Professional Documents

Culture Documents

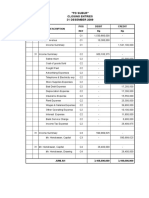

2007-2006 June 30 The Florida Bar Financial Statements

Uploaded by

Neil GillespieCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2007-2006 June 30 The Florida Bar Financial Statements

Uploaded by

Neil GillespieCopyright:

Available Formats

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

The Florida Bar and Subsidiaries

Financial Statements and

Supplemental Information

June 30, 2007 and 2006

1'---------------------1

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

The Florida Bar and Subsidiaries

Table of Contents

June 30, 2007 and 2006

Independent Auditors' Report 1 - 2

Management's Discussion and Analysis 3-7

Financial Statements

Consolidated Statements of Net Assets 8

Consolidated Statements of Revenues, Expenses, and Changes in Net Assets 9

Consolidated Statements of Cash Flows 10- 11

Notes to Consolidated Financial Statements 12 - 27

Supplementary Information

Consolidating Statement of Net Assets as of June 30, 2007. 28 - 29

Consolidating Statement of Revenues, Expense and Changes

in Net Assets for the year ended June 30,2007. 30

Consolidating Statement of Cash Flows for the year ended

June 30, 2007. 31 - 32

General Fund Schedule of Budgeted and Actual Revenues and Expenses

for the year ended June 30, 2007. 33 - 41

General Fund Reconciliation of Revenues and Expenses on a Budgetary Basis to

Totals Per the Consolidating Schedule of Statement of Revenues, Expenses

and Changes in Net Assets for the year ended June 30, 2007. 42

Clients' Security Fund Schedule of Budgeted and Actual Revenues and

Expenses for the year ended June 30, 2007. 43

Certification Fund Schedule of Budgeted and Actual Revenues and Expenses

for the year ended June 30, 2007. 44

Sections Fund Schedule of Budget and Actual Revenues and Expenses for the

year ended June 30,2007. 45 - 46

Other Reports

Report on Internal Control Over Financial Reporting and On Compliance and

Other Matters Based on an Audit of Financial Statements Performed in

Accordance with Government Auditing Standards 47 - 48

I

I

I

CARR, RIGGS &INGRAM, LLC

1713 Mahan Drive

Tallahassee, FL 32308

I

PI 850 878 8777

FI 850 878 2344

www.cricpa.com

I

I

I

I

I

I

I

I

I

I

American Institute of

Certified Public Accountants

I

Alabama Society of

Certified Public Accountants

I

Florida Institute of

Certified Public Accountants

I

Georgia Society of

Certified Public Accountants

I

Mississippi Society of

Certified Public Accountants

AICPA Alliance for CPA Firms

I

Center for Audit Quality

g ~ C R I

CAR R

RIGGS &

INGRAM

Independent Auditors' Report

Board of Governors

The Florida Bar

Tallahassee, Florida

We have audited the accompanying consolidated financial statements of the business

type activities of The Florida Bar and Subsidiaries (The Florida Bar) as of and for the

years ended June 30, 2007 and 2006, which comprise The Florida Bar's basic financial

statements as listed in the table of contents. These financial statements are the

responsibility of The Florida Bar's management. Our responsibility is to express an

opinion on these financial statements based on our audits.

We conducted our audits in accordance with auditing standards generally accepted in

the United States of America and the standards applicable to financial audits contained

in Government AUditing Standards, issued by the Comptroller General of the United

States. Those standards require that we plan and perform the audit to obtain

reasonable assurance about whether the financial statements are free of material

misstatement. An audit includes examining, on a test basis, evidence supporting the

amounts and disclosures in the financial statements. An audit also includes assessing

the accounting principles used and significant estimates made by management, as well

as evaluating the overall financial statement presentation. We believe that our audits

provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in

all material respects, the financial position of the business-type activities of The Florida

Bar and Subsidiaries as of June 30, 2007 and 2006, and the changes in financial

position and cash flows thereof for the years then ended in conformity with accounting

principles generally accepted in the United States of America.

In accordance with Government Auditing Standards, we have also issued our report

dated October 4, 2007, on our consideration of The Florida Bar and Subsidiaries'

internal control over financial reporting and on our tests of its compliance with certain

provisions of laws, regulations, contracts, and grant agreements and other matters. The

purpose of that report is to describe the scope of our testing of internal control over

financial reporting and compliance and the results of that testing, and not to provide an

opinion on the internal control over financial reporting or on compliance. That report is

an integral part of an audit performed in accordance with Government Auditing

Standards and should be considered in assessing the results of our audit.

I

I Board of Governors

The Florida Bar

Page 2

The management's discussion and analysis on pages 3 through 7 are not a required part of the

I

basic financial statements but is supplementary information required by accounting principles

generally accepted in the United States of America. We have applied certain limited

procedures, which consisted principally of inquiries of management regarding the methods of

I

measurement and presentation of the required supplementary information. However, we did not

audit the information and express no opinion on it.

I

Our audits were performed for the purpose of forming an opinion on the consolidated financial

I

statements that collectively comprise The Florida Bar and Subsidiaries' basic financial

statements. The supplementary information as listed in the table of contents, is presented for

the purposes of additional analysis and is not a required part of the basic consolidated financial

statements of The Florida Bar. Such information has been subjected to the auditing procedures

I

applied in the audit of the basic consolidated financial statements and, in our opinion, is fairly

stated in all material respects in relation to the basic consolidated financial statements taken as

a whole.

I

October 4, 2007

I

I

I

I

I

I

I

I

I

I

I

I

I

1

1

I

I

I

I

I

I

I

I

I

I

I

I

I

I

Management's Discussion and Analysis

11------------------

I

The Florida Bar and Subsidiaries

Management's Discussion and Analysis

I

I

The Florida Bar is the statewide professional and regulatory organization for lawyers with more

than 81,500 members. Headquartered in Tallahassee, The Florida Bar is a unified state bar by

rule of the Supreme Court of Florida. Membership in The Florida Bar is a necessary component of

Supreme Court of Florida regulation of all lawyers licensed to practice law in Florida (Article IV,

I

Section 15, Florida Constitution). The foundation for the organization is built on a philosophy of

equity and ethics. Through its programs and services, the Bar supports this philosophy with four

pillars that function as the mission of The Florida Bar: providing public service, protecting rights,

I

promoting professionalism and pursuing justice.

Overview of the Financial Statements

I

I

I This annual report consists of three parts - management's discussion and analysis, the basic

consolidated financial statements, and an optional section that presents supplementary

information. The supplementary information includes consolidating statements and comparisons of

actual results to budgeted results. The basic consolidated financial statements present the

consolidated financial position, results of operations, and cash flows of the Florida Bar and its

subsidiaries. The Florida Bar performs two overall activities as the statewide regulators of the

practice of law and the professional association of lawyers. Its activities are accounted for as a

proprietary type enterprise fund because it charges fees to provide its services similar to a

business enterprise.

I

The Statement of Net Assets includes all of The Florida Bar's assets and liabilities. The net assets

are the difference between The Florida Bar's assets and liabilities. The Statement of Revenues,

I

Expenses, and Changes in Net Assets include all of The Florida Bar's revenues and expenses

I

regardless of when the cash is received or paid. The change in net assets is one way to measure

The Florida Bar's financial health or position. A Statement of Cash Flows provides additional

information regarding the change in The Florida Bar's cash position.

Summary of Operations

I

I

At June 30, 2007 and 2006, The Florida Bar had $58,556,200 and $52,906,350, respectively in

total assets. Of this amount $51,221,438 and $46,034,465 was held in cash and investments and

$6,339,329 and 5,904,229 was invested in capital assets at June 30, 2007 and 2006, respectively.

The primary liability at June 30, 2007 and 2006 was deferred revenue of $9,362,874 and

$9,659,687, respectively, resulting from advance collection of member fees and prepayments for

Continuing Legal Education registrations. Our net assets were $42,327,971 and $36,311,836 at

I

June 30, 2007 and 2006, respectively.

These amounts are in line with the prior year's balances given the current changes in net assets.

