Professional Documents

Culture Documents

Matthews, Christopher Paper 167

Uploaded by

mayanksosOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Matthews, Christopher Paper 167

Uploaded by

mayanksosCopyright:

Available Formats

Wine Product Bundling: Who are the consumers?

An exploratory study

* Christopher Matthews, University of Adelaide The University of Adelaide Business School Email: christopher.matthews@student.adelaide.edu.au Simon Somogyi, University of Queensland University of Queensland, School of Agriculture & Food Sciences Email: s.somogyi@uq.edu.au Rob Van Zanten, University of Adelaide The University of Adelaide Wine Science and Business Email: rob.vanzanten@adelaide.edu.au

Keywords: Product Bundling; Segmentation; Wine Bundling; Wine

Abstract Product bundling is a widespread marketing strategy (Stremersch & Tellis, 2002; Yadav, 1994; Yadav & Monroe, 1993). Part of the attraction of a bundle is that the price is less than the sum of the prices for each of the products in the bundle. The strategy has been most recently used by large retailers in Australia, particularly liquor retailers who often bundle wine with other liquor products. However, there exists a paucity of research into consumer behaviour regarding wine product bundles. Hierarchical segmentation analysis via K-Mean cluster analysis was used to examine the nature of consumers perceptions of wine product bundles and commonalities among those consumers. Three clusters of wine product bundle consumers were identified. The information gained from this exploratory study was aimed at assisting the wine industry when formulating wine product bundles for the consumer. Introduction Product bundling is a marketing strategy, which has become quite common in the market place, particularly in the Australian wine industry. In a wine industry context, this technique involves bundling bottles of wine with other liquor products and paraphernalia, such as beer, spirits, other types of wine (e.g. sparkling wine) and items such as clothing, coasters, etc., which are sold at a single price. The bundle is then sold at a lower price than the sum of the individual products contained therein. This technique is particularly prevalent with the larger liquor retailers (such as Dan Murphys and 1st Choice Liquor), who routinely bundle a case of wine (a case being a unit of 6 or 12 bottles) with a case of beer (24 cans). While literature on the subject discusses the concept of product bundling, there is an absence of research specifically related to wine product bundles. Furthermore, little has been discussed about the types of consumer who would be interested in wine product bundles. As such, this paper will focus on generic product bundling and its application in a wine context by highlighting an exploratory study into the nature of wine product bundle consumers through K-means cluster analysis. The paper will discuss three aspects as follows. Firstly, literature currently available regarding product bundling; secondly, methods used to uncover the wine product bundle consumer; and, thirdly, results, discussion and areas for further research. Literature Review Product Bundling Wine product bundling has received minimal attention, if any, in available literature. As such, this discussion will focus on literature currently available with regard to generic product bundling. The latter reveals that the two most common forms of bundling are: (1) pure bundles; and (2) mixed bundles (Adams & Yellen, 1976; Koukova, Kannan, & Ratchford, 2008; Stremersch & Tellis, 2002). Pure bundles differ from mixed bundles in that the products are not offered for sale separately. Different areas of product bundling have been addressed over time, including: consumers evaluation of bundles, (Heeler, Nguyen, & Buff, 2007; M. D. Johnson, Herrmann, & Bauer, 1999; Nguyen, Heller, & Buff, 2009; Yadav, 1994; Yadav & Monroe, 1993); presentation and formulation of the product bundles (Hanson & Martin, 1990; Mulhern & Leone, 1991); and economic theories related to product bundling (Adams & Yellen, 1976; Burstein, 1960). Product categories selected for prior research have generally allowed for a particular research issue to be conveniently studied. These product categories have included attributes such as everyday use, well known brands, a symmetry between the products being bundled (close fit), ease of functional integration, and complementarity or balanced products (for example, a fast food meal offering two types of

