Professional Documents

Culture Documents

Motor Endorsement IMT Exam Print

Uploaded by

sekkilarjiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Motor Endorsement IMT Exam Print

Uploaded by

sekkilarjiCopyright:

Available Formats

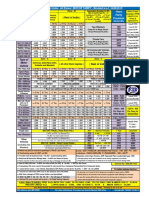

LIST OF IMT / ENDORSEMENT IMT/END . IMT - 1 IMT - 2 IMT - 3 CORRESPONDING GR GR.4. Extension of Geographical Area GR.7.

Valued Policies GR.17. Transfers REMARKS 1. Bangladesh 2. Bhutan 3. Nepal 4. Pakistan 5.Sri Lanka 6. Maldives Addl. Prem, (Any Class): 500/Package Policy, 100/Others Agreed Value Policy, Not permitted except, Vintage Car ( Manufactured Prior to 31.12.1940) Liability Only cover whether a standalone policy or part of Package policy- the transfer is automatic and is deemed to be effective from the date of transfer Transfer of Package can be done only on getting acceptable evidence of sale and a fresh proposal form duly filled and signed. The old Certificate of Insurance is required to be surrendered and a fee of Rs.50/- is to be collected for issue of fresh Certificate. If request is received within 14 days of the transfer, endorsement shall be effective from the actual date of transfer. If received after 14 days of the transfer, then endorsement will be effective only from the date of such request. A vehicle can be substituted by another vehicle of the same class for the balance period of the policy subject to adjustment of premium, if any, on pro-rata basis from the date of substitution. Policies and Certificates of Insurance are to be issued in the name of Hirer only and issuance in the joint names of the Hirer and Owner is prohibited. If Owner's interest is to be protected it should be done by the use of Endorsement IMT - 5. Policies and Certificates of Insurance are to be issued in the name of Lessee only and issuance in the joint names of the Lessee and Lessor is prohibited. If Lessors interest is to be protected, it should be done by the use of Endorsement IMT - 6. Policies and Certificates of Insurance are to be issued in the name of Registered Owner only and issuance in the joint names of the Registered Owner and Pledgee is prohibited. If Pledgees interest is to be protected, it should be done by the use of Endorsement IMT - 7. Discount @ 5% of the Own Damage premium, subject to a maximum of Rs.200/- for a Private Car and maximum of Rs.50/- for a Motorized Two Wheeler. Discount for only one membership. Private Cars certified by the Vintage and Classic Car Club of India as Vintage Cars (Prior to 31/12/1940) will be eligible for 25% discount on Own Damage Premium. Vehicles (other than those covered under Motor Trade policies) fitted with anti-theft devices approved by Automobile Research Association of India (ARAI), Pune and whose installation is duly certified by any of the Automobile Associations mentioned in GR.28 above are eligible for a discount of 2.5% on the OD component of premium subject to a maximum of Rs. 500/-. Vehicles laid up in garage and not in use for a period of not less than two consecutive months will be entitled This cannot be given as cash refund even if the policy is not renewed with the same insurer. To pay Rs.15/- towards administrative costs. Not allowed for lay-up of trailers and vehicles used for hire or reward or for Motor Trade purpose, except when the permits for vehicles are temporarily withheld or suspended by the Government. For vehicles specially designed / modified a discount of 50% may be allowed on the Own Damage premium in respect of both privately owned vehicles and vehicles owned and used by institutions engaged exclusively in the services of blind, handicapped and mentally challenged persons. Own premises to which the public have no general right of access and the vehicle is not licensed general road use; a discount of 33 1/3% is allowed. Vehicle used on a site /sites to which the public has no general right of access and the vehicle is not registered under the M V Act, a discount of 33 1/3% is allowed. Private Cars including three wheelers rated as Private cars and motorized two wheelers (not for hire or reward): For insured or any named person other than the paid driver and cleaner. Private Cars, three wheelers rated as Private cars and Motorized Two Wheelers (not used for hire or reward): For unnamed passengers limited to the registered carrying capacity of the vehicle other than the insured, his paid driver and cleaner.

