Professional Documents

Culture Documents

Merrion Products

Uploaded by

Vivek NarayananOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Merrion Products

Uploaded by

Vivek NarayananCopyright:

Available Formats

TABLE OF CONTENT

Title 1.0 2.0 3.0 4.0 Most Profitable Production Plan Break-even point Opportunity Cost Influence of Price

Page 1 5 7 8

Bibliography included on page 9.

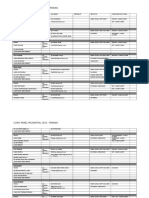

1.0 MOST PROFITABLE PRODUCTION PLAN Merrion Products Ltd. has their budgeted sales as well as production and net profit for the first quarter of year 20x7. Taking that as basic and applying over the additional criteria that imposed by the board of members in the meeting encourages the new figures to be planned out. Among the useful criteria that applied in the meeting are; raw material available up to 72000 Euros only; definite limit over the sales; and minimum production of 1000 units for each product.

To draw out the new plan, we start first by identifying profitable production and their priority as well. Product A B C D

Sales Price Direct material (imported) Direct labour and packaging Production overhead Budget sales (units) Budget sales revenue Contribution over each euro of sales Profit generated over each euro of imported raw material Priority of utilization contribution and imported raw materials

20 7 3 4 1500 30000 0.300 0.857

40 16 4 5 2000 80000 0.375 0.938

30 13 6 6 2000 60000 0.167 0.385

20 10 4 5 1500 30000 0.050 0.100

It is clearly stated in the text that Merrion Products production overhead includes both fixed and variable expense. The fixed production overhead is estimated to be 20000 euros and been apportioned to each product based on total anticipated sales revenue for each product. This concludes that the firm has been using Absorption Costing whereas they had included the fixed production overhead into each individual product itself. This is a setback for us whereas we cannot apportion this fixed production overhead cost into each product because we have not decide on how many quantity to produce for each product

line. Further, adding any assumption will lead us to additional puzzle of clearing the over or under absorption accounting cleanup some more. Overall, we know that absorption costing is ideal for seasonal product and this Merrion Products arent seasonal. This statement was concluded by adopting from the text itself whereas output for both products was sold by end of the year and demand outstripped production. This applies to all products as they are all successful products.

Therefore using absorption costing for these products arent favorable and merely misleading and adding additional complexity to design new most profitable production plan. As result of it, we stop using the absorption costing and impose marginal costing method. For that purpose, we identify and reverse apportion the fixed production costing as below. Product A B C D

Budget sales (units) Budget sales revenue Production overhead (absorption) Total production overhead Fixed production overhead Production overhead (marginal)

1500 30000 4 6000 3000 2

2000 80000 5 10000 8000 1

2000 60000 6 12000 6000 3

1500 30000 5 7500 3000 3

Now, we take the new production overhead cost into count and reconstruct the most profitable product table once again. This will increase the level of contribution and utilization of raw material for each of the product line but still sticking to the same priority of most profitable product. Product A B C D

Sales Price Direct material (imported) Direct labour and packaging Production overhead

20 7 3 2

40 16 4 1

30 13 6 3

20 10 4 3

Budget sales (units) Budget sales revenue Contribution over each euro of sales Profit generated over each euro of imported raw material Priority of utilization contribution and imported raw materials

1500 30000 0.400 1.143

2000 80000 0.475 1.188

2000 60000 0.267 0.615

1500 30000 0.150 0.300

Now we construct the new plan. But start with the condition applied by the board of members whereas we must produce at least 1000 units for each product line. Product A B C D Total

Sales Price Direct material (imported) Direct labour and packaging Production overhead Sales (units) Sales revenue Consumed raw material

20 7 3 2 1000 20000 7000

40 16 4 1 1000 40000 16000

30 13 6 3 1000 30000 13000

20 10 4 3 1000 20000 10000

110 46 17 9 4000 110000 46000

* We revise the sales of product B to maximum sales value as it is the first most profitable product. (88000/40 = 2200 units maximum sales) Sales (units) Sales revenue Consumed raw material 1000 20000 7000 2200 88000 35200 1000 30000 13000 1000 20000 10000 5200 158000 65200

* We revise the sales of product A to the maximum of available raw material resources and it is the second most. (Floor((72000-65200)/7)=971 units additional sales) Sales (units) Sales revenue Consumed raw material 1971 39420 13797 2200 88000 35200 1000 30000 13000 1000 20000 10000 6171 177420 71997

Finally, we conclude our findings as in this quarter; buy and consume imported raw material up to 71,997 Euros, we will need to sell 6171 units of products, and over the sales we will make 177,420 Euros. Now we present the final statement together the profit and loss account.

