Professional Documents

Culture Documents

Manufacturing Jobs For America - Bill Summaries

Uploaded by

MarkWarnerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Manufacturing Jobs For America - Bill Summaries

Uploaded by

MarkWarnerCopyright:

Available Formats

INCLUDED

LEGISLATION

October 29, 2013 BUILD Career and Technical Education Act Skills Training (S. 1293) Jeff Merkley (D-Ore.) Adult Education and Economic Growth Act Goal: Provide $20 million in new federal funding to (S. 1400) establish a 2-year pilot grant program supporting Jack Reed (D-R.I.), Sherrod Brown (D-Ohio) career and technical education exploration Goal: Increase investment in adult education, programs in middle schools and high schools. expand access to technology and digital literacy Status: Referred to Senate Health, Education, Labor skills for adult learners, require better coordination and Pensions Committee and integration of adult education with state workforce development systems and Community College to Career Fund (S. 1269) postsecondary education, and strengthen English Al Franken (D-Minn.), Mark Begich (D-Alaska), Dick and civics education for new Americans. Durbin (D-Ill.), Brian Schatz (D-Hawaii) Status: Referred to Senate Finance Committee Goal: Create an $8 billion fund co-administered by the DOL and the Dept. of Education. The purpose America Works Act (S. 453) is to facilitate training between community Kay Hagan (D-N.C.), Joe Donnelly (D-Ind.), Dean colleges and businesses. Heller (D-Nev.), Amy Klobuchar (D-Minn.), Chuck Status: Referred to Senate Health, Education, Labor Schumer (D-N.Y.) and Pensions Committee Goal: Reduce the "skills gap" by amending the Workforce Investment Act, Perkins Career and Manufacturing Universities Technical Education Act, and Trade Adjustment Chris Coons (D-Del.) Assistance Act to encourage federal job training Goal: Award grant to a university designated as a programs funded by these laws to give priority manufacturing university, in the amount of $25 consideration to programs that offer portable, million over a four-year window ($6.25 million per national and industry-recognized credentials. In year) to revamp its engineering programs to focus doing so, job training programs would be on manufacturing engineering and curricula encouraged to match the skills of workers with the specifically related to targeted industries. This bill needs of local employers, thereby training calls for the designation of 20 U.S. Manufacturing individuals for the jobs that are available in their Universities. communities right now. Status: Not yet introduced Status: Referred to Senate Health, Education, Labor and Pensions Committee

New Skills for New Jobs Debbie Stabenow (D-Mich.) Goal: Provide a federal match equal to the training repayment amounts (state income tax diversion to the community college) from programs like the Michigan New Jobs Training program. The federal government will provide those equal amounts to the community college every quarter. By matching the state contribution, the bill helps to decrease the repayment times of the current state programs and possibly double the number of eligible companies and workers that can participate. Status: Not yet introduced On-the-Job Training Act (S. 1227) Jeanne Shaheen (D-N.H.), Thad Cochran (R-Miss.) Goal: Authorize the Department of Labor to make grants to fund local On-the-Job Training programs. Grants will also provide state and local boards with resources to recruit employers and develop their OJT programs. Status: Referred to Senate Health, Education, Labor and Pensions Committee Race to the Shop Chris Coons (D-Del.) Goal: Create an annual $150 million competition to promote reforms in workforce education and skill training for advanced manufacturing in states and metropolitan areas. States and metropolitan areas would have to organize a task force to design and submit a proposal to address the manufacturing workforce and skills challenges within their region. An inter-agency partnership would review submissions and award annual implementation grants to the five states and five metropolitan areas with the strongest and most comprehensive plans. Status: Not yet introduced SECTORS Act (S. 1226) Sherrod Brown (D-Ohio), Bob Casey (D-PA), Susan Collins (R-Maine), Dick Durbin (D-Ill.) Goal: Facilitate partnerships between employers, educators, and local workforce administrators to train workers for some of the most needed 21st century jobs. Status: Referred to Senate Health, Education, Labor and Pensions Committee