IMT - 4

GR.18. Change of Vehicle

IMT - 5

GR.19. Vehicles Subject to Hire Purchase Agreement GR.20. Vehicles Subject to Lease Agreement

IMT - 6

IMT - 7

GR.21. Vehicles Subject to Hypothecation Agreement

IMT - 8 IMT - 9 IMT-10

GR.28. Automobile Association Membership Discount GR.29. Discount for Vintage Cars GR.30. Discount for Anti-Theft Devices

IMT-11A

IMT-11B

GR.31. Concession for Laid-Up Vehicles (where the entire period of lay-up has been intimated) DO where the entire period of lay-up is until further notice. Termination of the undeclared period of vehicle laid up. GR.33. Concessions for Specially Designed/ Modified Vehicles for the Blind, Handicapped and Mentally challenged persons. GR.35. Use of Vehicles within Insureds Premises.(All Classes) GR.35. Use of Vehicles within Insureds Sites.(Goods Carrying) 36 B. Optional Personal Accident Cover for persons other than Owner-Driver by paying extra premium.Max-2Lac DO

IMT-11C IMT-12

IMT-13 IMT-14 IMT-15

IMT-16

IMT-17 IMT-18 IMT-19 IMT-20

DO DO GR.37. Cover for vehicles imported without customs duty GR.39. Restriction (TPPD) Cover to 6000/-

In respect of all classes of vehicles: For paid drivers, cleaners and conductors. Motorized Two Wheelers with or without side car (used for hire or reward): For unnamed hirer/pillion passenger. Where the 'import duty' is not included in the IDV the premium chargeable under Section I shall be loaded by 30%. Not applicable to Class G Motor Trade - Internal Risks For all class of vehicle (Except 2wheelers-pvt. & Commercial) 7.5 lacs 2 wheelers-pvt. & Commercial 1 lac To restrict to the TPPD cover to the statutory limit of Rs. 6000/- as provided in the M. V. Act. Premium is reduced by 200/-(Comm. Excl.3wheelers, 2 wheelers and taxi), 150/- (Comm. -3 wheelers and taxi), Rs. 100/- (Private cars) and Rs. 50/- ( 2 wheelers pvt. & Comm.) Special exclusions and compulsory deductible (Applicable to all Commercial Vehicles excluding taxis and motorized two wheelers carrying passengers for hire or reward.) Compulsory deductible (Applicable to Private Cars, three wheelers rated as private cars, all motorized two wheelers, taxis, private car type vehicle plying for public/private hire, private type taxi let out on private hire) Voluntary deductible (For private cars/motorized two wheelers other than for hire or reward) Cover for lamps, tyres / tubes mudguards bonnet /side parts bumpers headlights and paintwork of damaged portion only . (For all Commercial Vehicles) When not included in the manufacturers selling price, an additional premium @ 4% on the value of such fittings to be charged.( to be specifically declared by the insured) Additional premium @ 4% on the value of such kit .( to be specifically declared by the insured) When the value of the CNG / LPG kit is not separately available, 5% extra on Own Damage premium. Additional premium of Rs. 60/- per vehicle, towards Liability Only cover. Fire Only: 0.50 % on IDV, Theft Only: 0.50 % on IDV, Fire & Theft Only: 0.75 % on IDV

IMT-21

GR.40. Compulsory Deductibles

IMT-22

DO

IMT-22A IMT-23

DO Additional premium @15% of the total gross OD premium for reinstatement of excluded cover. GR.41. Electrical / Electronic fittings GR.42. Use of CNG / LPG Fuel

IMT-24 IMT-25

IMT-26

GR.45A. Restricted cover for Fire and / or Theft Risks (Only while the vehicle is in garage and not in use) GR.45B. Restricted cover for Liability Only and Fire and / or Theft risks

