Professional Documents

Culture Documents

Portfolio Reviews: Monitor For Risk, Catalyst For Action

Uploaded by

Andrew ArmstrongOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Portfolio Reviews: Monitor For Risk, Catalyst For Action

Uploaded by

Andrew ArmstrongCopyright:

Available Formats

TRANSUNION WHITE PAPER TRANSUNION WHITE PAPER

Portfolio Reviews: Portfolio Reviews: Monitor for Risk, Catalyst for Action Monitor for Risk, Catalyst for Action

By Ezra D. Becker, Director, Consulting and Strategy, Financial Services Group By Ezra D. Becker, Vice President, Research and Consulting, Financial Services

1 2

Introduction Use a Portfolio Review to Quantify Risk in Your Portfolio

Use Serial Portfolio Reviews to Monitor Risk Trends

Use Portfolio Reviews for Valuation

A portfolio is simply the aggregate sum of the individual debt instruments it contains accounts, loans, credit cards, lines of credit or other instruments. As individual accountholders move through different life events, the creditworthiness and risk level of their accounts constantly change. And, because the level of risk contained in your debt portfolio is a function of the risk presented by these individual accounts, your portfolio constantly fluctuates too. Your portfolios performance, including both profitability and loss rates, directly correlates with how well you identify, anticipate and manage these fluctuations in individual risk. Clearly, the ability to understand and manage risk fluctuations is an essential part of any effective credit risk management strategy. One of the best ways to do this is by conducting regular portfolio reviews, which can provide both point-in-time and longitudinal statistics. This information gives you the ability to assess both overall portfolio risk and individual account-level risk, making it a key foundation for developing effective business rules and organizational strategies. This paper explains four ways in which your business may benefit from the use of portfolio reviews: Better risk quantification Improved trend monitoring More precise portfolio valuations Enhanced account management

Use Portfolio Reviews for Individual Account Management

Conclusion

Portfolio Reviews: Monitor for Risk, Catalyst for Action

Use a Portfolio Review to Quantify Risk in Your Portfolio

A portfolio review can quickly and objectively quantify the level of risk contained in your portfolio at any given time. It provides insight into your current balance of high-risk accounts against those that are low-risk.

Based on this empirical data, you can better determine how a portfolios risk profile fits your business rules and risk appetite, including organizational objectives, board directives and investor expectations. Quantitative knowledge of your portfolio is a vital component in satisfying examination and regulatory demands. Empirical results provide examiners with an objective foundation against which your account management strategies can be compared and validated. As such, an empirical, verifiable knowledge of your portfolios risk profile is integral to a comprehensive safety and soundness review. For example, in completing a soundness opinion, it is necessary to attest to the sufficiency of your reserves to compensate for uncollectible accounts. Simply measuring the raw numbers of accounts that are 30, 60 or 90 days past due has limited predictive ability. It doesnt tell you the likelihood that any sub-segment of accounts will further degrade or improve. It offers no insight into what estimated proportion of accounts can be rehabilitated and which have the potential to be sold or

FIGURE 1

An Understanding of Risk Distribution is Critical to Managing Your Portfolio

JANUARY 2011

Primary Profitability Zone

55 0

75 0

40

60

85

35

65

45

CREDIT RISK SCORE RANGE

This portfolio distribution is in line with management goals.

outsourced for collection. In contrast, by conducting a portfolio review you can quantify the probability of different account behaviors, thereby getting more statistically valid insight into these issues. With this insight, you can make more well-informed decisions about any further action you might need to initiate to control risk in your portfolio.

2011 TransUnion LLC All Rights Reserved

80

90

30

50

70

Portfolio Reviews: Monitor for Risk, Catalyst for Action

Use Serial Portfolio Reviews to Monitor Risk Trends

Portfolio reviews provide snapshots of a portfolios current risk distribution. By repeating the review at frequent intervals over a sustained period of time, such as on a monthly, quarterly or semi-annual basis, you can better identify changes and determine trends.

Not only is such historical trend data more predictive of future behavior, it also provides an effective means of monitoring the impact of time-sensitive or staggered operational changes. Most portfolios have a specific range of credit risk where accounts are usually quite profitable. As a general rule, this range commonly known as the sweet spotis not at the high-risk end of the spectrum because excessive charge-off rates would overwhelm any revenue streams. Lowestrisk customers are also unlikely to be profitable, since they generally do not carry large balances from cycle to cycle and usually make consistently on-time payments. This makes the near-prime risk segment generally the most profitable group for the majority of banks and credit unions. The near-prime group carries balances, makes reliable payments and generates occasional fees for minor delinquencies or services. Wherever the sweet spot is in your portfolio, it is important to understand how accounts move in and out of your most profitable risk range.