Skills Gap Strategy Act Joe Donnelly (D-Ind.) Goal: Directs the Department of Labor to develop a strategy to address the skills gap by providing recommendations to increase on-the-job training and apprenticeship opportunities, increase employer outreach efforts, and identify and prioritize in-demand credentials. The bill encourages the Department to develop the strategy using existing resources, programs, and personnel. Status: Not yet introduced Women and Minorities in STEM Booster Act of 2013 (S. 288) Kirsten Gillibrand (D-N.Y.), Mark Pryor (D-Ark.), Mary Landrieu (D-La.) Goal: Authorize funds for the National Science Foundation to manage a competitive grant program to promote women and minorities pursuing jobs in the STEM industry. Status: Referred to Senate Commerce Committee

Exports

American

Export

Promotion

Act

of

2013

Brian

Schatz

(D-Hawaii)

Goal:

Authorizes

the

International

Trade

Administrations

(ITA)

Market

Development

Cooperator

Program

(MDCP).

The

program

awards

grants

of

financial

and

technical

assistance

to

support

trade

association

or

local

chamber

of

commerce

projects

that

enhance

the

global

competitiveness

of

U.S.

industries.

Successful

grantees

pay

a

minimum

of

two-thirds

of

the

project

cost

and

agree

to

sustain

the

project

after

the

MDCP

award

period

ends.

On

average

from

1997

through

2012

projects

generated

$258

in

exports

for

every

$1

in

MDCP

awards

made

by

ITA.

Status:

Not

yet

introduced

Currency Exchange Rate Oversight Reform Act (S. 1114) Sherrod Brown (D-Ohio), Tammy Baldwin (D-Wis.), Richard Burr (R-N.C.), Bob Casey (D-Pa.), Susan Collins (R-Maine), Joe Donnelly (D-Ind.), Lindsey Graham (R-S.C.), Kay Hagan (D-N.C.), Angus King (I- Maine), Carl Levin (D-Mich.), Bernie Sanders (I-Vt.), Chuck Schumer (D-N.Y.), Jeff Sessions (Ala.), Debbie Stabenow (D-Mich.), Sheldon Whitehouse (D-R.I.) Goal: Use U.S. trade law to counter the economic harm to U.S. manufacturers caused by currency manipulation, and provide consequences for countries that fail to adopt appropriate policies to eliminate currency misalignment. Status: Referred to Senate Banking Committee FAIR Enforcement Against Duty Evasion Act Claire McCaskill (D-Mo.) Goal: Combat foreign companies that smuggle products into this country to avoid paying penalties for unfair trade practices. The bill creates know your customer rules for customs brokers and makes the information available to law enforcement, increasing the likelihood that lawbreakers can be identified and brought to justice. The bill would also create a safe harbor to shield brokers from fines if they make a good faith effort to comply. Status: Not yet introduced Green Energy Technology Manufacturing and Export Assistance Act of 2013 Mark Pryor (D-Ark.) Goal: Establish a Green Energy Technology Manufacturing and Export Assistance Program to, among other things, promote policies to reduce production costs and encourage innovation, investment, and productivity among businesses in the United States that export green energy technologies or related services and implement a national strategy with respect to the exportation of green tech. Status: Not yet introduced

SelectUSA Authorization Act of 2013 Brian Schatz (D-Hawaii) Goal: Authorize the SelectUSA program, a foreign direct investment initiative designed to promote the U.S. as the foremost place in the world to conduct business. Status: Not yet introduced Small Business Export Growth Act (S. 1179) Jeanne Shaheen (D-N.H.), Kelly Ayotte (D-N.H.) Goal: Help small businesses capitalize on export opportunities by removing red tape and improve federal export assistance programs for small businesses. Status: Referred to Senate Banking, Housing, and Urban Affairs Committee

Access

to

Capital

Amend

Section

179

Depreciation

(S.

1298)

Mark

Begich

(D-Alaska)

Goal:

Increase,

for

taxable

years

beginning

after

2013:

(1)

the

limitation

on

the

amount

of

the

expensing

allowance

for

depreciable

business

assets

from

$25,000

to

$200,000,

and

(2)

the

threshold

amount

over

which

such

expensing

allowance

is

reduced

from

$200,000

to

$800,000.

Status:

Referred

to

Senate

Finance

Committee

Angel

Investment

Tax

Credit

Act

of

2013

Mark

Pryor

(D-Ark.)

