Professional Documents

Culture Documents

18 Sadfasdf

Uploaded by

Alina MalikOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

18 Sadfasdf

Uploaded by

Alina MalikCopyright:

Available Formats

Lecture 18 Hedging the Risk of portfolio by Using index option contract

Suppose your portfolio has long positions in NYSE stocks valued at 50 million $ and NYSE index is now at 2500. What is risk to your portfolio? How can you hedge it using index option contracts? Risk is: That prices of shares in your portfolio would fall and you may have loss in market value of portfolio. Hedge: One month maturity put option on NYSE index at strike (exercise) price of 2400 is available. Note that underlying asset for index options is not is not stocks or gold, but index, therefore strike price is in terms of value of index. But to make it meaningful, the option exchanges use a dollar multiplier, in this case it is 100 dollars. Therefore one put option controls underlying value of: 100$ *strike price 100$*2400 = 240,000 to hedge 50 million $ value of your portfolio you need to buy how many put options? 240,000* X = 50,000,000 X=50,000,000/240,000 X=209 put option contracts Suppose you bought one month maturity 209 put options on NYSE- Index at option premium of 3 ( that is 3 points of index) at the strike price of 2400 (Index points): note it is out of money option because market price (2500) is higher than the strike price (2400), so exercising this put option now would mean selling some thing at 2400 which could have been sold at 2500 at its current market price. So no sane person would exercise this put option now, therefore it should be priced cheaply . Option Premium is the money you pay to buy an option contract. If option premium of this put option were 1, it would mean 1 index points *100$, and that would be 100$ Since Option Premium of this put option is 3, it means 3 index points *100$= 300$ Option premium for 209 put option contracts= 300$*209= 62,700$. And this is your investment in creating this hedge.

Suppose your fear of market decline within this month comes true; and after 25 days NYSE- index falls from 2500 to 2000. But you are hedged because you have bought( taken long position) in 209 put options on NYSE index. Dollar Value controlled by 1 put option contract is now: 2000 index points *100$= 200,000 If you can exercise it now you can make profit because now you can sell for 240,000 something which is at 200,000 at its current market price. So when market price is below strike price, put option is called inthe-money; and now due to fall in index from 2500 to 2000 this option is in the money, meaning, exercising this option would give profits to the option holder. Profits on one option contract = = = Exercise value Market value 240,000-200,000 40,000

On 209 options contracts your profit as hedger = 40,000$*209 = 8,360,000$ Now suppose during these 25 days your portfolio of shares initially valued at 50,000,000 has experienced a fall in prices as well , and is now worth 41,000,000. Your loss on portfolio is 50-41= 9 million dollars. But your gain on your long position in 209 put options has hedged some of that loss by giving you gain of 8.36 million. So most of your loss in your portfolio value has been neutralized ( hedged) by the profits on options Net loss to your portfolio is = 9 8.36=0.64 million or 640,000 dollars. You would notice that it was not a perfect hedge but did help you hedge most of the loss.

Index Arbitrage: S & P 500 index and futures contract on S & P 500 Index must have same value on the maturity date of the futures contract. You can make risk less profits by taking position in both the Index and Index futures contract: To take position in Index, you buy shares of an index mutual fund (long position in Index) or short sell them. Similarly you can take long or short position in futures contracts on S&P index. Example: Suppose by watching your screen you discovered ( and note it happens for brief periods) S&P index is greater in value than one month maturity futures contracts on S&P index

You know by maturity date index would fall or futures contract on index would go up, because both must have the same value that date. You can short sell the index (by shorting shares in S&P 500 index or by shorting mutual funds shares which mimics S&P 500 index), and you can take long position (buy) future contracts on index . By maturity date future contract would rise to give you profit or index would fall to give you profit; in any case you would have profits. Example: If today index is lower Index Futures contract You know both must be same on maturity date that means either index would go up or index future contract would fall You can take long position in index by buying shares of Index mutual fund or you can short index futures contract. On maturity date, again, you would have definite profits because by that time either mutual funds share would rise (index would increase) or future contract on index would fall and give you profit on your short position Computers are programmed to identify such mispricing and they automatically generate the relevant buy or sell orders in index and future on index. It is called programmed trading. This kind of investment strategy is called index arbitrage. It gives risk less profit to the investor who after taking the position holds it till the maturity date of the futures contract on index. Only momentarily such mispricing occurs, and only vigilant investor can take benefit of it; but due to computers now programmed to identify such mispricing, the frequency and length of mispricing periods are becoming more and more rare.

