Professional Documents

Culture Documents

Another New All Time High For The Dow Transportation Average.

Uploaded by

Richard SuttmeierOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Another New All Time High For The Dow Transportation Average.

Uploaded by

Richard SuttmeierCopyright:

Available Formats

Richard Suttmeier is the Chief Market Strategist at www.ValuEngine.com. ValuEngine is a fundamentally-based quant research firm in Melbourne, FL.

ValuEngine covers over 8,000 stocks every day. A variety of newsletters and portfolios containing Suttmeier's detailed research, stock picks, and commentary can be found http://www.valuengine.com/nl/mainnl To unsubscribe from this free email newsletter list, please click

http://www.valuengine.com/pub/Unsubscribe?

October 25, 2013 Another new all time high for the Dow Transportation Average.

The decline in yield on the US Treasury 10-Year stalled at my annual pivot at 2.476% with the 50-day SMA at 2.739%. The yield on the US Treasury 30-Year bond is between my monthly pivot at 3.628% and my quarterly risky level is 3.487%. The weekly chart shows the 10-Year yield below its five-week MMA at 2.643% and is now on the cusp of its 200-week SMA at 2.512%. The weekly chart shows the 30-year yield below its five-week MMA at 3.691 and is just below its 200-week SMA at 3.624%. 10-Year Note (2.514) Monthly, weekly and semiannual value levels are 2.603, 2.621 and 3.227 with daily and annual pivots at 2.472 and 2.476, and quarterly and annual risky levels at 2.252 and 1.981. Comex gold has a positive daily chart with the precious metal above its 50-day SMA at $1342.7. The 200-day SMA declined to $1435.4. The weekly chart shifts to neutral with a close this week above its five-week MMA at $1326.9. The 200-week SMA is $1478.3. Crude oil remains below its 200-day SMA at $98.65 as the daily chart remains oversold. The weekly chart remains negative with a weekly close below its five-week MMA at $102.48 and the 200-week SMA at $91.48. This is a sign of a weak economy. The euro vs. the dollar is above its 50-day and 200-day SMAs at $1.3446 and 1.3209 with another new 52-week high at 1.3825. The weekly chart remains positive but overbought with the five-week MMA at 1.3536 and the 200-week SMA at 1.3328. Comex Gold ($1345.8) Weekly and monthly value levels are $1266.6 and $1145.2 with a daily pivot at $1366.6, and quarterly and annual risky levels at $1435.6, $1599.9 and $1852.1. Nymex Crude Oil ($97.06) Monthly and daily pivots are $99.84 and $96.36 with weekly, semiannual, quarterly and annual risky levels at $102.80, $109.84, $114.36 and $115.23. The Euro (1.3801) Annual, quarterly, monthly and semiannual value levels are 1.3257, 1.2805, 1.2782, 1.2756 and 1.2477 with a daily pivot at 1.3824 and annual risky level at 1.4295. The daily chart for the Dow Industrial Average is positive but overbought with the 50-day SMA at 15,167.09 and its Sept. 18 all time high at 15,709.59. The S&P 500 is positive but overbought with its 50-day SMA at 1685.25 and its Oct. 22 all time high at 1759.33. The Nasdaq is positive but overbought with its 50-day SMA at 3735.95 and its multi-year high at 3947.67 set on Oct. 22. The Dow Transportation Average is positive but overbought with its 50-day SMA at 6561.31 and its Oct. 24 all time high at 7031.92. The Russell 2000 is positive but overbought with its 50-day SMA at 1060.32 and new all time high at 1121.53 set on Oct. 22.