Goal:

Allow

a

credit

against

income

tax

for

equity

investments

in

small

businesses.

Status:

Not

yet

introduced

Bring Jobs Home Act (S. 337) Debbie Stabenow (D-Mich.), Tammy Baldwin (D- Wis.), Richard Blumenthal (D-Conn.), Chris Coons (D-Del.), Dick Durbin (D-Ill.), Al Franken (D-Minn.), Amy Klobuchar (D-Minn.), Claire McCaskill (D-Mo.), Jack Reed (D-R.I.), Jay Rockefeller (D-W.Va.), Sheldon Whitehouse (D-R.I.) Goal: Grant business taxpayers a tax credit for up to 20% of insourcing expenses incurred for eliminating a business located outside the United States and relocating it within the United States. This bill would also deny a tax deduction for outsourcing expenses incurred in relocating a U.S. business outside the United States. Status: Referred to Senate Finance Committee Build America Bonds Ed Markey (D-Mass.) Goal: Allow state and local governments to sell taxable bonds to investors, and the federal government subsidizes a certain percentage of the interest costs. Status: Not yet introduced CREED Act (S. 289) Mary Landrieu (D-La.), Ben Cardin (D-Md.), Kay Hagan (D-N.C.), Johnny Isakson (R-Ga.), Tim Johnson (D-S.D.), Angus King (I-Maine), Claire McCaskill (D-Mo.), Jeanne Shaheen (D-N.H.) Goal: Extend the 2010 provision allowing small business owners to use SBA 504 loans to refinance existing commercial debt for any fiscal year during which the 504 base program operates at zero subsidy. By doing so, this program lowers small businesses monthly mortgage payments at no cost to taxpayers. Status: Referred to Senate Small Business and Entrepreneurship Committee

Expanding Industrial Energy and Water Efficiency Incentives Act of 2013 Brian Schatz (D-Hawaii) Goal: Offer targeted, non-permanent incentives to help U.S. manufacturing and industry become more globally competitive by employing smart technological improvements to reduce energy use and encourage water reuse. Status: Not yet introduced Job Creation through Energy Efficient Manufacturing Jeff Merkley (D-Ore.) Goal: Authorize $250 million in funding to a Financing Energy Efficient Manufacturing Program at the U.S. Department of Energy. That program would provide competitive grants to states to fund new or expanded industrial energy efficiency financing programs. These state programs could provide various forms of financing, but typically provide low-cost loans to manufacturers to help cover the up-front cost of energy efficient retrofits. Status: Not yet introduced Make It in America Tax Credit Act Debbie Stabenow (D-Mich.) Goal: Extend the 48C advanced energy manufacturing tax credit with $5 billion of additional allocations. First introduced in 2011, S. 1764. Status: Not yet introduced Manufacturing Reinvestment Account Richard Blumenthal (D-Conn.) Goal: Allow manufacturing firms to establish a manufacturing reinvestment account (MRA) in a community bank where manufacturers can make annual pre-tax contributions of up to $500,000 that may be held in the MRA for up to 7 years. Amounts distributed from the MRA are effectively taxed at a low 15 percent rate and must be used to purchase equipment and facilities or for job training. Status: Not yet introduced

