Professional Documents

Culture Documents

Fundamental Analysis of Nepalese Stock Exchange Return Using Fama French Three Factor Model

Uploaded by

Dipesh KarkiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fundamental Analysis of Nepalese Stock Exchange Return Using Fama French Three Factor Model

Uploaded by

Dipesh KarkiCopyright:

Available Formats

Fundamental Analysis of Nepalese Stock Exchange Return using Fama - French Three Factor Model

1. Introduction: 1.1 Background After the adoption of economic liberalization in the early 90s, Nepalese economy has witnessed sharp growth in both financial institution and service sectors. Further, rise of Initial Public Offering and simultaneous increase in trading in both volume and transaction at secondary market, has substantially expanded the capital market with current total market capitalization worth approximately Rs. 503,500 million. Today there are in total 228 companies listed in Nepal Stock Exchange that encompasses several industries viz- Commercial Banks, Finance Companies, Development Bank, Hotels, Hydropower and Manufacturing Sector. Further 50 different brokers are involved in day to day trading in stock exchange. In this context Nepalese Stock market has become a source for large amount of data that can be test bed for analyzing and verifying several established Portfolio Theories used in Fundamental Analysis of Capital Market. Besides the Nepalese stock market being characterized by mostly nave investors, lack of information and market inefficiency provides unique perspective for testing different financial models which hitherto has been performed only in developed market scenario. On this regard this study is an attempt to test and analyze Nepalese Stock Market using Fama-French Three Factor Model, determine its efficacy and relevancy in Nepalese context. Fama and French (1992), and to

1.2 Statement Of Problem i. Does Nepalese Stock Exchange return can be explained using established portfolio theories ii. Can Fama-French Model be applicable in Nepalese Context iii. Whether Fundamental Analysis using three-factor model is more pertinent for Nepalese Stock Market

1.3 Objective Fama French Model first devised by Eugene F.Fama and Kenneth R. French , Fama and French (1992) ,explains the return in stock market based on three risk factors viz- an overall market, book to market, and size/They found that the new model was superior in explaining the average stock return in US market than conventional Capital Asset Pricing Model. Outside of US however the model has been sparsely tested. In India studies, Connor and Sehgal (2001) , have shown that empirical result of three factor model appears to hold. Besides, a strong evidence of its relevancy in global context has been established in recent study which underlies the significance of local factors. In Nepalese context, since the market is still fledgling there has been only one reported study of its return done using the three factor model , Rana (2011). Further as mutual funds have now entered the market it is important for portfolio managers to evaluate the stock using latest and innovative model.

Thus the major objectives of this study are: i. ii. iii. iv. v. To Test the Fama-French Model in return of Nepalese Stock Exchange To Verify whether Nepalese stock return corresponds to established portfolio theories To attempt to explain the variation and risk factor associated with the return To address the seasonality issue in time series stock return To carry out fundamental analysis of stock return using three factor model

2. Literature Review Capital Asset Pricing Model by Sharpe (1964), Lintner (1965) and Mossin (1968) provides a simple yet powerful framework to explain the relationship between expected return on an asset and various components of risk associated with it. The theory builds upon mean variance optimization of portfolio first suggested by Markowitz (1952) and explains that return premium of any financial asset over risk free return is directly proportional to the systematic or non-diversifiable risk of given asset. The quantum of which is measured by evaluating covariance of asset return with overall market portfolio. The Sharpe-Lintner-Mossin CAPM equation can be mathematically represented as: ( ) [ ( = Cov( where, ( ) Expected Return on any Asset ) ) ] .......................i) ............................. ii)

= Risk Free Rate ( ) = Expected Return on Market Portfolio = Asset's market beta that measures sensitivity of asset's return to market return.

But despite its popularity its empirical validity was questioned since early stages. For instance Miller and Scholes (1972) highlighted the statistical errors associated in using individual securities for testing CAPM. Later the problem was overcome in study by Black, Jensen and Scholes (1972) by constructing portfolio of all the securities listed in Newyork stock exchange. Thus using portfolios rather than individual securities greatly increased the precision of beta. However the CAPM model relied too much in unrealistic assumption thus Roll (1977) claimed that CAPM cannot be validly tested unless true market portfolio is known. According to him following two scenarios may arise when resorting to market proxy while evaluating CAPM:

i)

Market proxy might be mean variance efficient when in actuality the true market portfolio may be otherwise.

ii)

Market proxy may be mean variance inefficient when in actuality the true market is efficient.

Later on Fama and French (1992) showed that CAPM failed to explain the cross section of average return in US stock from 1962- 1990. According to them the risk premium of security is influenced by multifactor instead of single market factor as proposed by CAPM. These factors includes size, value of the firm and market risk. Thus exposure to market, size and value acts as proxy for sensitivity to risk factors in the return. This assertion corroborated with Banz (1981) which had indicated that size effect of stock as statistically significant in explaining return alongside its betas. The study had shown that over period of 1936-1977 on an average return from holding small stocks was large. Similarly Rosenberg, Reid and Lanstein (1985) had shown that firms with high ratios of book value to the market value of common equity have higher returns than those with low book to market ratios. This was supported by Davis (1994) that found the relationship between average return and BE/ME in US stocks extends back till 1941. Fama and French (1995) provided an economic foundation for the empirical relationship between average stock return and size, and average stock return and book-to-market equity. The study explained that the size and BE/ME proxy is directly correlated to profitability and hence were able to better explain cross-section of average return as described in Fama and French (1993). Mathematically the Fama-French three factor model can be represented by equation below:

( ) where,

[ (

.......................iii)

E(SMB): Small Minus Big represents risk premium associated with size factor. E(HML): High Minus Low represents risk premium associated with value factor : sensitivity to size : sensitivity to value

Several studies across various international market has since been carried out that have either supported or contradicted the three factor model. For instance Aksu and Onder (2003) showed that size and value effect were proxy for firm specific risk in Istanbul Stock Exchange. Gaunt(2004) while studying the application of three factor model in Australian market found beta to be less than one and HML factor playing significant role in

asset pricing. Also Ajili (2005) suggests three factor model being superior to CAPM in modeling stock returns in French market. Similarly Connor and Sehgal (2001) found that all three Fama-French factors, market, size and value have pervasive returns in Indian Stock market. Bahl (2006) on the basis of adjusted coefficient of determination ( ) confirmed the efficacy of three factor model over CAPM in explaining common variation in for three factor model being

stock returns in Indian Stock Exchange. The study showed that the adjusted

87% meanwhile CAPM being just 76%. Taneja (2010) indicated that though the efficiency of three factor model as being good predictor cannot be ruled out in Indian context , there appears high degree of correlation between the size and value factor returns. In Nepal the capital market began back to 1936 when the shares of Biratnagar Jute Mills Ltd was floated. As outlined in brief history of Nepalese capital market in Gurung (2004) , the Security Exchange Centre was established for promoting growth in capital market. It operated under the Security Exchange Act that was enforced in 1984. In 1993 after the establishment of multi-party democratic system the SEC was restructured and policy level was divided into two distinct entities Security Board Of Nepal (SEBON) and Nepal Stock Exchange (NEPSE). Since January 13, 1994 NEPSE began its trading floor using "open out-cry" system for transactions. Thus NEPSE being an emerging market having existed for only over one and half decade, there hasn't been much study regarding the risk return relationship among its trade. Dangol (2009) shows that Nepalese stock market is not efficient in weak form. Besides Dangol (2008) indicates that swing in NEPSE is highly correlated with political events and hence there is significant linkage between common stock returns and political uncertainty. Further study by Dangol (2009) shows that capital appreciation is principal motivation for Nepsalese in general to invest in stock market. Meanwhile according to (Chhatkuli 2010) while analyzing NEPSE in period of 1998-2008, CAPM failed to predict the relationship between risk and return in Nepalese market. Recently the study by Rana (2011) shows that though the firm size does not explain the common stock return in context of Nepalese market , the role of book-to-market equity and stock beta however appears significant. Thus indicating the relevancy of three factor model in Nepalese context.

3. Research Methodology

The study type employed is correlation quantitative approach Walliman (2001) and Clarke (2005), which attempts to explore and investigate possible relationship of Nepalese stock exchange with market return, value factors and size factor. 3.1 Method of Data Collection Documentary method of data collection was employed for the study. All the documents containing the data pertaining to Nepalese Stock market from 2002 to 2012 , available in the official website of Nepalese Stock Exchange were collected. Meanwhile the risk free rate of return of the prevailing government treasury bill for the

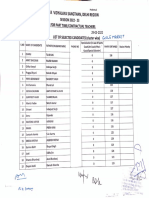

period of 2007 Aug to 2012 Jul available in the official website of central bank of Nepal (www.nrb.org.np) were also collected in excel sheet. Since the study requires both the stock returns and the risk free rate the study period was thus selected from August 2007 to Jul 2012. The list of enlisted companies in NEPSE for the study period were first enumerated from the website in an excel sheet. From among them A listed companies with their financial information regarding book value at the end of year were selected for the study. Following table shows the number of company that were in listed and number of company with available book value during each fiscal year for which study was carried out. Table 1 Data listed companies 2007-2008 No. of Enlisted Company No. of A listed company with available book value 142 67 2008-2009 159 71 2009-2010 176 62 2010-2011 207 116 2010-2012 216 116

The name of companies whose data were used in given fiscal years is listed in Appendix A. The data included were monthly stock returns of the company, yearly market capitalization, yearend book value of A listed companies and the risk free rate of return for the period of 60 months.

3.2 Data Validation For the purpose of data validation financial data such as book value was cross check against the annual reports of the five random companies viz- Nabil Bank Ltd, Nepal telecom, Laxmi Bank, SIddhartha Insurance and KIST bank. All the figures in annual report were matched with the data recorded from Nepal Stock Exchange. The validation showed consistent observation thus justifying the validity of data. The excerpt of annual report containing financial data is presented in Appendix B.

3.3 Construction of size and value portfolio: As required by the Fama -French Model the Factor portfolios based on Size and Value was constructed using following steps Bahl (2006): Step1: For each financial year ( July of year 't' to June of year 't+1' ) of given sample period the stocks was split into two group on the basis of size. - Small (S) and Big(B) . Where the small stocks comprises of those whose

10

market capitalization lie below the median value of included stock and Big comprise those which are above the median. Step2: For each financial year ( July of year 't' to June of year 't+1' ) of given sample period the stocks on the basis of value will be split into three BE/ME groups- Low(L), Medium (M), High (H) ; where L represents lower 30%, M represents middle 40% and H represents upper 30% of the value of BE/ME for the stocks of sample.

