Professional Documents

Culture Documents

Votorantim Financial Report

Uploaded by

hyjulio0 ratings0% found this document useful (0 votes)

38 views0 pagesAnnual Financial Statements 2007-Votoramtim Metais

Original Title

Annual Financial Statements 2007

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAnnual Financial Statements 2007-Votoramtim Metais

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

38 views0 pagesVotorantim Financial Report

Uploaded by

hyjulioAnnual Financial Statements 2007-Votoramtim Metais

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 0

(A free translation of the original in Portuguese)

Votorantim Participaes S.A.

and Subsidiaries

Consolidated Financial Statements at

December 31, 2007 and 2006

and Report of Independent Auditors

2

3

Votorantim Participaes S.A. and Subsidiaries

Consolidated Balance Sheets at December 31

In thousands of reais (A free translation of the original in Portuguese)

4

Supplementary information

Consolidated Industrial segment Financial segment Energy segment

Assets Note 2007 2006 2007 2006 2007 2006 2007 2006

Current assets

Cash and banks 878,735 377,592 727,074 282,875 55,070 56,168 96,591 38,549

Interbank investments 3 15,977,491 17,951,404 15,977,491 17,951,404

Financial investments and derivative financial instruments 3 27,925,993 23,959,773 10,559,780 8,842,475 19,384,246 15,657,616 72,543 107,011

Interbank accounts 1,006,101 1,438,828 1,006,101 1,438,828

Trade accounts receivable 4 2,532,712 2,436,270 2,274,519 2,128,430 258,193 307,840

Credit operations 5 12,976,669 9,136,992 12,976,669 9,136,992

Allowance for doubtful accounts (568,470) (308,703) (95,633) (459,253) (294,273) (13,584) (14,430)

Inventories 6 3,377,364 2,914,337 3,375,260 2,912,018 2,104 2,319

Taxes recoverable 7 2,034,135 2,089,612 1,516,400 1,849,410 483,414 205,627 34,321 34,575

Related parties 213,976

Dividends and interest on own capital receivable 78,158 34,502 237,719 159,452 856,958

Foreign exchange portfolio 856,958 752,238 752,238

Other 1,612,063 1,944,066 528,812 747,592 933,620 1,072,536 149,631 121,512

68,687,909 62,726,911 19,123,931 16,922,252 51,214,316 45,977,136 599,799 811,352

Non-current assets

Long-term receivables

Interbank investments 3 984,311 1,499,112 984,311 1,499,112

Financial investments and derivative financial instruments 3 820,357 755,262 318,610 1,112,443 957,273 1,715,645 549,190 250,352

Trade accounts receivable 90,222 24,435 59,682 505 30,540 23,930

Credit operations 5 13,804,461 7,300,087 13,804,461 7,300,087

Allowance for doubtful accounts (121,533) (119,846) (121,533) (119,846)

Loans receivable 8 513,744 456,588 513,744 456,588

Notes receivable 178,400 374,035 374,035

Tax incentives 7,636 23,058 7,636 23,058

Judicial deposits 15 721,109 569,458 664,926 541,869 33,617 6,531 22,566 21,058

Deferred income tax and social contribution 14 1,497,677 1,309,035 1,042,152 1,020,972 290,197 156,435 165,328 131,628

Taxes recoverable 7 894,414 986,747 880,218 799,383 172,435 14,196 14,929

Other receivables 809,954 575,159 465,959 64,087 372,394 401,148 149,990 144,834

20,200,752 13,753,130 3,952,927 4,392,940 16,320,720 11,131,547 931,819 586,731

Permanent assets

Investments

In affiliated companies 9 1,428,764 1,014,002 1,396,697 982,686 15,651 30,864 16,416 452

Goodwill 9 3,192,270 3,011,245 2,916,543 2,708,089 275,727 303,156

Property, plant and equipment 10 21,874,496 17,718,540 20,886,245 16,818,347 55,881 44,422 932,370 855,771

Deferred charges 582,308 720,353 534,888 684,833 38,523 28,019 8,897 7,500

27,077,838 22,464,140 25,734,373 21,193,955 110,055 103,305 1,233,410 1,166,879

47,278,590 36,217,270 29,687,300 25,586,895 16,430,775 11,234,852 2,165,229 1,753,610

Total assets 115,966,499 98,944,181 48,811,231 42,509,147 67,645,091 57,211,988 2,765,028 2,564,962

Votorantim Participaes S.A. and Subsidiaries

Consolidated Balance Sheets at December 31

In thousands of reais (continued)

The accompanying notes are an integral part of these consolidated financial statements and supplementary information.

5

Supplementary information

Consolidated Industrial segment Financial segment Energy segment

Liabilities and shareholders' equity Note 2007 2006 2007 2006 2007 2006 2007 2006

Current liabilities

Loans and financing 11 7,878,788 5,437,204 4,986,486 2,976,285 2,741,824 2,339,771 150,478 121,148

Deposits 8,944,093 8,351,556 10,526,343 8,902,138

Open market 17,347,430 13,784,733 17,347,430 13,784,733

Funds from acceptance and issuance of securities 12 509,563 446,739 509,563 446,739

Debentures 13 269,153 171,579 202,430 107,111 66,723 64,468

Suppliers 1,816,999 1,661,682 1,693,703 1,537,857 123,296 123,825

Salaries and payroll charges 638,288 398,206 363,142 292,283 275,146 105,923

Income tax and social contribution 8 890,851 1,314,198 295,105 660,500 585,021 628,388 10,725 25,310

Taxes and contributions payable 440,261 1,202,247 348,522 611,366 14,843 522,292 76,896 68,589

Dividends and interest on own capital payable 991,611 511,046 991,611 509,509 156,047 124,950 3,514 1,537

Derivative financial instruments 19 2,859,638 2,069,332 647,901 650,993 2,717,479 1,507,746 2,583 7,340

Foreign exchange portfolio 913,496 439,269 913,496 439,269

Advances from customers 145,799 218,379 145,799

Provision for contingencies and tax liabilities 15 660,149 486,001 637,473 486,001 22,676

Other liabilities 2,270,447 770,383 533,544 718,371 1,640,790 182,309 96,113 88,082

46,576,566 37,262,554 10,005,813 7,957,164 38,267,885 29,577,370 553,004 500,299

Non-current liabilities

Long-term liabilities

Loans and financing 11 16,743,054 15,449,309 12,723,367 12,764,257 2,993,836 1,713,426 1,025,851 971,626

Deposits 3,966,187 8,561,766 4,656,133 10,580,804

Open market 6,044,402 2,633,798 6,044,402 2,633,798

Funds from acceptance and issuance of securities 12 1,591,059 2,269,588 1,591,059 2,269,588

Debentures 13 4,005,394 4,190,241 3,878,687 3,770,220 441,387 420,021

Deferred income tax and social contribution 14 940,009 973,906 905,172 780,232 34,837 188,598 5,076

Provision for contingencies and tax liabilities 15 1,989,910 1,800,506 1,926,435 1,764,423 46,940 16,535 36,083

Derivative financial instruments 19 904,276 1,018,298 11,244 371,542 870,601 947,405 22,520 3,491

Subordinated debt 13 2,578,842 2,578,842

Other 1,013,112 800,189 643,734 904,571 232,928 489 136,450 141,588

39,776,245 37,697,601 16,209,952 16,585,025 22,928,265 22,104,328 1,642,743 1,577,885

Deferred income 9 2,445,014 660,374 2,433,814 652,814 11,200 7,560

Minority interest 2,913,131 2,657,956 2,895,625 2,654,335 4,988 3,326 12,518 295

Shareholders' equity 16 24,255,543 20,665,696 17,266,027 14,659,809 6,432,753 5,519,404 556,763 486,483

Total liabilities and shareholders' equity 115,966,499 98,944,181 48,811,231 42,509,147 67,645,091 57,211,988 2,765,028 2,564,962

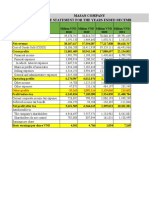

Votorantim Participaes S.A. and Subsidiaries

Consolidated Statements of Income

Years Ended December 31

In thousands of reais (A free translation of the original in Portuguese)

The accompanying notes are an integral part of these consolidated financial statements and supplementary information.