food in the same bundle). Wine product bundling offers a new dimension in the field of bundling research as it differs in at least three important attributes compared to the product categories typically used for this type of research. These attributes include: (1) a highly fragmented market, whereby no single company dominates the market and consumers are offered hundreds of wines in the setting of a traditional liquor outlet (Alonso & Liu, 2009); (2) the notion that a wine purchase is relatively high in risk (T. Johnson & Bruwer, 2004; Lacey, Bruwer, & Li, 2009); and (3) the notion that a wine purchase is often for an occasion and for occasion enhancement (Bruwer & Li, 2007; Spawton, 1991). In addition to these attributes, what must be highlighted is the concept that a product bundle is a type of deal. Therefore, any discussion on literature with regard to product bundling must also highlight literature into how prone consumers are towards a deal. This is discussed in the next section. General Deal Proneness Wine product bundling is a type of a deal, whereby consumers purchase two or more products at a price discounted from the sum of their individual prices. As such, it can be surmised that consumers who are attracted to wine product bundles are also prone to deals. Lichtenstein et al. (1995) discusses the nature of consumers perceptions of deals and developed an eight item scale, with the intention of measuring the level of consumers enjoyment of sales promotions and their tendency to buy the products associated with such deals. They also aimed at assessing whether consumers were prone to specific types of deals. Their scale could additionally be used across different types of promotions. Although their results showed that the proneness to deal was domain specific, the general deal proneness scale has nevertheless been widely utilized in the literature. As such, it is of interest to observe the extent of deal proneness in wine consumers particularly as wine product bundles can reasonably be considered to be a deal. The preceding literature has highlighted various aspects of product bundling, including consumers perceptions of product bundles (deals). As has been discussed, the nature of consumer behaviour regarding wine product bundling has not been identified and was the purpose of this research. In this connection, this paper will attempt to uncover consumer segments interested in wine product bundles. The next section of this paper will discuss research methods employed to uncover these segments. Method To obtain the data necessary to uncover wine product bundle consumer segments, quantitative survey interviews were conducted. Interview respondents were filtered by three criteria: (1) over 18 years of age; (2) resident in South Australia; and (3), wine consumers. The survey was conducted in 14 locations within South Australia. These included liquor stores, cellar door sales, regional visitor centres and main thoroughfares. A total of 262 valid questionnaires were obtained. The questionnaire was comprised 33 questions within three sections: (a) introductory questions; (b) specific product bundling questions; and (c) demographic questions. The introductory questions contained a scale in relation to general deal proneness (Lichtenstein, et al., 1995), which formed the basis for clustering analysis. Other introductory questions included respondents alcohol consumption patterns and the average price they would pay for the product categories contained in the stimuli. Specific product bundling questions included six items on consumers perception of: (a) convenience; (b) discount; (c) value for money; (d) the reason for product bundling; (e) wine quality within the

product bundle; as well as (f) the intention to purchase. These were all measured on a five point Likert scale. These constructs were chosen as prior research into product bundling suggested they were major factors in relation to: (a) consumer behaviour, perceived value and intention to buy (Andrews, Benedicktus, & Brady, 2010); (b) expectations and buying objectives (Puto, 1987); and (c) price discounting (Arora, 2008; Heeler, et al., 2007; Puto, 1987; Yadav & Monroe, 1993). Respondents were presented with three pictures (i.e. stimuli) representing three product bundles: (a) Wine-Champagne; (b) Wine-Beer; and (c) WineSpirit. The issue of possible bias (Aaker, Kumar, Day, & Leone, 2010; Charters, Lockshin, & Unwin, 1999) included: (a) prestige seeking; (b) social desirability; (c) labels/brands; and (d) price. This was addressed by creating bundles devoid of brands, quality and price. Additionally, the stimuli were randomised. It was considered that the absence of price, quality and brand reference points may present the respondent with some computational difficulty. Therefore a simpler two-product bundle was chosen for the said stimuli (Agarwal & Chatterjee, 2003). Hierarchical K-mean cluster analysis was used to segment the respondents. An active variable of general deal proneness was used in this clustering, as a relationship between deal proneness and product bundle attraction exists. Exploratory factor analysis using Principle Component Analysis was performed on the scale items for deal proneness. It was shown that the scale was extracting on one component. A Cronbach Alpha test was conducted on the general deal proneness scale (Lichtenstein, et al., 1995), which resulted in a .833 alpha. This suggested that the scale was reliable. K-means cluster analysis was also deemed an appropriate analysis method as it has been used numerous times to classify wine consumers in previous research (Bastian & Johnson, 2007; Bruwer & Li, 2007; Bruwer, Li, & Reid, 2002). The analysis was performed using Ward method and the resulting dendrogram uncovered three distinct clusters. Using the trial method discussed by Hair et al. (2006) and Janssens (2008), four clusters were uncovered, but one was rejected on the grounds that it contained too few respondents (less than 10). As such, the respondents were then clustered into the three groups, and ANOVA and cross-tab analysis was performed to see how the clusters perceived the active variable of deal proneness. ANOVA and cross-tab analysis were also performed to see how the clusters perceived the passive variables, i.e. the demographic information of the participants, their consumption by volume of the various types of alcoholic drinks and their perceptions of the wine bundles. Tukey and Bonferroni tests and post-hoc F-tests were performed to see if there was a statistical difference between the clusters in terms of active and passive variables. The tests showed that this difference was statistically significant (Janssens, et al., 2008). All test results, which were significant between the groups, were retained in the clusters. Statistical analysis of the responses was conducted using SPSS v17

