Professional Documents

Culture Documents

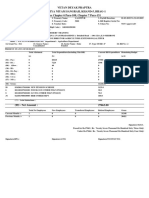

DEDUCTIONS

Uploaded by

Irysh BostonCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DEDUCTIONS

Uploaded by

Irysh BostonCopyright:

Available Formats

TAX LAW REVIEW DIGESTS Montero

Alcisso, Arriola, Cajucom, Calalang, Claudio, Escueta, Delos Santos, Dialino, Fajardo, Imperial, Juaquino, Martin, Martinez, Mendoza, Noel, Pangcog, Plazo osales, Sia, !", #enzuela aso,

Q. DEDUCTION

In general

CIR v ISABELA CULTURAL CORPORATION FACTS: ICC $as assessed %or de%icienc" income ta& ' (I disallo$ed e&pense deductions %or pro%essional and securit" ser)ices *" +, auditing ser)ices *" S-# . Co/ 0, legal ser)ices (engzon la$ o%%ice 1, El 2igre Securit" ser)ices3 and de%icienc" e&panded $it44olding ta&, $4en it %ailed to $it44old +5 e&panded $it44olding ta&/ 24e C2A cancelled and set aside t4e assessment notices 4olding t4at t4e claimed deductions %or pro%essional and securit" ser)ices $ere properl" claimed in +678 since it $as onl" in t4at "ear $4en t4e *ills demanding pa"ment $ere sent to ICC/ It also %ound t4at t4e ICC $it44eld +5 e&panded $it44olding ta& %or securit" ser)ices/ 24e CA a%%irmed 4ence t4e case at *ar/ ISSUE: 9:N t4e a%orementioned ma" *e deducted ELD: %or t4e auditing and legal ser)ices N; *ut %or t4e securit" ser)ices <ES 24e requisites %or deducti*ilit" o% ordinar" and necessar" trade, *usiness or pro%essional e&penses, li=e e&penses paid %or legal and auditing ser)ices are> a, t4e e&pense must *e ordinar" and necessar"? *, it must 4a)e *een paid or incurred during t4e ta&a*le "ear? c, it must 4a)e *een paid or incurred in carr"ing on t4e trade or *usiness o% t4e ta&pa"er and d, it must *e supported *" receipts, records and ot4er pertinent papers/

24e requisite t4at it must 4a)e *een paid or incurred during t4e ta&a*le "ear is quali%ied *" Sec/ @A o% NI C $4ic4 states t4at Bt4e deduction pro)ide %or in t4is title s4all *e ta=en %or t4e ta&a*le "ear in $4ic4 Cpaid or incurredD dependent upon t4e met4od o% accounting upon t4e *asis o% $4ic4 t4e net income is computed & & &E/

ICC uses t4e accrual met4od/ AM No/ +F0GGG pro)ides t4at under t4e accrual met4od, e&penses not claimed as deductions in t4e current "ear $4en t4e" are incurred CANN;2 *e claimed as deduction %rom income %or t4e succeeding "ear/ 24e accrual met4od relies upon t4e ta&pa"erDs rig4t to recei)e amount or its o*ligation to pa" t4em N;2 t4e actual receipt or pa"ment/ Amounts o% income accrue $4ere t4e rig4t to recei)e t4em *ecome %i&ed, $4ere t4ere is created an en%orcea*le lia*ilit"/ Hia*ilities are accrued $4en %i&ed and determina*le in amount/ 24e accrual o% income and e&pense is permitted $4en t4e AHHF E#EN2S 2ES2 4as *een met/ 24e test requires t4at> +, %i&ing o% a rig4t to income or lia*ilit" to pa" and 0, t4e a)aila*ilit" o% t4e reasona*le accurate determination o% suc4 income or lia*ilit"/ It does not require t4at t4e amount *e a*solutel" =no$n onl" t4at t4e ta&pa"er 4as in%ormation necessar" to compute t4e amount $it4 reasona*le accurac"/ 24e test is satis%ied $4ere computation remains uncertain i% its *asis is unc4angea*le/ 24e amount o% lia*ilit" does not 4a)e to *e determined e&actl", it must *e determined $it4 reasona*le accurac"/ In t4e case at *ar, t4e e&penses %or legal ser)ices pertain to t4e "ears +67@ and +67A/ 24e %irm 4as *een retained since +68G/ From t4e nature o% t4e claimed deduction and t4e span o% time during $4ic4 t4e %irm $as retained, ICC can *e e&pected to 4a)e reasona*l" =no$n t4e retainer %ees c4arged *" t4e %irm as $ell as compensation %or its ser)ices/ E&ercising due diligence, t4e" could

TAX LAW REVIEW DIGESTS Montero

Alcisso, Arriola, Cajucom, Calalang, Claudio, Escueta, Delos Santos, Dialino, Fajardo, Imperial, Juaquino, Martin, Martinez, Mendoza, Noel, Pangcog, Plazo osales, Sia, !", #enzuela aso,

4a)e inquired into t4e amount o% t4eir o*ligation/ It could 4a)e reasona*l" determined t4e amount o% legal and retainer %ees o$ing to t4eir %amiliarit" $it4 t4e rates c4arged/ 24e pro%essional %ees o% S-# cannot *e )alidl" claimed as deductions in +678/ ICC %ailed to present e)idence s4o$ing t4at e)en $it4 onl" reasona*le accurac", it cannot determine t4e pro%essional %ees $4ic4 t4e compan" $ould c4arge/

Fe*ruar" +6, +6A7, t4at said amount s4ould *e allo$ed as deduction *ecause it $as paid to its o%%icers as allo$ance or *onus pursuant to its *"Fla$s/ ISSUE! ELD> 9:N t4e *onus gi)en to t4e o%%icers o% t4e petitioner upon t4e sale o% its Muntinlupa land is an ordinar" and necessar" *usiness e&pense deducti*le %or income ta& purposes F N; RATIO> Sec/ 1G Ia, I+, o% t4e 2a& Code pro)ides t4at in computing net income, t4ere s4all *e allo$ed as deductions CE&penses, including all t4e ordinar" and necessary e&penses paid or incurred during t4e ta&a*le "ear in carr"ing on an" trade or *usiness, including a reasonable allowance %or personal ser)ices actually rendered/ 24e *onus gi)en to t4e o%%icers o% t4e petitioner as t4eir s4are o% t4e pro%it realized %rom t4e sale o% petitionerKs Muntinglupa land cannot *e deemed a deducti*le e&pense %or ta& purposes, e)en i% t4e a%oresaid sale could *e considered as a transaction %or carr"ing on t4e trade or *usiness o% t4e petitioner and t4e grant o% t4e *onus to t4e corporate o%%icers pursuant to petitionerKs *"Fla$s could, as an intraFcorporate matter, *e sustained/ 24e records s4o$ t4at t4e sale $as e%%ected t4roug4 a *ro=er $4o $as paid *" petitioner a commission o% PA+,J01/J0 %or 4is ser)ices/ ;n t4e ot4er 4and, t4ere is a*solutel" no e)idence o% an" ser)ice actuall" rendered *" petitionerKs o%%icers $4ic4 could *e t4e *asis o% a grant to t4em o% a *onus out o% t4e pro%it deri)ed %rom t4e sale/ 24is *eing so, t4e pa"ment o% a *onus to t4em out o% t4e gain realized %rom t4e sale cannot *e considered as a selling e&pense? nor can it *e deemed reasona*le and necessar" so as to ma=e it deducti*le %or ta& purposes/ 24e e&traordinar" and unusual amounts paid *" petitioner to t4ese directors in t4e guise and %orm o% compensation %or t4eir supposed ser)ices as suc4, without any relation to the measure of their actual services, cannot be regarded as ordinary and necessary expenses $it4in t4e meaning o% t4e la$/ 24is is in line $it4 t4e doctrine in t4e la$ o% ta&ation t4at t4e ta&pa"er must s4o$ t4at its claimed deductions clearl" come $it4in t4e language o% t4e la$ since allo$ances, li=e e&emptions, are matters o% legislati)e grace/

CIR v GENERAL FOODS AGUINALDO INDUSTRIES v CIR

FACTS: Aguinaldo Industries Corporation IAIC, is a domestic corporation engaged in t4e manu%acture o% %is4ing nets, a ta&Fe&empt industr" and t4e manu%acture o% %urniture/ For accounting purposes, eac4 di)ision is pro)ided $it4 separate *oo=s o% accounts/ Pre)iousl", AIC acquired a parcel o% land in Muntinlupa, izal, as site o% t4e %is4ing net %actor"/ Hater, it sold t4e Muntinlupa propert"/ AIC deri)ed pro%it %rom t4is sale $4ic4 $as entered in t4e *oo=s o% t4e Fis4 Nets Di)ision as miscellaneous income to distinguis4 it %rom its ta&Fe&empt income/ For t4e "ear +6AJ, AIC %iled t$o separate income ta& returns %or eac4 di)ision/ A%ter in)estigation, t4e e&aminers o% t4e (I %ound t4at t4e Fis4 Nets Di)ision deducted %rom its gross income %or t4at "ear t4e amount o% P8+,+7J/@7 as additional remuneration paid to t4e o%%icers o% AIC/ 24is amount $as ta=en %rom t4e net pro%it o% an isolated transaction Isale o% Muntinlupa land, not in t4e course o% or carr"ing on o% AICKs trade or *usiness, and $as reported as part o% t4e selling e&penses o% t4e Muntinlupa land/ !pon recommendation o% t4e e&aminer t4at t4e said sum o% P8+,+7J/@7 *e disallo$ed as deduction %rom gross income, petitioner asserted in its letter o%

TAX LAW REVIEW DIGESTS Montero

Alcisso, Arriola, Cajucom, Calalang, Claudio, Escueta, Delos Santos, Dialino, Fajardo, Imperial, Juaquino, Martin, Martinez, Mendoza, Noel, Pangcog, Plazo osales, Sia, !", #enzuela aso,

ATLAS CONSOLIDATED MINING v CIR

FACTS: Atlas is a corporation engaged in t4e mining industr" registered/ ;n August +680, CI assessed against Atlas %or de%icienc" income ta&es %or t4e "ears +6AJ and +6A7/ For t4e "ear +6AJ, it $as t4e opinion o% t4e CI t4at Atlas is not entitled to e&emption %rom t4e income ta& under A 6G6 *ecause same co)ers onl" gold mines/ For t4e "ear +6A7, t4e de%icienc" income ta& co)ers t4e disallo$ance o% items claimed *" Atlas as deducti*le %rom gross income/ Atlas protested %or reconsideration and cancellation, t4us t4e CI conducted a rein)estigation o% t4e case/ ;n ;cto*er +680, t4e Secretar" o% Finance ruled t4at t4e e&emption pro)ided in A 6G6 em*races all ne$ mines and old mines $4et4er gold or ot4er minerals/ Accordingl", t4e CI recomputed Atlas de%icienc" income ta& lia*ilities in t4e lig4t o% said ruling/ ;n June +68@, t4e CI issued a re)ised assessment entirel" eliminating t4e assessment %or t4e "ear +6AJ/ 24e assessment %or +6A7 $as reduced %rom $4ic4 Atlas appealed to t4e C2A, assailing t4e disallo$ance o% t4e %ollo$ing items claimed as deducti*le %rom its gross income %or +6A7> 2rans%er agentKs %ee, Stoc=4olders relation ser)ice %ee, !/S/ stoc= listing e&penses, Suit e&penses, and Pro)ision %or contingencies/ 24e C2A allo$ed said items as deduction e&cept t4ose denominated *" Atlas as stoc=4olders relation ser)ice %ee and suit e&penses/ (ot4 parties appealed t4e C2A decision to t4e SC *" $a" o% t$o I0, separate petitions %or re)ie$/ Atlas appealed onl" t4e disallo$ance o% t4e deduction %rom gross income o% t4e soFcalled stoc=4olders relation ser)ice %ee/ ISSUE! ELD> 9:N t4e Cannual pu*lic relations e&penseD Ia=a stoc=4olders relation ser)ice %ee, paid to a pu*lic relations consultant is a deducti*le e&pense %rom gross income