I

The original operating budgets for the General Fund (excluding the wholly-owned subsidiary and

I

controlled entities) for the years ended June 30,2007 and 2006, approved by the Florida Supreme

Court, planned on an increase in net assets of $724,991 and $482,000, respectively. After Board

of Governor amendments, the planned (decrease) increase became $(951,934) and $726,314,

I

respectively. General Fund actual operations resulted in a change in net assets of $2,963, 163 and

$2,582,203, respectively. This improved performance resulted primarily from better than planned

investment returns, increased sales in continuing legal education registrations and certifications

and efficiencies in operations of the various departments of The Florida Bar. Included in the

supplemental information is an actual to budget comparison for each department.

I

I

- 3

I

The Florida Bar and Subsidiaries

Management's Discussion and Analysis

I

I

For the year ended June 30, 2007 and 2006, The Florida Bar's budget funded most departments at

a continuation level. A consumer assistance program was implemented in 2006-07 to centralize all

I

complaint intake in Tallahassee. No other significant increased activity was implemented or

planned.

The Lawyer Regulation Department is currently in the process of restructuring and staffing its

consumer assistance program and is expected to have full implementation of the program in 2007

I

08.

I

CONDENSED CONSOLIDATED FINANCIAL INFORMATION

CONDENSED CONSOLIDATED STATEMENTS OF NET ASSETS

I

June 30,

I

Assets

Current assets

Capital assets, net

Total assets

I

I Liabilities

Current liabilities

Other liabilities

Total liabilities

I

Net assets

I

Invested in capital assets, net of related debt

Restricted for scholarships

Unrestricted

Total net assets

I

Total liabilities and net assets

I

I

I

I

I

I

-4

2007

$ 52,216,871

6,339,329

$ 58,556,200

$ 12,157,092

4,071,137

16,228,229

4,474,503

32,551

37,820,917

42,327,971

$ 58,556,200

2006 Change

$ 47,002,121

5,904,229

$ 52,906,350

$

$

5,214,750

435,100

5,649,850

$ 12,556,535

4,037,979

16,594,514

$ (399,443)

33,158

(366,285)

3,854,686

25,248

32,431,902

36,311,836

619,817

7,303

5,389,015

6,016,135

$ 52,906,350 $ 5,649,850

I

I

The Florida Bar and Subsidiaries

Management's Discussion and Analysis

I

I

I

I

CONDENSED CONSOLIDATED STATEMENTS OF NET ASSETS

June 30, 2006 2005 Change

Assets

Current assets $ 47,002,121 $ 38,912,927 $ 8,089,194

Capital assets, net 5,904,229 6,220,716 (316,487)

Total assets

Liabilities

Current liabilities

Other liabilities

Total liabilities

$ 52,906,350

$ 12,556,535

4,037,979

16,594,514

$ 45, 133,643 $ 7,772,707

$ 9,943,975 $ 2,612,560

4,077,261 (39,282)

14,021,236 2,573,278

I

I

Net assets

Invested in capital assets, net of related debt

Restricted for scholarships

Unrestricted

Total net assets

3,854,686

25,248

32,431,902

36,311,836

3,999,660 (144,974)

25,792 (544)

27,086,955 5,344,947

31,112,407 5,199,429

I

Total liabilities and net assets $ 52,906,350 $ 45, 133,643 $ 7,772,707

I

For more detailed information, see the accompanying Consolidated Statements of Net Assets.

CONDENSED CONSOLIDATED STATEMENTS OF REVENUES, EXPENSES

AND CHANGES IN NET ASSETS

I

June 30,

I

Operating revenues

Operating expenses

Net operating revenues

I

Non-operating revenues

I

Non-operating expenses

Net non-operating revenues

Increase in net assets

Net assets, beginning

I

Net assets, ending

2007

$ 39,732,682

(37,915,576)

1,817,106

4,361,648

(162,619)

4,199,029

6,016,135

36,311,836

$ 42,327,971

2006

$ 36,834,025

(33,968,523)

2,865,502

$

Change

2,898,657

(3,947,053)

(1 ,048,396)

2,505,173

(171,246)

2,333,927

1,856,475

8,627

1,865,102

5,199,429

31,112,407

816,706

5,199,429

$ 36,311,836 $ 6,016,135

I

I

I

I

- 5

I

The Florida Bar and Subsidiaries

Management's Discussion and Analysis

I

I

I

CONDENSED CONSOLIDATED STATEMENTS OF REVENUES, EXPENSES

AND CHANGES IN NET ASSETS

June 30, 2006 2005 Change

I

Operating revenues $ 36,834,025 $ 35,118,962 $ 1,715,063

Operating expenses (33,968,523) (32,417,175) (1,551,348)

Net operating revenues 2,865,502 2,701,787 163,715

I

Non-operating revenues 2,505,173 1,520,124 985,049

Non-operating expenses (171,246) (177,280) 6,034

Net non-operating revenues 2,333,927 1,342,844 991,083

I

Increase in net assets 5,199,429 4,044,631 1,154,798

Net assets, beginning 31,112,407 27,067,776 4,044,631

I Net assets, ending $ 36,311,836 $ 31,112,407 $ 5,199,429

I

For more detailed information, see the accompanying Consolidated Statements of Revenues,

Expenses, and Changes in Net Assets.

I

CAPITAL ASSETS

The Florida Bar had invested the f o l l o w i n ~ in Capital Assets:

I

June 30, 2007 2006 Change

Land $ 1,103,060 $ 1,103,060 $

Building and improvements 8,292,805 7,902,973 389,832

I

Landscaping and parking 120,318 120,318

I

Equipment and furnishings 4,632,356 4,456,519 175,837

Construction in progress 136,170 136,170

Total, prior to depreciation 14,284,709 13,582,870 701,839

I

Accumulated depreciation (7,945,380) (7,678,641 ) (266,739)

Net capital assets $ 6,339,329 $ 5,904,229 $ 435,100

I

I

I

I

I

- 6

I

I

The Florida Bar and Subsidiaries

Management's Discussion and Analysis

I

I

I

June 3D,

Land

Building and improvements

Landscaping and parking

Equipment and furnishings

Total, prior to depreciation

CAPITAL ASSETS

2006

$ 1,103,060

7,902,973

120,318

4,456,519

13,582,870

2005

$ 1,103,060

7,877,915

120,318

4,651,072

13,752,365

$

Change

25,058

(194,553)

(169,495)

I

Accumulated depreciation

Net capital assets

(7,678,641)

$ 5,904,229

(7,531,649)

$ 6,220,716 $

(146,992)

(316,487)

I

Presently, The Florida Bar has no plans to significantly alter its investment in capital assets.

I DEBT

I

At June 30, 2007 and 2006, The Florida Bar had $1 ,864,825 and $2,049,543, respectively

outstanding in a mortgage loan. The mortgage loan is scheduled to balloon on October 15,

I

2009. Management is evaluating its options for when the mortgage loan balloons.

Management will decide to either pay the loan or refinance the balloon. Investments have been

purchased to cover the required balloon payment if that is the selected course of action.

Future Financial Plan

I

I

The Florida Bar was created by the Supreme Court of Florida to assist it in regulating the

practice of law in Florida. It is primarily funded through lawyer payments of their required

annual fee, sale of continuing education programs to lawyers and other revenue from its

I

business partners and affiliates. There is no plan to materially change these revenue streams

for the next two years. Accordingly, there are no present plans to materially increase the scope

or nature of the services provided to the citizens of Florida and the lawyers authorized to serve

them.