Results The following segments were identified from the cluster analysis Affluent, Champagne Buying, Deal Avoiding, Bundle Selectors (n=55 21%) The main characteristic of the affluent, champagne buying, deal avoiding bundle selectors is their non-tendency towards deals. Demographically, this cluster has a high household income (i.e. more than 50% have incomes between $75,000-150,000), and they tend to be highly educated (i.e. more than 50% have a bachelor degree or higher). The Wine-Champagne bundle was most likely to be purchased by this cluster, with more being spent on Champagne than by the other two clusters. However, compared to the young, deal prone bundle seekers and the older, wealthy educated deal wavering bundle evaders, this group did not favour any specific wine bundle. Young, Deal Prone, Bundle Seekers (n=102 39%) The distinctive characteristic of this cluster is its tendency for deals, which makes them very interesting in the context of wine product bundling. This cluster has the highest intention for purchasing wine product bundles across the three wine product bundle types. When purchasing wine the young, deal prone bundle seekers rate promotion, price and discounts more highly than affluent, deal avoiding bundle selectors or the older, wealthy educated deal wavering bundle evaders. In addition, this cluster tends to be the youngest group (i.e. 53% aged between 18-39 years) and has the lowest household incomes (i.e. 47% earn less than $75,000). Young, deal prone bundle seekers also have lower education qualifications (i.e. 40% have a vocational certificate or lower). This cluster tends to pay less for Champagne than the other two clusters. Older, Wealthy, Educated, Deal Wavering, Bundle Evaders (n=105 40%) Although this clusters level of proneness towards deals is higher than the affluent, deal avoiding bundle selectors, it remains less deal prone. It also has the oldest respondents of all three clusters (i.e. 62% are aged above 44 years) and tends to have the highest household incomes (i.e. 48% have incomes greater than $100,000). Older, wealthy, educated, dealwavering, bundle evaders also have the highest education of the three clusters, with 21% having a postgraduate diploma or higher. Interestingly, this group does not favour any of the three bundles more than the other.

Discussion and Implications This exploratory study identified a number of wine product bundle consumer segments. Three consumer-type clusters were uncovered that can be used in the context of marketing wine. Of specific interest is the young, deal prone bundle seekers cluster. It tends to be young and have less household income than the other two clusters identified in the research. It has a propensity toward promotions and discounts, and price is an important factor in winepurchase decisions. These attributes offer wine marketers the opportunity to target this cluster with advertising and wine product bundles built around their profile. This cluster mainly contains Generation Y consumers and, as such, wine product bundling may be an avenue to attract these consumers more towards wine (Nowak, Thach, & Olsen, 2006). The affluent, deal avoiding bundle selectors and the older, wealthy, educated, deal wavering, bundle evaders also provide wine marketers with opportunities, but in a more limited way. Market intelligence gained from this research also suggests that some market segments should be

avoided when formulating wine product bundles. Nevertheless, more research needs to be undertaken to correlate these clusters with their perceptions and intentions to buy wine product bundles, so as to form actionable outcomes. An interesting observation is that certain clusters, particularly the affluent, deal avoiding, bundle selectors, tend to avoid deals but purchase bundles, if only a certain type.

