Professional Documents

Culture Documents

Microeconomics INDERJIT SINGH

Uploaded by

Jennifer KaurOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Microeconomics INDERJIT SINGH

Uploaded by

Jennifer KaurCopyright:

Available Formats

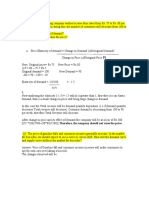

Part A Question 1 Price (RM) 500 600 700 800 900 1000 Quantity Demanded (tonnes) 15000 13000

11000 9000 7000 5000 Quantity Supplied (tonnes) 1000 3000 6000 9000 12000 15000 New Quantity demanded (tonnes) 12000 9000 6000 3000 1000 -

(a) P = RM800 Q = 9000 tonnes (b) TR = P x Q = 800 X 9000 = RM 7,200,000 (c) There is excess supply in the market. Price would decrease. (d) New: P = RM700 Q = 6000 tonnes TR = P x Q = 700 X 6000 = RM 4,200,000 The revenue earned is decreased.

Question 2 The table below illustrates the market for curry mee in Penang. Price (RM) 10 20 30 40 50 60 70 80 90 (a) P = RM50 Quantity supplied (units) 0 10 20 30 40 50 60 70 80 Q = 40 units Quantity demanded (units) 80 70 60 50 40 30 20 10 0 New Quantity demanded (units) 20 30 40 50 60 70 80 90 100

(b) TR = P x Q = 50 X 40 = RM 2000 (c) (i) Shown in the table. (ii) P = RM40 Q = 50 units

(iii) TR = P x Q = 40 X 50 = RM 2000 The revenue is the same, it did not decrease or increase.

Question 3 When the price per carton of Coke falls from RM16 to RM14, the quantity demanded increases from 200 to 300 cartons per month. The demand for Pepsi falls from 250 to 200 cartons per month. Price 1 : RM16 Price 2 : RM14 Quantity 1 : 200 Quantity 2 : 300

(a) Price elasticity of demand (midpoint formula) = (Q2-Q1) / [(Q2+Q1)/2] (P2-P1) / [(P2+P1)/2] = (300-200) / [(300+200)/2] (14-16) /[(14+16)/2] = -3% (Value <1 is Inelastic)

(b) Since the demand of coke is inelastic, an increase in price of coke causes an increase in the total revenue. This is because the increase in price does not have a large impact on quantity demanded. (c) CPEoD = (% Change in Quantity Demand for Good X) (% Change in Price for Good Y)

Question 4 Tax is imposed on the sale of petrol. In the diagram below, S0 is the supply curve before tax and S1 is the supply curve after tax.

(a) The price after tax : RM10 Decrease in price shift back to the left, and the new equilibrium intersection shows the increase in tax price. (b) A is at price at RM10, B is at price at RM2 and they both intersect quantity at 10. So you have RM8 as the tax paid for 10 units. Therefore 8/10 or 0.8 is the tax per unit. (c) Tax revenue = base X height = 10 X (10-2) = 10 X 8 = RM80 (d) Consumers burden of tax What consumer pays (difference) = RM10-RM5 = RM5 TAX = The difference X the Quantity = RM5 x 10 = RM50 Producers burden of tax What producers pays (difference) = RM5-RM2 =RM3 TAX = The difference X the Quantity = RM3 X 10 = RM30 The tax is made up of RM80 = RM50 (by consumer) and RM30 (by producer) (e) Producers tax revenue = base X height = 10 X 2 = RM 20

Part B Question 1 Indicate whether each of the following statements belong to microeconomics or macroeconomics. (a) Ah Beng allocates his money between food and clothes. Microeconomics (b) The number of workers in the entertainment industry has increased over the last five years. Microeconomics (c) The inflation rate in Cambodia has increased since the country opened up. Macroeconomics (d) The price of vegetables has increased as a result of higher tariff rate. Macroeconomics (e) Demand for fashion accessories will rise since the government had raised the income of civil servants. Macroeconomics

Question 2 Indicate whether each of the statements is positive or normative. (a) Government should eliminate subsidy for petrol and diesel. Normative (b) The elimination of subsidy will decrease the usage of vehicles. Positive (c) An increase in the income of consumers will increase the demand for goods and services. Positive (d) Protectionism policies on imported goods are necessary for all countries and it should be practiced. Normative (e) Higher tariff rate on imported goods will increase the price of imported goods. Positive

Question 3 Elaborate the effects of each of the following events on the equilibrium price and quantity in the Malaysian market. (Draw a diagram for EACH event) (a) A terrible drought wipes out 80 percent of rice production. What would happen to the equilibrium price and quantity of rice?