Step3: The six different portfolios- S/L, S/M, S/H, B/L, B/M, B/H was constructed by intersecting the stocks in two size and three value groups as computed from Step1 and Step3. The intersection of both size and value stocks for the period of Aug 2007 to Jul 2012 from the stock is shown in Appendix A . From among them three companies were randomly selected from each intersection set to construct sample portfolio of all six types. The selected stocks are listed in Appendix C.

Step4: Small Minus Big (SMB) factor which is meant to mimic the risk associated with the size was obtained by subtracting the average monthly return of three Big portfolios by average return of three small portfolios as given by following relation: SMB = (S/L +S/M +S/H)/3 - (B/L+B/M+B/H)/3 ................v)

Step 5: High Minus Low (HML) factor which is meant to mimic the risk associated with the value was be obtained by subtracting the average monthly return of two Low Portfolio from average return of two High portfolio as given by following relation: HML = (S/H + B/H) /2 - (S/L+B/L)/2 .......................vi)

4. DISCUSSION

4.1 Descriptive analysis After collecting the data the analysis was done using the methodology as stated in section 3.2 and 3.4. Number of stocks selected, the median market cap and the median BE/ME value for each financial year is as tabulated below in Table 2.

11

Table 2 Year No. of Companies Selected Aug 2007- Jul 2008 67 Rs. 379348000 Median Market Cap BE/ME 30th percentile 0.119772 70th percentile 0.41848

Aug 2008- Jul 2009

71

Rs. 504900000

0.148514

0.369939

Aug 2009- Jul 2010

62

Rs. 401700000

0.321645

0.56899

Aug 2010- Jul 2011

116

Rs. 314825040

0.526424

0.84915

Aug 2011- Jul 2012

116

Rs. 191867550

0.676166

1.057019

The result shows that the due to downward trend in share prices median market cap has been falling in last three years and similarly the book to market ratio has been rising thus indicating the undervalue of stocks in general. After determining the median parameters the stocks in each year were independently assorted to intersection of six different portfolio of S/L, S/M ,S/H , B/L, B/M, B/H as shown in Appendix C (Panel a- Panel e).The intersection was done by running inner join query in MS-Excel the specimen of which is given in Appendix I. From among them the top three from Big stocks and bottom three from small stocks were selected to compute the average SMB and HML parameter for each year. It should be noted that no company assorted into S/L category for period of 2007 Aug - 2011 Jul. The selected stocks for each portfolio is for different fiscal year is given in Appendix D. The preliminary descriptive analysis of all the portfolios done using SPSS 17.0 showed result tabulated in following table:

12

Table 3 (Average Monthly Return of various portfolio between Aug 2007 - Jul 2012) Portfolios B/L return B/M return B/H Return S/L Return S/M return S/H Return Rm-Rf SMB HML Mean -.0069542078 .0562649349 -.0188578160 .0004668171 .0121570987 -.0065826018 -.0104198298 -.0095727053 -.0073232543 Std. Deviation .09447987445 .27482881838 .13326598611 .02866563761 .10035026969 .08674339150 .08368890765 .11035779470 .08712751846 Skewness .141 4.534 2.526 3.853 2.564 .810 .591 -2.701 1.441 Kurtosis .956 23.253 11.382 27.450 9.787 3.250 .372 12.714 4.200

The above result shows that in the given period the average return of big portfolio is greater than that of small portfolio which is contrary to the Fama and French (1992). But this result is largely skewed by the presence of more than 5% positive return by B/M ratio. Besides the standard error of the B/M portfolio is even large thus it is difficult to draw any conclusion on this regard. Meanwhile in context of value stocks in both big and small group it appears that the average return increases from the Low to Medium and then fall in case of High return. This observation is again in contrary to Fama and French (1992) but is very much in line with Bahl (2006) that reports similar phenomena in context of Indian stocks. Table also shows that the average excess market return (Rm-Rf) is negative but the portfolio B/M , S/L and S/M has shown positive gains which indicates that the market is not efficient.. Further the Kurtosis value is significantly greater than zero which indicates that the returns are not normally distributed. Likewise the analysis of Pearson correlation as shown in Table 3 indicates significant negative correlation among Excess market return (Rm-Rf) and Size factor (SMB) meanwhile there is no correlation between HML with other two factors. This result is also very much similar to that of Bahl(2006). Further insignificant correlation between SMB and HML shows that the Size stocks are free of BE/ME effect and Value stock is immune from size. This finding is reflective of similar finding by Davis, Fama and French (1999). Table 4 Correlation between three factors Rm-Rf Rm-Rf Pearson Correlation Sig. (2-tailed) N SMB Pearson Correlation 60 -.488** 1 SMB -.488 .000 60 1

**

HML .027 .838 60 -.093

13

Sig. (2-tailed) N HML Pearson Correlation Sig. (2-tailed) N

.000 60 .027 .838 60 60 -.093 .478 60

.478 60 1

60

**. Correlation is significant at the 0.01 level (2-tailed).

4.2 Seasonality Check Technical analysis of US stocks especially shows the so called January effect where the small stocks outperform broader market as indicated by tax-loss selling hypothesis by Keim (1983). This implies a general practice by which investors sell stock at loss in order to offset gains from other profitable venture in order to decrease the incomet ax liability. Similarly Connor and Shegal (2001) indicates Diwali effect that correlates to selling stock during festivities. In this context it was pertinent to perform seasonality check in context of Nepalese stock as well. Generally there is intuition that in month of October during time of national festival Dashain there may be seasonality.

The table 4 shows the regression result of return in all the six portfolio and the three factor portfolio on dummy variable that is 1 in month off October and 0 in other month. Seasonality is indicated if the coefficient of b is significant. The result shows that none of the portfolio shows significant seasonality. Table 5 Seasonality Check with Dashain Festival ( Rt = a + b October (t)]

Portfolios B/L B/M B/H S/L S/M S/H Rm-Rf SMB HML

A -.006 .056 -.019 .001 .014 -.009 -.012 -.010 -.009

b -.008 .008 .004 -.003 -.028 .033 .016 .001 .021

t(a) -.492 1.489 -1.060 .185 1.065 -.798 -1.037 -.645 -.769

t(b) -.171 .058 .069 -.225 -.596 .820 .415 .024 .519

sig(a) .625 .142 .293 .854 .291 .428 .304 .522 .445

sig(b) .864 .954 .945 .823 .554 .416 .680 .981 .606

14

Table 6 Seasonality Check with July ( Rt = a + b July (t)]

a B/L B/M B/H S/L S/M S/H Rm-Rf SMB HML -.020 .066 -.016 .000 .012 -.007 -.020 -.010 .000

B .157 -.116 -.031 .008 .006 .006 .109 .002 -.092

t(a) -1.758 1.775 -.901 -.059 .852 -.603 -1.843 -.646 .028

t(b) 3.974 -.899 -.489 .622 .137 .157 2.978 .029 -2.336

sig(a) .084 .081 .371 .953 .398 .549 .071 .521 .978

sig(b) .000 .372 .626 .536 .892 .876 .004 .977 .023

Similarly in Nepal the fiscal year ends in month of July when all tax filing needs to be done. Thus the seasonality check was done by regressing the returns of portfolio on dummy variable of July as 1. The result is tabulated in Table 5 which shows that the seasonality thus exist among Excess Market Return (Rm-Rf) , B/L and HML portfolio. This indicates possible tax-loss hypothesis being applicable in Nepalese context as well.

4.4 Fitting the Fama French Model The study tested Fama-French Model using the standard multivariate linear regression model as explained in Campbell, Lo and Mackinlay (1997). The linear regression model is given by following relation ( where ) ............... vii)

: excess return on jth portfolio on time 't' : excess market return on jth portfolio on time 't' : return on size factor portfolio on time 't' : return on value factor portfolio : market, size and value factor exposure : intercept that indicates abnormal return on portfolio : mean zero asset specific return of portfolio 'j'

15

The hypothesized model thus illustrated above requires that

term be zero and

be independently and identically is a purely random or white

distributed as a normal distribution with zero mean and constant variance. Therefore

noise process , Gujrati (2007). Further by forcefully setting the factor exposure parameters to zero several different variant of Fama French model can be obtained. Appendix D provides the data used in fitting the regression model. 4.5 Checking Multicollinearity But before fitting the data with the model it is essential to check whether the data suffers from the multicollinearity or not whose presence will violate basic assumption of ordinary least square . As a result our least square calculation will produce over estimation. In order to test muticollinearity Variance Inflating Factor (VIF) was computed for all the independent variables which is illustrated in table 6. Since all the VIF are below 5 it is safe to conclude that the data doesn't suffer from multicollinearity Table 7 Multicollinearity test Factors VIF Rm-Rf 1.314 SMB 1.325 HML 1.009

4.6 Regression Model with Rm-Rf, SMB and HML as explanatory variables The fitted regression model as suggested by relation vii) is illustrated in table 7. Table 8 Excess return on portfolio Vs (Rm-Rf, SMB, HML) Dependent Portfolio B/L Factors (Constant) Rm-Rf SMB HML R Square: Adj. R square Durbin-Watson (Constant) Rm-Rf SMB HML R Square: B/H Adj. R square Coefficient -.010 .563 -.245 -.348 .546 .521 2.468 -.015 .303 -.364 1.089 .735 .721 -1.644 2.410 -3.809 10.294 .106 .019 .000 .000 t -1.166 4.825 -2.759 -3.538 p-value .249 .000 .008 .001

16

Durbin-Watson (Constant) Rm-Rf SMB HML R Square: Adj. R square B/M Durbin-Watson (Constant) Rm-Rf SMB HML R Square: Adj. R square S/M Durbin-Watson (Constant) SMB Rm-Rf HML R Square: Adj. R square S/H S/L Durbin-Watson No Estimates

1.906 0.028842 -0.3886 -2.07231 0.08312 0.614 0.593 1.361 .014 .186 .178 .294 .090 .042 1.490 -.003 .129 .276 .547 .346 .311 2.114 -.272 1.320 2.144 5.044 .786 .192 .036 .000 1.059 1.062 1.334 1.990 .294 .293 .188 .051 1.240551 -1.24255 -8.70273 0.315716 0.219944 0.21921 5.47E-12 0.753392

The detail of the analysis from the observation are as follows

4.6.1 Analysis of Significance of factor coefficient The findings shows that different portfolios demonstrate varying degree of response according to factors. For instance stock variation in both B/L and B/H portfolio can be best explained by all three market, size and value factors as they are significant p-value less than 0.05. Meanwhile B/M stock shows significant contribution in its variation by Size factor. On the other hand S/H portfolio can be best explained only by both Value factors and market returns. Likewise the returns of S/M portfolio cannot be explained by any factors at all. On the other hand S/L data wasn't estimated as there wasn't enough data. Further in none of the portfolio the constant term is significant indicating that there is no abnormal profit in any portfolio.