Conclusion and Future Research This exploratory study does not provide significant data to create actionable outcomes for an industry-wide approach to product bundling. However, it does provide a critical starting point for further research into this marketing strategy in the wine context. Also, this research has uncovered that wine product bundling is a marketing strategy that is amenable to alcohol consumers. An anecdotal review of advertisements and in-store offerings suggests that wine product bundling is still at an embryonic stage market. However, it is a strategy that is being employed by large wine companies to gain access to large wine retailers. The results of this study have revealed that wineries need to focus on targeting the consumer segment (cluster) most likely to seek wine product bundles. Furthermore, SME wineries have experienced difficulty gaining access to large liquor retailing in Australia. By bundling their wine products with spirits, beer and champagne, SME wineries may gain greater access to this retail format. It can be suggested that wineries also need to be producing beer and spirits (and joint venturing with champagne houses) to gain access to these consumer segments and therefore large liquor retail outlets. The results of this study have shown that product bundling is a marketing strategy which can be used by the wine industry, as there are consumer segments willing to buy the bundles. Due to the exploratory nature of the study the results have various limitations. Firstly, the survey was limited to the South Australian wine market and the scope of the questions was limited to a small number of constructs considered important for an exploratory study and a small sample size. As such, further research needs to be performed utilising a larger sample size with a greater geographic scope and a larger instrument. A further limitation in this research was the simple presentations that served as stimuli in the survey. Further research could provide stimuli that involve brand names, quality inferences and bundle prices. More investigation could be made into the highly deal prone cluster, which was younger and consisted mainly of generation-Y consumers. It would be of interest to further investigate who these consumers are purchasing for, whether they are simply purchasers or actual consumers of the bundled products, and which of the product bundles they would be most likely to buy. Additional insight could be obtained through qualitative in-depth interviews or focus group sessions that probe these issues or by quantitative surveys that test consumers this segment. An observation of interest from the study is that the affluent, deal avoiding, bundle selectors have a tendency to bypass deals however they are willing to purchase bundles. It was surmised that consumers who were deal prone would also be attracted to bundles and vice versa. Nevertheless, this observation appears to be contradictory. Additional research could further explore this anomaly and thereby investigate the affect that deal proneness has on wine bundle purchase intention.

References Aaker, D., Kumar, V., Day, G., & Leone, R. P. (2010). Marketing Research - Tenth Edition (10th ed.). NJ: John Wiley & Sons, Inc. Adams, W. J., & Yellen, J. L., 1976. Commodity Bundling and the Burden of Monopoly. The Quarterly Journal of Economics, 90 (3), 475-498. Agarwal, M. K., & Chatterjee, S., 2003. Complexity, uniqueness, and similarity in betweenbundle choice. Journal of Product & Brand Management, 12 (6), 358-376. Alonso, A. D., & Liu, Y., 2009. Wine tourism development in emerging Western Australian regions. International Journal of Contemporary Hospitality Management Science, 22 (2), 245-262. Andrews, M. L., Benedicktus, R. L., & Brady, M. K., 2010. The effect of incentives on customer evaluations of service bundles. Journal of Business Research, 63 (1), 71-76. Arora, R., 2008. Price bundling and framing strategies for complementary products. Journal of Product & Brand Management, 17 (7), 475 - 484. Bastian, S. E. P., & Johnson, T. E., 2007. A preliminary study of the relationship between Australian wine consumers' wine expertise and their wine purchasing and consumption behaviour. AUSTRALIAN JOURNAL OF GRAPE AND WINE RESEARCH, 13 (3), 186197. Bruwer, J., & Li, E., 2007. Wine-Related Lifestyle (WRL) Market Segmentation: Demographic and Behavioural Factors. Journal of Wine Research, 18 (1), 19-34. Bruwer, J., Li, E., & Reid, M., 2002. Segmentation of the Australian Wine Market Using a Wine-Related Lifestyle Approach. Journal of Wine Research, 13 (3), 217-242. Burstein, M. L., 1960. The economics of tie-in sales. Review of Economics and Statistics, 42 (1), 68-73. Charters, S., Lockshin, L., & Unwin, T., 1999. Consumer Responses to Wine Bottle Back Labels. Journal of Wine Research, 10 (3), 183-195. Hair, J. F., Black, W., Babin, B., Anderson, R., & Tatham, R. (2006). Multivariate data analysis. Upper Saddle River, N.J: Pearson Prentice Hall. Hanson, W., & Martin, R. K., 1990. Optimal Bundle Pricing. Management Science, 36 (2), 155-174. Heeler, R. M., Nguyen, A., & Buff, C., 2007. Bundles = discount? Revisiting complex theories of bundle effects. Journal of Product & Brand Management, 16 (7), 492-500. Janssens, W., Wijnen, K., De Pelsmacker, P., & Van Kenhove, P. (2008). Marketing Research with SPSS. Essex: Prentice Hall.