I

I

I

I

I

I

- 7

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

Financial Statements

I ~ - - - - - - - - - - -

I

The Florida Bar and Subsidiaries

Consolidated Statements of Net Assets

I

June 30,

I

Assets

I

Current assets

Cash and cash equivalents

Short-term investments

Accounts receivable, net

I

Prepaid expenses and other assets

Total current assets

I

Capital assets, net

Land

Buildings and improvements

I

Landscaping and parking

Equipment and furnishings

Construction in progress

I

Accumulated depreciation

Total capital assets, net

I

Total assets

Liabilities and Net Assets

I

Current liabilities

I

Current portion of long-term debt

Accounts payable

I

Claims payable

Accrued expenses

Deferred revenues

Security deposits

Total current liabilities

I

I Non-current liabilities

Long-term debt, less current portion

Compensated absences payable

Total non-current liabilities

I

Total liabilities

Net assets

Invested in capital assets, net of related debt

I

Restricted for scholarships

I

Unrestricted

Total net assets

Total liabilities and net assets

2007 2006

$ 10,667,868

40,553,570

577,459

417,974

52,216,871

$ 13,917,754

32,116,711

405,324

562,332

47,002,121

1,103,060

8,292,805

120,318

4,632,356

136,170

(7,945,380)

6,339,329

1,103,060

7,902,972

120,318

4,456,519

(7,678,640)

5,904,229

$ 58,556,200 $ 52,906,350

$ 198,939

1,586,408

53,595

907,385

9,362,874

47,891

$ 184,718

1,413,949

478,858

773,537

9,659,687

45,786

12,157,092 12,556,535

1,665,886

2,405,251

4,071,137

1,864,825

2,173,154

4,037,979

16,228,229 16,594,514

4,474,503

32,551

37,820,917

42,327,971

3,854,686

25,248

32,431,902

36,311,836

$ 58,556,200 $ 52,906,350

I

See accompanying notes to the consolidated financial statements.

I

- 8

I

The Florida Bar and Subsidiaries

Consolidated Statements of Revenues, Expenses and Changes in Net Assets

I

Years ended June 30, 2007 2006

I

Operating revenues

I

Annual fees $ 20,896,608 $ 20,284,163

Other fees from members 6,003,005 5,356,003

Sales of products and services 8,891,878 7,560,103

Advertising 2,315,354 2,223,308

I

Young lawyers 575,425 532,811

Grants and other 1,050,412 877,637

Total operating revenues 39,732,682 36,834,025

I

Operating expenses

Regulation of the practice of law 14,704,622 13,318,143

I

Cost of products and services provided to members 10,289,835 9,338,041

I

Unauthorized practice of law 1,344,015 1,248,161

Public service programs 1,738,927 1,999,453

Communications with members and the public 3,989,239 3,550,705

Administration 3,515,762 2,399,971

Legislation 401,101 417,473

I

Young lawyers 550,596 426,265

Depreciation and amortization 699,110 667,743

Other programs and costs 682,369 602,568

I

Total operating expenses 37,915,576 33,968,523

Operating income 1,817,106 2,865,502

I

Non-operating revenues (expenses)

Investment earnings 4,361,648 2,505,173

I

Interest expense (148,325) (164,679)

Loss on disposal of capital assets (14,294) (6,567)

Total non-operating revenues (expenses) 4,199,029 2,333,927

I

Ghange in net assets 6,016,135 5,199,429

I

Total net assets, beginning of year 36,311,836 31,112,407

Total net assets, end of year $ 42,327,971 $ 36,311,836

I

I

I

I

See accompanying notes to the consolidated financial statements.

I

- 9

I

The Florida Bar and Subsidiaries

I

Consolidated Statements of Cash Flows

Years ended June 3D, 2007 2006

I

Cash flows from operating activities:

Receipts from members, customers and other sources $ 39,800,129 $ 39,683,779

I

Payments to employees, suppliers and other vendors (37,493,257) (33,499,046)

Net cash provided by operating activities 2,306,872 6,184,733

I

Cash flows from non-capital and related financing activities:

I

Reduction of debt (184,718) (171,513)

Interest paid (148,325) (164,679)

Net cash (used in) non-capital and related financing activities (333,043) (336,192)

I

Cash 'flows from capital and related financing activities:

Acquisition of capital assets (1,148,504.) (357,823)

Net cash (used in) capital and related financing activities (1,148,504) (357,823)

I

Cash flows from investing activities:

Net change in repurchase agreement (1,499,475) (52,760)

I

Redemption of investments 32,951,300 11,850,573

I

Purchase of investments, net of decrease in fair value (39,888,684) (18,147,824)

Investment income 4,361,648 2,505,173

Net cash (used in) provided by investing activities (4,075,211 ) (3,844,838)

I

(Decrease) increase in cash and cash equivalents: (3,249,886) 1,645,880

Cash and cash equivalents, beginning of year 13,917,754 12,271,874

I

Cash and cash equivalents, end of year $ 10,667,868 $ 13,917,754

I

I

I

I

I

I See accompanying notes to the consolidated financial statements.

I

- 10

I

The Florida Bar and Subsidiaries

Consolidated Statements of Cash Flows (Continued)

I

Years ended June 30, 2007 2006

I

Reconciliation of operating income to net cash provided by

operating activities:

I

Operating income $ 1,817,106 $ 2,865,502

I

Adjustments to reconcile operating income to net cash

provided by operating activities:

Depreciation and amortization 699,110 667,743

I

(Increase) decrease in:

Accounts receivable, net

Prepaid expenses and other assets

(172,135)

144,358

267,081

(360,384)

I

Increase (decrease) in:

Accounts payable 172,459 110,990

Claims payable (425,263) 339,666

I

Accrued expenses

Deferred revenues

133,848

(296,813)

83,318

2,054,273

Security deposits 2,105 1,355

I

Compensated absenses payable

Net cash provided by operating activities $

232,097

2,306,872 $

155,189

6,184,733

I

Non-cash investing, capital, and financing acitivities

Change in the fair value of investments $ 1,195,805 $ 310,344

I

I

Supplemental information

Cash paid for interest

Loss on disposal of assets

$ 148,325

$ 14,294

$

$

164,679

6,567

I

I

I

I

I

I

See accompanying notes to the consolidated financial statements.

- 11 -

I

I

The Florida Bar and Subsidiaries

I

Notes to Consolidated Financial Statements

I

NOTE 1 - NATURE OF BUSINESS

I

The Florida Bar and Subsidiaries (The Florida Bar) is the statewide professional organization of

lawyers. It serves as an advocate and intermediary for attorneys, the court and the public. The

I

Florida Bar was established as a unified state bar by rule of the Supreme Court of Florida. The

Florida Bar regulates lawyers in Florida, investigates the unauthorized practice of law, offers

continuing legal education, publishes law journals and offers other member services.

I

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Reporting Entity

I

The Florida Bar is a unified state bar organized as an arm of the Supreme Court of the State of

Florida. It is considered a governmental entity because it was established by, and has the

potential to be dissolved by, the Supreme Court of Florida. Therefore, The Florida Bar adopted the

I

provisions of Statement No. 34 ("Statement No. 34") of the Governmental Accounting Standards

Board liBasic Financial Statements - and Management's Discussion and Analysis - for State and

Local Govemments," as amended by Statement No. 37.

I

In evaluating The Florida Bar as a reporting entity, management has considered all potential

component units for which The Florida Bar may be financially accountable and if found to be

I

financially accountable, be required to be included in The Florida Bar's financial statements. The

Florida Bar is financially accountable if it appoints a voting majority of an organization's governing

board and (1) it is able to impose its will on an organization or (2) there is a potential for an

I

organization to provide specific financial benefit to or impose specific financial burden on The

I

Florida Bar. Additionally, the primary government is required to consider other organizations for

which the nature and significance of their relationship with the primary government are such that

exclusion would cause the reporting entity's financial statements to be misleading or incomplete.

Management's analysis has disclosed no component units that should be included in The Florida

Bar's financial statements.

I

Basis of Presentation

I

The Florida Bar is accounted for as a proprietary type enterprise fund. Enterprise funds are used

to account for activities that are financed and operated in a manner similar to private business

enterprises: (1) where the costs of providing goods and services to the general public on a

I

continuing basis are to be financed through user charges; or (2) where the periodic determination

I

of net income is considered appropriate. Proprietary funds distinguish operating revenues and

expenses from non-operating items. Operating revenues and expenses generally result from

providing goods and services in connection with a proprietary fund's ongoing operations.