IMT-27

Liab. Only Policy with Fire only cover: Liability Only Premium + 25% of the OD Premium Liab. Only Policy with Theft only cover: Liability Only Premium + 30% of the OD Premium Liab. Only Policy with Fire & Theft only cover: Liability Only Premium + 50% of the OD Premium Legal liability (under the Employee's Compensation Act, 2009 , the Fatal Accidents Act, 1855 or at Common Law) to paid driver and/or conductor and/or cleaner employed in connection with the operation of insured vehicle (For all Classes of vehicles.) Legal liability {Under Common Law and Statutory Liability under the Fatal Accidents Act, 1855 for compensation (including legal costs of any claimant)} to employees of the insured other than paid driver and/or conductor and/or cleaner who may be travelling or driving in the employers car {Private Cars only/ Motorised two wheelers (not for hire or reward)} FOR TRAILERS Value to be declared. ( Applicable to Private Cars Only) RELIABILITY TRIALS AND RALLIES No indemnity granted to Promoters of the event. [Private Cars and Motorised Two Wheelers)] ACCIDENTS TO SOLDIERS /SAILORS/ AIRMEN EMPOYED AS DRIVERS Covers liability of the Insured to indemnify Ministry of Defence under the respective Regulations.

IMT-28

IMT-29

IMT-30 IMT-31

IMT-32

IMT-33 IMT-34

LOSS OF ACCESSORIES By paying Additional Premium. (Applicable to Motorised Two Wheeler Policies only) Use of commercial type vehicles for both commercial and private purposes Covers legal liability under Common Law and Statutory Liability under the Fatal Accidents Act, 1855 - By paying Additional Premium. (Applicable to Commercial Vehicle Policies only) HIRED VEHICLES DRIVEN BY HIRER (Applicable to four wheeled vehicles with carrying capacity not exceeding 6 passengers and Motorised Two wheelers) Indemnity to Hirer - Package Policy - Negligence of the insured or Hirer Legal Liability to Non-Fare Paying Passengers other than Statutory Liability except the Fatal Accidents Act, 1855 (Commercial Vehicles only) Legal Liability to Non Fare Paying Passengers who are not employees of the Insured (Commercial Vehicles only) Legal Liability to Fare paying Passengers excluding liability for accidents to employees of the Insured arising out of and in the course of their employment (Commercial and Motor Trade Vehicles only) Legal Liability to persons employed in connection with the operation and/or maintaining and/or Loading and/or Unloading of Motor Vehicles. (under the Employee's Compensation Act, 2009 , the Fatal Accidents Act, 1855 or at Common Law) (For GOODS VEHICLE) Legal Liability under the Workmens Compensation Act, 1923 in respect of the carriage of more than six employees (Excluding the Driver) in goods carrying vehicles Legal Liability to paid driver and/or Conductor and/or cleaner employed in connection with the operation of Motor vehicle. (For buses, taxis and motorized three/four wheelers under commercial vehicles) Motor Trade Policy - Class `F' For Private Carriers: Theft and conversion Risk: By Hirer Indemnity to Hirer - Package Policy - Negligence of the Owner or Hirer Indemnity to Hirer Liability only Policy - Negligence of the Owner or Hirer Road Risk only Geographical Area in all sections of policy except Sec II(i) 80 or 120 Kms. (Goods Carrying Commercial Vehicles Only) The insurer shall not be liable for any loss or damage, if the vehicle is carrying goods not belonging to the insured. On payment of additional premium @ 1.50% of IDV Clause ii (b) (1) of IMT- 35 deemed to be deleted Applicable only in case of Theft and/or Conversion of the entire vehicle. In consideration of payment of an additional premium, Insurer will indemnify any hirer against loss, damage and liability as defined in the policy arising in connection with the Vehicle insured while let on hire. In consideration of payment of an additional premium, Insurer will indemnify any hirer against liability as defined in the policy arising in connection with the Vehicle insured while let on hire. Legal Liability to passengers excluding liability for accidents to employees of the Insured arising out of and in course of their employment (Applicable to Ambulance/Hearses under class D of Commercial vehicles and to Motor Trade vehicles ) Excludes loss or damage resulting from overturning arising out of the operation as a tool. (But On payment of additional premium the same is covered Para (a) of IMT 47 to be deleted. On payment of additional premium, Loss or damage to trailers are covered except caused by ground obstructions.

