Professional Documents

Culture Documents

Tax Quiz 8-27

Uploaded by

mhilet_chiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Quiz 8-27

Uploaded by

mhilet_chiCopyright:

Available Formats

Tax Sparing Rule: the tax on dividend earned by a NRFC within the Phil.

is reduced by imposing a lower rate of 15% (in lieu of the 35%), on the condition that the country to which the NRFC is domiciled shall allow a credit against the tax due from the NRFC, which taxes are deemed to have been paid in the Philippines (Sec.28 [B] [5] b) (CIR vs. Procter & Gamble G.R. No 66838 December 2, 1991) =================================================== What is the tax sparing rule with regard to foreign corporation? What is the purpose for enacting the tax sparing rule? A foreign corporation not engaged in trade or business in the Philippines can avail of the 15% preferential rate of tax on gross income on the condition that the country in which the nonresident foreign corporation is domiciled shall allow a credit against the tax due from the nonresident foreign corporation taxes deemed to have been paid in the Philippines equivalent to 17% which represents the difference between the regular tax of 32% on cooperatives and the 10% as provided in Section 28 (B) of NIRC. The purpose of the tax sparring rule is to reduce the impact of international double taxation.

Who may not avail of deductions from gross income? 1. Citizens and resident aliens whose income is purely compensation income. They are allowed personal and additional exemptions and deduction for premium payments on health and hospitalization insurance. 2. Non-resident aliens not engaged in trade or business in the Philippines Non-resident foreign corporations

3.

Option to private educational institutions In addition to the allowable deductions, a private educational institution may, at its option, elect either: 1. To deduct expenditures otherwise considered as capital outlays of depreciable assets incurred during the taxable year for the expansion of school facilities; or To deduct allowance for depreciation thereof.

2. Tax credit

Tax credit refers to the taxpayers right to deduct from the income tax due the amount of tax he has paid to a foreign country subject to limitations.

Tax deduction v. tax credit In the former, the taxes are deducted from the gross income in computing the net income, while in the latter, the taxes are deducted from Philippine income tax itself. In the former, all taxes as a general rule, are allowed as deductions with some exemptions (enumerated above), while in the latter, only foreign income taxes may be claimed as credits against Philippine income tax.

Equitable doctrine of tax benefit This doctrine holds that a recovery of bad debt previously deducted from gross income constitutes taxable income if in the year the account was written off, the deduction resulted in a tax benefit, that is, in the reduction of taxable income of the taxpayer.

AND

CHARITABLE

OTHER CONTRIBUTIONS

Kinds of Charitable Contributions 1. Ordinary or those which are subject to limitations as to the amount deductible from gross income. Special or those which are deductible in full from gross income.

2.

Requisite for deductibility of charitable contributions 1. The contribution must actually be paid or made to the Philippine government or any political subdivision thereof or to any of the domestic corporations or associations specified by the NIRC. No part of the net income of the beneficiary must inure to the benefit of any private stockholder or individual. It must be made within the taxable year. It must not exceed 10% in the case of an individual and 5% in the case of a corporation of the taxpayers taxable income (except where the donation is deductible in full) to be determined without the benefit of the contribution. It must be evidenced by adequate records or receipts.

2.

3. 4.

5.

Contributions deductible in full 1. Donations to the Philippine government or to any of its political subdivisions according to a national priority plan determined by NEDA. Donations to foreign institutions or international organizations which are fully deductible in pursuance of or in compliance with agreements, treaties or commitments entered into by the Philippines or in pursuance of special laws. Donation to accredited non-governmental organization.

2.

3.

Non-government organization It means a non-profit domestic corporation: 1. Organized and operated exclusively for scientific, research, educational, character-building and youth and sports development, health, social welfare, cultural or charitable purposes, or a combination thereof, no part of the net income of which inures to the benefit of any private individual. Utilizes the contribution directly for the active conduct of the activities constituting the purpose or function for which it is organized and operated not later than the 15 th day of the their month after the close of the accredited NGOs taxable year in which the contribution were received. Administrative expense shall, in no case, exceed thirty percent (30%) of the total expenses. The assets, in the event of dissolution, would be distributed to another non-profit domestic corporation organized for similar purpose, or to the State for public purpose, or would be distributed by a court to another organization.

2.

3.

4.

Utilization 1. Utilization means: Any amount in cash or kind (including administrative expenses) paid or utilized to accomplish one or more purposes for which the accredited non-governmental organization was created or organized.

2.