The change in price, affects the supply curve. By raising the costs of production, it reduces the amount that the company produces and sells at any given price. The demand curve does not change because the higher cost of inputs does not directly affect the amount the buyer wants to buy. The supply curve shifts to the left because, at every price the total amount that buyers are willing to buy and able to sell is reduced.

(b) Suppose consumer incomes rise. What would happen to the equilibrium price and quantity of LCD television sets?

An event that raises quantity demanded at any given price shifts the curve to the right. The equilibrium price and the equilibrium quantity both rises.

(c) Suppose that paper has become cheaper and government is giving tax exemptions on book purchases. How will this affect the market for books?

An increase in supply shifts the supply curve to the right and an increase in demand shifts the demand curve to the right. As a result of these changes there will definitely be an increase in the equilibrium quantity in the market, but whether price is higher or lower will depend on whether the shift in supply or demand is greater and the elasticities of supply and demand. The supply and demand curves have shifted because there has been a change in the determinants of supply and demand. For example, there may have simultaneously been a increase in the level of income and also a decrease in the firm's costs.

Question 4 Using appropriate diagrams, explain the effects the following elasticities have on total revenue when price increases: (a) elastic demand When the demand is elastic (a price elasticity greater than 1), price and total revenue move in the opposite direction.

The demand curve is elastic. In this case, an increase in the price leads to a decrease in quantity demanded and is proportionally larger, so the total revenue decreases.

(b) inelastic demand When demand is inelastic (a price elasticity less than 1), price and total revenue move in the same direction

The demand curve is ineslatic. In this case an increase in the price leads to a decrease in quantity demanded that is proportionally smaller, so the total revenue increases.

You might also like

- Economic Environment of Business: Assignment 1 Fall 2013 Question 1: Demand/Supply (Chapter 3) (A)Document13 pagesEconomic Environment of Business: Assignment 1 Fall 2013 Question 1: Demand/Supply (Chapter 3) (A)Gaurav ShekharNo ratings yet

- AssignmentNO2 (Fa22 Rba 001)Document9 pagesAssignmentNO2 (Fa22 Rba 001)Taskeen ZafarNo ratings yet

- Model Question Paper and Answer FA520Document24 pagesModel Question Paper and Answer FA520balipahd_1No ratings yet

- ECON1000B: Principles of Microeconomics Midterm Test #1: October 8, 2010Document6 pagesECON1000B: Principles of Microeconomics Midterm Test #1: October 8, 2010examkillerNo ratings yet

- Assingment BEDocument3 pagesAssingment BERavi Prakash VermaNo ratings yet

- Tutorial 8-10 Q - EconomicsDocument4 pagesTutorial 8-10 Q - EconomicsJing ZeNo ratings yet

- Quiz Microeconomics BECO201 Date 30/10/2017 Name: IDDocument5 pagesQuiz Microeconomics BECO201 Date 30/10/2017 Name: IDAA BB MMNo ratings yet

- Assignment 1 (ECO162)Document13 pagesAssignment 1 (ECO162)Nor Fizhana50% (2)

- Tutorial 2Document5 pagesTutorial 2Tasneemah HossenallyNo ratings yet

- Assignment 1ADocument5 pagesAssignment 1Agreatguy_070% (1)

- Business Economics - Assignment SolutionDocument11 pagesBusiness Economics - Assignment SolutionGauthamNo ratings yet

- Homework Economic - Topic 2.3Document13 pagesHomework Economic - Topic 2.3Do Van Tu100% (1)

- #130337288ADocument10 pages#130337288A254No ratings yet

- Intro Micro UTS EssayDocument3 pagesIntro Micro UTS EssaynaylaNo ratings yet

- Problem Set 5Document6 pagesProblem Set 5Thulasi 2036No ratings yet

- Assignment 1Document2 pagesAssignment 1Tahsan Kabir100% (1)

- Chapter 4 MicroeconDocument13 pagesChapter 4 MicroeconLucasStarkNo ratings yet

- Practice Problem Set 1 With AnswersDocument7 pagesPractice Problem Set 1 With AnswersJoy colabNo ratings yet

- Assignment 2Document7 pagesAssignment 2Q bNo ratings yet

- Solution - Assignment PDFDocument7 pagesSolution - Assignment PDFQ bNo ratings yet