6

Supplementary information

Consolidated Industrial segment Financial segment Energy segment

Note 2007 2006 2007 2006 2007 2006 2007 2006

Gross revenues

Domestic sales 16,640,270 14,454,124 7,573,930 14,454,124

Export sales 7,573,930 7,639,052 16,640,270 7,639,052

Income from financial intermediation 7,427,103 8,017,160 7,607,426 8,071,313

Supply of electric energy 2,018,899 1,729,406 136,916 211,872 1,881,981 1,517,534

Service revenues 1,696,700 1,456,361 1,003,447 1,005,025 693,253 451,336

35,356,902 33,296,103 25,354,563 23,310,073 8,300,679 8,522,649 1,881,981 1,517,534

Taxes on sales and services and other deductions (4,940,671) (4,318,207) (3,960,120) (3,627,566) (287,934) (279,987) (692,617) (410,654)

Net revenues 30,416,231 28,977,896 21,394,443 19,682,507 8,012,745 8,242,662 1,189,364 1,106,880

Cost of products and services (14,776,964) (14,458,496) (13,977,793) (13,739,358) (4,747,934) (799,170) (719,138)

Expenses from financial intermediation (4,585,772) (5,683,868) (5,683,868)

Gross profit 11,053,495 8,835,532 7,416,650 5,943,149 3,264,811 2,558,794 390,194 387,742

Operating income (expenses)

Selling and lending expenses (2,109,614) (1,648,924) (1,338,906) (1,067,267) (709,309) (538,325) (61,399) (43,332)

General and administrative expenses (2,804,467) (1,373,987) (1,838,282) (623,471) (913,413) (709,285) (52,772) (41,231)

Other operating income (expenses), net 563,557 563,593 226,051 396,651 174,187 175,405 163,319 (8,463)

(4,350,524) (2,459,318) (2,951,137) (1,294,087) (1,448,535) (1,072,205) 49,148 (93,026)

Operating profit before results from investments and financial results 6,702,971 6,376,214 4,465,513 4,649,062 1,816,276 1,486,589 439,342 294,716

Results from investments

Equity in results of investees 9 174,921 152,261 174,921 152,261

Exchange variation on foreign investments (732,587) (420,958) (533,297) (327,685) (199,290) (93,273)

Goodwill amortization (933,382) (466,204) (905,363) (448,445) (28,019) (17,759)

(1,491,048) (734,901) (1,263,739) (623,869) (199,290) (93,273) (28,019) (17,759)

Financial income (expenses), net 1,963,079 739,501 2,020,442 779,110 (75,523) (93,762)

Operating profit 7,175,002 6,380,814 5,222,216 4,804,303 1,616,986 1,393,316 335,800 183,195

Non-operating income (expenses), net 20 539,387 280,829 207,920 280,584 319,124 (13,762) 12,343 14,007

Profit before taxation and minority interest 7,714,389 6,661,643 5,430,136 5,084,887 1,936,110 1,379,554 348,143 197,202

Income tax and social contribution

Current (2,029,366) (1,571,526) (1,499,880) (1,153,940) (416,859) (341,925) (112,627) (75,661)

Deferred (179,164) (174,893) (142,489) (261,641) (29,687) 103,903 (6,988) (17,155)

(2,208,530) (1,746,419) (1,642,369) (1,415,581) (446,546) (238,022) (119,615)

Profit before minority interest 5,505,859 4,915,224 3,787,767 3,669,306 1,489,564 1,141,532 228,528 104,386

Profit sharing (282,241) (196,032) (24,082) (14,913) (258,159) (181,119)

Minority interest (418,439) (319,581) (416,878) (318,861) (813) (720) (748)

Net income for the year 4,805,179 4,399,611 3,346,807 3,335,532 1,230,592 959,693 227,780 104,386

Votorantim Participaes S.A.

Statements of Changes in Shareholders' Equity

In thousands of reais unless otherwise indicated (A free translation of the original in Portuguese)

The accompanying notes are an integral part of these consolidated financial statements and supplementary information.

7

Capital Revenue

reserve reserve

Revaluation

Tax reserve Legal Retained

Note Capital incentives of subsidiaries reserve earnings Total

At December 31, 2005 12,112,210 836 17,047 561,699 5,618,540 18,310,332

Prior-year adjustments 16(e) (904,605) (904,605)

Adjusted opening balance 12,112,210 836 17,047 561,699 4,713,935 17,405,727

Capital increase 16(a) 268,328 268,328

Prior-year adjustments 16(e) (379,343) (379,343)

Net income for the year 4,337,983 4,337,983

Appropriation of net income

Legal reserve 216,899 (216,899)

Interest on own capital proposed (R$ 90.70 per thousand shares) 16(d) (488,028) (488,028)

Dividends paid and proposed (R$ 100.77 per thousand shares) 16(c) (542,242) (542,242)

At December 31, 2006 12,380,538 836 17,047 778,598 7,425,406 20,602,425

Net income for the year 4,784,193 4,784,193

Appropriation of net income 16(c)

Legal reserve 239,210 (239,210)

Dividends paid and proposed (R$ 211.16 per thousand shares) (1,136,245) (1,136,245)

At December 31, 2007 12,380,538 836 17,047 1,017,808 10,834,144 24,250,373

Votorantim Participaes S.A. and Subsidiaries

Consolidated Statements of Changes in Financial Position

Years Ended December 31

In thousands of reais (A free translation of the original in Portuguese)

8

Supplementary information

Consolidated Industrial segment Financial segment Energy segment

2007 2006 2007 2006 2007 2006 2007 2006

Financial resources were provided by

Operations

Net income for the year 4,805,179 4,399,611 3,346,807 3,335,533 1,230,592 959,693 227,780 104,386

Amounts not affecting working capital

Prior-year adjustments (379,343) (379,343)

Equity in results of investees (174,921) (152,261) (174,921) (152,261)

Exchange variation on foreign long-term net assets 242,519 420,958 242,519 327,685 93,273

Goodwill amortization 933,382 466,204 905,363 448,445 54,924 17,759

Depreciation, amortization and depletion 1,745,881 1,942,407 1,681,680 1,888,008 9,277 17,306 28,019 37,093

Residual value of permanent asset disposals 933,942 73,168 899,502 71,048 15,213 19,227 2,120

Gains on changes in equity investments (136,000) (136,000)

Deferred income tax and social contribution 179,164 174,893 142,489 261,641 29,687 (103,903) 6,988 17,155

Interest and monetary variation on long-term items (174,965) 147,165 (194,160) 121,460 19,195 25,705

Provision for contingencies 363,552 437,229 162,012 268,417 198,412 198,319 3,128 (29,507)

Minority interest 418,439 319,581 416,878 318,861 813 720 748

Funds provided by operations 9,272,172 7,713,612 7,428,169 6,752,837 1,483,994 786,065 360,009 174,711

From shareholders

Payment of capital 1,000,000 318 185,000

From third parties

Decrease in long-term receivables 602,165 509,760 92,405

Dividends and interest on own capital receivable and received 98,018 34,502 572,761 307,971

Sales of investments 9,261 133 9,128

Increase in long-term liabilities 1,213,188 7,895,018 579,015 776,802 625,525 6,817,463 267,301 300,753

Reduction of permanent assets due to capital decrease 159,779 159,779

Working capital of merged companies/increase in ownership interest 192,653

Total funds provided 10,583,378 16,414,337 8,579,945 8,347,370 2,109,519 8,603,661 627,628 1,114,429

Votorantim Participaes S.A. and Subsidiaries

Consolidated Statements of Changes in Financial Position

Years Ended December 31

In thousands of reais (continued)

The accompanying notes are an integral part of these consolidated financial statements and supplementary information.

9

Supplementary information

Consolidated Industrial segment Financial segment Energy segment

2007 2006 2007 2006 2007 2006 2007 2006

Financial resources were used for

Long-term receivables 6,280,162 1,938,128 800,497 5,218,860 1,728,652 260,805 209,476

Permanent assets

Investments 337,858 58,299 542,121 1,058,299 7,603 76,332

Property, plant and equipment 4,684,951 3,511,480 4,492,802 3,390,742 31,240 43,738 160,909 77,000

Deferred charges 51,485 108,137 46,685 106,918 4,800 1,219

Goodwill on acquisition of investments 1,114,407 875,398 1,061,316 875,398 53,091

Long-term net assets of subsidiaries acquired 171,659 768,394 171,659 675,193

Decrease in long-term liabilities 174,166 258,653 174,166

Change in minority interest 163,265 (319,855) 175,589 (321,584) (849) 2,024 (11,475) (295)

Tax incentives and others 14,104 (9,296) 9,902

Dividends and interest on own capital paid and proposed 1,136,245 1,030,270 1,136,244 1,030,270 317,243 273,471 157,500 23,001

Decrease in deferred income (3,640) 10,764 (3,640) 10,764

Capital reduction 178,441

Total funds used 13,936,392 8,169,285 8,426,913 6,805,940 5,562,854 2,058,649 891,886 749,242

Increase (decrease) in working capital (3,353,014) 8,245,052 153,030 1,541,430 3,453,335 6,545,012 (264,258) 365,187

Changes in working capital

Current assets

At the end of the year 68,687,909 62,726,911 19,123,931 16,922,252 51,214,316 45,977,136 599,799 811,352

At the beginning of the year (62,726,911) (50,401,338) (16,922,252) (13,366,243) (45,977,136) (37,245,848) (811,352) (564,312)

5,960,998 12,325,573 2,201,679 3,556,009 5,237,180 8,731,288 (211,553) 247,040

Current liabilities

At the end of the year 46,576,566 37,262,554 10,005,813 7,957,164 38,267,885 29,577,370 553,004 500,299

At the beginning of the year (37,262,554) (33,182,033) (7,957,164) (5,942,585) (29,577,370) (27,391,094) (500,299) (618,446)

9,314,012 4,080,521 2,048,649 2,014,579 8,690,515 2,186,276 52,705 (118,147)

Increase (decrease) in working capital (3,353,014) 8,245,052 153,030 1,541,430 3,453,335 6,545,012 (264,258) 365,187

(A free translation of the original in Portuguese)

Votorantim Participaes S.A. and Subsidiaries

Notes to the Consolidated Financial Statements

at December 31, 2007 and 2006

In thousands of reais, unless otherwise indicated

10

1 Operations

The corporate purpose of Votorantim Participaes S.A. and its subsidiaries (the Votorantim

Group) is to manage assets and businesses and to invest in other civil and commercial

companies of any nature, to further its interests.

