Professional Documents

Culture Documents

FIN 254 ASSIGNMENT PROJECT: RATIO ANALYSIS OF UNILEVER, P&G AND RECKITT BENCKISER

Uploaded by

Muntasir SizanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FIN 254 ASSIGNMENT PROJECT: RATIO ANALYSIS OF UNILEVER, P&G AND RECKITT BENCKISER

Uploaded by

Muntasir SizanCopyright:

Available Formats

FIN 254 (SEC: 19) ASSIGNMENT

PROJECT: RATIO ANALYSIS

PREPARED BY

MD. SHADMAN NAZMUK ANIK 030 MD. TANVIR ALAM 030 YEASMIN AKTER 030 M. NAFIZ IMTIAZ 030 ID# 111 0431 ID# 092 0023 ID# 073 168 ID# 062 606

Objective of the Project

This project look for a careful review of the areas led to the identification of the following specific research objectives: To find out the different time series outcome Cross check both the homogenous companies based on the same time series DuPont Analysis Measuring performance based on the above analysis Common size income statement analysis Analysis the companys average ratios with industrys average ratio. A detail analysis of the performance of Unilever, P&G and Reckitt Benckiser Group.

Companies selected

Unilever The Procter & Gamble Company (P&G)

~

2

Reckitt Benckiser plc (LSE: RB)

Background of the companies

Unilever: Unilever is a British-Dutch multinational corporation that owns many of the world's

consumer product brands in foods, beverages, cleaning agents and personal care products. Unilever owns more than 400 brands as a result of acquisitions, however, the company focuses on what are called the "billion-dollar brands", 13 brands, each of which achieve annual sales in excess of 1 billion. Unilever's top 25 brands account for more than 70% of sales. The brands fall almost entirely into two categories: Food and Beverages, and Home and Personal Care. Unilever's brands include: AvianceAxe/Lynx ,Ben & Jerry's, Dove, Flora/Becel,Heartbrand,Hellmann's,Knorr,Lipton,Lux(soap),Omo/Surf (detergent),Rexona/Sure,Wish-Bone, Sunsilk,TIGI (haircare). Unilevers purpose is to meet the everyday needs of people--everywhere anticipate the aspirations of our consumers and customers and to respond creatively and competitively with branded products and services which raise the quality of life.

The Procter & Gamble Company (P&G): The Procter & Gamble Company (P&G) is a

giant in the area of consumer goods. The leading maker of household products in the United States, P&G has operations in nearly 80 countries around the world and markets its nearly 300 brands in more than 160 countries; more than half of the company's revenues are derived overseas. Among its products, which fall into the main categories of fabric care, home care, beauty care, baby care, family care, health care, snacks, and beverages, are 16 that generate more than $1 billion in annual revenues: Actonel (osteoporosis treatment); Always (feminine protection); Ariel, Downy, and Tide (laundry care); Bounty (paper towels); Charmin (bathroom tissue); Crest (toothpaste); Folgers (coffee); Head & Shoulders, Pantene, and Wella (hair care);

Iams (pet food); Olay (skin care); Pampers (diapers); and Pringles (snacks). Committed to remaining the leader in its markets, P&G is one of the most aggressive marketers and is the largest advertiser in the world.

Reckitt Benckiser plc (LSE: RB): Reckitt Benckiser plc (LSE: RB) is a global

consumer goods company headquartered in Slough, United Kingdom. It is the world's largest producer of household products and a major producer of consumer healthcare and personal products. Its brands include Dettol (the world's largest-selling antiseptic), Strepsils (the world's largest-selling sore throat medicine), Veet (the world's largest-selling depilatory brand), Air Wick (the world's second largest-selling air freshener), Calgon, Cillit Bang, Durex and Vanish.It has operations in over 60 countries and its products are sold in over 180 countries.

We have chosen the above three companies for ratio analysis because the financial reports of these companies show considerable fluctuations between the figures which means that a thorough analysis of the ratios can be presented.

Time Series Analysis: Unilever

Liquidity Ratios Current Ratio Ratio Current ratio 2008 0.81 2009 2010 Avg 0.89

0.93 0.92

The current ratio of Unilever increased significantly after the year 2008. Generally a high current ratio is suggested for a company because the higher this ratio the more liquid the company is expected to be. Quick Ratio Ratio Quick ratio 2008 0.48 2009 0.57 2010 0.47 Avg 0.51

The quick ratio increased greatly in 2009 but then dropped back to 0.47 in 2010. Quick ratio 1.00 is recommended and higher this ratio the more liquid the company is. The Quick ratios are almost half of the current ratios which mean that a large portion of the current assets was occupied by inventories. Gearing Ratios Debt Ratio Ratio Debt ratio 2008 1.13 2009 0.83 2010 0.66 Avg 0.87

Debt ratio dropped gradually during the period 2008-2010. Debt ratio 0.87 means 87% of total assets is financed by liabilities and 13% is financed by shareholders equity. The lower this ratio

means better the performance of the company. If this ratio is more than 1.00 then the company will have high default risk. Time Interest Earned Ratio Ratio Time interest earned ratio 2008 15.20 2009 11.33 2010 13.80 Avg 13.4

This ratio decreased in 2009 but again increased in 2010 and this means that the profitability of the company has improved. The ratio 13.4 indicates that company has 13.4 times EBIT to repay its interest. Generally a company should keep this ratio higher so that it can easily pay its due interests. Activity Ratios Inventory Turnover Ratio Ratio Inventory Turnover ratio 2008 10.42 2009 11.13 2010 10.27 Avg 10.61

This ratio shows how many times company sold their inventories. Inventory turnover ratio 10.61 means that Unilever sold its inventories 10.61 times in 2010. Inventory turnover ratio was acceptable during the period 2008-2010 but the higher the inventory turnover ratio the better companys performance and the more efficient the company is. Avg. Collection Period Ratio Avg. Collection Period 2008 25days 2009 21days 2010 21 days Avg 22.3 days

The average collection period was almost stagnant during this period although it was higher a bit longer in 2008. The company should reduce this time so that it can have more cash available to run the business and improve its quick test ratio which is quite low.

