Professional Documents

Culture Documents

42728711ACST828ASS1

Uploaded by

etravoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

42728711ACST828ASS1

Uploaded by

etravoCopyright:

Available Formats

Assignement 1 Acst828 Options, Futures and Derivatives Nour de Vos 42728711

Question 1

1) An equity cfd is a contract for difference between 2 parties with a settlement made through cash payments. CFDs provide all the benefits and risks of owning a security without actually owning it. The trading is on a margin basis which mean margin requirement for trading this product.

2) The Cfd is based on an underlying which benefit from the same sensitivity as the underlying which can be shares, thus, the similarity here is same sensitivity up and down that shares. The other similarity with future is because we are not owning the underlying, and both product are based on margin requirement as if the settlement can be different between futures and cfd, in fact cfd is only settled in cash which is not the case for futures contracts. Other difference remain in the size of the minimum exposure, CFD offer a more smaller way to get expose instead of futures contracts, who are more bigger and increase the size of your exposure. Comparing to Options, the main difference between CFD and options, is the exposition, an option is a right to buy, but can be worthless or can be not exercised, with the cfd your position is a directional position long or short, with another party, and you need to settle in cash as an obligation of the contract, the difference is also in the payoff, because option have a limited downside when you buy a premium, CFDs dont have a limited up or downside such as you can loose more than your account, or your money invested.

2) the advantage for CFDs investors is the minimum exposures they can take instead of big size futures contracts, or options or shares. The main advantage remain the margin requirement instead of the all cash so you can leverage your position with less money than if you actually buy the shares. One of the disadvantage of Cfds against LEPO can be the commission upfront for buying a cfds, instead of a delayed payement in 2 times for the premium for the LEPO. The main similarity stay the margin trading and their exposure to the same type of underlying such as shares or index. But Cfds have more advantages against LEPO such as a more easy way of pricing, and a possibility to short a cfds by cutting exposure on the downside and have effect as an edge, which is not possible with LEPO because there exist only on form of a call options ! The other advantage of Cfds can be by the underlying traded, LEPO exist only on shares and index, whereas Cfds can exist on other underlying such as commodities like gold.

The similarity between futures and LEPO are as follow : first, they work both as margin requirement, and payment is deferred at expiration. Second, they both represent a number of underlying shares, such as a contract of LEPO represent 100 shares. They both have same underlying exposure, because LEPO are really deep in the money to get the same exposure than shares, such as the future contract. The difference between LEPO and futures are on cashflow, with a premium paid in 2 times and only when exercised, buyer of LEPO need to exercise the lepo at expiry, whereas futures contract is automatically cash settled at maturity. The other one is about risk margin : risk margin of a LEPO is calculated as % of underlying whereas initial margin for foturues contracts is fixed as fixed dollar amount. Finally, LEPO are traded on the ASX options market whereas futures are traded on futures market.

4) the main advantage of exchange traded CFDs are the liquidity and the credit risk who disappear by the standardization of the product, instead of an OTC which is more flexible, but less liquid and more risky because of the credit risk of the counterpart.

5) The difference in the deliverable and cash settle futures is the settlement at expiration. For cash settle futures, there is only an exchange of money between 2 parties. But Somes futures contracts in the ASX, ASX24 can be delivered by physical delivery, in this case the settlement is different. In the list of futures cited above, only the 90 days bank accepted bill futures contract can be physical delivered, but others in ASX exist such as Grain or Wool. Why investors uses Cash settlement? Because the cash settlement is more easy and convenient because it eliminates much of the transaction costs that would be incurred when physically delivering a good.

Question 2 a) The next payment will be the difference between the fixed rate and the libor rate. The payment will be netted and will go to the beneficiary party. Thus only the positive difference is going to one of the 2 parties, depending of the libor rate. b) From y point of view, we find (0.08-0.09)x20*1/2= -0.1 the sign is negative because the 4year swap have a current yield > than the 5 year swap, whereas normally, with a normal yield curve 5year swap yield > 4year swap yield. The swap can be valued in 2 ways, as long fixed currency usd and short fixed currency. We have a formula which is swap value = Bd-S0Bf We find =10-0.8*12.5=0 The other way is by a portfolio of forward F1=0.80*(1.05/1.06)^1= 0.79 F2= 0.80*(1.05/1.06)^2=0.7849 F3= 0.3887 C) when we use the put call parity, we can find a forward as f=-p+c which is represented by buying a call and short a put for same strike and same maturity, in our example cash flow are as follow = +4.60-11.04= -6.44 The second way for calculating a forward is as follow f=104.20-100*(e^-0.05*3/12)=-5.44 Thus there is an arbitrage opportunity of 1dollars (6.44-5.44=1) 3) The arbitrage opportunity is represented by buying the less expansive strategy and selling the same synthetic position at a higher price for a 1 dollar gain, because of the arbitrage opportunity. To create a profit of 1000 we need to execute the strategy 1000times, or by buying 1000forward at 5.44 (cost strategy = 1000*5.44=5440 and selling immediately the 1000 forward at 6.44 per unit thus 6440, the benefit of the strategy will be 1000 as wanted.

