Professional Documents

Culture Documents

02 Questions

Uploaded by

Lt GabrielCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

02 Questions

Uploaded by

Lt GabrielCopyright:

Available Formats

An introduction to cost terms and concepts

For the relevant cost data in items (1)(7), indicate which of the following is the best classification. (a) sunk cost (d) fixed cost (g) controllable cost (b) incremental cost (e) semi-variable cost (h) non-controllable cost (c) variable cost (f) semi-fixed cost (i) opportunity cost (1) A company is considering selling an old machine. The machine has a book value of 20 000. In evaluating the decision to sell the machine, the 20 000 is a ... (2) As an alternative to the old machine, the company can rent a new one. It will cost 3000 a year. In analysing the costvolume behaviour the rental is a ... (3) To run the firms machines, here are two alternative courses of action. One is to pay the operator a base salary plus a small amount per unit produced. This makes the total cost of the operators a ... (4) As an alternative, the firm can pay the operators a flat salary. It would then use one machine when volume is low, two when it expands, and three during peak periods. This means that the total operator cost would now be a ... (5) The machine mentioned in (1) could be sold for 8000. If the firm considers retaining and using it, the 8000 is a ... (6) If the firm wishes to use the machine any longer, it must be repaired. For the decision to retain the machine, the repair cost is a ... (7) The machine is charged to the foreman of each department at a rate of 3000 a year. In evaluating the foreman, the charge is a ... A company manufactures and retails clothing. You are required to group the costs which are listed below and numbered (1)(20) into the following classifications (each cost is intended to belong to only one classification): (i) direct materials (ii) direct labour (iii) direct expenses (iv) indirect production overhead (v) research and development costs (vi) selling and distribution costs (vii) administration costs (viii) finance costs (1) Lubricant for sewing machines (2) Floppy disks for general office computer (3) Maintenance contract for general office photocopying machine (4) Telephone rental plus metered calls (5) Interest on bank overdraft (6) Performing Rights Society charge for music broadcast throughout the factory (7) Market research undertaken prior to a new product launch (8) Wages of security guards for factory (9) Carriage on purchase of basic raw material (10) Royalty payable on number of units of product XY produced (11) Road fund licences for delivery vehicles (12) Parcels sent to customers (13) Cost of advertising products on television

AN INTRODUCTION TO COST TERMS AND CONCEPTS

Question IM 2.1 Intermediate: Cost classification

Question IM 2.2 Intermediate: Cost classification

(14) (15) (16) (17) (18) (19) (20)

Audit fees Chief accountants salary Wages of operatives in the cutting department Cost of painting advertising slogans on delivery vans Wages of storekeepers in materials store Wages of fork lift truck drivers who handle raw materials Developing a new product in the laboratory (10 marks) CIMA Cost Accounting 1

Question IM 2.3 Intermediate: Analysis of costs by behaviour for decision-making

The Northshire Hospital Trust operates two types of specialist X-ray scanning machines, XR1 and XR50. Details for the next period are estimated as follows: Machine Running hours Variable running costs (excluding plates) Fixed costs XR1 1100 () 27 500 20 000 XR50 2000 () 64 000 97 500

A brain scan is normally carried out on machine type XR1: this task uses special X-ray plates costing 40 each and takes four hours of machine time. Because of the nature of the process, around 10% of the scans produce blurred and therefore useless results. Required: (a) Calculate the cost of a satisfactory brain scan on machine type XR1. (7 marks) (b) Brain scans can also be done on machine type XR50 and would take only 1.8 hours per scan with a reduced reject rate of 6%. However, the cost of the X-ray plates would be 55 per scan. Required: Advise which type should be used, assuming sufficient capacity is available on both types of machine. (8 marks) (Total marks 15) CIMA Stage 1 Cost Accounting

Question IM 2.4 Intermediate: Product cost calculation

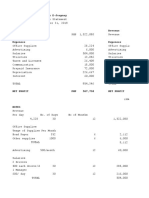

From the information given below you are required to: (a) prepare a standard cost sheet for one unit and enter on the standard cost sheet the costs to show sub-totals for: (i) prime cost (ii) variable production cost (iii) total production cost (iv) total cost (b) calculate the selling price per unit allowing for a profit of 15% of the selling price. The following data are given: Budgeted output for the year Standard details for one unit: Direct materials 40 square metres at 5.30 per square metre Direct wages: Bonding department 48 hours at 2.50 per hour Finishing department 30 hours at 1.90 per hour Budgeted costs and hours per annum: Variable overhead: () Bonding department 375 000 Finishing department 150 000 9800 units

(hours) 500 000 300 000

AN INTRODUCTION TO COST TERMS AND CONCEPTS

Fixed overhead: Production Selling and distribution Administration

() 392 000 196 000 98 000

(hours)

