Professional Documents

Culture Documents

Fed Statement June 2009

Uploaded by

andrewblogger0 ratings0% found this document useful (0 votes)

10 views2 pagesConditions in financial markets have generally improved in recent months. Although economic activity is likely to remain weak for a time, The Committee expects price stability. The Committee will maintain the target range for the federal funds rate at 0 to 1 / 4 percent.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentConditions in financial markets have generally improved in recent months. Although economic activity is likely to remain weak for a time, The Committee expects price stability. The Committee will maintain the target range for the federal funds rate at 0 to 1 / 4 percent.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views2 pagesFed Statement June 2009

Uploaded by

andrewbloggerConditions in financial markets have generally improved in recent months. Although economic activity is likely to remain weak for a time, The Committee expects price stability. The Committee will maintain the target range for the federal funds rate at 0 to 1 / 4 percent.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

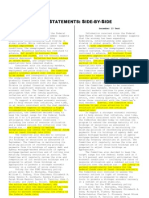

FOMC STATEMENTS: SIDE-BY-SIDE

June 24 Text April 29 Text

Information received since the Information received since the Federal

Federal Open Market Committee met in Open Market Committee met in March indicates

April suggests that the pace of economic that the economy has continued to contract,

contraction is slowing. Conditions in though the pace of contraction appears to be

somewhat slower. Household spending has shown

financial markets have generally improved signs of stabilizing but remains constrained

in recent months. Household spending has by ongoing job losses, lower housing wealth

shown further signs of stabilizing but and tight credit. Weak sales prospects and

remains constrained by ongoing job difficulties in obtaining credit have led

losses, lower housing wealth and tight businesses to cut back on inventories, fixed

credit. Businesses are cutting back on investment, and staffing. Although the

fixed investment and staffing but appear economic outlook has improved modestly since

to be making progress in bringing the March meeting, partly reflecting some

inventory stocks into better alignment easing of financial market conditions,

economic activity is likely to remain weak for

with sales. Although economic activity is a time. Nonetheless, the Committee continues

likely to remain weak for a time, the to anticipate that policy actions to stabilize

Committee continues to anticipate that financial markets and institutions, fiscal and

policy actions to stabilize financial monetary stimulus, and market forces will

markets and institutions, fiscal and contribute to a gradual resumption of

monetary stimulus, and market forces will sustainable economic growth in a context of

contribute to a gradual resumption of price stability.

sustained economic growth in a context of

price stability. In light of increasing economic slack

here and abroad, the Committee expects that

inflation will remain subdued. Moreover, the

The prices of energy and other Committee sees some risks that inflation could

commodities have risen of late. However, persist for a time below rates that best

substantial resource slack is likely to foster economic growth and price stability in

dampen cost pressures, and the Committee the longer term.

expects that inflation will remain

subdued for some time. In these circumstances, the Federal

Reserve will employ all available tools to

In these circumstances, the Federal promote economic recovery and to preserve

price stability. The Committee will maintain

Reserve will employ all available tools the target range for the federal funds rate at

to promote economic recovery and to 0 to 1/4 percent and anticipates that economic

preserve price stability. The Committee conditions are likely to warrant exceptionally

will maintain the target range for the low levels of the federal funds rate for an

federal funds rate at 0 to 1/4 percent extended period. As previously announced, to

and continues to anticipate that economic provide support to mortgage lending and

conditions are likely to warrant housing markets, and to improve overall

exceptionally low levels of the federal conditions in private credit markets, the

funds rate for an extended period. As Federal Reserve will purchase a total of up to

$1.25 trillion of agency mortgage-backed

previously announced, to provide support securities and up to $200 billion of agency

to mortgage lending and housing markets, debt by the end of the year. In addition, the

and to improve overall conditions in Federal Reserve will buy up to $300 billion of

private credit markets, the Federal Treasury securities by autumn. The Committee

Reserve will purchase a total of up to will continue to evaluate the timing and

$1.25 trillion of agency mortgage-backed overall amounts of its purchases of securities

securities and up to $200 billion of in light of the evolving economic outlook and

agency debt by the end of the year. In conditions in financial markets. The Federal

addition, the Federal Reserve will buy up Reserve is facilitating the extension of

credit to households and businesses and

to $300 billion of Treasury securities by supporting the functioning of financial

autumn. The Committee will continue to markets through a range of liquidity programs.

evaluate the timing and overall amounts The Committee will continue to carefully

of its purchases of securities in light monitor the size and composition of the

of the evolving economic outlook and Federal Reserve's balance sheet in light of

conditions in financial markets. The financial and economic developments.