You might also like

- Options 101 The Ultimate Beginners Guide To OptionsDocument47 pagesOptions 101 The Ultimate Beginners Guide To OptionsChicobiNo ratings yet

- Option StrategiesDocument25 pagesOption Strategiesaditya_singh3036844No ratings yet

- Option Strategy Builder Client PDFDocument13 pagesOption Strategy Builder Client PDFसन्तोष सिंह जादौनNo ratings yet

- Bull Call Spread & Put SpreadDocument16 pagesBull Call Spread & Put Spreadravirana60No ratings yet

- Derivatives TrainingDocument83 pagesDerivatives TrainingvaibhavgdNo ratings yet

- Credit Spreads:Beginners Guide to Low Risk, Secure, Easy to Manage, Consistent Profit for Long Term WealthFrom EverandCredit Spreads:Beginners Guide to Low Risk, Secure, Easy to Manage, Consistent Profit for Long Term WealthNo ratings yet

- Stock Option Basics: A Concise GuideDocument62 pagesStock Option Basics: A Concise GuideArvind DasNo ratings yet

- The Dynamic Law of ProsperityDocument1 pageThe Dynamic Law of Prosperitypapayasmin75% (4)

- Derivatives Option StrategiesDocument45 pagesDerivatives Option Strategiesjim125No ratings yet

- International FinanceDocument9 pagesInternational FinancelawrelatedNo ratings yet

- The Art of Communication PDFDocument3 pagesThe Art of Communication PDFHung Tran JamesNo ratings yet

- Understanding put optionsDocument10 pagesUnderstanding put optionsKsagarika PatraNo ratings yet

- Derivatives Future & OptionsDocument6 pagesDerivatives Future & OptionsNiraj Kumar SahNo ratings yet

- Organizational Transformations: Population Ecology TheoryDocument25 pagesOrganizational Transformations: Population Ecology TheoryTurki Jarallah100% (2)

- S&P500 Futures AnalysisDocument7 pagesS&P500 Futures Analysisee1993100% (1)

- Hedge Funds StrategiesDocument13 pagesHedge Funds StrategiesJoel FernandesNo ratings yet

- 2 Hedging With FUTURESDocument28 pages2 Hedging With FUTURESivona_dutuNo ratings yet

- FuturesDocument5 pagesFuturesVishnuNo ratings yet

- Future strategies for hedging portfolio riskDocument68 pagesFuture strategies for hedging portfolio riskRoshni MoryeNo ratings yet

- Introduction to Derivative Securities ChapterDocument37 pagesIntroduction to Derivative Securities ChapterMila AmandaNo ratings yet

- Unit 6 Option CombinationsDocument13 pagesUnit 6 Option CombinationsFadil Ashrafi Barkati KhanNo ratings yet

- 3 1 Heding With CfdsDocument8 pages3 1 Heding With CfdsSMO979No ratings yet

- Derivatives - Options, FuturesDocument102 pagesDerivatives - Options, Futuresmanmohanbora100% (2)

- Definition of 'Stop-Loss Order'Document25 pagesDefinition of 'Stop-Loss Order'Siddharth MehtaNo ratings yet

- Understand Call OptionsDocument1 pageUnderstand Call OptionsMustafa BhaiNo ratings yet

- Using Option Open Interest To Develop Short Term Price TargetsDocument11 pagesUsing Option Open Interest To Develop Short Term Price TargetsShaun DingNo ratings yet

- Nifty Futures: CMA Jagadish A DDocument3 pagesNifty Futures: CMA Jagadish A DmunigubiliNo ratings yet

- Stock Index Futures or Options ContractDocument7 pagesStock Index Futures or Options ContractarmailgmNo ratings yet

