Professional Documents

Culture Documents

Annex 2 GRP Project

Uploaded by

theianchengOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annex 2 GRP Project

Uploaded by

theianchengCopyright:

Available Formats

Annex

2: Guideline for Term Group Project

Aim

The aim of this group project is to provide you with an understanding of the annual reports. You should be able to critically analyze and evaluate various aspects of the financial statements, with emphasis on (but not limited to) the topics discussed in the course. Your group will assume the role of a financial analyst and conduct market research for a client (e.g., an individual investor). Your client has asked you to analyze the financial statements of one company and its competitors you may choose its major competitors from the same industry (two or three companies). Nonetheless, your analysis should focus on the chosen company. Besides, you need to compare its performance with its competitiors in the same industry.

Assessment and Submission The group project report carries 10% of the total marks of the course. It will be graded on the quality of the analyses. The due date and time for submission is on November 18th 2013 (Monday), 5pm. A hard copy report must be submitted at my office (SOA 5021). Please take note that late submission will be marked as zero. Company Selection Each group must select a company that is listed on the Singapore Stock Exchange (SGX). Format of the Group Report Ten pages maximum (excluding a cover page and appendix) Your report should include supporting analyses as appendices in addition to the ten-page main report (There is no page limit for the appendix). Your data should cover at least two years of the latest annual reports. Content The final report must include 1) a cover page, 2) executive summary, 3) analyses, and 4) conclusions. You are required to address all questions with (*) listed below. Feel free to address other listed questions in your report. Workings, if any, must be shown. You may use other sources of information (e.g. companys website, press release, newspaper clippings, etc) but they must be properly sourced and noted. Your report should not be just a bullet point list of answers. It must show a coherent flow and exhibit a cohesive examination of the company. You must discuss the subject firms profitability (including quality and persistence of earnings), effectiveness of asset utilization, debt servicing (liquidity, risk assessment), cash flows management, and overall performance where they are applicable.

Company and Industry Overview (*) What are the principal activities of the company? What is the geographical coverage of the company? (*) What are the major trends in the industry? (*) Who are the companies major competitors? Have any significant events happened at your companies that will be important to consider as you analyze their results? Income Statement Discussions (*)What were the companys total revenues for the year under review? State the composition of the revenues of the company, allocate according to products, locations, activities, etc where possible. (*)What are the bases of revenue recognition adopted by the company? Are they appropriate? (*)Looking at the revenue and net income in the three years presented in the annual report, would you say the company has had a good year? Provide evidence to justify your conclusion. (*)Draw up a common-sized statement for the year under review. Comment on the result. Current Assets and Current Liabilities (*)If your company has inventory, state which inventory cost flow assumption is used. State the composition of current assets and current liabilities for each year. (*)If your company has allowance for doubtful accounts, show how this allowance is determined. Long-Term Assets List by types and amounts the property, plant and equipment of the company. (*)What depreciation method does the company use for financial reporting? Is it appropriate? Long Term Debt and Equity Financing State the nature and amount of each liability in the long-term liabilities section of the balance sheet. (*)Considering your companys operating circumstances, which do you think is the best way to finance its purchase of long-term assets; through internally generated funds, shareholders contributions, or through long term borrowings?

Statement of Cash Flows (*)Compare the companys cash position for the year under review with that of the previous year. Comment on the improvement or deterioration of the companys cash position. (*) Which method (direct or indirect) did the company use in the preparation of its statement of cash flows? (*)State the main sources of cash inflow during the year and the main uses to which cash has been used. Financial Statements Analyses (*)Compute major financial ratios. (*)Calculate and comment on the efficiency ratios. (*)Calculate and comment on the profitability ratios. (*)Calculate and comment on the investment ratios. Useful references 1. Accounting Standards Council (ASC) : http://www.asc.gov.sg/ 2. Singapore Exchange (SGX): http://www.sgx.com/ (Annual reports are available for online download) 3. U.S. Securities and Exchange Commission (SEC): http://www.sec.gov/ 4. U.S. Financial Accounting Standards Board (FASB): http://www.fasb.org/ 5. New York Stock Exchange (NYSE): http://www.nyse.com/ 6. NASDAQ: http://www.nasdaq.com/ 7. MSN Money: http://money.msn.com/ 8. Yahoo Finance: http://finance.yahoo.com/ 9. Thomson ONE Banker and OneSource: Databases from SMU Library website

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Divorce Work SheetDocument4 pagesDivorce Work Sheettheiancheng100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Competency Model BooksDocument4 pagesCompetency Model Bookshoa quynh anhNo ratings yet

- Reconciliation AgreementDocument2 pagesReconciliation AgreementtheianchengNo ratings yet

- Running Head: MARKETING PLAN 1Document21 pagesRunning Head: MARKETING PLAN 1Isba RafiqueNo ratings yet

- Self-Instructional Manual (SIM) For Self-Directed Learning (SDL)Document34 pagesSelf-Instructional Manual (SIM) For Self-Directed Learning (SDL)sunny amarillo100% (1)