FIGURE 2

Downward Shift in Credit Score Distribution Over Time

JANUARY 2010

JANUARY 2011

Indicates potential need for tighter approval guidelines

55 0

75 0

40

60

85

35

65

45

CREDIT RISK SCORE RANGE

Unlike a one-time analysis, portfolio reviews over time can track and identify changes in your risk composition that could impact profitabilityeither adversely or positively.

Disproportionate growth in the number of lowest-risk customers could signify overly conservative business rules and lending practices, which may be diminishing returns on your portfolio. Increases in the proportion of highest-risk customers can indicate red flags for your policies, such as inappropriately low approval standards or a disproportionate number of accounts deteriorating.

Greater numbers of accounts with an upward trend in credit score may indicate opportunities to increase profitability by increasing credit lines/changing the product pricing structure to better accommodate these customers.

In essence, portfolio reviews give you greater insight into portfolio behavior, not just composition. So, instead of simply knowing how your portfolio is performing today, you can better evaluate past performance, predict future trends and changes in behavior, and set strategies to take maximum advantage of that knowledge.

2011 TransUnion LLC All Rights Reserved

80

90

3

30

50

70

Portfolio Reviews: Monitor for Risk, Catalyst for Action

Use Portfolio Reviews for Valuation

In any financial services business, a portfolio is one of your most basic, valuable assets. Its vital that you know how much your portfolio is worth at any given time.

Portfolio valuations are complex undertakings that need to answer two fundamental questions:

What is the book value of my accounts? How much of that value am I likely to actually be able to collect?

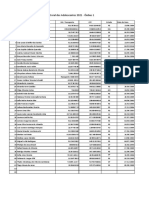

FIGURE 3

Portfolio Review Can Help in Estimating the Value of a Portfolio

Volume of Loans on Books 894 - 925 868 - 893 857 - 867 Probability of Serious Default (90+ DPD) Estimated Volume Generating Returns

$6,294,505,401 $7,226,841,600 $7,421,956,630 $7,480,167,758 $7,396,487,455 $7,202,604,662 $6,870,089,228 $6,474,051,395 $5,956,259,713 $5,322,497,879 $4,593,660,010 $3,916,906,148 $3,161,122,210 $2,474,224,699 $1,763,420,201 $1,144,882,595 $562,391,372 $153,689,199

0.57% 0.97% 1.43% 1.31% 1.60% 1.97% 2.13% 2.51% 3.00% 3.43% 4.35% 4.70% 5.48% 6.15% 6.84% 8.23% 9.58% 12.15%

TOTAL BOOK VALUE:

$6,258,626,720 $7,156,741,236 $7,315,822,650 $7,382,177,560 $7,278,143,655 $7,060,713,350 $6,723,756,327 $6,311,552,705 $5,777,571,922 $5,139,936,201 $4,393,835,800 $3,732,811,559 $2,987,892,713 $2,322,059,880 $1,642,802,259 $1,050,658,757 $508,514,278 $135,015,961

Credit Risk Model Score Band

With a portfolio review, you can more precisely estimate the worth of your accounts and calculate more appropriate discount rates to account for the risk of loss. As a result, you can get a much better estimate of how much a portfolio is worth so that you neither overpay as a purchaser nor accept too low a price as a seller.

847 - 856 835 - 846 825 - 834 814 - 824 804 - 813 793 - 803 781 - 792 768 - 780 756 - 767 742 - 755 728 - 741 711 - 727 692 - 710 665 - 691 624 - 664

ESTIMATED TRUE VALUE:

$85,415,758,153 $83,178,633,535 % OF BOOK VALUE: 97.38%

2011 TransUnion LLC All Rights Reserved

Portfolio Reviews: Monitor for Risk, Catalyst for Action

In conjunction with a loss odds chart easily obtainable from most scoring model vendorsportfolio review data lets you assess the odds of bankruptcy or other credit loss, such as an account going more than 90 days past due. Odds of these credit events are calculated for each band of the scoring model used to evaluate your portfolio. Applying those odds against the aggregate dollar amount in each scoring band provides for a precise estimate of the value of the portfolio (EVP). Put into practice, this information helps risk managers make better decisions. If your calculated EVP for a given portfolio were 84% of face value, why would you sell for 68% or buy for 93% of face value?

A single debt portfolio represents a tiny fraction of the overall debt burden of the population. However, generic credit scores use experience data from a vast number of similar accounts to predict performance within any given loan type (i.e., credit cards, auto loans, etc.). By using these analytically derived credit scores, you can value a portfolio against other similar portfolios with more quantitative rigor and determine a much more statistically valid value. In essence, a portfolio review incorporates open-market forces into a private transaction.