RATIO> Section 1G Ia, I+, o% t4e 2a& Code allo$s a deduction o% Lall t4e ordinar" and necessar" e&penses paid or incurred during t4e ta&a*le "ear in carr"ing on an" trade or *usiness/L An item o% e&penditure, in order to *e deducti*le under t4is section o% t4e statute, must %all squarel" $it4in its language/ 2o *e deducti*le as a *usiness e&pense, t4ree conditions are imposed, namel"> I+, t4e e&pense must *e ordinar" and necessar", I0, it must *e paid or incurred $it4in t4e ta&a*le "ear, and I1, it must *e paid or incurred in carr"ing in a trade or *usiness/ In addition, not onl" must t4e ta&pa"er meet t4e *usiness test, 4e must su*stantiall" pro)e *" e)idence or records t4e deductions claimed under t4e la$, ot4er$ise, t4e same $ill *e disallo$ed/ 24e mere allegation o% t4e ta&pa"er t4at an item o% e&pense is ordinar" and necessar" does not justi%" its deduction/ 24e SC 4as ne)er attempted to de%ine $it4 precision t4e terms Lordinar" and necessar"/L As a guiding principle, ordinaril", an e&pense $ill *e considered Lnecessar"L $4ere t4e e&penditure is appropriate and 4elp%ul in t4e de)elopment o% t4e ta&pa"erKs *usiness/ It is Lordinar"L $4en it connotes a pa"ment $4ic4 is normal in relation to t4e *usiness o% t4e ta&pa"er and t4e surrounding circumstances/ 24e term Lordinar"L does not require t4at t4e pa"ments *e 4a*itual or normal in t4e sense t4at t4e same ta&pa"er $ill 4a)e to ma=e t4em o%ten? t4e pa"ment ma" *e unique or nonFrecurring to t4e particular ta&pa"er a%%ected/ 24ere is t4us no 4ard and %ast rule on t4e matter/ 24e rig4t to a deduction depends in eac4 case on t4e particular %acts and t4e relation o% t4e pa"ment to t4e t"pe o% *usiness in $4ic4 t4e ta&pa"er is engaged/ 24e intention o% t4e ta&pa"er o%ten ma" *e t4e controlling %act in ma=ing t4e determination/ Assuming t4at t4e e&penditure is ordinar" and necessar" in t4e operation o% t4e ta&pa"erKs *usiness, t4e ans$er to t4e question as to $4et4er t4e e&penditure is an allo$a*le deduction as a *usiness e&pense must *e determined %rom t4e nature o% t4e e&penditure itsel%, $4ic4 in turn depends on t4e e&tent and permanenc" o% t4e $or= accomplis4ed *" t4e e&penditure/

TAX LAW REVIEW DIGESTS Montero

Alcisso, Arriola, Cajucom, Calalang, Claudio, Escueta, Delos Santos, Dialino, Fajardo, Imperial, Juaquino, Martin, Martinez, Mendoza, Noel, Pangcog, Plazo osales, Sia, !", #enzuela aso,

It appears t4at on Decem*er +6AJ, Atlas increased its capital stoc=/ It claimed t4at its s4ares o% stoc= $ere sold in t4e !nited States *ecause o% t4e ser)ices rendered *" t4e pu*lic relations %irm/ 24e in%ormation a*out Atlas gi)en out and pla"ed up in t4e mass communication media resulted in %ull su*scription o% t4e additional s4ares issued *" Atlas? consequentl", t4e Cstoc=4olders relation ser)ice %eeD, t4e compensation %or ser)ices carr"ing on t4e selling campaign, $as in e%%ect spent %or t4e acquisition o% additional capital, ergo, a capital e&penditure, and not an ordinar" e&pense/ It is not deducti*le %rom Atlas gross income in +6A7 *ecause e&penses relating to recapitalization and reorganization o% t4e corporation, t4e cost o% o*taining stoc= su*scription, promotion e&penses, and commission or %ees paid %or t4e sale o% stoc= reorganization are capital e&penditures/ 24at t4e e&pense in question $as incurred to create a %a)ora*le image o% t4e corporation in order to gain or maintain t4e pu*licKs and its stoc=4oldersK patronage, does not ma=e it deducti*le as *usiness e&pense/ As 4eld in a !S case , e%%orts to esta*lis4 reputation are a=in to acquisition o% capital assets and, t4ere%ore, e&penses related t4ereto are not *usiness e&pense *ut capital e&penditures/ Note> 24e *urden o% proo% t4at t4e e&penses incurred are ordinar" and necessar" is on t4e ta&pa"er and does not rest upon t4e -o)ernment/ 2o a)ail o% t4e claimed deduction, it is incum*ent upon t4e ta&pa"er to adduce su*stantial e)idence to esta*lis4 a reasona*l" pro&imate relation petition *et$een t4e e&penses to t4e ordinar" conduct o% t4e *usiness o% t4e ta&pa"er/ A logical lin= or ne&us *et$een t4e e&pense and t4e ta&pa"erKs *usiness must *e esta*lis4ed *" t4e ta&pa"er/

and s4ares o% stoc=s in di%%erent corporations/ 2o manage t4e properties, said c4ildren, namel", Antonio, Eduardo and Jose o&as %ormed a partners4ip called o&as " Compania/ ;n June +6A7, t4e CI assessed de%icienc" income ta&es against t4e o&as (rot4ers %or t4e "ears +6A1 and +6AA/ Part o% t4e de%icienc" income ta&es resulted %rom t4e disallo$ance o% deductions %rom gross income o% )arious *usiness e&penses and contri*utions claimed *" o&as/ (see expense items below) 24e o&as *rot4ers protested t4e assessment *ut inasmuc4 as said protest $as denied, t4e" instituted an appeal in t4e C2A, $4ic4 sustained t4e assessment e&cept t4e demand %or t4e pa"ment o% t4e %i&ed ta& on dealer o% securities and t4e disallo$ance o% t4e deductions %or contri*utions to t4e P4ilippine Air Force C4apel and Mijas de JesusK etiro de Manresa/ Not satis%ied, o&as *rot4ers appealed to t4e SC/ 24e CI did not appeal/ ISSUES! ELD: 9:N t4e deductions %or *usiness e&penses and contri*utions deducti*le RATIO: 9it4 regard to t4e disallo$ed deductions Ie&penses %or tic=ets to a *anquet gi)en in 4onor o% Sergio ;smena and *eer gi)en as gi%ts to )arious persons, la*elled as representation e&penses,, representation e&penses are deducti*le %rom gross income as e&penditures incurred in carr"ing on a trade or *usiness under Section 1GIa, o% t4e 2a& Code pro)ided t4e ta&pa"er pro)es t4at t4e" are reasona*le in amount, ordinar" and necessar", and incurred in connection $it4 4is *usiness/ In t4e case at *ar, t4e e)idence does not s4o$ suc4 lin= *et$een t4e e&penses and t4e *usiness o% o&as/ 24e petitioners also claim deductions %or contri*utions to t4e Pasa" Cit" Police, Pasa" Cit" Firemen, and (aguio Cit" Police C4ristmas %unds, Manila Police 2rust Fund, P4ilippines MeraldKs %und %or ManilaKs neediest %amilies and ;ur Had" o% Fatima c4apel at Far Eastern !ni)ersit"/ 24e contri*utions to t4e C4ristmas %unds o% t4e Pasa" Cit" Police, Pasa" Cit" Firemen and (aguio Cit" Police are not deducti*le %or t4e reason t4at t4e C4ristmas %unds $ere not spent

ROXAS v CTA

FACTS: Don Pedro o&as and Dona Carmen A"ala, Spanis4 su*jects, transmitted to t4eir grandc4ildren *" 4ereditar" succession agricultural lands in (atangas, a residential 4ouse and lot in Manila,

TAX LAW REVIEW DIGESTS Montero

Alcisso, Arriola, Cajucom, Calalang, Claudio, Escueta, Delos Santos, Dialino, Fajardo, Imperial, Juaquino, Martin, Martinez, Mendoza, Noel, Pangcog, Plazo osales, Sia, !", #enzuela aso,

for public purposes *ut as C4ristmas gi%ts to t4e %amilies o% t4e mem*ers o% said entities/ !nder Section 16I4,, a contribution to a government entity is deductible when used exclusively for public purposes/ For t4is reason, t4e disallo$ance must *e sustained/ ;n t4e ot4er 4and, t4e contri*ution to t4e Manila Police trust %und is an allo$a*le deduction %or said trust %und *elongs to t4e Manila Police, a go)ernment entit", intended to *e used e&clusi)el" %or its pu*lic %unctions/ 24e contri*utions to t4e P4ilippines MeraldKs %und %or ManilaKs neediest %amilies $ere disallo$ed on t4e ground t4at t4e P4ilippines Merald is not a corporation or an association contemplated in Section 1G I4, o% t4e 2a& Code/ It s4ould *e noted 4o$e)er t4at t4e contri*utions $ere not made to t4e P4ilippines Merald *ut to a group o% ci)ic spirited citizens organized *" t4e P4ilippines Merald solel" %or c4arita*le purposes/ 24ere is no question t4at t4e mem*ers o% t4is group o% citizens do not recei)e pro%its, %or all t4e %unds t4e" raised $ere %or ManilaKs neediest %amilies/ Suc4 a group o% citizens ma" *e classi%ied as an association organized e&clusi)el" %or c4arita*le purposes mentioned in Section 1GI4, o% t4e 2a& Code/ 24e contri*ution to ;ur Had" o% Fatima c4apel at t4e Far Eastern !ni)ersit" s4ould also *e disallo$ed on t4e ground t4at t4e said uni)ersit" gi)es di)idends to its stoc=4olders/ Hocated $it4in t4e premises o% t4e uni)ersit", t4e c4apel in question 4as not *een s4o$n to *elong to t4e Cat4olic C4urc4 or an" religious organization/ It *elongs to t4e Far Eastern !ni)ersit", contri*utions to $4ic4 are not deducti*le under Section 1GI4, o% t4e 2a& Code %or t4e reason t4at t4e net income o% said uni)ersit" injures to t4e *ene%it o% its stoc=4olders.

real properties and claimed deductions $4ic4 $ere not allo$a*le/ 24e collector required 4im to pa" de%icienc" income ta&/ ;n appeal *" Namora, t4e C2A reduced t4e amount o% de%icienc" income ta&/ Namora appealed, alleging t4at t4e C2A erred in dissallo$ing P+G,@J7/AG, as promotion e&penses incurred *" 4is $i%e %or t4e promotion o% t4e (a" #ie$ Motel and Farmacia Namora I$4ic4 is O o% P0G,6AJ/GG, supposed *usiness e&penses,/ Namora alleged t4at t4e C2A erred in disallo$ing P+G,@J7/AG as promotion e&penses incurred *" 4is $i%e %or t4e promotion o% t4e (a" #ie$ Motel and Farmacia Namora/ Me contends t4at t4e $4ole amount o% P0G,6AJ/GG as promotion e&penses, s4ould *e allo$ed and not merel" oneF4al% o% it, on t4e ground t4at, $4ile not all t4e itemized e&penses are supported *" receipts, t4e a*sence o% some supporting receipts 4as *een su%%icientl" and satis%actoril" esta*lis4ed/ ISSUE: $:n C2A erred in allo$ing onl" one 4al% o% t4e promotion e&penses/ N; ELD: Section 1G, o% t4e 2a& Code, pro)ides t4at in computing net income, t4ere s4all *e allo$ed as deductions all t4e ordinar" and necessar" e&penses paid or incurred during t4e ta&a*le "ear, in carr"ing on an" trade or *usiness/ Since promotion e&penses constitute one o% t4e deductions in conducting a *usiness, same must satis%" t4ese requirements/ Claim %or t4e deduction o% promotion e&penses or entertainment e&penses must also *e su*stantiated or supported *" record s4o$ing in detail t4e amount and nature o% t4e e&penses incurred/ Considering, as 4ereto%ore stated, t4at t4e application o% Mrs/ Namora %or dollar allocation s4o$s t4at s4e $ent a*road on a com*ined medical and *usiness trip, not all o% 4er e&penses came under t4e categor" o% ordinar" and necessar" e&penses? part t4ereo% constituted 4er personal e&penses/ 24ere 4a)ing *een no means *" $4ic4 to ascertain $4ic4 e&pense $as incurred *" 4er in connection $it4 t4e *usiness o% Mariano Namora and $4ic4 $as incurred %or 4er personal *ene%it, t4e Collector and t4e C2A in t4eir