The weekly chart for Dow Industrials shifts to positive with a close this week above its five-week MMA at 15,300.26. The weekly chart for the S&P 500 remains positive with its five-week MMA at 1707.81. The weekly chart for the Nasdaq stays positive but overbought with its five-week MMA at 3795.89 as momentum remains well above 80.00 at 93.75. The weekly chart for Dow Transports is positive but overbought with its five-week MMA at 6688.76. The weekly chart for the Russell 2000 remains positive but overbought with its five-week MMA at 1080.11 as momentum remains above 80.00 and 92.30. The major equity averages have entered a wide zone of risky levels, except Dow Industrials. Monthly, semiannual and quarterly risky levels are 15,932, 16,490 and 16,775 Dow Industrials, 1853.8 S&P 500, 4025 Nasdaq, 7104 and 7205 Dow Transports and 1163.21 Russell 2000. Monthly and semiannual pivots are 1746.4 and 1743.5 S&P 500, 3830 and 3759 Nasdaq, 6811 Dow Transports and 1092.46 and 1089.42 Russell 2000. My annual value levels remain at 12,696 Dow Industrials, 1348.3 S&P 500, 2806 Nasdaq, 5469 Dow Transports, and 809.54 Russell 2000. Daily Dow: (15,509) Semiannual and annual value levels are 14,724 and 12,696 with daily and weekly pivots at 15,500 and 15,418, the Sept. 18 all time high at 15,709.59, and monthly, semiannual and quarterly risky levels at 15,932, 16,490 and 16,775. S&P 500 (1751.8) Weekly, semiannual and annual value levels are 1727.5, 1606.9, 1400.7 and 1348.3 with semiannual and monthly pivots at 1743.5 and 1746.4, the Oct. 22 all time high at 1759.33, and daily and quarterly risky levels at 1769.6 and 1853.8. NASDAQ (3929) Weekly, monthly, annual, semiannual and annual value levels are 3888, 3830, 3759, 3668 and 2806 with the Oct. 22 multi-year high at 3947.67, and daily and quarterly risky levels at 3968 and 4025. NASDAQ 100 (NDX) (3362) Semiannual, weekly, monthly and annual value levels are 3304, 3226, 3254 and 2463 with the Oct. 22 multi-year high at 3384.35, and daily and quarterly risky levels at 3406 and 3477. Dow Transports (7023) Weekly and annual value levels are 6710, 5925 and 5469 with a monthly pivot at 6811, the Oct. 24 all time high at 7031.92, and daily, semiannual and quarterly risky levels at 7065, 7104 and 7205. Russell 2000 (1119.69) Weekly, semiannual, monthly and annual value levels are 1102.54, 1089.42, 1092.46, 860.25 and 809.54 with the Oct. 22 all time high at 1121.53, and daily and quarterly risky levels at 1126.93 and 1163.21. The SOX (494.15) My annual value level is 338.03 with the Oct. 22 multi-year high at 508.75, and daily, weekly, monthly, quarterly and semiannual risky level at 499.73, 516.84, 512.13, 514.87 and 533.56. Dow Utilities: (502.18) Daily, weekly and semiannual value levels are 497.68, 485.82 and 481.92 with monthly, quarterly, semiannual and annual risky levels at 512.80, 520.55, 523.33 and 540.37. To learn more about ValuEngine check out www.ValuEngine.com. Any comments or questions contact me at RSuttmeier@gmail.com.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Bank Sort CodesDocument1 pageBank Sort CodesAnonymous tg2LDSi74% (19)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Australia Financial SystemDocument14 pagesAustralia Financial SystemVipra BhatiaNo ratings yet

- The Power of The Pivots Continue For The Major Equity Averages.Document2 pagesThe Power of The Pivots Continue For The Major Equity Averages.Richard SuttmeierNo ratings yet

- We Now Have Negative Weekly Charts For The Nasdaq and Russell 2000.Document2 pagesWe Now Have Negative Weekly Charts For The Nasdaq and Russell 2000.Richard SuttmeierNo ratings yet

- Daily Charts Are Negative For The Five Major Equity Averages.Document2 pagesDaily Charts Are Negative For The Five Major Equity Averages.Richard SuttmeierNo ratings yet

- Dow, Nasdaq, Russell 2000 Are Below Pivots at 16,245 / 4272 and 1180.35!Document2 pagesDow, Nasdaq, Russell 2000 Are Below Pivots at 16,245 / 4272 and 1180.35!Richard SuttmeierNo ratings yet

- The Power of The Pivots' Remains The 2014 Stock Market Theme.Document2 pagesThe Power of The Pivots' Remains The 2014 Stock Market Theme.Richard SuttmeierNo ratings yet

