Professional Documents

Culture Documents

All About Mutual Funds

Uploaded by

Tanmoy ChakrabortyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

All About Mutual Funds

Uploaded by

Tanmoy ChakrabortyCopyright:

Available Formats

MBA

Education

&

Careers

36 December 2010

Eco Fundas for you

I

nvestors whose risk tolerance is low, dread

the stock market because of the inherent fear

that the market will crash and they will loose

their savings. The reasoning behind this is very

straight forward: almost every boom in the market

has been followed by a crash (correction as

market analysts call it), when over-priced stocks

in the market correct their value. In order to

reduce the risk of losing ones money, it is

important to have a well diversified investment

portfolio. Also, it so happens that, sometimes, the

money one has is not enough to buy such a

diversified portfolio. It is in this context that mutual

funds (also called an AMC) come into picture.

What is an AMC? What is an AMC? What is an AMC? What is an AMC? What is an AMC?

An Asset Management Company (AMC) pools

money from investors and invests it in a

portfolio on behalf of the investors. The money

pooled is the mutual fund, which is invested

in various asset classes like equity, bonds,

debentures, commercial paper, and

government securities. In simple words, a

mutual fund is simply a financial intermediary

that allows a group of investors to pool their

money together with a predetermined

investment objective.

All about Mutual Funds

PROMOD JOSEPH

MBA, VIRGINIA TECH.

Who is a Fund Manag Who is a Fund Manag Who is a Fund Manag Who is a Fund Manag Who is a Fund Manager? er? er? er? er?

A

n MF has a fund manager who is

responsible for investing the pooled

money into specific securities. The fund manager,

with his team, tracks and researches different

financial instruments and manages the fund. Even

though one of the advantages is the services of

professionals, the biggest advantage is the

diversification.

What is Div What is Div What is Div What is Div What is Diversification? ersification? ersification? ersification? ersification?

D

iversification is the idea of spreading

money across different types of

investments. When one investment is down,

another might be up. Diversifying the investment

reduces the risk considerably. AMCs make

investments in a variety of stocks and securities

which reduces the risk by providing a diversified

portfolio.

The most basic level of diversification is to buy

multiple stocks rather than just one stock. MFs

are set up to buy many stocks. Beyond that, they

can diversify even more by purchasing different

kinds of stocks, bonds, gold, commodities, and

so on. A person would have to invest a lot of time

to buy all these investments and may not be able

to buy because of financial constraints. But if a

few MF units are purchased, then investments are

automatically diversified in a predetermined

MBA

Education

&

Careers

December 2010 37

ECO FUNDAS FOR YOU: ALL ABOUT MUTUAL FUNDS

M E &

C

category of investments. Here the investor is

spared the time and effort of tracking investments,

collecting income, etc. Another advantage is that

investments can be made in small amounts, that

too as and when the investor has money to invest.

Mutual funds are registered with SEBI and are

highly regulated. In this way, investors are also

assured about a trusted monitoring of their money.

T TT TTypes of Mutual Funds ypes of Mutual Funds ypes of Mutual Funds ypes of Mutual Funds ypes of Mutual Funds

A

n Equity Fund invests a major part in

shares (equities). Since the returns are

directly linked to the performance of the stock

market, an EF carries a comparatively higher risk.

A Diversified Fund invests in companies spread

across sectors. If one sector does not do well,

another sector would bail the fund out.

A Sector Fund invests mainly in equity shares of

companies in a particular business sector or

industry (for example, IT).

An Index Fund replicates the portfolio of a

particular benchmark index like Sensex. The

value of the IF varies in proportion to the

benchmark index.

A Tax Saver Fund offers tax benefits to investors

under the Income Tax Act.

A Debt / Income Fund invests in instruments like

bonds, debentures, government securities, and

commercial paper. The fund aims to provide a

regular and steady income to the investor.

A Liquid Fund / Money Market Fund aims at

providing easy liquidity, safety of capital, and

some decent returns. An LF invests in highly

liquid short term instruments like treasury bills

and commercial papers. The period of investment

could be as short as a day.

A Gilt Fund ensures safety of the principal

amount and also a secured return. A GF is able to

ensure this as it invests exclusively in

government securities which guarantee returns.

A Balanced Fund invests both in equity shares and

fixed-income-bearing instruments (debt) in some

proportion. The idea is to provide the safety and

steadiness of debt market while capitalising on the

high returns earned from the equity markets.