Most Profitable Production Plan Product A B C D Total

Sales Price Direct material (imported) Direct labour and packaging Production overhead Sales (units) Cost of sales Sales revenue

20 7 3 2 1971 23652 39420

40 16 4 1 2200 46200 88000

30 13 6 3 1000 22000 30000

20 10 4 3 1000 17000 20000

110 46 17 9 6171 108852 177420

Profit and Loss Account Statement Euros Sales Cost of sales Gross margin Less: Fixed production overhead 177420 108852 68568 20000 48568 Administration expenses Distribution expenses Sales commission Financial expenses Net profit 19900 5700 17742 800 44142 4426

2.0 BREAK EVEN POINT Merrion Products Ltd is having multiple product line. Therefore, before calculating the break even point, we need to assume some criteria such as: 1. The price of the each product is constant. This means the product A should not be sold at price 10 Euros to customer A and 20 Euros to customer B. They should be constant either 10 Euros or 20Euros to both customer A and B. 2. Cost is linear. When production increases, cost should increase in same ratio. For example if the product 1000 unit of product D is 17000 Euro, then the 2000 units of its production should cost 34000 Euro whereas it grow in linear, same ratio. 3. We assume the sales mix price is same and constant and we use average contribution on them. For example, if 10% of Product A sales drop, then 10% of Product B, Product C, as well as Product D sales must also drop we assume so to generate the break even. 4. The 10% of sales revenue is solid commission and therefore we assume this 10% as our variable cost. This results to variables cost of every product to rise by 10% and contribution reduces.

Product

Total

Sales Price Cost of sales Contribution Contribution (after commission) Sales (units) Sales revenue Sales weight

20 12 8 6 1971 39420 22.22%

40 21 19 15 2200 88000 49.60%

30 22 8 5 1000 30000 16.91%

20 17 3 1 1000 20000

110 72 38 27 6171 177420

11.27% 100.00%

*Fixed cost

= = =

Expenses - Commission + Fixed production overhead 44142-17742-20000 46400

Break even point in sales revenue =

Fixed cost Weighted average P/V ratio

46400 27 / 110

189,037 Euros sales

Break even point in sales unit =

Fixed cost Weighted average contribution margin per unit

46400 27

1,719 units of product

3.0 OPPORTUNITY COST There is an opportunity for the decision of producing 1000 units for each product line.

If we produce minimum of 1000 units for each product line: Product Sales Price Direct material (imported) Sales (units) Consumed raw material Sales revenue A 20 7 1971 13797 39420 B 40 16 2200 35200 88000 C 30 13 1000 13000 30000 D 20 10 1000 10000 20000 Total 110 46 6171 71997 177420

If we are not restricted to minimum of 1000 units for each product line: Product Sales Price Direct material (imported) Sales (units) Consumed raw material Sales revenue A 20 7 3000 21000 60000 B 40 16 2200 35200 88000 C 30 13 1215 15795 36450 D 20 10 0 0 0 Total 110 46 6415 71995 184450

Opportunity cost = Sales without minimum 1000 - Sales with minimum 1000 = 184450- 177420 = 7030 Euros

Conclusion, Merrion Products Ltd forgoes 7030 Euros due to the decision of producing minimum 1000 units per product line. This is their opportunity cost.