- Transports and Russell 2000 Lag in Reaction To Fed Chief Yellen.Document2 pagesTransports and Russell 2000 Lag in Reaction To Fed Chief Yellen.Richard SuttmeierNo ratings yet

- Registered Mutual Funds As On Oct 12 2023Document13 pagesRegistered Mutual Funds As On Oct 12 2023bnrathod0902No ratings yet

- 110821-Network Grievance Redressal Nodal Officer - EnglishDocument2 pages110821-Network Grievance Redressal Nodal Officer - EnglishLearn AutoNo ratings yet

- NTMCM 040418Document22 pagesNTMCM 040418Ananya GuptaNo ratings yet

- Wa0024.Document9 pagesWa0024.revathirajakrishnanNo ratings yet

- Disclosure of Payment OptionDocument1 pageDisclosure of Payment Optionpiku86No ratings yet

- SL No Farmerregno Farmername Schemename K2Utrno Paymentdate Accountnumber Dbtbeneficiaryamount Bankname SanctionordernoDocument19 pagesSL No Farmerregno Farmername Schemename K2Utrno Paymentdate Accountnumber Dbtbeneficiaryamount Bankname SanctionordernoMohan MylarappaNo ratings yet

- Manila Standard Today - Business Daily Stocks Review (May 22, 2013)Document1 pageManila Standard Today - Business Daily Stocks Review (May 22, 2013)Manila Standard TodayNo ratings yet

- All Banks Official Missed Call Balance Enquiry NumberDocument17 pagesAll Banks Official Missed Call Balance Enquiry NumberS.N.RajasekaranNo ratings yet

- CORPO LAW 2019 Part 3Document3 pagesCORPO LAW 2019 Part 3Sinetch EteyNo ratings yet

- E StatementDocument11 pagesE Statementankit kumarNo ratings yet

- List of Banks in NepalDocument3 pagesList of Banks in NepalnancyNo ratings yet

- MonzoDocument90 pagesMonzoMarian ChiriacNo ratings yet

- PDFDocument12 pagesPDFDyna JoseNo ratings yet

- OCS Group India Pvt. LTDDocument12 pagesOCS Group India Pvt. LTDNivedan KothekarNo ratings yet

- NYSEDocument105 pagesNYSE2N3055No ratings yet

- Sosialisasi Sales - Target UndanganDocument65 pagesSosialisasi Sales - Target UndanganBayu SubeniNo ratings yet

- Futures Margin and Lot SizeDocument5 pagesFutures Margin and Lot Sizekutra3000No ratings yet

- Delhi Bank 2Document56 pagesDelhi Bank 2doon devbhoomi realtorsNo ratings yet

- ETF Screener - JustETF A2Document4 pagesETF Screener - JustETF A2fish0123No ratings yet

- ISFC and NEFT Codes of All BanksDocument1,578 pagesISFC and NEFT Codes of All BanksPrasad KulkarniNo ratings yet

- Case Assignment in Civil Atty RabanesDocument27 pagesCase Assignment in Civil Atty RabanesSheron BiaseNo ratings yet

- Attendee List As of 4-22-19.Document7 pagesAttendee List As of 4-22-19.karthik83.v209No ratings yet

- Derivative KitDocument253 pagesDerivative KitSathish BettegowdaNo ratings yet

- Goldman Sachs Introduction - PDF - Investment Banking - Goldman SachsDocument51 pagesGoldman Sachs Introduction - PDF - Investment Banking - Goldman Sachsdamaxip240No ratings yet

- Embee's Audit Questionnaire (002) VIKASDocument1 pageEmbee's Audit Questionnaire (002) VIKASAsep SofyanNo ratings yet

- DtlStatement 08082022055359Document17 pagesDtlStatement 08082022055359Aralt visaNo ratings yet

- Zacharia MkumboDocument6 pagesZacharia MkumboZacharia MkumboNo ratings yet

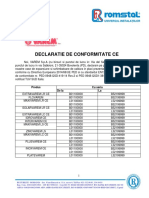

- Declaratie de Conformitate Ce: Cu Seria Produs de La LaDocument3 pagesDeclaratie de Conformitate Ce: Cu Seria Produs de La LaVasile Marian AdrianNo ratings yet