I

Operating expenses for The Florida Bar include the costs of personnel, contractual services,

supplies, utilities, repairs and maintenance, and depreciation on capital assets. All revenues and

expenses not meeting this definition are reported as non-operating revenues and expenses.

I

I

- 12

I

The Florida Bar and Subsidiaries

Notes to Consolidated Financial Statements

I

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

I

Basis of Accounting

I

Basis of accounting refers to when revenues and expenses are recognized in the accounts and

I

reported in the financial statements. The financial statements are prepared on the accrual basis of

accounting in accordance with accounting principles generally accepted in the United States of

America. Under this method, revenues are recognized when they are earned and expenses are

I

recognized when they are incurred. The measurement focus of proprietary fund types is on a flow

of economic resources method, which emphasizes the determination of net income, financial

position, and cash flow. All fund assets and liabilities, current and non-current, are accounted for in

the Consolidated Statements of Net Assets.

I

Cash and Cash Equivalents

All demand deposit accounts, daily repurchase agreements and short-term highly liquid

investments with original maturities of three months or less are reported as cash equivalents.

I

Investments

I

Investments are reported at fair value, which are based on quoted market prices. The

I

determination of realized gains and losses is independent of the determination of the net change in

the fair value of investments. Realized gains and losses on investments held in a previous fiscal

year and sold in the current period were used to compute the change in fair value for the previous

year and the current year.

I

Capital Assets

I

Capital assets are stated at cost less accumulated depreciation. The cost of capital assets is

depreciated over the estimated useful lives of the related assets, ranging from 5 to 40 years, using

the straight-line method. When capital assets are retired or otherwise disposed of, the costs and

related accumulated depreciation are removed from the accounts and any resulting gain or loss is

reflected in the Consolidated Statements of Revenues, Expenses and Changes in Net Assets, in

I

the period of disposal.

Claims Payable

I

The Florida Bar created the Clients' Security Fund (the Fund) to compensate people who have

suffered financial losses due to misappropriation of funds by errant Florida Bar members. The

I

Fund is financed by $20 of each Florida Bar member's annual fees. Claims payable represent

amounts payable from the Fund.

I

Deferred Revenues

I

Deferred revenues consist primarily of membership fees collected in advance, prepaid advertising

and prepaid legal education courses.

I

I

- 13

I

The Florida Bar and Subsidiaries

Notes to Consolidated Financial Statements

I

I

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Allocation of Expenses

I

The costs of providing the various programs, services, and other activities have been summarized

on a functional basis in the Consolidated Statement of Revenues, Expenses and Changes in Net

Assets. Accordingly, certain costs have been allocated among the programs and supporting

I

services benefited.

Principles of Consolidation

I

I

The accompanying consolidated financial statements include the accounts of The Florida Bar and

its wholly-owned subsidiary, The Florida Bar Building Corporation, and its other controlled entities,

Florida Lawyers Association for the Maintenance of Excellence, Inc., and The Florida Attorneys

Charitable Trust. All significant intercompany transactions and accounts have been eliminated in

consolidation.

I

Income Taxes

I

The Florida Bar is an administrative agency of the Supreme Court and is not subject to federal or

state income tax. The Florida Bar Building Corporation, Florida Lawyers Association for the

Maintenance of Excellence, Inc., and The Florida Attorneys Charitable Trust have been granted

exemption from federal and state income taxes except on unrelated business income under

I

Sections 501 (c)(25), 501 (c)(6), and 501 (c)(3), respectively, of the Internal Revenue Code.

Accordingly, no liability for income taxes is reflected in these financial statements.

I

Estimates

I

The preparation of financial statements in conformity with accounting principles generally accepted

in the United States of America requires management to make estimates and assumptions that

affect the reported amounts of assets and liabilities and disclosure of contingent assets and

I

liabilities at the date of the financial statements and the reported amounts of revenues and

expenses during the reporting period. Actual results could differ from those estimates.

Concentration

I

The Florida Bar receives the majority of its revenue from lawyers licensed to practice in the State of

Florida.

I

Net Assets

Net assets are categorized as invested in capital assets, restricted for scholarships, and

undesignated. Invested in capital assets is intended to reflect the portion of net assets that are

I

associated with non-liquid, capital assets. Restricted for scholarships consists of monies restricted

for the annual G. Kirk Haas fund scholarships. Undesignated assets consist of all other assets not

included in the previous categories.

I

I

I

- 14

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

The Florida Bar and Subsidiaries

Notes to Consolidated Financial Statements

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Derivative Financial Instruments

The Florida Bar follows the provisions of Governmental Accounting Standards Board (GASB)

Technical Bulletin No. 2003-1, Disclosure Requirements for Derivatives Not Reported at Fair Value

on the Statement of Net Assets, an amendment to GASB Technical Bulletin 94-1. GASB Technical

Bulletin No. 2003-1 provides an updated definition of derivatives and requires certain disclosures

regarding the government's objective for entering into derivative transactions and the derivative's

terms, fair value, and risk exposures.

Recent Accounting Pronouncements

The Florida Bar prospectively adopted Governmental Accounting Standards Board (GASB) No. 45,

Accounting and Financial Reporting by Employers for Postemployment Benefits Other than

Pensions (OPEB), during the year ended June 30,2007. This statement establishes standards for

the measurement, recognition, and display of OPEB expenses and related liabilities, note

disclosures and, if applicable, required supplementary information, in the financial reports of

governmental employers. OPEB costs are accrued when the related services are received by The

Florida Bar.

NOTE 3-CASH AND CASH EQUIVALENTS

Cash and cash equivalents are subject to custodial credit risk. Custodial credit risk is the risk that

in the event of a bank or other counterparty failure, The Florida Bar's cash and cash equivalents

may not be returned. The Florida Bar's policy with respect to custodial credit risk is that The Florida

Bar will only maintain demand deposit accounts with financial institutions in which management

believes that the risk is limited because the financial institutions are large with strong financial

positions.

Cash and cash equivalents are held at two financial institutions. Operating cash is held at a

financial institution insured by the Federal Deposit Insurance Corporation up to $100,000 each for

the parent and subsidiary accounts. Operating cash balances were $2,561,243 and $2,021,114 at

June 30, 2007 and 2006, respectively. Additional cash and money market funds are held at al

financial institution insured by the Securities Investor Protection Corporation up to $100,000./

Additional cash and money market funds were $8,106,625 and $11,896,640 at June 30, 2007 and/

2006, respectively.

- 15

I

The Florida Bar and Subsidiaries

Notes to Consolidated Financial Statements

I

I

NOTE 4 - INVESTMENTS

Investment Objectives and Policies

I

Investments will be made for the sole interest and exclusive purpose of providing investment

returns for The Florida Bar. The Florida Bar's investment objectives and policies are achieved

I

through a short-term account portfolio and a long-term account portfolio. The ultimate

responsibility for the proper supervision of The Florida Bar's investment portfolio rests with the

Board of Directors and the Investment Committee.

The purpose of the short-term portfolio is to provide for The Florida Bar's short-term working

I

capital needs. The short-term portfolio possesses a short-term time horizon (one to three years)

and within this horizon, the primary objectives of the short-term portfolio are to preserve capital

for short-term cash flow needs, provide liquidity, and to achieve attractive short-term yields

I

consistent with the preservation of capital.

I

The purpose of the long-term investment portfolio is to provide for The Florida Bar's operating

needs and to fund The Florida Bar's programs both today and into the future. The long-term

I

portfolio possesses an intermediate to long-term horizon (five to seven years) and within this

horizon, the primary objectives of the long-term portfolio are to provide long-term growth of

capital and income.