Johnson, M. D., Herrmann, A., & Bauer, H. H., 1999. The effects of price bundling on consumer evaluations of product offerings. International Journal of Research in Marketing , 16 (2), 129-142. Johnson, T., & Bruwer, J., 2004. Generic Consumer Risk-Reduction Strategies (RRS) in Wine-Related Lifestyle Segments of the Australian Wine Market. International Journal of Wine Marketing, 16 (1), 5 - 35. Koukova, N. T., Kannan, P. K., & Ratchford, B. T., 2008. Product form bundling: Implications for marketing digital products. Journal of Retailing, 84 (2), 181-194. Lacey, S., Bruwer, J., & Li, E., 2009. The role of perceived risk in wine purchase decisions in restaurants. International Journal of Wine Business Research, 21 (2), 99-117. Lichtenstein, D. R., Netemeyer, R. G., & Burton, S., 1995. Assessing the Domain Specificity of Deal Proneness: A Field Study. The Journal of Consumer Research, 22 (3), 314-326. Mulhern, F. J., & Leone, R. P., 1991. Implicit price bundling of retail products - a multiproduct approach to maximizing store profitability. Journal of Marketing, 55 (4), 63-76. Nguyen, A., Heller, R. M., & Buff, C., 2009. Consumer perceptions of bundles. Journal of Product & Brand Management, 18 (3), 218-225. Nowak, L., Thach, L., & Olsen, J., 2006. Wowing the millennials: creating brand equity in the wine industry. Journal of Product & Brand Management, 15 (5), 316-323. Puto, C. P., 1987. The Framing of Buying Decisions. Journal of Consumer Research, 14 (3), 301-315. Spawton, T., 1991. Marketing Planning for Wine. European Journal of Marketing, 25 (3), 648. Stremersch, S., & Tellis, G. J., 2002. Strategic bundling of products and prices: A new synthesis for marketing. Journal of Marketing, 66 (1), 55-72. Yadav, M. S., 1994. How buyers evaluate product bundles - a model of anchoring and adjustment. Journal of Consumer Research, 21 (2), 342-353. Yadav, M. S., & Monroe, K. B., 1993. How buyers perceive savings in a bundle price - an examination of a bundles transaction value. Journal of Marketing Research, 30 (3), 350-358.

You might also like

- DS Exl HDocument53 pagesDS Exl HKaushik Mashettiwar13% (8)

- Solution Manual For Microeconomics 4th Edition by BesankoDocument21 pagesSolution Manual For Microeconomics 4th Edition by Besankoa28978213333% (3)

- International Business AssignmentDocument12 pagesInternational Business AssignmentRaymond ChongNo ratings yet

- HEINEKEN +Logo+GuideDocument8 pagesHEINEKEN +Logo+GuideCristian Villella RojasNo ratings yet

- Relevance Versus Convenience in Business Research: The Case of Country-of-Origin Research in MarketingDocument33 pagesRelevance Versus Convenience in Business Research: The Case of Country-of-Origin Research in MarketingAmbreen AtaNo ratings yet

- Packaging Industries (Coca-Cola & Pepsi)Document32 pagesPackaging Industries (Coca-Cola & Pepsi)Karan100% (1)

- Culture-Specific Consumption Patterns of German and Ukrainian Wine ConsumersDocument11 pagesCulture-Specific Consumption Patterns of German and Ukrainian Wine ConsumersCristina SavaNo ratings yet

- Creating and Managing Regional Umbrella Brands: A Comprehensive Quantitative Approach (Refereed)Document22 pagesCreating and Managing Regional Umbrella Brands: A Comprehensive Quantitative Approach (Refereed)fkkfoxNo ratings yet

- Consumer Attitudes and Loyalty Towards Private BrandsDocument11 pagesConsumer Attitudes and Loyalty Towards Private BrandsAnoushka SequeiraNo ratings yet

- Consumer Intentions and Purchase BehaviorDocument11 pagesConsumer Intentions and Purchase BehaviorAhmed ZakariaNo ratings yet

- 1 s2.0 S1877042816306255 Main PDFDocument9 pages1 s2.0 S1877042816306255 Main PDFAnișoara BoldișorNo ratings yet

- 17099905Document14 pages17099905Sidra NaeemNo ratings yet

- Spacil Teichmannov 2016Document10 pagesSpacil Teichmannov 2016banprclbthuongmaiNo ratings yet