Avg. Payment Period

Ratio Avg. Period

2008 Payment 35days

2009 36days

2010 50days

Avg 40.3 days

The average payment period was satisfactory for the period 2009 to 2010 period its average payment period was higher than its average collection period. Total Asset Turnover Ratio Ratio 2008 1.12 Total asset turnover ratio The total asset turnover ratio was almost stagnant during this period. The total asset turnover ratio 1.12 in 2008 showed that the company was able to make sales 1.12 times by using its total assts. This ratio also shows the efficiency of the company. So to increase Unilevers performance the company should increase this ratio. Profitability Ratios Gross Profit Margin Ratio 2008 47.33% Gross Profit Margin The gross profit margin was almost stable throughout the three years. The company should increase this ratio further. This stability of the companys performance has also been reflected in its total asset turnover ratio. 2009 48.32% 2010 47.91% Avg 47.85% 2009 1.08 2010 1.08 Avg 1.09

Net Profit Margin

Ratio Net profit Margin

2008 12.41%

2009 8.46%

2010 9.59%

Avg 10.15%

Net profit margin decreased significantly from 2008 to 2010. Since gross profit margin was almost stable, an increase in operating expenses has caused this decrease and this shows inefficiency of the management. Operating Profit Margin Ratio Operating Profit Margin 2008 17.69% 2009 12.61% 2010 14.32% Avg 14.87%

Operating profit margin decreased significantly from 2008 to 2010. Since gross profit margin was almost stable, an increase in operating expenses has caused this decrease and this shows inefficiency of the management. Return on Total Asset (ROA) Ratio Return on Total Asset 2008 13.91% 2009 9.10% 2010 10.31% Avg 11.1%

The return on total assets shows an overall decrease from the period 2008 to 2010 which absolutely shows that the company is not properly utilizing its total assets and thats why its return decreased. The company should increase this ratio to become more efficient. This ratio reflects on the decrease in net profit margin and the operating profit margin. Return on Equity (ROE) Ratio Return on equity 2008 50.53% 2009 27.93% 2010 29.30% Avg 35.9%

The return on equity also shows an overall decrease during the three years. The ratio 35.9% means that the company was able to make 35.9% net income against shareholders capital.

Earnings per Share (EPS) Ratio 2008 2009 $1.99 2010 $2.48 Avg $2.47

Earnings per $2.94 share (EPS)

The earnings per share show the profitability of the company. Higher EPS means higher profit. The companys performance was best in 2008 which means that the company made good profit. Market Ratio P/E Ratio Ratio P/E Ratio 2008 $10.94 2009 $16.16 2010 $12.96 Avg $13.4

The P/E ratio was highest in 2009 which means investors were ready to pay $16.16 for getting each dollar of the companys earnings. The P/E ratio declined in 2010 which indicates that the demand for the companys share declined. This can be because of not being efficient during these years. M/B Ratio Ratio M/B Ratio 2008 3.84 2009 5.44 2010 4.82 Avg 4.7

The M/B ratio shows an overall decrease during the three-year period. This means that the demand for the companys share declined. This can be because of not being efficient.

Industry Average Vs Unilever Average

~

10

Current ratio, industry average = 0.752 Current ratio, Unilever average = 0.89 The current ratio of Unilever increased significantly after the year 2008. The average current ratio of Unilever is 0.89 which is greater than the industry average which means that the company has an excellent liquidity position. Quick ratio, industry average = 0.40 Quick ratio, Unilever average = 0.51 The quick ratio increased greatly in 2009 but then dropped back to 0.47 in 2010. The Quick ratios are almost half of the current ratios which mean that a large portion of the current assets was occupied by inventories. But the average quick ratio of Unilever is well above the industry average. Debt ratio, industry average = 0.68 Debt ratio, Unilever average = 0.87 Debt ratio dropped gradually during the period 2008-2010 but the average value is quite close to the o the industry average which reflects on the financial position of the business. Times interest earned ratio, industry average = 15.39 times Times interest earned ratio, Unilever average = 13.4 times This ratio decreased in 2009 but again increased in 2010 and this means that the profitability of the company has improved. So the company can easily pay its due interests. The company average is 13.4% which is close to the industry average. Inventory turnover ratio, industry average = 9.46 times Inventory turnover ratio, Unilever average = 10.61 times

11

Inventory turnover ratio was acceptable during the period 2008-2010. The company average for this ratio is 10.61 times. The higher the inventory turnover ratio the better companys performance and the more efficient the company is. Avg. Collection Period, industry average = 30.77 days Avg. Collection Period, Unilever average = 22.3 days The companys average collection period is 22.3 days. The lower this ratio the more liquid the company is. Avg. Payment Period, industry average = 33.77 days Avg. Payment Period, Unilever average = 40.3 days The average payment period was satisfactory for the period 2009 to 2010 its average payment period was higher than its average collection period. The company average is higher than the industry average and that is very positive. Total asset turnover ratio, industry average = 0.98 times Total asset turnover ratio, Unilever average = 1.09 times This ratio is well above the industry average. This indicates that the company is utilizing its assets very efficiently. Gross Profit Margin, industry average = 53.5% Gross Profit Margin, Unilever average = 47.85% The average gross profit margin is a bit lower than the industry average. Higher cost of raw materials may be the reason behind this. Net profit Margin, industry average = 14.63% Net profit Margin, Unilever average = 10.15% The average net profit margin is much lower than the industry average. Greater operating expenses are the main factor of this lower net profit.

12

Operating Profit Margin, industry average = 15.19% Operating Profit Margin, Unilever average = 14.87% The average operating profit margin is a bit lower than the industry average. Greater operating expenses are the main factor of this lower operating profit. Return on Total Asset, industry average = 11.23% Return on Total Asset, Unilever average = 11.1% The return on total assets of Unilever is very close to the industry average. The return on total assets shows an overall decrease from the period 2008 to 2010. The management should look after the matter before the return on total assets drops below the industry average. Return on equity, industry average = 26.57% Return on equity, Unilever average = 35.9% The average value for return on equity of the company is very high compared to the industry average. Earnings per share (EPS), industry average = $2.94 Earnings per share (EPS), Unilever average = $2.47 The companys average EPS is a bit lower than the industry average. This is a result of lower profitability of the company. P/E Ratio, industry average = 14.84 P/E Ratio, Unilever average = 13.4 The P/E ratio was highest in 2009 which means investors were ready to pay $16.16 for getting each dollar of the companys earnings. The P/E ratio declined in 2010 which indicates that the demand for the companys share declined. The P/E ratio represents the market confidence of a company. The average value of the P/E ratio is very close to the industry average which means that Unilever has enough market confidence.

13

M/B Ratio, industry average = 3.95 M/B Ratio, Unilever average = 4.7 The M/B ratio is a lot lower than the industry average and this is not favorable.

Common-Size Income Statement of Unilever

Dec 31, 2010 Dec 31, 2009 Dec 31, 2008 Turnover Cost of sales Gross profit Distribution and selling costs Research and development Restructuring Business disposals, impairments and other one-off items Gains on US healthcare and UK pensions Other Administrative expenses Operating profit Bank loans, overdrafts, bonds and other loans Dividends paid on preference shares Preference shares provision Net gain (loss) on derivatives for which hedge accounting is not applied Finance costs Finance income Pensions and similar obligations -1.08 -0.01 -0.01 - 1.11% 0.17 0.05 -1.20 -0.02 -0.05 -1.27% 0.19 -0.41 -1.24 -0.02 0.01 -1.25% 0.26 0.35 100.00 -52.09 47.91% -26.50 -2.10 -1.32 0.70 -4.37 -7.09% 14.32% 100.00 -51.68 48.32% -23.78 -2.24 - 2.25 0.07 -7.52 11.94% 12.61% 100.00 -52.67 47.33% -22.97 -2.29 -2.14 5.27 -7.52 -6.68% 17.69%

14

Net finance costs Share of net profit (loss) of joint ventures and associates Other income from non-current investments Profit before taxation Taxation Net profit from continuing operations Profit for the year from discontinued operations Net profit

-0.89% 0.25 0.17 13.85% -3.47 10.39% 10.39%

-1.49% 0.29 0.94 12.34% -3.16 9.19% 9.19% -0.73 8.46%

-0.63% 0.32 0.22 17.59% -4.55 13.04% 13.04% -0.64 12.41%

Net profit attributable to non-controlling interests -0.80 Net profit attributable to shareholders equity 9.59%

Common Size Income Statement Analysis

From the common size income statement presented above it can be seen that there was no significant change in the percentage of cost of goods sold and hence the gross profits. Administrative expenses were the highest in 2009 which resulted in a lower operating profit. This jump in the administrative expenses shows the inefficiency of the management in 2009. The operating profit was then brought back to track in 2010 which ultimately resulted in a higher net profit.