17

4.6.2 Test of Autocorrelation The table also shows the test of Autocorrelation using Durbin-Watson statistics, Durbin and Watson( 1951). It shows that portfolios B/H, B/L and S/H has DW value between two critical values of 1.5 < d < 2.5 and therefore we can assume that there is no first order linear auto-correlation in the data. But the portfolio S/M with d= 1.490 and portfolio B/M with d=1.361 indicates slight negative autocorrelation. This suggest possible misspecification of the model that can be due to omission of certain explanatory variable or inappropriate mathematical model.

4.6.3 Test of Heteroscesdasticity The ordinary least square assumes that the underlying data be homoscesdastic that is the variance of error term should be constant for all the observation. The absence of homoscesdastic condition will result in heteroscesdasticity which similar to multicollinearity and autocorrelation will cause the ordinary least square estimates unbiased and inefficient. The basic method for detecting heteroscesdasticty is the scatter plot between predicted value and the residuals. If pattern appears then it indicates presence of heteroscesdasticty. The five panels in Apeendix B

illustrates the scatter plot between the predicted value and the residuals for all five portfolios. All the plots so some inherent pattern thus justifying need for testing the hetersoscesdasticity. For this purpose Breusch-Pagan and Koenker test were employed with null hypothesis assumption of Homosecesdasticity. The test used in SPSS is given in Apendix C.

(H0: homoscesdasticity) Breusch_Pagan Val B/L B/M B/H S/M S/H 30.239 40.754 61.149 14.513 1.325 p-value .0000 .0000 .0000 0.0023 0.7232 Koenker test val 9.423 10.495 22.223 2.941 0.703 p-value .0242 0.0148 0.0001 0.4 0.8725

18

The result shows that except for S/H portfolio all other portfolio suffer from the significant heteroscesdasticity with p-value less than 0.05. This indicates that the result obtained by simple regression as tabulated in table 7 may not be accurate. Therefore heteroscesdasticity adjusted regression was performed using the methods HC0, HC1, HC2, HC3 and HC4 method by Hayes and Cai (2007) was used that produced result as tabulated in table 8.

Table 9 Heteroscedasticity-Consistent Regression Results B/L Portfolio Coeff Constant Rm-Rf SMB HML SE(HC) .0109 .1996 .2867 .1834 t -.9276 2.8235 -.8556 -1.8968 P>|t| .3576 .0066 .3959 .0630 R-Square SE(HC) .0113 .1587 .3856 .2285 t -1.3628 1.9093 -.9451 4.7663 P>|t| .1784 .0613 . 3487 .0000 R-Square SE(HC) .0258 .3260 .9165 .4941 t 1.1198 -1.1921 -2.2611 .1682 P>|t| .2676 .2382 .0277 .8670 R-Square SE(HC) .0104 .1445 .1874 .1670 t -.2516 1.9110 .6907 3.2747 P>|t| .8023 .0611 .4926 .0018 R-Square SE(HC) .0155 t .8930 P>|t| .3757 0.0904 0.3549 0.61640 0.7354 R-Square 0.5458

-.0101 .5635 -.2453 -.3478

B/H Portfolio Coeff Constant Rm-Rf SMB HML

-.0154 .3029 -.3644 1.0890

B/M Portfolio Coeff Constant Rm-Rf SMB HML

.0288 -.3886 -2.0723 .0831

S/H Portfolio Coeff Constant Rm-Rf SMB HML

-.0026 .2761 .1295 .5469

S/M portfolio Coeff Constant

.0138

19

Rm-Rf SMB HML

.1861 .1781 .2937

.1910 .2179 .2077

.9741 .8174 1.4140

.3342 .4171 .1629

The analysis shows that return on B/L portfolio variation can be explained by market return and value factor. In the mean time the size factor has been relegated to insignificant. Likewise B/H factor also is influenced only by market return and value parameters. Meanwhile market factors influence on S/H portfolio was removed in the adjustment. On the other hand B/M factor remained dependent on Size while S/M portfolio was again independent from all three factors. But it has to be noted that upon heteroscesdasity correction the coefficient of determination remain unchanged. Thus the finding is very much consistent with Rana (2011) with regard to significant influence of market and value stock in cross-sectional return of Nepalese stock.

4.6.4 Analysis of Coefficient Of Determination Coefficient of Determination is the most important measure for testing the goodness of fit . It computes the percentage of total variation of dependent variable that can be explained by the regression model. The analysis shows that depending on the portfolio the coefficient of determination varies considerably. From table 7 it is possible to discern that the B/H portfolio can be best explained by the three factor model as 73.54 % of its excess return variation can be explained by the model. Meanwhile only 9.04% of S/M portfolio can be explained by the Fama-French model. This variation in finding necessitates that all the cross section returns be regressed using single factor CAPM model as well as inclusion of other factors independently so as to identify which model best fits the stock returns. 4.7 CAPM analysis. Regressing the excess return on portfolio against excess market return using the following relation ( we obtained following result as shown in table 9 Table 10 Coeffieicnt of Determination in CAPM B/L (constant) p-value constant (Rm-Rf) -0.04 .704 .712 B/H -0.017 0.301 .568 B/M 0.062 0.078 .949 S/H -0.009 0.447 0.208 S/M 0.009 0.504 0.080 )

20

p-value Rm-Rf R square Adjusted R square

0.000 0.396 0.385

.005 0.127 0.122

0.025 0.083 0.068

0.125 0.04 0.024 0.004 -0.013

0.615

The result shows that the three portfolio (B/L, B/H and B/M) are consistent with CAPM model with significant market exposure. Meanwhile S/H and S/M model do not show significant market exposure. Comparing the result in table 9 with table 8 in trms of coefficient of determination it is apparent that the Fama-French model better explain the variation in portfolio returns than CAPM model. For instance in B/H portfolio the R2 in three factor model is 73.54 % while that of CAPM model is simply 12.7%. So the result shows the superiority of Fama-French model over the conventional CAPM model in explaining cross-sectional market return.

4.8 Fitting Fama-French Model with Excess Returns of Individual Stock

The discussion and findings in previous section shows that excess return on different cross-sectional portfolios in Nepalese Stock Exchange constructed by intersecting both value and size stocks is better explained by Fama-French Model than CAPM. So it is intuitive to test the ability of three factor model in explaining return of individual stock. For this purpose a hetersoscesdastic adjusted regression was carried out on excess returns of three stocks selected randomly using both Fama-French and CAPM model whose results are tabulated below Table 11 Fitting Fama-French and CAPM on individual stock Himalayan Bank Ltd Fama-French Result Coeff SE(HC) P>|t| CAPM result Coeff SE(HC) P>|t|

Constant RmRf SMB HML

.0043 1.3401 .0181 .1806

.0126 .2440 .1745 .1386

.7322 .0000 .9176 .1979

0.0028 1.335

0.0122 0.1663

0.8202 0.000

R-sq P-value

0.6380 .0000

0.628 0.000

Ace Development Bank

21

Coeff

SE(HC)

P>|t|

Coeff

SE(HC)

P>|t|

Constant RmRf SMB HML

.0065 1.2045 .1939 .7737

.0200 .2995 .3839 .3487

.7461 .0002 .6158 .0310

-.0023 1.1733

.0207 .9137 .30 .0004

R-sq P-value

0.5245 .0.0001

0.3531 0.0004

Chilime Hydropower Coeff Constant RmRf SMB HML SE(HC) .0111 .1484 .1676 .1752 P>|t| .4631 .0000 .6339 .5865 Coeff .0085 1.0054 SE(HC) .0104 .1314 P>|t| .4169 .0000

.0082 .9518 -.0803 .0959

R-sq P-value

0.5790 .0.0000

0.5681 0.0000

The result thus obtained shows that the excess return of all three stock selected randomly from period between 2007 August to 2012 July has significant market return factor whereas effect of size and value factor are negligible. But despite this three factor model better explained the return variance than the CAPM due to its superior R square value.

5. Limitation The study since being done for partial fulfillment of MBA requirement may not have been exhaustive enough for capturing the details of the Nepalese stock exchange. Besides , since Nepalese stock exchange is characterized by inefficiency and unavailability of data the research has not been able to analyze the data at same depth as it has been carried out in US or Indian Stock Market. For instance according to law and Right To Information Act 2007 it is required that all the publicly traded companies should timely release the annual report to public domain. However it was discovered that there was truancy in abiding the law strictly. Hence the research dependent only on data from those companies who have publicly made their data available. Further the risk free rate pertaining to return on Treasury Bill was also made available only from 2007 onwards by Nepal Rastra Bank. Hence the study pool was

22

restricted for period of 60 months from (2007 Aug - 2012 Jul). Meanwhile the methodology employed used capital gains as the sole returns and didn't account for dividend and capital gain taxes, thus analysis thus may not be able to represent the real picture of market while including those left out parameters. Besides the time limitation imposed for study also impose restricted opportunity for carrying out research freely. Further because of lack of similar study in Nepalese context there is no precedence to benchmark the findings.

6. Conclusion The study has checked the relevance of Fama-French three factor model in context of Nepalese stock exchange. Further study also compared and contrasted three factor model and CAPM in their ability to explain the return of cross sectional portfolio as well as individual stock. It can be concluded from the results based on coefficient of determination as discussed in section 4.6 7 shows the superiority of Fama French model over CAPM in explaining the variation in the return of portfolios. In all five portfolios (B/L, B/M, B/H, S/M, S/L) three factor model has better explanatory power. However the result also indicated that Excess market Return and Value factor are apparently more significant than Size factor in model fitting. The analysis also showed that the intercept term in the model was insignificant in all portfolios. Hence it can be concluded that none of the portfolio yields abnormal excess return over the market. Further as discussed in section 4.7, the randomly selected individual stock of companies however is significantly dependent only on excess Market returns. Thus it can be concluded that in case of individual stock unlike crosssectional portfolio CAPM model is more suitable due to its low computational complexity. Besides the study also checked for the Multicollinearity, Heteroscesdasticity and Autocorrelation for possible violation of ordinary least square assumption. The data showed significant heteroscesdasticity which was corrected to determine the three-factor model. Also the study tested for the seasonality in Nepalese stock return using the dummy regression model. The result showed that there is significant seasonality in month of July thus indicating possibility of tax loss effect in nepalese stock market. Study also showed that festive season of November there is no seasonality effect. Further the study has thoroughly enumerated the steps required to carry out the research and thus provides the methodological guidelines for similar studies to be undertaken in future. Thus it can be concluded that the research was able to fulfill all the objectives stated in the outset of the study.