IMT-35 IMT-36 IMT-37 IMT-37A IMT-38

IMT-39

IMT-39A IMT-40

IMT-41 IMT-42 IMT-43 IMT-44 IMT-45 IMT-46

IMT-47 IMT-48

Mobile Cranes/Drilling Rigs/ Mobile Plants/Excavators/ Navvies/ Shovels/ Grabs/Rippers Agricultural and Forestry Vehicles And Other Miscellaneous vehicles with Trailers attached - Extended Cover Cinema Film Recording and Publicity Vans Mobile Shops /Canteens and Mobile Surgeries/ Dispensaries

IMT-49 IMT-50 IMT-51 IMT-52

Exclusion of Liability to the Public Working Risk (Except as required by the Motor Vehicle Act, 1988) The insurer shall be under no liability in respect of loss or damage unless they are firmly and permanently fixed to the body of the vehicle and are not detachable from time to time The insurer shall be under no liability except loss or damage to the vehicle and TP liability for vehicle only. Exclusion of damage while in use as a Tool of Trade (Except as required by the Motor Vehicle Act, 1988)

The insurer shall be under no liability under Section II of this Policy in respect of liability incurred. IMT-53 IMT-54 Specified Attachments (Special Type Vehicles) Mobile Plant-Inclusion of Liability to the Public Working Risk Where Tool of Trade is used only for work performed in or upon the Vehicle or Trailer Mobile Plant - Inclusion of Liability to the Public Working Risk (All Other Cases) Trailers (Road Transit Only) While any attachment in "Schedule of attachments" is attached to the Motor Vehicle or is detached and out of use the indemnity provided by this Policy shall apply in respect of any such attachment (Except as required by the Motor Vehicle Act, 1988) The Insurer shall be under no liability under Section II of this Policy in respect of liability except TP liability for vehicle only. (Except as required by the Motor Vehicle Act, 1988) The Insurer shall be under no liability under Section II of this Policy in respect of liability except TP liability for vehicle only. In consideration of the payment of an additional premium Section I and II of this Policy shall extend to the Motor Vehicle for the purpose of being towed. But insurer shall not be liable in respect of damage to property conveyed by the towed vehicle and anything other than is permitted by law. Motorised Two Wheelers (Motor Trade Only) The Motor Car(s), Motorised Two wheelers, Motor Vehicle(s) described in the Schedule, may be let out on loan or hire to insured's customers when their vehicle(s) is/are under repair with the insured. On payment of an additional premium the Policy shall be operative whilst the vehicle insured is being used by the insured or with the permission of the insured by a Member Director or employee of the insured for social domestic or pleasure purposes. On payment of an additional premium the policy shall be operative whilst the vehicles are being driven for the purpose of demonstration by person(s) not in the employment of the insured provided he/she/they is/are driving with the insured's permission and is/are accompanied by the insured or by any person(s) in the insured's employment. On payment of an additional premium the policy shall be operative whilst the vehicles insured are being used for purpose of demonstration or tuition by any other person, provided he/she is driving with the insured's permission and is accompanied by a named driver mentioned in the policy Schedule. On payment of an additional premium the words .when the liability of the Insurer is limited to 50% of the cost of the replacement .. are to be deleted from proviso (b) of Section I (1) of the policy.

IMT-55

IMT-56

IMT-57 IMT-58

IMT-59

Loan or Hire of Motor Cars, Motorised Two wheelers, Motor vehicles to Customers by Motor Dealers (Motor Trade Only) Private use of vehicle by Member/Director/Employee of the insured (Motor Trade only) Demonstration - Driving Extension (Applicable to Motor Trade Policies Only) Tuition - Driving Extension (Applicable only to Motor Trade Policies issued on named driver basis.) Deletion of 50% Limitation clause in respect of damage to tyres. (Applicable to Motor Trade Road Transit Risks Policies only) Restriction of Cover to Liability Risks only (Motor Trade Internal Risks Policy)

IMT-60

IMT-61

IMT-62

IMT-63

a) Section I and II(2)(i) and the word "other" in Section II (2)(ii) of this Policy in the Schedule to this Policy are deemed to be cancelled and (b) the Insurer shall not be liable in respect of damage to the Motor Vehicle or its accessories.