Any amount paid to acquire an asset used (or held for use) directly in carrying out one or more purposes for which the accredited nongovernmental organization was created or organized.

Proof of deductions Contributions or gifts shall be allowable as deductions only if verified under the rules and regulations prescribed by the Secretary of Finance.

Gains and losses from short sales, etc. Gains or losses from short sales of property shall be considered as gains or loses from sales or exchanges of capital assets. Gains or losses attributable to the failure to exercise privileges or options to buy or sell property shall be considered as capital gains or losses.

General rule on the recognition of gain or loss upon the sale or exchange of property The general rule is that the entire amount of the gain or loss, as the case may be, shall be recognized, i.e. taxable or deductible.

Exceptions 1. Transactions where gains and losses are not recognized a. Exchange of property where the property received is not substantially different from the property disposed of. [Section 140, Reg. No. 2] Exchange of property solely in kind in pursuance of corporate mergers and consolidations. Exchange by a person of his property for stocks in a corporation as a result of which said person, alone or together with others not exceeding four persons, gains control of said corporation.

b.

c.

2.

Transactions where gain is recognized but not the loss a. b. Transactions between related taxpayers Illegal transactions

c. Exchanges of property, not solely in kind, in pursuance of corporate mergers and consolidations

Losses from wash sales of stock or securities No deduction for loss shall be allowed for wash sales unless the claim is made by a dealer in stock or securities and with respect to a transaction made in the ordinary course of the business of such dealer.

Wash sale A wash sale occurs where it appears that within a period beginning thirty (30) days before the date of the sale or disposition of shares of stock or securities and ending thirty (30) days after such date, the taxpayer has acquired (by purchase or exchange) or has entered into a contract or option to so acquire, substantially identical stock or securities.

You might also like

- INCOME TAX REVIEWER FOR MARIANO MARCOS STATE UNIVERSITYDocument50 pagesINCOME TAX REVIEWER FOR MARIANO MARCOS STATE UNIVERSITYMay Encarnina P. Gaoiran100% (5)

- Lecture 3 - Income Taxation (Corporate)Document8 pagesLecture 3 - Income Taxation (Corporate)Lovenia Magpatoc50% (2)

- Energy Utility BillDocument3 pagesEnergy Utility Billbob100% (1)

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Taxation ReviewerDocument19 pagesTaxation ReviewerjwualferosNo ratings yet

- Spelling HardDocument11 pagesSpelling Hardmhilet_chiNo ratings yet

- Lecture Notes Allowable DeductionsDocument51 pagesLecture Notes Allowable DeductionsRaymond MedinaNo ratings yet

- Legal Medicine NewDocument19 pagesLegal Medicine Newmhilet_chiNo ratings yet

- Income Tax Principles and Types in the PhilippinesDocument36 pagesIncome Tax Principles and Types in the PhilippinesPascua PeejayNo ratings yet

- Income Tax Rates & ClassificationsDocument216 pagesIncome Tax Rates & ClassificationsalicorpanaoNo ratings yet

- Basic Overview of Corporate Income Taxation in the PhilippinesDocument7 pagesBasic Overview of Corporate Income Taxation in the PhilippinesMae Katherine Grande Lumbria100% (1)

- I. Basic Concepts in Income TaxationDocument79 pagesI. Basic Concepts in Income Taxationcmv mendoza100% (1)

- Gross vs Net Income Tax GuideDocument22 pagesGross vs Net Income Tax GuideJayson Pajunar ArevaloNo ratings yet

- Trust and CommitmentDocument11 pagesTrust and CommitmentdjumekenziNo ratings yet

- #15 Notes in Allowable DeductionsDocument15 pages#15 Notes in Allowable DeductionsJaypee Palcis100% (1)

- Taxation Law DoctrinesDocument5 pagesTaxation Law DoctrinesĽeońard ŮšitaNo ratings yet

- DO 193 s2016Document13 pagesDO 193 s2016khraieric16No ratings yet

- Dealings in Property: Lesson 12Document18 pagesDealings in Property: Lesson 12lcNo ratings yet

- Maharashtra Blacklisted Engineering CollegesDocument3 pagesMaharashtra Blacklisted Engineering CollegesAICTENo ratings yet

- Product Portfolio ManagementDocument4 pagesProduct Portfolio ManagementAna Maria Spasovska100% (1)

- Articles of Partnership General PartnershipDocument2 pagesArticles of Partnership General Partnershipkarizzadiemsen100% (1)