Du Pont Analysis of Unilever

ROE (%) Dec 31, 2010 Dec 31, 2009 Dec 31, 2008 29.30 27.93 50.53 = Tax Burden 0.73 0.73 0.73 Interest Burden 0.92 0.91 0.93 EBIT Margin (%) 14.14 12.81 18.19 Asset Turnover 1.08 1.08 1.12 Leverage 2.84 3.07

15

The return on equity also shows an overall decrease during the three years. The ratio 35.9% means that the company was able to make 35.9% net income against shareholders capital. The company should increase this ratio to become more efficient.

Dec 31, 2010 Dec 31, 2009 Dec 31, 2008

ROA (%) = 10.31 9.10 13.91

Tax Burden 0.73 0.73 0.73

Interest Burden 0.92 0.91 0.93

EBIT Margin (%) 14.14 12.81 18.19

Asset Turnover 1.08 1.08 1.12

The return on total assets shows an overall decrease from the period 2008 to 2010 which absolutely shows that the company is not properly utilizing its total assets and thats why its return decreased. The company should increase this ratio to become more efficient. This ratio reflects on the decrease in net profit margin and the operating profit margin.

Conclusion

The level of efficiency and the liquidity of Unilever are good enough but the profitability of the company is below the industry average. The ratio analysis reveals that higher operating expenses and higher cost of raw materials are the main causes of this lower profitability.

Suggestions to Unilever

The management should try to cut off some of the operating expenses in order to maximize net income and increase profitability of the business.

16

Time Series Analysis: Reckitt Benckiser

~

17

Liquidity Ratios Current Ratio Ratio 2008 0.46 Current ratio The current ratio of Reckitt Benckiser was okay. Generally a high current ratio is suggested for a company because the higher this ratio the more liquid the company is expected to be. Quick Ratio Ratio Quick ratio 2008 0.33 2009 0.44 2010 0.35 Avg 0.37 2009 0.61 2010 0.46 Avg 0.51

The quick was higher, 0.44, in 2009 and declined again to 0.35 in 2010. Quick ratio 1.00 is recommended and higher this ratio the more liquid the company is. A quick ratio provides a better measure of overall liquidity of the company. Gearing Ratios Debt Ratio Ratio Debt ratio 2008 0.64 2009 0.54 2010 0.73 Avg 0.64

In the year 2008 company has financed more than half of its assets with debt and so in the years 2009 and 2010. The lower this ratio means better the performance of the company. If this ratio is more than 1.00 then the company will have high default risk.

Time Interest Earned Ratio

18

Ratio

2008 18.06

2009 23.63

2010 11.96

Avg 17.88

Time interest earned ratio This ratio increased from 18.06 in 2008 to 23.63 in 2009. The ratio 17.88 indicates that company has 17.88 times EBIT to repay its interest. Generally the company should keep it higher so that it can easily pay its due interests. Activity Ratios Inventory Turnover Ratio Ratio 2008 4.81 Inventory Turnover ratio This ratio shows how many times company sold their inventories. Inventory turnover ratio 8.36 means Reckitt Benckiser sold its inventories 8.36 times in 2010. Inventory turnover ratio was acceptable during this period 2008-2010 but the higher this turnover the better companys performance. Avg. Collection Period Ratio Avg. Collection Period 2008 50days 2009 43days 2010 37days Avg 43 days 2009 6.35 2010 8.36 Avg 6.51

The average collection period was almost stagnant during this period although it was higher, 50days in 2008. The company should reduce this time because then it will have more cash available to run its business properly.

Avg. Payment Period Ratio 2008 2009 2010 Avg

19

Avg. Payment Period

33days

31days

29days

31days

The average payment period was not satisfactory because from 2008 to 2010 period its avg. payment time was lower than its avg. collection period. Total Asset Turnover Ratio Ratio 2008 1.32 Total asset turnover ratio The total asset turnover dropped significantly in the year 2010. The total asset turnover ratio 1.32 in 2008 showed that the company was able to make sales 1.32 times by using its total assts. This ratio also shows the efficiency of the company. So to increase the performance of Reckitt Benckiser so the company should increase this ratio. Profitability Ratios Gross Profit Margin Ratio Gross Profit Margin 2008 59.27% 2009 60.2% 2010 60.58% Avg 60.02% 2009 1.34 2010 1.21 Avg 1.29

The gross profit margin increased from year 2008 to the year 2010. This shows that companys gross profit increased during this period and hence the performance in terms of gross profit also increased. The company should increase this ratio further more.

Net Profit Margin Ratio 2008 2009 2010 Avg

20

16.34% Net profit Margin

18.29%

18.55%

17.73%

Net profit margin increased from 16.34% in 2008 to 18.55% in 2010 which means the performance of the company was improving during this period. Reduction in operating expenses could be a factor. The company should increase this ratio to become more efficient. Operating Profit Margin Ratio 2008 23.35% Operating Profit Margin Operating profit margin was highest 26.39% in 2010 and lowest 23.35% in 2008 but this margin was almost stagnant during this period. This shows that companys operating profit was good but to become more efficient the company should increase this margin. Return on Total Asset (ROA) Ratio Return on Total Asset 2008 12.20% 2009 16.37% 2010 11.75% Avg 13.44% 2009 24.56% 2010 26.39% Avg 24.77%

The return on total asset increased from year2008 to year 2009 which absolutely shows that the company is properly utilizing its total assets and thats why its return increased. But we can see that it decreased in 2010 by some percentage which is not good. The company should increase this ratio to become more efficient. Return on Equity (ROE) Ratio Return on equity 2008 24.01% 2009 25.62% 2010 22.09% Avg 23.91%

The return on equity increased from 24.01%in 2008 to 25.62% in 2009, although it declined slightly at 2010. The ratio 24.01% means that the company was able to make 24.01% net income against shareholders capital.