4.0 INFLUENCE OF PRICE When the price increases by 7 Euro for each product, this will impact the analysis. The reason is, we had designed the plan based on most profitable product whereas Product B is first and followed by Product A, C and D. Most profitable product refers to products that make the firm earn larger piece of profit by optimizing contribution over each Euro of sales and utilizing usage of imported raw material which very limited in our case. Now, when the price is revised, the most profitable product priority changes respectively to be Product A first, and followed by Product B, C, and D. Below is the table to illustrate the situation:

Product

Sales Price Direct material (imported) Direct labour and packaging Production overhead Total variable cost Total contribution Contribution over each euro of sales Profit generated over each euro of imported raw material Priority of utilization contribution and imported raw materials

27 7 3 2 12 15 0.556 2.143

47 16 4 1 21 26 0.553 1.625

37 13 6 3 22 15 0.405 1.154

27 10 4 3 17 10 0.370 1.000

BIBLIOGRAPHY

Colin Drury, 2003, Cost & Management Accounting: An Introduction, Thomson Learning

Dr. Glen Brown, INTRODUCTION TO COSTS ACCOUNTING: Methods and Techniques, Globusz Publishing, New York, Berlin.

10

You might also like

- Managing Work Flow and Conducting Job AnalysisDocument25 pagesManaging Work Flow and Conducting Job AnalysisPrimenavigatorNo ratings yet

- International BusinessDocument59 pagesInternational BusinessRizwan ZisanNo ratings yet

- ACC51112 Transfer PricingDocument7 pagesACC51112 Transfer PricingjasNo ratings yet

- 6 Process Selection and Facility LayoutDocument42 pages6 Process Selection and Facility LayoutRubaet HossainNo ratings yet

- CH1: Management Accounting in ContextDocument21 pagesCH1: Management Accounting in ContextÝ ThủyNo ratings yet

- Cost-Volume-Profit Relationships: Solutions To QuestionsDocument90 pagesCost-Volume-Profit Relationships: Solutions To QuestionsKathryn Teo100% (1)

- Https Doc 0k 0s Apps Viewer - GoogleusercontentDocument4 pagesHttps Doc 0k 0s Apps Viewer - GoogleusercontentAnuranjan Tirkey0% (1)

- The Balanced Scorecard: A Tool To Implement StrategyDocument39 pagesThe Balanced Scorecard: A Tool To Implement StrategyAilene QuintoNo ratings yet

- The Utease CorporationDocument8 pagesThe Utease CorporationFajar Hari Utomo0% (1)

- Absorption Costing Vs Variable CostingDocument2 pagesAbsorption Costing Vs Variable Costingneway gobachew100% (1)

- Chaptyer One of IntroductionDocument18 pagesChaptyer One of IntroductionLe nternetNo ratings yet

- ABC Costing Guide for Managerial Accounting ToolsDocument3 pagesABC Costing Guide for Managerial Accounting Toolssouayeh wejdenNo ratings yet

- 1 ++Marginal+CostingDocument71 pages1 ++Marginal+CostingB GANAPATHYNo ratings yet

- Brkeven Ex2 PDFDocument1 pageBrkeven Ex2 PDFSsemakula Frank0% (1)

- Improving Healthy by Getting LeanDocument3 pagesImproving Healthy by Getting LeanLaura100% (2)

- Benchmark - Organizational Design, Structure, and Change PresentationDocument12 pagesBenchmark - Organizational Design, Structure, and Change PresentationVikram . PanchalNo ratings yet

- Master Budget Assignment CH 9Document4 pagesMaster Budget Assignment CH 9api-240741436No ratings yet

- Topic 2 - Cost and Cost SystemDocument28 pagesTopic 2 - Cost and Cost SystemTân Nguyên100% (1)

- Competitiveness, Strategy, and Productivity: or Distribution Without The Prior Written Consent of Mcgraw-Hill EducationDocument39 pagesCompetitiveness, Strategy, and Productivity: or Distribution Without The Prior Written Consent of Mcgraw-Hill EducationnuggsNo ratings yet

- CHAPTER 5 - Assignment SolutionDocument16 pagesCHAPTER 5 - Assignment SolutionCoci KhouryNo ratings yet

- 2012 EE enDocument76 pages2012 EE enDiane MoutranNo ratings yet

- Study Guide SampleDocument154 pagesStudy Guide SampleBryan Seow0% (1)

- Absorption CostingDocument34 pagesAbsorption Costinggaurav pandeyNo ratings yet