Question 3 Compute cost of 3 options involved and overall strategy. First we compute via Black Scholes the cost of different calls used in the strategy. First call with S = 0.80 and X=0.75, with a volatility of 40% and r=0.06, we find c=0.095459 In the same way for c2 with s= 0.80 et x=0.80. c2= 0.068125 And for c3 with s=0.80 and x=0.85 we find c3=0.047007 Thus the overall strategy is : c1 + 2x-c2 +c3, in term of cost : -0.095459 +2x(0.068125)-0.047007 The cost of the strategy is = -0.0062144 (for detailed calculation see appendix)

Butterfly payoff (see appendix for details on excel)

0.2

0.1

payoff profit

-0.1

-0.2

The butterfly is profitable when the price of underlying is in the range between 0.76 and 0.84. 2) the payoff from a butterfly can be seen as a function of F(St) such as follow F(St)=X1-2X+X3

For the payoff, we define the butterfly payoff as follow = max (S-X1,0)-2max(S-X2,0)+max(SX3,0) As we already showed in our precedent graph, payoff can be positive for S=0.80 with a payoff of 0.05 and cant be negative because of the last call which cap the upside loss of the 2 short call. When S=0.85, the payoff is 0, and remain 0 for all the upside, because of neutrality (2long call and 2 shorts calls)

We can define the formula as F(St)= x1-2x2+x3, the value cannot be negative because of the strict equality x1<x2<x3. The result cant be negative. Now, when we use a discounted approach we find this expression e^-r(T-t)Eq(F(St)) which is issue from 1) discounted expectation of option payoff and 2) a risk neutral distribution.

3) we know that both American and European call options values are less than the stock price, because S is an upper bound for these option values, thus : in our function Butterfly : X12X2+X3, we can find that 75-80*2+85 =0 and thus that in the upper limit, the price of the butterfly remain 0, in the same way under 0.75 which is the strike of the first call, all call expires worthless, without any value. Thus, we can define the payoff strategy of 0 when S<X=0.75; positive when S={0.75-0.85} and a payoff of 0 when S>0.85. To conclude this inequality remain regardless of black sholes because of the upper limite and the strict inequality stated above.

4) using the put-call parity formula which is c p = S- Xe^-rT Thus we can express a call by a put as follow: c= +p + S-Xe^-rt which say a long call can be representend by a long put + long forward. Thus, we can replace c by p+S-Xe^-rt in our butterfly strategy Thus C1= p1+S-Xe^-rt = p1 + 80-75e^-0.06*1 Thus C2=p2+S-Xe^-rt= p2+80-80e^-0.06*1 (x2) Thus C3=p3+S-Xe^-rt=p3+80-85e^-0.06*1 We now need to calculate the put price of p1, p2 et p3. by Black Scholes formula (see appendix), we find P1=3.5141 P2=5.7123 P3=8.5241 Thus, we find C1 = 3.5141+80-75xe^-0.06*3/12 = 9.62 (by a put computation, close to our 9.615) We find C2= 5.7123+80-80xe^-0.06*0.25= 6.90 (close to our 6.88) And we find C3=8.5241+80-85xe^-0.06*0.25=4.789 (instead of 4.78) Here we have computed the value of call by put by the put-call parity.