2011 TransUnion LLC All Rights Reserved

Portfolio Reviews: Monitor for Risk, Catalyst for Action

Use Portfolio Reviews for Individual Account Management

In an increasingly competitive market, relationships are essential for customer retention. Portfolio reviews enable you to see beyond your own limited lending relationship with particular individuals and provide insight into each consumers overall financial profile.

Credit Risk Score Range

Whether on a one-time basis or as part of a portfolio trend analysis, this insight can help you determine the most appropriate offers and strategies to retain your most profitable accounts, decrease surprises and reduce attrition. When an individual changes his or her credit behaviorwhether adversely or positivelythis change in behavior is not always distributed equally across all accounts. For example, due to an affinity with a credit union or preference for one account, a consumer may continue to perform well on certain accounts while others deteriorate. By the time the situation is recognized, it may be too latethe opportunity for an institution to make corrective changes may be gone. This can lead to unanticipated losses, particularly for credit unions and community banks. With regular portfolio reviews, you can noticeably reduce the possibility of such scenarios. A review can uncover changes in performance outside your own relationship and help you identify downward trends in other accounts held by that consumer. This gives you the opportunity to review the consumers account more thoroughly and, if

FIGURE 4

A Customer Can Become More Credit-Worthy Over Time

681

653 631 617 603 582

1 0

LY

LY

AR

AR

AR

JU

JU

NU

NU

warranted, make pre-emptive changes to limit your exposure to losssuch as tightening limits on revolving lines, adjusting interest rates to compensate for the consumers new higher-risk standing, or using more aggressive collection strategies for early stage delinquency. Conversely, for consumers whose credit standing has improved since you made your original underwriting decision, there is a higher likelihood of competitors targeting them with attractive offers. This can act to trigger your own account retention strategies, such as offering improved account services or more favorable terms.

JA

JA

It should be noted that, because portfolio reviews are conducted pursuant to the account management permissible purpose, they cannot legitimately be used for cross-sell purposes. Nonetheless, portfolio reviews provide a wealth of information at the account level to help you tailor your treatment strategies to improve retention of profitable accounts while mitigating the impact of unprofitable ones.

2011 TransUnion LLC All Rights Reserved

JA

NU

JU

LY

1 0

Portfolio reviews are a significant way for mid-market banks and credit unions to monitor, manage, and act upon their portfolio credit risk and enhance overall portfolio returns. Beyond this, they can deepen accountholder relationships and build the foundation for loyalty and continuing business growth. Large financial organizations have long been using custom tools and credit reporting company data to perform these credit risk analyses, but few options have been available for mid-tier institutions. TransUnion Express Portfolio Review is a new risk management offering designed with the needs of this market in mind. While still useful for the largest of banks and card issuers, the combination of performance and value makes Express Portfolio Review particularly attractive to mid-market banks and credit unions. This easy-to-use online solution lets an institution choose from a list of over 200 attributes and 17 scores to fit its portfolio management objectives. Express Portfolio Review can accommodate portfolio reviews up to 300,000 records and results are returned in less than 48 hours.

Portfolio Reviews: Monitor for Risk, Catalyst for Action

2011 TransUnion LLC All Rights Reserved No part of this publication may be reproduced or distributed in any form or by any means, electronic or otherwise, now known or hereafter developed, including, but not limited to, the Internet, without the explicit prior written consent from TransUnion LLC. Requests for permission to reproduce or distribute any part of, or all of, this publication should be mailed to: Law Department TransUnion 555 West Adams Chicago, Illinois 60661 The T logo, TransUnion, and other trademarks, service marks, and logos (the Trademarks) used in this publication are registered or unregistered Trademarks of TransUnion LLC, or their respective owners. Trademarks may not be used for any purpose whatsoever without the express written permission of the Trademark owner.

2011 TransUnion LLC All Rights Reserved 555 West Adams Street Chicago, Illinois 60661 USA transunion.com/business

2011 TransUnion LLC All Rights Reserved

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- FNL Responsibilities For Lenders WP 2014Document7 pagesFNL Responsibilities For Lenders WP 2014Andrew ArmstrongNo ratings yet

- Pipeline Hedging: The New Imperative For The Independent Mortgage Banker.Document8 pagesPipeline Hedging: The New Imperative For The Independent Mortgage Banker.Andrew ArmstrongNo ratings yet

- Mortgage Lending: Product & Pricing Engines - Strategic Uses For Compliance, Competitiveness & ProfitDocument7 pagesMortgage Lending: Product & Pricing Engines - Strategic Uses For Compliance, Competitiveness & ProfitAndrew ArmstrongNo ratings yet