21

Earnings per Share (EPS) Ratio 2008 2009 $1.95 2010 $2.14 Avg $1.86

Earnings per $1.55 share (EPS)

The earnings per share increased in 2008 & 2010. The companys performance was best $ 2.14in 2010 Means Company made good net profit. Market Ratio P/E Ratio Ratio P/E Ratio 2008 $16.51 2009 $16.29 2010 $17.84 Avg $16.88

The P/E ratio was highest $ 17.84 in 2010 means investors were ready to pay $ 17.84 for getting each dollar of the companys earnings. This P/E ratio declined in 2009 which means that investors demand for the companys share declined than increased again at 2010. This can be because of not being efficient during these years. M/B Ratio Ratio M/B Ratio 2008 2.33 2009 3.41 2010 5.42 Avg 3.72

The M/B ratio grew significantly from 2008 to 2010 which indicates that the value of the company in the market has taken an upward trend.

Industry Average Vs e Reckitt Benckiser Average

Current ratio, industry average = 0.752

22

Current ratio, Reckitt Benckiser average = 0.51 Reckitt Benckiser Groups average current ratio, 0.51, is less than the industry average which is not that favorable because, generally, the higher the current ratio, the more liquid the firm is considered to be. Quick ratio, industry average = 0.40 Quick ratio, Reckitt Benckiser average = 0.37 The average quick ratio is 0.37 for the Reckitt Benckiser Group which is almost close to the industry average of 0.40. Here, also the higher the ratio, and the better it is for the company in terms of liquidity. Debt ratio, industry average = 0.68 Debt ratio, Reckitt Benckiser average = 0.64 Average debt ratio for this company with 0.64 is also almost close to the industry average. I can say that its actually better than the industry average because this company has used less money financed by other people to generate its profit than the industry average. Times interest earned ratio, industry average = 15.39 times Times interest earned ratio, Reckitt Benckiser average = 17.88 times In terms of times interest earned ratio, Reckitt Benckiser Groups also doing better in comparison with the industry average. The company has an average times interest earned ratio of 17.88 and the industry average is 15.39. The ratio 17.88 indicates that company has 17.88 times EBIT to repay its interest. Generally the company should keep it higher so that it can easily pay its due interests. Inventory turnover ratio, industry average = 9.46 times Inventory turnover ratio, Reckitt Benckiser average = 6.51 times

23

The average inventory turnover ratio of this company with 6.51 is lower than the industry average which is not a good indicator of performance in this aspect for this company because the higher this turnover the better companys performance. Avg. Collection Period, industry average = 30.77 days Avg. Collection Period, Reckitt Benckiser average = 43 days The average collection period, or average age of accounts receivable, is useful in evaluating credit and collection policies. The average collection period for the company is 43 days whereas the average collection period for the industry average is 30.77 days which is not favorable for the company in comparison with the industry average. Generally its good to get your payment back as soon as you can. So I think the company should set a standard to get back the receivable as soon as possible so that they can invest the money in other fields to generate profit. Avg. Payment Period, industry average = 33.77 days Avg. Payment Period, Reckitt Benckiser average = 31 days The average payment period is almost close to the industry average for this company. Its 31 days for this company and the industry average is 33.77 days. Generally, the more time you take to get back the payment, the more you can use the money to generate revenue or profit. Total asset turnover ratio, industry average = 0.98 times Total asset turnover ratio, Reckitt Benckiser average = 1.29 times The average total asset turnover ratio for this company with 1.29times is better than the industry average with 0.98times because the higher a firms total asset turnover, the more efficiently its assets have been used. Gross Profit Margin, industry average = 53.5% Gross Profit Margin, Reckitt Benckiser average = 60.02%

24

The average gross profit margin for this company with 60.02% is also higher than the industry average with 53.05% which shows that the companys performance is better (that is, the lower the relative cost of merchandise sold). Operating Profit Margin, industry average = 15.19% Operating Profit Margin, Reckitt Benckiser average = 17.73% The operating profit margin measures the percentage of each sales dollar remaining after all costs and expenses other than interest, taxes, and preferred stock dividends are deducted. It represents the pure profits earned on each sales dollar. This companys operating profit margin is 24.77% which is better than the industry average. Net profit Margin, industry average = 14.63% Net profit Margin, Reckitt Benckiser average = 27.77% This companys net profit margin with 17.73% is better than the industry average. Return on Total Asset, industry average = 11.23% Return on Total Asset, Reckitt Benckiser average = 13.44% Here, the return on total asset is 13.44% which is higher than the industry average and it is good for the company to have a higher percentage of it because it measures the overall effectiveness of management in generating profits with its available assets. Return on equity, industry average = 26.57% Return on equity, Reckitt Benckiser average = 23.91% Here, the return on equity is 23.91% which is close to the industry average but still a little lower than the industry average. Generally the higher these returns the better off are the owners. Earnings per share (EPS), industry average = $2.94 Earnings per share (EPS), Reckitt Benckiser average = $1.86

25

Here, it is $1.86 for this company. The companys average EPS is a bit lower than the industry average. This is a result of lower profitability of the company P/E Ratio, industry average = $14.84 P/E Ratio, Reckitt Benckiser average = $16.88 The P/E ratio was highest 17.84 in 2010 means investors were ready to pay $ 17.84 for getting each dollar of the companys earnings. This P/E ratio declined in 2009 which means that investors demand for the companys share declined than increased again at 2010. The P/E ratio is higher with 16.88 for this company in comparison with the industry average which shows that company got enough market confidence. M/B Ratio, industry average = 3.95 M/B Ratio, Reckitt Benckiser average = 21.19 The company got 3.72 which is favorable.

Reckitt Benckiser Group Common Size income Statement

Dec31,2010 Dec31,2009

Total Revenue Cost of Revenue, Total Gross Profit Selling/General/Administrative Expenses, Total Research & Development Depreciation/Amortization Interest Expense (Income), Net Operating Unusual Expense (Income) Other Operating Expenses, Total Operating Income Interest Income (Expense), Net Non-Operating Gain (Loss) on Sale of Assets Other, Net

Dec31,2008

100 39.41 60.59 32.75 1.42 0.47 0.0 1.19 -0.45 25.21 0.0 0.0 0.0 100 39.84 60.16 33.88 1.57 0.37 0.0 0.17 -0.23 24.40 0.0 0.0 0.0 100 40.73 59.27 34.19 1.60 0.41 0.0 0.49 -0.35 22.93 0.0 0.0 0.0

26

Income Before Tax Income Tax - Total Income After Tax Minority Interest Equity In Affiliates U.S. GAAP Adjustment Net Income Before Extra. Items Total Extraordinary Items Net Income

25.21 6.70 18.51 -0.02 0.0 0.0 18.49 0.0 18.49

24.40 6.11 18.29 0.0 0.0 0.0 18.29 0.0 18.29

22.93 5.39 17.54 0.0 0.0 0.0 17.54 0.0 17.54

Common Size Income Statement Analysis

Income statement of any company provides a financial summary of the firms operating results during a specified period. Here, we can see the Common Size Income Statement of Reckitt Benckiser Group for the year ended December 31, 2010, 2009, and 2008. The companys gross profit also increased from year 2008 to year 2010 which indicates that the company was doing better overtime. After deducting all the general/ administrative expenses the company got its operating income which also increased from year 2008 to year 2010 $2130 million. Here, the income before tax is higher as well over time from year 2008 to year 2010. The net income for the company for the company has increased from year 2008 to year 2010 which indicates that the company has generated higher income overtime and its overall performance has improved.