Small BREW Act (S. 917) Ben Cardin (D-Md.), Mark Begich (D-Alaska), Tammy Baldwin (D-Wis.), Tom Carper (D-Del.), Thad Cochran (R-Miss.), Susan Collins (R-Maine), Chris Coons (D-Del.), Angus King (I-Maine), Bob Menendez (D-N.J.), Jeff Merkley (D-Ore.), Barbara Mikulski (D-Md.), Rob Portman (R-Ohio), Bernie Sanders (I-Vt.), Chuck Schumer (D-N.Y.), Jon Tester (D-Mont.), Roger Wicker (R-La.), Ron Wyden (D- Ore.) Goal: Under current law, brewers generally pay an $18 excise tax on each barrel brewed. Small brewers, currently defined as those that brew fewer than 2 million barrels of beer a year, pay a reduced excise tax of $7 per barrel for the first 60,000 barrels of beer they brew each year. The Small BREW Act would reduce the excise tax applicable to brewers producing up to 6 million barrels per year to just $3.50 on the first 60,000 barrels and $16 on additional barrels below 2 million per year. Status: Referred to Senate Finance Committee Small Business Savings Account Mark Pryor (D-Ark.) Goal: Create tax preferred Small Business Savings Accounts to pay for trade or business expenses, including operating capital, the purchase of equipment or facilities, marketing, training, incorporation, and accounting fees. Allows annual contributions to such accounts up to $10,000. Status: Not yet introduced Startup Innovation Credit Act (S. 193) Chris Coons (D-Del.), Roy Blunt (R-Mo.), Mike Enzi (R-Wyo.), Tim Kaine (D-Va.), Jim Moran (R-Kan.), Marco Rubio (R-Fla.), Chuck Schumer (D-N.Y.), Debbie Stabenow (D-Mich.) Goal: Help startup manufacturers get access to the R&D credit. Currently, startup firms are shut out of the R&D credit, yet newer companies are the ones that create the most jobs. This legislation would allow new manufacturers to claim their R&D credit against their employment taxes, providing much needed cash flow to fuel growth. Status: Referred to Senate Finance Committee

Conditions Necessary for Growth

MLP Parity Act (S. 795) Chris Coons (D-Del.), Jim Moran (R-Kan.), Lisa Murkowski (R-Alaska), Debbie Stabenow (D-Mich.) Goal: Level the playing field between traditional and new energy businesses by helping energy- generation and transmission companies form master limited partnerships, which combine the funding advantages of corporations and the tax advantages of partnerships. Status: Referred to Senate Finance Committee America Recruits Act Mark Warner (D-Va.) Goal: Promote the on shoring of jobs to rural and underdeveloped areas, strengthen workforce training and industry certification programs, and expand U.S. exports. Status: Not yet introduced American Jobs Matter Act (S. 1246) Chris Murphy (D-Conn.), Richard Blumenthal (D- Conn.), Sherrod Brown (D-Ohio), Jeff Merkley (D- Ore.) Goal: Require the Department of Defense, for the first time, to measure domestic employment as a factor in rewarding a contract. American manufacturing firms will be able to leverage their contribution to the U.S. economy to win federal contracts by demonstrating how many jobs they will create or retain with the award of a contract. Status: Referred to Senate Armed Services Committee American Manufacturing Competitiveness Act of 2013 Chris Coons (D-Del.) Goal: Direct the White House National Science and Technology Council, in consultation with business, labor and academia, to develop a national manufacturing competitiveness strategy. Status: Not yet introduced

American Manufacturing Initiative Carl Levin (D-Mich.) Goal: Address the R&D tax credit, vehicle mandates and goals, tax credits for advanced technology and flexible fuel vehicles, programs to support U.S. manufacturing, fair trade enforcement, health care, advanced vehicle development, fuel conservation and biofuels, fuel conservation and biofuels, fuel savings, and Department of Defense manufacturing initiatives. Status: Portions of the proposal have been adopted Building a Stronger America Act of 2013 Mark Pryor (D-Ark.) Goal: Strengthen manufacturing and competitiveness and promote US exports. Strengthen employment clusters to organize regional success, promote workforce innovation for new jobs and applied education, and attract and grow jobs with certification and training standards. Status: Not yet introduced Clean Technology Consortia Ed Markey (D-Mass.) Goal: Link inventors with investors and entrepreneurs to bridge the valley of death and get innovations out of the lab and into the factory. Similar legislation has passed the House multiple times as part of the 2009 climate bill and the 2010 America COMPETES re-auth, but has not passed the Senate. Status: Not yet introduced Fab Lab Dick Durbin (D-Ill.) Goal: Create a federal charter for a non-profit organization called The National Fab Lab Network (NFLN). NFLN would act as a public- private partnership whose purpose is to facilitate the creation of a national network of fab labs and serve as a resource to assist stakeholders with their effective operation. Status: Not yet introduced