- BE Lecture 2 Demand & SupplyDocument47 pagesBE Lecture 2 Demand & SupplyRenata Cleia Lopes HenriquesNo ratings yet

- EcoMan Problem Set 1Document2 pagesEcoMan Problem Set 1Katharine NervaNo ratings yet

- Microeconomics Problem Set 2Document8 pagesMicroeconomics Problem Set 2Thăng Nguyễn BáNo ratings yet

- ElasticityDocument14 pagesElasticitysidlbsimNo ratings yet

- Topic 4 OdlDocument10 pagesTopic 4 OdlNur NabilahNo ratings yet

- Assigement 1Document11 pagesAssigement 1ShahidUmarNo ratings yet

- Case Study On Tortillas With AnswersDocument6 pagesCase Study On Tortillas With AnswersTran Nhat Thang50% (2)

- Lecture3 QuestionSolutionsDocument4 pagesLecture3 QuestionSolutionsCherHanNo ratings yet

- StudyGuide PDFDocument36 pagesStudyGuide PDFSamihaSaanNo ratings yet

- Econ 1550 Sem 20304Document14 pagesEcon 1550 Sem 20304M Aminuddin AnwarNo ratings yet

- Eco 162 Microeconomics PDFDocument22 pagesEco 162 Microeconomics PDFjungkook wifeNo ratings yet

- Part A. Multiple ChoicesDocument4 pagesPart A. Multiple ChoicesJessica FeliciaNo ratings yet

- EC2101 Practice Problems 9 SolutionDocument4 pagesEC2101 Practice Problems 9 Solutiongravity_coreNo ratings yet

- Sample With AnswersDocument7 pagesSample With Answerssubash1111@gmail.comNo ratings yet

- EconomicsDocument69 pagesEconomicsNikithaNo ratings yet

- Assignment 3 Pme Hss1021Document3 pagesAssignment 3 Pme Hss1021Suraj PandaNo ratings yet

- Assignment Solution Eco HHHHDocument4 pagesAssignment Solution Eco HHHHIsmail ismailNo ratings yet

- MN - Economic Practice QuestionsDocument11 pagesMN - Economic Practice QuestionsMartin GerardNo ratings yet

- ECO 3108 - Tutorial 2: The Basics of Supply and Demand Name: - Student ID: - DateDocument5 pagesECO 3108 - Tutorial 2: The Basics of Supply and Demand Name: - Student ID: - DateLEE SHXIA YAN MoeNo ratings yet

- Ugbs 201 T1Document5 pagesUgbs 201 T1richmannkansahNo ratings yet

- HW1 Business Economics Spring 2020 AnswersDocument20 pagesHW1 Business Economics Spring 2020 AnswersBo Rae100% (1)

- ASSIGNMENT 3 A and 3B PDFDocument9 pagesASSIGNMENT 3 A and 3B PDFBilal BilalNo ratings yet

- 2.0 Demand AnalysisDocument25 pages2.0 Demand AnalysisNotYGurLzNo ratings yet

- 01 Econ 208 Week 1 Tutorial SolutionsDocument6 pages01 Econ 208 Week 1 Tutorial SolutionsdariusNo ratings yet

- Study Material - Hots Questions Economics 2009-10Document33 pagesStudy Material - Hots Questions Economics 2009-10vishaljalanNo ratings yet

- MICRO ASS 1 Eco 401Document3 pagesMICRO ASS 1 Eco 401Uroona MalikNo ratings yet

- Managerial Economics Topic 5Document65 pagesManagerial Economics Topic 5Anish Kumar SinghNo ratings yet

- GE273 Homework Week3Document3 pagesGE273 Homework Week3MrDiazNo ratings yet

- BACore1-Activity #4Document5 pagesBACore1-Activity #4Arnold Quachin TanayNo ratings yet

- Economics For Managers GTU MBA Sem 1 Chapter 4 ElasticityDocument44 pagesEconomics For Managers GTU MBA Sem 1 Chapter 4 ElasticityRushabh VoraNo ratings yet

- Fall 2022 - ECO402 - 1 - BC210424490Document4 pagesFall 2022 - ECO402 - 1 - BC210424490Kinza LaiqatNo ratings yet

- Ch6 - Textbook QuestionsDocument7 pagesCh6 - Textbook QuestionsavawkNo ratings yet

- Economics Assignment 1Document7 pagesEconomics Assignment 1Ashlyn Mclean0% (1)