23

7. Recommendation

The study is a prelude to further similar asset pricing portfolio model fitting in context of Nepalese Market. As shown by the results portfolio constructed using intersecting Small size and Middle value (S/M) couldn't be explained by both CAPM and three factor model. This situation thus opens possibility for factor analysis to identify possible underlying parameters that can better explain the variance in return than established model. Also the result showed that coefficient of determination for all the portfolios was not very high above (80%) using the Fama-French model. This indicates the possibility of other underlying factors such as momentum that may influence cross sectional portfolio return as suggested by Carhart (1997) .

Further since the study only included the portfolio constructed using common equity stock there is a possibility of future research of fitting three factor model in mixed portfolio that includes fixed income assets such as bond, debenture and preferential shares alongside common stock.

8. REFERENCES Ajili, S. (2005). The Capital Asset Pricing Model and the Three Factor Model of Fama and French Revisited in the Case of France, Working Paper. Aksu, M. H. & Onder, T (2003). The Size and Book to-Market Effects and their Role as Risk Proxies in the

Istanbul Stock Exchange, Koc University, Graduate School of Business, Working Paper 2000-2004.

Bahl, B (2006). Testing the Fama and French Three Factor Model and Its Variants for the Indian Stock working paper.

Returns,

Banz, R. W., (1981). The Relationship between Return and Market Value of Common Stock, Financial Economics, 9, pp.3-18.

Journal of

Cambell, J. Y., Lo, A. W., Mackinlay, A. C (1997). The Econometrics of Financial Markets, Princeton University Press, Princeton N.J , U.S.A Carhart, Mark M. (1997). On Persistence in Mutual Fund Performance. Journal of Finance 52 (1): 5782

Chhatkuli, K. (2010). An Examination of Relationship between Risk and Return in the Nepalese Stock Market, Journal of Meijo ,3, pp. 149-170

Clarke, R. J. (2005). Research Methodologies, HDR Seminar Series. Faculty of Commerce, University of Wollongong.

24

Connor, G & Sehgal, S(2001). Tests of the Fama and French Model in India, working paper, pp.I-19.

Decision,

30.2,

Davis, J (1994). The cross-section of realized stock returns: The pre-COMPUSTAT evidence, Journal of Finance 49, pp. 1579-1593. Durbin, J. & Watson , G.S. (1951). Testing for serial Correlation in Least- Squares Regression, Biometrika, 38, pp 159-171 Fama, E., F. & French, K. R. (1992). The Cross Section of Expected Stock Returns, The Journal of Finance, 47, pp.427-465.

Fama, E. F. & French, K. R.(1993). Common Risk Factors in the Return on Stocks and Bonds, Financial Economics, 33, pp.3-56.

Journal

of

Fama, E. F. & French, Kenneth, R. (1995). Size and Book to Market Factors in Earnings and Returns, The Journal of Finance, 50, pp.131-156.

Gaunt, C. (2004). Size and Book to Market Effects and The Fama French Three Factor Asset Pricing Model: Evidence from the Australian stock market, Accounting and Finance 44, pp. 27-44.

Gujarati, D. N.(2007). Basic Econometrics, Tata McGraw-Hill, pp. 817

Gurung, J. B. (2004). Growth and Performance of Securities Market in Nepal. The Journal of Nepalese Business Studies, pp. 85-92.

Hayes, A. F., & Cai, L. (2007). Using heteroscedasticity-consistent standard error estimators in OLS regression: An introduction and software implementation. Behavior Research Methods, 39, 709-722

Kiem, D. B. (1983). Size-Related Anomalies and Stock Return Seasonality: Further Empirical Evidence, Journal of Financial Economics 12.

Lintner, J. (1965). The Valuation of Risk Assets and The Selection of Risky Investments in Stock Portfolios and Capital Budgets, Review of Economics and Statistics 47, 13-37.

Mossin, J. (1968). Optimal Multiperiod Portfolio Policies, The Journal of Business,41, pp. 215-229

Rana, S. B. (2011). Stock Beta, Firm Size and Book-To-Market Effects On Cross-Section of Common Stock Returns In Nepal. The Lumbini Journal of Business and Economics 1.

25

Rosenberg, B., Kenneth R. & Ronald L. (1985). Persuasive Evidence of Market Inefficiency, Journal of Portfolio Management 11, pp. 9-17.

Sharpe, W. F. (1964). Capital Asset Prices: A theory of Market Equilibrium under Conditions of Risk, Journal of Finance 19, pp. 425-442.

Taneja, Y. P. (2010). Revisiting Fama French Three Factor Model in Indian Stock Market, The Journal of Business Perspective, 14, pp. 267 - 274. Walliman, N (2001). Your Research Project: A step by step guide for first time researcher. Sage Publication

26

APPENDIX A : Companies selected for different fiscal year with their Market cap and BE/ME value Panel A (Companies selected in 2007-2008 with their BE/ME ratio and Market Cap) S.No 1 Nabil Bank Ltd. 2 Nepal Investment Bank Ltd. 3 Standard Chartered Bank Ltd. 4 Himalayan Bank Ltd. 5 Nepal SBI Bank Limited 6 Everest Bank Ltd 7 Bank of Kathmandu 8 Nepal Industrial & Co.Bank 9 Machhachapuchhre Bank Ltd 10 Laxmi Bank Limited 11 Kumari Bank Ltd 12 Siddhartha Bank Limited 13 Uniliver Nepal Ltd. 14 Chilime Hydro power Co. 15 Nepal Insurance Co.Ltd. 16 Himalayan Gen.Insu. Co.Ltd. 17 United Insurance Co.(Nepal)Ltd. 18 Everest Insurance Co. Ltd. 19 Premier Insurance co. Ltd. 0.720333333 High 90000000 0.501443299 High 261900000 0.650793651 High 189000000 0.579710145 High 217350000 0.539285714 High 359444400 0.170691421 Middle 11396352000 big smal l smal l smal l smal l smal l 0.062197561 Low 3774870000 big 0.114835069 Low 9538560000 big 0.136069652 Middle 9045000000 big 0.106433064 Low 8147160000 big 0.096237154 Low 10393888945 big 0.108325545 Low 10169280000 big 0.069280851 Low 14173820550 big 0.093470626 Low 11838960000 big 0.118848445 Low 13198269201 big 0.13370202 Middle 24081057000 big 0.074980966 Low 46497547200 big 0.095661224 Low 29495927300 big 0.079317536 Low 36259980750 big Company Be/ME Value marketcap Size

27

20 Neco Insurance Co. 21 Alliance Insurance Co. Ltd. 22 Sagarmatha Insurance Co.Ltd 23 Nepal Life Insurance Co. Ltd. 24 Life Insurance Co. Nepal 25 26 NIDC Capital Markets Ltd. 27 National Finance Co. Ltd. 28 Nepal Share Markets Ltd. 29 Annapurna Finance Co.Ltd. 30 Kathmandu Finance Limited. 31 Peoples Finance Limited. 32 Citizen Investment Trust 33 34 Narayani Finance Limited 35 Ace Development Bank Ltd. 36 Gorkha Finance Ltd. 37 Universal Finance Ltd. 38 Maha Laxmi Finance Ltd. 39 Lalitpur Finance Ltd. 0.300628931 Middle 603703125 0.120167926 Middle 952800000 0.591908127 High 170418072 0.6514 High 60000000 0.131028037 Middle 2739200000 0.133297491 Middle 744360840 Nepal Aawas Bikas Beeta Co. Ltd. 0.229971388 Middle 493619820 0.516552511 High 262800000 0.185979971 Middle 587160000 0.663157895 High 108157500 0.110040816 Low 2963520000 0.080035928 Low 7214400000 0.190371429 Middle 1647258900 0.138190899 Middle 912262500 Nepal Finance and Saving Co.Ltd. 0.523936842 High 142500000 0.112895257 Low 2530000000 0.073505093 Low 4172500000 0.794117647 High 171666000 0.954025974 High 77000000 1.441550388 High 70950000

smal l smal l smal l big big smal l big big big big smal l big smal l

big big big smal l smal l big big

28

40 Goodwill Finance Co. Ltd. 41 Paschimanchal Finance Co. Ltd 42 Lumbini Finance Ltd. 43 Siddhartha Finance Limited 44 Alpic Everest Finance Co. Ltd. 45 United Finance Ltd 46 International Leasing & Fin. Co. 47 Shree Investment Finance Co. Ltd 48 Central Finance Co. Ltd. 49 Premier Finance Co. Ltd 50 Nava Durga Finance Co.Ltd. 51 Butwal Finance Ltd 52 Standard Finance Ltd. 53 Cosmic Mer.Bank & Fin. 54 KIST Merchant Bank. & Fin 55 World Merchant Bank Ltd 56 Birgunj Finance Ltd 57 Capital Mer. Bamk & Fin 58 Everest Finance Ltd, 59 Prudential Bittiya Sans 60 Royal Mer. Bank.& Fin 0.241121495 Middle 323204735 0.411963636 Middle 137500000 0.6294 High 40000000 0.096062992 Low 4089400000 0.088409091 Low 958320000 0.303030303 Middle 594000000 0.109749499 Low 1996000000 0.634230769 High 136592820 0.156956989 Middle 675180000 0.126792636 Middle 719016072 0.389248366 Middle 121025142 0.318306998 Middle 146721600 0.200337838 Middle 577200000 0.289454225 Middle 381696000 0.24047541 Middle 878400000 0.159144385 Middle 701250000 0.206958042 Middle 446160000 0.11615041 Low 698360000 0.433684211 High 171000000 0.547679181 High 148258000 0.194249605 Middle 316500000

smal l smal l smal l big big big big big big smal l smal l big big smal l big big big big smal l smal l smal

29

l 61 Guheyshwori Mer. Bank. Fin 62 Bhajuratna Fin.& Sav. Co. Ltd. 63 Development Credit Bank Ltd. 64 Nirdhan Utthan Bank Ltd. 65 Chhimek Vikash Bank Ltd. 66 Siddhartha Vikash Bank Ltd 67 Sanima Vikash Bank Ltd. 0.076 Low 4576000000 big 0.076327869 Low 1640480625 big 0.728037736 High 82150000 2.424552239 High 105956614 0.151192982 Middle 9468748800 big smal l smal l 1.150491803 High 42700000 0.139526012 Middle 533543245 big smal l