Made in America Manufacturing Act (S. 63) Kirsten Gillibrand (D-N.Y.), Richard Blumenthal (D- Conn.), Chris Coons (D-Del.), Jeff Merkley (D-Ore.), Jack Reed (D-R.I.), Sheldon Whitehouse (D-R.I.) Goal: Create a competitive program that awards states and regions with funding to support local manufacturers through low-interest loans to build new facilities and upgrade equipment, and access to capital and technical assistance to develop exporting opportunities and to connect innovative small suppliers with larger companies. Funding would also go towards job training and vocational education programs that partner businesses with colleges, local workforce centers and other skill providers to prepare workers for manufacturing jobs. Status: Referred to Senate Commerce Committee Native Small Business Conformity Act of 2013 Brian Schatz (D-Hawaii) Goal: Expand opportunities for Native small businesses under the Small Business Act's HUBZone and Native 8(a) programs by providing common requirements and eligibility standards for Indian tribes, Alaska Native Corporations and Native Hawaiian Organizations. Status: Not yet introduced Rebuild American Manufacturing Act (S. 544) Tom Harkin (D-Iowa) Goal: Require the President to establish a national manufacturing strategy every two years and submit that strategy to Congress. Status: Referred to Senate Commerce Committee Restoring America's Manufacturing Competitiveness Act of 2013 Mark Pryor (D-Ark.) Goal: Establish a National Advanced Manufacturing Program to coordinate manufacturing research and development. Status: Not yet introduced

You might also like

- Insurance Commission Signed LetterDocument2 pagesInsurance Commission Signed LetterMarkWarnerNo ratings yet

- Resolution Honoring Hispanic Heritage MonthDocument6 pagesResolution Honoring Hispanic Heritage MonthMarkWarnerNo ratings yet

- GOE19968Document17 pagesGOE19968MarkWarner100% (1)

- Deepfakes Letter To YouTubeDocument2 pagesDeepfakes Letter To YouTubeMarkWarnerNo ratings yet

- Signed Pre-Ex LetterDocument4 pagesSigned Pre-Ex LetterMarkWarner100% (1)

- Deepfakes Letter To TumblrDocument2 pagesDeepfakes Letter To TumblrMarkWarnerNo ratings yet

- Deepfakes Letter To TwitchDocument2 pagesDeepfakes Letter To TwitchMarkWarnerNo ratings yet

- ILLICIT CASH Act, As IntroducedDocument133 pagesILLICIT CASH Act, As IntroducedMarkWarner100% (1)

- MCG 19647 LatestDocument3 pagesMCG 19647 LatestMarkWarnerNo ratings yet

- Deepfakes Letter To PinterestDocument2 pagesDeepfakes Letter To PinterestMarkWarnerNo ratings yet

- Deepfakes Letter To TikTokDocument2 pagesDeepfakes Letter To TikTokMarkWarnerNo ratings yet

- The Illicit Cash Act One PagerDocument2 pagesThe Illicit Cash Act One PagerMarkWarner100% (1)

- Letter To EsperDocument2 pagesLetter To EsperMarkWarnerNo ratings yet

- Letter To Congressional Leadership Re Miners Healthcare and PensionsDocument2 pagesLetter To Congressional Leadership Re Miners Healthcare and PensionsMarkWarnerNo ratings yet

- 9.25.19 Letter To AgriLogic Industrial Hemp Crop InsuranceDocument2 pages9.25.19 Letter To AgriLogic Industrial Hemp Crop InsuranceMarkWarnerNo ratings yet

- MCG 19610Document3 pagesMCG 19610MarkWarnerNo ratings yet

- 2019.09.23 Warner USIP China SpeechDocument13 pages2019.09.23 Warner USIP China SpeechMarkWarnerNo ratings yet

- MobileXUSA Letter23Document2 pagesMobileXUSA Letter23MarkWarnerNo ratings yet

- US Customs and Border Protection Contractor Breach LetterDocument2 pagesUS Customs and Border Protection Contractor Breach LetterMarkWarner0% (1)

- Letter To DOJDocument1 pageLetter To DOJMarkWarnerNo ratings yet

- President VCWarner 31JUL19Document2 pagesPresident VCWarner 31JUL19MarkWarnerNo ratings yet

- CPSC Correspondence Re Beach UmbrellasDocument4 pagesCPSC Correspondence Re Beach UmbrellasMarkWarnerNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Assignement Primark AnitaDocument16 pagesAssignement Primark AnitaAnita Krishnan100% (1)