We need to apply the formula expressed with q=0.06 and r=0.05 We find that with S=0.816, the c1=0.91796 which is 0.96 the value of the first call with s=0.80 In the same way, c2=0.09086 which represent 1.33 of the first price (increase of 33%) and for c3 we find 0.089925 instead of 0.047007 which represent an increase by 1.91 or (91%) For a change in the other sens with s=0.784 We find c1=0.75072 instead of 0.095446 which is a 0.7865 the original price, so the price of the call have decrease here but for c2 we find 0.074504 instead of 0.068125, which represent an increase of 9% and final c3= 0.073915 for the last call, the increase of price represent an increase of 57% (1.57 the old price) Thus, we can conclude that in term of sensitivity, the OTM are more sensitive to any change of price, with a change of +91% and +57%, the second more sensitive is the ATM options with a change of 33% and 9% and the least sensitive remain the ITM options with a decrease of the option value in both time.

Question 4 If q=93.50 the yield is thus 6.50/100 = 0.065 We know Sdelivery = 100 000x(100-1/2*6.5) = 967 500 Tick value = 10000*1/2*0.01= 50$ For the pvbp : we know it is the amount the price of a bond changes when the yield change by 1 point. Thus for a 1 basis point decrease in y, y=6.49 and Q= 93.51 thus price of the bond change to S P(y=7)= 4m/0.035x(1-1/1.03495)^10)+100/(1.03495)^10 Price of bond = 104.1583 in same way for the second one, we can find P2 where y=6.99, we find P2=104.2009443 thus the difference is the pvbp we find PVBP=0.0426 We calculate the Pvbp/tick value = 0.0426/50= 0.000852

3) first we need to compute the duration which is given by the formula D= (Tx1/(1+i)^t/(1+i)^t we compute the duration from the precedent formula and find D= 4.33 to compute the modified duration from duration, we need to discount by 1+I such as 4.33/1.07=4.04. Modified duration of bond =4.04 Now we need to compute the modified duration for the future contract: where face value = 100 000, y=6.5% and coupon rate of 6%. Thus we find a duration of 2.83 and Modified duration of 2.66 4) Modified duration 1/ modified duration 2 x value b1/ value b2 First we recompute value b1 and value b2 on base of facevalue of 100 We find For b1 with n=5, face=100, c=8%,y=7% b1=104.10 For b2: with n=3,face=100,c=6%,y=6.5% b2=98.68 Thus 4.04/2.66 x 104.10/98.68 = 1.60 We need to change for a correct face value, which for we need to multiply by x100 and we find a hedge ratio of 160. We thus need 160 contracts of futures to hedge our position with the 5 year bond. We need to be short 160 futures for hedging our long position in the 5 year bond. 5) if y1=7.10 and for future y2=100-93.40/100, y2= 6.6%

Thus b1 For b1 with n=5, face=100, c=8%, y=7.1% b1=103.68 For b2: with n=3,face=100,c=6%,y=6.6% b2=98.41 Duration for b1=4.33 modified duration 4.04 Duration for b2 = 2.83, modified duration = 2.66 Thus the new hedge ratio as follow = (4.04/2.66 x 103.68/98.41) = 1.60 The hedge ratio stay the same because the increase of yield for both bond were the same. 6) the future price change from 98.68 to 98.41 = 0.27 The initial deposit based on a 5% deposit will be 967 500*0.05= 48375 The new required will be = 967 000*0.05= 48 350 with y=6.6% because of q=93.40 We find 967 000 by S=10000*(100-1/2*6.6). the amount of the variation margin required will be 48375-48350=+25, we got an extra margin of 25$, which can be explained by bond price falling because of higher yield. 7) if the change is not proportionate, the hedge ratio will change, we need to recompute all the information with the new information such as B1 stay the same: b1 with n=5, face=100, c=8%, y=7.1% b1=103.68 B2 will change with n=3, face =100, c=6% Q=93.41 y=6.59% b2=98.44 (instead of 98.41) Thus duration of b2 will doesnt change and become D2=2.83 Modified duration 2=2.66 New hedge ratio N2= (4.04/2.66 x 103.68/98.44)=1.5996

QUESTION 5. Binomial Model The up factor = u = Su/S thus 1.25/1 = 1.25 The down factor Sd= sd/s 0.8/1 = 0.8 Q=R-d/u-d Q=1.098770-0.8/(1.25-0.8) =0.664 The per period discount factor is 1/R such as 1/0.98770 = 1.0124 For node 4, we can find it as follow Node4= 1*1.25= 1.25 (=node 2) and then node 2x 1.25, which is = 1.25*1.25=1.5625 In the same way for node6, node3=1*0.8=0.8, thus node 6= (node3 * 0.8) = 0.8*0.8=0.64 Both node4 and node6 appear to be correct. In the same way for time3, Node7 = node4*1.25 which is 1.5625*1.25= 1.953125 (correct with the table) For Node10, we can find node10 by node6*0.8 such as 0.64*0.8=0.512 Both node7 and node10 appear to be correct. 3) if we use same u and d for the tree in table3 We should find = 1.1772*0.8 = 0.94176 for first step down (node3) We should find 0.94176*1.25 = 1.1772 for the leg up (node5) We should find 1.1772*1.25=1.4715 for second leg up (node8) And finally we should find 1.4715*0.8=1.1772 for last leg down (Node13)

hedge ratio h= Cu-Cd/ Su- Sd for first leg down : Cu = 1/1.098770 (0.664 x 0.2943) = 0.1778 Cd= 1/0.098770(1-0.664x0) h1 = 0.1772/1.4715-0.94176 h1= 0.335 for node3 cu=0.4238x0.664)1/1.098770 =0.5505 1.1772-0.7534)X0.664 X 1/1.09877 = 0.256 cd=0 h2= (cu-cd/1,772-0.7534) h2=0.604 cu= 0.2973x0.664 )1/1.098770=0.177 cd=0

h3= 0.177/1.4715-0.94176 h3= 0.335 cu=0.3678x0.664 x 1/1.098770=0.400 cd=0 h4=cu / 1.8393-1.1772 h4= 0.6043

for B as Bond zcb holding we know that B=1/R*(cu-hsu) B=1/1.098770*(0.1778-0.335*1.4715)= -0.28 B2=1/1.098770*(0.256-0.604*1.1772)= -0.414 B3=1/1.098770*(0.177-0.335*1.4715)= -0.28755 B4=1/1.098770*(0.400-0.6043*1.8393)= -0.6475 Now for knowing if the strategy is self-financing, we need to check the cost of strategy, by 1. Going long call cu and by shorting B number of bond.

Thus we find that at all step the strategy is self-financing, in term of cashflow shorting is receiving money and buying a call is an outflow, thus, we find For S1 = -Cu1 + B1 = -0.1778 + 0.28= 0.1022 In same way for other step, we find that all overall cashflow is positive because of Bn>cn at all step. For S2= 0.256 +0.414=0.158 For S3= 0.177 + 0.28755=0.11055 For S4= 0.400+ 0.6475=0.2475 5) Thus because of the way we have composed our portfolio, we have a minimum guarantee of return which is 10% which can be compared to a return of ZCB with a yield of 10% and an other part composed of an OTM call option with a strike at 1.10. thus, we can define the payoff of this gold linked note as follow = 1 ZCB with y=10% and a call option with strike X=1.10 Thus the payoff is as follow = 1.1 +1*max(V1-1.1). In this expression, 1.1 represent the payoff of the ZCB with yield of 10% and the other part represent the payoff of 1 call option with X=1.1

Valuation using the analytic approach = We need to value 1. ZCB of y=10 thus p=1.1/1.1^1 and the call option with black scholes formula

Call Option = Where:

We find C= 0.1780 which is close to our binomial estimate of 0.1778. And P= 1.1/1.1^1 = 1 thus ZCB = 1 Thus total value of contract = 1+0.1780 = 1.178 Compared to the binomial approach of 1+0.778=1.1778, we can say that the valuation is at 0.0002 the same.

6) if we can exercised early such as time t=0.5, we need to evaluate the contract based on early exercise by an American binomial model, by doing so with excel we find that the price of the call change, and increase to 0.18169 instead of 0.1778. This is completely normal, because early exercise increase the time value of an options, which is represented by the fact that American option value is always > to European option value. Thus, our contract prices increase from 1.18169 instead of 1.1778. 7) as we calculated in 6, the contract payoff is composed by the ZCB which keep its payoff of VT with max payoff of 1.1 at maturity t=1, because of y=10% and the call option with a strike X=1.1 the payoff of the call when an early exercise is possible becomes Vt+max(1.1-Vt,0). 8) As we know, for valuation of American option, we need to use the backwards recursion procedure with one adjustment; it permits to give the option value at any node at time t as discounted expectation of the option value at time t+1. Thus we can find the following discounted expectation of Value = e^-r(T-t)Eq(Vt + max(1.1-Vt). We Remarque the last expression has the put payoff of an European option.

7) If we can exercise early at time t=0.5, we need to price again our portfolio but with an American way, such as americain option with early exercise. We know in our binomial model

that the early exercice of an option is Max(1.1-Vt), in our example, we need to add the value of the bond at time 0.5 which can be represented by Vt, Thus, we now have a correct payoff represented by Vt+max(1.1-Vt,0) 8) For the American option with early exercise we need to use the process of backwards recursion procedure. This process give the option value at time t as the discounted expectation of the option values at time t+1. In our case we know the payoff at time t+1 wich is t=1 with a payoff of Vt+max(1.1,Vt,0), thus we can express the value at time=0.5 by this process as discounted value of t=1 Thus by applying the backward recursion procedure to our payoff at time t=1 we find : e^-r(Tt)Eq(Vt+max(1.1-Vt,0) which is the value at time 0.5 discounted from t=1.

b) in our payoff at time t=1 V1= Vt+ max(1.1-Vt,0), we can recognize that the last expression max(1.1-Vt) is similar to a put payoff of the form max(X-S) where X=1.1 and S= Vt. Thus, the last expression of our payoff formula at time T=1 can be represented by the formula V=Vt+P where p is a put such as the second part of our expression in our payoff at time t=1

9) we know that value 1= vt + max (1.1-Vt,0) and value2= Vt+Pt but we also know that Value = Max(value1, value2), because an american option is always the maximum value between early exercice value (value1) and continuation value (value2) ! thus, we need to replace max(value1,value2) by their expressions: Value = max(Vt+max(1.1-Vt,0) + max(Vt+P), the value of the option is the higher max of this 2 expressions, such as we can factorized by max and rearrange with vt and we find expression as follow Value = Vt + max(Pt, max(1.1-vt,0)

APPENDIX Exemple of BS calculation c1

$ 0.8000 $ 0.7500

inputs S = Spot price (or exchange rate in the case of currency options) X = Exercise Price 0.25 T = Term to Maturity r = risk free rate (domestic economy risk free 6.00% rate) y = dividend yield (or foreign economy risk free 0.00% rate for currency option)

40.00% =volatility of stock / currency

calculations / outputs 5.0000

0.0645

-0.0050 0.2977 0.0977 0.617031106 0.538911806 $0.800000 $0.738834

results $0.095459 $0.034292 $0.061166 value of long forward contract

BLACK SCHOLES with FOREIGN AND DOMESTIC RATE

r q s t vol K 1/volxsqrt t ln

0.05 0.06 0.816 0.25 0.4 0.8 0.5 0.019803 d1 d2

0.16

0.018651 0.50744 -0.18135 0.428047 -0.01 0.99 -0.015 0.985112 0.0125 0.987577

e^-qt e^-rt

C1 X=0.816 X=0.81 C1 0.091796 C2 0.09086 C3 0.089925 with s=0.784 C11 0.075072 c12 0.074504 c13 0.073915

S=0.80 0.095446 0.068125 0.047007

sensitivity difference 0.961759 1.333725 1.913013

0.095446 0.786539 0.068125 1.093637 0.047007 1.572425

Example of Bond Calculation to confirm the manual calculation in the assignement and macaulay duration formula

inputs 10 n = term of bond in periods $ 100.00 F = face value of bond c = coupon rate per period per $1 of face 5.0000% value 6.0000% y = yield to maturity per period outputs $92.64 P = present value of bond cashflows

For the duration calculation

I used this formula

n = number of cash flows t = time to maturity C = cash flow i = required yield M = maturity (par) value P = bond price

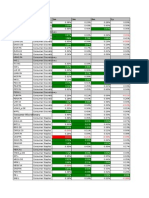

Butterfly appendix strike stock price at mat 0.6 0.61 0.62 0.63 0.64 0.65 0.66 0.67 0.68 0.69 0.7 0.71 0.72 0.73 0.74 0.75 0.76 0.77 0.78 0.79 0.8 0.81 0.82 0.83 0.84 0.85 0.86 0.87 0.88 0.89 0.9 0.91 0.92 0.93 0.94 0.95 0.96 0.97 0.75 payoff c1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0.01 0.02 0.03 0.04 0.05 0.06 0.07 0.08 0.09 0.1 0.11 0.12 0.13 0.14 0.15 0.16 0.17 0.18 0.19 0.2 0.21 0.22 0.8 payoff c2 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0.01 0.02 0.03 0.04 0.05 0.06 0.07 0.08 0.09 0.1 0.11 0.12 0.13 0.14 0.15 0.16 0.17 0.85 payoff c3 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0.01 0.02 0.03 0.04 0.05 0.06 0.07 0.08 0.09 0.1 0.11 0.12 payoff 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0.01 0.02 0.03 0.04 0.05 0.04 0.03 0.02 0.01 0 0 0 0 0 0 0 0 0 0 0 0 0 profit -0.0061 -0.0061 -0.0061 -0.0061 -0.0061 -0.0061 -0.0061 -0.0061 -0.0061 -0.0061 -0.0061 -0.0061 -0.0061 -0.0061 -0.0061 -0.0061 0.0039 0.0139 0.0239 0.0339 0.0439 0.0339 0.0239 0.0139 0.0039 -0.0061 -0.0061 -0.0061 -0.0061 -0.0061 -0.0061 -0.0061 -0.0061 -0.0061 -0.0061 -0.0061 -0.0061 -0.0061

0.98 0.99 1

0.23 0.24 0.25

0.18 0.19 0.2

0.13 0.14 0.15

0 0 0

-0.0061 -0.0061 -0.0061

0.2

0.1

payoff profit

-0.1

-0.2

You might also like

- Option NoteDocument2 pagesOption NoteetravoNo ratings yet

- Consent Form FCC ParagonDocument1 pageConsent Form FCC ParagonetravoNo ratings yet

- Symbol Sectors 1m 3m 6m 1yDocument13 pagesSymbol Sectors 1m 3m 6m 1yetravoNo ratings yet

- Ntro To-Options 2012Document53 pagesNtro To-Options 2012etravoNo ratings yet

- Ratings CriteriaDocument1 pageRatings CriteriaAakash KhandelwalNo ratings yet

- Credit Default Swap Valuation IDocument35 pagesCredit Default Swap Valuation ISharad Dutta0% (1)

- Equity Index Fair Value MonitorDocument2 pagesEquity Index Fair Value MonitoretravoNo ratings yet

- Tudor Capital Europe LLP Pillar 3 Disclosure PDFDocument7 pagesTudor Capital Europe LLP Pillar 3 Disclosure PDFetravoNo ratings yet

- Was Senior Management at Barings Aware That There Was A Problem at BFS? ExplainDocument4 pagesWas Senior Management at Barings Aware That There Was A Problem at BFS? ExplainetravoNo ratings yet

- L 1-R Credit Spread D (0, T - Years) SP Cumul: PDF CumDocument5 pagesL 1-R Credit Spread D (0, T - Years) SP Cumul: PDF CumetravoNo ratings yet

- Symbol Sectors 1m 3m 6m 1yDocument13 pagesSymbol Sectors 1m 3m 6m 1yetravoNo ratings yet

- Business ValuationDocument7 pagesBusiness ValuationetravoNo ratings yet

- Chart Implied Volatility Data in Real-TimeDocument2 pagesChart Implied Volatility Data in Real-TimeetravoNo ratings yet

- Capital Guaranteed Notes Ba Rrier Reverse Convertibles: Example: Autocallable NoteDocument4 pagesCapital Guaranteed Notes Ba Rrier Reverse Convertibles: Example: Autocallable NoteetravoNo ratings yet

- FT WordDocument1 pageFT WordetravoNo ratings yet

- Assignement DerivativesDocument4 pagesAssignement DerivativesetravoNo ratings yet

- XRTrading Cover LetterDocument1 pageXRTrading Cover LetteretravoNo ratings yet

- Finacial TimesDocument2 pagesFinacial TimesetravoNo ratings yet

- Finacial TimesDocument2 pagesFinacial TimesetravoNo ratings yet

- Dispersion Trading Reference For StartingDocument1 pageDispersion Trading Reference For StartingetravoNo ratings yet

- Group Assignment Strategic ManagementDocument2 pagesGroup Assignment Strategic ManagementetravoNo ratings yet

- Bain and Company Global Private Equity Report 2012 PDFDocument72 pagesBain and Company Global Private Equity Report 2012 PDFLinus Vallman JohanssonNo ratings yet

- Gem Global Report 2010revDocument85 pagesGem Global Report 2010revRafael Martins VieiraNo ratings yet

- Finacial TimesDocument2 pagesFinacial TimesetravoNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Lec 6 TutorialDocument27 pagesLec 6 TutorialsentryNo ratings yet

- Hull OFOD10e MultipleChoice Questions Only Ch14Document4 pagesHull OFOD10e MultipleChoice Questions Only Ch14Kevin Molly Kamrath0% (1)

- STS - The Basis of The Sangha Trading SystemDocument9 pagesSTS - The Basis of The Sangha Trading SystemThe Children of the Journey SanghaNo ratings yet

- Lecture 12 - Grassmann Algebra and de Rham Cohomology (Schuller's Geometric Anatomy of Theoretical Physics)Document13 pagesLecture 12 - Grassmann Algebra and de Rham Cohomology (Schuller's Geometric Anatomy of Theoretical Physics)Simon ReaNo ratings yet

- CHPT 12 Derivatives and Foreign Currency: Concepts and Common TransactionsDocument9 pagesCHPT 12 Derivatives and Foreign Currency: Concepts and Common TransactionsKamran ShafiNo ratings yet

- Tensors PresentationDocument7 pagesTensors PresentationDong LuNo ratings yet

- GGSPL Corporate PresentationDocument10 pagesGGSPL Corporate PresentationpduvvuriNo ratings yet

- Cournot's Model Without Using DerivativesDocument5 pagesCournot's Model Without Using DerivativesShyamShah13No ratings yet

- CV Emmanuel ClaessensDocument1 pageCV Emmanuel ClaessensAnonymous 67Gz377rsANo ratings yet

- MBA (FM) Final Result End Term Dec. 2018 Batch 2015 OnwardsDocument19 pagesMBA (FM) Final Result End Term Dec. 2018 Batch 2015 OnwardsSahilNo ratings yet

- The Ethics of DerivativesDocument10 pagesThe Ethics of DerivativesHaniyaAngelNo ratings yet

- Bonds and DerivativesDocument149 pagesBonds and DerivativesLinh LinhNo ratings yet

- Vector Calculus - WikipediaDocument29 pagesVector Calculus - WikipediaAnonymous gUjimJKNo ratings yet

- Hedging Option Greeks PDFDocument10 pagesHedging Option Greeks PDFpiyush_rathod_13No ratings yet

- IFRS 9 ProposalDocument12 pagesIFRS 9 ProposalMuhammad Shahbaz KhanNo ratings yet

- Financial Derivatives Taxation CubetaDocument7 pagesFinancial Derivatives Taxation CubetaMarius AngaraNo ratings yet

- Partial Differential EquationDocument9 pagesPartial Differential EquationEng Shakir H100% (1)

- Hedging Performance of Protective Puts and Covered Calls Portfolio: A Study of NSE NIFTY OptionsDocument27 pagesHedging Performance of Protective Puts and Covered Calls Portfolio: A Study of NSE NIFTY OptionsRahul PinnamaneniNo ratings yet

- Formula For SOA MFEDocument4 pagesFormula For SOA MFEferferNo ratings yet

- Relative-Motion Analysis of Two Particles Using Translating AxesDocument18 pagesRelative-Motion Analysis of Two Particles Using Translating AxesAtef NazNo ratings yet

- HP Calculators: HP 33S Using The Formula Solver - Part 2Document8 pagesHP Calculators: HP 33S Using The Formula Solver - Part 2GilcileneNascimentoNo ratings yet

- Vector Calculus NotesDocument3 pagesVector Calculus NotesChamil GomesNo ratings yet

- Hedging With Options: Peter Carr Bloomberg LP/Courant Institute, NYUDocument48 pagesHedging With Options: Peter Carr Bloomberg LP/Courant Institute, NYUKarthick NklNo ratings yet

- Candlestick Success Rate 60 PercentDocument12 pagesCandlestick Success Rate 60 PercentClipper52aNo ratings yet

- Financial DerivativeDocument2 pagesFinancial DerivativearmailgmNo ratings yet

- Mortgage Pools, Pass-Throughs, and CmosDocument24 pagesMortgage Pools, Pass-Throughs, and CmossamuelNo ratings yet

- Derivatives MarketsDocument9 pagesDerivatives Marketsdebaditya_mohantiNo ratings yet

- Bond-CDS Basis Trading HandbookDocument92 pagesBond-CDS Basis Trading HandbookFutrbllnr75% (4)

- Ilija Murisic - Fairplay - UBS Blue Sea IndexDocument1 pageIlija Murisic - Fairplay - UBS Blue Sea Indexakasaka99No ratings yet

- Newman-Penrose FormalismDocument7 pagesNewman-Penrose FormalismAnonymous kg7YBMFHNo ratings yet