Professional Documents

Culture Documents

Acct1501 Tutorial Questions Solutions Week3

Uploaded by

chunkityikOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acct1501 Tutorial Questions Solutions Week3

Uploaded by

chunkityikCopyright:

Available Formats

Australian School of Business

ACCT1501 Accounting and Financial Management 1A Session 2 2013

TUTORIAL WEEK 3 Solutions to Tutorial Questions

Tutorial Questions: v DQ 2.6, 2.10; Problems 2.7, 2.9, 2.11

DQ 2.6

a A balance sheet can indicate whether a company is financially sound by a comparison of the amount of finance raised by debt with the amount raised from owners. The higher the proportion raised by the debt, the higher the risk to the creditors. b The working capital, i.e. current assets less current liabilities indicates a companys ability to pay its bills on time. This assumes that the current assets can be readily turned into cash. c To declare a dividend a company must have adequate cash (or overdraft facilities) and adequate retained profits. The decision will be influenced by shareholder expectations. d The age of equipment can be ascertained by comparing cost of equipment to accumulated depreciation.

DQ 2.10

Your explanations will have been in your own words, perhaps something like the following: a Net profit is part of shareholders equity because the increase in resources earned as mentioned above belongs to the owners, who may withdraw it as dividends. Until they do withdraw it, it is part of their ownership interest. b Net profit could be reported on the balance sheet by just showing that shareholders equity has increased since the prior period. The income statement was developed to provide an explanation of the details of the change in owners equity and to separate that from any dividends withdrawn by the owners during the period. c Companies earn profits when their revenues are greater than the expenses incurred in earning those revenues. Dividends are a distribution of profit to shareholders, not an expense of running a business.

Problem 2.7

Finewines Limited Balance sheet as at 30 June 2012 $ Liabilities 4,340 Accounts payable 9,800 10,460 50,800 Shareholders equity Share capital Retained profits

Assets Cash Inventory of grapes Accounts receivable Kitchen equipment

$ 10,680 40,000 24,720

Total shareholders equity Total assets 75,400 Total liabilities and shareholders equity

64,720

75,400

Net profit for the year (which is not distributed as dividends) is technically called retained profits on the balance sheet, and is a type of shareholders equity. Accounts payable is a liability, not an asset. Accounts receivable is an asset, not a liability. Kitchen equipment is an asset, not shareholders equity nor a liability. Liabilities and share capital should be separately categorised. Individual totals for each of: assets, liabilities and owners equity should be calculated and displayed (unless there is only one or no items in a category, in which case the total is obvious). Totals for each side of the balance sheet should be calculated (to check it balances). Dollar signs should be displayed to indicate that the numbers represent dollars.

Problem 2.9

1 Century Cinemas Income Statement For the year ended 31 December 2012 $ $ Ticket revenue 81,700 Confectionary sales 12,300 Less Cost of confectionary sold (10,500) Gross profit 83,500 Less operating expenses Advertising expense 42,780 Rent expense 33,200 Electricity expense 5,090 (81,070) Net profit 2,430

Century Cinemas Statement of retained profits For the year ended 31 December 2012 Retained profits, 1 January 2012 Net profit for 2012 Retained profits, 31 December 2012 $ 59,720 2,430 62,150

3 Current assets Cash Accounts receivable Inventory Noncurrent assets Furniture & fittings Land & buildings Projection equipment Total assets

Century Cinemas Balance Sheet as at 31 December 2012 $ Current liabilities 4,610 Accounts payable 13,450 18,000 Noncurrent liabilities 36,060 Loan payable Total liabilities 34,000 Shareholders equity 60,000 Share capital 41,000 Retained profits 135,000 171,060 Total liabilities and shareholders equity

$ 13,910 35,000 48,910 60,000 62,150 122,150 171,060

Problem 2.11

1 2 3 4 5 6 7 8 9 Assets Increase Increase NE Increase NE Decrease NE Increase Increase Liabilities NE* Increase NE Increase NE Decrease NE Increase NE Shareholders equity Increase NE NE NE NE NE NE NE Increase Notes

Assets increased and decreased Assets increased and decreased Assets increased and decreased

*NE (no effect)

You might also like

- The Cestui Que Vie Act (1666) - People Are Owned Under Old English LawDocument9 pagesThe Cestui Que Vie Act (1666) - People Are Owned Under Old English Lawzimaios100% (2)

