Professional Documents

Culture Documents

SWIFT messaging network enables global bank fund transfers & payments

Uploaded by

Deen Mohammed ProtikOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SWIFT messaging network enables global bank fund transfers & payments

Uploaded by

Deen Mohammed ProtikCopyright:

Available Formats

SWIFT: It is the abbreviation of the society for Worldwide Inter bank Financial Telecommunication.

SWIFT is a bank owned non-profit co-operative based in Belgium servicing the financial community worldwide. SWIFT global network carries an average 4 million message daily and estimated average value of payment messages is USD 2 trillion. SWIIFT is a highly secured messaging network enables Banks to send and receive Fund Transfer, L/C related and other free format messages to and from any banks active in the network. Thing SWIFT facility, Bank will be able to serve its customers more profitable by proving L/C, payment & other messages efficiently and with up most security. Especially it will be of great help for our clients dealing with Imports, Exports & Remittances etc. National Bank limited began to make full use of the services of SWIFT right from 2002. In 2003 the software of SWIFT has been shifted from SWIFT. Alliance Entry to SWIFT Alliance Access and 5 major AD Branches of NBL have been directly connected with the SWIFT network. Up to the end of 2003. NBL have executed bilateral key exchange (BKE) with 233 banks across the world which is increasing continuously. 2. Credit Card Programme of NBL:

In this age of modern technology, millions of people across the world have been using credit card every moment as a medium of exchange and increasingly becoming more & more confident in using credit card. Master card & Visa card are the two most popular and globally used brands of Credit card. NBL has set an enviable precedence by being the first among domestic banks and financial institutions to issue internationally usable master card from `1997. It may be mentioned that National Bank Ltd. have issued credit card from 1st July 2003. NBL use two types of credit card. Such asVisa Card Master Card

For creating credit card in NBL people needs three things. Suppose. They have to provide security tin Number Passport/ Identity certificate from Union Parisad Chairman.

Visa Card & Master card may be Golden or silver. It is mainly depend on amount of dollar ($). Suppose if anyone want to create. Golden visa/Master card then he/she has to pay more than $

2000 & for silver card has to pay less than $ 2000. By Using Master card or Visa Card, one can be purchased all necessary goods & services from their selected out lets. 3. E-BSW/ATM Service of NBL:

EBSW for electronic Banking service for windows which provides a full range of reporting capabilities and a comprehensive range of transaction initiation options. ATM for Automated Teller machine (ATM), a new concept in modern banking. It has already been introduced to facilitate subscribes 24 hours cash access through a plastic card. In the dynamic process of modern banking, NBL has elevated its services to the highest standard by bringing E-Banking and ATM services at the doorstep of clients. Today, the entire banking system has been undergoing a revolutionary change in providing improved services to the clients. One of the important media in this process of client service improvement is ATM. Use of ATM has made the life style of clients much more easier and comfortable. The notable characteristics of ATM are1. 2. 3. 4. Payments facility for 24 hours a day Arrangement for payment of Bills. Instant inquiry Multiple location facility at Dhaka, Chittagong & Sylhet.

You might also like

- Onevanilla Prepaid Mastercard Balance - Onevanilla Visa Gift CardDocument7 pagesOnevanilla Prepaid Mastercard Balance - Onevanilla Visa Gift Cardjames smithNo ratings yet

- CBPR Plus MT MX EquivalenceDocument15 pagesCBPR Plus MT MX EquivalenceDandy Arifiyanto100% (1)

- Swiftnet PDFDocument7 pagesSwiftnet PDFCarlos AlexandreNo ratings yet

- Swift Report Nostrodlt Public ReleaseDocument28 pagesSwift Report Nostrodlt Public Releasepenta100% (1)

- Business Sale Agreement TemplateDocument2 pagesBusiness Sale Agreement TemplatecmdelrioNo ratings yet

- Streamline Global Banking with Alliance Lite2Document18 pagesStreamline Global Banking with Alliance Lite2veldanezNo ratings yet

- Swift 4Document86 pagesSwift 4Freeman JacksonNo ratings yet

- ISO 20022 library models standardDocument4 pagesISO 20022 library models standardsri_vas4uNo ratings yet