- Store Brands vs. Manufacturer Brands ConDocument22 pagesStore Brands vs. Manufacturer Brands ConRandy RosalNo ratings yet

- Consumer PerceptionsDocument10 pagesConsumer PerceptionsSyahridzuel Ulquiorra SchifferNo ratings yet

- The Importance of Packaging Design For Own-Label Food BrandsDocument15 pagesThe Importance of Packaging Design For Own-Label Food BrandsMayank AgarwalNo ratings yet

- Article Review - Using Product V1 Dawit FinalDocument44 pagesArticle Review - Using Product V1 Dawit FinaldanielaltahNo ratings yet

- Extrinsic and Intrinsic Cue EffectsDocument10 pagesExtrinsic and Intrinsic Cue Effectsroy royNo ratings yet

- Overview of The StudyDocument7 pagesOverview of The Studysonabeta07No ratings yet

- Consumer Segment AttitudeDocument18 pagesConsumer Segment AttitudeProfaditi RautNo ratings yet

- Consumer Decision-Making Styles and Local Brand Biasness: Exploration in The Czech RepublicDocument15 pagesConsumer Decision-Making Styles and Local Brand Biasness: Exploration in The Czech RepublicVerlyn TenienteNo ratings yet

- How To Sell White Lable ProductDocument35 pagesHow To Sell White Lable ProductHeru Muara SidikNo ratings yet

- Consumer Behaviour For Wine 2.0Document22 pagesConsumer Behaviour For Wine 2.0Ricardo CunhaNo ratings yet

- Decision-Making Behaviour Towards Casual Wear Buying: A Study of Young Consumers in Mainland ChinaDocument10 pagesDecision-Making Behaviour Towards Casual Wear Buying: A Study of Young Consumers in Mainland ChinaHarish VermaNo ratings yet

- Prenil Dakhara CH-2Document11 pagesPrenil Dakhara CH-2prenil dakharaNo ratings yet

- 011-Icssh 2012-S00010Document6 pages011-Icssh 2012-S00010Asim KhanNo ratings yet

- Karl E Henion (1981)Document11 pagesKarl E Henion (1981)Javier LLoveras GutierrezNo ratings yet

- Spousal Purchasing Behavior As An Influence On Brand EquityDocument17 pagesSpousal Purchasing Behavior As An Influence On Brand EquityHitesh PrajapatiNo ratings yet

- Do Ethical Values Work? A Quantitative Study of The Impact of Fair Trade Coffee On Consumer BehaviorDocument13 pagesDo Ethical Values Work? A Quantitative Study of The Impact of Fair Trade Coffee On Consumer Behaviorumerfarooq1982No ratings yet

- ContentServer With Cover Page v2Document15 pagesContentServer With Cover Page v2Sonam GuptaNo ratings yet

- Consumer Attitude Toward Gray Market GoodsDocument17 pagesConsumer Attitude Toward Gray Market GoodsdarshanNo ratings yet

- Older ShoppertypesfromstoreimagefactorsDocument11 pagesOlder ShoppertypesfromstoreimagefactorsSugan PragasamNo ratings yet

- CrossDocument8 pagesCrossDeep LofghterNo ratings yet

- Elderly Consumers in Marketing Research A Systematic Literature Review andDocument25 pagesElderly Consumers in Marketing Research A Systematic Literature Review andsaddamNo ratings yet

- Pricing of Conspicuous Goods - A Competitive Analysis of Social Effects. Wilfred Amaldoss - Sanjay JainDocument33 pagesPricing of Conspicuous Goods - A Competitive Analysis of Social Effects. Wilfred Amaldoss - Sanjay Jainopiu99roNo ratings yet

- Consumer Behavior: Product Characteristics and Quality PerceptionDocument32 pagesConsumer Behavior: Product Characteristics and Quality PerceptionVo Minh Thu (Aptech HCM)No ratings yet

- Consumer Preference For Product Bundles PDFDocument8 pagesConsumer Preference For Product Bundles PDFneelakanta srikarNo ratings yet

- Arun Project FinalDocument73 pagesArun Project FinalArun R NairNo ratings yet

- Jurnal Pricing StrategyDocument8 pagesJurnal Pricing StrategySyafira FirdausiNo ratings yet

- A Decision Tree Approach To Modeling The Private Label Apparel ConsumerDocument12 pagesA Decision Tree Approach To Modeling The Private Label Apparel ConsumerYudistira Kusuma DharmawangsaNo ratings yet

