Professional Documents

Culture Documents

Agriauto Industries

Uploaded by

waqas ali ahmadOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Agriauto Industries

Uploaded by

waqas ali ahmadCopyright:

Available Formats

Agriauto Industries

Last Updated on Tuesday, 30 November 1999 05:00Wednesday, 21 December 2011 10:08

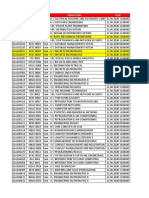

Highlights - Corporate News Agriauto Industries is one of the leading auto component manufacturers of Pakistan. The Company was incorporated in 1981and it is a part of one of the leading business groups of Pakistan, the House of Habib. The Company over the years through technical collaboration with leading international firms have grown to become an important part of the auto and allied industry of Pakistan. In FY11, the Company contributed Rs 1.25 billion to the national exchequer. This hefty contribution to the national exchequer signifies the importance of the component manufacturer for both auto sector and the country. PRODUCT RANGE The Company manufactures original equipment for the leading car, bike, tractor and other auto companies. The Company at the same time manufactures equipment for sale in the aftercare market. The company's wide product range includes high quality shock absorbers and strut, pipe fork, Gabriel brand shock absorbers, cylinder sleeves, gaskets, camshafts, door lock and hinges and steering boxes. HIGHLIGHTS FOR THE AUTO SECTOR The year FY11 was the year of consolidation for the whole auto and allied sector. After being terribly hit in FY09, the auto sectors both two wheelers, passenger cars and commercial vehicles experienced a rise in demand. The rise primarily came from the rural economy as the agriculturist had good incomes due to the high support prices set up by the government. Further strengthening the Agricultural sector was the surge in the global commodity prices due to increase in international demand. The record export achieved by Pakistan and the all-time high remittances were also the demand pullers. Despite all of this the sales are still below the pre-crisis level. Industry member attribute a large amount of this shortfall to the unavailability of financing by the banks. Overall an increase of 10 percent was seen in the passenger car segment in FY11 compared to the last year, largest increase was seen in the light commercial vehicle segment which grew by more than 18 percent in FY11.

HIGHLIGHTS FOR THE COMPANY In the start of the year Company had to face serious problems in the form of hampered supplies due to Tsunami in Japan. After that the government's decision to impose taxes on the tractor sales came into play. The decision to impose taxes and then a statement to make some exemptions gave birth to the sentiment that the taxes would be completely abolished. This ambiguity about the decision brought the tractor industry to a complete halt. Consequently affecting Agriauto, as the tractor industry is one of their clients. The management, however, believes that an even greater threat to the Company is the power shortage that is pushing up the cost of production and hence putting upwards pressure on prices. However, the ever-increasing demand for two wheelers and three wheelers somewhat consolidated the slow down caused by the tractor industry. And in the end the Company was able to achieve a better bottom line this year. Turnover Turnover increased from Rs 3.9 billion in FY10 to Rs 3.98 billion in FY11. The number would have been much higher if the tractor industry hadn't come to almost a complete halt. However, the turnover for the Company saw a small increase of roughly 2 percent in FY11, since the motorcycles and the passenger car sector had a good demand. Profitability The rising production cost due to the surge in fuel prices and energy shortages pushed up the cost of sales in FY11. The Company was not able to transfer the rise in cost to its customers. Both of these affects combined together pushed down the gross profit in FY11 from 24.5 percent in FY10 to 20.3 percent in FY11. Despite increase in the distribution and administrative expenses, the profit after tax surged by 11 percent. This is not something to cheer as the major contributor to the increase in bottom-line profitability is the other operating income; that is the income earned not from the general course of business. The other operating income head was roughly a Rs 90 million expense in FY10 and this year it stood at a positive Rs 70 billion. The earnings came from the prudent investment made by the Company. The EPS continued the upwards trend it had started in FY09 and in FY11 reached a level of Rs 15.24. An 11 percent increase over the last year.

Short- and long-term solvency The short-term liquidity position of the Company has been improving over a period of time. In FY11 the upwards trend continued, the short-term liquidity position improved as the current ratio increased for 5.95 in FY10 to 7.42 in FY11. The same was the case for the long-term solvency. Both the debt to assets ratio and the debt to equity ratio fell in FY11. This decrease in the debt to asset ratio is due to an increase in assets. The short-term investment rose considerably in FY11 as compared to FY10. Investments The Company made investments to upgrade its manufacturing facilities. The Company imported buffing and polishing machines from Japan. A total of Rs 44.86million was invested in FY11. The purchases also include new spot and seam welding machines. The components maker has plans to invest more in FY12. The Company has also decided to invest Rs 33 million in SAP (ERP) software. However, these costs will be implemented next year. Outlook Company's policy to be abreast with the latest technology and its strong brand name are its biggest resources. The Company by utilising its resources to the maximum has outperformed in the past and would outperform in the future as well. Courtesy: Business Recorder forex pakistan