The Votorantim Group is a privately-held conglomerate which holds investments in a business

portfolio, as follows:

(a) Industrial segment

(i) Votorantim Cement Division (VC)

The Cement Division is comprised of companies that manufacture cement, aggregates,

hydrated lime, mortar, agricultural limestone, plaster and concrete. Through its investees, in

addition to the operations in Brazil, VC carries out operations in the United States, Canada and

Bolivia.

In December 2006, the Cement Division acquired Companhia de Cimento Ribeiro Grande

("CCRG") and, in October 2007, it acquired the companies of the Prestige Group

headquartered in Florida (United States), which are leading companies in the ready-mix

concrete sector in the states of Florida, North Carolina, California and Texas.

(ii) Votorantim Metal Division

In the metal segment, Votorantim operates in the aluminum, zinc, nickel and steel markets.

In addition to its operations in Brazil, the Metal Division has investments in Peru, through

Votorantim Metais - Cajamarquilla S.A., where it operates in the production and sale of zinc,

and in Colombia, in the long steel market, through a 52% interest in Aceras Paz Del Rio, a

company purchased at the beginning of 2007.

(iii) Votorantim Pulp and Paper Division (VCP)

With integrated operations in Brazil, ranging from the production of timber to the distribution of

products to the end consumer, VCP's shares are traded on the So Paulo Stock Exchange

and its Level III ADRs are traded on the New York Stock Exchange.

Votorantim Participaes S.A. and Subsidiaries

Notes to the Consolidated Financial Statements

at December 31, 2007 and 2006

In thousands of reais, unless otherwise indicated

11

Approximately 80% of the pulp production is channeled to the foreign market, whereas the

paper production is mainly destined for the Brazilian market.

On May 24, 2006, the corporate restructuring related to the acquisition of the ownership

interest in Ripasa S.A. Celulose e Papel was completed. As a result of this transaction, there

are the following contractual conditions for put and call stock options with the former controlling

shareholders of Ripasa, who received preferred shares of VCP: in the first five years, the

former shareholders have a put option, which is exercisable only if the shares are free of any

liens or encumbrances, and, in the last year, VCP has a call option. The amount of the option,

as established in a contract, is R$ 318,488, adjusted by the SELIC interest rate effective on

March 31, 2005 up to the date of the transaction, should such take place.

On February 1, 2007, the Votorantim Group entered into an agreement with International

Paper, the purpose of which was the exchange of industrial and forest assets between these

two companies. As a result of this agreement, VCP transferred to International Paper the pulp

and paper plant based in the municipality of Luiz Antonio (State of So Paulo), as well as the

forest base of this unit. In turn, International Paper transferred to VCP assets relating to a pulp

plant under construction, with all related rights, as well as the land and planted forests located

in the outskirts of Trs Lagoas (State of Mato Grosso do Sul). This transaction generated

negative goodwill of R$ 1,781,000 relating to the difference between the shareholders' equity

of the companies participating in the exchange.

In September 2007, VCP and the Finnish company Ahlstrom Corporation formalized a joint

venture involving the paper businesses of VCP's unit located in Jacare (State of So Paulo),

as described in Note 9(a).

(iv) Votorantim Energy Division

The Energy Division manages the production of 31 hydroelectric power plants, some of which

under the shared energy system and others owned by the Votorantim Group, as well as four

thermoelectric power plants. The Votorantim Group owns another six hydroelectric power

plants which are in the project phase or under construction.

In 2006, the Energy Division increased to 50% its ownership interest in VBC Energia, which is

the main parent company of CPFL, one of the leading companies in the Brazilian electric

power sector.

(v) Votorantim Agribusiness Division

The Agribusiness Division is mainly engaged in the production of concentrated orange juice,

and has commercial offices in Europe, North America and Asia, in addition to port terminals in

Santos, Antwerp (Belgium) and Newcastle (Australia).

Votorantim Participaes S.A. and Subsidiaries

Notes to the Consolidated Financial Statements

at December 31, 2007 and 2006

In thousands of reais, unless otherwise indicated

12

(vi) Votorantim Chemical Division

The Chemical Division supplies raw materials such as nitrocellulose, hydrofluoric acid and

aluminum fluoride to various industrial sectors.

(b) Votorantim financial division

The Financial Division operates in the wholesale, retail, treasury and resource management

sectors. It has a subsidiary and a branch in Nassau, as well as an office in London and a

brokerage firm in New York. The transactions are carried out by a group of institutions which

operate in the financial market in an integrated manner. The main activities carried out by this

division are related to: (i) consumer financing (especially vehicle financing); (ii) investment

banking and treasury products for corporate customers; (iii) resource management;

(iv) brokerage; and (v) lease transactions for both corporate entities and individuals.

(c) Votorantim New Businesses Division (VNN)

VNN is specialized in the new investments of the Votorantim Group and operates in two areas

- the diversification of businesses and venture capital management.

2 Presentation of the Financial Statements and

Significant Accounting Practices

The consolidated financial statements have been prepared and are presented in accordance

with accounting practices adopted in Brazil.

The preparation of financial statements requires management to make estimates and

assumptions that affect the reported amounts of assets and liabilities and revenues and

expenses, including estimates relating to the selection of the useful lives of property, plant and

equipment, provisions necessary for contingent liabilities and the determination of provisions

for income tax and other similar charges. Actual results may differ from the estimates.

(a) Determination of net income

Net income is determined on the accrual basis of accounting. Sales and service revenues and

related costs are recognized upon product delivery or at the time the services are rendered.

Provisions are recorded for discounts and rebates granted to customers, return estimates and

other adjustments in the same period in which the sales are recorded.

Votorantim Participaes S.A. and Subsidiaries

Notes to the Consolidated Financial Statements

at December 31, 2007 and 2006

In thousands of reais, unless otherwise indicated

13

Income from financial intermediation basically consists of income accrued on credit operations,

foreign exchange transactions, marketable securities and derivative financial instruments.

Revenues from electric energy distribution are recognized based on the tariffs regulated by the

National Electric Energy Agency (ANEEL) when the energy is billed. Unbilled revenues, related

to each monthly billing cycle, are accrued considering the actual energy load made available in

the month and the annual loss rate. The difference between the estimated unbilled revenues

and the actual unbilled revenues, which, from a historical perspective, has not been significant,

is recognized in the subsequent month. Revenues arising from the sale of the energy

generated are accounted for based on the delivery and capacity generated at rates specified in

contractual terms or current market price.

(b) Financial investments and derivative

financial instruments

(i) Financial segment

Marketable securities are classified into the following categories, based on management's

investment intention:

. Trading securities - acquired to be actively and frequently traded, adjusted to market value

against results for the period.

. Securities available for sale - securities that are neither trading securities nor securities held

to maturity, adjusted to market value against a shareholders' equity account, net of tax

effects.

. Securities held to maturity - securities which management acquires with the intention and

financial capacity to hold up to maturity, recorded at updated acquisition cost and not

adjusted to market value.

Derivative financial instruments are evaluated and classified as hedge or non-hedge. In the

financial segment, the transactions that use financial instruments, carried out at customers'

request, or on own account, or which do not comply with the hedging criteria defined in

BACEN Circular 3082, are recorded at market value, with realized and unrealized gains and

losses directly recorded in the statement of income.

(ii) Industrial and energy segments

Investment fund quotas are classified as "Trading securities", as they were acquired to be

actively and frequently traded. The other financial investments are recorded at cost of

purchase plus accrued income, since Votorantim Participaes S.A. and its subsidiaries intend

to hold the investment up to maturity.

Votorantim Participaes S.A. and Subsidiaries

Notes to the Consolidated Financial Statements

at December 31, 2007 and 2006

In thousands of reais, unless otherwise indicated

14

The derivative financial instruments (Note 19) for hedge purposes are evaluated and

accounted for according to the conditions under which they were contracted and are not

recorded at market value.

The financial investments, as well as the transactions involving derivative financial instruments,

contracted with Votorantim Finanas S.A. and subsidiaries, were fully eliminated upon

consolidation.

(c) Allowance for doubtful accounts

The allowance for doubtful accounts is recorded at an amount deemed sufficient by

management to cover estimated losses on the collection of trade accounts receivable, as well

as the rules of the Brazilian Central Bank (BACEN) for the financial segment and the official

accounting manual for the shared energy segment.

(d) Inventories

Inventories are stated at average cost of purchase or production, which is lower than

replacement cost or realizable value. Provisions are established for inventory obsolescence

and impairment, when applicable. Advances to suppliers and imports in transit are stated at

the accumulated cost at the end of the year.

(e) Other current assets and long-term receivables

These are recorded at cost plus, when applicable, earnings calculated on a pro rata daily basis

and accrued monetary and exchange variations up to the balance sheet date, adjusted by a

provision to reflect the realizable values. Assets which will be realized after the twelve months

subsequent to the date of the financial statements are classified as non-current assets.