- Ch03 P15 Build A ModelDocument2 pagesCh03 P15 Build A ModelHeena Sudra77% (13)

- Financial Accounting Workbook Version 2Document90 pagesFinancial Accounting Workbook Version 2Honey Crisostomo EborlasNo ratings yet

- Managerial FinanceDocument7 pagesManagerial FinanceHafsa Siddiq0% (1)

- SEx 2Document20 pagesSEx 2Amir Madani100% (3)

- Chapter 2: Financial Statements and Cash Flow AnalysisDocument43 pagesChapter 2: Financial Statements and Cash Flow AnalysisshimulNo ratings yet

- Deped Coa2011 Observation RecommendationDocument81 pagesDeped Coa2011 Observation RecommendationAnthony Sutton100% (7)

- Routing Mapping Payments As Transactions v3Document235 pagesRouting Mapping Payments As Transactions v3Jj018320No ratings yet

- AR Practice Problems Solution PDFDocument7 pagesAR Practice Problems Solution PDFLorraine Mae RobridoNo ratings yet

- IATA TaxDocument1,510 pagesIATA TaxMiguelRevera100% (1)

- AR PresentationDocument32 pagesAR PresentationSaq IbNo ratings yet

- Statement of Cash Flows 3Document7 pagesStatement of Cash Flows 3Rashid W QureshiNo ratings yet

- Wiley - Practice Exam 1 With SolutionsDocument10 pagesWiley - Practice Exam 1 With SolutionsIvan Bliminse80% (5)

- Financial Statements and Accounting Transactions: Solutions Manual For Chapter 2 9Document70 pagesFinancial Statements and Accounting Transactions: Solutions Manual For Chapter 2 9Tấn Lộc LouisNo ratings yet

- Concepts Review and Critical Thinking Questions 4Document6 pagesConcepts Review and Critical Thinking Questions 4fnrbhcNo ratings yet

- Exam 1 - Sample Exam SolutionsDocument7 pagesExam 1 - Sample Exam SolutionsArnulfo ArmamentoNo ratings yet

- CF-A#1 - Waris - 01-322221-024Document8 pagesCF-A#1 - Waris - 01-322221-024Waris 3478-FBAS/BSCS/F16No ratings yet

- Assured Shorthold Tenancy AgreementDocument8 pagesAssured Shorthold Tenancy AgreementemyNo ratings yet

- 1P91+F2012+Midterm Final+Draft+SolutionsDocument10 pages1P91+F2012+Midterm Final+Draft+SolutionsJameasourous LyNo ratings yet

- Tamba HanaDocument2 pagesTamba HanaircasinagaNo ratings yet

- TQ Ans Wk3Document3 pagesTQ Ans Wk3seling97No ratings yet

- Module 1, Chapter 1 Handout Introduction To Financial StatementsDocument5 pagesModule 1, Chapter 1 Handout Introduction To Financial StatementssdfsdfuignbcbbdfbNo ratings yet

- Introduction To Financial Accounting: Key Terms and Concepts To KnowDocument16 pagesIntroduction To Financial Accounting: Key Terms and Concepts To KnowAmit SharmaNo ratings yet

- Mid-Term Exam Financial Accounting ReviewDocument5 pagesMid-Term Exam Financial Accounting ReviewĐoàn Tài ĐứcNo ratings yet

- Analysis Solutions Acc 411Document13 pagesAnalysis Solutions Acc 411dre_emNo ratings yet

- Financial Statements ExplainedDocument36 pagesFinancial Statements ExplainedTakouhiNo ratings yet

- Workshop Solutions T1 2014Document78 pagesWorkshop Solutions T1 2014sarah1379No ratings yet

- Midterm Test - Code 36 - FA - Sem 2 - 21.22Document5 pagesMidterm Test - Code 36 - FA - Sem 2 - 21.22Đoàn Tài ĐứcNo ratings yet

- Midterm Test - Code 4 - FA - Sem 2 - 21.22Document5 pagesMidterm Test - Code 4 - FA - Sem 2 - 21.22Đoàn Tài ĐứcNo ratings yet

- Midterm Test - Code 40 - FA - Sem 2 - 21.22Document5 pagesMidterm Test - Code 40 - FA - Sem 2 - 21.22Đoàn Tài ĐứcNo ratings yet