- Makerere University College of Business and Management Studies Master of Business AdministrationDocument15 pagesMakerere University College of Business and Management Studies Master of Business AdministrationDamulira DavidNo ratings yet

- Independent University, Bangladesh: Submitted ToDocument14 pagesIndependent University, Bangladesh: Submitted ToHashib ArmanNo ratings yet

- ACC51112 Balanced ScorecardDocument6 pagesACC51112 Balanced ScorecardjasNo ratings yet

- Intro to Prod & Ops Mgmt: Value, Goods vs Services, Ops Manager RolesDocument20 pagesIntro to Prod & Ops Mgmt: Value, Goods vs Services, Ops Manager RolesJehad MahmoodNo ratings yet

- SM Manpower AustraliaDocument37 pagesSM Manpower Australiadhwani malde100% (1)

- CA IPCC Cost Accounting Theory Notes On All Chapters by 4EG3XQ31Document50 pagesCA IPCC Cost Accounting Theory Notes On All Chapters by 4EG3XQ31Bala RanganathNo ratings yet

- Balanced Scorecard and Responsibility AccountingDocument7 pagesBalanced Scorecard and Responsibility AccountingMonica GarciaNo ratings yet

- MARGINAL COSTING ExamplesDocument10 pagesMARGINAL COSTING ExamplesLaljo VargheseNo ratings yet

- Solution Manual For Book CP 4Document107 pagesSolution Manual For Book CP 4SkfNo ratings yet

- Chapter 7 Asset Investment Decisions and Capital RationingDocument31 pagesChapter 7 Asset Investment Decisions and Capital RationingdperepolkinNo ratings yet

- Exam281 20131Document14 pagesExam281 20131AsiiSobhiNo ratings yet

- Flexible Budgets and Overhead Analysis: True/FalseDocument69 pagesFlexible Budgets and Overhead Analysis: True/FalseRv CabarleNo ratings yet

- Joint Product L7 UpdatedDocument14 pagesJoint Product L7 Updatedviony catelinaNo ratings yet

- Chapter 5 ABC System For StudentsDocument14 pagesChapter 5 ABC System For StudentsNour Al Kaddah100% (1)

- Strategy Evaluation and ReviewDocument20 pagesStrategy Evaluation and ReviewsalmanmushtaqNo ratings yet

- Financial Analysis - HomeworkDocument7 pagesFinancial Analysis - HomeworkTuan Anh LeeNo ratings yet

- Accumulating and Assigning Cost To ProductDocument3 pagesAccumulating and Assigning Cost To ProductAchmad Faizal AzmiNo ratings yet

- The Correct Answer For Each Question Is Indicated by ADocument19 pagesThe Correct Answer For Each Question Is Indicated by Aakash deepNo ratings yet

- Chapter 1 StudentsDocument7 pagesChapter 1 StudentsArah Opalec0% (1)

- Reviewer in Financial MarketDocument6 pagesReviewer in Financial MarketPheobelyn EndingNo ratings yet

- CVP Multiple Product DiscussionDocument5 pagesCVP Multiple Product DiscussionheyheyNo ratings yet

- Hello PDFDocument57 pagesHello PDFMursalin HossainNo ratings yet

- Managerial Accounting Workbook Version 1 PDFDocument88 pagesManagerial Accounting Workbook Version 1 PDFYashrajsing LuckkanaNo ratings yet

- Stevenson 13e Chapter 4Document28 pagesStevenson 13e Chapter 4----No ratings yet

- Question 1 Hatem MasriDocument5 pagesQuestion 1 Hatem Masrisurvivalofthepoly0% (1)

- Cost Behavior AnalysisDocument43 pagesCost Behavior AnalysisRay LiuNo ratings yet

- Cost Accounting and Management AccountingDocument11 pagesCost Accounting and Management AccountingCollins AbereNo ratings yet

- Investment Centers and Transfer Pricing Ch 13Document41 pagesInvestment Centers and Transfer Pricing Ch 13Karen hapukNo ratings yet

- Estimating service costs in a consulting firmDocument11 pagesEstimating service costs in a consulting firmPat0% (1)