- Best Practices For Maximizing ProfitabilityDocument7 pagesBest Practices For Maximizing ProfitabilityAndrew ArmstrongNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Invoice: Page 1 of 2Document2 pagesInvoice: Page 1 of 2Gergo JuhaszNo ratings yet

- I.T. Past Papers Section IDocument3 pagesI.T. Past Papers Section IMarcia ClarkeNo ratings yet

- Running Head: Problem Set # 2Document4 pagesRunning Head: Problem Set # 2aksNo ratings yet

- Maharashtra Government Dilutes Gunthewari ActDocument2 pagesMaharashtra Government Dilutes Gunthewari ActUtkarsh SuranaNo ratings yet

- Wallem Philippines Shipping vs. SR Farms (2010)Document1 pageWallem Philippines Shipping vs. SR Farms (2010)Teff QuibodNo ratings yet

- Project Initiation Document (Pid) : PurposeDocument17 pagesProject Initiation Document (Pid) : PurposelucozzadeNo ratings yet

- Coral Dos Adolescentes 2021 - Ônibus 1: Num Nome RG / Passaporte CPF Estado Data de NascDocument1 pageCoral Dos Adolescentes 2021 - Ônibus 1: Num Nome RG / Passaporte CPF Estado Data de NascGabriel Kuhs da RosaNo ratings yet

- Climate Model Research ReportDocument13 pagesClimate Model Research Reportapi-574593359No ratings yet

- E3 - Mock Exam Pack PDFDocument154 pagesE3 - Mock Exam Pack PDFMuhammadUmarNazirChishtiNo ratings yet

- Pronunciation SyllabusDocument5 pagesPronunciation Syllabusapi-255350959No ratings yet

- Climate Change (B Ok - CC)Document481 pagesClimate Change (B Ok - CC)Rashid LatiefNo ratings yet

- Ost BSMDocument15 pagesOst BSMTata Putri CandraNo ratings yet

- Blcok 5 MCO 7 Unit 2Document12 pagesBlcok 5 MCO 7 Unit 2Tushar SharmaNo ratings yet

- Gwinnett Schools Calendar 2017-18Document1 pageGwinnett Schools Calendar 2017-18bernardepatchNo ratings yet

- VoterListweb2016-2017 81Document1 pageVoterListweb2016-2017 81ShahzadNo ratings yet

- Project ReportDocument63 pagesProject Reportdeepak singhNo ratings yet

- Bung Tomo InggrisDocument4 pagesBung Tomo Inggrissyahruladiansyah43No ratings yet

- The Renaissance PeriodDocument8 pagesThe Renaissance PeriodAmik Ramirez TagsNo ratings yet

- Metaphysics Aristotle Comm Aquinas PDFDocument778 pagesMetaphysics Aristotle Comm Aquinas PDFhsynmnt100% (1)

- Alembic LTD.,: International Standards Certifications (South Asia) Pvt. LTDDocument7 pagesAlembic LTD.,: International Standards Certifications (South Asia) Pvt. LTDJamil VoraNo ratings yet

- Hack Tata Docomo For Free G..Document3 pagesHack Tata Docomo For Free G..Bala Rama Krishna BellamNo ratings yet

- OD2e L4 Reading Comprehension WS Unit 3Document2 pagesOD2e L4 Reading Comprehension WS Unit 3Nadeen NabilNo ratings yet

- Unit 7:: Intellectual PropertyDocument52 pagesUnit 7:: Intellectual Propertyمحمد فائزNo ratings yet

- Session - 30 Sept Choosing Brand Elements To Build Brand EquityDocument12 pagesSession - 30 Sept Choosing Brand Elements To Build Brand EquityUmang ShahNo ratings yet

- Security Incidents and Event Management With Qradar (Foundation)Document4 pagesSecurity Incidents and Event Management With Qradar (Foundation)igrowrajeshNo ratings yet

- 11 Its A Magical World - Bill WattersonDocument166 pages11 Its A Magical World - Bill Wattersonapi-560386898100% (8)

- 202E13Document28 pages202E13Ashish BhallaNo ratings yet

- Active Critical ReadingDocument22 pagesActive Critical ReadingYonn Me Me KyawNo ratings yet

- Final Project Report - Keiretsu: Topic Page NoDocument10 pagesFinal Project Report - Keiretsu: Topic Page NoRevatiNo ratings yet

- Clark Water Corporation vs. BIR First DivisionDocument19 pagesClark Water Corporation vs. BIR First DivisionMarishiNo ratings yet