- FSD5Document2 pagesFSD5Leo the BulldogNo ratings yet

- Assignment For Placed StuentsDocument20 pagesAssignment For Placed Stuentsarul kumarNo ratings yet

- Hedge (Finance) : What Does Hedge Mean?Document4 pagesHedge (Finance) : What Does Hedge Mean?kkrathodNo ratings yet

- DRM-Intro To DerivativesDocument6 pagesDRM-Intro To Derivativeschandu prakashNo ratings yet

- Financial Engineering & Risk Management: Unit - VDocument16 pagesFinancial Engineering & Risk Management: Unit - VPrakash ChoudharyNo ratings yet

- Derivatives ManagementDocument13 pagesDerivatives ManagementMaharajascollege KottayamNo ratings yet

- Trading CfdsDocument12 pagesTrading CfdsPipo SimNo ratings yet

- What are forward contracts? Understanding forward contracts and how they workDocument33 pagesWhat are forward contracts? Understanding forward contracts and how they worksivannarayana katragaddaNo ratings yet

- 7.futures NSE GuidDocument4 pages7.futures NSE GuidAMAN KUMAR KHOSLANo ratings yet

- Index Futures RMFDDocument17 pagesIndex Futures RMFDAbhi_The_RockstarNo ratings yet

- Study Notes Trading StrategiesDocument16 pagesStudy Notes Trading Strategiesalok kundaliaNo ratings yet

- Definition of 'Strangle'Document2 pagesDefinition of 'Strangle'rajviNo ratings yet

- NiftyDocument15 pagesNiftySayali KambleNo ratings yet

- Hedging Through Futures: Prof Mahesh Kumar Amity Business SchoolDocument21 pagesHedging Through Futures: Prof Mahesh Kumar Amity Business SchoolasifanisNo ratings yet

- Notes 3 OptionsDocument12 pagesNotes 3 OptionsAravind SNo ratings yet

- Stock Index FuturesDocument4 pagesStock Index FutureswannaflynowNo ratings yet

- Section 1 - Introduction To Index Options: Essential Terms and DefinitionsDocument16 pagesSection 1 - Introduction To Index Options: Essential Terms and DefinitionspkkothariNo ratings yet

- Assignment 1stDocument3 pagesAssignment 1stAmmar ButtNo ratings yet

- Problem Set 3-Group 9Document6 pagesProblem Set 3-Group 9WristWork Entertainment100% (1)

- MacrooDocument7 pagesMacrooLeulNo ratings yet

- Finance HelpDocument15 pagesFinance HelpkaminiNo ratings yet

- Derivatives and Commodity ExchangesDocument53 pagesDerivatives and Commodity ExchangesMonika GoelNo ratings yet

- Work Sheet 02 - FDDocument4 pagesWork Sheet 02 - FDBhavesh RathiNo ratings yet

- Hedging Is Basically Done To Reduce The Risk of Your Current Investment PositionsDocument6 pagesHedging Is Basically Done To Reduce The Risk of Your Current Investment PositionssujitmandotNo ratings yet

- Chapter 3 - Insurance, Collars and Other StrategiesDocument41 pagesChapter 3 - Insurance, Collars and Other Strategiescalun12100% (1)

- Options Strategies ExplainedDocument30 pagesOptions Strategies ExplainedUbraj NeupaneNo ratings yet

- Ch06 SM GE PDFDocument10 pagesCh06 SM GE PDFPia ErikssonNo ratings yet

- Derivatives - 4 PDFDocument10 pagesDerivatives - 4 PDFKsagarika PatraNo ratings yet

- Module 1 - Beginners-Nathi-1Document8 pagesModule 1 - Beginners-Nathi-1Lubna AallyNo ratings yet

- Put Futures Credit Spread Out-Of-The-Money DownsideDocument8 pagesPut Futures Credit Spread Out-Of-The-Money Downsidemm1979No ratings yet

- Beginners Guide To Shorting Crypto v1.1Document10 pagesBeginners Guide To Shorting Crypto v1.1NovicaNo ratings yet

- Homework 6Document6 pagesHomework 6LiamNo ratings yet

- Stocks and Crypto DefinitionsDocument7 pagesStocks and Crypto DefinitionsAndrei GeorgeNo ratings yet