- MA-16-How Well Am I Doing - Financial Statement AnalysisDocument72 pagesMA-16-How Well Am I Doing - Financial Statement AnalysisAna Patricia Basa MacapagalNo ratings yet

- MCS MatH QSTN NewDocument7 pagesMCS MatH QSTN NewSrijita SahaNo ratings yet

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- Productivity and Reliability-Based Maintenance Management, Second EditionFrom EverandProductivity and Reliability-Based Maintenance Management, Second EditionNo ratings yet

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- Quality Management System Process A Complete Guide - 2020 EditionFrom EverandQuality Management System Process A Complete Guide - 2020 EditionNo ratings yet

- Presentation 1Document31 pagesPresentation 1Rohit Panchal67% (3)

- Talent Management A Crystal Ball-WP-0811Document6 pagesTalent Management A Crystal Ball-WP-0811Vivek NarayananNo ratings yet

- Nestle Contadina Pizza and Pasta-05!07!2014Document7 pagesNestle Contadina Pizza and Pasta-05!07!2014Vivek Narayanan100% (2)

- Sample Behavioral Interview QuestionsDocument4 pagesSample Behavioral Interview QuestionsVivek Narayanan100% (1)

- MR ProposalDocument7 pagesMR ProposalVivek NarayananNo ratings yet

- Job AnalysisDocument6 pagesJob AnalysisVivek NarayananNo ratings yet

- MarkStrat Final ReportDocument12 pagesMarkStrat Final ReportHanson Zhou100% (1)

- Consumer Behavior Project-Group 10: Fernando Ayala Shonit Mittal Vivek NarayananDocument9 pagesConsumer Behavior Project-Group 10: Fernando Ayala Shonit Mittal Vivek NarayananVivek NarayananNo ratings yet

- MAE FinalDocument12 pagesMAE FinalVivek NarayananNo ratings yet

- Session 1 - 2 Overview of BMDocument22 pagesSession 1 - 2 Overview of BMVivek NarayananNo ratings yet

- 5allen 18Document22 pages5allen 18Vivek NarayananNo ratings yet

- Introduction About HRMDocument17 pagesIntroduction About HRMPratik BhotikaNo ratings yet

- Vivek SportsDocument13 pagesVivek SportsVivek NarayananNo ratings yet

- IOCL AnalysisDocument3 pagesIOCL AnalysisVivek NarayananNo ratings yet

- Presentation 1Document31 pagesPresentation 1Rohit Panchal67% (3)

- Planning and Preparing The Data AnalysisDocument28 pagesPlanning and Preparing The Data AnalysisVivek NarayananNo ratings yet

- Stats Chapter 3Document10 pagesStats Chapter 3Vivek NarayananNo ratings yet

- Ma AssDocument7 pagesMa AssVivek NarayananNo ratings yet

- Berkshire Threaded Fasteners Company CaseDocument2 pagesBerkshire Threaded Fasteners Company Casesmart200100% (2)

- Case 3-1 CoffeeBuylowDocument2 pagesCase 3-1 CoffeeBuylowVivek NarayananNo ratings yet

- SustainabilityDocument1 pageSustainabilityVivek NarayananNo ratings yet

- "Putting The Enterprise Into The Enterprise System" & Other ERP InsightsDocument19 pages"Putting The Enterprise Into The Enterprise System" & Other ERP InsightsPradip ValaNo ratings yet

- SustainabilityDocument1 pageSustainabilityVivek NarayananNo ratings yet

- Stat 2: Probability Tricks, and A ReviewDocument50 pagesStat 2: Probability Tricks, and A ReviewYashas IndalkarNo ratings yet

- Speech SlideDocument1 pageSpeech SlideVivek NarayananNo ratings yet

- IBM QuiZ (1) SdmimdDocument43 pagesIBM QuiZ (1) SdmimdVivek NarayananNo ratings yet

- 1HMEE5013 Exam Q JAN2017 S14Document5 pages1HMEE5013 Exam Q JAN2017 S14kumar6125100% (1)

- Timoshenko Beam TheoryDocument8 pagesTimoshenko Beam Theoryksheikh777No ratings yet