- AnswerDocument8 pagesAnswerShamik SenghaniNo ratings yet

- Midterm Test - Code 37 - FA - Sem 2 - 21.22Document5 pagesMidterm Test - Code 37 - FA - Sem 2 - 21.22Đoàn Tài ĐứcNo ratings yet

- Homework Solutions Chapter 1Document9 pagesHomework Solutions Chapter 1Evan BruendermanNo ratings yet

- AC 310 Lab Problems - 9.7.2021Document2 pagesAC 310 Lab Problems - 9.7.2021Abdullah alhamaadNo ratings yet

- Chapter 5 PartnershipDocument10 pagesChapter 5 PartnershipMelkamu Dessie TamiruNo ratings yet

- A Level Recruitment TestDocument9 pagesA Level Recruitment TestFarrukhsgNo ratings yet

- Term Exam 2edited Answer KeyDocument10 pagesTerm Exam 2edited Answer KeyPRINCESS HONEYLET SIGESMUNDONo ratings yet

- Chapter 4 Sample BankDocument18 pagesChapter 4 Sample BankWillyNoBrainsNo ratings yet

- Sample ACCT101 final exam questions and solutionsDocument12 pagesSample ACCT101 final exam questions and solutionshappystoneNo ratings yet

- Omair Masood: AS Level MCQs MadnessDocument75 pagesOmair Masood: AS Level MCQs MadnessAli Qazi100% (11)

- FIN300 Homework 1Document7 pagesFIN300 Homework 1JohnNo ratings yet

- Financial Administration Exercises 1Document8 pagesFinancial Administration Exercises 1ScribdTranslationsNo ratings yet

- Final - Problem Set FM FinalDocument25 pagesFinal - Problem Set FM FinalAzhar Hussain50% (2)

- Rinconada - ProjectDocument29 pagesRinconada - ProjectRINCONADA ReynalynNo ratings yet

- Closing Entries and Post-Closing Trial BalanceDocument21 pagesClosing Entries and Post-Closing Trial BalanceAL Babaran CanceranNo ratings yet

- 4 5809728989157133277Document7 pages4 5809728989157133277yoniakia2124No ratings yet

- CF MBA S23 Ch2 (B2) QsDocument6 pagesCF MBA S23 Ch2 (B2) QsWaris 3478-FBAS/BSCS/F16No ratings yet

- 3.7 ExercisesDocument6 pages3.7 ExercisesGeorgios MilitsisNo ratings yet

- MBA 5015 Managerial Finance-Lesson 1-HomeworkDocument3 pagesMBA 5015 Managerial Finance-Lesson 1-HomeworkpravinNo ratings yet

- Soal Test Intermediate 2 MAC 2020Document6 pagesSoal Test Intermediate 2 MAC 2020DikaGustianaNo ratings yet

- THPS 1 - Summer 2023Document9 pagesTHPS 1 - Summer 2023Ruth KatakaNo ratings yet

- Far Chap 8 SolDocument61 pagesFar Chap 8 SolCaterpillarNo ratings yet

- Analyze Financial Ratios to Evaluate Business PerformanceDocument13 pagesAnalyze Financial Ratios to Evaluate Business PerformanceAtyaFitriaRiefantsyahNo ratings yet

- Workshop 2 - Questions - Introduction To Accounting and FinanceDocument7 pagesWorkshop 2 - Questions - Introduction To Accounting and FinanceSu FangNo ratings yet

- Analyze Bartlett Company's Financial StatementsDocument46 pagesAnalyze Bartlett Company's Financial StatementsMustakim Bin Aziz 1610534630No ratings yet

- Merger & Acquisition Accounting & Auditing Impact - Liquidation and Reorganisation - Jawaban Tugas Week 10Document10 pagesMerger & Acquisition Accounting & Auditing Impact - Liquidation and Reorganisation - Jawaban Tugas Week 10Ragil Kuning ManikNo ratings yet

- Example Mid TermDocument7 pagesExample Mid TermvelusnNo ratings yet

- ACC101 Chapter1newDocument16 pagesACC101 Chapter1newtazebachew birkuNo ratings yet

- FMGT 1321 Midterm 1 Review Questions: InstructionsDocument7 pagesFMGT 1321 Midterm 1 Review Questions: InstructionsAnnabelle Wu0% (1)