A Hedge Fund is a high risk fund that adopts

highly speculative trading strategies.

Cardinal Rule of Investing

The amount of money you make or lose depends

on the amount of risk you take.

The author is Centre Director, T.I.M.E. Madurai

You might also like

- Export Import ContractsDocument21 pagesExport Import ContractsTanmoy ChakrabortyNo ratings yet

- Cash VoucherDocument2 pagesCash VoucherTanmoy ChakrabortyNo ratings yet

- Imf & WtoDocument19 pagesImf & WtoTanmoy ChakrabortyNo ratings yet

- Export ManagementDocument33 pagesExport ManagementTanmoy ChakrabortyNo ratings yet

- Sbi Technical Officer Advertisement EnglishDocument2 pagesSbi Technical Officer Advertisement EnglishTanmoy ChakrabortyNo ratings yet

- INCOTERMSDocument20 pagesINCOTERMSTanmoy ChakrabortyNo ratings yet

- EouDocument12 pagesEouTanmoy ChakrabortyNo ratings yet

- Export HousesDocument3 pagesExport HousesTanmoy ChakrabortyNo ratings yet

- Exim BankDocument14 pagesExim BankIamBe KasNo ratings yet

- Documentation FinalDocument68 pagesDocumentation FinalTanmoy ChakrabortyNo ratings yet

- Risks in EX-IMDocument15 pagesRisks in EX-IMTanmoy ChakrabortyNo ratings yet

- Valuation of SecuritiesDocument47 pagesValuation of SecuritiesTanmoy ChakrabortyNo ratings yet

- Documentation FinalDocument68 pagesDocumentation FinalTanmoy ChakrabortyNo ratings yet

- Methods of PaymentsDocument26 pagesMethods of PaymentsKunal KalraNo ratings yet

- Assistant Advt.Document1 pageAssistant Advt.Tanmoy ChakrabortyNo ratings yet

- Website DisplayDocument3 pagesWebsite DisplayTanmoy ChakrabortyNo ratings yet

- Comparisonbetweenwaterfallmodelandspiralmodel 120812120006 Phpapp02Document9 pagesComparisonbetweenwaterfallmodelandspiralmodel 120812120006 Phpapp02Sohail MerchantNo ratings yet

- Notification SBI General Insurance Manager Executive Other PostsDocument26 pagesNotification SBI General Insurance Manager Executive Other PostsTanmoy ChakrabortyNo ratings yet

- Indian Navy Logistic Edu July 2014 NotificationDocument1 pageIndian Navy Logistic Edu July 2014 NotificationTanmoy ChakrabortyNo ratings yet

- Beta Examples and ProblemsDocument2 pagesBeta Examples and ProblemsTanmoy ChakrabortyNo ratings yet

- Technical AnalysisDocument45 pagesTechnical AnalysisTanmoy Chakraborty100% (1)

- Valuation of Securities: by - ) Ajay Rana, Sonam Gupta, Shivani, Gurpreet, ShilpaDocument46 pagesValuation of Securities: by - ) Ajay Rana, Sonam Gupta, Shivani, Gurpreet, ShilpaTanmoy ChakrabortyNo ratings yet

- Problems On Range, SD, CV and Semi - VarianceDocument14 pagesProblems On Range, SD, CV and Semi - VarianceTanmoy ChakrabortyNo ratings yet

- Information Systems PlanningDocument10 pagesInformation Systems PlanningRachit Puri100% (4)

- Final Research Project - Report - FormatDocument7 pagesFinal Research Project - Report - FormatTanmoy ChakrabortyNo ratings yet

- Portfolio Management of High Networth Individuals in Earth Infrastructures LimitedDocument60 pagesPortfolio Management of High Networth Individuals in Earth Infrastructures Limitedsunilmondal_20085874No ratings yet

- Tan 21Document4 pagesTan 21Tanmoy ChakrabortyNo ratings yet

- 10 1 1 390 3021Document67 pages10 1 1 390 3021Tanmoy ChakrabortyNo ratings yet

- Latest Who & Who''sDocument6 pagesLatest Who & Who''sTanmoy ChakrabortyNo ratings yet

- Tan 24Document26 pagesTan 24Tanmoy ChakrabortyNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- PDACN634Document69 pagesPDACN634sualihu22121100% (1)