- RRBs IN AEPSDocument20 pagesRRBs IN AEPSKáúśtúbhÇóólNo ratings yet

- Routing Mapping Payments As Transactions v3Document235 pagesRouting Mapping Payments As Transactions v3Jj018320No ratings yet

- Swiftready Label - For Corproates Cash ManagementDocument17 pagesSwiftready Label - For Corproates Cash ManagementFreeman JacksonNo ratings yet

- Swift PMPG Guidelines IntradayliquiditylitfDocument46 pagesSwift PMPG Guidelines IntradayliquiditylitfSamuel BedaseNo ratings yet

- 7 0 Saa Daily Ops GuideDocument335 pages7 0 Saa Daily Ops GuideNi Kadek Suastini100% (1)

- SWIFT SR2021 MT BusinessHighlightsDocument13 pagesSWIFT SR2021 MT BusinessHighlightsmelol40458No ratings yet

- Achieving Treasury Visibility by Leveraging SWIFT: Scott Montigelli KyribaDocument3 pagesAchieving Treasury Visibility by Leveraging SWIFT: Scott Montigelli Kyribabeevant100% (1)

- Swift Connectivity Brochure CommunitycloudleafletDocument7 pagesSwift Connectivity Brochure CommunitycloudleafletObilious90No ratings yet

- Alliance Access Products Family Compatibility MatrixDocument1 pageAlliance Access Products Family Compatibility MatrixOscar Alberto ZambranoNo ratings yet

- SWIFT Training Catalogue 2013: - Our Knowledge, Your SolutionDocument74 pagesSWIFT Training Catalogue 2013: - Our Knowledge, Your SolutionFreeman JacksonNo ratings yet

- Working Capital FinancingDocument44 pagesWorking Capital FinancingShoib ButtNo ratings yet

- Swift - Training - Your Route To Iso 20022 and The CBPR Guidelines - 57531 - v3 - 0Document2 pagesSwift - Training - Your Route To Iso 20022 and The CBPR Guidelines - 57531 - v3 - 0万涛No ratings yet

- SWIFT Joining Process: List of DocumentsDocument35 pagesSWIFT Joining Process: List of DocumentsJohn SamboNo ratings yet

- Cyclos ReferenceDocument126 pagesCyclos ReferenceEnric ToledoNo ratings yet

- Your Route To ISO 20022 and The CBPR+ GuidelinesDocument2 pagesYour Route To ISO 20022 and The CBPR+ GuidelinesBalaji NatarajanNo ratings yet

- Postilion Developer ExternalDocument2 pagesPostilion Developer ExternalMwansa MachaloNo ratings yet

- Clear 2 PayDocument2 pagesClear 2 PayJyoti KumarNo ratings yet

- EMVCo 3DS SDKSpec 220 122018Document130 pagesEMVCo 3DS SDKSpec 220 122018klcekishoreNo ratings yet

- Swift Global Vendor Webinar June 2021Document34 pagesSwift Global Vendor Webinar June 2021Beniamin KohanNo ratings yet

- Dynamic Currency Conversion Performance GuideDocument24 pagesDynamic Currency Conversion Performance GuideElvis RenNo ratings yet

- Alliance Access KitDocument4 pagesAlliance Access KitP Delgado RicardoNo ratings yet

- Interface Qualification For A FIN InterfaceDocument10 pagesInterface Qualification For A FIN InterfaceFreeman JacksonNo ratings yet

- Mumbai PPN List of HospitalsDocument47 pagesMumbai PPN List of HospitalsPriyanka PatelNo ratings yet

- Installation and User Guide: Autoclient 2.1Document90 pagesInstallation and User Guide: Autoclient 2.1nashwan mustafaNo ratings yet

- Swift 1Document31 pagesSwift 1Freeman JacksonNo ratings yet

- Global ATM Market Report: 2013 Edition - Koncept AnalyticsDocument11 pagesGlobal ATM Market Report: 2013 Edition - Koncept AnalyticsKoncept AnalyticsNo ratings yet

- Sps Lantin Vs Lantion Digested CaseDocument1 pageSps Lantin Vs Lantion Digested CaseEarl LarroderNo ratings yet

- How To Test The Next Standards Release in Future Mode On Your Alliance AccessDocument2 pagesHow To Test The Next Standards Release in Future Mode On Your Alliance AccessOscar Alberto ZambranoNo ratings yet