Du Pont Analysis

Return on Total Asset (ROA) Ratio Return on Total Asset 2008 12.20% 2009 16.37% 2010 11.75% Avg 13.44%

The return on total asset increased from year2008 to year 2009 which absolutely shows that the company is properly utilizing its total assets and thats why its return increased. But we can see

27

that it decreased in 2010 by some percentage which is not good. The company should increase this ratio to become more efficient. Return on Equity (ROE) Ratio Return on equity 2008 24.01% 2009 25.62% 2010 22.09% Avg 23.91%

The return on equity increased from 24.01%in 2008 to 25.62% in 2009, although it declined slightly at 2010. The ratio 24.01% means that the company was able to make 24.01% net income against shareholders capital.

Conclusion

Liquidity position of the company is not so strong. EPS is lower than the industry average

Suggestions to Reckitt Benckiser

They should increase their current and quick ratio because its lower than the industry average and liquidity of assets matters a lot for any company. The EPS should be increased because it is less than the industry average and its showing lower profitability for the organization.

28

29

Time Series Analysis: Proctor & Gamble

Liquidity Ratios Current Ratio Ratio Current ratio 2008 0.77 2009 0.79 2010 0.71 Avg 0.75

The current ratio of Proctor and Gamble was almost stagnant over the years 2008 to 2010. Generally a high current ratio is suggested for a company because the higher this ratio the more liquid the company is expected to be. Quick Ratio Ratio Quick ratio 2008 0.34 2009 0.33 2010 0.34 Avg 0.33

The quick ratio was almost stable trough out the three-year period. Quick ratio 1.00 is recommended, the higher this ratio the more liquid the company is. A quick ratio provides a better measure of overall liquidity of the company. Gearing Ratios Debt Ratio Ratio Debt ratio 2008 0.53 2009 0.59 2010 0.49 Avg 0.53

Debt ratio was almost stagnant during the period 2008-2009 but it dropped significantly in 2010. Debt ratio 0.49 means 49% of total asset is financed by loan and 51% is financed by shareholders equity. The lower this ratio means better the performance of the company. If this ratio is more than 1.00 then the company will have high default risk.

30

Time Interest Earned Ratio Ratio 2008 18.8 Time interest earned ratio This ratio continued to decrease from 18.8 in 2008 to 11.96 in 2010. The ratio 14.90 indicates that company has 14.90 times EBIT to repay its interest. Generally the company should keep it higher so that it can easily pay its due interests. Activity Ratios Inventory Turnover Ratio Ratio 2008 9.92 Inventory Turnover ratio This ratio shows how many times company sold their inventories. Inventory turnover ratio 1236 means P & G sold its inventories 12.36 times in 2010. Inventory turnover ratio was acceptable during the period 2008-2010 but the higher this turnover the better companys performance. Avg. Collection Period Ratio Avg. Collection Period 2008 30days 2009 27days 2010 25days Avg 27 days 2009 11.49 2010 12.36 Avg 11.25 2009 13.96 2010 11.96 Avg 14.90

The average collection period was almost stagnant during this period although it was higher, 30days, in 2008. The company should reduce this time because then it will have more cash available to run its business properly.

31

Avg. Payment Period Ratio Avg. Payment Period 2008 30days 2009 28days 2010 34days Avg 30 days

The average payment period was satisfactory because from 2009 to 2010 period its average payment time was higher than its average collection period. In 2008 its avg. payment period was 30days than its avg. collection period 30days which is not expected not to be in this this way. Total Asset Turnover Ratio Ratio 2008 0.58 Total asset turnover ratio The total asset turnover ratio was almost unchanged during this period. The total asset turnover ratio 0.58 in 2008 showed that the company was able to make sales 0.58 times by using its total assts. This ratio also shows the efficiency of the company. So to increase the performance of P&G so the company should increase this ratio. Profitability Ratios Gross Profit Margin Ratio Gross Profit Margin 2008 51.27 2009 50.78 2010 51.76 Avg 51.27 2009 0.59 2010 0.52 Avg 0.56

The gross profit margin declined to 50.27% in 2009, although in 2010 it was 51.78%. This shows that companys gross profit increased during this period and hence the performance in terms of gross profit also increased. This might be a result of cheaper raw materials. The company should increase this ratio further more

32

Net Profit Margin Ratio Net profit Margin 2008 14.87% 2009 17.5% 2010 16.13% Avg 16%

Net profit margin increased from 175% in 2009 which means the performance of the company was improving during this period. The company should increase this ratio to become more efficient because at 2010 it declined. Overall the profitability of the company increased throughout this three-year period which shows improved efficiency of the management. Operating Profit Margin Ratio 2008 5.70% Operating Profit Margin Operating profit margin was highest 6.60% in 2010 and lowest 5.5% in 2009 and it shows an overall increase during this period. This shows that companys operating profit was good but to become more efficient the company should increase this margin. Return on Total Asset (ROA) Ratio Return on Total Asset 2008 8.80% 2009 9.50% 2010 9.20% Avg 9.16% 2009 5.50% 2010 6.60% Avg 5.93%

The return on total asset increased from 9.50% in 2009 which absolutely shows that the company is properly utilizing its total assets and thats why its return increased. The company should increase this ratio to become more efficient.

33

Return on Equity (ROE) Ratio Return on equity 2008 17.38% 2009 21.70% 2010 20.90% Avg 19.9%

The return on equity increased from 17.38% in 2008 to 21.70% in 2009 although it declined slightly at 2010. The ratio 20.90% means that the company was able to make 20.90 % net income against shareholders capital. The company should increase this ratio to become further more efficient. Earnings per Share (EPS) Ratio Earnings per share 2008 $4.49 2009 $4.46 2010 $4.49 Avg $4.49

The earnings per share increased in 2008 & 2010. The companys performance was best $ 4.49 in 2010 means company made good net profit. Market Ratio P/E Ratio Ratio P/E Ratio 2008 $17.61 2009 $11.24 2010 $13.86 Avg $14.23

The P/E ratio was highest $ 17.61 in 2008 means investors were ready to pay $ 17.61 for getting each dollar of the companys earnings. This P/E ratio declined in 2009 which means that investors demand for the companys share declined than increased again at 2010. This can be because of not being efficient during these years.

34

M/B Ratio Ratio M/B Ratio 2008 3.54 2009 3.12 2010 3.67 Avg 3.44

The M/B ratio was almost stagnant in 2008, 2009 and 2010.