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- SPM Chemistry Form 5 - Redox Part 1Document4 pagesSPM Chemistry Form 5 - Redox Part 1ysheng98No ratings yet

- Regulatory Framework For Water Dams in QuebecDocument2 pagesRegulatory Framework For Water Dams in QuebecRaveeNo ratings yet

- DRS Rev.0 GTP-TR1!01!002 Condensate RecyclingDocument4 pagesDRS Rev.0 GTP-TR1!01!002 Condensate RecyclingBalasubramanianNo ratings yet

- Ground PlaneDocument1 pageGround Planeaeronautical rajasNo ratings yet

- Power - Distribution Transformers @2020V2Document34 pagesPower - Distribution Transformers @2020V2Musfiqul AzadNo ratings yet

- Emerging Therapeutic Options in The Management of Diabetes Recent Trends, Challenges and Future DirectionsDocument21 pagesEmerging Therapeutic Options in The Management of Diabetes Recent Trends, Challenges and Future DirectionsGabriela PachecoNo ratings yet

- The Fat CatsDocument7 pagesThe Fat CatsMarilo Jimenez AlgabaNo ratings yet

- Proposal Form NagDocument1 pageProposal Form Nagnitheesh kumarNo ratings yet

- Igc 3 Practical NeboshDocument20 pagesIgc 3 Practical NeboshAbdelkader FattoucheNo ratings yet

- RA - Ducting WorksDocument6 pagesRA - Ducting WorksResearcherNo ratings yet

- Chapter 4: Palm Oil and Oleochemical Industries.: Presented By: Lovelyna Eva Nur Aniqah Siti MaryamDocument15 pagesChapter 4: Palm Oil and Oleochemical Industries.: Presented By: Lovelyna Eva Nur Aniqah Siti MaryamdaabgchiNo ratings yet

- Staff Code Subject Code Subject Data FromDocument36 pagesStaff Code Subject Code Subject Data FromPooja PathakNo ratings yet

- Emcoturn 365Document362 pagesEmcoturn 365mikadoturkNo ratings yet

- Balmatech Go Ep Tds 2022-03 GBDocument2 pagesBalmatech Go Ep Tds 2022-03 GBAnalista De CalidadNo ratings yet

- The Russian Review - 2020 - ROTH EY - Listening Out Listening For Listening in Cold War Radio Broadcasting and The LateDocument22 pagesThe Russian Review - 2020 - ROTH EY - Listening Out Listening For Listening in Cold War Radio Broadcasting and The LateOkawa TakeshiNo ratings yet

- MHT-CET 2021 Question Paper: 25 September 2021Document3 pagesMHT-CET 2021 Question Paper: 25 September 2021Sank DamNo ratings yet

- Manual Elspec SPG 4420Document303 pagesManual Elspec SPG 4420Bairon Alvira ManiosNo ratings yet

- Electro-Mechanical SectorDocument22 pagesElectro-Mechanical SectorKen LeeNo ratings yet

- Department of Mechanical EnginneringDocument11 pagesDepartment of Mechanical EnginneringViraj SukaleNo ratings yet

- Construction Companies in AlbaniaDocument17 pagesConstruction Companies in AlbaniaPacific HRNo ratings yet

- PricelistDocument4 pagesPricelistMAYMART CASABANo ratings yet

- Danh M C AHTN 2017 - HS Code 2017 PDFDocument564 pagesDanh M C AHTN 2017 - HS Code 2017 PDFBao Ngoc Nguyen100% (1)

- Dragons and Winged SerpentsDocument5 pagesDragons and Winged SerpentsYuna Raven100% (1)

- Notes Ch. 4 - Folk and Popular CultureDocument7 pagesNotes Ch. 4 - Folk and Popular CultureVienna WangNo ratings yet

- An Overview of The IEEE Color BooksDocument6 pagesAn Overview of The IEEE Color BooksOhm666No ratings yet

- Free-Field Equivalent Localization of Virtual AudioDocument9 pagesFree-Field Equivalent Localization of Virtual AudiojulianpalacinoNo ratings yet

- Geology and Mineralization of The Maggie Creek DistrictDocument28 pagesGeology and Mineralization of The Maggie Creek DistrictRockstone Research Ltd.No ratings yet

- An Infallible JusticeDocument7 pagesAn Infallible JusticeMani Gopal DasNo ratings yet

- 9 Daftar Pustaka VaricelaDocument2 pages9 Daftar Pustaka VaricelaAfrina FaziraNo ratings yet

- Traditional EmbroideryDocument38 pagesTraditional EmbroiderySabrina SuptiNo ratings yet