IMT-64

Open-Air Car Parks (Motor Trade Internal Risks Only) Work Away From Premises (Motor Trade Internal Risks Only)

On payment of an additional premium, the Premises shall be deemed to include the car park at (LOCATION)* superficial area not exceeding (APPROPRIATE AREA)** On payment of an additional premium, the premises are deemed to include any place at which the insured is performing work not being premises under the control of the insured provided that the insurer shall not be liable in respect of injury or damage resulting from the driving of the vehicle insured in a public place in INDIA within the meaning of the Motor Vehicles Act, 1988.

IMT-65

Sub Sections under IMT : 11 (Not there)11A,11B,11C . 22 & 22A. 37 & 37A. 39 & 39A Total IMT 65 + 5 Extra = 70

You might also like

- REGULATIONS SUMMARYDocument9 pagesREGULATIONS SUMMARYSadasivuni007No ratings yet

- Motor InsuranceDocument66 pagesMotor InsuranceVijay86% (7)

- Tractor Insurance in IndiaDocument15 pagesTractor Insurance in IndiaManoj KumarNo ratings yet

- Minimum Deductibles Applicable For Fire & Engg Policies: Annexure 1Document6 pagesMinimum Deductibles Applicable For Fire & Engg Policies: Annexure 1m48bbsrNo ratings yet

- IC 67 Marine Insurance Chapter 1 MCQ Questions PDFDocument8 pagesIC 67 Marine Insurance Chapter 1 MCQ Questions PDFAmi Mehta50% (2)

- Fire & Engg W.E.F. 01-11-2018Document6 pagesFire & Engg W.E.F. 01-11-2018Utsav J BhattNo ratings yet

- Understanding Consequential Loss InsuranceDocument34 pagesUnderstanding Consequential Loss InsuranceAnmol GulatiNo ratings yet

- Ic 57 Fire Insurane One LinerDocument14 pagesIc 57 Fire Insurane One Linerprabhat87aish50% (2)

- MOTOR Insurance-3Document46 pagesMOTOR Insurance-3m_dattaias100% (1)

- Motor Tariff Wef 16-06-2019Document1 pageMotor Tariff Wef 16-06-2019Digvijay Kanoje100% (1)

- Fire & Eng.Document14 pagesFire & Eng.Anzu HondaNo ratings yet

- IC 72 Motor Insurance PDFDocument597 pagesIC 72 Motor Insurance PDFSaba Ansari77% (13)

- HRM Paper (Ic-90)Document8 pagesHRM Paper (Ic-90)anon-917692100% (2)

- A Study of Fire Insurance With Refernce To Bajaj Allianz General InsuranceDocument90 pagesA Study of Fire Insurance With Refernce To Bajaj Allianz General InsuranceshreyaNo ratings yet

- All India Tariff CARDocument62 pagesAll India Tariff CARManish Kumar GuptaNo ratings yet

- Fire Insurance IC 57 Chapter 4 & 5: D. All of Above A. StfiDocument6 pagesFire Insurance IC 57 Chapter 4 & 5: D. All of Above A. StfiRajat DeshmukhNo ratings yet

- Ic 72 - Motor InsuranceDocument2 pagesIc 72 - Motor Insurancepriyarss230% (2)

- MCQ Motor For PE Training 2018 VKA-1 PDFDocument7 pagesMCQ Motor For PE Training 2018 VKA-1 PDFJayalakshmi RajendranNo ratings yet