Panel B (Companies selected in 2008-2009 with their BE/ME ratio and Market Cap) S.No 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Company Nabil Bank Ltd. Nepal Investment Bank Ltd. Standard Chartered Bank Ltd. Himalayan Bank Ltd. Nepal SBI Bank Limited Everest Bank Ltd Bank of Kathmandu Nepal Industrial & Co.Bank Machhachapuchhre Bank Ltd Laxmi Bank Limited Kumari Bank Ltd Siddhartha Bank Limited NMB Bank Ltd. Uniliver Nepal Ltd. BE/ME 0.042957746 0.099236311 0.018266223 0.060488636 0.093315789 0.065291242 0.091754286 0.125230906 0.252351738 0.157749529 0.237914286 0.1228 0.226452906 0.028705882 Value Low Low Low Low Low Low Low Low Middle Middle Middle Low Middle Low MarketCap 47311945530 33410116332 56011180640 21405384000 16596102900 15683031000 14776963250 12841804800 6428599380 11661674382 7547904000 8280000000 5489000000 3912975000 Size Big Big Big Big Big Big Big Big Big Big Big Big Big Big

30

15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50

Chilime Hydro power Co. National LifeInsu. Co.Ltd. Himalayan Gen.Insu. Co.Ltd. United Insurance Co.(Nepal)Ltd. Everest Insurance Co. Ltd. Premier Insurance co. Ltd. Sagarmatha Insurance Co.Ltd Nepal Life Insurance Co. Ltd. Life Insurance Co. Nepal Lumbini General Insurance Nepal Finance and Saving Co.Ltd. NIDC Capital Markets Ltd. National Finance Co. Ltd. Nepal Share Markets Ltd. Annapurna Finance Co.Ltd. Kathmandu Finance Limited. Peoples Finance Limited. Citizen Investment Trust Nepal Aawas Bikas Beeta Co. Ltd. Narayani Finance Limited Gorkha Finance Ltd. Universal Finance Ltd. Maha Laxmi Finance Ltd. Goodwill Finance Co. Ltd. Paschimanchal Finance Co. Ltd Lumbini Finance Ltd. Siddhartha Finance Limited Alpic Everest Finance Co. Ltd. United Finance Ltd International Leasing & Fin. Co. Shree Investment Finance Co. Ltd Central Finance Co. Ltd. Premier Finance Co. Ltd Nava Durga Finance Co.Ltd. Butwal Finance Ltd Standard Finance Ltd.

0.085131173 0.211588629 0.845263158 0.384353741 0.864421053 0.722736842 0.464920635 0.105606178 0.214779412 0.763315217 0.41785 0.138708333 0.134685714 0.361702128 0.255618557 0.434570552 0.382035088 0.349328767 0.647102041 0.139041219 0.390844156 0.30880597 0.148513854 0.199296 0.475255973 0.300249554 0.083231571 0.463970894 0.146547912 0.289852459 0.156347607 0.261724138 0.310728863 0.293620352 0.121550388 0.361852941

Low Middle High High High High High Low Middle High High Low Low Middle Middle High High Middle High Low High Middle Low Middle High Middle Low High Low Middle Middle Middle Middle Middle Low Middle

9455616000 789360000 287280000 176400000 288562500 193800000 141372000 3885000000 1700000000 230000000 120000000 1215000000 1647258900 1218240000 2542176000 247434000 575995830 584000000 338637775 2384352972 183414000 201731640 1143360000 721713125 148258000 504900000 1167499446 375180000 1221000000 3952800000 800352000 500638049 162993600 232989428 852772560 493680000

Big Big Small Small Small Small Small Big Big Small Small Big Big Big Big Small Big Big Small Big Small Small Big Big Small Small Big Small Big Big Big Small Small Small Big Small

31

51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71

World Merchant Bank Ltd Birgunj Finance Ltd Capital Mer. Bamk & Fin Everest Finance Ltd, Prudential Bittiya Sans Royal Mer. Bank.& Fin IME Financial Institution Bhajuratna Fin.& Sav. Co. Ltd. Civil Merchant bittya sanstha ICFC Bittya Sanstha Ltd. Chhimek Vikash Bank Ltd. Business Dev. Bank Ltd. Siddhartha Vikash Bank Ltd Sanima Vikash Bank Ltd. Sahayogi Vikas Bank Gurkha Development Bank Swabalamwan Bikash Bank Ace Development Bank Ltd. Himchuli Bikash Bank Ltd. Excel Development Bank BiratLaxmi Development Bank

0.281487805 0.104613636 0.188235294 0.640939597 0.319 0.221272727 0.124675186 1.540533333 0.832133676 0.247327273 0.369939024 0.217830769 0.565573123 0.169272031 0.726538462 0.156973501 0.662650602 0.602040816 0.090653153 0.681033333 0.303147139

Middle Low Middle High Middle Middle Low High High Middle Middle Middle High Middle High Middle High High Low High Middle

295200000 1125937560 2543389040 59600000 440000000 738399200 2342431278 57750000 194500000 1811610350 101680000 1365000000 1631850000 3006720000 74880000 3441600000 366382667 2690354016 1598400000 60000000 367000000

Small Big Big Small Small Big Big Small Small Big Small Big Big Big Small Big Small Big Big Small Small

Panel C (Companies selected in 2009-2010 with their BE/ME ratio and Market Cap) S.No 1 2 3 4 5 6 7 8 9 10 11 Company Nabil Bank Ltd. Nepal Investment Bank Ltd. Standard Chartered Bank Ltd. Himalayan Bank Ltd. Nepal SBI Bank Limited Everest Bank Ltd Bank of Kathmandu Machhachapuchhre Bank Ltd Laxmi Bank Limited Kumari Bank Ltd Siddhartha Bank Limited be/me 0.13590604 0.229787234 0.099887161 0.314362745 0.262726046 0.161171779 0.245535714 0.407553191 0.21445614 0.292735043 0.280540541 Value Low Low Low Low Low Low Low Middle Low Low Low marketcap 23023408480 16969835745 45856277244 9924314400 12297712323 10412766000 9930119640 3707290440 6572045280 5549719032 6975817200 Size big big big big big big big big big big big

32

12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47

Siddhartha Bank Limited NMB Bank Ltd. DCBL Bank Ltd. KIST Bank Limited Uniliver Nepal Ltd. Chilime Hydro power Co. National LifeInsu. Co.Ltd. Himalayan Gen.Insu. Co.Ltd. Everest Insurance Co. Ltd. Premier Insurance co. Ltd. Sagarmatha Insurance Co.Ltd Nepal Life Insurance Co. Ltd. Life Insurance Co. Nepal Lumbini General Insurance Nepal Finance and Saving Co.Ltd. NIDC Capital Markets Ltd. Nepal Share Markets Ltd. Kathmandu Finance Limited. Peoples Finance Limited. Citizen Investment Trust Nepal Aawas Bikas Beeta Co. Ltd. Gorkha Finance Ltd. Universal Finance Ltd. Maha Laxmi Finance Ltd. Goodwill Finance Co. Ltd. Paschimanchal Finance Co. Ltd Lumbini Finance Ltd. Siddhartha Finance Limited United Finance Ltd Shree Investment Finance Co. Ltd Central Finance Co. Ltd. Premier Finance Co. Ltd Nava Durga Finance Co.Ltd. Butwal Finance Ltd Standard Finance Ltd. World Merchant Bank Ltd

0.231283784 0.378813559 0.434384615 0.513869347 0.338635816 0.344831971 0.255576132 0.569871795 0.508019169 0.88826087 0.52073955 0.124070588 0.200293103 0.617333333 0.666440678 0.388372093 0.921666667 0.968383234 0.51649789 0.483018868 0.531589147 1.286896552 0.714126984 0.481875 0.566933333 0.892694301 0.95484 0.249114286 0.46962585 0.363632479 0.417515528 0.419254237 0.678717949 0.201551282 0.71988764 0.929294118

Low Middle Middle Middle Middle Middle Low High Middle High Middle Low Low High High Middle High High Middle Middle Middle High High Middle Middle High High Low Middle Middle Middle Middle High Low High High

6975817200 4218499705 4319078400 3980000000 3819984300 8032896000 641520000 235872000 316912500 164220000 349290942 2550000000 1450000000 206250000 115050000 734713910 751680000 152103600 700761600 530000000 432420642 200512670 273136374 1209600000 259816725 126955400 281250000 608525400 1030837500 707616000 470046262 290199760 250062930 644537400 1783211298 309264000

big big big big big big big small small small small big big small small big big small big big big small small big small small small big big big big small small big big small

33

48 49 50 51 52 53 54 55 56 57 58 59 60 61 62

Birgunj Finance Ltd Prudential Bittiya Sans IME Financial Institution Civil Merchant bittya sanstha ICFC Bittya Sanstha Ltd. Nepal Industrial Dev. Corp. Chhimek Vikash Bank Ltd. Sanima Vikash Bank Ltd. Sahayogi Vikas Bank Gurkha Development Bank Swabalamwan Bikash Bank Himchuli Bikash Bank Ltd. Excel Development Bank BiratLaxmi Development Bank Subbecha Bikas Bank Ltd.

