safeguarding The Interest of Minority Shareholders Interests of in Public Companies in MalaysiaDocument3 pagesRole of MSWG in Safeguarding The Interest of Minority Shareholders Interests of in Public Companies in MalaysiaRita Lakhsmi100% (2)

- LAHEY, KAthleen A. - Women and Civil Liberties PDFDocument10 pagesLAHEY, KAthleen A. - Women and Civil Liberties PDFCarol Marini100% (1)

- People vs. BugtongDocument3 pagesPeople vs. BugtongJane Yonzon-Repol0% (1)

- Lease To Purchase Option Agreement (Template)Document4 pagesLease To Purchase Option Agreement (Template)Emeka Nkem100% (2)

- Rodolfo Tigoy v. Court of Appeals G.R. No. 144640Document1 pageRodolfo Tigoy v. Court of Appeals G.R. No. 144640Norie SapantaNo ratings yet

- CA modifies RTC ruling, finds accused guilty of child abuseDocument16 pagesCA modifies RTC ruling, finds accused guilty of child abuseLeopoldo, Jr. BlancoNo ratings yet