- Certificate of Insurance and Policy ScheduleDocument2 pagesCertificate of Insurance and Policy SchedulePrabha Engira PrabhakarNo ratings yet

- Motor Insurance Study Material FinalDocument67 pagesMotor Insurance Study Material FinalsekkilarjiNo ratings yet

- Chapter:-1 Introduction of Insurance: Introduction To Service SectorDocument56 pagesChapter:-1 Introduction of Insurance: Introduction To Service SectorDinesh RominaNo ratings yet

- Mega Risk Insurance TataDocument87 pagesMega Risk Insurance TatakrishnaraopvrNo ratings yet

- Introduction to Insurance Agents and Customer ServiceDocument46 pagesIntroduction to Insurance Agents and Customer ServicePolireddy Venna100% (2)

- 613v1-Principles and Practice of General InsuranceDocument18 pages613v1-Principles and Practice of General InsuranceŠ Òű VïķNo ratings yet

- Fac SlipDocument2 pagesFac SlipAman Divya100% (1)

- Ic 38 MCQ 1Document23 pagesIc 38 MCQ 1ClassicaverNo ratings yet

- Free Irda Ic 38 Insurance Agents GeneralDocument12 pagesFree Irda Ic 38 Insurance Agents GeneralShabaz AliNo ratings yet

- Ic 11 Top4sure 'Real Feel' Timed ExamDocument52 pagesIc 11 Top4sure 'Real Feel' Timed ExamKalyani JayakrishnanNo ratings yet

- Ic 11 Top4sure Most Important 'Last Day Revision' Test 3Document27 pagesIc 11 Top4sure Most Important 'Last Day Revision' Test 3Kalyani JayakrishnanNo ratings yet

- IC 26 - LIFE INSURANCE FINANCE PRACTICE TEST 1 KEY POINTSDocument33 pagesIC 26 - LIFE INSURANCE FINANCE PRACTICE TEST 1 KEY POINTSLaxminarayana Madavi0% (1)

- Role of Insurance in India's Economic DevelopmentDocument2 pagesRole of Insurance in India's Economic Developmentanbu100% (1)

- Britannia's training proceduresDocument28 pagesBritannia's training proceduresKaran BishtNo ratings yet

- Project Report: To Be Submitted For The Partial Fulfilment of The Requirements For The Award of The Degree ofDocument63 pagesProject Report: To Be Submitted For The Partial Fulfilment of The Requirements For The Award of The Degree ofAkshay SinghalNo ratings yet

- Car WC - Petronas Refinery and Petrochemical Corporation SDN BHD Unijaya Industri SDN BHDDocument6 pagesCar WC - Petronas Refinery and Petrochemical Corporation SDN BHD Unijaya Industri SDN BHDniedanorNo ratings yet

- General Insurance PDFDocument166 pagesGeneral Insurance PDFSathish S JainNo ratings yet

- IC38 Janamghutti v1 10052019 PDFDocument67 pagesIC38 Janamghutti v1 10052019 PDFMahesh S Gour75% (4)

- Motor InsuranceDocument35 pagesMotor InsuranceS1626No ratings yet

- Top 11 Car Insurance Companies in IndiaDocument43 pagesTop 11 Car Insurance Companies in IndiaNeeluSutharNo ratings yet

- Revised Motor Write Up 2017 by Vishnu Aggarwal - 1495172351969 - 1497886446365 - 1497927814392Document24 pagesRevised Motor Write Up 2017 by Vishnu Aggarwal - 1495172351969 - 1497886446365 - 1497927814392Manish DeoleNo ratings yet

- IC-24 - Legal Aspects of Life AssuranceDocument1 pageIC-24 - Legal Aspects of Life Assuranceaman vermaNo ratings yet

- Miscellaneous InsuranceDocument82 pagesMiscellaneous Insurancem_dattaias100% (6)

- Fire & Engg Claim Manual PDFDocument30 pagesFire & Engg Claim Manual PDFLawrence100% (1)