- Cross Cultural Marketing DissertationDocument4 pagesCross Cultural Marketing DissertationWhoCanWriteMyPaperForMeSingapore100% (1)

- Building Icon Wine Brands: Exploring The Systemic Nature of Luxury WinesDocument19 pagesBuilding Icon Wine Brands: Exploring The Systemic Nature of Luxury WinesFrancesco SchiavoneNo ratings yet

- Modeling Consumer AttitudesDocument17 pagesModeling Consumer AttitudessahinchandaNo ratings yet

- Wang and ChenDocument6 pagesWang and Chenyonasabraham266No ratings yet

- Cross-Cultural Advertising Research: What Do We Know About The Influence of Culture On Advertising?Document29 pagesCross-Cultural Advertising Research: What Do We Know About The Influence of Culture On Advertising?api-310418628No ratings yet

- IBRKK Handel - Wew - 2 2017.156 169Document14 pagesIBRKK Handel - Wew - 2 2017.156 169tonyNo ratings yet

- Spain Consumer Values & SegmentationDocument32 pagesSpain Consumer Values & Segmentationsheeba_roNo ratings yet

- Actual Market Prices and Consumer Price KnowledgeDocument15 pagesActual Market Prices and Consumer Price KnowledgeHani BerryNo ratings yet

- Millward Brown ModelDocument14 pagesMillward Brown ModeljbaksiNo ratings yet

- 10 11648 J Ajtab 20180402 12Document5 pages10 11648 J Ajtab 20180402 12Manu BansalNo ratings yet

- Drivers of Brand Commitment: A Cross-National Investigation: Andreas B. Eisingerich and Gaia RuberaDocument16 pagesDrivers of Brand Commitment: A Cross-National Investigation: Andreas B. Eisingerich and Gaia RuberaFiaz MehmoodNo ratings yet

- Consumer Based GloblaDocument20 pagesConsumer Based GloblaBatica MitrovicNo ratings yet

- Cross Cultural Advertising ResearchDocument29 pagesCross Cultural Advertising ResearchZain SulaimanNo ratings yet

- Consumer BehaviourDocument61 pagesConsumer BehaviourDILIPKUMAR939No ratings yet

- Consumer Ethnocentrism and Attitudes Towards Domestic and Foreign ProductsDocument18 pagesConsumer Ethnocentrism and Attitudes Towards Domestic and Foreign ProductsBarkha AgarwalNo ratings yet

- Elderly Consumers in Marketing Research A SystematDocument25 pagesElderly Consumers in Marketing Research A SystematXUEYAN SHENNo ratings yet

- Effects of Perfume Packaging OnDocument21 pagesEffects of Perfume Packaging OnInés WangNo ratings yet

- Winzar 1992Document12 pagesWinzar 1992Simarjit SinghNo ratings yet

- Cultural Value, Consumption Value, and Global Brand Image: A Cross-National StudyDocument22 pagesCultural Value, Consumption Value, and Global Brand Image: A Cross-National StudyMansi SainiNo ratings yet

- Cross Calture AdvertisementDocument28 pagesCross Calture AdvertisementderekdynoNo ratings yet

- A Study of The Primary Evaluative Criteria in The Precious Jewellery Market in The UKDocument16 pagesA Study of The Primary Evaluative Criteria in The Precious Jewellery Market in The UKPriya GognaNo ratings yet

- Business Research Dissertation: Student preference on food brands in Tesco stores in the North East of UKFrom EverandBusiness Research Dissertation: Student preference on food brands in Tesco stores in the North East of UKNo ratings yet

- The Competitive Power of the Product Lifecycle: Revolutionise the way you sell your productsFrom EverandThe Competitive Power of the Product Lifecycle: Revolutionise the way you sell your productsNo ratings yet

- Macroeconomic and Industry AnalysisDocument21 pagesMacroeconomic and Industry Analysismayanksos100% (1)

- Assignment of LabDocument2 pagesAssignment of LabmayanksosNo ratings yet

- A Study On Contract Labour at Iffco KandlaDocument43 pagesA Study On Contract Labour at Iffco KandlamayanksosNo ratings yet

- Objectives and Importance of DisinvestmentDocument2 pagesObjectives and Importance of DisinvestmentmayanksosNo ratings yet

- Cases Study On DisinvestmentDocument23 pagesCases Study On Disinvestmentmayanksos100% (1)