"AMORA v CIR FACTS: Mariano Namora, o$ner o% t4e (a" #ie$ Motel and Farmacia Namora, %iled 4is income ta& returns/ 24e CI %ound t4at 4e %ailed to %ile 4is return o% t4e capital gains deri)ed %rom t4e sale o% certain

TAX LAW REVIEW DIGESTS Montero

Alcisso, Arriola, Cajucom, Calalang, Claudio, Escueta, Delos Santos, Dialino, Fajardo, Imperial, Juaquino, Martin, Martinez, Mendoza, Noel, Pangcog, Plazo osales, Sia, !", #enzuela aso,

decisions, considered AG5 o% t4e said amount o% P0G,6AJ/GG as *usiness e&penses and t4e ot4er AG5, as 4er personal e&penses/ 9e 4old t4at said allocation is )er" %air to Mariano Namora, t4ere 4a)ing *een no receipt $4atsoe)er, su*mitted to e&plain t4e alleged *usiness e&penses, or proo% o% t4e connection $4ic4 said e&penses 4ad to t4e *usiness or t4e reasona*leness o% t4e said amount o% P0G,6AJ/GG/ In t4e case o% #isa"an Ce*u 2erminal Co/, Inc/ )/ CI /, it $as declared t4at re#re$ent%t&on e'#en$e$ (%)) *n+er t,e -%te.or/ o( 0*$&ne$$ e'#en$e$ 1,&-, %re %))o1%0)e +e+*-t&on$ (ro2 .ro$$ &n-o2e3 &( t,e/ 2eet t,e -on+&t&on$ #re$-r&0e+ 0/ )%13 #%rt&-*)%r)/ $e-t&on 45 6%7 89:3 o( t,e T%' Co+e; t,%t to 0e +e+*-t&0)e3 $%&+ 0*$&ne$$ e'#en$e$ 2*$t 0e or+&n%r/ %n+ ne-e$$%r/ e'#en$e$ #%&+ or &n-*rre+ &n -%rr/&n. on %n/ tr%+e or 0*$&ne$$; t,%t t,o$e e'#en$e$ 2*$t %)$o 2eet t,e (*rt,er te$t o( re%$on%0)ene$$ &n %2o*nt. T,e/ $,o*)+ %)$o 0e -overe+ 0/ $*##ort&n. #%#er$; &n t,e %0$en-e t,ereo( t,e %2o*nt #ro#er)/ +e+*-t&0)e %$ re#re$ent%t&on e'#en$e$ $,o*)+ 0e +eter2&ne+ (ro2 %v%&)%0)e +%t%.

amount o% P07,GA@/GG plus interests/ 24e Court o% 2a& Appeals upon re)ie$ing t4e assessment at t4e ta&pa"erKs petition, up4eld respondentKs disallo$ance o% t4e principal item o% petitionerKs 4a)ing paid to Mr/ C/ M/ Mos=ins, its %ounder and controlling stoc=4older t4e amount o% P66,6JJ/6+ representing AG5 o% super)ision %ees earned *" it and set aside respondentKs disallo$ance o% t4ree ot4er minor items/ Petitioner questions in t4is appeal t4e 2a& CourtKs %indings t4at t4e disallo$ed pa"ment to Mos=ins $as an inordinatel" large one, $4ic4 *ore a close relations4ip to t4e recipientKs dominant stoc=4oldings and t4ere%ore amounted in la$ to a distri*ution o% its earnings and pro%its/ I$$*e: 94et4er t4e AG5 super)ision %ee paid to Mos=in ma" *e deducti*le %or income ta& purposes/ R*)&n.: NO. R%t&o: Mos=in o$ns 66/85 o% t4e CM Mos=ins . Co/ Me $as also t4e President and C4airman o% t4e (oard/ 24at as c4airman o% t4e (oard o% Directors, 4e recei)ed a salar" o% P1,JAG/GG a mont4, plus a salar" *onus o% a*out P@G,GGG/GG a "ear and an amounting to an annual compensation o% P@A,GGG/GG and an annual salar" *onus o% P@G,GGG/GG, plus %ree use o% t4e compan" car and receipt o% ot4er similar allo$ances and *ene%its, t4e 2a& Court correctl" ruled t4at t4e pa"ment *" petitioner to Mos=ins o% t4e additional sum o% P66,6JJ/6+ as 4is equal or AG5 s4are o% t4e 75 super)ision %ees recei)ed *" petitioner as managing agents o% t4e real estate, su*di)ision projects o% Paradise Farms, Inc/ and ealt" In)estments, Inc/ 1%$ &nor+&n%te)/ )%r.e %n+ -o*)+ not 0e %--or+e+ t,e tre%t2ent o( or+&n%r/ %n+ ne-e$$%r/ e'#en$e$ %))o1e+ %$ +e+*-t&0)e &te2$ 1&t,&n t,e #*rv&e1 o( t,e T%' Co+e/ 24e %act t4at suc4 pa"ment $as aut4orized *" a standing resolution o% petitionerKs *oard o% directors, since LMos=ins 4ad personall" concei)ed and planned t4e projectL cannot c4ange t4e picture/ 24ere could *e no question t4at as C4airman o% t4e *oard

Expenses

C.M. F%-t$: Petitioner, a domestic corporation engaged in t4e real estate *usiness as *ro=ers, managing agents and administrators, %iled its income ta& return %or its %iscal "ear ending Septem*er 1G, +6AJ s4o$ing a net income o% P60,A@G/0A and a ta& lia*ilit" due t4ereon o% P+7,AG7/GG, $4ic4 it paid in due course/ !pon )eri%ication o% its return, CI , disallo$ed %our items o% deduction in petitionerKs ta& returns and assessed against it an income ta& de%icienc" in t4e OS<INS=CO3 INC. v CIR

TAX LAW REVIEW DIGESTS Montero

Alcisso, Arriola, Cajucom, Calalang, Claudio, Escueta, Delos Santos, Dialino, Fajardo, Imperial, Juaquino, Martin, Martinez, Mendoza, Noel, Pangcog, Plazo osales, Sia, !", #enzuela aso,

and practicall" an a*solutel" controlling stoc=4older o% petitioner, Mos=ins $ielded tremendous po$er and in%luence in t4e %ormulation and ma=ing o% t4e compan"Ks policies and decisions/ E)en just as *oard c4airman, going *" petitionerKs o$n enumeration o% t4e po$ers o% t4e o%%ice, Mos=ins, could e&ercise great po$er and in%luence $it4in t4e corporation, suc4 as directing t4e polic" o% t4e corporation, delegating po$ers to t4e president and ad)ising t4e corporation in determining e&ecuti)e salaries, *onus plans and pensions, di)idend policies, etc/ It is a general rule t4at K(onuses to emplo"ees made in good %ait4 and as additional compensation %or t4e ser)ices actuall" rendered *" t4e emplo"ees are deducti*le, pro)ided suc4 pa"ments, $4en added to t4e stipulated salaries, do not e&ceed a reasona*le compensation %or t4e ser)ices rendered/ 24e conditions precedent to t4e deduction o% *onuses to emplo"ees are> I+, t4e pa"ment o% t4e *onuses is in %act compensation? I0, it must *e %or personal ser)ices actuall" rendered? and I1, t4e *onuses, $4en added to t4e salaries, are Kreasona*le $4en measured *" t4e amount and qualit" o% t4e ser)ices per%ormed $it4 relation to t4e *usiness o% t4e particular ta&pa"er/ 24ere is no %i&ed test %or determining t4e reasona*leness o% a gi)en *onus as compensation/ 24is depends upon man" %actors, one o% t4em *eing t4e amount and qualit" o% t4e ser)ices per%ormed $it4 relation to t4e *usiness/K ;t4er tests suggested are> pa"ment must *e Kmade in good %ait4K? Kt4e c4aracter o% t4e ta&pa"erKs *usiness, t4e )olume and amount o% its net earnings, its localit", t4e t"pe and e&tent o% t4e ser)ices rendered, t4e salar" polic" o% t4e corporationK? Kt4e size o% t4e particular *usinessK? Kt4e emplo"eesK quali%ications and contri*utions to t4e *usiness )entureK? and Kgeneral economic conditions/ Mo$e)er, Kin determining $4et4er t4e particular salar" or compensation pa"ment is reasona*le, t4e situation must *e considered as $4ole/ ;rdinaril", no single %actor is decisi)e/ / / / it is important to =eep in mind t4at it seldom 4appens t4at t4e application o% one test can gi)e satis%actor" ans$er, and t4at ordinaril" it is t4e interpla" o% se)eral %actors, properl" $eig4ted %or t4e particular case, $4ic4 must %urnis4 t4e %inal ans$er/L

PetitionerKs case %ails to pass t4e test/ ;n t4e rig4t o% t4e emplo"er as against respondent Commissioner to %i& t4e compensation o% its o%%icers and emplo"ees, $e t4ere 4eld %urt4er t4at $4ile t4e emplo"erKs rig4t ma" *e conceded, t4e question o% t4e allo$ance or disallo$ance t4ereo% as deducti*le e&penses %or income ta& purposes is su*ject to determination *" CI / As %ar as petitionerKs contention t4at as emplo"er it 4as t4e rig4t to %i& t4e compensation o% its o%%icers and emplo"ees and t4at it $as in t4e e&ercise o% suc4 rig4t t4at it deemed proper to pa" t4e *onuses in question, all t4at 9e need sa" is t4is> t4at rig4t ma" *e conceded, *ut %or income ta& purposes t4e emplo"er cannot legall" claim suc4 *onuses as deducti*le e&penses unless t4e" are s4o$n to *e reasona*le/ 2o 4old ot4er$ise $ould open t4e gate o% rampant ta& e)asion/ Hastl", 9e must not lose sig4t o% t4e %act t4at t4e question o% allo$ing or disallo$ing as deducti*le e&penses t4e amounts paid to corporate o%%icers *" $a" o% *onus is determined *" respondent e&clusi)el" %or income ta& purposes/ Concededl", 4e 4as no aut4orit" to %i& t4e amounts to *e paid to corporate o%%icers *" $a" o% *asic salar", *onus or additional remuneration P a matter t4at lies more or less e&clusi)el" $it4in t4e sound discretion o% t4e corporation itsel%/ (ut t4is rig4t o% t4e corporation is, o% course, not a*solute/ It cannot e&ercise it %or t4e purpose o% e)ading pa"ment o% ta&es legitimatel" due to t4e State/L CALANOC v CIR <UEN"LE = STREIF3 INC. v CIR FACTS: Petitioner is a domestic corporation engaged in t4e importation o% te&tiles, 4ard$are, sundries, c4emicals, p4armaceuticals, lum*ers, groceries, $ines and liquor? in insurance and lum*er? and in some e&ports/ 94en Petitioner %iled its Income 2a& eturn, it deducted %rom its gross income t4e %ollo$ing items>

TAX LAW REVIEW DIGESTS Montero

Alcisso, Arriola, Cajucom, Calalang, Claudio, Escueta, Delos Santos, Dialino, Fajardo, Imperial, Juaquino, Martin, Martinez, Mendoza, Noel, Pangcog, Plazo osales, Sia, !", #enzuela aso,

+/ salaries, directorsK %ees and *onuses o% its nonFresident president and )iceFpresident? 0/ *onuses o% its resident o%%icers and emplo"ees? and 1/ interests on earned *ut unpaid salaries and *onuses o% its o%%icers and emplo"ees/ 24e CI disallo$ed t4e deductions and assessed Petitioner %or de%icienc" income ta&es/ Petitioner requested %or reFe&amination o% t4e assessment/ CI modi%ied t4e same *" allo$ing as deducti*le all items comprising directorsK %ees and salaries o% t4e nonFresident president and )iceFpresident, *ut disallo$ing t4e *onuses inso%ar as t4e" e&ceed t4e salaries o% t4e recipients, as $ell as t4e interests on earned *ut unpaid salaries and *onuses/ 24e C2A modi%ied t4e assessment and ruled t4at $4ile t4e *onuses gi)en to t4e nonFresident o%%icers are reasona*le, *onuses gi)en to t4e resident o%%icers and emplo"ees are quite e&cessi)e/ ISSUES!RULING: 9:N t4e C2A erred in ruling t4at t4e measure o% t4e reasona*leness o% t4e *onuses paid to its nonFresident president and )iceFpresident s4ould *e applied to t4e *onuses gi)en to resident o%%icers and emplo"ees in determining t4eir deducti*ilit"Q N;/ It is a general rule t4at L(onuses to emplo"ees made in good %ait4 and as additional compensation %or t4e ser)ices actuall" rendered *" t4e emplo"ees are deducti*le, pro)ided suc4 pa"ments, $4en added to t4e stipulated salaries, do not e&ceed a reasona*le compensation %or t4e ser)ices rendered/E 24e condition precedents to t4e deduction o% *onuses to emplo"ees are> +/ t4e pa"ment o% t4e *onuses is in %act compensation? 0/ it must *e %or personal ser)ices actuall" rendered? and

1/ t4e *onuses, $4en added to t4e salaries, are reasona*le $4en measured *" t4e amount and qualit" o% t4e ser)ices per%ormed $it4 relation to t4e *usiness o% t4e particular ta&pa"er 24ere is no %i&ed test %or determining t4e reasonableness o% a gi)en *onus as compensation/ Mo$e)er, in determining $4et4er t4e particular salar" or compensation pa"ment is reasona*le, t4e situation must *e considered as a $4ole/ Petitioner contended t4at it is error to appl" t4e same measure o% reasona*leness to *ot4 resident and nonFresident o%%icers *ecause t4e nature, e&tent and qualit" o% t4e ser)ices per%ormed *" eac4 $it4 relation to t4e *usiness o% t4e corporation $idel" di%%er/ Said nonFresident o%%icers 4ad rendered t4e same amount o% e%%icient personal ser)ice and contri*ution to deser)e equal treatment in compensation and ot4er emoluments/ 24ere is no special reason %or granting greater *onuses to suc4 lo$er ran=ing o%%icers t4an t4ose gi)en to t4e nonFresident president and )ice president/ 9:N t4e C2A erred in allo$ing t4e deduction o% t4e *onuses in e&cess o% t4e "earl" salaries o% t4e emplo"eesQ N;/ 24e deducti*le amount o% said *onuses cannot *e only equal to t4eir respecti)e "earl" salaries considering t4e postF$ar polic" o% t4e corporation in gi)ing salaries at lo$ le)els *ecause o% t4e unsettled conditions resulting %rom $ar and t4e imposition o% go)ernment controls on imports and e&ports and on t4e use o% %oreign e&c4ange $4ic4 resulted in t4e diminution o% t4e amount o% *usiness and t4e consequent loss o% pro%its on t4e part o% t4e corporation/ 24e pa"ment o% *onuses in amounts a little more t4an t4e "earl" salaries recei)ed considering t4e pre)ailing circumstances is in our opinion reasona*le/ 9:N t4e C2A erred in disallo$ing t4e deduction o% interests on earned *ut unpaid salaries and *onusesQ N;/

TAX LAW REVIEW DIGESTS Montero

Alcisso, Arriola, Cajucom, Calalang, Claudio, Escueta, Delos Santos, Dialino, Fajardo, Imperial, Juaquino, Martin, Martinez, Mendoza, Noel, Pangcog, Plazo osales, Sia, !", #enzuela aso,

!nder t4e la$, in order t4at interest ma" *e deducti*le, it must *e paid Lon inde*tedness/L It is t4ere%ore imperati)e to s4o$ t4at t4ere is an existing indebtedness $4ic4 ma" *e su*jected to t4e pa"ment o% interest/ Mere t4e items in)ol)ed are unclaimed salaries and *onus participation $4ic4 cannot constitute inde*tedness $it4in t4e meaning o% t4e la$ *ecause $4ile t4e" constitute an o*ligation on t4e part o% t4e corporation, it is not t4e latterKs %ault i% t4e" remained unclaimed/ 94ate)er an emplo"ee ma" %ail to collect cannot *e considered an inde*tedness %or it is t4e concern o% t4e emplo"ee to collect it in due time/ 24e $illingness o% t4e corporation to pa" interest t4ereon cannot *e considered a justi%ication to $arrant deduction/

Picop $as proper and allo$a*le/ In t4e instant Petition, t4e CI insists on its original position/ ISS!E> 94et4er Picop is entitled to deductions against income o% interest pa"ments on loans %or t4e purc4ase o% mac4iner" and equipment/ MEHD> <ES/ Interest pa"ments on loans incurred *" a ta&pa"er I$4et4er (;IFregistered or not, are allo$ed *" t4e NI C as deductions against t4e ta&pa"erKs gross income/ 24e *asis is +6JJ 2a& Code Sec/ 1G I*,/+ 24us, t4e general rule is t4at interest e&penses are deducti*le against gross income and t4is certainl" includes interest paid under loans incurred in connection $it4 t4e carr"ing on o% t4e *usiness o% t4e ta&pa"er/ In t4e instant case, t4e CI does not dispute t4at t4e interest pa"ments $ere made *" Picop on loans incurred in connection with the carrying on of the registered operations of Picop , i/e/, t4e %inancing o% t4e purc4ase o% mac4iner" and equipment actuall" used in t4e registered operations o% Picop/ Neit4er does t4e CI den" t4at suc4 interest pa"ments $ere legally due and demandable under t4e terms o% suc4 loans, and in %act paid *" Picop during t4e ta& "ear +6JJ/

+

Interest

PAPER INDUSTRIES v CA 6 De-. 93 9>>?7 Facts> ;n )arious "ears I+686, +6J0 and +6JJ,, Picop o*tained loans %rom %oreign creditors in order to %inance t4e purc4ase o% mac4iner" and equipment needed %or its operations/ In its +6JJ Income 2a& eturn, Picop claimed interest pa"ments made in +6JJ, amounting to P@0,7@G,+1+/GG, on t4ese loans as a deduction %rom its +6JJ gross income/ 24e CI disallo$ed t4is deduction upon t4e ground t4at, *ecause t4e loans 4ad *een incurred %or t4e purc4ase o% mac4iner" and equipment, t4e interest pa"ments on t4ose loans s4ould 4a)e *een capitalized instead and claimed as a depreciation deduction ta=ing into account t4e adjusted *asis o% t4e mac4iner" and equipment Ioriginal acquisition cost plus interest c4arges, o)er t4e use%ul li%e o% suc4 assets/ (ot4 t4e C2A and t4e Court o% Appeals sustained t4e position o% Picop and 4eld t4at t4e interest deduction claimed *"

Sec/ 1G/ Deduction from ross Income/ P 24e %ollo$ing ma" *e deducted %rom gross income> &&& &&& &&& I*, Interest> I+, In general/ P 24e amount o% interest paid $it4in t4e ta&a*le "ear on indebtedness, e&cept on inde*tedness incurred or continued to purc4ase or carr" o*ligations t4e interest upon $4ic4 is e&empt %rom ta&ation as income under t4is 2itle> / / / IEmp4asis supplied, 6

TAX LAW REVIEW DIGESTS Montero

Alcisso, Arriola, Cajucom, Calalang, Claudio, Escueta, Delos Santos, Dialino, Fajardo, Imperial, Juaquino, Martin, Martinez, Mendoza, Noel, Pangcog, Plazo osales, Sia, !", #enzuela aso,

24e contention o% CI does not spring o% t4e +6JJ 2a& Code *ut %rom e)enue egulations 0 Sec/ J6/ 0 Mo$e)er, t4e Court said t4at t4e term BinterestE 4ere s4ould *e construed as t4e soFcalled @t,eoret&-%) &ntere$t3@ t4at is to sa", interest LcalculatedL or computed 6%n+ not incurred or paid7 (or t,e #*r#o$e o( +eter2&n&n. t,e @o##ort*n&t/ -o$t@ o( &nve$t&n. (*n+$ &n % .&ven 0*$&ne$$. S*-, @t,eoret&-%)@ or &2#*te+ &ntere$t +oe$ not %r&$e (ro2 % )e.%))/ +e2%n+%0)e &ntere$tA0e%r&n. o0)&.%t&on &n-*rre+ 0/ t,e t%'#%/er $4o 4o$e)er $is4es to %ind out, e/g/, $4et4er 4e $ould 4a)e *een *etter o%% *" lending out 4is %unds and earning interest rat4er t4an in)esting suc4 %unds in 4is *usiness/ ;ne t4ing t4at Section J6 quoted a*o)e ma=es clear is t4at interest $4ic4 does constitute a c4arge arising under an interestF*earing o*ligation is an allo$a*le deduction %rom gross income/ On)/ &( $&r %$B$: 6For (*rt,er +&$-*$$&on o( CIRC$ -ontent&on7 It is claimed *" t4e CI t4at Section J6 o% e)enue egulations No/ 0 $as Lpatterned a%terL paragrap4 +/088F+ I*,, entitled L2a&es and Carr"ing C4arges C4argea*le to Capital Account and 2reated as Capital ItemsL o% t4e !/S/ Income 2a& egulations, $4ic4 paragrap4 reads as %ollo$s> I(, !axes and "arrying "harges / P 24e items t4us c4argea*le to capital accounts are P I++, In t4e case o% real propert", $4et4er impro)ed or unimpro)ed and $4et4er producti)e or nonproducti)e/

Ia, Interest on a loan I*ut not t4eoretical interest o% a ta&pa"er using 4is o$n %unds,/ 24e truncated e&cerpt o% t4e !/S/ Income 2a& egulations quoted *" t4e CI needs to *e related to t4e rele)ant pro)isions o% t4e !/S/ Internal e)enue Code, $4ic4 pro)isions deal $it4 t4e general topic o% adjusted *asis %or determining allo$a*le gain or loss on sales or e&c4anges o% propert" and allo$a*le depreciation and depletion o% capital assets o% t4e ta&pa"er> Present #ule/ 24e Internal e)enue Code, and t4e egulations promulgated t4ereunder pro)ide t4at L$o deduction shall be allowed for amounts paid or accrued for suc4 ta&es and carrying charges as, under regulations prescri*ed *" t4e Secretar" or 4is delegate, are c4argea*le to capital account $it4 respect to propert", if the taxpayer elects, in accordance $it4 suc4 regulations, to treat such ta&es orcharges as so chargeable/L At t4e same time, under t4e adjustment o% *asis pro)isions $4ic4 4a)e just *een discussed, it is pro)ided t4at adjustment s4all *e made %or all Le&penditures, receipts, losses, or ot4er itemsL properl" c4argea*le to a capital account, t4us including ta&es and carr"ing c4arges? 4o$e)er, an exception exists, in which event such ad%ustment to the capital account is not made, with respect to taxes and carrying charges which the taxpayer has not elected to capitali&e but for which a deduction instead has been ta'en/ DD IEmp4asis supplied, 24e Lcarr"ing c4argesL $4ic4 ma" *e capitalized under t4e a*o)e quoted pro)isions o% t4e !/S/ Internal e)enue Code include, as t4e CI 4as pointed out, interest on a loan LI*ut not t4eoretical interest o% a ta&pa"er using 4is o$n %unds,/L 94at t4e CI %ailed to point out is t4at such Lcarrying chargesL may, at t4e election o% t4e ta&pa"er, either be (a) capitali&ed in $4ic4 case t4e cost *asis o% t4e capital assets,

Sec. 79. Interest on Capital. Interest calculated for cost-keeping or other purposes on account of capital or surplus invested in the business, which does not represent a charge arising under an interest-bearing obligation, is not allowable deduction from gross income. (Emphases supplied)

+G

TAX LAW REVIEW DIGESTS Montero

Alcisso, Arriola, Cajucom, Calalang, Claudio, Escueta, Delos Santos, Dialino, Fajardo, Imperial, Juaquino, Martin, Martinez, Mendoza, Noel, Pangcog, Plazo osales, Sia, !", #enzuela aso,

e/g/, mac4iner" and equipment, $ill *e adjusted *" adding t4e amount o% suc4 interest pa"ments or alternati)el", *e (b) deducted from gross income o% t4e ta&pa"er/ S4ould t4e ta&pa"er elect to deduct t4e interest pa"ments against its gross income, t4e ta&pa"er cannot at the same time capitalize t4e interest pa"ments/ In ot4er $ords, t4e ta&pa"er is not entitled to both the deduction from gross income and the ad%usted (increased) basis %or determining gain or loss and t4e allo$a*le depreciation c4arge/ 24e !/S/ Internal e)enue Code does not prohibit the deduction of interest on a loan o*tained %or purc4asing mac4iner" and equipment against gross income, unless t4e ta&pa"er 4as also or previously capitali&ed the same interest payments and t4ere*" adjusted t4e cost *asis o% suc4 assets/

!nder t4e la$, %or interest to *e deducti*le, it must *e s4o$n t4at t4ere *e an inde*tedness, t4at t4ere s4ould *e interest upon it, and t4at $4at is claimed as an interest deduction s4ould 4a)e *een paid or accrued $it4in t4e "ear/ It is 4ere conceded t4at t4e interest paid *" respondent $as in consequence o% t4e late pa"ment o% 4er donorKs ta&, and t4e same $as paid $it4in t4e "ear it is soug4t to *e declared/ 2o sustain t4e proposition t4at t4e interest pa"ment in question is not deducti*le %or t4e purpose o% computing respondentKs net income, petitioner relies 4ea)il" on section 7G o% e)enue egulation No/ 0 I=no$n as Income 2a& egulation, promulgated *" t4e Department o% Finance, $4ic4 pro)ides t4at Lt4e $ord Rta&esK means ta&es proper and no deductions s4ould *e allo$ed %or amounts representing interest, surc4arge, or penalties incident to delinquenc"/L 24e court *elo$, 4o$e)er, 4eld section 7G as inapplica*le to t4e instant case *ecause $4ile it implements sections 1GIc, o% t4e 2a& Code go)erning deduction o% ta&es, t4e respondent ta&pa"er see=s to come under section 1GI*, o% t4e same Code pro)iding %or deduction o% interest on inde*tedness/ ISSUE: 94et4er or not suc4 interest $as paid upon an inde*tedness $it4in t4e contemplation o% section 1G I*, I+, o% t4e 2a& CodeQ RULING: <es/ According to t4e Supreme Court, alt4oug4 interest pa"ment %or delinquent ta&es is not deducti*le as ta& under Section 1GIc, o% t4e 2a& Code and section 7G o% t4e Income 2a& egulations, t4e ta&pa"er is not precluded t4ere*" %rom claiming said interest pa"ment as deduction under section 1GI*, o% t4e same Code/ SEC/ 1G Deductions from gross income/ P In computing net income t4ere s4all *e allo$ed as deductions P I*, Interest>

CIR v VDA DE PRIETO FACTS: ;n Decem*er @, +6@A, t4e respondent con)e"ed *" $a" o% gi%ts to 4er %our c4ildren, namel", Antonio, (enito, Carmen and Mauro, all surnamed Prieto, real propert" $it4 a total assessed )alue o% P760,@6J/AG/ A%ter t4e %iling o% t4e gi%t ta& returns on or a*out Fe*ruar" +, +6A@, t4e petitioner Commissioner o% Internal e)enue appraised t4e real propert" donated %or gi%t ta& purposes at P+,01+,087/GG, and assessed t4e total sum o% P++J,JG8/AG as donorKs gi%t ta&, interest and compromises due t4ereon/ ;% t4e total sum o% P++J,JG8/AG paid *" respondent on April 06, +6A@, t4e sum o% PAA,6J7/8A represents t4e total interest on account o% deliquenc"/ 24is sum o% PAA,6J7/8A $as claimed as deduction, among ot4ers, *" respondent in 4er +6A@ income ta& return/ Petitioner, 4o$e)er, disallo$ed t4e claim and as a consequence o% suc4 disallo$ance assessed respondent %or +6A@ t4e total sum o% P0+,@+G/17 as de%icienc" income ta& due on t4e a%oresaid PAA,6J7/8A, including interest up to Marc4 1+, +6AJ, surc4arge and compromise %or t4e late pa"ment/

++

TAX LAW REVIEW DIGESTS Montero

Alcisso, Arriola, Cajucom, Calalang, Claudio, Escueta, Delos Santos, Dialino, Fajardo, Imperial, Juaquino, Martin, Martinez, Mendoza, Noel, Pangcog, Plazo osales, Sia, !", #enzuela aso,

I+, In general/ P 24e amount o% interest paid $it4in t4e ta&a*le "ear on inde*tedness, e&cept on inde*tedness incurred or continued to purc4ase or carr" o*ligations t4e interest upon $4ic4 is e&empt %rom ta&ation as income under t4is 2itle/ 24e term Linde*tednessL as used in t4e 2a& Code o% t4e !nited States containing similar pro)isions as in t4e a*o)eFquoted section 4as *een de%ined as an unconditional and legall" en%orcea*le o*ligation %or t4e pa"ment o% mone"/ 2o gi)e to t4e quoted portion o% section 7G o% our Income 2a& egulations t4e meaning t4at t4e petitioner gi)es it $ould run counter to t4e pro)ision o% section 1GI*, o% t4e 2a& Code and t4e construction gi)en to it *" courts in t4e !nited States/ Suc4 e%%ect $ould t4us ma=e t4e regulation in)alid %or a Lregulation $4ic4 operates to create a rule out o% 4armon" $it4 t4e statute, is a mere nullit"/L As alread" stated, section 7G implements onl" section 1GIc, o% t4e 2a& Code, or t4e pro)ision allo$ing deduction o% ta&es, $4ile 4erein respondent see=s to *e allo$ed deduction under section 1GI*,, $4ic4 pro)ides %or deduction o% interest on inde*tedness/

BIR RULING NO 55EA55

!axes

CIR v LEDNIC<F

(osses

PAPER INDUSTRIES v CA 6 De-. 93 9>>?7

24e Paper Industries Corporation o% t4e P4ilippines ILPicopL,, is a P4ilippine corporation

registered $it4 t4e (oard o% In)estments IL(;IL, as

a pre%erred pioneer enterprise $it4 respect to its integrated pulp and paper mill, and as a pre%erred non)pioneer enterprise $it4 respect to its integrated pl"$ood and )eneer mills/ In +686, +6J0 and +6JJ, Picop o*tained loans %rom %oreign creditors in order to %inance t4e purc4ase o% mac4iner" and equipment needed %or its operations/ Picop also issued promissor" notes o% a*out P01GM, on $:c it paid P@AM in interest/ In its +6JJ Income 2a& eturn, Picop claimed t4e interest pa"ments on t4e loans as DED!C2I;NS %rom its +6JJ gross income/ 24e CI disallo$ed t4is deduction upon t4e ground t4at, *ecause t4e loans 4ad *een incurred %or t4e purc4ase o% mac4iner" and equipment, t4e interest pa"ments on t4ose loans s4ould 4a)e *een capitalized instead and claimed as a depreciation deduction ta=ing into account t4e adjusted *asis o% t4e mac4iner" and equipment Ioriginal acquisition cost plus interest c4arges, o)er t4e use%ul li%e o% suc4 assets/ I> 9:n t4e interest pa"ments can *e deducted %rom gross income S <ES transaction ta& > 24e +6JJ NI C does not pro4i*it t4e deduction o% interest on a loan incurred %or acquiring mac4iner" and equipment/ Neit4er does our +6JJ NI C compel t4e capitalization o% interest pa"ments on suc4 a loan/ 24e +6JJ 2a& Code is simpl" silent on a ta&pa"erKs rig4t to elect one or t4e ot4er ta& treatment o% suc4 interest pa"ments/ Accordingl", t4e general rule t4at interest pa"ments on a legall" demanda*le loan are deducti*le %rom gross income must *e applied/ In t4is case, t4e CI does not dispute t4at t4e interest pa"ments $ere made *" Picop on loans incurred in connection with the carrying on of the registered operations of Picop, i/e/, t4e %inancing o% t4e purc4ase o% mac4iner" and equipment actuall" used in t4e registered operations o% Picop/ Neit4er does t4e CI den" t4at suc4 interest pa"ments $ere legally due and demandable under t4e

+0

TAX LAW REVIEW DIGESTS Montero

Alcisso, Arriola, Cajucom, Calalang, Claudio, Escueta, Delos Santos, Dialino, Fajardo, Imperial, Juaquino, Martin, Martinez, Mendoza, Noel, Pangcog, Plazo osales, Sia, !", #enzuela aso,

terms o% suc4 loans, and in %act paid *" Picop during t4e ta& "ear +6JJ/ 24e CI 4as *een una*le to point to an" pro)ision o% t4e +6JJ 2a& Code or an" ot4er Statute t4at requires t4e disallo$ance o% t4e interest pa"ments made *" Picop/ 2MIS PA 2 DI T; S!PE MA-E2S> 24e CI in)o=es Section J6 o% e)enue egulations No/ 0 $:c pro)ides t4at Interest calculated %or costF=eeping or ot4er purposes on account o% capital or surplus in)ested in t4e *usiness, which does not represent a charge arising under an interest)bearing obligation , is not allo$a*le deduction %rom gross income/ It is claimed *" t4e CI t4at Section J6 o% e)enue egulations No/ 0 $as Lpatterned a%terL paragrap4 +/088F+ I*,, entitled L2a&es and Carr"ing C4arges C4argea*le to Capital Account and 2reated as Capital ItemsL o% t4e !/S/ Income 2a& egulations, $4ic4 paragrap4 reads as %ollo$s> I(, !axes and "arrying "harges/ P 24e items t4us c4argea*le to capital accounts are P I++, In t4e case o% real propert", $4et4er impro)ed or unimpro)ed and $4et4er producti)e or nonproducti)e/ Ia, Interest on a loan I*ut not t4eoretical interest o% a ta&pa"er using 4is o$n %unds,/ D9

accrued for suc4 ta&es and carrying charges as, under regulations prescri*ed *" t4e Secretar" or 4is delegate, are c4argea*le to capital account $it4 respect to propert", if the taxpayer elects, in accordance $it4 suc4 regulations, to treat such ta&es or charges as so chargeable/L At t4e same time, under t4e adjustment o% *asis pro)isions $4ic4 4a)e just *een discussed, it is pro)ided t4at adjustment s4all *e made %or all Le&penditures, receipts, losses, or ot4er itemsL properl" c4argea*le to a capital account, t4us including ta&es and carr"ing c4arges? 4o$e)er, an exception exists, in which event such ad%ustment to the capital account is not made, with respect to taxes and carrying charges which the taxpayer has not elected to capitali&e but for which a deduction instead has been ta'en/ 24e Lcarr"ing c4argesL $4ic4 ma" *e capitalized under t4e a*o)e quoted pro)isions o% t4e !/S/ Internal e)enue Code include, as t4e CI 4as pointed out, interest on a loan LI*ut not t4eoretical interest o% a ta&pa"er using 4is o$n %unds,/L 94at t4e CI %ailed to point out is t4at such Lcarrying chargesL may, at t4e election o% t4e ta&pa"er, either be (a) capitali&ed in $4ic4 case t4e cost *asis o% t4e capital assets, e/g/, mac4iner" and equipment, $ill *e adjusted *" adding t4e amount o% suc4 interest pa"ments or alternati)el", *e (b) deducted from gross income o% t4e ta&pa"er/ S4ould t4e ta&pa"er elect to deduct t4e interest pa"ments against its gross income, t4e ta&pa"er cannot at the same time capitalize t4e interest pa"ments/ In ot4er $ords, t4e ta&pa"er is not entitled to both the deduction from gross income and the ad%usted (increased) basis %or determining gain or loss and t4e allo$a*le depreciation c4arge/ 24e !/S/

24e truncated e&cerpt o% t4e !/S/ Income 2a& egulations quoted *" t4e CI needs to *e related to t4e rele)ant pro)isions o% t4e !/S/ Internal e)enue Code, $4ic4 pro)isions deal $it4 t4e general topic o% adjusted *asis %or determining allo$a*le gain or loss on sales or e&c4anges o% propert" and allo$a*le depreciation and depletion o% capital assets o% t4e ta&pa"er> Present #ule/ 24e Internal e)enue Code, and t4e egulations promulgated t4ereunder pro)ide t4at L$o deduction shall be allowed for amounts paid or

+1

TAX LAW REVIEW DIGESTS Montero

Alcisso, Arriola, Cajucom, Calalang, Claudio, Escueta, Delos Santos, Dialino, Fajardo, Imperial, Juaquino, Martin, Martinez, Mendoza, Noel, Pangcog, Plazo osales, Sia, !", #enzuela aso,

Internal e)enue Code does not prohibit the deduction of interest on a loan o*tained %or purc4asing mac4iner" and equipment against gross income, unless t4e ta&pa"er 4as also or previously capitali&ed the same interest payments and t4ere*" adjusted t4e cost *asis o% suc4 assets/ BIR RULING 45A55

issued, *eing original issuances, are su*ject to t4e DS2 imposed under Section +JA o% t4e 2a& Code at t4e rate o% P0 on eac4 P0GG, or %ractional part t4ereo%, o% t4e par )alue o% t4e ne$ epu*lic s4ares issued/ 24e net operating losses o% eac4 o% epu*lic, Fortune, MPCC and Iligan are preser)ed a%ter t4e proposed s4are s$ap and ma" *e carried o)er and claimed as a deduction %rom t4eir respecti)e gross income, pursuant to Section 1@ID,I1, o% t4e 2a& Code, *ecause t4ere is no su*stantial c4ange in t4e eit4er epu*lic or Fortune or MPCC or Iligan/L

D&.e$t o( BIR R*)&n. No. 545AD555 +%te+ A*.*$t 953 D555

INCOME TAX; T%'A(ree 2er.er *n+er -ert%&n -on+&t&on F Pursuant to Section @GIc,I0, o% t4e 2a& Code, no gain or loss s4all *e recognized *" (lue Circle P4ilippines, Inc/ I(CPI,, ound o"al, Inc/ I I,, SM In)estment Corporation ISMIC,, S"smart Corporation and C-.E Moldings on t4e trans%er o% t4eir Fortune, Neus and Iligan s4ares to epu*lic, in e&c4ange %or ne epu*lic s4ares, *ecause t4e" toget4er 4old more t4an A+5 o% t4e total )oting stoc= o% epu*lic a%ter t4e trans%er/ 24e trans%er t4roug4 t4e %acilities o% t4e PSE *" t4e 8t4 to t4e last trans%eror o% t4eir Fortune and Neus s4ares to epu*lic in e&c4ange %or ne$ epu*lic s4ares $ill *e su*ject to t4e O o% +5 stoc= transaction ta& *ased on t4e gross selling price or gross )alue in mone" o% t4e s4ares trans%erred, $4ile t4e 8t4 to t4e last trans%eror o% t4e Iligan s4ares $ill *e su*ject to capital gains ta& IC-2, at t4e rate o% A5, o% t4e par )alue o% t4e s4ares trans%erred/ 24e ne$ epu*lic s4ares to *e +@

BIR RULING D5EA>5 24is is letter requesting in *e4al% o% Porcelana Mari$asa, Inc/ IPMI,, a ruling con%irming an opinion t4at t4e %oreign e&c4ange loss incurred *" PMI is a deducti*le loss in +66G/ It is represented t4at PMI is a corporation esta*lis4ed and organized under P4ilippine la$s? t4at it 4as e&isting !S dollar loans %rom Norita=e Compan", Himited INorita=e, and 2o"ota 2sus4o Corporation I2o"ota, in t4e aggregate amounts o% !S UJ,818,8J6/+J and !S U1,GA@,8J+/0J, respecti)el", t4at in +676, t4e parties agreed to con)ert t4e said dollar denominated loans into pesos at t4e e&c4ange rate pre)ailing on June 1G, +676? t4at in Decem*er +676, *ot4 agreements $ere appro)ed *" t4e Central (an= su*ject to t4e su*mission o% a cop" eac4 o% t4e signed agreements incorporating t4e con)ersion? t4erea%ter, dra%ts o% t4e amended agreements $ere su*mitted to t4e Central (an= %or preF appro)al? t4at on Januar" 06, +66G, t4e Central (an= ad)ised PMIKs counsel on t4eir %indings and comments on t4e said dra%ts $4ic4 $ere considered and incorporated in t4e %inal amended agreements? t4at in June +66G, t4e parties su*mitted to t4e Central

TAX LAW REVIEW DIGESTS Montero

Alcisso, Arriola, Cajucom, Calalang, Claudio, Escueta, Delos Santos, Dialino, Fajardo, Imperial, Juaquino, Martin, Martinez, Mendoza, Noel, Pangcog, Plazo osales, Sia, !", #enzuela aso,

(an= t4e signed agreements? t4at counsel o% PMI is o% t4e opinion t4at in t4e case o% PMI, t4e resultant loss on con)ersion o% !S dollar denominated loans to peso is more t4an a s4rin=age in )alue o% mone"? t4at t4e appro)al *" t4e Central (an= and t4e signing *" t4e parties o% t4e agreements co)ering t4e said con)ersion esta*lis4ed t4e loss, a%ter $4ic4, t4e loss *ecame %inal and irre)oca*le, so t4at recoupment is reasona*l" impossi*le? and t4at 4a)ing *een %i&ed and determina*le, t4e loss is no longer suscepti*le to c4ange, 4ence, it could %airl" *e stated t4at suc4 4as *een sustained in a closed and completed transaction/ In repl" t4e commissioner in%ormed PMI t4at t4e annual increase in )alue o% an asset is not ta&a*le income *ecause suc4 increase 4as not "et *een realized/ 24e increase in )alue i/e/, t4e gain, could onl" *e ta&ed $4en a disposition o% t4e propert" occurred $4ic4 $as o% suc4 a nature as to constitute a realization o% suc4 gain, t4at is, a se)erance o% t4e gain %rom t4e original capital in)ested in t4e propert"/ 24e same conclusion o*tains as to losses/ 24e annual decline in t4e )alue o% propert" is not normall" allo$a*le as a deduction/ Mence, to *e allo$a*le t4e loss must *e realized/ 94en %oreign currenc" acquired in connection $it4 a transaction in t4e regular course o% *usiness is disposed ordinar" gain or loss results %rom t4e %luctuation/ 24e loss is deducti*le onl" %or t4e "ear it is actuall" sustained/ It is sustained during t4e "ear in $4ic4 t4e loss occurs as e)idenced *" t4e completed transaction and as %i&ed *" identi%ia*le occurring in t4at "ear/ No ta&ation e)ent 4as as "et *een consummated prior to t4e remittance o% t4e sc4eduled amortization/ Accordingl", PMIKs request %or con%irmation o% opinion $as denied considering t4at %oreign e&c4ange losses sustained as a result o% con)ersion or de)aluation o% t4e peso )isFaF)is t4e %oreign currenc" or !S dollar and )ice )ersa *ut $4ic4 remittance o% sc4eduled amortization consisting o% principal and interests pa"ment on a %oreign loan 4ad not actuall" *een made are not deducti*le %rom gross income %or income ta& purposes/

BIR RULING 9GGAH? I2ec4nicall", t4is ruling 4as no stated %acts/ It just said t4at a request %or ruling dated Jul" +, +67A $as sent to t4e (I %or t4e purpose o% clari%"ing t4e issue, as 4erein stated/,

FACTS: equest to clari%" t4e deducti*ilit" o% %oreign e&c4ange losses incurred *" reason o% t4e de)aluation o% t4e peso/ 24e losses arose %rom matured *ut unremitted principal repa"ments on loans a%%ected *" t4e de*tFrestructuring program in t4e P4ilippines/

ISSUE: 94et4er or not %oreign e&c4ange losses are deducti*le %or income ta& purposes/

ELD: N;/ 24e annual increase in )alue o% an asset is N;2 2AVA(HE INC;ME *ecause suc4 increase 4as not "et *een realized/ 24e increase in )alue, i/e/, t4e gain, could onl" *e ta&ed $4en a disposition o% t4e propert" occurred $4ic4 $as o% suc4 a nature as to constitute a realization o% suc4 gain, t4at is, a se)erance o% t4e gain %rom t4e original capital in)ested in t4e propert"/ 24e a%orementioned rule also applies to losses/ 24e annual decrease in t4e )alue o% propert" is not normall" allo$a*le as a loss/ Mence, to *e allo$a*le t4e loss must *e realized/

+A

TAX LAW REVIEW DIGESTS Montero

Alcisso, Arriola, Cajucom, Calalang, Claudio, Escueta, Delos Santos, Dialino, Fajardo, Imperial, Juaquino, Martin, Martinez, Mendoza, Noel, Pangcog, Plazo osales, Sia, !", #enzuela aso,

94en %oreign currenc" acquired in connection $it4 a transaction in t4e regular course o% *usiness is disposed o%, ordinar" gain or loss results %rom t4e %oreign e&c4ange %luctuations/ 2ME H;SS IS DED!C2I(HE ;NH< F; 2ME <EA I2 IS AC2!AHH< S!S2AINED/ 24us, t4ere is no ta&a*le e)ent prior to t4e remittance o% t4e sc4eduled amortization/

a/ Funds a)aila*le %or P4ile& management agreement? and */

Mining

during

t4e

Compensation to P4ile& Mining $4ic4 s4all *e %i%t" per cent IAG5, o% t4e net pro%it?

Accordingl", %oreign e&c4ange losses sustained as a result o% de)aluation o% t4e peso )isFaF)is t4e %oreign currenc" e/g/, !S dollar, *ut $4ic4 remittance o% sc4eduled amortization consisting o% principal and interests pa"ments on a %oreign loan 4as not actuall" *een made are N;2 DED!C2I(HE %rom gross income %or income ta& purposes/

In t4e course o% managing and operating t4e project, P4ile& Mining made ad)ances o% cas4 and propert" in accordance $it4 t4e agreement/ Mo$e)er, t4e mine su%%ered continuing losses o)er t4e "ears $4ic4 resulted to petitionerKs $it4dra$al as manager and cessation o% mine operations/ 24e parties e&ecuted a LCompromise $it4 Dation in Pa"mentL $4erein (aguio -old admitted an inde*tedness to P4ile& Mining, $4ic4 $as su*sequentl" amended to include additional o*ligations/ Su*sequentl", P4ile& Mining $rote o%% in its +670 *oo=s o% account t4e remaining outstanding inde*tedness o% (aguio -old *" c4arging P++0,+18,GGG/GG to allo$ances and reser)es t4at $ere set up in +67+ and P0,78G,J87/GG to t4e +670 operations/ In its +670 annual income ta& return, P4ile& Mining deducted %rom its gross income t4e amount o% P++0,+18,GGG/GG as Lloss on settlement o% recei)a*les %rom (aguio -old against reser)es and allo$ances/L Mo$e)er, (I disallo$ed t4e amount as deduction %or *ad de*t and assessed petitioner a de%icienc" income ta& o% P80,7++,+8+/16/ I$$*e> 94et4er t4e deduction %or *ad de*ts $as )alidQ e)+> No/ For a deduction %or *ad de*ts to *e allo$ed, all requisites must *e satis%ied, to $it> Ia, t4ere $as a )alid and e&isting de*t? I*, t4e de*t $as ascertained to *e $ort4less? and Ic, it $as c4arged o%% $it4in t4e ta&a*le "ear $4en it $as determined to *e $ort4less/

NOTE: 2o sustain a loss means t4at t4e loss 4as occurred as e)idenced *" a closed and completed transaction and as %i&ed *" identi%ia*le e)ents occurring in t4at "ear/ A closed transaction is a ta&a*le e)ent $4ic4 4as *een consummated/

*ad debts

P ILEX MINING v CIR F%-t$> P4ile& Mining entered into a management agreement $it4 (aguio -old/ 24e partiesK agreement $as denominated as LPo$er o% Attorne"L $4ic4 pro)ided among ot4ers>

+8

TAX LAW REVIEW DIGESTS Montero

Alcisso, Arriola, Cajucom, Calalang, Claudio, Escueta, Delos Santos, Dialino, Fajardo, Imperial, Juaquino, Martin, Martinez, Mendoza, Noel, Pangcog, Plazo osales, Sia, !", #enzuela aso,

24ere $as no )alid and e&isting de*t/ 24e nature o% agreement *et$een P4ile& Mining and (aguio -old is t4at o% a partners4ip or joint )enture/ !nder a contract o% partners4ip, t$o or more persons *ind t4emsel)es to contri*ute mone", propert", or industr" to a common %und, $it4 t4e intention o% di)iding t4e pro%its among t4emsel)es/ Perusal o% t4e agreement denominated as t4e LPo$er o% Attorne"L indicates t4at t4e parties 4ad intended to create a partners4ip and esta*lis4 a common %und %or t4e purpose/ 24e" also 4ad a joint interest in t4e pro%its o% t4e *usiness as s4o$n *" a AGFAG s4aring in t4e income o% t4e mine/ #ie$ed %rom t4is lig4t, t4e ad)ances can *e c4aracterized as petitionerDs in)estment in a partners4ip $it4 (aguio -old %or t4e de)elopment and e&ploitation o% t4e Sto/ Nino mine/ Since t4e ad)anced amount partoo= o% t4e nature o% an in)estment, it could not *e deducted as a *ad de*t %rom petitionerKs gross income/

allo$ing 1 accounts to *e claimed as deductions/ Mo$e)er, +1 supposed B*ad de*tsE $ere disallo$ed as t4e C2A claimed t4at t4ese $ere not su*stantiated and did not satis%" t4e jurisprudential requirement o% B$ort4lessness o% a de*tE 24e CA denied t4e petition %or re)ie$/

ISSUE: 94et4er or not t4e CA $as correct in disallo$ing t4e +1 accounts as *ad de*ts/

RULING:<ES/ (ot4 t4e C2A and CA relied on t4e case o% Collector )s/ -oodric4 International, $4ic4 laid do$n t4e requisites %or B$ort4lessness o% a de*tE to $it> In said case, $e 4eld t4at %or de*ts to *e considered as L$ort4less,L and t4ere*" quali%" as L*ad de*tsL ma=ing t4em deducti*le, t4e ta&pa"er s4ould s4o$ t4at 697 t,ere &$ % v%)&+ %n+ $*0$&$t&n. +e0t. 6D7 t,e +e0t 2*$t 0e %-t*%))/ %$-ert%&ne+ to 0e 1ort,)e$$ %n+ *n-o))e-t&0)e +*r&n. t,e t%'%0)e /e%r; 647 t,e +e0t 2*$t 0e -,%r.e+ o(( +*r&n. t,e t%'%0)e /e%r; %n+ 6G7 t,e +e0t 2*$t %r&$e (ro2 t,e 0*$&ne$$ or tr%+e o( t,e t%'#%/er. A++&t&on%))/3 0e(ore % +e0t -%n 0e -on$&+ere+ 1ort,)e$$3 t,e t%'#%/er 2*$t %)$o $,o1 t,%t &t &$ &n+ee+ *n-o))e-t&0)e even &n t,e (*t*re. Furt4ermore, t4ere are steps outlined to *e underta=en *" t4e ta&pa"er to pro)e t4at 4e e&erted diligent e%%orts to collect t4e de*ts, vi&/> 697 $en+&n. o( $t%te2ent o( %--o*nt$; 6D7 $en+&n. o( -o))e-t&on )etter$; 647 .&v&n. t,e %--o*nt to % )%1/er (or -o))e-t&on; %n+ 6G7 (&)&n. % -o))e-t&on -%$e &n -o*rt. P C onl" used t4e testimon" o% its accountant Ms/ Masagana in order to pro)e t4at t4ese accounts $ere *ad de*ts/ 24is $as considered *" all 1 courts to *e sel%Fser)ing/ 24e SC said t4at P C %ailed to e&ercise due diligence in order to ascertain t4at t4ese

P ILIPPINE REFINING CO v CA FACTS: P4ilippine e%ining Corp IP C, $as assessed de%icienc" ta& pa"ments %or t4e "ear +67A in t4e amount o% around +/7M/ 24is %igure $as computed *ased on t4e disallo$ance o% t4e claim o% *ad de*ts *" P C/ P C dul" protested t4e assessment claiming t4at under t4e la$, *ad de*ts and interest e&pense are allo$a*le deductions/ 94en t4e (I su*sequentl" garnis4ed some o% P CDs properties, t4e latter considered t4e protest as *eing denied and %iled an appeal to t4e C2A $4ic4 set aside t4e disallo$ance o% t4e interest e&pense and modi%ied t4e disallo$ance o% t4e *ad de*ts *"

+J

TAX LAW REVIEW DIGESTS Montero

Alcisso, Arriola, Cajucom, Calalang, Claudio, Escueta, Delos Santos, Dialino, Fajardo, Imperial, Juaquino, Martin, Martinez, Mendoza, Noel, Pangcog, Plazo osales, Sia, !", #enzuela aso,

de*ts $ere uncollecti*le/ In %act, P C did not e)en s4o$ t4e demand letters t4e" allegedl" ga)e to some o% t4eir de*tors/ FERNANDE" Facts> Fernandez Mermanos is an in)estment compan"/ 24e CI assessed it %or alleged de%icienc" income ta&es/ It claimed as deduction, among ot4ers, losses in or *ad de*ts o% Pala$an Manganese Mines Inc/ $4ic4 t4e CI disallo$ed and $as sustained *" t4e C2A/ ERMANOS v CIR

E)en assuming t4at t4ere $as )alid or su*sisting de*t, t4e de*t $as not deducti*le in +6A+ as a $ort4less de*t as Pala$an $as still in operation in +6A+ and +6A0 as Fernandez continued to gi)e ad)ances in t4ose "ears/ It 4as *een 4eld t4at i% t4e de*tor corporation alt4oug4 losing mone" or insol)ent $as still operating at t4e end o% t4e ta&a*le "ear, t4e de*t is not considered $ort4less and t4ere%ore not deducti*le/

Depreciation

BASILAN ESTATES v CIR

Issue> 9:N disallo$ance is correct

LIMPAN INVESTMENT v CIR FAC2S>

Meld> <ES It $as s4o$n t4at Pala$an Manganese Mines soug4t %inancial 4elp %rom Fernandez to resume its mining operations 4ence a Memorandum o% Agreement IM;A, $as e&ecuted $4ere Fernandez $ould gi)e "earl" ad)ances to Pala$an/ (ut it still continued to su%%er loses and Fernandez realized it could no longer reco)er t4e ad)ances 4ence claimed it as $ort4less/ Hoo=ing at t4e M;A, Fernandez did not e&pect to *e repaid/ 24e consideration %or t4e ad)ances $as +A5 o% t4e net pro%its/ I% t4ere $ere no earnings or pro%its t4ere $as no o*ligation to repa"/ #oluntar" ad)ances $it4out e&pectation o% repa"ment do not result in deducti*le losses/ Fernandez cannot e)en sue %or reco)er" as t4e o*ligation to repa" $ill onl" arise i% t4ere $as net pro%its/ No *ad de*t could arise $4ere t4ere is no )alid and su*sisting de*t/

(I assessed de%icienc" ta&es on Himpan Corp, a compan"t4at leases real propert", %or underdeclaring its rental income%or "ears +6A8FAJ *" around P0GT and P7+T respecti)el"/Petitioner appeals on t4e ground t4at portions o% t4eseunderdeclared rents are "et to *e collected *" t4e pre)iouso$ners and turned o)er or recei)ed *" t4e corporation/Petitioner cited t4at some rents $ere deposited $it4 t4e court,suc4 t4at t4e corporation does not 4a)e actual nor constructi)econtrol o)er t4em/24e sole $itness %or t4e petitioner, Solis ICorporate Secretar"F2reasurer, admitted to some undeclared rents in +6A8 and+6AJ, and t4at some *alances $ere not collected *" t4ecorporation in +6A8 *ecause t4e lessees re%used to recognizeand pa" rent to t4e ne$ o$ners and t4at t4e corpDs presidentIsa*elo Him collected some rent and reported it in 4is personalincome statement, *ut did not turn o)er t4e rent to t4ecorporation/ Me also cites lac= o% actual or constructi)e controlo)er rents deposited $it4 t4e court/ ISS!E> 9;N t4e (I $as correct in assessing de%icienc" ta&esagainst Himpan Corp/ %or undeclared rental income

+7

TAX LAW REVIEW DIGESTS Montero

Alcisso, Arriola, Cajucom, Calalang, Claudio, Escueta, Delos Santos, Dialino, Fajardo, Imperial, Juaquino, Martin, Martinez, Mendoza, Noel, Pangcog, Plazo osales, Sia, !", #enzuela aso,

MEHD> <es/ Petitioner admitted t4at it indeed 4ad undeclaredincome Ialt4oug4 onl" a part and not t4e %ull amount assessed*" (I ,/ 24us, it 4as *ecome incum*ent upon t4em to pro)et4eir e&cuses *" clear and con)incing e)idence, $4ic4 it 4as%ailed to do/Issue> 94en is t4ere constructi)e receipt o% rentQ9it4 regard to +6AJ rents deposited $it4 t4e court, and$it4dra$n onl" in +6A7, t4e court )ie$ed t4e corporation as4a)ing constructi)el" recei)ed said rents/ 24e nonFcollection$as t4e petitionerDs %ault since it re%used to re%used to acceptt4e rent, and not due to nonFpa"ment o% lessees/ Mence,alt4oug4 t4e corporation did not actuall" recei)e t4e rent, it isdeemed to 4a)e constructi)el" recei)ed t4em/

Sec/ 1@IM,Il, o% t4e NI C1 speci%icall" mentions Laccredited domestic corporation or associationsL and LnonFgo)ernment organizationsL/ ;n t4e ot4er 4and, su*paragrap4 I0,Ic, o% t4e same Section o% t4e 2a& Code de%ines a LnonFgo)ernment organizationL to mean a nonFpro%it domestic corporation/ In implementing Sec/ 1@IM, o% t4e NI C, +1F67@ $as issued and in relation to t4e t"pe o% entities t4at ma" *e accredited, $4ic4 speci%icall" re%ers to organizations or associations created or organized under P4ilippine la$s/

1

IM, C4arita*le and ;t4er Contri*utions/ P

Depletion

CONSOLIDATED MINES v CTA BIR RULING 9>A59 FACTS: ;n ;cto*er 1, 0GGG, t4e P4ilippine Council %or N-; Certi%ication IPCNC, sent a request %or ruling to t4e (I , mainl" to see= an opinion i% Conser)ation International ICI,, an international organization, can *e granted a donee institution status/ Note t4at CIDs 4ome o%%ice and *oard mem*ers are *ased a*road, 4ence, PCNCDs e)aluation process on go)ernance cannot *e %ull" e&ecuted/ ISSUE: 94et4er or not international organizations $it4 4ome o%%ices a*road are quali%ied to *e granted donee institution status/ ELD: N;/