- III AssociateDocument2 pagesIII Associateagupta_118177No ratings yet

- Chapter 03 - Principles & Practice of Life InsuranceDocument21 pagesChapter 03 - Principles & Practice of Life InsuranceShubham GuptaNo ratings yet

- Car Insurance Survey PDFDocument4 pagesCar Insurance Survey PDFMoneylife FoundationNo ratings yet

- Automobile Recall and Liability: A Case Study On Indian Automobile IndustryDocument16 pagesAutomobile Recall and Liability: A Case Study On Indian Automobile IndustryNik SatNo ratings yet

- Sla - PrudentDocument9 pagesSla - Prudentloveleen_samuelNo ratings yet

- IC-57 PaperDocument18 pagesIC-57 PaperTasleem Sayad33% (3)

- Proportional Treaty SlipDocument3 pagesProportional Treaty SlipAman Divya100% (1)

- Project Insurance by Er. Amrit Lal Meena, SBM National Insurance Company LTDDocument52 pagesProject Insurance by Er. Amrit Lal Meena, SBM National Insurance Company LTDDr S Rajesh KumarNo ratings yet

- Insurance OmbudsmanDocument2 pagesInsurance OmbudsmanVivek GuptaNo ratings yet

- Ic s01 Fire and Loss of Profitt Insurance - FinalDocument59 pagesIc s01 Fire and Loss of Profitt Insurance - FinalRanjithNo ratings yet

- Motor OD Manual SummaryDocument201 pagesMotor OD Manual SummaryMani Rathinam100% (1)

- IC 01 - KEY PRINCIPLES OF INSURANCE EXAMDocument30 pagesIC 01 - KEY PRINCIPLES OF INSURANCE EXAMSohini0% (1)

- Ic 14Document3 pagesIc 14Saurabh Singh50% (2)

- Introduction To General Insurance: Chapter - 1Document4 pagesIntroduction To General Insurance: Chapter - 1Pankaj GuptaNo ratings yet

- Ic 11 Top4sure Practice Test No. 3Document27 pagesIc 11 Top4sure Practice Test No. 3Kalyani JayakrishnanNo ratings yet

- Motor Endorsement IMT Exam PrintDocument4 pagesMotor Endorsement IMT Exam PrintJayalakshmi RajendranNo ratings yet

- General Regulations of India Motor TARIFF 2002Document28 pagesGeneral Regulations of India Motor TARIFF 2002navjot singhNo ratings yet

- 85 - Motor Add - On Covers - 30th April 2010Document26 pages85 - Motor Add - On Covers - 30th April 2010JKNo ratings yet

- HR and LegalDocument166 pagesHR and LegalsekkilarjiNo ratings yet

- Aviations Study MaterialDocument14 pagesAviations Study Materialsekkilarji67% (3)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Motor Insurance Study Material FinalDocument67 pagesMotor Insurance Study Material FinalsekkilarjiNo ratings yet

- FIRE Study Material FinalDocument25 pagesFIRE Study Material Finalsekkilarji50% (2)

- MOTOR INSURANCE GENERAL REGULATION Exam PrintDocument10 pagesMOTOR INSURANCE GENERAL REGULATION Exam Printsekkilarji100% (1)

- Marine Insurance Study MaterialDocument14 pagesMarine Insurance Study Materialsekkilarji100% (3)

- ENGG Study Material No Print FinalDocument13 pagesENGG Study Material No Print FinalSekkilarji ShanmugamNo ratings yet

- ENGG Study Material No Print FinalDocument13 pagesENGG Study Material No Print FinalSekkilarji ShanmugamNo ratings yet

- Pile Foundation As Per IRC 112Document59 pagesPile Foundation As Per IRC 112ARVIND SINGH RAWAT0% (1)

- M Shivkumar PDFDocument141 pagesM Shivkumar PDFPraveen KumarNo ratings yet

- 1.4 Market FailureDocument42 pages1.4 Market FailureRuban PaulNo ratings yet

- ZCT ZCT ZCT ZCT: 40S 60S 80S 120S 210SDocument1 pageZCT ZCT ZCT ZCT: 40S 60S 80S 120S 210SWilliam TanNo ratings yet