1.216397849 0.779722222 0.223362832 0.659895288 0.398272059 1.213083333 0.356469388 0.228189135 0.529923372 0.286997519 0.951898734 0.415809524 1.240483871 0.490397554 0.55045283

High High Low High Middle High Middle Low Middle Low High Middle High Middle Middle

781200000 144000000 1409450130 190860570 895923664 357454080 151900000 3816960000 156600000 2127840000 273998860 1381174200 248000000 179850000 267120000

big small big small big small small big small big small big small small small

Panel D (Companies selected in 2010-2011 with their BE/ME ratio and Market Cap) S.No 1 2 3 4 5 6 7 8 9 10 11 company Ace Development Bank Ltd. Alliance Insurance Co. Ltd. Alpic Everest Finance Co. Ltd. Annapurna Bikas Bank Annapurna Finance Co.Ltd. Api Finance Limtied Arun Valley Hydropower Dev Co Ltd Asian Life Insurance Company Bageshowori Dev.Bank Bank of Asia Nepal Limited Bank of Kathmandu BE/ME 0.780141844 1.184067797 0.685180723 0.974150943 0.516912442 1.138734177 0.250753425 0.60017341 0.504113924 0.550364583 0.307719298 Value Medium high Medium high low high low Medium low Medium low marketcap 1058151279 81401238 178682400 712320000 568713600 189600000 1156801800 622800000 156420000 3840000000 7749039990 Size Big Small Small Big Big Small Big Big Small Big Big

34

12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46

Birat Laxmi Devt Bank Birgunj Finance Ltd Business Development Bank Ltd Butwal Finance Ltd Capital Mer. Bamk & Fin Central Finance Co. Ltd. Chhimek Vikash Bank Ltd. Chilime Hydro power Co. Citizen Bank International Ltd Citizen Investment Trust Civil Merchant Bittiya Sanstha Ltd Clean Energy Devlopment Bank Ltd CRYSTAL FINANCE Ltd. DCBL Bank Ltd. Everest Bank Ltd Everest Insurance Co. Ltd. Excel Development Bank Ltd. Fewa Finance Co. Ltd. Gandaki Bikash Bank Ltd Global Bank Ltd Goodwill Finance Co. Ltd. Gorkha Finance Ltd. Gurkha Development Bank Himalayan Bank Ltd. Himalayan Gen.Insu. Co.Ltd. ICFC Bittiya Sanstha Ltd IME Financial Institution Imperial Financial Institution Ltd Infrastructure Development Bank Ltd International Leasing & Fin. Co. Kaski Finance Limited Kasthamandap Dev Bank Ltd Kathmandu Finance Limited. KIST Bank Ltd Kuber Merchant Bittiya Sanstha Ltd

0.958843537 0.607528736 0.737163121 1.078672566 0.747428571 0.426020761 0.512528736 0.496788321 0.496081081 0.658444444 0.701875 0.619161677 1.10965812 0.760915033 0.303464351 0.51316129 0.533892857 0.456441948 0.715789474 0.493971292 0.601878453 1.438411215 0.466447368 0.394417391 0.84985 0.680787879 0.481463415 0.973239437 1.059065421 0.496585366 0.677951807 1.140978261 0.892253521 0.673935484 0.846349206

high Medium Medium high Medium low low low low Medium Medium Medium high Medium low low Medium low Medium low Medium high low low high Medium low high high low Medium high high Medium Medium

243459636 730800000 972984600 253731443 1309097300 485154993 299497500 5997312000 4440000000 648000000 207848160 1816960000 81900000 2795772672 9085312262 313875000 224000000 728910000 342000000 3135000000 543000000 166608095 1203840000 11500000000 201600000 543483105 1180374912 89815000 856000000 1328400000 348600000 588800000 198306692 3100000000 189000000

Small Big Big Small Big Big Small Big Big Big Small Big Small Big Big Small Small Big Big Big Big Small Big Big Small Big Big Small Big Big Big Big Small Big Small

35

47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81

Kumari Bank Ltd Lalitpur Finance Ltd. Laxmi Bank Limited Lord Buddha Finance Limited Lumbini Bank Ltd. Lumbini Finance Ltd. Lumbini General Insurance Machhachapuchhre Bank Ltd Maha Laxmi Finance Ltd. Malika Devt Bank Ltd Miteri Development Bank Ltd. Nabil Bank Ltd. National Life Insurance Company Ltd Narayani National Finance Co. Ltd. Nava Durga Finance Co.Ltd. Neco Insurance Co. Nepal Aawas Bikas Beeta Co. Ltd. Nepal Bangladesh Bank Ltd. Nepal Credit & Com. Bank NDEP Development Bank Ltd. Nepal Doorsanchar Company Limited Nepal Express Finance Ltd Nepal Finance and Saving Co.Ltd. Nepal Industrial & Co.Bank Nepal Insurance Co.Ltd. Nepal Investment Bank Ltd. Nepal Life Insurance Co. Ltd. Nepal SBI Bank Limited Nepal Share Markets Ltd. Nerude Laghubitta Bikash Bank NIDC Capital Markets Ltd. Nilgiri Vikas Bank Ltd Nirdhan Utthan Bank Ltd. NMB Bank Ltd Paschimanchal Finance Co. Ltd

0.514022556 0.574474576 0.35 0.863013699 0.508778281 1.426029412 0.96671875 0.819473684 0.616222222 0.756928105 0.905625 0.211661342 0.34757485 0.881933333 0.8318 1.294642857 0.570462963 0.882230769 0.648023952 0.973275862 0.750190931 0.669119171 0.963529412 0.258788462 0.589046243 0.369592233 0.320565371 0.261256637 0.598505747 2.637368421 0.833693694 0.92380531 0.819744681 0.618717949 0.509490196

low Medium low high low high high Medium Medium Medium high low low high Medium high Medium high Medium high Medium Medium high low Medium low low low Medium high Medium high Medium Medium low

3627476580 554215615 3920167360 243090000 2210000000 198900000 160000000 2164171478 756000000 76500000 115568640 25400245472 440880000 979145400 189856050 129360000 362078424 2418505700 2322786300 633516600 62850000000 253910800 208397475 5930496000 355336464 12396404835 1698000000 10548898040 751680000 3895000 493112616 56500000 306602150 3900000000 201286800

Big Big Big Small Big Small Small Big Big Small Small Big Big Big Small Small Big Big Big Big Big Small Small Big Big Big Big Big Big Small Big Small Small Big Small

36

82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116

Pashupati Dev Bank Limited Peoples Finance Limited. Pokhara Finance Ltd. Prabhu Finance Company Ltd Premier Finance Co. Ltd Premier Insurance co. Ltd. Prime Commercial Bank Limited Prime Life Insurance Company Ltd Prudential Finance Company Ltd Purwanchal Grameen Bikash Bank Reliable Finance Ltd Resunga Bikas Bank Ltd. Royal Mer. Bank.& Fin Sagarmatha Insurance Co.Ltd Sagarmatha Mer Banking & Finance Ltd Sanima Vikash Bank Ltd. Sewa Bikas Bank Ltd Shikhar Bittiya Sanstha Ltd Shikhar Insurance Co. Ltd. Shree Investment Finance Co. Ltd Siddhartha Bank Limited Siddhartha Development Bank Limited Siddhartha Finance Limited Siddhartha Insurance Limited Soaltee Hotel Ltd. Standard Chartered Bank Ltd. Standard Finance Ltd. Subhechha Bikas Bank Limited Swabalamwan Bikash Bank Triveni Bikas Bank Limited Uniliver Nepal Ltd. Union Finance Co. Ltd. United Finance Ltd United Insurance Co.(Nepal)Ltd. Universal Finance Ltd.

1.00875 0.518954545 0.685534884 0.792421053 0.602702703 0.967898089 0.562882883 0.738070175 0.774492754 0.136673575 0.891478873 0.893493151 0.754761905 0.7034 0.870072464 0.219315895 1.141121495 1.343545455 0.475031847 0.346099476 0.453222222 0.87605042 0.773137255 1.101619048 0.181138614 0.133861111 0.770955882 0.893370166 1.4425 0.863101266 0.188640452 0.652611111 0.554271357 0.588 0.757012195

high low Medium Medium Medium high Medium Medium Medium low high high Medium Medium high low high high low low low high Medium high low low Medium high high high low Medium Medium Medium Medium

728000000 650496000 667244760 775200000 267876744 160140000 4708620000 615600000 138000000 579000000 281160000 89352000 503653584 387477000 362250000 3816960000 123050000 110000000 392500000 442814400 4242051000 767550000 266526000 105000000 3014686582 28948609800 1362453576 209815200 188677760 207349246 4401866700 314825040 697743750 177000000 248857536

Big Big Big Big Small Small Big Big Small Big Small Small Big Big Big Big Small Small Big Big Big Big Small Small Big Big Big Small Small Small Big Small Big Small Small

37

Panel E (Companies selected in 2011-2012 with their BE/ME ratio and Market Cap) S.No 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 company Ace Development Bank Ltd. Asian Life Insurance Company Bank of Asia Nepal Limited Birgunj Finance Ltd Business Development Bank Ltd Capital Mer. Bamk & Fin Citizen Investment Trust Clean Energy Devlopment Bank Ltd DCBL Bank Ltd. Gandaki Bikash Bank Ltd Goodwill Finance Co. Ltd. ICFC Bittiya Sanstha Ltd Kaski Finance Limited KIST Bank Ltd Lalitpur Finance Ltd. Machhachapuchhre Bank Ltd Maha Laxmi Finance Ltd. Nepal Aawas Bikas Beeta Co. Ltd. Nepal Credit & Com. Bank Nepal Doorsanchar Company Limited Nepal Insurance Co.Ltd. Nepal Share Markets Ltd. NIDC Capital Markets Ltd. NMB Bank Ltd Pokhara Finance Ltd. Prabhu Finance Company Ltd Prime Commercial Bank Limited Prime Life Insurance Company Ltd Royal Mer. Bank.& Fin Sagarmatha Insurance Co.Ltd Standard Finance Ltd. United Finance Ltd Annapurna Finance Co.Ltd. BE/ME 0.780141844 0.60017341 0.550364583 0.607528736 0.737163121 0.747428571 0.658444444 0.619161677 0.760915033 0.715789474 0.601878453 0.680787879 0.677951807 0.673935484 0.574474576 0.819473684 0.616222222 0.570462963 0.648023952 0.750190931 0.589046243 0.598505747 0.833693694 0.618717949 0.685534884 0.792421053 0.562882883 0.738070175 0.754761905 0.7034 0.770955882 0.554271357 0.516912442 Value Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium low marketcap 1058151279 622800000 3840000000 730800000 972984600 1309097300 648000000 1816960000 2795772672 342000000 543000000 543483105 348600000 3100000000 554215615 2164171478 756000000 362078424 2322786300 62850000000 355336464 751680000 493112616 3900000000 667244760 775200000 4708620000 615600000 503653584 387477000 1362453576 697743750 568713600 size Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big

38

34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68

Arun Valley Hydropower Dev Co Ltd Bank of Kathmandu Central Finance Co. Ltd. Chilime Hydro power Co. Citizen Bank International Ltd Everest Bank Ltd Fewa Finance Co. Ltd. Global Bank Ltd Gurkha Development Bank Himalayan Bank Ltd. IME Financial Institution International Leasing & Fin. Co. Kumari Bank Ltd Laxmi Bank Limited Lumbini Bank Ltd. Nabil Bank Ltd. National Life Insurance Company Ltd Nepal Industrial & Co.Bank Nepal Investment Bank Ltd. Nepal Life Insurance Co. Ltd. Nepal SBI Bank Limited Peoples Finance Limited. Purwanchal Grameen Bikash Bank Sanima Vikash Bank Ltd. Shikhar Insurance Co. Ltd. Shree Investment Finance Co. Ltd Siddhartha Bank Limited Soaltee Hotel Ltd. Standard Chartered Bank Ltd. Uniliver Nepal Ltd. Annapurna Bikas Bank Infrastructure Development Bank Ltd Kasthamandap Dev Bank Ltd Narayani National Finance Co. Ltd. Nepal Bangladesh Bank Ltd.