- List 2Document3 pagesList 2agnessNo ratings yet

- Online Assessment For ECO120 Principles of Economics (Oct 2021 To Feb 2022)Document9 pagesOnline Assessment For ECO120 Principles of Economics (Oct 2021 To Feb 2022)AIN ZULLAIKHANo ratings yet

- EconDocument30 pagesEcondsouzad12100% (1)

- Supply and Demand: Analytical QuestionsDocument22 pagesSupply and Demand: Analytical QuestionsNghĩa Phạm HữuNo ratings yet

- Macro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsFrom EverandMacro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsNo ratings yet

- What Do You Think About The Video? Do You Have A Dream. What Is It? What Will You Do For Make It True?Document34 pagesWhat Do You Think About The Video? Do You Have A Dream. What Is It? What Will You Do For Make It True?moynovheeNo ratings yet

- Spare Parts, Instruction and Maintenance Manual For Spanco Model 300 Jib CranesDocument16 pagesSpare Parts, Instruction and Maintenance Manual For Spanco Model 300 Jib CranesAndres LopezNo ratings yet

- Business O Level Notes - Chapter 16 PDFDocument4 pagesBusiness O Level Notes - Chapter 16 PDFHeba KhattabNo ratings yet

- Tesla Takes On MichiganDocument20 pagesTesla Takes On MichiganCato InstituteNo ratings yet

- Ebook Startup 101 How Experts Drive Success PDFDocument12 pagesEbook Startup 101 How Experts Drive Success PDFGoce KuzmanovskiNo ratings yet

- Brand Experience at Big BazaarDocument6 pagesBrand Experience at Big Bazaarroopa_655068668No ratings yet

- Bir Comparison SLSPDocument5 pagesBir Comparison SLSPchris cardino100% (1)

- Introduction To: ErvicesDocument152 pagesIntroduction To: ErvicesBhawna SharmaNo ratings yet

- Phoenix Mining Catalog 2009Document37 pagesPhoenix Mining Catalog 2009José VillegasNo ratings yet

- E-Commerce: Mechanisms, Infrastructures, and ToolsDocument38 pagesE-Commerce: Mechanisms, Infrastructures, and ToolshulahopNo ratings yet

- Activity Ratio: Globe Telecom. CompanyDocument2 pagesActivity Ratio: Globe Telecom. CompanyNCTNo ratings yet

- Discussion Questions - Coca Cola in IndiaDocument1 pageDiscussion Questions - Coca Cola in IndiathecluelessNo ratings yet

- Offensive and Defensive StrategiesDocument23 pagesOffensive and Defensive StrategiesAsad Farooq80% (5)

- Chapter 7 AnswerDocument16 pagesChapter 7 AnswerKathy WongNo ratings yet

- ATL Practice QuestionsDocument80 pagesATL Practice Questionssauravds7100% (1)

- A Study of Marginal Costing of Haier India Pvt. LTD Pune City.Document72 pagesA Study of Marginal Costing of Haier India Pvt. LTD Pune City.Asif MemonNo ratings yet

- Positioning of Company XDocument15 pagesPositioning of Company X2rohitjacob100% (1)

- Project Taxation Law NewDocument20 pagesProject Taxation Law NewmanasaNo ratings yet

- The Marketing Game Information DeckDocument29 pagesThe Marketing Game Information DeckretrokryzNo ratings yet

- LeasesDocument3 pagesLeasesBrian Christian VillaluzNo ratings yet

- CPM Case Study From Vikrant SehgalDocument3 pagesCPM Case Study From Vikrant SehgalvikrantNo ratings yet

- Catering Company Business PlanDocument20 pagesCatering Company Business Plansatkartar100% (1)

- Wedding Videography Business PlanDocument29 pagesWedding Videography Business PlanSachin RNo ratings yet

- Introduction To Business TaxesDocument60 pagesIntroduction To Business TaxesRobilyn BollosaNo ratings yet

- Internship ReportDocument57 pagesInternship ReportNoufal Km92% (12)

- ENTREPRENEURSHIPDocument6 pagesENTREPRENEURSHIProbloxaxl7No ratings yet

- CV-Zakir Hussain PDFDocument4 pagesCV-Zakir Hussain PDFzaki3125239715zaki100% (1)

- Menu Engineering Chapter 1Document47 pagesMenu Engineering Chapter 1Rizkiy A. Fadlillah100% (2)

- CH 08Document22 pagesCH 08Abdalelah FrarjehNo ratings yet

- Weetabix Assignment 1Document16 pagesWeetabix Assignment 1Fadekemi Adelabu100% (1)