- Notes 3 OptionsDocument12 pagesNotes 3 OptionsAravind SNo ratings yet

- Exports of Pakistan September: Textile & Clothing 57% Food 15% Other Sector 12% Maunfacturing 11% Minerals & Metals 5%Document2 pagesExports of Pakistan September: Textile & Clothing 57% Food 15% Other Sector 12% Maunfacturing 11% Minerals & Metals 5%Alina MalikNo ratings yet

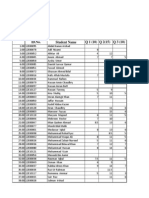

- Mausummery Lawn - Cambric 2014 Franchis Shahzad EME: Total AmountDocument3 pagesMausummery Lawn - Cambric 2014 Franchis Shahzad EME: Total AmountAlina MalikNo ratings yet

- Cambric 2014 Order SheetDocument1 pageCambric 2014 Order SheetAlina MalikNo ratings yet

- Currency Management and Accounts: SBP BSC (Bank) An Overview of PerformanceDocument11 pagesCurrency Management and Accounts: SBP BSC (Bank) An Overview of PerformanceSabyasachi MohapatraNo ratings yet

- Job Application FormDocument1 pageJob Application Formupstar_mughalNo ratings yet

- Mausummery Lawn - Cambric 2014 Franchisee:: Code Design ColorsDocument3 pagesMausummery Lawn - Cambric 2014 Franchisee:: Code Design ColorsAlina MalikNo ratings yet

- Ensuring Fair Testing Through Established StandardsDocument9 pagesEnsuring Fair Testing Through Established StandardsAlina MalikNo ratings yet

- History Hblpr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test resDocument7 pagesHistory Hblpr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test resAlina MalikNo ratings yet

- Banking MBA For Professionals I Sec B Quizzes Spring Semester 2013 Part IIDocument12 pagesBanking MBA For Professionals I Sec B Quizzes Spring Semester 2013 Part IIAlina MalikNo ratings yet

- History Hblpr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test resDocument7 pagesHistory Hblpr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test resAlina MalikNo ratings yet

- gre/2014/special-Quadrilaterals-On-The-Gre/ Feb 4, 2014 - ... and The Facts That You Should Know. These Will Allow You To Answer Questions Quickly and Understand The Basic Nature of These Shapes.Document6 pagesgre/2014/special-Quadrilaterals-On-The-Gre/ Feb 4, 2014 - ... and The Facts That You Should Know. These Will Allow You To Answer Questions Quickly and Understand The Basic Nature of These Shapes.Alina MalikNo ratings yet

- Hedging The Risk of Portfolio by Using Index Option ContractDocument3 pagesHedging The Risk of Portfolio by Using Index Option ContractAlina MalikNo ratings yet

- First Name Surname: Dd/Mm/YyyyDocument2 pagesFirst Name Surname: Dd/Mm/YyyyAlina MalikNo ratings yet

- Report 14pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...Document1 pageReport 14pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...pr 8, 2015 - The last date to apply apply is 19 April for answer key test result online stay ... hbl mto program 2015; hbl mto jobs 2015; hbl 2015 mto test result ...Alina MalikNo ratings yet

- SDFDocument3 pagesSDFAlina MalikNo ratings yet

- Admission Application FormLSEDocument10 pagesAdmission Application FormLSEAlina MalikNo ratings yet

- CRlecture AsdasdDocument13 pagesCRlecture AsdasdAlina MalikNo ratings yet

- Admission Application FormLSEDocument10 pagesAdmission Application FormLSEAlina MalikNo ratings yet

- Islamic Banking and Prohibition of Riba/interest: Full Length Research PaperDocument5 pagesIslamic Banking and Prohibition of Riba/interest: Full Length Research PaperAlina MalikNo ratings yet

- Supply Chain Management Group Names 2Document3 pagesSupply Chain Management Group Names 2Alina MalikNo ratings yet