Industry Average Vs Proctor & Gamble Average

Current ratio, industry average = 0.752 Current ratio =0.75 The average current ratio of Unilever is 0.75 which is equal to the industry average which means that the company has maintained an excellent liquidity position. Quick ratio, industry average = 0.40 Quick ratio, P&G Average = 0.33 The Quick ratio is less than current ratios which mean that a portion of the current assets was occupied by inventories. The average quick ratio of Unilever is below the industry average which means company performed worse than industry. Debt ratio, industry average = 0.68 Debt ratio, P&G average = 0.53 The Debt ratio is the quite close and below than the industry average which reflects that company worked well on debt management than industry. Times interest earned ratio, industry average = 15.39 Times interest earned ratio, P&G average = 14.90

35

This ratio is more than the industry average so we can say company has done well in that sector than industry. So the company can easily pay its due interests. Inventory turnover ratio, industry average = 9.46 times Inventory turnover ratio, P&G average = 11.25 times Inventory turnover ratio was acceptable during the period 2008-2010. The company average for this ratio is 11.25 times. The higher the inventory turnover ratio the better companys performance and the more efficient the company is and the company average is greater than industry average so its indicating about companys good performance. Avg. Collection Period, industry average = 30.77 days Avg. Collection Period, P&G average = 27 days The companys average collection period is 27 days. The lower this ratio the more liquid the company is and the company average is below than industry average which means company has done better than industry. Avg. Payment Period, industry average = 33.77 days Avg. Payment Period, P&G average = 30 days The average payment period was satisfactory for the period 2009 to 2010 its average payment period was higher than its average collection period. The company average is lower than the industry average and that is proof of companys efficiency. Total asset turnover ratio, industry average = 0.98 times Total asset turnover ratio, P&G average = 0.56 times This ratio is below than the industry average. This indicates that the company is not utilizing its assets very efficiently compare to other company of industry. Gross Profit Margin, industry average = 53.5% Gross Profit Margin, P&G average = 51.27%

36

The average gross profit margin is lower than the industry average. It means company is doing worse than its competitor. Higher cost of raw materials may be the reason behind this. Net profit Margin, industry average = 14.63% Net profit Margin, P&G average = 16% The average net profit margin is much higher than the industry average. This means company has deal with this area more efficiently than industry Operating Profit Margin, industry average = 15.19% Operating Profit Margin, P&G average = 5.93% The average operating profit margin is much lower than the industry average, means the company is very less efficient in this area than competitor. Greater operating expenses are the main factor of this lower operating profit. Return on Total Asset, industry average = 11.23% Return on Total Asset, P&G average = 9.16% The return on total assets of P&G is much lower than the industry average which means they are less efficient in roa than industry. The return on total assets shows an overall decrease from the period 2008 to 2010. The management should look after the matter before the return on total assets drops below the industry average. Return on equity, industry average = 26.57% Return on equity, P&G average = 19.9% The average value for return on equity of the company is very low compared to the industry average means they are not efficiently using their equity compare to industry. Earnings per share (EPS), industry average = $2.94 Earnings per share (EPS), P&G average = $4.49

37

The companys average EPS is higher even double than the industry average. This is a result of higher profitability of the company compare to other company in the industry. P/E Ratio, industry average = 14.84 P/E Ratio, P&G average = 14.23 The P/E ratio was highest in 2009 which means investors were ready to pay $16.16 for getting each dollar of the companys earnings. The P/E ratio declined in 2010 which indicates that the demand for the companys share declined. The P/E ratio represents the market confidence of a company. The average value of the P/E ratio is very close to the industry average which means that P&G has enough market confidence. M/B Ratio, industry average = 3.95 M/B Ratio, P&G average = 3.44 The M/B ratio is close to the industry average and this is very good for company because it indicate the company has created a good market value of their share than their competitor.

Procter & Gamble Co. Common Size Income Statement for the12 months ended

Jun 30, 2010 Jun 30, 2009 Net sales Cost of products sold Gross profit Selling, general and administrative expense Operating income (loss) Interest expense Other non-operating income (expense), net Earnings from continuing operations before income taxes 100.00 -48.04 51.96% -31.67 20.30% - 1.20 -0.04 19.06% 100.00 -49.22 50.78% -30.38 20.40% -1.72 0.71 19.39% Jun 30, 2008 100.00 -48.73 51.27% -30.81 20.46% -1.76 0.55 19.25%

38

Income taxes on continuing operations Net earnings from continuing operations Net earnings from discontinued operations Net earnings

-5.20 13.87% 2.27 16.13%

-5.10 14.29% 2.71 17.00%

-4.79 14.46% 1 4.46%

Common Size Income Statement Analysis

Here, we can see the income statement of P&G Group for the year ended December 31, 2010, 2009, and 2008. The companys gross profit also decreased during the year 2009 due to greater percentage of cost of goods sold. After deducting all the general/ administrative expenses the company got its operating income which also decreased during the year 2009 and it was almost same at 2010. The net income for the company for the company has increased from year 2008 to year 2009 which indicates improved profitability of the company but it again decreased. So the companys overall performance is not good.

DU-PONT Analysis of P&G

ROE TABLE

Year ROE= Tax Burdon *Interest Burdon 2008 2009 2010 17.38 21.29 20.83 0.75 0.77 0.76 .92 .93 .95 *EBIT Margin 21.58 23.09 22.87 *Asset Turnover .58 .59 .62 2.07 2.14 2.10 *Leverage

39

The return on equity increased from 17.38% to 21.70% in 2009 although it declined slightly at 2010. The ratio 20.90% means that the company was able to make 20.90 % net income against shareholders capital. The company should increase this ratio to become further more efficient

ROA TABLE

Year ROA= Tax Burdon *Interest Burdon 2008 2009 2010 8.39 9.96 8.39 0.75 0.77 0.76 .92 .93 .95 *EBIT Margin 21.58 23.09 22.87 *Asset Turnover .58 .59 .62

The return on total asset increased from 9.50% in 2009 which absolutely shows that the company is properly utilizing its total assets and thats why its return increased. The company should increase this ratio to become more efficient.

Conclusion

The level of efficiency and the liquidity of P&G are not well compare to whole industry but company has done well in some area than industry. The ratio analysis reveals that company has done very badly on ROA, ROE and other activity ratio compare to industry which has been lowering the companys overall performance.

Suggestions to P&G

The company should try to improve its ROA, ROE and other activity ratios.

Learnings

After completing this project we have learnt how to analyze different ratios and give predictions

40

on the basis of the ratios calculated. We have also learnt how to relate ratios with one another and arrive at a conclusion.