- Armstrong April Quarterly 2022Document108 pagesArmstrong April Quarterly 2022Rob PortNo ratings yet

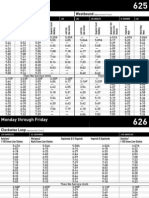

- LA Metro - 625-626Document4 pagesLA Metro - 625-626cartographicaNo ratings yet

- Jason HickelDocument1 pageJason HickelAlaiza Bea RuideraNo ratings yet

- Damodaran PDFDocument79 pagesDamodaran PDFLokesh Damani0% (1)

- Weimar Republic Model AnswersDocument5 pagesWeimar Republic Model AnswersFathima KaneezNo ratings yet

- New SSP SpreadsheetDocument20 pagesNew SSP SpreadsheetAdhitya Dian33% (3)

- Espresso Cash Flow Statement SolutionDocument2 pagesEspresso Cash Flow Statement SolutionraviNo ratings yet

- 2014-04-03 The Calvert GazetteDocument24 pages2014-04-03 The Calvert GazetteSouthern Maryland OnlineNo ratings yet

- Infosys advantages in implementing Java based eProcurement systemDocument1 pageInfosys advantages in implementing Java based eProcurement systemAshwini RungtaNo ratings yet

- Equity vs. EqualityDocument5 pagesEquity vs. Equalityapi-242298926No ratings yet

- Currency and interest rate swaps explainedDocument33 pagesCurrency and interest rate swaps explainedHiral PatelNo ratings yet

- Myths and Realities of Eminent Domain AbuseDocument14 pagesMyths and Realities of Eminent Domain AbuseInstitute for JusticeNo ratings yet

- 10A. HDFC Jan 2021 EstatementDocument10 pages10A. HDFC Jan 2021 EstatementNanu PatelNo ratings yet

- Integration of Renewable Energie Sources Into The German Power Supply System in The 2015-2020 Period With Outlook To 2025Document587 pagesIntegration of Renewable Energie Sources Into The German Power Supply System in The 2015-2020 Period With Outlook To 2025tdropulicNo ratings yet

- Mxkufðuð: Elðumx (UlxmkDocument8 pagesMxkufðuð: Elðumx (UlxmkDharmesh MistryNo ratings yet

- Nifty MasterDocument35 pagesNifty MasterAshok Singh BhatiNo ratings yet

- Total Amount Due: P1,799.00: BIR CAS Permit No. 0415-126-00187 SOA Number: I000051735833Document2 pagesTotal Amount Due: P1,799.00: BIR CAS Permit No. 0415-126-00187 SOA Number: I000051735833Pia Ber-Ber BernardoNo ratings yet

- Shoppers Paradise Realty & Development Corporation, vs. Efren P. RoqueDocument1 pageShoppers Paradise Realty & Development Corporation, vs. Efren P. RoqueEmi SicatNo ratings yet

- Challenges Face by Least Developing Countries (LDCS)Document4 pagesChallenges Face by Least Developing Countries (LDCS)Amal nabNo ratings yet

- Chapter 1-Introduction To Green BuildingsDocument40 pagesChapter 1-Introduction To Green Buildingsniti860No ratings yet

- DaewooDocument18 pagesDaewooapoorva498No ratings yet

- Get in Guaranteed: With Ticketmaster Verified TicketsDocument2 pagesGet in Guaranteed: With Ticketmaster Verified Ticketsoair2000No ratings yet

- Dhakras Bhairavi SDocument137 pagesDhakras Bhairavi SReshma PawarNo ratings yet

- AGI3553 Plant ProtectionDocument241 pagesAGI3553 Plant ProtectionDK White LionNo ratings yet

- Beximco Pharmaceuticals International Business AnalysisDocument5 pagesBeximco Pharmaceuticals International Business AnalysisEhsan KarimNo ratings yet

- UEH Mid-Term Micro Fall 2020 - B46Document4 pagesUEH Mid-Term Micro Fall 2020 - B46SƠN LƯƠNG THÁINo ratings yet

- Partner Ledger Report: User Date From Date ToDocument2 pagesPartner Ledger Report: User Date From Date ToNazar abbas Ghulam faridNo ratings yet

- Understanding essay questionsDocument11 pagesUnderstanding essay questionsfirstclassNo ratings yet

- ASOS Factory List November 2021 Final ListDocument45 pagesASOS Factory List November 2021 Final Listishika maluNo ratings yet