- Bosch Quality CertificationDocument7 pagesBosch Quality CertificationMoidu ThavottNo ratings yet

- Corporate Income Tax GuideDocument46 pagesCorporate Income Tax GuideCanapi AmerahNo ratings yet

- Essential Farm Tools and Their UsesDocument13 pagesEssential Farm Tools and Their Usesmhilet_chi78% (9)

- Taxation of Income: Exclusions and InclusionsDocument11 pagesTaxation of Income: Exclusions and Inclusionsmary jhoyNo ratings yet

- Tesco CaseDocument17 pagesTesco CaseShaina SinghNo ratings yet

- Etching and Intaglio ToolsDocument4 pagesEtching and Intaglio Toolsmhilet_chi100% (1)

- 04 CorporationsDocument76 pages04 Corporationsjustine reine cornicoNo ratings yet

- Income Taxation Mamalateo NotesDocument19 pagesIncome Taxation Mamalateo Notesclandestine2684100% (1)

- DeductionsDocument7 pagesDeductionsConcerned CitizenNo ratings yet

- CHAPTER 13 A - Regular Allowable Itemized DeductionsDocument4 pagesCHAPTER 13 A - Regular Allowable Itemized DeductionsDeviane CalabriaNo ratings yet

- Bad Debt & Depreciation Tax TreatmentDocument5 pagesBad Debt & Depreciation Tax TreatmentSeanmigue TomaroyNo ratings yet

- tAX LESSON B .Document10 pagestAX LESSON B .intramuramazingNo ratings yet

- Reviewer Strat TaxDocument11 pagesReviewer Strat Taxregine bacabagNo ratings yet

- National TaxationDocument18 pagesNational TaxationShiela Joy CorpuzNo ratings yet

- The Philippines Income TaxDocument8 pagesThe Philippines Income TaxmendozaivanrichmondNo ratings yet

- Taxes That Affect ForeignersDocument4 pagesTaxes That Affect ForeignersasiajcvrNo ratings yet

- Types of Organizations Revised Corporation CodeDocument11 pagesTypes of Organizations Revised Corporation CodeNadie LrdNo ratings yet

- Instructions For Form 4548 2011 Michigan Business Tax (MBT) Quarterly ReturnDocument4 pagesInstructions For Form 4548 2011 Michigan Business Tax (MBT) Quarterly ReturnjoshisanjeevNo ratings yet

- Chapter 3-A - Income IAE TaxDocument16 pagesChapter 3-A - Income IAE TaxJEFFERSON CUTENo ratings yet

- Income Tax Chapter 4Document7 pagesIncome Tax Chapter 4Anton LauretaNo ratings yet

- Tax Discussion by Atty Saddedin Macarambon 1Document9 pagesTax Discussion by Atty Saddedin Macarambon 1MICHAEL VINCENT CONTAOI ROBASNo ratings yet

- Gross Income NotesDocument20 pagesGross Income NotesCheng OlayvarNo ratings yet

- Final Income Taxation Lesson 5: Passive Income and Withholding Tax RatesDocument28 pagesFinal Income Taxation Lesson 5: Passive Income and Withholding Tax Rateslc50% (4)

- Itemized Deductions & Self-Test ExercisesDocument29 pagesItemized Deductions & Self-Test ExercisesRouve BontuyanNo ratings yet

- Tax 1 ReviewerDocument7 pagesTax 1 ReviewerRaymond SangalangNo ratings yet

- Income and Withholding TaxesDocument67 pagesIncome and Withholding TaxesPo EllaNo ratings yet

- Acc212 Handout:: Midlands State University Department of AccountingDocument23 pagesAcc212 Handout:: Midlands State University Department of AccountingPhebieon MukwenhaNo ratings yet

- Taxation Review: Module Ii - Income TaxDocument51 pagesTaxation Review: Module Ii - Income TaxCanapi AmerahNo ratings yet

- Princples of Taxation: Janet G. Taojo-Matuguinas, Cpa, Mba PresenterDocument43 pagesPrincples of Taxation: Janet G. Taojo-Matuguinas, Cpa, Mba PresenterMae NamocNo ratings yet

- Chapter 4 Commercial and Industrial Activities - Part 2Document37 pagesChapter 4 Commercial and Industrial Activities - Part 2sherygafaarNo ratings yet

- 3 Income Tax ConceptsDocument37 pages3 Income Tax ConceptsRommel Espinocilla Jr.No ratings yet

- LGU Tax Exemption Powers vs Real Property TaxDocument4 pagesLGU Tax Exemption Powers vs Real Property TaxNikki Beverly G. BacaleNo ratings yet