(f) Investments

Investments in associated companies are accounted for on the equity method of accounting,

plus goodwill and negative goodwill arising from investments (Note 9).

Other investments are stated at cost of purchase, adjusted for inflation up to December 31,

1995, including a provision for probable losses on their realization, when applicable.

Goodwill and negative goodwill determined on the purchase of a company is calculated as the

difference between the purchase value and the book value of the investment acquired.

Votorantim Participaes S.A. and Subsidiaries

Notes to the Consolidated Financial Statements

at December 31, 2007 and 2006

In thousands of reais, unless otherwise indicated

15

Goodwill, based on future economic recovery, is amortized over the period of recovery, not

exceeding 10 years. Negative goodwill is amortized only upon the realization of the related

asset by sale or disposal.

(g) Property, plant and equipment

Property, plant and equipment is stated at cost of purchase or construction, plus price-level

adjustments up to 1995. Depreciation is calculated on the straight-line basis at the rates

mentioned in Note 10. Forestry development costs, primarily project implementation costs, are

capitalized as incurred. The interest arising from financing directly linked to these assets while

under construction is capitalized. The capitalized interest is added to the cost of the related

assets and amortized over their useful lives.

The Votorantim Group is a member of consortia for operating hydroelectric power plants and

has its own hydroelectric power plants which are recorded in its property, plant and equipment.

The revenues generated by the consortia, arising from the sale of production surpluses, are

traded on the Wholesale Energy Market and presented in the statement of income net of

expenses.

Expenses with mineral studies and research are treated as operating expenses until the

economic feasibility of the commercial exploration of mineral reserves is proven. Once this

feasibility has been proven, the expenses incurred start to be capitalized as costs with mine

development. During the development stage of a mine, the expenses with removal of topsoil

are capitalized as part of the development costs. After the mine becomes productive, these

expenses are treated as production costs.

(h) Deferred charges

Deferred charges, which consist primarily of pre-operational expenditures related to expansion

projects, are amortized over a period of up to 10 years.

(i) Income tax, social contribution and

tax incentives

The provision for income tax and deferred income tax on tax losses and temporary differences

is determined at the rate of 25%, and for social contribution and deferred social contribution on

social contribution losses and temporary differences at the rate of 9%. Certain subsidiaries are

also subject to income tax arising from their operations abroad.

Income tax and social contribution are accrued on taxable results. The deferred tax benefit on

tax losses and credits available for offset is generally recognized as an asset to the extent that

Votorantim Participaes S.A. and Subsidiaries

Notes to the Consolidated Financial Statements

at December 31, 2007 and 2006

In thousands of reais, unless otherwise indicated

16

realization is considered probable. The realization of a deferred income tax asset is dependent

on whether there will be sufficient taxable income in future years. Accordingly, the amount of

deferred income tax asset considered realizable may be reduced should there be a reduction

in the estimates of future taxable income.

Taxes on income are recognized in the statement of income gross of tax incentives. The tax

incentive benefit is credited directly to shareholders' equity at the time the option for the

incentive is made, against a decrease in liabilities.

(j) Current and long-term liabilities

These liabilities are stated at known or estimated amounts including, when applicable, accrued

charges and indexation adjustments. The provisions for profit sharing are recorded when the

companies grant this right to the employees, in accordance with performance-based plans. As

occurs with assets, liabilities which will be realized after the twelve months subsequent to the

date of the financial statements are classified as non-current liabilities.

(l) Contingent assets, contingent liabilities

and legal obligations

The recognition, measurement and disclosure of contingent assets and liabilities and legal

obligations are carried out in accordance with the criteria defined by Accounting Standards and

Procedures (NPC) 22 of the Institute of Independent Auditors of Brazil (IBRACON).

. Contingent assets - are only recognized in the financial statements when there is enough

evidence to assure their realization and final and unappealable court decisions, which

makes the gain practically certain.

. Contingent liabilities - are recognized in the financial statements when, based on the

opinion of legal advisors and management, the risk of an unfavorable outcome for a judicial

or administrative lawsuit is regarded as probable, requiring a probable disbursement of

funds to settle the obligations and when the amounts involved are measurable with

sufficient security. The contingent liabilities classified as possible losses are not recorded in

the books and should only be disclosed in the notes to the financial statements, whereas

those classified as remote are neither accrued nor disclosed.

. Legal obligations - these derive from legal proceedings related to tax liabilities being

challenged with respect to their legality or constitutionality. Regardless of the assessment

about the probability of a favorable outcome, these amounts are fully recognized in the

financial statements.

Votorantim Participaes S.A. and Subsidiaries

Notes to the Consolidated Financial Statements

at December 31, 2007 and 2006

In thousands of reais, unless otherwise indicated

17

(m) Environmental expenses

Expenses related to environmental restoration are recorded in the statement of income when

incurred. Other environmental costs are also recorded as expenses unless they increase the

value of the assets and/or provide future economic benefits, in which cases they are

capitalized.

Liabilities are recorded when the expenses are considered probable and can be reasonably

estimated. The calculation of the liabilities is based on current laws and regulations, as well as

on available technology. In general, this record is only made when the companies are

committed to a formal action plan.

(n) Interest on own capital

Brazilian corporations are allowed to deduct, as a financial expense for tax purposes, the

interest attributed to shareholders' equity. For financial reporting purposes, the interest

attributed to shareholders' equity is recorded as a deduction from unappropriated retained

earnings, in a manner similar to a dividend.

(o) Pension plan and other post-retirement

benefits

The contributions made by Votorantim Participaes S.A. and its subsidiaries to defined

contribution pension plans and employee welfare plans (Note 17) were determined by

independent actuaries and are recorded as operating expenses.

An indirect subsidiary of Votorantim Participaes S.A. abroad, Votorantim Cement North

America Inc., and the jointly-controlled companies VBC Energia S.A., Usinas Siderrgicas de

Minas Gerais S.A. - USIMINAS, Ripasa S.A. Celulose e Papel and Aracruz Celulose S.A. have

defined benefit plans that also offer, among other services, medical assistance and life

insurance. The cost of the retirement benefits and of the other benefits of these plans granted

to eligible employees is determined on the projected benefit method pro-rated over the period

of service and management's best estimates of investment yields, salary adjustments, future

cost trends and mortality and retirement age of the employees.

(p) Consolidated financial statements

To enhance the transparency as to its financial position and the results of its operations, the

Votorantim Group has opted to present consolidated financial statements, prepared in

Votorantim Participaes S.A. and Subsidiaries

Notes to the Consolidated Financial Statements

at December 31, 2007 and 2006

In thousands of reais, unless otherwise indicated

18

accordance with accounting practices adopted in Brazil, and covering the industrial, financial

and energy segments. Investments, accounts receivable and payable, income and expenses

and unrealized gains among the companies were eliminated. Minority interest in shareholders'

equity and in the results is stated separately.

Jointly-controlled companies were consolidated proportionally to the ownership interest held in

their capital and include VBC Energia S.A., Aracruz Celulose S.A., Ripasa S.A. Celulose e

Papel, Usinas Siderrgicas de Minas Gerais S.A. - Usiminas and Suwannee American

Cement, LLC.

The results of the subsidiaries and jointly-controlled companies acquired during the period

were included in the consolidated financial statements as from the date of acquisition.

In the consolidated financial statements, the goodwill arising from transactions with third

parties continued to be recorded in investments, whereas the negative goodwill was

transferred to the "Deferred income" account.

The balances and results of derivative financial instruments and financial investments

contracted to hedge the consolidated foreign exchange exposure of the Votorantim Group

were fully eliminated in the preparation of the consolidated financial statements.

Votorantim Participaes S.A. and its subsidiaries adopt uniform accounting practices to

record their operations and value their balance sheet accounts. The financial statements of

foreign associated companies and subsidiaries were prepared under the accounting principles

of their home countries, in their respective currencies. For equity accounting and consolidation

purposes, these financial statements were adjusted to the accounting practices adopted in

Brazil and translated into reais at the rates in effect at the balance sheet date. The statement

of income accounts were translated at the average monthly exchange rate. Foreign exchange

gains and losses of the Parent Company are directly recorded in the statement of income for

the year.