The asset allocation guidelines with regard to acceptable asset classes, the overall target asset

mix, and the representative indices of each asset class are as follows:

I

Short-Term

I

Asset Classes

Short-Term Fixed Income

Cash and Equivalents

I

Long-Term

I

Asset Classes

I

Large Cap Equity

Mid Cap Equity

Small Cap EqUity

International

Emerging Market Equity

Real Assets

I

REITs

TIPS

Cash and Equivalents

I

I

I

I

Target

Minimum Mix Maximum

35.0t'o 50.0t'o 65.0%

35.0% 50.0% 65.0%

Target

Minimum Mix Maximum

14.0

0

k 20.0% 26.0%

4.0% 6.0% 8.0%

4.0% 6.0%

8.00/0

9.8k 14.0

0

k 18.2t'o

O.Ot'o 2.0% 4.0%

0.0% 2.0% 4.0%

1.0% 3.0% 5.0%

1.0% 3.0

0

k 5.0%

2.0

0

k 4.0

0

k 6.0

0

k

- 16

Representative

Index

Lehman Brothers 1-3 year Govt Bond Index

Citigroup U.S. 90-Day Treasury Bills

Representative

Index

Standard & Poor's 500 Index

Russell Mid Cap Index

Russell 2000 Index

MSCI EAFE Index

MSCI Emerging Markets Free Index

Dow Jones AIG Commodity Index

NAREIT Equity Index

Lehman Brothers US TIPS Index

Citigroup U.S. 90-Day Treasury Bills

I

The Florida Bar and Subsidiaries

Notes to Consolidated Financial Statements

I

I

NOTE 4 - INVESTMENTS (CONTINUED)

Investments

I

At June 30, The Florida Bar's investment balances were as follows:

I

June 30,

I

Repurchase agreement

Mutual funds - debt securities (ST) *

Mutual funds - debt securities (LT) *

US Treasuries

I

Federal Agencies

Corporate Bonds &Other Fixed Income

Municipal Bonds

I

US Treasury Bonds

Mutual funds - equity securities

Stocks

Total investments

Fair Value

$ 2,173,963

7,081,588

4,854,913

2,279,114

3,656,258

913,232

1,354,845

3,212,727

15,026,930

$ 40,553,570

2007

Maturity

Daily

2 year average **

N/A

5 year average**

15 year average**

16 year average**

11 year average**

2 year average **

N/A

N/A

2006

Rating Fair Value

N/A $ 674,488

Ba to Aaa 9,548,510

N/A 7,429,690

Aaa

Aaa

Baa2 to Aaa

A1 to Aaa

Aaa

N/A 1,701,705

N/A 12,762,318

$ 32,116,711

I

* The Florida Bar invests in short-term mutual funds, which consist of debt securities (Le. fixed income securities).

The Florida Bar's short-term mutual funds are not invested directly in fixed income debt securities. The Florida Bar is

able to sell their interest in these mutual funds' at will (subject to potential redemption fees).

I

** Represents the average maturity of debt securities held by The Florida Bar.

Credit Risk

I

Investments in fixed income debt securities through mutual funds must adhere to the policy of

meeting an average quality rating of A or higher for the long-term portfolio and AA or higher for

I

the short-term portfolio by either Standards & Poor's, Moody's or Fitch Investors Service at the

time of purchase. Investments in corporate holdings must be rated investment grade or better

by either Standards & Poor's, Moody's or Fitch Investors Service at the time of purchase.

I

Concentration of Credit Risk

I

Investments in equity securities are subject to a maximum 5% commitment at cost and 10

%

weighting at market of the account's total market 'value for any individual security or single

I

issuer. Investment in fixed income securities are subject to no more than 5% of the account's

market value invested in a single issue or in direct obligations of a single issuer with the

exception of the U.S. Government and its agencies so long as any such government or agency

I

issue shall be backed with the full faith and credit of the U.S. Government. In addition, no more

than 15% of the fixed income securities may be invested in mortgage backed or asset backed

securities of a single issuer, with the exception of those issued by the U.S. Government, its

agencies, or its sponsored agencies.

I

I

I

- 17

I

The Florida Bar and Subsidiaries

Notes to Consolidated F'inancial Statements

I

I

NOTE 4 - INVESTMENTS (CONTINUED)

Interest Rate Risk

I

Interest rate risk arises from investments in debt instruments and is defined as the risk that

I

changes in interest rates will adversely affect the fair value of an investment. The Florida Bar's

investment in U.S. Treasuries, federal agencies, corporate bonds, municipal bonds and U.S.

Treasury bonds are directly subject to the interest rate risk of debt instruments. The Florida Bar

I

is not directly subject to the interest rate risk for its short-term debt instruments, as investments

in these debt securities are entered into through mutual funds and The Florida Bar is able to sell

their interest in these mutual funds at will (subject to potential redemption fees). Additionally,

I

The Florida Bar has elected to participate in mutual funds with target durations of one to two

years (low duration funds). However, investments in mutual funds are with the understanding

that the investment policies stated in the mutual fund's prospectus supersedes the guidelines

established by The Florida Bar.

Custodial Credit Risk

I

I

Custodial credit risk is the risk that in the event of bankruptcy of the custodial entity, The Florida

Bar's deposits may not be returned to it. The Florida Bar's policy regarding custodial credit risk

is that deposits subject to overnight repurchase agreements shall only be invested in securities

I

I

backed by the United States government. Additionally, The Florida Bar will only hold investment

securities that are insured or registered and held by The Florida Bar, or its designated agent, in

the name of The Florida Bar. The repurchase agreement is exposed to uninsured and

uncollateralized custodial credit risk with Bank of America. Investments held through Morgan

Stanley have Securities Investor Protection Corporation coverage up to $500,000 per customer

for cash and securities and excess protection provided by the Customer Asset Protection

Company for up to the net equity value of cash and securities in Morgan Stanley's account.

Investments in PIMCO mutual funds are held by a third party trust company.

I

Foreign Currency Risk

Investments in international equity securities are limited to SEC-Registered, U.S. exchange

I

listed, U.S. dollar-denominated securities in foreign domiciled issuers. Investments in

I

international debt securities are limited to SEC-registered, U.S. dollar-denominated, U.S.

government backed securities issued by foreign governments. The Florida Bar invests in

international securities through American Depository Receipts (ADRs). ADRs represent

I

I

investments in shares of foreign companies traded on the U.S. financial markets and are

denominated in U.S. dollars and, thus, are not exposed to foreign currency risk. Investments in

foreign currency-denominated government bonds, any type of foreign corporate bond, or any

other type of foreign currency are not allowed. Securities of foreign companies traded on

foreign stock exchanges may be purchased only with the written permission of The Florida Bar's

Investment Committee. Additionally, the investment policy approves the use of mutual funds,

which may include foreign securities, with the understanding that the investment policies stated

in the mutual fund's prospectus supersede the guidelines set forth in The Florida Bar's

investment policy.

I

I

- 18

I

I

The Florida Bar and Subsidiaries

Notes to Consolidated Financial Statements

I

I

NOTE 4 - INVESTMENTS (CONTINUED)

Derivative Instruments

I

The Florida Bar's investment policy states that investments in options, derivatives and financial

futures are prohibited in separately managed accounts. Additionally, the investment policy

approves the use of mutual funds, which may include derivative instruments, with the

I

understanding that the investment policies stated in the mutual fund's prospectus supersede the

guidelines set forth in The Florida Bar's investment policy.

I

NOTE 5 - ACCOUNTS RECEIVABLE, NET

The following is a summary of accounts receivable, net:

I June 30, 2007 2006

I

Accounts receivable $ 602,359 $ 430,224

Allowance for doubtful accounts (24,900) (24,900)

Accounts receivable, net $ 577,459 $ 405,324

I

I

I

NOTE 6 - CAPITAL ASSETS, NET

Capital assets not being depreciated:

Land

Construction in Progress

Total capital assets not depreciated

July 1, 2006

$ 1,103,060

1,103,060

Additions

$ -

136,170

136,170

Deletions June 30, 2007

$ - $ 1,103,060

136,170

1,239,230

I

I

Capital assets being depreciated:

Buildings and improvements

Landscaping and parking

Equipment and furnishings

Total capital assets being depreciated

7,902,972

120,318

4,456,519

12,479,809

389,833

674,799

1,064,632

(498,962)

(498,962)

8,292,805

120,318

4,632,356

13,045,479

I

I

I

Less accumulated depreciation for:

Buildings and improvements

Landscaping and parking

Equipment and furnishings

Total accumulated depreciation

Total capital assets being depreciated, net

(4,269,950)

(120,318)

(3,288,372)

(7,678,640)

4,801,169

(263,422)

(435,688)

(699,110)

365,522

432,370

432,370

(66,592)

(4,533,372)

(120,318)

(3,291,690)

(7,945,380)

5,100,099

I

I

Total capital assets, net

Depreciation expense for

$667,743, respectively.

the years

$ 5,904,229 $ 501,692

ended June 30, 2007 and

$ (66,592) $ 6,339,329

2006 was $699,110 and

I

- 19

I

The Florida Bar and Subsidiaries

Notes to Consolidated Financial Statements

I

I

NOTE 7 - LONG-TERM LIABILITIES

Long-Term Debt

I

The following is a summary of long-term debt:

June 30, 2007 2006

I

I

Renewal mortgage note payable to Bank of America in the amount

of $2,986,384 due on October 15, 2009. Monthly payments of

principal began on November 15, 1999 at $9,383 with annual

I

increases of $723 per month each November 15th based on a 15

year amortization with a balloon payment of $1,396,760 at maturity.