Industry average values

Current ratio.. 0.752 Quick ratio. 0.40 Debt ratio... 0.68 Times interest earned ratio 15.39 times Inventory turnover ratio... 9.46 times Avg. Collection Period.. 30.77 days Avg. Payment Period..... 33.77 days Total asset turnover ratio... 0.98 times Gross Profit Margin... 53.05% Net profit Margin.. 14.63% Operating Profit Margin 15.19% Return on Total Asset 11.23% Return on equity. 26.57% Earnings per share (EPS)... $2.94 P/E Ratio... 14.84 M/B Ratio. 3.95

41

42

You might also like

- Financial Analysis of Unilever PakistanDocument7 pagesFinancial Analysis of Unilever Pakistanzainab malikNo ratings yet

- Ratio AnalysisDocument46 pagesRatio AnalysisshariquetharaniNo ratings yet

- Financial Analysis of Unilever: Created by Pei Yin, MA Ling YinDocument7 pagesFinancial Analysis of Unilever: Created by Pei Yin, MA Ling YinAditi BhiteNo ratings yet

- Unilever Strategic ReportDocument60 pagesUnilever Strategic Reportwasi_ali100% (1)

- Supporting Growth Through Innovation Network in UnileverDocument21 pagesSupporting Growth Through Innovation Network in Unileversuongxuongnui0% (1)

- Unilever TodayDocument34 pagesUnilever TodayEmee Haque50% (2)

- Jatiya Kabi Kazi Nazrul Islam University: Trishal, MymensinghDocument15 pagesJatiya Kabi Kazi Nazrul Islam University: Trishal, Mymensinghhasan mahmudNo ratings yet

- Unilever 5ps WRKSHPDocument9 pagesUnilever 5ps WRKSHPAbhimita GaineNo ratings yet

- Introduction To Financial ManagementDocument31 pagesIntroduction To Financial ManagementzewdieNo ratings yet

- Brand EquityDocument7 pagesBrand Equitypawanshrestha1No ratings yet

- University of Central Punjab Gujranwala: Techniques of TQM in Unilever Submitted FromDocument11 pagesUniversity of Central Punjab Gujranwala: Techniques of TQM in Unilever Submitted FromNimra MughalNo ratings yet

- Project On UnileverDocument27 pagesProject On Unileverirfan103158100% (1)

- V1 UnileverDocument16 pagesV1 Unileversakshi tandonNo ratings yet

- Unilever's Organizational Culture of PerformanceDocument11 pagesUnilever's Organizational Culture of PerformanceHa Nguyen100% (1)

- Unilever's Global Reach and Sustainable Living PlanDocument10 pagesUnilever's Global Reach and Sustainable Living PlanAbhinav Chauhan50% (2)

- Structural Analysis of Telecommunication and Tele Services IndustryDocument6 pagesStructural Analysis of Telecommunication and Tele Services IndustryVigneshwarNo ratings yet

- Cost of Capital of UK CompaniesDocument8 pagesCost of Capital of UK CompaniesSonia AgarwalNo ratings yet

- MasterThesis UniliverDocument76 pagesMasterThesis UniliverVita SonyaNo ratings yet

- Strategic ManagementDocument39 pagesStrategic ManagementNguyen Hanh ChiNo ratings yet

- Assignment Case of Unilever 2020 SustainabilityDocument4 pagesAssignment Case of Unilever 2020 Sustainabilitysardar hussainNo ratings yet

- Unilever & P&G Case Study AnalysisDocument61 pagesUnilever & P&G Case Study AnalysisMuneeza Akhtar Muneeza Akhtar100% (2)

- VRIO Analysis of Unilever and P GDocument8 pagesVRIO Analysis of Unilever and P GJackson KasakuNo ratings yet

- 2.changing Challenges For The Operations - Engineering Managers-1Document34 pages2.changing Challenges For The Operations - Engineering Managers-1b00199916No ratings yet

- Unilever PresentationDocument16 pagesUnilever PresentationTaha SiddiquiNo ratings yet

- Apple Harvesting in IndiaDocument38 pagesApple Harvesting in Indiaphani_mtpNo ratings yet

- Financial Statement Analysis UnileverDocument19 pagesFinancial Statement Analysis UnileverGelay MagatNo ratings yet

- Unilever Case StudyDocument4 pagesUnilever Case StudyKyron JacquesNo ratings yet

- Dhanu UniliverDocument8 pagesDhanu Uniliverdhanu26101990No ratings yet

- Unilever DraftDocument16 pagesUnilever DraftAyush GowriahNo ratings yet

- Unilever and The CarrollDocument4 pagesUnilever and The Carrollrida100% (1)

- AppleDocument21 pagesAppleFun Toosh345No ratings yet

- Unilever Digital Success Story: Integrating Media For Strong BrandsDocument4 pagesUnilever Digital Success Story: Integrating Media For Strong BrandsNana NguyễnNo ratings yet

- Unilever's Five Forces Analysis Shows Competition and Consumers Most Impact BusinessDocument7 pagesUnilever's Five Forces Analysis Shows Competition and Consumers Most Impact BusinessZaidNo ratings yet

- Inventory Management in Supply ChainDocument11 pagesInventory Management in Supply Chainparadise AngelNo ratings yet

- Marketing Management - EditedDocument18 pagesMarketing Management - EditedCrystal D'SouzaNo ratings yet

- Toyota Marketing EnvironmentDocument3 pagesToyota Marketing Environmentmohammedakbar88No ratings yet

- HUL Financial Analysis Reveals Decreasing Liquidity RatiosDocument19 pagesHUL Financial Analysis Reveals Decreasing Liquidity Ratiosspantdur100% (1)

- Marketing Management Course Project on Unilever's BCG MatrixDocument19 pagesMarketing Management Course Project on Unilever's BCG MatrixBatool AbbasNo ratings yet

- Case StudyDocument6 pagesCase StudyJahidul KarimNo ratings yet

- Unilever Pakistan LimitedDocument126 pagesUnilever Pakistan LimitedXohaib UQNo ratings yet

- Assignment On UnileverDocument24 pagesAssignment On Unileverihkibria50% (8)

- Unilever BDDocument27 pagesUnilever BDShawon Islam0% (1)

- A Financial Ratio Analysis of Hindustan Unilever Limited (HUL)Document5 pagesA Financial Ratio Analysis of Hindustan Unilever Limited (HUL)Santosh KumarNo ratings yet

- Corporate Social Responsibility of TESCODocument22 pagesCorporate Social Responsibility of TESCOPanigrahi AbhaNo ratings yet

- Business Strategy: Assignment of HND (Higher National Diploma)Document21 pagesBusiness Strategy: Assignment of HND (Higher National Diploma)HanyNo ratings yet

- Strategy Indira.1Document20 pagesStrategy Indira.1Praveen MishraNo ratings yet

- Unilever's Sustainability Strategies and Organizational StructureDocument4 pagesUnilever's Sustainability Strategies and Organizational StructureParvin AkterNo ratings yet

- Assignment On Toyota1Document4 pagesAssignment On Toyota1Sirsha PattanayakNo ratings yet

- Ebay Inc.Document14 pagesEbay Inc.asmshihabNo ratings yet

- Accounts Receivables ManagementDocument7 pagesAccounts Receivables ManagementDipanjan DasNo ratings yet

- Portfolio AnalysisDocument19 pagesPortfolio Analysiss100% (3)

- Inside Unilever - The Evolving Transnational CompanyDocument22 pagesInside Unilever - The Evolving Transnational CompanybenjameNo ratings yet

- Unilever (Strategy & Policy)Document10 pagesUnilever (Strategy & Policy)Joshua BerkNo ratings yet