The consolidated financial statements include the balances of the following directly or

indirectly-held subsidiaries:

Percentage

2007 2006

Industrial segment

Cement

Call Ita Participaes Minas Gerais S.A. 100.00 100.00

Calmit Industrial Ltda. 100.00 100.00

Votorantim Participaes S.A. and Subsidiaries

Notes to the Consolidated Financial Statements

at December 31, 2007 and 2006

In thousands of reais, unless otherwise indicated

19

Percentage

2007 2006

Calsete Industrial S.A. 100.00 100.00

Votorantim Cimentos Brasil Ltda. 100.00 100.00

Votorantim Cimentos NNE 98.80 98.80

Empresa de Transporte CPT Ltda. 100.00 100.00

Engemix S.A. 100.00 100.00

St. Barbara Cement Inc. (Canada) 100.00 100.00

St. Marys Cement Inc. (Canada and United States) 100.00 100.00

Suwannee American Cement, LLC (United States) 50.00 50.00

Votorantim Cement North America, Inc. (Canada) 100.00 100.00

Votorantim Cimentos Ltda. 98.47 98.47

Votorantim Investimentos Internacionais S.A. 100.00 100.00

Metallurgy

Companhia Brasileira de Alumnio 99.77 99.74

Indstria e Comrcio Metalrgica Atlas S.A. 99.86 99.86

Votorantim Metais Nquel S.A. (i) 100.00 100.00

Votorantim Metais - Cajamarquilla S.A. (Peru) 99.06 99.06

Siderrgica Barra Mansa S.A. 100.00 100.00

Votorantim Metais e Zinco S.A. 99.92 99.92

Votorantim Metais Ltda. 100.00 100.00

Usinas Siderrgicas de Minas Gerais S.A. - Usiminas 5.76 5.76

Aceras Paz del Ro S.A. (Colombia) 52.00

Pulp and paper

Aracruz Celulose S.A. 12.35 12.35

Nova HPI Participaes e Comrcio Ltda. (ii) 100.00

Ripasa S.A. Celulose e Papel 50.00 50.00

Votorantim Celulose e Papel S.A. 52.15 52.15

Agribusiness

Citrovita Comercial Exportadora S.A. (iii) 99.99

Citrovita Industrial e Comercial Ltda. (iii) 100.00

Citrovita Agro Industrial Ltda. 99.99 99.99

Citrovita Agro Pecuria Ltda. 99.99 99.99

Sucorrico S.A. (ii) 100.00

Chemical

Companhia Agro Industrial Igarassu (iv) 99.98

Companhia Nitro Qumica Brasileira 99.98 99.98

Trading

Votorantim International Holding 100.00 100.00

The Bulk Service Corporation 75.00 75.00

Votorantim Participaes S.A. and Subsidiaries

Notes to the Consolidated Financial Statements

at December 31, 2007 and 2006

In thousands of reais, unless otherwise indicated

20

Percentage

2007 2006

Holding companies and other segments

Hailstone Limited 100.00 100.00

TIVIT - Tecnologia da Informao S.A. 99.99 99.99

Santa Cruz Gerao de Energia S.A. 100.00 100.00

Votorantim Comercial Exportadora e Importadora Ltda. 99.98 99.98

Votorantim Comrcio e Indstria Ltda. 100.00 100.00

Votorantim Investimentos Industriais S.A. 100.00 100.00

Votorantim Investimentos Latino-Americanos S.A. 100.00 94.56

Votorantim Cimentos Amrica S.A. 100.00 94.56

Votocel Investimentos Ltda. 100.00 100.00

Votorantim Energia Ltda. 100.00 100.00

Voto - Votorantim Overseas Trading Operations III Ltd. 100.00 100.00

Voto - Votorantim Overseas Trading Operations IV Ltd. 100.00 100.00

Votorantim Novos Negcios Ltda. 99.99 99.99

Financial segment

Banco Votorantim S.A. 99.92 99.92

BV Financeira S.A. 99.99 99.99

BV Leasing e Arrendamento Mercantil S.A. 99.99 99.99

BV Sistemas Ltda. 99.94 99.94

BV Trading S.A. 99.99 99.99

CP Promotora de Vendas Ltda. 99.40 99.40

Votorantim Bank Limited 95.94 95.84

Votorantim Finanas S.A. 100.00 100.00

Votorantim International Business Limited 100.00 100.00

Votorantim C.T.V.M. Ltda. 99.98 99.98

Votorantim Asset Management D.T.V.M. Ltda. 99.99 99.99

Votorantim Seguros e Previdncia S.A. 99.99 99.99

Banco Votorantim Securities, Inc. 100.00 100.00

Energy segment

VBC Energia S.A. 50.00 50.00

(i) Companhia Nquel Tocantins was merged into Minerao Serra da Fortaleza S.A. during 2006 and

its name was changed to Votorantim Metais Nquel S.A.

(ii) Transferred to Votorantim Investimentos Industriais S.A. and merged in December 2007.

(iii) Merged into Votorantim Participaes S.A. in December 2007.

(iv) Company sold in July 2007.

Votorantim Participaes S.A. and Subsidiaries

Notes to the Consolidated Financial Statements

at December 31, 2007 and 2006

In thousands of reais, unless otherwise indicated

21

(q) Reconciliation of shareholders' equity and

net income for the year between the parent

company and the consolidated

Shareholders' equity Results for the year

2007 2006 2007 2006

Parent Company 24,250,373 20,602,425 4,784,193 4,337,983

Supplement to equity pick-up (*) 86,711 63,271 25,083 61,628

Adjustment of unrealized

profits, net of tax effects (81,541) (4,097)

Consolidated 24,255,543 20,665,696 4,805,179 4,399,611

(*) Refers to a supplement of equity pick-up of companies included in the consolidated

statements of Votorantim Participaes S.A., with residual investments spread over the

Group and stated at historical cost, whose balances were adjusted upon consolidation.

Votorantim Participaes S.A. and Subsidiaries

Notes to the Consolidated Financial Statements

at December 31, 2007 and 2006

In thousands of reais, unless otherwise indicated

22

3 Financial Investments and Derivative

Financial Instruments

Supplementary information

Consolidated Industrial segment Financial segment Energy segment

2007 2006 2007 2006 2007 2006 2007 2006

Trading securities (*)

Financial Treasury Bills (LFTs) 169,337 332,983 169,337 332,983

National Treasury Bills (LTNs) 218,668 2,129,024 218,668 2,129,024

National Treasury Notes (NTNs) 7,866,028 4,724,047 7,866,028 4,724,047

Bank Deposit Certificates (CDBs)

Eurobonds 1,505,742 958,304 1,505,742 958,304

Brazilian foreign debt securities 211,271 289,498 211,271 289,498

Foreign debt securities of other countries 2,098,682 2,220,603 2,098,682 2,220,603

Debentures 1,194,440 1,087,669 1,194,440 1,087,669

Investment fund quotas 5,264,698 5,009,917 4,100,902 3,666,966 1,163,796 1,342,951

Credit Rights Investment Fund (FIDC) 829,479 77,519 2,715 77,519 826,764

Floating rate securities 1,093,238 465,223 94,827 998,411 465,223

Other 224,796 832,453 224,796 832,453

20,676,379 18,127,240 4,198,444 3,744,485 16,477,935 14,382,755

Securities held to maturity

Eurobonds 202,370 680,910 202,370 680,910

Foreign currency denominated investments 2,172,435 1,652,865 2,171,767 2,016,264 27,672

Bank Deposit Certificates (CDBs) 1,055,734 1,792,611 3,228,385 3,891,821 72,543 107,011

Interbank Deposit Certificates (CDIs) 286,757 209,658 286,757 209,658

Purchase and sale commitments 462,228 462,228

Debentures 509,979 343,042 275,470 92,690 549,190 250,352

Other 248,843 248,843

4,938,346 4,679,086 6,673,450 6,210,433 230,042 680,910 621,733 357,363

Derivative financial instruments (Note 19) 3,131,625 1,908,709 6,496 3,633,542 2,309,596

28,746,350 24,715,035 10,878,390 9,954,918 20,341,519 17,373,261 621,733 357,363

Current (27,925,993) (23,959,773) (10,559,780) (8,842,475) (19,384,246) (15,657,616 ) (72,543) (107,011)

Long-term 820,357 755,262 318,610 1,112,443 957,273 1,715,645 549,190 250,352

Votorantim Participaes S.A. and Subsidiaries

Notes to the Consolidated Financial Statements

at December 31, 2007 and 2006

In thousands of reais, unless otherwise indicated

23

(*) Trading securities - the criteria for the pricing of marketable securities are defined by the risk management area of Votorantim Participaes S.A.

and Votorantim Finanas S.A., considering prices and rates officially disclosed by entities such as the National Association of Open Market

Institutions (ANDIMA) and the Futures and Commodities Exchange (BM&F), in addition to possible price adjustments for low liquidity securities,

which consider offers, latest prices, possible dispersal and other factors to fairly determine the market value, in the local and foreign markets.

For securities traded in the Brazilian market, the average rates of the instruments disclosed by ANDIMA are considered, for the closing date, as

well as the closing price disclosed for positions in the BM&F, the prices of the last negotiations of debentures disclosed by ANDIMA, taking into

account the adoption of criteria considered to be adequate to establish the price of low liquidity instruments. For the assets of foreign investees,

the closing prices for the public debt securities in the international market disclosed by Bloomberg and other information services are

considered, as well as the adoption of criteria considered to be adequate for the correct pricing of low liquidity securities.

The Public Securities, Eurobonds and C-Bonds issued by the Brazilian government fall due up to January 2018 and, for the most part, are

recorded in current assets, irrespective of their maturity terms, due to the highly liquid nature of the instruments and intent to optimize market

opportunities.

Investment fund quotas are recorded at their realizable value obtained by the quotation available at the closing date of the financial statements.

Votorantim Finanas S.A., through its subsidiary Votorantim Asset Management D.T.V.M.