Interest is payable monthly based on a contract rate equal to the

I

London Interbank Offering Rate (LIBOR) (5.32% at June 30, 2007)

plus 47 basis points. However, the interest rate was swapped in a

hedge transaction. See Note 8 below. The mortgage is

I

collateralized by real estate owned by The Florida Bar Building

Corporation and guaranteed by The Florida Bar. $ 1,864,825 $ 2,049,543

Current portion (198,939) (184,718)

Long-term debt, less current portion $ 1,665,886 $ 1,864,825

I

I

Years ended June 30,

The following are maturities of long-term debt:

Amount

I

I

I

2008

2009

2010

Total

Compensated Absences Payable

Compensated absences payable consisted of the following:

$ 198,939

214,255

1,451,631

$ 1,864,825

I

I

June 30,

Accrued vacation

Accrued sick leave

Total compensated absences

2007

$ 1,451,600

953,651

$ 2,405,251

2006

$ 1,289,710

883,444

$ 2, 173, 154

I

I

I

- 20

I

The Florida Bar and Subsidiaries

Notes to Consolidated Financial Statements

I

I

NOTE 7 - LONG-TERM LIABILITIES (CONTINUED)

Changes in Long-Term Liabilities

I

Changes in long-term liabilities are summarized as follows:

I

Balance Balance

July 1,2006 Additions Reductions June 30, 2007

Long-term debt $ 2,049,543 $ - $ (184,718) $ 1,864,825

Compensated absences 2,173,154 1,746,807 (1,514,710) 2,405,251

I

Total long-term liabilities $ 4,222,697 $ 1,746,807 $ (1,699,428) $ 4,270,076

I

NOTE 8 - DERIVATIVE DISCLOSURE -INTEREST RATE SWAP

I

Objective of the interest rate swap. In October 1999, The Florida Bar refinanced an 8.5%

fixed rate mortgage to a variable rate mortgage based on the LIBOR rate plus .47%. To

I

manage its interest rate exposure under the variable rate renewal mortgage note payable to

Bank of America, The Florida Bar entered into a hedge transaction on October 13, 1999 to swap

its floating rate for a fixed rate through a 120 month interest rate swap provided by Bank of

'America.

I

Terms. The swap was for the notional amount of $2,986,384 which was equal to the principal

amount of the underlying variable rate debt. The notional amount declines each year as the

principal amount of the associated debt declines. At June 30, 2007 and 2006, the notional

amount was $1,864,825 and $2,049,543, respectively. The swap was entered into at the same

I

time that the debt was refinanced (October 1999). Under the swap, The Florida Bar pays the

I

Bank of America a contracted interest rate of 30-day LIBOR plus .47% and receives a payment

from Bank of America based on the coupon rate of the swap which is 6.97%. The net effect of

the two contractual rates is an effective fixed rate of 7.44%. The swap matures on October 15,

2009.

I

I

Fair value. Due to the difference between the two rates, the swap had a negative fair value of

$63,775 and $80,999 as of June 30,2007 and 2006, respectively. The fair value was estimated

by the Bank of America as identified in the Schedule to the International Swap Dealers

Association Master Agreement (ISDA) using the mid-market level method. This method is in

accordance with market conventions, which take into consideration estimates about relevant

I

present and future market conditions, as well as size and liquidity of the position and related

actual or potential hedging transactions.

Basis risk. The swap exposes The Florida Bar to basis risk should the LIBOR rates decrease

significantly. If a change occurs that results in a significant decrease in LIBOR rates, the

I

expected cost savings may not be realized.

I

Termination risk. The Florida Bar or the Bank of America may terminate the swap if the other

party fails to perform under terms of the agreement. If at the time of termination the swap has a

negative fair value, The Florida Bar would be liable to the Bank of America for a payment equal

to the swap's fair value.

I

- 21

I

I

The Florida Bar and Subsidiaries

I

Notes to Consolidated Financial Statements

I

NOTE 8 - DERIVATIVE DISCLOSURE -INTEREST RATE SWAP (CONTINUED)

I

Swap payments and associated debt. Using rates as of June 30, 2007, debt service

requirements of the renewal mortgage note payable and the swap payments, assuming current

interest rates remain the same for their term, were as follows. As rates vary, the variable-rate

interest payments and swap payments will vary.

I

Year ending Interest rate Net debt

June 30 Principal Interest Total swap, net service

I

2008 $ 198,939 $ 102,788 $ 301,727 $ 20,948 $ 322,675

2009 214,255 90,870 305,125 18,519 323,644

2010 1,451,631 20,747 1,472,378 4,228 1,476,606

I

Total $ 1,864,825 $ 214,405 $ 2,079,230 $ 43,695 $ 2,122,925

I

NOTE 9 - REVENUE AND EXPENSE CLASSIFICATION

I

The significant revenue and expense accounts presented in the consolidated financial

statements are described as follows:

Other Fees from Members

I

Includes revenues from members other than annual dues such as advertising approval fees,

certification fees and section dues.

I

I

Sales of Products and Services

Includes revenues from sources such as Continuing Legal Education (CLE) registrations, sales

of publications and meeting revenues.

I

Grants and Other

I

Includes grants received from The Florida Bar Foundation, cost recoveries from discipline

cases, rents received in The Bar Center Building Fund and other sources of revenue.

Regulation of the Practice of Law

I

Includes expenses incurred for Lawyer Regulation, Lawyer Advertising, Ethics, Continuing Legal

Education Rules (CLER), Membership Records and Certification.

I

Cost of Products and Services Provided to Members

Includes expenses such as the cost of CLE courses and publications, Legal Office Management

I

Advisory Services (LOMAS), voluntary member assistance programs, meetings, committee

activity and section activity.

I

I

- 22

I

The Florida Bar and Subsidiaries

Notes to Consolidated Financial Statements

I

I

NOTE 9 - REVENUE AND EXPENSE CLASSIFICATION (CONTINUED)

Communication with Members and the Public

I

Includes the expenses of the Public Information Department and The Florida Bar Journal and

News.

I

Administration

I

Includes board and officer expenses, the cost of the Executive Director's office, General

Counsel, Research, Planning and Evaluation, and liability and property insurance.

I

NOTE 10 - RETIREMENT PLANS

I

The Florida Bar sponsors a defined contribution pension plan, The Florida Bar Employees'

Pension Plan (the Plan), which is available to all salaried personnel having completed six

months of service. The Plan is administered by The Florida Bar Retirement Committee. The

I

Plan may be amended at any time by The Florida Bar. Employer contributions are discretionary

and are currently made for all eligible employees based on a formula which was 11

0

/0 of covered

compensation and 4.30/0 on covered compensation exceeding 80

0

/0 of the Social Security wage

I

base for the years ended June 30, 2007 and 2006. The employer contributions are allocated to

separate participant accounts and invested by the Trustee in the funds selected by the

employee from those offered by the Plan Administrator. Participant accounts vest based on the

following schedule:

I

I

< 3 years 0

0

/0

3 -4 years 40

0

/0

4 - 5 years 60

0

/0

5 - 6 years 80

0

/0

> 6 years 1000/0

Forfeited contributions are held in a separate account and are used to reduce future employer

I

contributions. The plan has been amended to comply with all applicable Federal tax laws. The

pension contribution made equaled the contribution required during the years ended June 30,

2007 and 2006 for the Plan years ended December 31, 2006 and 2005 and was $1,434,567

I

and $1,275,351, respectively.