- Biz Talk Accelerator For SwiftDocument4 pagesBiz Talk Accelerator For SwiftDragiša ČabarkapaNo ratings yet

- Aa 7 3 RLDocument45 pagesAa 7 3 RLJoyce ShiNo ratings yet

- SWIFT - PresentationVisit Us at Management - Umakant.infoDocument50 pagesSWIFT - PresentationVisit Us at Management - Umakant.infowelcome2jungleNo ratings yet

- SWIFT Messages: Each Block Is Composed of The Following ElementsDocument10 pagesSWIFT Messages: Each Block Is Composed of The Following ElementsMAdhuNo ratings yet

- Ekran Swift BookletDocument11 pagesEkran Swift BookletMammon BusNo ratings yet

- Manual SWIFT FINDocument12 pagesManual SWIFT FINJohnNo ratings yet

- Swift Training Swiftsmart Full Training Catalogue December 2016Document15 pagesSwift Training Swiftsmart Full Training Catalogue December 2016Oscar Alberto ZambranoNo ratings yet

- Process of Cash AcceptanceDocument5 pagesProcess of Cash AcceptanceJayakrishnaraj AJDNo ratings yet

- RMA Planing Guide 200708 v1 1-1-36Document36 pagesRMA Planing Guide 200708 v1 1-1-36viswanath_manjulaNo ratings yet

- Postilion Developer External PDFDocument2 pagesPostilion Developer External PDFMwansaNo ratings yet

- IWSVA 5.0 GuideDocument379 pagesIWSVA 5.0 GuideDiana MalkisNo ratings yet

- 7 0 Saa Inst Admin Guide SolDocument310 pages7 0 Saa Inst Admin Guide SolSumit GambhirNo ratings yet

- Swift Whitepaper Supply Chain Finance 201304Document8 pagesSwift Whitepaper Supply Chain Finance 201304Rami Al-SabriNo ratings yet

- IMF (FinTech Notes) Blockchain Consensus Mechanisms - A Primer For SupervisorsDocument18 pagesIMF (FinTech Notes) Blockchain Consensus Mechanisms - A Primer For SupervisorsMuning AnNo ratings yet

- Very Easy Money Transfer: E-ChequeDocument15 pagesVery Easy Money Transfer: E-ChequeKartheek AldiNo ratings yet

- How To Understand Payment Industry in BrazilDocument32 pagesHow To Understand Payment Industry in BrazilVictor SantosNo ratings yet

- Eracom HSMDocument43 pagesEracom HSMEngineerrNo ratings yet

- ISO 20022 Payments Initiation - Maintenance 2019 - 2020 Message Definition Report - Part 2Document287 pagesISO 20022 Payments Initiation - Maintenance 2019 - 2020 Message Definition Report - Part 2kafihNo ratings yet

- Secure Mobile Banking SRSDocument7 pagesSecure Mobile Banking SRSAkanksha SinghNo ratings yet

- Ethoca Merchant Data Provision API Integration Guide V 3.0.1 (February 13, 2019)Document13 pagesEthoca Merchant Data Provision API Integration Guide V 3.0.1 (February 13, 2019)NastasVasileNo ratings yet

- Customer Information File User Manual PDFDocument314 pagesCustomer Information File User Manual PDFFahim KaziNo ratings yet

- Harmonisation of ISO 20022: Partnering With Industry For Faster, Cheaper, and More Transparent Cross-Border PaymentsDocument13 pagesHarmonisation of ISO 20022: Partnering With Industry For Faster, Cheaper, and More Transparent Cross-Border PaymentsAryan HateNo ratings yet

- TEUSERDocument98 pagesTEUSERdsr_ecNo ratings yet

- Cisp What To Do If CompromisedDocument60 pagesCisp What To Do If CompromisedkcchenNo ratings yet

- SWIFT Gpi: Delivering The Future of Cross-Border PaymentsDocument24 pagesSWIFT Gpi: Delivering The Future of Cross-Border PaymentsInggrita Emanuelin100% (1)

- Get Ready For: Universal Payment ConfirmationsDocument4 pagesGet Ready For: Universal Payment Confirmationsswift adminNo ratings yet