Ltda., manages various fixed and variable income funds with total net assets of R$ 28,921,606

(2006 - R$ 23,649,758). Of the total financial investments in investment fund quotas held by

the industrial segment, R$ 3,800,654 (2006 - R$ 3,814,713) was invested in funds managed

by Votorantim Asset Management D.T.V.M. Ltda.

Interbank investments

The breakdown of the interbank investment portfolio, by type, is as follows:

Supplementary information

Financial segment

2007 2006

Open market investments

Funded position 4,600,203 6,264,005

Financed position 5,835,783 9,127,721

Short position 2,473,654 1,523,791

Investments in interbank deposits 2,436,187 2,494,632

Investments in foreign currency 1,338,823 19,240

Other 277,152 21,127

16,961,802 19,450,516

Short-term (15,977,491) (17,951,404)

Long-term 984,311 1,499,112

Votorantim Participaes S.A. and Subsidiaries

Notes to the Consolidated Financial Statements

at December 31, 2007 and 2006

In thousands of reais, unless otherwise indicated

24

4 Trade Accounts Receivable -

Industrial Segment

Credit risk is minimized by the broad customer base and control procedures, as well as the

monitoring of customers' credit limits. Votorantim Participaes S.A. and its subsidiaries also

contract a credit insurance policy for most of their export receivables.

The companies of the industrial segment have irrevocable receivable assignment transactions

to the Credit Rights Investment Fund (FIDC). The fund is managed by Banco Bradesco S.A.

and, at December 31, 2007, reported a net equity of R$ 3,123 (2006 - R$ 251,707), of which

R$ 285 (2006 - R$ 191,721) are in senior quotas owned by closed-end funds of subsidiaries

and R$ 2,838 (2006 - R$ 59,987) in subordinated quotas held by subsidiaries. In December

2007, management of Votorantim requested the dissolution of this fund, to be carried out in the

first quarter of 2008.

At December 31, 2007, the outstanding balance of receivables assigned to the FIDC is R$ 516

(2006 - R$ 257,896). During the year ended December 31, 2007, the expenses incurred on

these assignments amounted to R$ 20,000 (2006 - R$ 30,231), classified as financial

expenses in the consolidated statement of income for the year.

At December 31, 2007, the subsidiary VCP has outstanding vendor transactions amounting to

R$ 224,207 (2006 - R$ 257,708), classified as a deduction from the balances of local trade

accounts receivable. VCP guarantees these transactions and potential losses are taken into

consideration in the establishment of the allowance for doubtful accounts.

5 Credit Operations

(a) Breakdown of credit operations

Supplementary information

Financial segment

2007 2006

Loans - public sector 182,856 200,725

Loans - private sector 8,977,910 4,532,312

Financing - private sector 16,860,252 11,561,819

Financing - rural, marketable securities and others 159,561 142,223

Leasing and foreign exchange portfolio (*) 600,551

26,781,130 16,437,079

Short-term (12,976,669 ) (9,136,992)

Long-term 13,804,461 7,300,087

Votorantim Participaes S.A. and Subsidiaries

Notes to the Consolidated Financial Statements

at December 31, 2007 and 2006

In thousands of reais, unless otherwise indicated

25

(*) In 2006, leasing was classified as "Other receivables" and the foreign exchange portfolio as a deduction from

"Other liabilities".

(b) Analysis of the portfolio by type of customer

Supplementary information

Financial segment

2007 2006

Industry 5,938,605 2,739,690

Commerce 1,769,176 1,259,171

Rural 256,346 182,034

Other services 2,375,674 1,882,152

Financial institutions 25,560 33,857

Individuals 16,415,769 10,741,946

26,781,130 16,838,850

(c) Analysis of the portfolio of credit operations by

corresponding risk levels

The analysis of the portfolio by risk level in the financial segment, including, in 2006, the

balances of leasing and the foreign exchange portfolio, is as follows:

Supplementary information

2007

Credits Credits

Risk level falling due overdue Total

AA 6,431,916 6,431,916

A 15,375,964 15,375,964

B - overdue from 15 to 30 days 2,820,479 669,475 3,489,954

C - overdue from 31 to 60 days 275,077 410,059 685,136

D - overdue from 61 to 90 days 94,290 152,636 246,926

E - overdue from 91 to 120 days 8,451 99,339 107,790

F - overdue from 121 to 150 days 1,358 79,486 80,844

G - overdue from 151 to 180 days 4,401 59,727 64,128

H - overdue for more than 180 days 10,543 287,929 298,472

25,022,479 1,758,651 26,781,130

Votorantim Participaes S.A. and Subsidiaries

Notes to the Consolidated Financial Statements

at December 31, 2007 and 2006

In thousands of reais, unless otherwise indicated

26

Supplementary information

2006

Credits Credits

Risk level falling due overdue Total

AA 2,614,249 2,614,249

A 10,266,181 10,266,181

B - overdue from 15 to 30 days 1,209,110 556,442 1,765,552

C - overdue from 31 to 60 days 1,175,702 411,318 1,587,020

D - overdue from 61 to 90 days 104,208 112,503 216,711

E - overdue from 91 to 120 days 6,004 82,395 88,399

F - overdue from 121 to 150 days 630 57,656 58,286

G - overdue from 151 to 180 days 675 46,585 47,260

H - overdue for more than 180 days 4,360 190,832 195,192

15,381,119 1,457,731 16,838,850

6 Inventories

Consolidated

2007 2006

Finished products 932,005 878,976

Work in process 1,091,118 873,490

Raw materials and auxiliary materials 513,116 413,405

Consumable materials warehouse 454,448 445,764

Imports in transit 150,280 202,518

Other 236,397 100,184

3,377,364 2,914,337

7 Taxes Recoverable

Taxes recoverable mainly refer to income tax withheld on earnings from financial investments

and Value-added Tax on Sales and Services (ICMS) credits arising from the purchase of

property, plant and equipment and consumable products, recorded based on the realization

terms estimated by management.

Votorantim Participaes S.A. and Subsidiaries

Notes to the Consolidated Financial Statements

at December 31, 2007 and 2006

In thousands of reais, unless otherwise indicated

27

8 Main Balances and Transactions with Related Parties

Consolidated

Assets Liabilities Expenses

Company 2007 2006 2007 2006 2007 2006

Suppliers

BAESA - Energtica Barra Grande S.A. 99 8,404 (34,354) (48,337)

Machadinho Energtica S.A. 28,421 30,651 (52,188) (48,639)

Minerao Rio do Norte S.A. 5,677 (121,492)

Petrocoque S.A. Indstria e Comrcio 5,546 (108,789)

34,197 44,601 (208,034) (205,765)

Loans

Hejoassu Administrao S.A. 513,744 456,588

The transactions are carried out under conditions agreed upon between the parties and may or may not bear financial charges, with no defined settlement term.

Votorantim Participaes S.A. and Subsidiaries

Notes to the Consolidated Financial Statements

at December 31, 2007 and 2006

In thousands of reais, unless otherwise indicated

28

9 Investments

(a) Main investees

2007 Consolidated

Adjusted net Equity in results Investment balance

Adjusted income for Ownership -

Companies net equity the year % 2007 2006 2007 2006

BAESA - Energtica Barra Grande S.A. 525,199 82,914 15.00 12,437 7,662 78,780 66,461

Campos Novos Energia S.A. 487,688 129,706 44.77 58,070 218,338 174,032

Ahlstrom VCP Indstria de Papis Especiais S.A. (*) 166,377 4,386 40.00 1,755 66,551

Compaia Minera Milpo S.A.A. 539,465 167,129 24.88 41,582 51,215 134,263 123,055

Machadinho Energtica S.A. 355,598 (1,797) 33.14 (625) 935 117,828 104,038

Minerao Rio do Norte S.A. 591,012 432,143 10.00 43,727 34,567 59,101 58,489

Petrocoque S.A. Indstria e Comrcio 59,103 27,475 22.50 7,079 (823 ) 13,298 9,944

Rio Verdinho Energia S.A. 34,580 100.00 34,580

Sirama Participaes Administrao e Transportes Ltda. 252,967 90,990 38.25 34,804 34,097 96,762 89,984

Exchange variation in affiliated company (20,747)

Other investments (3,161) 24,608 228,908 232,069

Advances for purchase of subsidiaries 140,400

Total investments stated on the equity

method of accounting 174,921 152,261 1,188,809 858,072

Investments carried at cost

Alunorte - Alumina do Norte S.A. 95,858 85,208

Tijuca Sociedade de Minerao 29,910

Other investments

Industrial segment 82,120 39,406

Financial segment 15,651 30,864

Energy segment 16,416 452

239,955 155,930

Total investments 174,921 152,261 1,428,764 1,014,002

Votorantim Participaes S.A. and Subsidiaries

Notes to the Consolidated Financial Statements

at December 31, 2007 and 2006

In thousands of reais, unless otherwise indicated

29

(*) As mentioned in Note 1(a), VCP and the Finnish company Ahlstrom Corporation formalized a joint venture

involving the paper businesses of VCP's unit located in Jacare, State of So Paulo. The Brazilian subsidiary of

Ahlstrom Corporation became the holder of 60% of the capital of Ahlstrom VCP Indstria de Papis Especiais

S.A., whereas the remaining 40% is held by VCP. The amount of the transaction was R$ 233,458, generating a

non-operating gain of R$ 136,264. In addition, a Put and Call Option Agreement was entered into between

VCP and Ahlstrom relating to the 40%-interest held by VCP. This agreement is effective for up to two years as

from September 2007.