I

The Florida Bar also has a deferred compensation plan. The plan is for the benefit of all eligible

employees who elect to participate.

I

I

I

I

- 23

I

The Florida Bar and Subsidiaries

Notes to Consolidated Financial Statements

I

NOTE 11 - RETIREE POSTEMPLOYMENT HEALTH BENEFITS

I

Plan Description. The Florida Bar Retiree Health Plan (TFBRHP) is a single-employer defined

benefit healthcare plan administered by The Florida Bar. TFBRHP provides health insurance

I

benefits to eligible employees at early retirement, disability or 'full retirement. The Florida Bar

has the authority to establish and amend benefit provisions to TFHRHP.

I

Funding Policy. The contribution requirements of plan members and The Florida Bar are

I

established and may be amended by The Florida Bar. The required contribution is based on an

actuarially determined percentage of total active payroll. For fiscal year ended June 30, 2007,

The Florida Bar contributed $1,281,688 to the plan. Plan members, who are ages 62 through

65 or disabled, are required to contribute $25 per month for retiree-only coverage and $100 per

month for all other member coverage.

I

Annual OPES Cost and Net OPES Obligation. The Florida Bar's annual other postemployment

benefit (OPEB) cost (expense) is calculated based on the annual required contribution of the

employer (ARC), an amount actuarially determined in accordance with the parameters of GASB

I

Statement 45. The ARC represents a level of funding that, if paid on an ongoing basis, is

projected to cover normal cost each year and amortize any unfunded actuarial liabilities (or

funding excess) over a period not to exceed thirty years. Based on the January 1, 2006,

I

actuarial valuation, the ARC is 0.97% of active payroll payable for the fiscal year ending June

I

30,2007. The following table shows the components of The Florida Bar's annual OPEB cost for

the year, the amount actually contributed to the plan, and changes in The Florida Bar's net

OPEB obligation to TFBRJ-IP:

Annual required contribution $ 64,766

I

Interest on net OPEB obligation

Adjustments to annual required contribution

Annual OPEB cost (expense)

I

Net OPEB obligation - July 1, 2007

Annual OPEB cost (expense) for 2007

I

Benefits paid during 2007

Contributions made during 2007

$ 64,766

$ 1,230,002

64,766

(13,080)

(1,281,688)

I

Net OPEB obligation - June 30, 2007 $

I

The Florida Bar's annual OPEB cost, the percentage of annual OPEB cost contributed to the

plan, and the net OPEB obligation for 2007 were as follows:

I

AnnualOPEB Percentage of Annual OPEB Cost Net OPES

Fiscal Year Ended Cost Contribtued Obligation

6/30/2007 $ 64,766 100

0

Jb $

I

I

I

- 24

I

The Florida Bar and Subsidiaries

Notes to Consolidated Financial Statements

I

I

NOTE 11 - RETIREE POSTEMPLOYMENT HEALTH BENEFITS (CONTINUED)

Funded Status and Funding Progress. As of January 1, 2006, the first actuarial valuation date,

the plan was unfunded. The actuarial accrued liability for benefits was calculated to be

I

$1,203,784. The covered payroll (annual payroll of active employees covered by the plan) was

$12,946,872, and the ratio of the UAAL to the covered payroll was 9.30

0

AJ. The liability was

funded in June 2007.

I

I

Actuarial valuations of an ongoing plan involve estimates of the value of reported amounts and

assumptions about the probability of occurrence of events far into the future. Examples include

assumptions about future employment, mortality, and the healthcare cost trend. Amounts

I

determined regarding the funded status of the plan and the annual required contributions of the

employer are subject to continual revision as actual results are compared with past expectations

and new estimates are made about the future.

I

Actuarial Methods and Assumptions. Projections of benefits for financial reporting purposes are

based on the substantive plan (the plan as understood by the employer and the plan members)

and include the types of benefits provided at the time of each valuation and the historical pattern

of sharing of benefit costs between the employer and plan members to that point. The actuarial

methods and assumptions used include techniques that are designed to reduce the effects of

I

short-term volatility in actuarial accrued liabilities and the actuarial value of assets, consistent

with the long-term perspective of the calculations.

I

In the January 1, 2006 actuarial valuation, the projected unit credit actuarial cost method was

I

used. The actuarial assumptions included a 6% investment rate of return, which is a blended

rate of the expected long-term investment returns on plan assets and on the employer's own

investments, and an annual healthcare cost trend rate of 12AJ initially, reduced by decrements

I

to an ultimate rate of 60/0 in the year 2010 and beyond. Both rates included a 3% inflation

assumption. As of the January 1, 2006 actuarial valuation, TFBRHP did not have plan assets in

trust solely to provide benefits to retirees and their beneficiaries. However, the actuary assumed

I

that TFBRHP would start to pre-fund benefits and the investment rate of return was based on

this fact. The UAAL is being amortized as a level percentage of projected payroll on an open

basis. The remaining amortization period at January 1, 2006 was 30 years.

NOTE 12 - LEASES

I

The Florida Bar is the lessee of office space under operating leases expiring in various years

through the year 2017, with escalation clauses.

I

I

I

I

I

- 25

I

The Florida Bar and Subsidiaries

Notes to Consolidated Financial Statements

I

I

NOTE 12 - LEASES (CONTINUED)

The Florida Bar leases office space from its wholly-owned subsidiary, The Florida Bar Building

Corporation. The intercompany rental income and rental expense have been eliminated in

I

consolidation.

Future minimum rental payments are as follows:

I

Years ending June 30, Amount

2008 $ 717,229

2009 676,454

I

2010 559,887

2011 205,583

2012 203,798

I

Thereafter 1,110,623

Total minimum future rental payments $ 3,473,574

I

Total rental expense for the fiscal year ended June 30, 2007 and 2006 was $860,045 and

$757,530, respectively.

I

The Florida Bar is also the lessor of certain office space in a building owned by The Florida Bar.

The space is rented to unrelated entities under operating leases expiring in various years

through the year 2009. Rental income for the fiscal years ended June 30, 2007 and 2006 were

I

$507,083 and $499,561, respectively.

Future minimum rental receipts are as follows:

Years ending June 30, Amount

I

I

2008 $ 265,991

2009 66,986

Total minimum future rental payments $ 332,977

I

NOTE 13 - CONTINGENCIES

I

The Florida Bar is involved in several actions as defendant and/or co-defendant. The majority

of the actions are expected to be settled with little or no financial impact to The Florida Bar. An

I

accurate assessment of any significant liability is not determinable although management of The

Florida Bar believes that the possibility of any significant liability arising from current litigation is

extremely remote.

I

NOTE 1 4 ~ - COMMITMENTS

The Florida Bar has contracted with various hotels to reserve facilities, rooms, and food and

beverage services for meetings and seminars to be held through 2015. If The Florida Bar

I

should choose to cancel the contract(s), liquidating damages will be due to the hotel. Generally,

liquidating damages are tiered depending on the time between cancellation and scheduled

arrival date and are based on a percentage of anticipated revenues.

I

I

- 26

I

The Florida Bar and Subsidiaries

I

Notes to Consolidated Financial Statements

I

NOTE 14 - COMMITMENTS (CONTINUED)

I

The following is a schedule of estimated liquidating damages that The Florida Bar would incur

should they cancel the contract(s) as of June 30, 2007:

I

Estimated

liquidating

I

Event damages

Annual Meeting $ 674,810

Mid-Year Meeting 98,682

I

Board of Governors Meeting 130,746

General Meeting 15,700

Section Meeting 592,893

Continuing Legal Education Seminars 356,745

Total commitment $ 1,869,576

I

NOTE 15 - DESIGNATED FUND BALANCES

I

I

The Florida Bar has designated certain net assets to be used for specific program purposes. As

of June 30,2007 and 2006, the designated net assets were $14,691,134 and $12,073,656,

respectively.