Federal Reserve is monitoring the size

and composition of its balance sheet and Voting for the FOMC monetary policy action

will make adjustments to its credit and were: Ben S. Bernanke, Chairman; William C.

Dudley; Elizabeth A. Duke; Charles L. Evans;

liquidity programs as warranted. Donald L. Kohn; Jeffrey M. Lacker; Dennis P.

Lockhart; Daniel K. Tarullo; Kevin M. Warsh;

Voting for the FOMC monetary policy and Janet L. Yellen.

action were: Ben S. Bernanke, Chairman;

William C. Dudley; Elizabeth A. Duke;

Charles L. Evans; Donald L. Kohn; Jeffrey

M. Lacker; Dennis P. Lockhart; Daniel K.

Tarullo; Kevin M. Warsh; and Janet L.

Yellen.

You might also like

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Raj MehtaNo ratings yet

- Survey Questionnier For Startup BarriersDocument5 pagesSurvey Questionnier For Startup BarriersSarhangTahir100% (4)

- Mini MBA 2020 12 Month ProgrammeDocument8 pagesMini MBA 2020 12 Month Programmelaice100% (1)

- 0927 UsfiwDocument42 pages0927 Usfiwbbj1039No ratings yet

- Chapter 1: Financial Management and the Financial EnvironmentDocument76 pagesChapter 1: Financial Management and the Financial EnvironmentJulio RendyNo ratings yet

- Customer Satisfaction Towards HDFC BANKS and SBIDocument89 pagesCustomer Satisfaction Towards HDFC BANKS and SBIdivya palaniswamiNo ratings yet

- Accounting For PartnershipsDocument3 pagesAccounting For PartnershipsRixa Doreen Antoja50% (2)

- CRMO Basic RiskDocument29 pagesCRMO Basic RiskPASCA/51421120226/ARLINGGA K100% (1)

- Davey Brothers Watch Co. SubmissionDocument13 pagesDavey Brothers Watch Co. SubmissionEkta Derwal PGP 2022-24 BatchNo ratings yet

- General Management Project Report PDFDocument54 pagesGeneral Management Project Report PDFvishal voraNo ratings yet

- FOMCstatementDocument2 pagesFOMCstatementCBNo ratings yet

- FOMC0810Document2 pagesFOMC0810arborjimbNo ratings yet

- 2010-09-21 - Fed Side by Side StatementsDocument2 pages2010-09-21 - Fed Side by Side Statementsglerner133926No ratings yet

- Fomc Statements - Side-By-sideDocument2 pagesFomc Statements - Side-By-sideurbanovNo ratings yet

- SidebysidefedDocument1 pageSidebysidefedandrewbloggerNo ratings yet

- Fed Side by Side 20120125Document3 pagesFed Side by Side 20120125andrewbloggerNo ratings yet

- Fomc S: S - S: Tatements IDE BY IDEDocument3 pagesFomc S: S - S: Tatements IDE BY IDEandrewbloggerNo ratings yet

- Fed SideDocument1 pageFed Sideannawitkowski88No ratings yet

- Fomc S: S - S: Tatements IDE BY IDEDocument3 pagesFomc S: S - S: Tatements IDE BY IDEarborjimbNo ratings yet

- Fed Statements Side by SideDocument1 pageFed Statements Side by SideTaylor CottamNo ratings yet

- FOMC Rate Decision 04.25.12Document1 pageFOMC Rate Decision 04.25.12Pensford FinancialNo ratings yet

- Fed 09212011Document2 pagesFed 09212011andrewbloggerNo ratings yet

- FOMC Side by Side 11022011Document2 pagesFOMC Side by Side 11022011andrewbloggerNo ratings yet

- Fed TalkDocument2 pagesFed TalkTelegraphUKNo ratings yet

- January - March FOMC Statement ComparisonDocument1 pageJanuary - March FOMC Statement Comparisonshawn2207No ratings yet

- FOMC Redline MarchDocument2 pagesFOMC Redline MarchZerohedgeNo ratings yet

- Fed Keeps Rates Near Zero, Sees Slower RecoveryDocument2 pagesFed Keeps Rates Near Zero, Sees Slower RecoveryEduardo VinanteNo ratings yet

- Fomc S: S - S: Tatements IDE BY IDEDocument3 pagesFomc S: S - S: Tatements IDE BY IDEarborjimbNo ratings yet

- September FOMC RedlineDocument2 pagesSeptember FOMC RedlineZerohedgeNo ratings yet

- Oct FOMC RedlineDocument2 pagesOct FOMC RedlineZerohedgeNo ratings yet

- Sidebyside 08092011Document1 pageSidebyside 08092011andrewbloggerNo ratings yet

- FOMC Word For Word Changes. 05.01.13Document2 pagesFOMC Word For Word Changes. 05.01.13Pensford FinancialNo ratings yet

- Fomc StatmentDocument1 pageFomc Statmentapi-280585983No ratings yet

- FOMC Word For Word Changes 03.20.13Document2 pagesFOMC Word For Word Changes 03.20.13Pensford FinancialNo ratings yet

- December 17, 2014 Compared With October 29, 2014 Jeremie Cohen-SettonDocument3 pagesDecember 17, 2014 Compared With October 29, 2014 Jeremie Cohen-Settonapi-273992067No ratings yet

- Fomc Septiembre 2015Document2 pagesFomc Septiembre 2015cocoNo ratings yet

- Press Release: For Release at 2:00 P.M. EDTDocument2 pagesPress Release: For Release at 2:00 P.M. EDTTREND_7425No ratings yet

- Monetary Policy Report to CongressDocument27 pagesMonetary Policy Report to CongressDGat2No ratings yet

- FedDocument4 pagesFedandre.torresNo ratings yet

- Federal Reserve Issues FOMC Statement: ShareDocument2 pagesFederal Reserve Issues FOMC Statement: ShareTREND_7425No ratings yet

- 2018.01.31 FED Press ReleaseDocument2 pages2018.01.31 FED Press ReleaseTREND_7425No ratings yet

- Interpret The Tone-FOMC Statements Answer Key: Advance Your CareerDocument3 pagesInterpret The Tone-FOMC Statements Answer Key: Advance Your CareerTarun TiwariNo ratings yet

- Global MarketsDocument2 pagesGlobal MarketsSunny M.No ratings yet

- Fed bond buying to end in June but strong dollar policy lacks credibilityDocument1 pageFed bond buying to end in June but strong dollar policy lacks credibilityhweinermanNo ratings yet

- Press ReleaseDocument2 pagesPress Releaseapi-26018528No ratings yet

- Monetary 20230614 A 1Document4 pagesMonetary 20230614 A 1Jhony SmithYTNo ratings yet

- Yellen HHDocument7 pagesYellen HHZerohedgeNo ratings yet

- 2018.09.26 FED Press ReleaseDocument1 page2018.09.26 FED Press ReleaseTREND_7425No ratings yet

- Money and The Federal Reserve System: Learning ObjectivesDocument16 pagesMoney and The Federal Reserve System: Learning ObjectivesNeven Ahmed HassanNo ratings yet

- Yellen TestimonyDocument7 pagesYellen TestimonyZerohedgeNo ratings yet

- SystemDocument8 pagesSystempathanfor786No ratings yet

- Fed Redline FebruaryDocument2 pagesFed Redline FebruaryPradeep SolankiNo ratings yet

- Powell 20230621 ADocument5 pagesPowell 20230621 ADaily Caller News FoundationNo ratings yet

- Fed Doves No Longer Rule The Roost: Economic and Financial AnalysisDocument5 pagesFed Doves No Longer Rule The Roost: Economic and Financial AnalysisOwm Close CorporationNo ratings yet

- Peso Balanced Fund: Investment ObjectiveDocument10 pagesPeso Balanced Fund: Investment ObjectiveErwin Dela CruzNo ratings yet