(15 marks) CIMA Cost Accounting 1

AN INTRODUCTION TO COST TERMS AND CONCEPTS

You might also like

- Exam281 20131Document14 pagesExam281 20131AsiiSobhiNo ratings yet

- Cost Accounting AssignmentDocument3 pagesCost Accounting AssignmentMkaeDizonNo ratings yet

- Managerial Accounting Chapter 5 Practice Exam SolutionsDocument4 pagesManagerial Accounting Chapter 5 Practice Exam Solutionsjklein2588No ratings yet

- Cost II Chapter ThreeDocument11 pagesCost II Chapter ThreeSemira100% (1)

- AMBO-104 Accounting For Managers Assignment AssignmentDocument12 pagesAMBO-104 Accounting For Managers Assignment AssignmentEsha VermaniNo ratings yet

- QuestionsDocument8 pagesQuestionsZavyarNo ratings yet

- Assignment 1111Document8 pagesAssignment 1111SAAD HUSSAINNo ratings yet

- Case Agr-Chem SolnDocument10 pagesCase Agr-Chem SolnSagar Rajiv VazeNo ratings yet

- Questions On Relevant Information and Decision MakingDocument3 pagesQuestions On Relevant Information and Decision MakingGizachew Nadew100% (1)

- Chapter 10, Question 1. ADocument22 pagesChapter 10, Question 1. ANeldybanik100% (2)

- Wilkerson ABC at CapacityDocument1 pageWilkerson ABC at CapacityTushar DuaNo ratings yet

- Case 6-26 Solution ExpertyDocument6 pagesCase 6-26 Solution ExpertyDevianna AzzahraNo ratings yet

- A FM 102 March 112011Document5 pagesA FM 102 March 112011truly wulandariNo ratings yet

- Implementing Target CostingDocument31 pagesImplementing Target CostingJonnattan MuñozNo ratings yet

- 2014 Bep Analysis ExercisesDocument5 pages2014 Bep Analysis ExercisesaimeeNo ratings yet

- Chapter Problems: High-Low Method EstimatesDocument2 pagesChapter Problems: High-Low Method EstimatesYvonne TotesoraNo ratings yet

- CP - Cma CaseDocument5 pagesCP - Cma CaseYicong GuNo ratings yet

- Absorption Costing WorksheetDocument10 pagesAbsorption Costing WorksheetFaizan ChNo ratings yet

- ABC Costing Guide for Managerial Accounting ToolsDocument3 pagesABC Costing Guide for Managerial Accounting Toolssouayeh wejdenNo ratings yet

- Cost II AssignmentDocument4 pagesCost II AssignmentmeazadgafuNo ratings yet

- Case Case:: Colorscope, Colorscope, Inc. IncDocument4 pagesCase Case:: Colorscope, Colorscope, Inc. IncBalvinder SinghNo ratings yet

- HorngrenIMA14eSM ch10Document64 pagesHorngrenIMA14eSM ch10Piyal Hossain100% (2)

- Javier Danna Assignment 2.3 &3.5Document4 pagesJavier Danna Assignment 2.3 &3.5Danna ClaireNo ratings yet

- Manual 16 Jun 2021 - Part 1Document6 pagesManual 16 Jun 2021 - Part 1Feni AlvitaNo ratings yet

- Assignment 2Document4 pagesAssignment 2Noor KhanNo ratings yet

- Activity-Based Costing: A Guide to Calculating True Product CostsDocument3 pagesActivity-Based Costing: A Guide to Calculating True Product CostsRoikhanatun Nafi'ahNo ratings yet

- Budget VarianceDocument4 pagesBudget VariancePutri AmandhariNo ratings yet

- Estimating service costs in a consulting firmDocument11 pagesEstimating service costs in a consulting firmPat0% (1)

- CVP Analysis SolutionsDocument23 pagesCVP Analysis SolutionsAdebayo Yusuff AdesholaNo ratings yet

- ICAEW 2023 BST Mock Lotus AsDocument24 pagesICAEW 2023 BST Mock Lotus Asdatgooner97No ratings yet

- AMA Suggested Telegram Canotes PDFDocument427 pagesAMA Suggested Telegram Canotes PDFAnmol AgalNo ratings yet

- HW 6 KeyDocument5 pagesHW 6 KeyRosinda ArendainNo ratings yet

- ADM3346 Assignment 2 Fall 2019 Revised With Typos CorrectdDocument3 pagesADM3346 Assignment 2 Fall 2019 Revised With Typos CorrectdSam FishNo ratings yet

- PS3 ADocument10 pagesPS3 AShrey BudhirajaNo ratings yet

- Kent's E-Jeepney Kent's E-Jeepney: TotalDocument20 pagesKent's E-Jeepney Kent's E-Jeepney: TotalKentNo ratings yet

- Chapter 4Document45 pagesChapter 4Yanjing Liu67% (3)

- Perfect Competition 2Document3 pagesPerfect Competition 2Aakash MehtaNo ratings yet

- Phuket Beach Hotel Case Analysis: Corporate Finance F3, 2015Document9 pagesPhuket Beach Hotel Case Analysis: Corporate Finance F3, 2015Ashadi CahyadiNo ratings yet

- Baseball Card Emporium CaseDocument1 pageBaseball Card Emporium CaseCarolina Andrade0% (1)

- Assignment-Transfer PricingDocument2 pagesAssignment-Transfer PricingMerliza Jusayan100% (1)

- Bca 423-Marginal Vs Absoption Costing.Document8 pagesBca 423-Marginal Vs Absoption Costing.James GathaiyaNo ratings yet

- Answer Chapter 1 QuestionsDocument1 pageAnswer Chapter 1 QuestionsMeizhao QianNo ratings yet

- Cost FM 2 PDFDocument276 pagesCost FM 2 PDFYogesh ThakurNo ratings yet

- Managerial Accounting: Tools For Business Decision-MakingDocument56 pagesManagerial Accounting: Tools For Business Decision-MakingdavidNo ratings yet

- Financial and Managerial ExercisesDocument5 pagesFinancial and Managerial ExercisesBedri M Ahmedu50% (2)

- Ra 6938Document2 pagesRa 6938GaryNo ratings yet

- Chapter 1 QuizDocument7 pagesChapter 1 QuizRichie Sơn NguyễnNo ratings yet

- CMA Individual Assignment 1 & 2Document3 pagesCMA Individual Assignment 1 & 2Abdu YaYa Abesha100% (2)

- 1.5performance Management PDFDocument232 pages1.5performance Management PDFsolstice567567No ratings yet

- Final LogdesDocument30 pagesFinal LogdesRihana Nhat KhueNo ratings yet

- f5 Class Test 1Document5 pagesf5 Class Test 1Emon D' CostaNo ratings yet

- Accounting 2Document7 pagesAccounting 2vietthuiNo ratings yet

- CH 07Document19 pagesCH 07damaris ramos100% (1)

- Est For BTECHDocument2 pagesEst For BTECHRakesh SharmaNo ratings yet

- Productivity and Reliability-Based Maintenance Management, Second EditionFrom EverandProductivity and Reliability-Based Maintenance Management, Second EditionNo ratings yet

- 02 QuestionsDocument5 pages02 QuestionsfaizthemeNo ratings yet

- Review QsDocument92 pagesReview Qsfaiztheme67% (3)

- Ilide - Info Review Qs PRDocument93 pagesIlide - Info Review Qs PRMobashir KabirNo ratings yet

- Advanced Management Accounting Assignment 20200001Document7 pagesAdvanced Management Accounting Assignment 20200001Sandra K JereNo ratings yet

- CA Course Work Take HomeDocument4 pagesCA Course Work Take HomeOgwang JoshuaNo ratings yet

- The New Meaning of Educational Change: Michael FullanDocument1 pageThe New Meaning of Educational Change: Michael FullanLt GabrielNo ratings yet

- Microfinance in EvolutionDocument19 pagesMicrofinance in EvolutionLt GabrielNo ratings yet

- Nbfira CA Mou ArticleDocument2 pagesNbfira CA Mou ArticleLt GabrielNo ratings yet

- BX Diss Rest Loan For WebsiteDocument31 pagesBX Diss Rest Loan For WebsiteLt GabrielNo ratings yet

- Management AccountingDocument1 pageManagement AccountingLt GabrielNo ratings yet

- May 2012 Q5 Example Answers For ClassDocument8 pagesMay 2012 Q5 Example Answers For ClassLt GabrielNo ratings yet

- Revision Notes 6AG507 Performance EvaluationDocument3 pagesRevision Notes 6AG507 Performance EvaluationLt GabrielNo ratings yet

- 203 RationaleDocument1 page203 RationaleNam PhệNo ratings yet

- 6AG507 Lecture 7 2013 Cost Management For UdoDocument25 pages6AG507 Lecture 7 2013 Cost Management For UdoLt GabrielNo ratings yet

- A&A Week 5 1213Document19 pagesA&A Week 5 1213Lt GabrielNo ratings yet

- Audit and Assurance QuestionsDocument3 pagesAudit and Assurance QuestionsLt GabrielNo ratings yet

- Audit and Assurance QuestionsDocument3 pagesAudit and Assurance QuestionsLt GabrielNo ratings yet

- Audit Weekly TutorialsDocument1 pageAudit Weekly TutorialsLt GabrielNo ratings yet

- Process Costing Systems ExplainedDocument8 pagesProcess Costing Systems ExplainedEwelina ChabowskaNo ratings yet

- Seeta High School Post - 2023 S.6 Pure Mathematics Paper 1Document3 pagesSeeta High School Post - 2023 S.6 Pure Mathematics Paper 1vanessablessed999No ratings yet

- Torrent Downloaded From Demonoid - PHDocument13 pagesTorrent Downloaded From Demonoid - PHcobalt boronNo ratings yet

- Service Manual Viasonix PletismógrafoDocument33 pagesService Manual Viasonix PletismógrafodhcastanoNo ratings yet

- Comic StripDocument10 pagesComic StripRamNo ratings yet

- Course Schedule 2020 - NIOSHCertDocument3 pagesCourse Schedule 2020 - NIOSHCertJamsari SulaimanNo ratings yet

- Epidermal Permeability Barrier Defects and Barrier Repair Therapy in Atopic DermatitisDocument12 pagesEpidermal Permeability Barrier Defects and Barrier Repair Therapy in Atopic DermatitisMisaeldpdNo ratings yet

- Genetic Engineering Provides Benefits While Posing Minimal RisksDocument10 pagesGenetic Engineering Provides Benefits While Posing Minimal RisksJohn Javier100% (1)

- Deneghra's Deadly ArsenalDocument23 pagesDeneghra's Deadly ArsenalwitekmtNo ratings yet

- MCS in NepalDocument8 pagesMCS in NepalSourabh InaniNo ratings yet

- 7.the Evaluation of Kinetic Absorbency of 3 DifferentDocument7 pages7.the Evaluation of Kinetic Absorbency of 3 DifferentAle ZuzaNo ratings yet

- Airbus A321-100 Lufthansa: Recolored by Cibula Papercraft 2019Document7 pagesAirbus A321-100 Lufthansa: Recolored by Cibula Papercraft 2019Siva Adithya100% (2)

- Modeling of Hydro PlantDocument57 pagesModeling of Hydro Plantshift incharge ikhepNo ratings yet

- Grade 11 Test On AdjustmentsDocument6 pagesGrade 11 Test On AdjustmentsENKK 25No ratings yet

- Shacman series transmission parts catalogDocument2 pagesShacman series transmission parts catalogMarcos Armando Torrey MenaNo ratings yet

- 2022 Housing Security FindingsDocument34 pages2022 Housing Security FindingsValerie Osier100% (1)

- Uganda DTIS Vol1Document230 pagesUganda DTIS Vol1Naresh MandowaraNo ratings yet

- LESSON NOTES Hangul Batchim Rules 3: Flowing, Palatalization, and Special Rules with the Consonant HieungDocument4 pagesLESSON NOTES Hangul Batchim Rules 3: Flowing, Palatalization, and Special Rules with the Consonant HieungSt SNo ratings yet

- PAS 40 investment accounting rulesDocument6 pagesPAS 40 investment accounting rulesElaiza Jane CruzNo ratings yet

- University of Engineering & Technology (UET) Taxila Computer Communication Networks LABDocument8 pagesUniversity of Engineering & Technology (UET) Taxila Computer Communication Networks LABAreeba NoorNo ratings yet

- Operation of Portable Generators - IET Wiring GuideDocument7 pagesOperation of Portable Generators - IET Wiring GuideRyan Scott100% (1)

- ELC 151 Group Assignment 9Document4 pagesELC 151 Group Assignment 9imie imieNo ratings yet

- Clerical Model Solved Paper 1Document15 pagesClerical Model Solved Paper 1himita desaiNo ratings yet

- Suzuki DieselDocument746 pagesSuzuki DieselDante Allegro100% (1)

- I CT Material ReferenceDocument96 pagesI CT Material Referencefsolomon100% (19)

- Restricting and Sorting DataDocument38 pagesRestricting and Sorting Datafhunny_1No ratings yet

- Review Development Economics - 2020 - Memon - Income Inequality and Macroeconomic InstabilityDocument32 pagesReview Development Economics - 2020 - Memon - Income Inequality and Macroeconomic InstabilityTAhmedNo ratings yet

- Method of Preparation and Systematic Examination of A Direct Fecal SmearDocument3 pagesMethod of Preparation and Systematic Examination of A Direct Fecal SmearCelne CentinoNo ratings yet

- ShampooDocument98 pagesShampooKing Nitin AgnihotriNo ratings yet

- Student Assignment Analyzes Statistics ProblemsDocument2 pagesStudent Assignment Analyzes Statistics ProblemsKuberanNo ratings yet

- Introduction To Social Return On InvestmentDocument12 pagesIntroduction To Social Return On InvestmentSocial innovation in Western Australia100% (2)