- MAstering IATFDocument20 pagesMAstering IATFGyanesh_DBNo ratings yet

- Face SerumDocument10 pagesFace SerumLiliana CojocaruNo ratings yet

- Concept of Health and IllnessDocument24 pagesConcept of Health and IllnessHydra Olivar - Pantilgan100% (1)

- 4th QUARTER EXAMINATION IN TLE 8Document3 pages4th QUARTER EXAMINATION IN TLE 8judy ann sottoNo ratings yet

- CMD Civil Shaft Construction Capability Statement 2015Document20 pagesCMD Civil Shaft Construction Capability Statement 2015aecom2009No ratings yet

- Bemidji Police Department 1-14-13Document19 pagesBemidji Police Department 1-14-13John HagemanNo ratings yet

- Sheet 01Document1 pageSheet 01Rajeshwari YeoleNo ratings yet

- Tank Cleaning ConsiderationsDocument1 pageTank Cleaning ConsiderationsAdele PollardNo ratings yet

- Eye, E.N.T. & Dental AnaesthesiaDocument22 pagesEye, E.N.T. & Dental AnaesthesiawellawalalasithNo ratings yet

- Gastronomia 10 Competition GuideDocument21 pagesGastronomia 10 Competition Guidefpvillanueva100% (1)

- 0 BOSH FrameworkDocument18 pages0 BOSH Frameworkharold fontiveros100% (1)

- 2 - Electrical Energy Audit PDFDocument10 pages2 - Electrical Energy Audit PDFPrachi BhaveNo ratings yet

- Epreuve LV 2 Anglais Premiere L Composition 2e Semestre 2023Document2 pagesEpreuve LV 2 Anglais Premiere L Composition 2e Semestre 2023Thierno ousmane DialloNo ratings yet

- Heat Affected Zone: Page 1 of 5Document5 pagesHeat Affected Zone: Page 1 of 5sujkubvsNo ratings yet

- Rockaway Times 11-21-19Document44 pagesRockaway Times 11-21-19Peter MahonNo ratings yet

- Uia Teaching Hospital BriefDocument631 pagesUia Teaching Hospital Briefmelikeorgbraces100% (1)

- 10 B Plas List PPR Eng GreenDocument15 pages10 B Plas List PPR Eng GreenZakaria ChouliNo ratings yet

- Rhodes-Solutions Ch2 PDFDocument16 pagesRhodes-Solutions Ch2 PDFOscar GarzónNo ratings yet

- BOM Eligibility CriterionDocument5 pagesBOM Eligibility CriterionDisara WulandariNo ratings yet

- Report Information From Proquest: February 24 2014 06:18Document19 pagesReport Information From Proquest: February 24 2014 06:18Emma Elena StroeNo ratings yet

- Amazon To Unionize or NotDocument4 pagesAmazon To Unionize or NotPatrick MutetiNo ratings yet

- Apraxia of Speech and Grammatical Language Impairment in Children With Autism Procedural Deficit HypothesisDocument6 pagesApraxia of Speech and Grammatical Language Impairment in Children With Autism Procedural Deficit HypothesisEditor IJTSRDNo ratings yet

- Chapter 11 Blood Specimen Handling: Phlebotomy, 5e (Booth)Document35 pagesChapter 11 Blood Specimen Handling: Phlebotomy, 5e (Booth)Carol Reed100% (2)

- Courses at NeevDocument10 pagesCourses at NeevDr Mohan SavadeNo ratings yet

- Outcome of Pelvic Fractures Identi Fied in 75 Horses in A Referral Centre: A Retrospective StudyDocument8 pagesOutcome of Pelvic Fractures Identi Fied in 75 Horses in A Referral Centre: A Retrospective StudyMaria Paz MorenoNo ratings yet

- 29 TM5 Kireina Akhlak AnnisaDocument30 pages29 TM5 Kireina Akhlak AnnisaTamaraNo ratings yet