- Monetary 20230726 A 1Document4 pagesMonetary 20230726 A 1Verónica SilveriNo ratings yet

- The Pensford Letter - 2.24.14Document2 pagesThe Pensford Letter - 2.24.14Pensford FinancialNo ratings yet

- Monetary 20230201 A 1Document4 pagesMonetary 20230201 A 1tamhid nahianNo ratings yet

- ChairDocument4 pagesChairandre.torresNo ratings yet

- FOMCpresconf 20220316Document26 pagesFOMCpresconf 20220316marchmtetNo ratings yet

- Chair Powell Signals Fed Taper Coming SoonDocument26 pagesChair Powell Signals Fed Taper Coming SoonmarcoNo ratings yet

- The Financial Stability Report Holistically AssessesDocument8 pagesThe Financial Stability Report Holistically AssessesKhushal PuriNo ratings yet

- Ife - UsaDocument13 pagesIfe - Usagiovanni lazzeriNo ratings yet

- Federal Reserve Issues FOMC Statement: ShareDocument1 pageFederal Reserve Issues FOMC Statement: ShareTREND_7425No ratings yet

- Westpac - Fed Doves Might Have Last Word (August 2013)Document4 pagesWestpac - Fed Doves Might Have Last Word (August 2013)leithvanonselenNo ratings yet

- Federal Reserve StatementDocument4 pagesFederal Reserve StatementTim MooreNo ratings yet

- Felicia Irene - Week 5Document27 pagesFelicia Irene - Week 5felicia ireneNo ratings yet

- Fomc S: S - S: Tatements IDE BY IDEDocument3 pagesFomc S: S - S: Tatements IDE BY IDEandrewbloggerNo ratings yet

- FOMC Side by Side 11022011Document2 pagesFOMC Side by Side 11022011andrewbloggerNo ratings yet

- Fed Side by Side 20120125Document3 pagesFed Side by Side 20120125andrewbloggerNo ratings yet

- China Economics 09192011Document3 pagesChina Economics 09192011andrewbloggerNo ratings yet

- Fed 09212011Document2 pagesFed 09212011andrewbloggerNo ratings yet

- Historical Unemployment Recent Unemployment: Productivity and CostsDocument4 pagesHistorical Unemployment Recent Unemployment: Productivity and CostsandrewbloggerNo ratings yet

- Commodity Chartbook 09302011Document9 pagesCommodity Chartbook 09302011andrewbloggerNo ratings yet

- SPRD 08152011Document1 pageSPRD 08152011andrewbloggerNo ratings yet

- Airline Comps 20110606Document4 pagesAirline Comps 20110606andrewbloggerNo ratings yet

- Commodity Chartbook 20110802Document9 pagesCommodity Chartbook 20110802andrewbloggerNo ratings yet

- Retail Same Store Sales 20110901Document2 pagesRetail Same Store Sales 20110901andrewbloggerNo ratings yet

- Retail Same Store SalesDocument2 pagesRetail Same Store SalesandrewbloggerNo ratings yet

- Crox 20110728Document2 pagesCrox 20110728andrewbloggerNo ratings yet

- Sidebyside 08092011Document1 pageSidebyside 08092011andrewbloggerNo ratings yet

- China Eco StatsDocument4 pagesChina Eco StatsandrewbloggerNo ratings yet

- Oil COT 20110510Document1 pageOil COT 20110510andrewbloggerNo ratings yet

- Apple Conference Call Notes 3Q 2011Document6 pagesApple Conference Call Notes 3Q 2011andrewbloggerNo ratings yet

- Retail Same Store Sales 20110516Document2 pagesRetail Same Store Sales 20110516andrewbloggerNo ratings yet

- Commodity Chartbook: April 6, 2011Document8 pagesCommodity Chartbook: April 6, 2011andrewbloggerNo ratings yet

- CTRP Earnings Worksheet: Actual 0.24 $ 124.32 $ Surprise 12.68% 11.75%Document4 pagesCTRP Earnings Worksheet: Actual 0.24 $ 124.32 $ Surprise 12.68% 11.75%andrewbloggerNo ratings yet

- Key Index Support May162011Document4 pagesKey Index Support May162011andrewbloggerNo ratings yet