The financial statements of the associated companies and subsidiaries at December 31, 2007

and 2006 were audited and/or reviewed by independent auditors.

The report of the independent auditors on the financial statements at December 31, 2007 and

2006 of the jointly-controlled subsidiary VBC Energia S.A. contains a matter of emphasis

paragraph relating to the provisional tariff rates granted by ANEEL to some of its subsidiaries.

In view of the provisional nature of this tariff revision, there may be changes upon its final

approval.

(b) Changes in investments

Consolidated

2007 2006

Balance at the beginning of the year 1,014,002 885,535

Equity in results 195,668 152,264

Purchases of investments and capital increase in investees 337,858 58,299

Sales of investments and capital reduction in investees (9,261)

Gains (losses) and exchange variation on investments (20,747) (38,333)

Dividends received and receivable (98,018) (34,502)

Balance at the end of the year 1,428,764 1,014,002

Votorantim Participaes S.A. and Subsidiaries

Notes to the Consolidated Financial Statements

at December 31, 2007 and 2006

In thousands of reais, unless otherwise indicated

30

(c) Goodwill (negative goodwill) on acquisitions

Supplementary information

Consolidated Industrial segment Financial segment Energy segment

2007 2006 2007 2006 2007 2006 2007 2006

Goodwill

Aceras Paz Del Rio S.A. (i) 584,577 584,577

Angra do Reis Ltda. (v) 50,655 50,655

Aracruz Celulose S.A. (ii) 185,499 329,411 185,499 329,411

BAESA - Energtica Barra Grande S.A. (iii) 7,545 9,334 7,545 9,334

Campos Novos Energia S.A. (iii) 64,297 68,891 64,297 68,891

Companhia de Cimento Ribeiro Grande (iv) 231,607 224,693 231,607 224,693

Companhia Paulista de Fora e Luz (viii) 136,356 149,971 136,356 149,971

Compaia Minera Milpo S.A.A. (v) 103,922 155,191 103,922 155,191

Machadinho Energtica S.A. (v) 16,652 16,652

Minerao Zona da Mata Ltda. (v) 25,993 26,986 25,993 26,986

Prestige Gunite Inc. (v) 220,006 220,006

Rio Grande Energia S.A. (viii) 42,527 42,602 42,527 42,602

Rio Verdinho Energia S.A. (v) 28,990 28,990

RioCell S.A. (vii) 23,120 27,806 23,120 27,806

Ripasa S.A. Celulose e Papel (v) 545,344 734,999 545,344 734,999

S&W Materials Inc. (ii) 11,872 17,735 11,872 17,735

Softway Center Servios de Teleatendimentos a Clientes S.A. (v) 43,038 43,038

St. Marys Cement Inc. (v) 336,303 432,191 336,303 432,191

Sucorrico S.A. 148,071 148,071

Suwannee American Cement, LLC (ii) 23,735 37,616 23,735 37,616

The Bulk Service (v) 50,935 63,906 50,935 63,906

Tivit Terceirizao de Tecnologia e Servio S.A. (v) 36,766 36,766

VBC Energia S.A. (v) 126,945 120,000 126,945 120,000

Votorantim Metais - Cajamarquilla S.A. (v) 138,640 196,813 138,640 196,813

Other (v) 156,946 225,029 60,102 114,446 96,844 110,583

3,192,270 3,011,245 2,916,543 2,708,089 275,727 303,156

Negative goodwill (deferred income)

Empresa de Transporte CPT Ltda. (1,409) (1,409) (1,409) (1,409)

Hailstone Limited (vi) (199,013) (199,013) (199,013) (199,013)

VCP-MS Celulose Sul Mato-Grossense Ltda. (1,781,000) (1,781,000)

Votorantim Celulose e Papel (349,996) (349,996) (349,996) (349,996)

Other (113,596) (109,956) (102,396) (102,396) (11,200) (7,560)

(2,445,014) (660,374) (2,433,814) (652,814) (11,200) (7,560)

Votorantim Participaes S.A. and Subsidiaries

Notes to the Consolidated Financial Statements

at December 31, 2007 and 2006

In thousands of reais, unless otherwise indicated

31

(i) As mentioned in Note 1, on March 16, 2007, the Votorantim Group purchased, at an auction held on the Stock Exchange of Colombia,

8,206,215,228 common shares of the Colombian steel company Aceras Paz del Rio S.A., which account for 52% of this company's capital, for

US$ 502,100 thousand, equivalent to R$ 1,034,268 on that date, including goodwill of R$ 925,094, of which R$ 634,823 is supported by the

expectation of future profitability and will be amortized in up to ten years, and R$ 290,271 relates to the appreciation of assets and will be

amortized over the useful lives of the assets.

(ii) Goodwill supported by the expectation of future profitability, amortized over an eight-year period.

(iii) Goodwill supported by the expectation of future profitability, amortized over ten years as from the start-up of the plant's operations.

(iv) In November 2006, the Votorantim Group purchased the control of Companhia de Cimento Ribeiro Grande, for R$ 425,376, including goodwill

of R$ 319,963, of which R$ 224,912 is supported by the expectation of future profitability and will be amortized in up to ten years, and

R$ 94,781, net of tax effects, relates to the appreciation of assets and will be amortized over the useful lives of the assets.

(v) Goodwill supported by the expectation of future profitability, amortized in up to ten years.

(vi) In August 2002, Votorantim Participaes S.A. acquired the control of Optiglobe Tecnologia da Informao S.A. This transaction generated net

negative goodwill of R$ 199,013.

(vii) Goodwill on the acquisition of the control of Riocell S.A. supported by: (i) the market value of the assets, which will be amortized in accordance

with their realization and (ii) the expectation of future profitability, which will be amortized over ten years as from January 2004.

(viii) Goodwill being amortized based on the expectation of future profitability over the remaining concession period.

9 Property, Plant and Equipment

Consolidated

2007 2006

Cost

Accumulated

depreciation/

depletion Net Net

Annual depreciation/

depletion rates - %

Land and buildings 6,008,415 (1,788,109) 4,220,306 3,684,332 0 to 10

Equipment and installations 18,987,349 (10,047,134) 8,940,215 8,735,418 4 to 25

Vehicles 673,324 (498,960) 174,364 201,842 10 to 25

Furniture and fixtures 216,406 (144,292) 72,114 88,872 10 to 20

Mining rights 874,597 (87,548) 787,049 790,152 (i)

Plantations and forests 1,725,583 (262,120) 1,463,463 1,135,007 (i)

Construction in progress (ii) 5,899,991 5,899,991 2,449,636

Other 527,613 (210,619) 316,994 633,281 4 to 33

34,913,278 (13,038,782) 21,874,496 17,718,540

Supplementary information

Industrial segment

2007 2006

Cost

Accumulated

depreciation/

depletion Net Net

Annual depreciation/

depletion rates - %

Land and buildings 5,846,335 (1,735,536) 4,110,799 3,606,786 0 to 10

Equipment and installations 17,635,705 (9,244,377) 8,391,328 8,225,831 4 to 25

Vehicles 653,977 (481,494) 172,483 199,338 10 to 25

Furniture and fixtures 209,909 (139,811) 70,098 85,055 10 to 20

Mining rights 874,597 (87,548) 787,049 790,152 (i)

Plantations and forests 1,725,583 (262,120) 1,463,463 1,135,007 (i)

Construction in progress (ii) 5,738,450 5,738,450 2,252,375

Other 304,486 (151,911) 152,575 523,803 4 to 33

32,989,042 (12,102,797) 20,886,245 16,818,347

Votorantim Participaes S.A. and Subsidiaries

Notes to the Consolidated Financial Statements

at December 31, 2007 and 2006

In thousands of reais, unless otherwise indicated

32

Financial segment

2007 2006

Accumulated

Annual

depreciation

Cost depreciation Net Net rates - %

IT equipment 66,958 (37,788) 29,170 20,788 20

Other 42,946 (16,235) 26,711 23,634 10

109,904 (54,023) 55,881 44,422

Energy segment

2007 2006

Cost

Accumulated

depreciation/

depletion Net Net

Annual

depreciation/

depletion

rates - %

Land and buildings 162,080 (52,573) 109,507 77,546 (iii)

Equipment and installations 1,284,686 (764,969) 519,717 488,799 (iii)

Vehicles 19,347 (17,466) 1,881 2,504 (iii)

Furniture and fixtures 6,497 (4,481) 2,016 3,817 (iii)

Construction in progress 161,541 161,541 197,261 (iii)

Other 180,181 (42,473) 137,708 85,844 (iii)

1,814,332 (881,962) 932,370 855,771

(i) Depletion is calculated based on the extraction of mineral resources and forests, taking into consideration the estimated lives

of the reserves or the total volume of timber to be harvested from the forests.