- Market Portfolio (18 - 22 FEB) : Reasons For Having A Bullish Trend On KSE-100 Index On 22nd February 2013Document6 pagesMarket Portfolio (18 - 22 FEB) : Reasons For Having A Bullish Trend On KSE-100 Index On 22nd February 2013Alina MalikNo ratings yet

- Assignment 2Document11 pagesAssignment 2Alina MalikNo ratings yet

- AMSY-6 OpManDocument149 pagesAMSY-6 OpManFernando Piñal MoctezumaNo ratings yet

- Official Correspondence in English CompleteDocument55 pagesOfficial Correspondence in English Completeyadab rautNo ratings yet

- Budget Planner Floral Style-A5Document17 pagesBudget Planner Floral Style-A5Santi WidyaninggarNo ratings yet

- 41720105Document4 pages41720105renu tomarNo ratings yet

- F. nucleatum L-cysteine Desulfhydrase GeneDocument6 pagesF. nucleatum L-cysteine Desulfhydrase GeneatikramadhaniNo ratings yet

- ICE Professional Review GuidanceDocument23 pagesICE Professional Review Guidancerahulgehlot2008No ratings yet

- Kristy Gallazin Edte 431 - Assignment 2 Newsletter pdf12Document4 pagesKristy Gallazin Edte 431 - Assignment 2 Newsletter pdf12api-301047467No ratings yet

- B§ÐmMm OÝ_ : EH$ {Z~§YmVrc H$ënZmDocument70 pagesB§ÐmMm OÝ_ : EH$ {Z~§YmVrc H$ënZmVikas NikharangeNo ratings yet

- All India Ticket Restaurant Meal Vouchers DirectoryDocument1,389 pagesAll India Ticket Restaurant Meal Vouchers DirectoryShauvik HaldarNo ratings yet

- Jeff Roth CVDocument3 pagesJeff Roth CVJoseph MooreNo ratings yet

- ECUMINISMDocument2 pagesECUMINISMarniel somilNo ratings yet

- Oil Immersed TransformerDocument8 pagesOil Immersed TransformerAbdul JabbarNo ratings yet

- Choi, J H - Augustinian Interiority-The Teleological Deification of The Soul Through Divine Grace PDFDocument253 pagesChoi, J H - Augustinian Interiority-The Teleological Deification of The Soul Through Divine Grace PDFed_colenNo ratings yet

- MA KP3-V2H-2 enDocument155 pagesMA KP3-V2H-2 enJavier MiramontesNo ratings yet

- 2017 Climate Survey ReportDocument11 pages2017 Climate Survey ReportRob PortNo ratings yet

- Innovations in Teaching-Learning ProcessDocument21 pagesInnovations in Teaching-Learning ProcessNova Rhea GarciaNo ratings yet

- PPT ch01Document45 pagesPPT ch01Junel VeriNo ratings yet

- Week 10 8th Grade Colonial America The Southern Colonies Unit 2Document4 pagesWeek 10 8th Grade Colonial America The Southern Colonies Unit 2santi marcucciNo ratings yet

- Chemical Reaction Engineering: Cap Iii: Rate Laws and StoichiometryDocument53 pagesChemical Reaction Engineering: Cap Iii: Rate Laws and StoichiometryMarthaAlbaGuevaraNo ratings yet

- 3D Model of Steam Engine Using Opengl: Indian Institute of Information Technology, AllahabadDocument18 pages3D Model of Steam Engine Using Opengl: Indian Institute of Information Technology, AllahabadRAJ JAISWALNo ratings yet

- Council Of Architecture Scale Of ChargesDocument4 pagesCouncil Of Architecture Scale Of ChargesAshwin RajendranNo ratings yet

- Unit 3 Administrative AdjudicationDocument18 pagesUnit 3 Administrative AdjudicationkipkarNo ratings yet

- 2 Obligations General Provisions 1156 1162Document15 pages2 Obligations General Provisions 1156 1162Emanuel CenidozaNo ratings yet

- Integrating Force - Com With MicrosoftDocument11 pagesIntegrating Force - Com With MicrosoftSurajAluruNo ratings yet

- Handouts - Entity Relationship DiagramDocument8 pagesHandouts - Entity Relationship Diagramsecret studetNo ratings yet