- Trina Solar (TSL)Document2 pagesTrina Solar (TSL)andrewbloggerNo ratings yet

- GT SolarDocument2 pagesGT SolarandrewbloggerNo ratings yet

- Silver COT 20110510Document1 pageSilver COT 20110510andrewbloggerNo ratings yet

- Major Index TrendsDocument9 pagesMajor Index TrendsandrewbloggerNo ratings yet

- Major Index TrendsDocument9 pagesMajor Index TrendsandrewbloggerNo ratings yet

- TSL04132011Document2 pagesTSL04132011andrewbloggerNo ratings yet

- Perrigo (PRGO)Document2 pagesPerrigo (PRGO)andrewbloggerNo ratings yet

- China Eco 1Document1 pageChina Eco 1andrewbloggerNo ratings yet

- Russell 2000 Stock Index: Chart LegendDocument4 pagesRussell 2000 Stock Index: Chart LegendandrewbloggerNo ratings yet

- Bharat Bohra ProjectDocument63 pagesBharat Bohra ProjectManvendra AcharyaNo ratings yet

- NBFC Audit ProgramDocument8 pagesNBFC Audit ProgramPankaj AmbreNo ratings yet

- Quiz 1 AnswersDocument6 pagesQuiz 1 AnswersAlyssa CasimiroNo ratings yet

- CFAS Module 8Document42 pagesCFAS Module 8Eu NiceNo ratings yet

- Tugas 1 Akuntansi PengantarDocument6 pagesTugas 1 Akuntansi PengantarblademasterNo ratings yet

- Reading #2 - Unit3 - Lloyds Titanic Trifold 2019 Digital PDFDocument2 pagesReading #2 - Unit3 - Lloyds Titanic Trifold 2019 Digital PDFSaud AidrusNo ratings yet

- Global Depository ReceiptsDocument4 pagesGlobal Depository ReceiptsSaiyam ChaturvediNo ratings yet

- Acf PresenntationDocument6 pagesAcf PresenntationanjuNo ratings yet

- Instant Download Ebook PDF Fundamentals of Corporate Finance 5th Canadian Edition PDF ScribdDocument41 pagesInstant Download Ebook PDF Fundamentals of Corporate Finance 5th Canadian Edition PDF Scribdlauryn.corbett387100% (41)

- CBR Swing BasicDocument29 pagesCBR Swing BasickrisnaNo ratings yet

- Cell Phone Shop FinalDocument26 pagesCell Phone Shop Finalapi-249675528No ratings yet

- CPA 1 Financial Accounting-1Document8 pagesCPA 1 Financial Accounting-1LYNETTE NYAKAISIKINo ratings yet

- Fiber Monthly Statement: This Month's SummaryDocument3 pagesFiber Monthly Statement: This Month's SummarySwamy BudumuriNo ratings yet

- Blue and White Collage Geography Quiz PresentationDocument21 pagesBlue and White Collage Geography Quiz PresentationMohammed MehranNo ratings yet

- Beta Leverage Divisional BetaDocument2 pagesBeta Leverage Divisional Betazunaira_riaz3271No ratings yet

- Anti Bouncing Law, Pdic, Bank Secrecy Law and Truth in Lending Act.Document12 pagesAnti Bouncing Law, Pdic, Bank Secrecy Law and Truth in Lending Act.dash zarinaNo ratings yet

- Fair Practice Code-Valid Upto 31032024Document6 pagesFair Practice Code-Valid Upto 31032024Tejas JoshiNo ratings yet

- Impact of Demonetization On Indian Economy: Anjali Ahuja Sakshi AnandDocument3 pagesImpact of Demonetization On Indian Economy: Anjali Ahuja Sakshi AnandHEMANTH KUMARNo ratings yet

- Girnar Insurance Brokers Private Limited: Salary Slip For The Month of November - 2022Document2 pagesGirnar Insurance Brokers Private Limited: Salary Slip For The Month of November - 2022karanmitroo1No ratings yet

- ABM 12 (Cash Flow Statement) CFSDocument6 pagesABM 12 (Cash Flow Statement) CFSWella LozadaNo ratings yet

- BPO Business Registration RequirementsDocument6 pagesBPO Business Registration RequirementsLester PaulinoNo ratings yet