- Chapter: 2. Creation of New Ventures: Entrepreneurship For EngineersDocument11 pagesChapter: 2. Creation of New Ventures: Entrepreneurship For EngineersAbdulhakim BushraNo ratings yet

- 10.4324 9780203116098 PreviewpdfDocument32 pages10.4324 9780203116098 PreviewpdfAhmed HonestNo ratings yet

- T3TMD - Miscellaneous Deals - R10Document78 pagesT3TMD - Miscellaneous Deals - R10KLB USERNo ratings yet

- BSBMGT608 Student Assessment Tasks 2020Document45 pagesBSBMGT608 Student Assessment Tasks 2020Chirayu ManandharNo ratings yet

- Property Settlement AgreementDocument9 pagesProperty Settlement AgreementtheianchengNo ratings yet

- Pre Divorce AgreementDocument3 pagesPre Divorce AgreementtheianchengNo ratings yet

- Divorce General ReleaseDocument2 pagesDivorce General ReleasebobbiebogusNo ratings yet

- Child Visitation, Standard NoticeDocument2 pagesChild Visitation, Standard NoticetheianchengNo ratings yet

- Child Visitation Rights, Viiolation NoticeDocument2 pagesChild Visitation Rights, Viiolation NoticetheianchengNo ratings yet

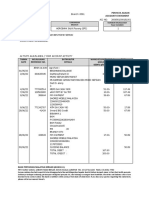

- Bank Reconciliation ExampleDocument3 pagesBank Reconciliation ExampletheianchengNo ratings yet

- Exec Summary Population White PaperDocument7 pagesExec Summary Population White PapertheianchengNo ratings yet

- Child Support Payments, Viiolation NoticeDocument2 pagesChild Support Payments, Viiolation NoticetheianchengNo ratings yet

- Advantages of Windows and Advantages of AndroidDocument1 pageAdvantages of Windows and Advantages of AndroidtheianchengNo ratings yet

- Cisco System Inc - Summary - FinalDocument7 pagesCisco System Inc - Summary - FinalRishabh KumarNo ratings yet

- Paper Uad Submit ReviewDocument5 pagesPaper Uad Submit Reviewpelangi puspaNo ratings yet

- Brand Awareness Big Bazar 79 11Document78 pagesBrand Awareness Big Bazar 79 11sathishNo ratings yet

- SIP ProjectDocument22 pagesSIP ProjectAnkita SinghNo ratings yet

- Comparrative Analysis of Npa of Private Sector and Public Sector BankDocument79 pagesComparrative Analysis of Npa of Private Sector and Public Sector Bankhoney sriNo ratings yet

- Management Skills & Attributes #1Document13 pagesManagement Skills & Attributes #1Mr Akash100% (1)

- Points About Ledger ScrutinyDocument4 pagesPoints About Ledger ScrutinyRahul JainNo ratings yet

- Audit Internship Report Nida DKDocument28 pagesAudit Internship Report Nida DKShan Ali ShahNo ratings yet

- Material Inspection Request (MIR) : Fr-QC-17-00Document1 pageMaterial Inspection Request (MIR) : Fr-QC-17-00Tayyab AchakzaiNo ratings yet

- Doing Business in BruneiDocument67 pagesDoing Business in BruneiAyman MehassebNo ratings yet

- Jun 2022Document1 pageJun 2022aiman marwanNo ratings yet

- PNC Annual RPT 2020 LowresDocument229 pagesPNC Annual RPT 2020 LowresShehani ThilakshikaNo ratings yet

- Job Vacancies in PPB GroupDocument10 pagesJob Vacancies in PPB GroupFarin MustafaNo ratings yet

- L.V. Prasad Eye Institute: Innovating The Business of Eye CareDocument9 pagesL.V. Prasad Eye Institute: Innovating The Business of Eye CareFadhila Nurfida HanifNo ratings yet

- Historical Evolution of Organisational Behavior: Cont..Document19 pagesHistorical Evolution of Organisational Behavior: Cont..Center For Social work Studies Dibrugarh UniversityNo ratings yet

- MNM CV June2023Document3 pagesMNM CV June2023adarsh dNo ratings yet

- What You Should Know About The Cap RateDocument4 pagesWhat You Should Know About The Cap RateJacob YangNo ratings yet

- Global Location Strategy For Automotive SuppliersDocument24 pagesGlobal Location Strategy For Automotive SuppliersJia XieNo ratings yet

- KotakDocument2 pagesKotakRandhir RanaNo ratings yet

- External Factor EvaluationDocument8 pagesExternal Factor EvaluationRobert ApolinarNo ratings yet

- RFP Template Government ModelDocument19 pagesRFP Template Government ModellgdkulclsubucvhgdjNo ratings yet

- Certificate in Records and Information ManagementDocument2 pagesCertificate in Records and Information ManagementChris OkikiNo ratings yet

- B2C Cross-Border E-Commerce Export Logistics ModeDocument7 pagesB2C Cross-Border E-Commerce Export Logistics ModeVoiceover SpotNo ratings yet