(ii) Refers mainly to the projects for the expansion, modernization and operational improvements at the plants of the Metal,

Cement and CBA divisions, as well as the assets of VCP's pulp plant under construction, arising from the exchange described

in Note 1. In addition, it includes investments of CBA for the construction of hydroelectric power plants of R$ 63,922.

Management expects to obtain environmental licenses so that these power plants can start to generate energy in the medium

term. Based on the opinion of its legal advisors, management expects favorable outcomes to the environmental lawsuits and

approval of the pending licenses.

(iii) The average depreciation rate of the assets is approximately 5.00% p.a. in the distribution companies and 2.6% p.a. in the

generating companies.

Votorantim Participaes S.A. and Subsidiaries

Notes to the Consolidated Financial Statements

at December 31, 2007 and 2006

In thousands of reais, unless otherwise indicated

33

11 Loans and Financing

Supplementary information

Consolidated Industrial segment Financial segment Energy segment

Annual financial charges at

Type/purpose December 31, 2007 2007 2006 2007 2006 2007 2006 2007 2006

In foreign currency

Export prepayment Exchange variation + LIBOR + 0.25% to 4.125% 4,813,028 5,975,237 4,813,028 5,975,237

Advances on exchange contracts Exchange variation + 5.4% to 5.7% 683,835 47,157 683,835 47,157

Purchases of assets Exchange variation + LIBOR + 2.14 to 3.56% 1,472,351 2,142,924 1,472,351 2,142,924

Eurobonds Exchange variation + 7.75% and 7.875% 1,092,243 1,317,325 1,092,243 1,317,325

Import financing Exchange variation + LIBOR 1.2% to 1.80% 989,223 354,455 989,223 354,455

Compror supplier financing Exchange variation + LIBOR + 2.60% 289,506 251,601 289,506 251,601

Working capital (includes Resolutions no. 63 and 2770) Exchange variation + 5.15% to 6.70% 2,768,654 2,826,881 2,768,654 2,736,664 90,217

Loans for onlending Exchange variation + 5.59% to 6.79% 2,610,463 4,053,197 2,610,463 4,053,197

Other Exchange variation + 3.00% to 4.00% 1,293,876 336,104 1,135,188 336,104 158,688

16,013,179 17,304,881 13,244,028 13,161,467 2,610,463 4,053,197 158,688 90,217

In local currency

National Bank for Economic and Social

Development (BNDES) TJLP + 3.8% to 7.36% 3,006,808 3,062,855 2,079,690 2,144,800 927,118 918,055

Loans for onlending 1.30% to 11% 3,125,197 3,125,197

Working capital 102.3% to 102.59% of the CDI 1,468,597 1,468,597

Other Long-term Interest Rate (TJLP) + 2.75% to 3.30% 1,008,061 518,777 917,538 434,275 90,523 84,502

8,608,663 3,581,632 4,465,825 2,579,075 3,125,197 1,017,641 1,002,557

24,621,842 20,886,513 17,709,853 15,740,542 5,735,660 4,053,197 1,176,329 1,092,774

Current (7,878,788) (5,437,204) (4,986,486) (2,976,285) (2,741,824) (2,339,771) (150,478) (121,148)

Long-term 16,743,054 15,449,309 12,723,367 12,764,257 2,993,836 1,713,426 1,025,851 971,626

Long-term amounts fall due as follows

2008 2,527,900 1,675,226 770,000 82,674

2009 3,422,374 2,148,569 2,520,041 1,644,234 655,585 306,393 246,748 197,942

2010 2,750,767 1,529,413 1,950,740 916,209 655,585 486,686 144,442 126,518

2011 2,585,387 3,852,228 1,799,133 3,590,884 655,585 150,347 130,669 110,997

2012 4,390,796 5,391,199 3,868,634 4,937,704 411,022 111,140 453,495

2013 onwards 3,593,730 2,584,819 616,059 392,852

16,743,054 15,449,309 12,723,367 12,764,257 2,993,836 1,713,426 1,025,851 971,626

Votorantim Participaes S.A. Subsidiaries

Notes to the Consolidated Financial Statements

at December 31, 2007 and 2006

In thousands of reais, unless otherwise indicated

34

(a) Agreements

Votorantim Participaes S.A., the subsidiaries Votorantim Celulose e Papel S.A. and

Votorantim International Holding N.V. and the jointly-controlled subsidiary VBC Energia S.A.

entered into loan and financing agreements subject to the following main covenants:

(a) certain restrictions upon issuing new financing, (b) restrictions on certain transactions with

related parties and participation in mergers with other companies, (c) commitment to meet the

volume of contracts to be in conformity with a coverage rate, (d) conformity with financial

indices, such as capitalization, interest coverage, minimum retained earnings and financial

borrowing rates. In the event of non-compliance with the conditions of these covenants,

through a notification from the financial institutions, the outstanding balance becomes

immediately due. The subsidiary Votorantim Cement North America, Inc. has loans with

covenants that restrict the payment of dividends and new financing. Additionally, the covenants

have been calculated considering only the consolidated financial statements of the industrial

segment to ensure their consistency with the financial statements of previous periods. The

Companies are in compliance with all the terms set forth in the covenants.

(b) Collateral

Loans and financing are collateralized by statutory lien on the financed equipment, promissory

notes and sureties from the shareholders.

12 Funds from Acceptance and Issuance

of Securities

Liabilities for funds from acceptance and issuance of securities relate to funds in foreign and

local currency raised through the issuance of securities in the international market and with

foreign banks for onlending to local customers, bearing financial charges of up to 14.28% p.a.,

plus exchange variation.

Votorantim Participaes S.A. Subsidiaries

Notes to the Consolidated Financial Statements

at December 31, 2007 and 2006

In thousands of reais, unless otherwise indicated

35

13 Issuance of Debentures and Subordinated Debt

(a) Debentures

Consolidated

Annual financial

charges

2007 2006

Long- Long-

Current term Current term

Votorantim Finanas S.A.

Subject to exchange

variation

12.04% + exchange

variation

82,635 1,583,343 27,775 977,662

Floating DI + 0.35% 119,795 2,295,344 79,336 2,792,558

202,430 3,878,687 107,111 3,770,220

VBC Energia S.A.

Floating

Long-term Interest

Rate (TJLP) +

2.5 to 6%

56,211 99,088 51,972 195,606

Floating

Interbank Deposit

Certificate (CDI) +

up to 5%

8,764 10,963 198,300

Floating

General Market Price

Index (IGP-M) +

9.5%

1,748 27,619 1,533 26,115

66,723 126,707 64,468 420,021

269,153 4,005,394 171,579 4,190,241

The debentures are subject to restrictions set forth in covenants that require compliance with

certain financial indices set at pre-established parameters. Management understands that

such restrictions and covenants are being duly complied with.

(b) Subordinated debt

Annual Consolidated

financial

charges 2007

Votorantim Finanas S.A.

Bank Deposit Certificate (CDB)

Floating rate DI 1,118,215

Debentures

Floating rate DI + 0.5% p.a. 1,460,627

2,578,842

Votorantim Participaes S.A. Subsidiaries

Notes to the Consolidated Financial Statements

at December 31, 2007 and 2006

In thousands of reais, unless otherwise indicated

36

14 Deferred Income Tax and Social Contribution

Deferred tax assets and liabilities refer to income tax and social contribution losses and temporary differences of income tax and social contribution and are classified as long-

term receivables and liabilities reflecting the estimate of realization based on projections of future realization and profitability of the respective companies. These consider the

prescriptive periods and, in the case of income tax and social contribution losses, the limit of 30% for annual taxable income offset, as established by current legislation.

Supplementary information

Consolidated Industrial segment Financial segment Energy segment

2007 2006 2007 2006 2007 2006 2007 2006

Assets

Income tax and social contribution losses 281,705 416,509 223,813 246,357 41,170 148,877 16,722 21,275

Temporary differences

Provision for contingencies 439,161 313,056 390,862 273,450 40,202 30,499 8,097 9,107

Provision for doubtful accounts 277,744 215,541 5,459 11,279 267,519 195,409 4,766 8,853

Provision for losses on investments 117,564 3,425 51,958 3,425 65,606

Deferral of loss on swap agreements 235,654 418,074 219,759 340,372 15,895 77,702

Tax benefit on goodwill 187,814 132,912 53,141 37,222 134,673 95,690

Other provisions 149,703 248,947 124,702 224,871 1 25,001 24,075

1,689,345 1,748,464 1,069,694 1,136,976 430,392 452,488 189,259 159,000

Current assets (other receivables) (191,668 ) (439,429) (27,542) (116,004) (140,195) (296,053) (23,931) (27,372)

Long-term 1,497,677 1,309,035 1,042,152 1,020,972 290,197 156,435 165,328 131,628

Liabilities

Deferral of gain on swap agreements 192,986 503,287 21,626 196,467 171,360 306,820

Adjustments to market value of property, plant and equipment 160,827 198,848 160,827 198,848

Adjustments to market value 128,362 185,028 69,118 60,934 59,244 124,094

Accelerated depreciation 78,307 44,677 72,757 44,677 5,550

Cost of reforestation 114,086 23,419 114,086 23,419

Deferral of foreign exchange variation 473,771 139,928 473,771 139,928

Other 19,362 140,595 19,362 68,674 6,742 5,076