- 203 KStandard Training PresentationDocument42 pages203 KStandard Training PresentationLouis FontanellaNo ratings yet

- HAMProjectsDocument26 pagesHAMProjectsarmaanNo ratings yet

- Current LiabilitiesDocument3 pagesCurrent LiabilitiesAhlaya Lyrica Cadence SadoresNo ratings yet

- Chapter 10 Septian Pajrin MuktiDocument6 pagesChapter 10 Septian Pajrin MuktiSeptian Pajrin MuktiNo ratings yet

- Lecture 13 Introduction To Real Estate Finance (MS PowerPoint)Document32 pagesLecture 13 Introduction To Real Estate Finance (MS PowerPoint)minani marcNo ratings yet

- Financial Literacy: Jessie B. LorenzoDocument23 pagesFinancial Literacy: Jessie B. LorenzoRichelda DizonNo ratings yet

- Loan JurisprudenceDocument476 pagesLoan Jurisprudenceamazing_pinoyNo ratings yet

- 504 Loan Refinancing ProgramDocument5 pages504 Loan Refinancing ProgramPropertywizzNo ratings yet

- New Century Financial Corporation Case StudyDocument21 pagesNew Century Financial Corporation Case StudyNadiya80% (5)

- Glossary of Banking Terms and DefinitionsDocument23 pagesGlossary of Banking Terms and Definitionsalok_sycogony1No ratings yet

- Acciona Spain Investors DayDocument25 pagesAcciona Spain Investors DayVasiliy BogdanovNo ratings yet

- Pre - 19 June 2022Document17 pagesPre - 19 June 2022Delowar HossainNo ratings yet

- Mortgage Observer May 2012Document36 pagesMortgage Observer May 2012NewYorkObserverNo ratings yet

- Finance101 Sample Questions 3a08Document19 pagesFinance101 Sample Questions 3a08Eve LNo ratings yet

- Advance Related Service Charges (C&I, SME and AGL Segments)Document24 pagesAdvance Related Service Charges (C&I, SME and AGL Segments)Richa GuptaNo ratings yet

- ScriptDocument4 pagesScriptJuanNo ratings yet

- Diagnositic SurveyReport Women SMEsDocument141 pagesDiagnositic SurveyReport Women SMEsAyza FatimaNo ratings yet

- Fonseca Wang 2022 - How Much Do Small Businesses Rely On Personal CreditDocument51 pagesFonseca Wang 2022 - How Much Do Small Businesses Rely On Personal CreditsreedharbharathNo ratings yet

- 2024 l 004874Document21 pages2024 l 004874Ann DwyerNo ratings yet

- FAR08.01d-Presentation of Financial StatementsDocument7 pagesFAR08.01d-Presentation of Financial StatementsANGELRIEH SUPERTICIOSONo ratings yet

- Tools Nbot 31122019Document464 pagesTools Nbot 31122019Medi NasutionNo ratings yet

- IA3 1st HandoutDocument3 pagesIA3 1st HandoutUyara LeisbergNo ratings yet

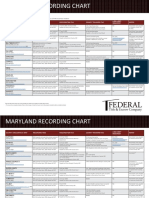

- Maryland Transfer and Recordation Tax Table (2020)Document2 pagesMaryland Transfer and Recordation Tax Table (2020)Federal Title & Escrow CompanyNo ratings yet

- What Is Loan-to-Value (LTV) RatioDocument6 pagesWhat Is Loan-to-Value (LTV) RatioJason CarterNo ratings yet

- Decision Making in BusinessDocument10 pagesDecision Making in BusinessbagumaNo ratings yet

- Indiabulls Housing Finance - The CrashDocument7 pagesIndiabulls Housing Finance - The CrashSam SanghviNo ratings yet

- 10 Attchment - Memorandum of MortgageDocument10 pages10 Attchment - Memorandum of Mortgageapi-3803117No ratings yet

- Week 1 Output-KingDocument4 pagesWeek 1 Output-KingAlexis KingNo ratings yet

- Lecture 08Document27 pagesLecture 08simraNo ratings yet