- Hho9e Ch01 SMDocument101 pagesHho9e Ch01 SMWhitney NuckolsNo ratings yet

- Pe - 2Document29 pagesPe - 2Matt KNo ratings yet

- Review Session1-MidtermDocument7 pagesReview Session1-MidtermBich VietNo ratings yet

- VCE Accounting - VCAA Unit 3 2012 Suggested SolutionsDocument13 pagesVCE Accounting - VCAA Unit 3 2012 Suggested SolutionsConnect EducationNo ratings yet

- AC557 W5 HW Questions/AnswersDocument5 pagesAC557 W5 HW Questions/AnswersDominickdad100% (3)

- Capital Expenditures BudgetDocument4 pagesCapital Expenditures BudgetDawit AmahaNo ratings yet

- Finman FinalsDocument4 pagesFinman FinalsJoana Ann ImpelidoNo ratings yet

- Past Year Exam Paper Bank Discount & Promissory NotesDocument5 pagesPast Year Exam Paper Bank Discount & Promissory Notesatiqahcantik100% (1)

- A Project Report On Financial Statement AnalysisDocument92 pagesA Project Report On Financial Statement Analysisziyan skNo ratings yet

- Journal Entry GuideDocument3 pagesJournal Entry GuideFeerose Kumar GullaNo ratings yet

- 2A COMMUNICATIVE Are You A Saver or A Spender?Document1 page2A COMMUNICATIVE Are You A Saver or A Spender?B McNo ratings yet

- 01-JUN-2019 - 30-JUN-2019 (1) - UnlockedDocument3 pages01-JUN-2019 - 30-JUN-2019 (1) - UnlockedSwethasri KNo ratings yet

- London Examinations Igcse: AccountingDocument24 pagesLondon Examinations Igcse: AccountingSadman DibboNo ratings yet

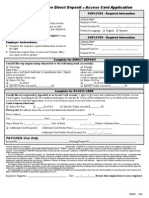

- Dir DepDocument1 pageDir Depfazlah8106No ratings yet

- 2.study of E-Wallet Awareness and Its Usage in MumbaiDocument14 pages2.study of E-Wallet Awareness and Its Usage in Mumbaiphamuyen11012003No ratings yet

- Bse 20171024Document53 pagesBse 20171024BellwetherSataraNo ratings yet

- Johor Corp 2008Document209 pagesJohor Corp 2008khairulkamarudinNo ratings yet

- Crash Course For Ethics CFA Level-I Exam: This Files Has Expired at 30-Jun-13Document50 pagesCrash Course For Ethics CFA Level-I Exam: This Files Has Expired at 30-Jun-13Aspanwz SpanwzNo ratings yet

- MCCP LeafDocument2 pagesMCCP LeafManish GoelNo ratings yet

- Walter BagehotDocument4 pagesWalter BagehotdantevantesNo ratings yet

- Pay Your Condo Fees Online or at the OfficeDocument1 pagePay Your Condo Fees Online or at the OfficeKobe Lawrence VeneracionNo ratings yet

- Apply for TAN number onlineDocument1 pageApply for TAN number onlineNIKUL DARJINo ratings yet

- Worksheet Multiple ChoiceDocument11 pagesWorksheet Multiple ChoiceiamjnschrstnNo ratings yet

- Bank database schema and queriesDocument8 pagesBank database schema and queriesAndrea Alejandra Cruz OrtizNo ratings yet

- Components of Cash and Cash EquivalentsDocument5 pagesComponents of Cash and Cash EquivalentsJomel BaptistaNo ratings yet

- Understanding Customer Behavior at SCBDocument78 pagesUnderstanding Customer Behavior at SCBHimanshu Saini0% (1)

- 003 Bonnevie v. Court of Appeals, G.R. No. L-49101, October 24, 1983 PDFDocument2 pages003 Bonnevie v. Court of Appeals, G.R. No. L-49101, October 24, 1983 PDFRomarie AbrazaldoNo ratings yet

- Funding Grid ToolDocument3 pagesFunding Grid ToolSamuel Kagoru GichuruNo ratings yet

- 1314-1269 Cotizacion 3 Sistemas Quoncer PDFDocument4 pages1314-1269 Cotizacion 3 Sistemas Quoncer PDFByron Xavier Lima CedilloNo ratings yet

- Group 2Document26 pagesGroup 2Hyunjin imtreeeNo ratings yet