NOTE 16 - RISK MANAGEMENT PROGRAMS

I

The Florida Bar is exposed to various risks of loss related to torts; theft of, damage to, and

destruction of assets; errors and omissions; injuries to employees; and natural disasters.

I

Workers' compensation, property, and general liability coverage are provided through

I

commercial insurance carriers. Management continuously reviews the limits of coverage and

believes that current coverage is adequate. There were no significant reductions in insurance

coverage from the previous year.

I

I

I

I

I

I

- 27

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

I

Supplementary Information

IL...----------------.-J

------------------

The Florida Bar and Subsidiaries

Consolidating Statement of Net Assets

Clients'

General Bar Center Security Certification Sections Eliminating Total

June 30, 2007 Fund Fund Fund Fund Fund Entries All Funds

Assets

Current assets

Cash and cash equivalents

Short-term investments

Accounts receivable, net

Due from other funds

Prepaid expenses and other assets

Total current assets

$ 9,533,712

40,553,570

545,576

-

443,091

51,075,949

$ 1,134,156

-

-

5,415,255

-

6,549,411

$ -

-

-

4,621,087

-

4,621,087

$ -

-

-

789,453

-

789,453

$ -

-

-

3,969,392

-

3,969,392

$ -

-

31,883

(14,795,187)

(25,117)

(14,788,421 )

$ 10,667,868

40,553,570

577,459

417,974

52,216,871

Restricted assets

Investment in The Florida Bar

Building Corporation

Total restricted assets

1,611,647

1,611,647

-

-

-

-

-

-

-

-

(1,611,647)

(1,611,q47)

Capital assets, net

Land

Buildings and improvements

Landscaping and parking

Equipment and furnishings

Construction in progress

Accumulated depreciation

Total capital assets, net

-

-

-

-

-

-

-

1,103,060

8,292,805

120,318

4,632,356

136,170

(7,945,380)

6,339,329

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

1,103,060

8,292,805

120,318

4,632,356

136,170

(7,945,380)

6,339,329

Total assets $ 52,687,596 $ 12,888,740 $ 4,621,087 $ 789,453 $ 3,969,392 $ (16,400,068) $ 58,556,200

See Independent Auditors' Report.

- 28

- - - - - - - - - - - - - - - - - - -

The Florida Bar and Subsidiaries

Consolidating Statement of Net Assets

(Continued)

Clients'

General Bar Center Security Certification Sections Eliminating Total

June 30,2007 Fund Fund Fund Fund Fund Entries All Funds

Liabilities and Net Assets

Current liabilities

Current portion of long-term debt $ - $ 198,939 $ - $ - $ - $ - $ 198,939

Accounts payable 2,937,134 15,006 - - - (1,365,732) 1,586,408

Claims payable - - 53,595 - - - 53,595

Accrued expenses 907,385 - - - - - 907,385

Due to other funds 13,397,572 - - - - (13,397,572)

Deferred revenues 9,362,874 - - - - - 9,362,874

Security deposits - 73,008 - - - (25,117) 47,891

Total current liabilities 26,604,965 286,953 53,595 - - (14,788,421 ) 12,157,092

Non-current liabilities

Long-term debt, less current portion - 1,665,886 - - - - 1,665,886

Compensated absences payable 2,405,251 - - - - - 2,405,251

Total non-current liablities 2,405,251 1,665,886 - - - - 4,071,137

Total liabilities 29,010,216 1,952,839 53,595 - - (14,788,421 ) 16,228,229

Net assets

Invested in capital assets, net of related debt - 4,474,503 - - - 4,474,503

Restricted for scholarships 32,551 - - - - - 32,551

Unrestricted

Designated 515,046 4,849,751 4,567,492 789,453 3,969,392 - 14,691,134

Undesignated 23,129,783 - - - - - 23,129,783

Contributed capital - 1,611,647 - - - (1,611,647)

Total net assets 23,677,380 10,935,901 4,567,492 789,453 3,969,392 (1,611,647) 42,327,971

Total liabilities and net assets $ 52,687,596 $12,888,740 $ 4,621,087 $ 789,453 $ 3,969,392 $ (16,400,068) $ 58,556,200

See Independent Auditors' Report.

- 29

- - - - - - - - - - - - - - - - - - -

The Florida Bar and Subsidiaries

Consolidating Statement of Revenues, Expenses and Changes in Net Assets

Clients'

General Bar Center Security Certification Sections Eliminating Total

Year ended June 30, 2007 Fund Fund Fund Fund Fund Entries All Funds

Operating revenues

Annual fees $ 20,896,608 $ - $ - $ - $ - $ - $ 20,896,608

Other fees from members 3,757,073 - - 1,074,551 1,171,381 - 6,003,005

Sales of products and services 6,344,212 - - 5,515 2,542,151 - 8,891,878

Advertising 2,315,354 - - - - - 2,315,354

Young lawyers 575,425 - - - - - 575,425

Grants and other 526,919 978,887 81,001 - - (536,395) 1,050,412

Total operating revenues 34,415,591 978,887 81,001 1,080,066 3,713,532 (536,395) 39,732,682

Operating expenses

Regulation of the practice of law 13,972,125 - - 936,414 - (203,917) 14,704,622

Cost of products and services provided to members 7,345,063 - - - 3,051,525 (106,753) 10,289,835

Unauthorized practice of law 1,363,825 - - - - (19,810) 1,344,015

Public service programs 586,698 - 1,160,737 - - (8,508) 1,738,927

Communication with members and the public 4,047,917 - - - - (58,678) 3,989,239

Administration 3,567,529 - - - - (51,767) 3,515,762

Legislation 406,995 - - - - (5,894) 401,101

Young lawyers 558,686 - - - - (8,090) 550,596

Depreciation and amortization - 699,110 - - - - 699,110

Other programs and costs 240,424 514,923 - - - (72,978) 682,369

Total operating expenses 32,089,262 1,214,033 1,160,737 936,414 3,051,525 (536,395) 37,915,576

Operating income (loss) 2,326,329 (235,146) (1,079,736) 143,652 662,007 - 1,817,106

Non-operatlng revenues (expenses)

Investment earnings 3,126,872 464,834 388,230 48,322 333,390 - 4,361,648

Interest expense - (148,325) - - - - (148,325)

Loss on disposal of capital assets - (14,294) - - - - (14,294)

Total non-operating revenues 3,126,872 302,215 388,230 48,322 333,390 - 4,199,029

Change In net assets 5,453,201 67,069 (691,506) 191,974 995,397 - 6,016,135

Net assets, beginning of year 20,711,247 9,924,400 3,716,362 597,479 2,973,995 (1,611,647) 36,311,836

Transfers (to) from other funds (2,487,068) 944,432 1,542,636

Net assets, end of year $ 23,677,380 $ 10,935,901 $ 4,567,492 $ 789,453 $ 3,969,392 $ (1,611,647) $ 42,327,971

See Independent Auditors' Report.

- 30

- - - - - - - - - - - - - - - - - - -

The Florida Bar and Subsidiaries

Consolidating Statement of Cash Flows

Clients'

General Bar Center Security Certification Sections Eliminating Total

Year ended June 30,2007 Fund Fund Fund Fund Fund Entries All Funds

Cash flows from operating activities:

Receipts from members, customers and other sources $ 33,946,214 $ 978,887 $ 81,001 $ 1,080,066 $ 3,713,532 $ 429 $ 39,800,129

Payments to employees, suppliers and other vendors (32,200,890) 352,603 (469,231 ) (1,128,388) (4,046,922) (429) (37,493,257)

Net cash provided by (used in) operating activities 1,745,324 1,331,490 (388,230) (48,322) (333,390) - 2,306,872

Cash flows from non-capital and related financing activities:

Reduction of debt - (184,718) - - - - (184,718)

Interest paid - (148,325) - - - - (148,325)

Net cash (used in) non-capital and related financing

activities - (333,043) - - - - (333,043)

Cash flows from capital and related financing activities: