Professional Documents

Culture Documents

INDIAN BANK - Taking Banking Technology To The Common Man

Uploaded by

nellai kumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

INDIAN BANK - Taking Banking Technology To The Common Man

Uploaded by

nellai kumarCopyright:

Available Formats

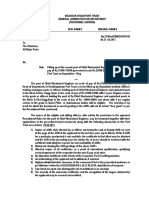

:: INDIAN BANK :: Taking Banking Technology to the Common Man

http://www.indianbank.in/rate_deposit.php

About Us

Products

Loans

Deposits

Services

News

Info

Contacts

Links

Home

Recruitment of executive for assignment for updating manuals of instructions / master circulars "INDIAN BONANZA-2013" - 91 days deposit at 9.75% p.a is launched for deposits of Rs 1 Crore to Rs 5 Crore Recruitment for post of Asst. General Manager (Treasury)(SMG-Scale V) Applications invited from Forensic Auditors Indian Bank launches new facility -- Online renewal of Arogya Raksha Policy List of candidates provisionally selected for Appointment as Clerks Credit Card Customers are requested not to reveal credit card details viz. Card Number, Name, Date of Birth, CVV Number, Date of Validity to anyone including to the staff of Indian Bank No penalty on premature withdrawal of domestic term deposit Withdrawal of Service Charge for Credit Card payment in the form of Cash or Cheque Compliance with KYC Guidelines - Public Notice OTP for Credit Card Online Transactions Seeding of Aadhaar number in customers CBS accounts Anonymous calls for enticing Indian Bank Credit Card holders with offer of prizes/gifts Non-CTS-2010 standard cheques are to be withdrawn completely by 31.12.2013 Alert to Customers on Card Skimming in ATMs Newsroom

home > Deposit rates Interest Rates on Domestic Term Deposits % p.a (w.e.f. 21.06.2013) (% per annum)

Branch Network Internet Banking ATM Network Mobile Banking Phone Banking Credit Card Debit/ATM Card Prepaid Cards Newsroom Notifications Deposit Rates Lending Rates Service Charges / Forex Rates Products Palette Educational Loan IB Swarna Mudra Schemes Wealth Management Services

Notifications What is new Press Releases Tender/Bids/Auction Career Awards & Accolades Interest Rates & Service Charges (Quick Glance) Deposit Rates Lending Rates Service Charges / Forex Rates Marketing updates - Morning Mantra

Applicable for single deposit of Rs.1 lakh and above For Deposit of above Rs 5 crore, acceptance of such deposits will be at the approval of the Treasury Branch With Effect From 01.04.2013, there will not be any penalty on premature withdrawal of domestic rupee deposit. In case of premature withdrawal, interest applicable for the appropriate period run will be paid.

Info Basel-II Disclosures Right to Information Act Customer Centric Services Best Practices Code

IMPORTANT: 1. For Special Domestic Term Deposit scheme for Senior Citizens, for deposits up to a 5 crore,additional rate of interest of 0.50% p.a is payable for 15 days to 10 years over the card rate in respect of Short Term Deposit, Fixed Deposit, Reinvestment Plan Schemes. For Recurring Deposit, additional interest rate of 0.50% p.a is payable for the period of 6 months to 120 months (multiples of 3 months). 2. The rates are applicable to IB Tax Saver schemes also. For the deposits of Senior Citizens, under this scheme, additional rate of 0.50% p.a is payable for the respective maturity period. 3. The rate of interest on domestic term deposit is also applicable to Capital Gains Scheme Type B (Term Deposits) 1988 Scheme. 4. "INDIAN BONANZA-2013" 91 days- deposit at 9.75% p.a is applicable for deposits of Rs 1 Crore to Rs 5 Crore. The product will be operational with effect from 19.08.2013 with following CONDITIONS: * Account should be opened only under the deposit product code allotted specifically for this category. *Additional interest rate offered to Senior Citizen / Staff / Staff Senior Citizen are not extended to this product. * All other terms and conditions of existing domestic term deposit scheme is applicable to this product also. The revised interest rates on domestic term deposits and additional interest rates offered to senior citizens are applicable only to fresh deposits and on renewal of maturing deposits. All other terms and conditions remain unchanged. Interest Rates on SB / NRO / NRE Accounts (Savings Bank Account, No Frill account, Non Resident Ordinary and Non Resident External Account)

NRE/ FCNR/ RFC (Term & SB) Deposits in various foreign currencies for 1, 2, 3, 4 and 5 year terms Deposit rates of above Rs 5 crore (Depostis of amount rs 5 crore and above) Foreclosure charges (Charges for foreclosure of domestic term deposits)

Press-Release | Tenders/Bids/Auction | Careers | Downloads | Disclaimer | Feedback | Online Customer Complaints (SPGRS)

Indian Bank, 2009

1 of 1

24-08-2013 10:46

You might also like

- Employment FormatDocument3 pagesEmployment Formatalan90% (49)

- Stock Trak ReportDocument5 pagesStock Trak Reportnhausaue100% (6)

- MCB Internship Report on Types of Bank AccountsDocument23 pagesMCB Internship Report on Types of Bank AccountsnishazaidiNo ratings yet

- Retail Products and Services of State Bank of IndiaDocument81 pagesRetail Products and Services of State Bank of IndiaNishant Singh50% (2)

- Union Cumulative Deposit Scheme and moreDocument9 pagesUnion Cumulative Deposit Scheme and morehisri6350No ratings yet

- LIC Superannuation Claim Form PDFDocument3 pagesLIC Superannuation Claim Form PDFManoj Mantri50% (2)

- Assignment 2Document2 pagesAssignment 2Eindra Nwe100% (1)

- MCB Bank ReportDocument30 pagesMCB Bank ReportdadagfazalNo ratings yet

- GCC 2013-14Document7 pagesGCC 2013-14Noble MeshakNo ratings yet

- Promotion Study Material For BankDocument271 pagesPromotion Study Material For BankJack Meena100% (1)

- Documentation of Bank (Bank of Baroda)Document40 pagesDocumentation of Bank (Bank of Baroda)Devesh Verma100% (1)

- CP ASSOCIATES BULLET POINTSDocument13 pagesCP ASSOCIATES BULLET POINTSvikashvacNo ratings yet

- Sbi ProjectDocument7 pagesSbi ProjectSumeet KambleNo ratings yet

- Marketing Mix OldDocument15 pagesMarketing Mix OldAisha rashidNo ratings yet

- Savings Deposit Products FeaturesDocument10 pagesSavings Deposit Products FeaturesHarish YadavNo ratings yet

- NR ReminiscenseDocument4 pagesNR ReminiscenselejinvNo ratings yet

- Procedures Undertaken Before Granting Bank Finance & Banking ServicesDocument24 pagesProcedures Undertaken Before Granting Bank Finance & Banking ServicesNikhil RanjanNo ratings yet

- Deposit Schemes: Savings Plus AccountDocument17 pagesDeposit Schemes: Savings Plus AccountMAnmit SIngh DadraNo ratings yet

- Commercial Banking Assignment: Analysis of Assets and Liabilities of A BankDocument15 pagesCommercial Banking Assignment: Analysis of Assets and Liabilities of A BankAyaz QaiserNo ratings yet

- Bank Deposit Accounts: Types, Strategies and GuidelinesDocument66 pagesBank Deposit Accounts: Types, Strategies and Guidelineslokesh palNo ratings yet

- Project Report "Banking System" in India Introduction of BankingDocument27 pagesProject Report "Banking System" in India Introduction of BankingShruti GargNo ratings yet

- Corporate Banking NRI Services: DepositsDocument1 pageCorporate Banking NRI Services: DepositsGangadhar MauryaNo ratings yet

- Project Report on Banking System and Credit Schemes in IndiaDocument9 pagesProject Report on Banking System and Credit Schemes in IndiamanishteensNo ratings yet

- Types of Bank AccountsDocument13 pagesTypes of Bank AccountsD PNo ratings yet

- Corporation BankDocument31 pagesCorporation BankShruti Das50% (2)

- Provisional Tax Saving Fixed Deposit Confirmation AdviceDocument3 pagesProvisional Tax Saving Fixed Deposit Confirmation AdviceKunda MalleshNo ratings yet

- Banking ReportDocument8 pagesBanking Reportisteaq ahamedNo ratings yet

- Axis Bank Term Deposit ProductsDocument35 pagesAxis Bank Term Deposit ProductsSaroj Kumar PandaNo ratings yet

- Gen-Next Junior (Saving Account) : Product NatureDocument6 pagesGen-Next Junior (Saving Account) : Product NaturedinkaramNo ratings yet

- Stanbic IBTC Bank Product Knowledge Assessment Test Study PackDocument32 pagesStanbic IBTC Bank Product Knowledge Assessment Test Study PackMike TelkNo ratings yet

- PDS Revision Eng & BM Online (Final)Document6 pagesPDS Revision Eng & BM Online (Final)Faiziya BanuNo ratings yet

- 47-Corporate Salary Package - CSPDocument3 pages47-Corporate Salary Package - CSPmevrick_guyNo ratings yet

- 41 New Products of SBI (As On 30.09.2010)Document10 pages41 New Products of SBI (As On 30.09.2010)Abhinav SaraswatNo ratings yet

- Standard Chartered Bank Performance EvaluationDocument32 pagesStandard Chartered Bank Performance Evaluationjahid262No ratings yet

- PNB Registers 16.7% Growth, Aims Rs 10 Lakh Crore Turnover By2013Document8 pagesPNB Registers 16.7% Growth, Aims Rs 10 Lakh Crore Turnover By2013Anil DhankharNo ratings yet

- Project Report On Banking SystemDocument16 pagesProject Report On Banking SystemArun Kumar0% (1)

- Small Business Credit CardDocument97 pagesSmall Business Credit CardVKM2013No ratings yet

- Bank Account Basics: Types, Opening Process & Customer ServiceDocument30 pagesBank Account Basics: Types, Opening Process & Customer ServiceShaifaliChauhanNo ratings yet

- Deposit SchemesDocument7 pagesDeposit SchemesTarun GargNo ratings yet

- BankDocument36 pagesBankSachin ManjhiNo ratings yet

- RHB - PDS - OverdraftDocument6 pagesRHB - PDS - OverdraftjoekaledaNo ratings yet

- Government Startup Loans in India: Schemes and ProvidersDocument10 pagesGovernment Startup Loans in India: Schemes and ProvidersSriniketh SridharNo ratings yet

- Government of India Small Savings SchemesDocument16 pagesGovernment of India Small Savings SchemesPranav BhattadNo ratings yet

- Burgundy-Mid With SignDocument2 pagesBurgundy-Mid With SignS.r.SiddharthNo ratings yet

- SAVE MONEY WITH BANK SAVINGS ACCOUNTSDocument11 pagesSAVE MONEY WITH BANK SAVINGS ACCOUNTSপ্রিয়াঙ্কুর ধরNo ratings yet

- PNB Savings Account FeaturesDocument28 pagesPNB Savings Account Featuresgauravdhawan1991No ratings yet

- BanksDocument24 pagesBanksViral Mandalia0% (1)

- History and Islamic banking services of Allied Bank LimitedDocument21 pagesHistory and Islamic banking services of Allied Bank LimitedRiaz MirzaNo ratings yet

- Banker's Digest 2014Document247 pagesBanker's Digest 2014suprajaconjeti1No ratings yet

- SBI Investment ProductsDocument20 pagesSBI Investment ProductssaravananNo ratings yet

- Most Important Terms & ConditionsDocument93 pagesMost Important Terms & Conditionslancy_dsuzaNo ratings yet

- Project Report "Banking System" in India Introduction of BankingDocument15 pagesProject Report "Banking System" in India Introduction of BankingshabnammerajNo ratings yet

- Customers' Deposit Accounts: Unit IVDocument26 pagesCustomers' Deposit Accounts: Unit IVShaifaliChauhanNo ratings yet

- Bank Detail by SidDocument20 pagesBank Detail by Sidsiddhartha bhattacharjeeNo ratings yet

- PNB Doctor - S DelightDocument18 pagesPNB Doctor - S DelightNishesh KumarNo ratings yet

- Internet Banking : Welcome AboardDocument6 pagesInternet Banking : Welcome AboardSmuthu MariNo ratings yet

- Assignment: Submitted ToDocument12 pagesAssignment: Submitted ToYadwinder SinghNo ratings yet

- Process of Retail LendingDocument26 pagesProcess of Retail Lendingkaren sunil100% (1)

- Cut Your Clients Tax Bill: Individual Tax Planning Tips and StrategiesFrom EverandCut Your Clients Tax Bill: Individual Tax Planning Tips and StrategiesNo ratings yet

- Guide to Modern Personal Finance: For Students and Young Adults: Guide to Modern Personal Finance, #1From EverandGuide to Modern Personal Finance: For Students and Young Adults: Guide to Modern Personal Finance, #1No ratings yet

- Annual PlanDocument1 pageAnnual PlanMurali VNo ratings yet

- Q 38Document30 pagesQ 38nellai kumarNo ratings yet

- ISRO Answer Key-Mechanical PDFDocument4 pagesISRO Answer Key-Mechanical PDFnellai kumarNo ratings yet

- 11 Physics Exemplar Chapter 4Document10 pages11 Physics Exemplar Chapter 4adarshNo ratings yet

- Invalid Access: Recruitment of Probationary OfficersDocument1 pageInvalid Access: Recruitment of Probationary Officersnellai kumarNo ratings yet

- Nasik Press NotificationDocument14 pagesNasik Press NotificationSANTOSH KUMAR DHULIPALANo ratings yet

- SSC JE Cut Off Marks 2015-2014-2013-2012Document7 pagesSSC JE Cut Off Marks 2015-2014-2013-2012nellai kumarNo ratings yet

- Manonmaniam Sundaranar University M.Phil & PhD Entrance Exam Date ExtendedDocument1 pageManonmaniam Sundaranar University M.Phil & PhD Entrance Exam Date Extendednellai kumarNo ratings yet

- HDVBDocument2 pagesHDVBnellai kumarNo ratings yet

- 2 Carnot CycleDocument6 pages2 Carnot CyclecaptainhassNo ratings yet

- Fluid Mechanics Ideas For SchoolDocument15 pagesFluid Mechanics Ideas For SchoolJonathan NeuroNo ratings yet

- BEL Recruitment 2017 For Probationary Engineer - Direct Link To ApplyDocument9 pagesBEL Recruitment 2017 For Probationary Engineer - Direct Link To Applynidhi tripathiNo ratings yet

- Answer Keys UPSC IAS Pre CSAT Exam Paper 2016 Paper 2 Held On 07-08-2016Document2 pagesAnswer Keys UPSC IAS Pre CSAT Exam Paper 2016 Paper 2 Held On 07-08-2016GajendraPatelNo ratings yet

- 11 Physics RevisionNotes Chapter 4 PDFDocument8 pages11 Physics RevisionNotes Chapter 4 PDFnellai kumarNo ratings yet

- Class11 Physics1 Answers NCERT TextBook EnglishEditionDocument12 pagesClass11 Physics1 Answers NCERT TextBook EnglishEditionRajesh KasturiNo ratings yet

- 2017 10 Not Eng Ccs II G2a Non OtDocument29 pages2017 10 Not Eng Ccs II G2a Non OtMOHAN RAJNo ratings yet

- Physics Part I ContentDocument14 pagesPhysics Part I ContentGopalKrishnaUpadhyayNo ratings yet

- ISO-9001 Iso-14001 Ohsas-18001: No.C1/Rect/CME/2016/1942Document10 pagesISO-9001 Iso-14001 Ohsas-18001: No.C1/Rect/CME/2016/1942nellai kumarNo ratings yet

- Mechanical Question BankDocument22 pagesMechanical Question Bankmustafa67% (3)

- Transmission of Heat QuestionsDocument7 pagesTransmission of Heat Questionsnellai kumarNo ratings yet

- Laws of Motion: © Ncert Not To Be RepublishedDocument9 pagesLaws of Motion: © Ncert Not To Be Republishednellai kumarNo ratings yet

- AdvertisementDocument11 pagesAdvertisementAnonymous ey6J2bNo ratings yet

- LIC Admin Officer Exam Solved Previous Year PaperDocument4 pagesLIC Admin Officer Exam Solved Previous Year Papernellai kumarNo ratings yet

- Keep 317Document30 pagesKeep 317nellai kumarNo ratings yet

- Corporation Bank PO Exam 9 - 5 - 2 0 1 0 Answer KeyDocument5 pagesCorporation Bank PO Exam 9 - 5 - 2 0 1 0 Answer Keyhaibye424No ratings yet

- Gdce Je Pway Tmo Application FormDocument1 pageGdce Je Pway Tmo Application Formnellai kumarNo ratings yet

- WavesDocument8 pagesWavesnellai kumarNo ratings yet

- 11 Physics Chapter 8 Assignment 1Document1 page11 Physics Chapter 8 Assignment 1nellai kumarNo ratings yet

- 11 Physics Chapter 6 Test 1 PDFDocument2 pages11 Physics Chapter 6 Test 1 PDFnellai kumarNo ratings yet

- LIC Admin Officer Exam Solved Previous Year PaperDocument26 pagesLIC Admin Officer Exam Solved Previous Year Paperkartikey_22No ratings yet

- What is Bitcoin? The Beginner's Guide to Understanding BitcoinDocument4 pagesWhat is Bitcoin? The Beginner's Guide to Understanding BitcoinDevonNo ratings yet

- Introduction to Price Multiples: PER, PBV, P/S, PCFDocument5 pagesIntroduction to Price Multiples: PER, PBV, P/S, PCFSyed Arham MurtazaNo ratings yet

- Summary (NEW Lease)Document3 pagesSummary (NEW Lease)Anonymous AGI7npNo ratings yet

- SLS 3231 - Financial Services Law - March 2016Document2 pagesSLS 3231 - Financial Services Law - March 2016Brad WafffNo ratings yet

- Working Capital Management of Reliance Infra LTDDocument76 pagesWorking Capital Management of Reliance Infra LTDniceprachiNo ratings yet

- Bank Audit Process and TypesDocument33 pagesBank Audit Process and TypesVivek Tiwari50% (2)

- Portfolio Risk AnalysisDocument4 pagesPortfolio Risk AnalysisHarneet ChughNo ratings yet

- Acquisition Leveraged Finance (한성원)Document18 pagesAcquisition Leveraged Finance (한성원)Claire Jingyi Li100% (5)

- Pristine's Cardinal Rules of TradingDocument44 pagesPristine's Cardinal Rules of Tradingsk77*100% (11)

- J WF 1 J Lflujq Iaj AnDocument13 pagesJ WF 1 J Lflujq Iaj AnOmprakash JhaNo ratings yet

- NICEHoldingsInvestorsRelations 2020 3Q ENGDocument31 pagesNICEHoldingsInvestorsRelations 2020 3Q ENGSimonasNo ratings yet

- Group Task on Financial Statements PresentationDocument21 pagesGroup Task on Financial Statements PresentationJolianne SalvadoOfcNo ratings yet

- Company Analysis of Infibeam AvenusDocument18 pagesCompany Analysis of Infibeam AvenusPratik WankhedeNo ratings yet

- Pa1 01Document88 pagesPa1 01Chriscelle JadeNo ratings yet

- Letter of Interest TemplatesDocument9 pagesLetter of Interest TemplatesMelissa BritoNo ratings yet

- Win22 Pill1A2 RBI Monetary Policy MrunalDocument13 pagesWin22 Pill1A2 RBI Monetary Policy MrunalVinay H PNo ratings yet

- I Am Sharing 'TCWD-ASSIGNMENT1' With YouDocument4 pagesI Am Sharing 'TCWD-ASSIGNMENT1' With YouQUENIE SAGUNNo ratings yet

- Earn an MBA at UKM's Graduate School of BusinessDocument2 pagesEarn an MBA at UKM's Graduate School of BusinessMohd Fadzly Engan0% (1)

- Trading With Time Time SampleDocument12 pagesTrading With Time Time SampleRasmi Ranjan100% (1)

- FinTech Frontiers Cloud Computing and Artificial Intelligence Applications For Intelligent Finance Investment and Blockchain in The Financial SectorDocument13 pagesFinTech Frontiers Cloud Computing and Artificial Intelligence Applications For Intelligent Finance Investment and Blockchain in The Financial SectorauthoralmightyNo ratings yet

- NonCurrent AssetsDocument31 pagesNonCurrent AssetsNikhil RamtohulNo ratings yet

- Aliso Viejo Ranch PresentationDocument14 pagesAliso Viejo Ranch PresentationavranchNo ratings yet

- Annual Report KIJA 2015 56 - 63Document210 pagesAnnual Report KIJA 2015 56 - 63David Susilo NugrohoNo ratings yet

- Intrim Report - Avinash Kumar SinghDocument26 pagesIntrim Report - Avinash Kumar SinghArjun KhareNo ratings yet

- Korean Stock TradingDocument5 pagesKorean Stock TradingcasefortrilsNo ratings yet

- ABC Apartments Operating StatementAnswer SheetDocument1 pageABC Apartments Operating StatementAnswer SheetAmy MatosNo ratings yet