- Pub - Perspectives On Global Cultures Issues in Cultural PDFDocument190 pagesPub - Perspectives On Global Cultures Issues in Cultural PDFCherlyn Jane Ventura TuliaoNo ratings yet

- CP R77.30 ReleaseNotesDocument18 pagesCP R77.30 ReleaseNotesnenjamsNo ratings yet

- IJRP 2018 Issue 8 Final REVISED 2 PDFDocument25 pagesIJRP 2018 Issue 8 Final REVISED 2 PDFCarlos VegaNo ratings yet

- Ragavendhar Seeks Entry Software JobDocument2 pagesRagavendhar Seeks Entry Software JobfferferfNo ratings yet

- Pahang JUJ 2012 SPM ChemistryDocument285 pagesPahang JUJ 2012 SPM ChemistryJeyShida100% (1)

- DownloadDocument11 pagesDownloadAnonymous ffje1rpaNo ratings yet

- DelhiDocument40 pagesDelhiRahul DharNo ratings yet

- ENVPEP1412003Document5 pagesENVPEP1412003south adventureNo ratings yet

- Gatk Pipeline Presentation: From Fastq Data To High Confident VariantsDocument8 pagesGatk Pipeline Presentation: From Fastq Data To High Confident VariantsSampreeth ReddyNo ratings yet

- Carmina GadelicaDocument37 pagesCarmina GadelicaoniricsNo ratings yet

- RFID Receiver Antenna Project For 13.56 MHZ BandDocument5 pagesRFID Receiver Antenna Project For 13.56 MHZ BandJay KhandharNo ratings yet

- Description MicroscopeDocument4 pagesDescription MicroscopeRanma SaotomeNo ratings yet

- Clinical behavior analysis and RFT: Conceptualizing psychopathology and its treatmentDocument28 pagesClinical behavior analysis and RFT: Conceptualizing psychopathology and its treatmentAnne de AndradeNo ratings yet

- Linear Piston Actuators: by Sekhar Samy, CCI, and Dave Stemler, CCIDocument18 pagesLinear Piston Actuators: by Sekhar Samy, CCI, and Dave Stemler, CCIapi-3854910No ratings yet

- FAI - Assignment Sheet (Both Assignments)Document5 pagesFAI - Assignment Sheet (Both Assignments)Wilson WongNo ratings yet

- Unit Test Nervous System 14.1Document4 pagesUnit Test Nervous System 14.1ArnelNo ratings yet

- Biology GCE 2010 June Paper 1 Mark SchemeDocument10 pagesBiology GCE 2010 June Paper 1 Mark SchemeRicky MartinNo ratings yet

- MAN 2 Model Medan Introduction to School Environment ReportDocument45 pagesMAN 2 Model Medan Introduction to School Environment ReportdindaNo ratings yet

- Applied Physics Mini Launcher Lab ReportDocument12 pagesApplied Physics Mini Launcher Lab ReportTalharashid RamzanNo ratings yet

- Pressing and Finishing (Latest)Document8 pagesPressing and Finishing (Latest)Imran TexNo ratings yet

- Clinnic Panel Penag 2014Document8 pagesClinnic Panel Penag 2014Cikgu Mohd NoorNo ratings yet

- Finding My Voice in ChinatownDocument5 pagesFinding My Voice in ChinatownMagalí MainumbyNo ratings yet

- Picco Tac 1095 N Hydrocarbon ResinDocument2 pagesPicco Tac 1095 N Hydrocarbon ResindevanandamqaNo ratings yet

- Auerbach Slideshow How To Write A ParagraphDocument22 pagesAuerbach Slideshow How To Write A ParagraphFreakmaggotNo ratings yet

- Monetary System 1Document6 pagesMonetary System 1priyankabgNo ratings yet

- Ethics Book of TAMIL NADU HSC 11th Standard Tamil MediumDocument140 pagesEthics Book of TAMIL NADU HSC 11th Standard Tamil MediumkumardjayaNo ratings yet

- Big Band EraDocument248 pagesBig Band Erashiloh32575% (4)

- 1 API 653 Exam Mar 2015 MemoryDocument12 pages1 API 653 Exam Mar 2015 MemorymajidNo ratings yet