- Report On General BankingDocument7 pagesReport On General BankingDeen Mohammed ProtikNo ratings yet

- Commercial Banking in BangladeshDocument14 pagesCommercial Banking in BangladeshDeen Mohammed ProtikNo ratings yet

- Topic 4 New Service DevelopmntDocument26 pagesTopic 4 New Service DevelopmntDeen Mohammed ProtikNo ratings yet

- Nike Assignment (Short)Document7 pagesNike Assignment (Short)Deen Mohammed ProtikNo ratings yet

- Strategic Marketing BUMKT 6923Document44 pagesStrategic Marketing BUMKT 6923Deen Mohammed ProtikNo ratings yet

- Resolution for Internet Banking FacilityDocument2 pagesResolution for Internet Banking FacilityKarthikNo ratings yet

- Abhishek Kumar Department of Management Studies Kumaun University, NainitalDocument69 pagesAbhishek Kumar Department of Management Studies Kumaun University, NainitalAarav AroraNo ratings yet

- ASEAN MA For FP 2014 Prog Booklet - 060914Document20 pagesASEAN MA For FP 2014 Prog Booklet - 060914Nova Maulidian HidayatNo ratings yet

- Quarter 2 - Module 1 General MathematicsDocument6 pagesQuarter 2 - Module 1 General MathematicsKristine AlcordoNo ratings yet

- Damon K. Roberts Plea AgreementDocument2 pagesDamon K. Roberts Plea AgreementWashington ExaminerNo ratings yet

- Intern Report - Sanima BankDocument11 pagesIntern Report - Sanima BankRajan ParajuliNo ratings yet

- Mcqs For Chapter 5 Islamic Bonds and DerivativesDocument3 pagesMcqs For Chapter 5 Islamic Bonds and DerivativesalaaNo ratings yet

- CASH AND CASH EQUIVALENTS TheoDocument1 pageCASH AND CASH EQUIVALENTS Theovenice cambryNo ratings yet

- Commercial Banking: Chapter ThreeDocument39 pagesCommercial Banking: Chapter ThreeYoseph KassaNo ratings yet

- Cagungun vs. Planters Dev't BankDocument21 pagesCagungun vs. Planters Dev't BankBam BathanNo ratings yet

- What Are SMEsDocument2 pagesWhat Are SMEsarshaikh83No ratings yet

- CFG Accounting and Finance Considerations PWC Winter 2014Document39 pagesCFG Accounting and Finance Considerations PWC Winter 2014timevalueNo ratings yet

- ICC FBI INTERPOL Agreement for International TradeDocument19 pagesICC FBI INTERPOL Agreement for International TradeAngga Larnezza KuntaraNo ratings yet

- Criminal ProcedureDocument51 pagesCriminal ProcedureJohn Adrian MaulionNo ratings yet

- Indemnity BondDocument3 pagesIndemnity BondPoojitha sNo ratings yet

- English Form For DB Account Opening Form For StudentsDocument7 pagesEnglish Form For DB Account Opening Form For StudentsFelly M. LogioNo ratings yet

- 2005 11 03 - DR3Document1 page2005 11 03 - DR3Zach EdwardsNo ratings yet

- Agency Digest Jan27Document9 pagesAgency Digest Jan27weygandtNo ratings yet

- Cost Break Down For Project NelsonDocument10 pagesCost Break Down For Project NelsonAdopt a Dog in Sri LankaNo ratings yet

- MC Brandmark Guidelines v8,1Document16 pagesMC Brandmark Guidelines v8,1Bruno SilvaNo ratings yet

- Account Opening Form English - CDRDocument2 pagesAccount Opening Form English - CDRrk759603No ratings yet

- HSBC BankDocument40 pagesHSBC BankPrasanjeet PoddarNo ratings yet

- Loans and Deposits ExplainedDocument8 pagesLoans and Deposits ExplainedVsgg NniaNo ratings yet

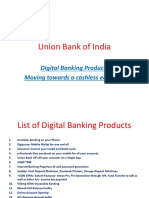

- Digital Banking Products From UBIDocument18 pagesDigital Banking Products From UBISawan NathwaniNo ratings yet

- Bank database schema and queriesDocument8 pagesBank database schema and queriesAndrea Alejandra Cruz OrtizNo ratings yet