- SMEDocument24 pagesSMEKetan AhirNo ratings yet

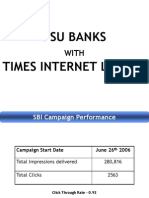

- Psu Banks Times Internet LimitedDocument14 pagesPsu Banks Times Internet LimitedmayanksosNo ratings yet

- Mayank Post ReportDocument27 pagesMayank Post ReportmayanksosNo ratings yet

- Branding of SonyDocument1 pageBranding of SonymayanksosNo ratings yet

- Chapter 7, Francis & CherunilamDocument13 pagesChapter 7, Francis & CherunilammayanksosNo ratings yet

- Bharti EnterpriseDocument25 pagesBharti EnterprisemayanksosNo ratings yet

- Safal Future Media KitDocument4 pagesSafal Future Media KitSt. ace RNo ratings yet

- Management of Financial Resources and Performance - Syllabus - Level 7Document5 pagesManagement of Financial Resources and Performance - Syllabus - Level 7Muhammad RafiuddinNo ratings yet

- KLR Influencer RoadmapDocument1 pageKLR Influencer RoadmapArlene B. AuroNo ratings yet

- Sales TrainingDocument146 pagesSales TrainingdsunteNo ratings yet

- Gee Tem Group11 Bsed Math3aDocument17 pagesGee Tem Group11 Bsed Math3aVerly Cañada RepuelaNo ratings yet

- Catchment Analysis Infinity IIDocument26 pagesCatchment Analysis Infinity IIAnkush LoveNo ratings yet

- Ranaweera-Prabhu2003 Article OnTheRelativeImportanceOfCustoDocument9 pagesRanaweera-Prabhu2003 Article OnTheRelativeImportanceOfCustoRowelyn FloresNo ratings yet

- These Are Some of The Flavors: Sold in Stores, Restaurants, and in More Than 200 CountriesDocument4 pagesThese Are Some of The Flavors: Sold in Stores, Restaurants, and in More Than 200 CountriesPrasad JoshiNo ratings yet

- Margin, Markdown, MarkonDocument1 pageMargin, Markdown, MarkonJonarissa BeltranNo ratings yet

- Whizz Bang March ReportDocument22 pagesWhizz Bang March ReportCezar JulNo ratings yet

- MGT 703 Major Project FinalDocument13 pagesMGT 703 Major Project FinalAmeliaNo ratings yet

- Marketing Strategy vs. Marketing PlanDocument2 pagesMarketing Strategy vs. Marketing PlanNansaa BayarNo ratings yet

- Maruti ProjectDocument88 pagesMaruti ProjectSahil DangNo ratings yet

- 02 The Economic Problem - Scarcity and Choice PDFDocument37 pages02 The Economic Problem - Scarcity and Choice PDFAakanksha Singh0% (1)

- Marketing Strategies of AdidasDocument61 pagesMarketing Strategies of AdidasUmesh TyagiNo ratings yet

- CPM FrameworkDocument33 pagesCPM FrameworkalfroscasNo ratings yet

- Assignment No 2 Production TheoryDocument2 pagesAssignment No 2 Production TheoryCami Kmyutza0% (2)

- 15G383 1b Whitepaper European GatewaysDocument11 pages15G383 1b Whitepaper European GatewaysNatanael1975No ratings yet

- Ryan Air SWOTDocument20 pagesRyan Air SWOTIvanNo ratings yet

- Food For Thought Illustrated EssayDocument13 pagesFood For Thought Illustrated EssayThe Guardian100% (1)

- 中国消费:新时代的开始(英)Document6 pages中国消费:新时代的开始(英)jessica.haiyan.zhengNo ratings yet

- Lecture 3 Notes - Marketing ResearchDocument44 pagesLecture 3 Notes - Marketing ResearchSilvia XuNo ratings yet

- Digital MarketingDocument24 pagesDigital MarketingNavin NarineNo ratings yet

- Consumer Behaviour For Financial ServicesDocument19 pagesConsumer Behaviour For Financial Servicessonia.raniNo ratings yet

- Case Study On DHLDocument2 pagesCase Study On DHLDeepak R GoradNo ratings yet

- ANG MAYREL ANGEL V. - Thesis Book PDFDocument82 pagesANG MAYREL ANGEL V. - Thesis Book PDFmiguelNo ratings yet