- Income Taxation I G Income Tax: N EneralDocument46 pagesIncome Taxation I G Income Tax: N Eneralresu8No ratings yet

- Income TaxDocument45 pagesIncome Taxresu8No ratings yet

- Module 1: Income Tax PrinciplesDocument18 pagesModule 1: Income Tax PrinciplesJun MagallonNo ratings yet

- C Corporations Tax Return and DeductionsDocument9 pagesC Corporations Tax Return and DeductionssheldonNo ratings yet

- View in Online Reader: Text Size +-RecommendDocument7 pagesView in Online Reader: Text Size +-RecommendRhea Mae AmitNo ratings yet

- Situs of Taxation Literally Means Place of TaxationDocument19 pagesSitus of Taxation Literally Means Place of TaxationRowie Ann Arista SiribanNo ratings yet

- Summary of You Tube VideoDocument2 pagesSummary of You Tube VideoErylle Jeen VivasNo ratings yet

- Deductibility of Interest ExpenseDocument2 pagesDeductibility of Interest ExpenseFerjeanie BernandinoNo ratings yet

- Fisher v. Trinidad (43 Phil 973) : Stock: Income TaxationDocument48 pagesFisher v. Trinidad (43 Phil 973) : Stock: Income TaxationCassey Koi Farm0% (1)

- Business Tax Laws (Phils)Document15 pagesBusiness Tax Laws (Phils)Jean TanNo ratings yet

- Taxation Methods and Income RecognitionDocument7 pagesTaxation Methods and Income RecognitionJenelyn Alingasa LadaranNo ratings yet

- TaxationDocument3 pagesTaxationErwin MacaspacNo ratings yet

- TAXNDocument22 pagesTAXNMonica MonicaNo ratings yet

- Sir Lectures Final TaxDocument12 pagesSir Lectures Final TaxCrystal KateNo ratings yet

- Folk Dances Group 4Document6 pagesFolk Dances Group 4mhilet_chiNo ratings yet

- 06 Respiratory 8 SlidesDocument19 pages06 Respiratory 8 Slidesmhilet_chiNo ratings yet

- Partnership Quiz Jan 30Document2 pagesPartnership Quiz Jan 30mhilet_chiNo ratings yet

- IRR of RA 10754 Expanding Benefits for PWDsDocument8 pagesIRR of RA 10754 Expanding Benefits for PWDsmhilet_chiNo ratings yet

- Partnership Quiz1Document1 pagePartnership Quiz1mhilet_chiNo ratings yet

- Authorization Winding UpDocument1 pageAuthorization Winding Upmhilet_chiNo ratings yet

- Geography of AsiaDocument11 pagesGeography of Asiamhilet_chiNo ratings yet

- 06 Respiratory 8 SlidesDocument19 pages06 Respiratory 8 Slidesmhilet_chiNo ratings yet

- Taxation PresentationDocument10 pagesTaxation Presentationmhilet_chiNo ratings yet

- CPA BOA ACCREDITATION REQUIREMENTS FOR TEACHINGDocument1 pageCPA BOA ACCREDITATION REQUIREMENTS FOR TEACHINGmhilet_chiNo ratings yet

- Dual CitizenDocument1 pageDual Citizenmhilet_chiNo ratings yet

- Tax o Foreign TransactionsDocument2 pagesTax o Foreign Transactionsmhilet_chi100% (1)

- Psychological IncapacityDocument7 pagesPsychological Incapacitymhilet_chiNo ratings yet

- Glittering Points That Downward Thrust. Sparkling Swords and Spears That Never RustDocument2 pagesGlittering Points That Downward Thrust. Sparkling Swords and Spears That Never Rustmhilet_chiNo ratings yet

- Extradition CasesDocument25 pagesExtradition Casesmhilet_chiNo ratings yet

- Editorial SportDocument4 pagesEditorial Sportmhilet_chiNo ratings yet

- Tax Table of TaxationDocument3 pagesTax Table of Taxationmhilet_chiNo ratings yet

- Modes of AppealDocument1 pageModes of Appealmhilet_chiNo ratings yet

- 2007 Tax BarDocument6 pages2007 Tax Barmhilet_chiNo ratings yet

- Bangs A MoroDocument3 pagesBangs A Moromhilet_chiNo ratings yet

- Other Freedom of Expression CasesDocument3 pagesOther Freedom of Expression Casesmhilet_chiNo ratings yet