0.250753425 0.307719298 0.426020761 0.496788321 0.496081081 0.303464351 0.456441948 0.493971292 0.466447368 0.394417391 0.481463415 0.496585366 0.514022556 0.35 0.508778281 0.211661342 0.34757485 0.258788462 0.369592233 0.320565371 0.261256637 0.518954545 0.136673575 0.219315895 0.475031847 0.346099476 0.453222222 0.181138614 0.133861111 0.188640452 0.974150943 1.059065421 1.140978261 0.881933333 0.882230769

low low low low low low low low low low low low low low low low low low low low low low low low low low low low low low high high high high high

1156801800 7749039990 485154993 5997312000 4440000000 9085312262 728910000 3135000000 1203840000 11500000000 1180374912 1328400000 3627476580 3920167360 2210000000 25400245472 440880000 5930496000 12396404835 1698000000 10548898040 650496000 579000000 3816960000 392500000 442814400 4242051000 3014686582 28948609800 4401866700 712320000 856000000 588800000 979145400 2418505700

Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big Big

39

69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103

NDEP Development Bank Ltd. Pashupati Dev Bank Limited Sagarmatha Mer Banking & Finance Ltd Siddhartha Development Bank Limited Alpic Everest Finance Co. Ltd. Civil Merchant Bittiya Sanstha Ltd Excel Development Bank Ltd. Kuber Merchant Bittiya Sanstha Ltd Malika Devt Bank Ltd Nava Durga Finance Co.Ltd. Nepal Express Finance Ltd Nirdhan Utthan Bank Ltd. Premier Finance Co. Ltd Prudential Finance Company Ltd Siddhartha Finance Limited Union Finance Co. Ltd. United Insurance Co.(Nepal)Ltd. Universal Finance Ltd. Bageshowori Dev.Bank Chhimek Vikash Bank Ltd. Everest Insurance Co. Ltd. Paschimanchal Finance Co. Ltd Alliance Insurance Co. Ltd. Api Finance Limtied Birat Laxmi Devt Bank Butwal Finance Ltd CRYSTAL FINANCE Ltd. Gorkha Finance Ltd. Himalayan Gen.Insu. Co.Ltd. Imperial Financial Institution Ltd Kathmandu Finance Limited. Lord Buddha Finance Limited Lumbini Finance Ltd. Lumbini General Insurance Miteri Development Bank Ltd.

0.973275862 1.00875 0.870072464 0.87605042 0.685180723 0.701875 0.533892857 0.846349206 0.756928105 0.8318 0.669119171 0.819744681 0.602702703 0.774492754 0.773137255 0.652611111 0.588 0.757012195 0.504113924 0.512528736 0.51316129 0.509490196 1.184067797 1.138734177 0.958843537 1.078672566 1.10965812 1.438411215 0.84985 0.973239437 0.892253521 0.863013699 1.426029412 0.96671875 0.905625

high high high high Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium Medium low low low low high high high high high high high high high high high high high

633516600 728000000 362250000 767550000 178682400 207848160 224000000 189000000 76500000 189856050 253910800 306602150 267876744 138000000 266526000 314825040 177000000 248857536 156420000 299497500 313875000 201286800 81401238 189600000 243459636 253731443 81900000 166608095 201600000 89815000 198306692 243090000 198900000 160000000 115568640

Big Big Big Big Small Small Small Small Small Small Small Small Small Small Small Small Small Small Small Small Small Small Small Small Small Small Small Small Small Small Small Small Small Small Small

40

104 105 106 107 108 109 110 111 112 113 114 115 116

Neco Insurance Co. Nepal Finance and Saving Co.Ltd. Nerude Laghubitta Bikash Bank Nilgiri Vikas Bank Ltd Premier Insurance co. Ltd. Reliable Finance Ltd Resunga Bikas Bank Ltd. Sewa Bikas Bank Ltd Shikhar Bittiya Sanstha Ltd Siddhartha Insurance Limited Subhechha Bikas Bank Limited Swabalamwan Bikash Bank Triveni Bikas Bank Limited

1.294642857 0.963529412 2.637368421 0.92380531 0.967898089 0.891478873 0.893493151 1.141121495 1.343545455 1.101619048 0.893370166 1.4425 0.863101266

high high high high high high high high high high high high high

129360000 208397475 3895000 56500000 160140000 281160000 89352000 123050000 110000000 105000000 209815200 188677760 207349246

Small Small Small Small Small Small Small Small Small Small Small Small Small

41

APPENDIX B. Annual Report Excrept

APPENDIX C : Stocks selected for constructing different cross sectional portfolio across different fiscal year

2007-2008 portfolio B/L Portfolio

Selected Companies a) Unilever Ltd b) Nabil Bank Ltd c) Standard Chartered Bank Ltd

a) Ace Development Bank Ltd B/M Portfolio b) Chilime Hydropower c) International Leasing Company

No companies B/H Portfolio S/L Portfolio S/M Portfolio No Companies a) Navadurga Finance Ltd b) Premier Finance Ltd c) Prudential Finance Ltd S/h Portofolio a) Sagamartha Insurance b) Citizen Investment Trust c) Gorkha Finance

2008-2009 portfolio B/L Portfolio

Selected Companies a) Unilever Ltd b) Nabil Bank Ltd c) Standard Chartered Bank Ltd

a) Citizen Investment Trust B/M Portfolio b) Goodwill Finance c) International Leasing a) Ace Development Bank B/H Portfolio b) Siddhartha Development Bank c) People's Finance

42

S/L Portfolio S/M Portfolio

No Companies a) Navadurga Finance Ltd b) Premier Finance Ltd c) Prudential Finance Ltd

S/H Portofolio

a) Sagamartha Insurance b) Excel Development Bank c) Gorkha Finance

2009-2010 portfolio B/L Portfolio

Selected Companies a) Kumari Bank Lts b) Nabil Bank Ltd c) Standard Chartered Bank Ltd

a) Citizen Investment Trust B/M Portfolio b) Unilever Ltd c) Chilime Hyrdopower

a) Nepal Share Market B/H Portfolio b) Standard Finance c) Birgunj Finance

S/L Portfolio S/M Portfolio

No Companies a) Goodwill Finance b) Premier Finance Ltd c) Sagarmatha Insurance

S/H Portofolio

a) Navadurga Finance b) Excel Development Bank c) Gorkha Finance

2010-2011 portfolio B/L Portfolio

Selected Companies a) Unilever Ltd b) Nabil Bank Ltd c) Standard Chartered Bank Ltd a) Citizen Investment Trust

43

B/M Portfolio

b) NIDC capital market c) Nepal Telecom a) Narayani National Finance

B/H Portfolio

b) Siddhartha Development Bank c) Nepal Bangladesh Bank

S/L Portfolio S/M Portfolio

No Companies a) Navadurga Finance b) Premier Finance Ltd c) Sagarmatha Insurance

S/H Portofolio

a) Lumbini General Insurance b) ReliableFinance c) Gorkha Finance

2011-2012 portfolio B/L Portfolio

Selected Companies a) Unilever Ltd b) Nabil Bank Ltd c) Standard Chartered Bank Ltd a) Citizen Investment Trust

B/M Portfolio

b) NIDC capital market c) Nepal Telecom a) Narayani National Finance

B/H Portfolio

b) Siddhartha Development Bank c) Nepal Bangladesh Bank

S/L Portfolio

a) Everest Insurance b) Paschimanchal Finance c) Bageshwori development Bank

S/M Portfolio

a) Navadurga Finance b) Premier Finance Ltd c) Sagarmatha Insurance

S/H Portofolio

a) Lumbini General Insurance b) ReliableFinance c) Gorkha Finance

44

45

APPENDIX D: Fama-French model fitting data

S/HRf RmRf J u l

Perio d 2007Aug 2007Sept 2007Oct 2007Nov 2007dec 2008jan 2008Feb 2008Mar 2008Apr 2008May 2008June 2008Jul 2008Augt 2008Sept 2008Oct 2008Nov 2008Dec 2009Jan 2009Feb 2009Mar 2009Apr

Ret B/L 0.03 3996 0.09 1899 0.08 8255 0.06 3996 0.26 36 0.20 145 0.05 715 0.09 516 0.01 168 0.02 5733 0.07 6964 0.11 131 0.15 9514 0.11 119 0.02 1 0.13 822 0.02 069 0.04 717 0.02 562 0.00 447 0.05 3669

Ret B/M 0.97 593 1.69 0517 0.10 9269 0.07 6889 0.30 2848 0.69 6445 0.15 27 0.05 696 0.05 678 0.09 12 0.00 2019 0.15 021 0.18 4608 0.02 788 0.17 2926 0.01 215 0.01 14 0.01 562 0.07 527 0.02 542 0.03 9656

Ret B/H

Ret S/L

Ret S/M 0.46 4506

Ret S/H 0.25 8933 0.02 381 0.06 7284 0.01 25 0.02 6284 0.01 5605 0.03 016 0.00 189 0.00 753 0.00 3607

Rf 0.00 3483 0.00 3483 0.00 3483 0.00 3483 0.00 3483 0.00 3483 0.00 3483 0.00 3483 0.00 3483 0.00 3483 0.00 3483 0.00 3483 0.00 4668 0.00 4668 0.00 4668 0.00 4668 0.00 4668 0.00 4668 0.00 4668 0.00 4668 0.00 4668

B/LRf 0.03 0513 0.08 8416 0.08 4772 0.06 0513 0.26 708 0.19 7966 0.06 064 0.09 865 0.01 516 0.02 225 0.07 3481 0.10 7827 0.15 4846 0.11 585 0.02 567 0.14 289 0.02 536 0.05 184 0.03 029 0.00 914 0.04 9001

B/M -Rf 0.97 2447 1.68 7034 0.10 5786 0.07 3406 0.29 9365 0.69 2962 0.15 618 0.06 044 0.06 026 0.09 468 0.00 146 0.15 37 0.17 9941 0.03 255 0.16 8258 0.01 682 0.01 606 0.02 029 0.07 994 0.03 009 0.03 4988