- Woolworth Analysis by Saurav GautamDocument15 pagesWoolworth Analysis by Saurav Gautamsaurav gautamNo ratings yet

- Associated British FoodsDocument16 pagesAssociated British FoodsMohd Shahbaz Husain100% (1)

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- Global Corporate Entrepreneurship: Perspectives, Practices, Principles, and PoliciesFrom EverandGlobal Corporate Entrepreneurship: Perspectives, Practices, Principles, and PoliciesNo ratings yet

- Chapter 05Document31 pagesChapter 05Muntasir SizanNo ratings yet

- Chapter 04Document41 pagesChapter 04Muntasir SizanNo ratings yet

- Financial Statements & AnalysisDocument14 pagesFinancial Statements & AnalysisMuntasir SizanNo ratings yet

- Brand Article by RafiDocument27 pagesBrand Article by RafiFahim RizwanNo ratings yet

- UND Wellness Center Mission Promotes Health and EnrichmentDocument6 pagesUND Wellness Center Mission Promotes Health and EnrichmentMuntasir SizanNo ratings yet

- The Role & Environment of Managerial FinanceDocument25 pagesThe Role & Environment of Managerial FinanceMuntasir SizanNo ratings yet

- Brand Article by RafiDocument27 pagesBrand Article by RafiFahim RizwanNo ratings yet

- Brand Article by RafiDocument27 pagesBrand Article by RafiFahim RizwanNo ratings yet

- THE ENTERPRISE RESOURCE Planning (ERP)Document9 pagesTHE ENTERPRISE RESOURCE Planning (ERP)Muntasir SizanNo ratings yet

- Budgeting of A CompanyDocument10 pagesBudgeting of A CompanyMuntasir SizanNo ratings yet

- Praxis Business School: Assignment OnDocument29 pagesPraxis Business School: Assignment OnArihantNo ratings yet

- Factor Endowments and Distribution of Industrial Production Across The WorldDocument38 pagesFactor Endowments and Distribution of Industrial Production Across The WorldMuntasir SizanNo ratings yet

- Ad AppealsDocument9 pagesAd AppealsSree Ganga GNo ratings yet

- Q 2what Is A Responsibility Centre? List and Explain Different Types of Responsibility Centers With Sketches. Responsibility CentersDocument3 pagesQ 2what Is A Responsibility Centre? List and Explain Different Types of Responsibility Centers With Sketches. Responsibility Centersmadhura_454No ratings yet

- Sales Report: Sweet Bliss CompanyDocument6 pagesSales Report: Sweet Bliss CompanyDonna Julian ReyesNo ratings yet

- Protect Against Rising Rates With CapsDocument13 pagesProtect Against Rising Rates With Capsz_k_j_vNo ratings yet

- Transparency & Accountability in AaaDocument13 pagesTransparency & Accountability in AaaCordy IkeanyiNo ratings yet

- Dealership Application FormDocument3 pagesDealership Application Formudhayakumar uNo ratings yet

- Property Investment Tips Ebook - RWinvest PDFDocument40 pagesProperty Investment Tips Ebook - RWinvest PDFddr95827No ratings yet

- Partnership - I: "Your Online Partner To Get Your Title"Document10 pagesPartnership - I: "Your Online Partner To Get Your Title"Arlene Diane OrozcoNo ratings yet

- Total Item Description Unit PriceDocument3 pagesTotal Item Description Unit PriceMartin Kyuks100% (2)

- Valuation of SharesDocument11 pagesValuation of Shareslekha1997No ratings yet

- Journalizing TransactionsDocument19 pagesJournalizing TransactionsChristine Paola D. LorenzoNo ratings yet

- 2.2 - Sample 2 - BOT Contract (Coal-Fired Plant)Document116 pages2.2 - Sample 2 - BOT Contract (Coal-Fired Plant)Maha8888No ratings yet

- Projected Demand Sales: TotalDocument20 pagesProjected Demand Sales: Total버니 모지코No ratings yet

- Amicorp Trustees Presentation 2013Document26 pagesAmicorp Trustees Presentation 2013Rohan GhallaNo ratings yet

- Statement 20140508Document2 pagesStatement 20140508franraizerNo ratings yet

- CFO VP Finance Project Controls Engineer in Morristown NJ Resume Matthew GentileDocument2 pagesCFO VP Finance Project Controls Engineer in Morristown NJ Resume Matthew GentileMatthewGentileNo ratings yet

- Forbes 12 Best Stocks To Buy For 2024Document29 pagesForbes 12 Best Stocks To Buy For 2024amosph777No ratings yet

- Income TaxDocument7 pagesIncome Tax20BCC64 Aruni JoneNo ratings yet

- Report On Ocean ParkDocument6 pagesReport On Ocean ParkSalamat Ali100% (1)

- Funding Early Stage Ventures Course #45-884 E Mini 4 - Spring 2011 Wednesdays, 6:30 - 9:20 P.M. Room 152 Instructor: Frank Demmler Course DescriptionDocument10 pagesFunding Early Stage Ventures Course #45-884 E Mini 4 - Spring 2011 Wednesdays, 6:30 - 9:20 P.M. Room 152 Instructor: Frank Demmler Course DescriptionBoboy AzanilNo ratings yet

- IB Tutorial 7 Q1Document2 pagesIB Tutorial 7 Q1Kahseng WooNo ratings yet

- Investment Principles and Checklists OrdwayDocument149 pagesInvestment Principles and Checklists Ordwayevolve_us100% (2)

- RMIT FR Week 3 Solutions PDFDocument115 pagesRMIT FR Week 3 Solutions PDFKiabu ParindaliNo ratings yet

- Keith Weiner The Swiss Franc Will CollapseDocument16 pagesKeith Weiner The Swiss Franc Will CollapseTREND_7425No ratings yet

- Solidbank VS Permanent Homes, Inc. 625 SCRA 275Document16 pagesSolidbank VS Permanent Homes, Inc. 625 SCRA 275June DoriftoNo ratings yet

- Credit Management - Config and UserguideDocument34 pagesCredit Management - Config and UserguideAmit NandaNo ratings yet

- Ali Inam S/O Inam Ullah 50-F-2-Johar Town LHR: Web Generated BillDocument1 pageAli Inam S/O Inam Ullah 50-F-2-Johar Town LHR: Web Generated BillMuhammad Irfan ButtNo ratings yet

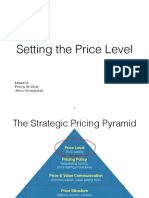

- Lesson 6 - Price LevelDocument17 pagesLesson 6 - Price LevelMuktesh SinghNo ratings yet

- Chapter 7 Slides FIN 435Document18 pagesChapter 7 Slides FIN 435Wasim HassanNo ratings yet

- Analysis of The Impact of Foreign Direct Investment On The Indian EconomyDocument212 pagesAnalysis of The Impact of Foreign Direct Investment On The Indian EconomylovejotsinghcbsNo ratings yet

- Car Loan Application FormDocument6 pagesCar Loan Application FormSuhail AhmedNo ratings yet