- People Vs QuinanolaDocument16 pagesPeople Vs Quinanolamhilet_chiNo ratings yet

- Manual of Regulations For Private Higher EducationDocument115 pagesManual of Regulations For Private Higher EducationLyceum Lawlibrary50% (2)

- Toyota CaseDocument25 pagesToyota Casemhilet_chiNo ratings yet

- Team Patay Decision (Diocese of Bacolod v. Comelec) - Leonen PonenciaDocument71 pagesTeam Patay Decision (Diocese of Bacolod v. Comelec) - Leonen Ponenciamhilet_chiNo ratings yet

- Hrmassignment 1Document4 pagesHrmassignment 1Nazmi Demon LordNo ratings yet

- Audi AnswerrDocument10 pagesAudi AnswerrHend MoneimNo ratings yet

- Disaster Recovery Using VMware Vsphere Replication and Vcenter Site Recovery Manager Sample ChapterDocument41 pagesDisaster Recovery Using VMware Vsphere Replication and Vcenter Site Recovery Manager Sample ChapterPackt PublishingNo ratings yet

- Lean Webinar Series:: Metrics-Based Process MappingDocument58 pagesLean Webinar Series:: Metrics-Based Process MappingRicardo Fernando DenoniNo ratings yet

- Human Resource Department: Subject: General PolicyDocument19 pagesHuman Resource Department: Subject: General PolicyAhmad HassanNo ratings yet

- Strategic Change ManagementDocument38 pagesStrategic Change ManagementFaisel MohamedNo ratings yet

- PDF Created With Pdffactory Pro Trial Version: Sps1000 Schematic Ac - inDocument1 pagePDF Created With Pdffactory Pro Trial Version: Sps1000 Schematic Ac - inTiago RechNo ratings yet

- MIS AssignmentDocument16 pagesMIS AssignmentUsman Tariq100% (1)

- Exploring The Continuum of Social and Financial Returns: Kathy BrozekDocument11 pagesExploring The Continuum of Social and Financial Returns: Kathy BrozekScott OrnNo ratings yet

- How to Become a Successful EntrepreneurDocument43 pagesHow to Become a Successful EntrepreneurKyla Francine Tiglao100% (1)

- FNVBDocument26 pagesFNVBpatrick hughesNo ratings yet

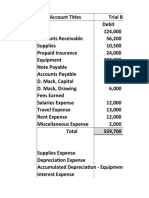

- Trial Balance Accounting RecordsDocument8 pagesTrial Balance Accounting RecordsKevin Espiritu100% (1)

- Gas Portfolio and Transport OptimizationDocument10 pagesGas Portfolio and Transport OptimizationDaplet ChrisNo ratings yet

- P - Issn: 2503-4413 E - Issn: 2654-5837, Hal 78 - 85 Studi Brand Positioning Toko Kopi Kekinian Di IndonesiaDocument8 pagesP - Issn: 2503-4413 E - Issn: 2654-5837, Hal 78 - 85 Studi Brand Positioning Toko Kopi Kekinian Di IndonesiaNurul SyafitriiNo ratings yet

- Guidelines for Granting IT Course PermitsDocument20 pagesGuidelines for Granting IT Course Permitsanislinek15No ratings yet

- History of JollibeeDocument8 pagesHistory of JollibeeMailene Almeyda CaparrosoNo ratings yet

- Contact ListDocument4 pagesContact ListNandika RupasingheNo ratings yet

- IT project scope management, requirements collection challenges, defining scope statementDocument2 pagesIT project scope management, requirements collection challenges, defining scope statementYokaiCONo ratings yet

- The Accounting ReviewDocument34 pagesThe Accounting ReviewShahibuddin JuddahNo ratings yet

- Construction Management: ENCE4331: Cost and Price ExamplesDocument7 pagesConstruction Management: ENCE4331: Cost and Price ExamplesTania MassadNo ratings yet

- 5834 GETCO 15-31-53 STC 75 2020 WEB Tender Upkeep Switch Yard 66kV Hansalpur Group SSDocument92 pages5834 GETCO 15-31-53 STC 75 2020 WEB Tender Upkeep Switch Yard 66kV Hansalpur Group SSKhozema GoodluckNo ratings yet

- Catalog Labu ScaffoldDocument4 pagesCatalog Labu ScaffoldLabu ScaffoldNo ratings yet

- ME - Assignment 2 - Shivakumar SRDocument2 pagesME - Assignment 2 - Shivakumar SRNagendra PattiNo ratings yet