0 0.00 5051 0.01 1348 0.00 9602 0.01 1642 0.00 4902 0.39 8551

0 0.10 6764 0.17 6418 0.13 2288 0.00 6116 0.00 6614 0.21 6941 0.00 477 0.08 5264

0 0.04 0941 0.00 4301 0.04 9094 0.04 7752 0.01 331 0.07 3746 0.01 4879 0.14 522 0.15 9076 0.18 7512

0 0.61 4841 0.26 907 0.00 146 0.05 201 0.19 437 0.05 481 0.01 405 0.47 0565 0.33

B/HRf 0.00 348 0.00 348 0.00 348 0.00 348 0.00 348 0.00 348 0.00 348 0.00 348 0.00 348 0.00 348 0.00 348 0.00 348 0.61 0174 0.27 374 0.00 613 0.05 668 0.19 904 0.05 947 0.01 872 0.46 5897 0.34

S/M -Rf 0.46 1023 0.00 348 0.00 348 0.00 1567 0.00 7864 0.00 6119 0.00 8158 0.00 1419 0.39 5067 0.00 348 0.00 348 0.10 3281 0.17 175 0.12 762 0.00 1448 0.00 1946 0.21 2273 0.00 944 0.08 0596 0.00 467 0.06

SM B 0.09 55 0.58 62 0.04 341 0.04 944 0.00 054 0.29 09 0.08 3885 0.05 1711 0.15 3158 0.02 3024 0.02 633 0.06 2203 0.25 941 0.19 6507 0.03 22 0.06 5231 0.17 2383 0.04 2569 0.01 8329 0.09 387 0.12 2431

HM L 0.11 2468 0.03 404 0.01 049 0.03 825 0.14 4943 0.09 292 0.04 3656 0.04 6637 0.00 2074 0.01 106 0.03 848 0.03 518 0.22 9814 0.05 44 0.03 3644 0.03 6451 0.04 997 0.00 3621 0.06 682 0.31 7055 0.10

Das hain

0.25 545 0.02 0326 0.06 3801 0.01 598 0.02 2801 0.01 2122 0.02 6676 0.00 537 0.01 102 0.00 0124 0.00 348 0.03 7457 0.00 037 0.04 4426 0.04 3084 0.01 798 0.06 9078 0.01 0211 0.14 989 0.15 4408 0.18 2844

0.00 9982 0.15 3919 0.05 0722 0.05 9219 0.11 7264 0.06 879 0.15 415 0.12 586 0.04 1189 0.07 6295 0.15 0797 0.03 1664 0.12 1349 0.10 492 0.04 774 0.14 072 0.09 396 0.10 678 0.00 0955 0.00 0878 0.01

0 0

0 0.06

0 0

0 0

46

832 2009May 2009Jun 2009jul 2009Aug 2009Sep 2009Oct 2009Nov 2009Dec 2010Jan 2010Feb 2010Mar 2010Apr 2010May 2010Jun 2010jul 2010Aug 2010Sep 2010Oct 2010Nov 2010Dec 2011Jan 2011Feb 0.02 3301 0.10 1435 0.08 001 0.04 4525 0.22 266 0.08 355 0.06 856 0.03 557 0.07 593 0.05 667 0.00 96 0.08 817 0.02 3773 0.04 0182 0.06 8333 0.07 794 0.08 349 0.00 4593 0.05 66 0.05 606 0.08 7271 0.01 063 0.05 7938 0.01 363 0.05 0141 0.01 649 0.02 188 0.01 041 0.01 3146 0.01 64 0.02 012 0.01 7423 0.00 291 0.03 813 0.03 4614 0.01 633 0.06 034 0.05 6706 0.03 652 0.04 2017 0.00 4873 0.01 807 0.03 939 0.00 498 0.02 702 0.11 35 0.06 599 0.01 961 0.05 968 0.03 846 0.03 391 0.04 384 0.01 185 0.04 559 0.00 917 0.03 107 0.01 2168 0.11 703 0.16 407 0.10 85 0.02 133 0.05 556 0.05 356 0.01 6005 0.03 013 0.03 093

521 0.04 7613 0.16 948 0.04 834 0.23 449 0.03 197 0.00 1255 0.01 4172 0.00 5193 0.01 913 0.04 3001 0.14 439 0.01 415 0.02 818 0.14 615 0.04 349 0.00 15 0.00 252 0.10 867 0.00 946 0.02 3411 0.08 64 0.04 9983 0.02 55 0.04 822 0.00 4668 0.00 4668 0.00 4668 0.00 5182 0.00 5182 0.00 5182 0.00 5182 0.00 5182 0.00 5182 0.00 5182 0.00 5182 0.00 5182 0.00 5182 0.00 5182 0.00 5182 0.00 6088 0.00 6088 0.00 6088 0.00 6088 0.00 6088 0.00 6088 0.00 6088 0.01 8634 0.09 6767 0.07 5342 0.03 9342 0.22 784 0.08 873 0.07 374 0.04 076 0.08 112 0.06 185 0.01 478 0.09 335 0.01 8591 0.03 4999 0.06 3151 0.08 403 0.08 958 0.00 149 0.06 269 0.06 215 0.08 1183 0.01 672 0.05 327 0.01 83 0.04 5473 0.02 167 0.02 706 0.01 559 0.00 7963 0.02 159 0.02 53 0.01 2241 0.00 809 0.04 331 0.02 9431 0.02 151 0.06 553 0.05 0618 0.04 261 0.03 5929 0.00 122 0.02 416 0.04 548 0.01 107

299 0.03 169 0.11 817 0.07 065 0.02 479 0.06 486 0.04 365 0.03 909 0.04 902 0.01 703 0.05 077 0.01 436 0.03 625 0.00 6986 0.12 221 0.16 925 0.11 459 0.02 742 0.06 165 0.05 965 0.00 9917 0.03 622 0.03 702

988 0.04 2945 0.17 415 0.00 467 0.04 5756 0.18 902 0.01 103 0.03 577 0.02 3183 0.03 4199 0.00 0846 0.00 4155 0.03 244 0.04 639 0.06 056 0.01 509 0.00 609 0.01 174 0.07 446 0.02 039 0.02 32 0.07 56 0.05 76 0.05 301 0.23 916 0.03 664 0.00 393 0.00 899 1.04 E-05 0.02 431 0.03 7819 0.14 957 0.01 934 0.03 337 0.15 134 0.04 867 0.00 668 0.00 77 0.11 475 0.01 555 0.01 7323 0.09 249 0.04 3895 0.03 159 0.05 43

356 0.00 514 0.00 7103 0.11 5498 0.04 143 0.13 271 0.03 746 0.07 509 0.03 751 0.03 735 0.07 664 0.03 06 0.07 064 0.02 411 0.07 4515 0.00 081 0.05 639 0.10 858 0.02 6083 0.00 1859 0.07 565 0.01 6618 0.00 274 0.01 831 0.12 609 0.03 205 0.01 4588 0.04 485 0.04 3921 0.01 3202 0.05 5726 0.00 0964 0.02 5571 0.00 0944 0.00 535 0.05 175 0.01 2098 0.04 7886 0.00 7024 0.04 2077 0.01 201 0.00 1529 0.03 0334 0.03 759 0.01 773

224 0.04 933 0.22 471 0.08 898 0.03 144 0.08 8577 0.02 5138 0.00 7761 0.01 737 0.04 015 0.00 154 0.01 388 0.04 453 0.02 755 0.07 935 0.11 746 0.06 961 0.02 6351 0.01 837 0.04 168 0.06 1024 0.07 145 0.03 426

0 0.05 0939 0.18 384 0.00 585 0.03 059 0.02 8366 0.03 9381 0.00 6029 0.00 9338 0.02 726 0.04 121 0.05 538 0.00 991

0 0.00 565 0.06 838 0.01 43 0.01 711 0.06 951 0.05 151

47

2011Mar 2011Apr 2011May 2011Jun 2011jul 2011Aug 2011Sep 2011Oct 2011Nov 2011Dec 2012Jan 2012Feb 2012Mar 2012Apr 2012May 2012Jun 2012jul

0.05 196 0.03 253 0.04 715 0.17 515 0.25 748 0.05 714 0.05 509 0.05 804 0.01 207 0.04 832 0.08 4385 0.04 931 0.00 0944 0.02 4465 0.08 0627 0.10 406 0.16 6877

0.01 6487 0.01 649 0.01 291 0.15 556 0.11 304 0.03 0656 0.05 946 0.00 2232 0.02 607 0.01 697 0.05 0393 0.02 435 0.03 7176 0.03 317 0.16 7725 0.08 458 0.02 493

0.08 254 0.06 935 0.04 639 0.09 69 0.06 4901 0.05 656 0.07 281 0.02 1034 0.01 782 0.02 63 0.04 136 0.13 002 0.00 1844 0.01 7937 0.29 3292 0.03 4895 0.06 964

0 0.00 662 0.01 066 0.00 4505

0 0.02 768 0.06 246 0.01 159 0.01 0607 0.03 053 0.03 1138 0.06 789 0.01 3321 0.00 3077 0.18 0548 0.05 125 0.04 0722

0.09 566 0.03 924 0.02 405 0.08 491 0.02 311 0.04 9427 0.11 133 0.02 388 0.01 1797 0.03 866 0.02 409 0.02 683 0.02 415 0.04 936 0.28 6305 0.15 734 0.01 3136

0.00 6088 0.00 6088 0.00 6088 0.00 6088 0.00 6088 0.00 1304 0.00 1304 0.00 1304 0.00 1304 0.00 1304 0.00 1304 0.00 1304 0.00 1304 0.00 1304 0.00 1304 0.00 1304 0.00 1304

0.05 805 0.03 862 0.05 323 0.18 124 0.25 1392 0.05 845 0.05 64 0.05 935 0.01 337 0.04 963 0.08 3081 0.05 061 0.00 036 0.02 3161 0.07 9323 0.10 537 0.16 5573

0.01 0399 0.02 257 0.01 9 0.16 165 0.11 913 0.02 9352 0.06 077 0.00 0928 0.02 4766 0.01 828 0.04 9089 0.02 565 0.03 5872 0.03 447 0.16 6421 0.08 589 0.02 3626

0.08 863 0.07 544 0.05 248 0.10 299 0.05 8813 0.05 786 0.07 412 0.01 973 0.01 6515 0.02 761 0.04 267 0.13 132 0.00 054 0.01 6633 0.29 1988 0.03 3591 0.07 095

0 0.01 111 0.00 0233

0 0.04 915 0.09 854 0.01 461 0.08 586