Il, In -eneral/ P Contri*utions or gi%ts actuall" paid or made $it4in t4e ta&a*le "ear to, or %or t4e use o% t4e -o)ernment o% t4e P4ilippines or an" o% its agencies or an" political su*di)ision t4ereo% e&clusi)el" %or pu*lic purposes, or to accredited domestic corporations or associations organized and operated e&clusi)el" %or religious, c4arita*le, scienti%ic, "out4 and sports de)elopment, cultural or educational purposes or %or t4e re4a*ilitation o% )eterans, or to social $el%are institutions or to nonFgo)ernment organizations, in accordance $it4 rules and regulations promulgated *" t4e Secretar" o% Finance, upon recommendation o% t4e Commissioner, no part o% t4e net income o% $4ic4 inures to t4e *ene%it o% an" pri)ate stoc=4older or indi)idual in an amount not in e&cess o% ten percent I+G5, in t4e case o% an indi)idual, and %i)e percent IA5, in t4e case o% a corporation o% t4e ta&pa"erKs ta&a*le income deri)ed %rom trade, *usiness or pro%ession as computed $it4out t4e *ene%it o% t4is and t4e %ollo$ing su*paragrap4sL/

@

SEC/ +/ De%inition o% 2erms/ P For purposes o% t4ese enumerated s4all 4a)e t4e %ollo$ing meanings>

egulations, t4e terms 4erein

a, LNonFstoc=, nonFpro%it corporation or organizationL P s4all re%er to a corporation or association: organization re%erred to under Section 1G IE, and I-, o% t4e 2a& Code created or organized under P4ilippine la$s e&clusi)el" %or one or more o% t4e %ollo$ing purposes> &&& &&& &&&

*, LNonFgo)ernment ;rganization IN-;,L P s4all re%er to a nonFstoc=, nonFpro%it domestic corporation or organization as de%ined under Section 1@IM,I0,Ic, o% t4e 2a& Code organized and operated e&clusi)el" / / /L

+6

TAX LAW REVIEW DIGESTS Montero

Alcisso, Arriola, Cajucom, Calalang, Claudio, Escueta, Delos Santos, Dialino, Fajardo, Imperial, Juaquino, Martin, Martinez, Mendoza, Noel, Pangcog, Plazo osales, Sia, !", #enzuela aso,

24us, t4e (I opined t4at a nonFstoc=, nonFpro%it corporation or organization must *e created or organized under P4ilippine Ha$s and t4at an N-; must *e a nonFpro%it domestic corporation, t4is ;%%ice is o% t4e opinion t4at a %oreign corporation, li=e Conser)ation International, $4et4er resident or nonFresident, cannot *e accredited as donee institution/

4M P ILIPPINES v CIR F%-t$> 1M P4ilippines, Inc/ is a su*sidiar" o% t4e Minnesota Mining and Manu%acturing Compan" Ior L1MFSt/ PaulL, a nonFresident %oreign corporation $it4 principal o%%ice in St/ Paul, Minnesota, !/S/A/ It is t4e e&clusi)e importer, manu%acturer, $4olesaler, and distri*utor in t4e P4ilippines o% all products o% 1MFSt/ Paul/ 2o ena*le it to manu%acture, pac=age, promote, mar=et, sell and install t4e 4ig4l" specialized products o% its parent compan", and render t4e necessar" postFsales ser)ice and maintenance to its customers, 1M P4ils/ entered into a LSer)ice In%ormation and 2ec4nical Assistance AgreementL and a LPatent and 2rademar= Hicense AgreementL $it4 t4e latter under $4ic4 t4e 1m P4ils/ agreed to pa" to 1MFSt/ Paul a tec4nical ser)ice %ee o% 15 and a ro"alt" o% 05 o% its net sales/ (ot4 agreements $ere su*mitted to, and appro)ed *", t4e Central (an= o% t4e P4ilippines/ t4e petitioner claimed t4e %ollo$ing deductions as *usiness e&penses> Ia, ro"alties and tec4nical ser)ice %ees o% P 1,GAG,8@8/GG? and I*, preFoperational cost o% tape coater o% P6J,@7A/G7/ As to Ia,, t4e Commissioner o% Internal e)enue allo$ed a deduction o% PJ6J,G@8/G6 onl" as tec4nical ser)ice %ee and ro"alt"

%or locall" manu%actured products, *ut disallo$ed t4e sum o% P0,101,A66/G0 alleged to 4a)e *een paid *" t4e petitioner to 1MFSt/ Paul as tec4nical ser)ice %ee and ro"alt" on P@8,@J+,667/GG $ort4 o% %inis4ed products imported *" t4e petitioner %rom t4e parent compan", on t4e ground t4at t4e %ee and ro"alt" s4ould *e *ased onl" on locall" manu%actured goods/ 94ile as to I*,, t4e CI onl" allo$ed P+6,A@@/JJ or oneF%i%t4 I+:A, o% 1M P4ils/capital e&penditure o% P6J,G@8/G6 %or its tape coater $4ic4 $as installed in +6J1 *ecause suc4 e&penditure s4ould *e amortized %or a period o% %i)e IA, "ears, 4ence, pa"ment o% t4e disallo$ed *alance o% PJJ,J@G/17 s4ould *e spread o)er t4e ne&t %our I@, "ears/ 24e CI ordered 1M P4il/ to pa" P7@G,A@G as de%icienc" income ta& on its +6J@ return, plus P1A1,G08/7G as +@5 interest per annum %rom Fe*ruar" +A, +6JA to Fe*ruar" +A, +6J8, or a total o% P+,+61,A88/7G/ 1M P4ils/ protested t4e CI Ds assessment *ut it did not ans$er t4e protest, instead issuing a $arrant o% le)"/ 24e C2A a%%irmed t4e assessment on appeal/ Issue> 94et4er or not 1M P4ils is entitled to t4e deductions due to ro"altiesQ uling> No/ C( Circular No/ 161 I egulations -o)erning o"alties: entals, dated Decem*er J, +6J1 $as promulgated *" t4e Central (an= as an e&c4ange control regulation to conser)e %oreign e&c4ange and a)oid unnecessar" drain on t4e countr"Ks international reser)es I86 ;/-/ No/ A+, pp/ ++J1JF17,/ Section 1FC o% t4e circular pro)ides t4at ro"alties s4all *e paid onl" on commodities manu%actured *" t4e licensee under t4e ro"alt" agreement>

0G

TAX LAW REVIEW DIGESTS Montero

Alcisso, Arriola, Cajucom, Calalang, Claudio, Escueta, Delos Santos, Dialino, Fajardo, Imperial, Juaquino, Martin, Martinez, Mendoza, Noel, Pangcog, Plazo osales, Sia, !", #enzuela aso,

Section 1/ equirements %or Appro)al and egistration/ P 24e requirements %or appro)al and registration as pro)ided %or in Section 0 a*o)e include, *ut are not limited to t4e %ollo$ing> a/ &&& &&& &&&

rentals or ot4er pa"ments required to *e made as a condition to t4e continued use or possession, %or t4e purpose o% t4e trade, pro%ession or *usiness, %or propert" to $4ic4 t4e ta&pa"er 4as not ta=en or is not ta=ing title or in $4ic4 4e 4as no equit"/ Petitioner points out t4at t4e Central *an= L4as no sa" in t4e assessment and collection o% internal re)enue ta&es as suc4 po$er is lodged in t4e (ureau o% Internal e)enue,L t4at t4e 2a& Code Lne)er mentions Circular 161 and t4ere is no la$ or regulation go)erning deduction o% *usiness e&penses t4at re%ers to said circular/L Ip/ 6, Petition/, 24e argument is specious, %or, alt4oug4 t4e 2a& Code allo$s pa"ments o% ro"alt" to *e deducted %rom gross income as *usiness e&penses, it is C( Circular No/ 161 t4at de%ines $4at ro"alt" pa"ments are proper/ Mence, improper pa"ments o% ro"alt" are not deducti*le as legitimate *usiness e&penses/ ESSO STANDARD v CIR FACTS: ESS; deducted %rom its gross income, as part o% its ordinar" and necessar" *usiness e&penses, t4e amount it 4ad spent %or drilling and e&ploration o% its petroleum concessions/ 24is claim $as disallo$ed *" t4e CI on t4e ground t4at t4e e&penses s4ould *e capitalized and mig4t *e $ritten o%% as a loss onl" $4en a Ldr" 4oleL s4ould result/ ESS; t4en %iled an amended return and claimed as ordinar" and necessar" e&penses 2%r.&n (ee$ it 4ad paid to t4e Central (an= on its pro%it remittances to its Ne$ <or= 4ead o%%ice/ 24e CI disallo$ed t4e claimed deduction %or t4e margin %ees paid/ CI assessed ESS; a de%icienc" income ta& $4ic4 arose %rom t4e disallo$ance o% t4e margin %ees/

*/ &&& &&& &&& c/ 24e ro"alt":rental contracts in)ol)ing manu%acturingK ro"alt", e/g/, actual trans%ers o% tec4nological ser)ices suc4 as secret %ormula:processes, tec4nical =no$ 4o$ and t4e li=e s4all not e&ceed %i)e IA, per cent o% t4e $4olesale price o% t4e commodit":ties manu%actured under t4e ro"alt" agreement/ For contracts in)ol)ing Kmar=etingK ser)ices suc4 as t4e use o% %oreign *rands or trade names or trademar=s, t4e ro"alt":rental rate s4all not e&ceed t$o I0, per cent o% t4e $4olesale price o% t4e commodit":ties manu%actured under t4e ro"alt" agreement/ 24e producerKs or %oreign licensorKs s4are in t4e proceeds %rom t4e distri*ution:e&4i*ition o% t4e %ilms s4all not e&ceed si&t" I8G, per cent o% t4e net proceeds Igross proceeds less local e&penses, %rom t4e e&4i*ition:distri*ution o% t4e %ilms/ /// IEmp4asis supplied/, Ip/ 0J, ollo/, Clearl", no ro"alt" is pa"a*le on t4e $4olesale price o% %inis4ed products imported *" t4e licensee %rom t4e licensor/ Mo$e)er, petitioner argues t4at t4e la$ applica*le to its case is onl" Section 06Ia,I+, o% t4e 2a& Code $4ic4 pro)ides> Ia, E&penses/ P I+, (usiness e&penses/ P IA, In general/ P All ordinar" and necessar" e&penses paid or incurred during t4e ta&a*le "ear in carr"ing on an" trade or *usiness, including a reasona*le allo$ance %or salaries or ot4er compensation %or personal ser)ices actuall" rendered? tra)elling e&penses $4ile a$a" %rom 4ome in t4e pursuit o% a trade, pro%ession or *usiness,

0+

TAX LAW REVIEW DIGESTS Montero

Alcisso, Arriola, Cajucom, Calalang, Claudio, Escueta, Delos Santos, Dialino, Fajardo, Imperial, Juaquino, Martin, Martinez, Mendoza, Noel, Pangcog, Plazo osales, Sia, !", #enzuela aso,

ESS; paid under protest and claimed %or a re%und/ CI denied t4e claims %or re%und, 4olding t4at t4e margin %ees paid to t4e Central (an= could not *e considered ta&es or allo$ed as deducti*le *usiness e&penses/ ISSUES: +/ $:n margin %ee is a ta& and s4ould *e deducti*le %rom ESS;Ds gross income/ N; 0/ I% margin %ees are not ta&es, $:n t4e" s4ould ne)ert4eless *e considered necessar" and ordinar" *usiness e&penses and t4ere%ore still deducti*le %rom its gross income/ N;/ ELD: +/ N;/ A margin is not a ta& *ut an e&action designed to cur* t4e e&cessi)e demands upon our international reser)es/ 24e margin %ee $as imposed *" t4e State in t4e e&ercise o% its police po$er and not t4e po$er o% ta&ation/ 0/ N;/ 2o *e deducti*le as a *usiness e&pense, t4ree conditions are imposed, namel"> I+, t4e e&pense must *e ordinar" and necessar", I0, it must *e paid or incurred $it4in t4e ta&a*le "ear, and I1, it must *e paid or incurred in carr"ing on a trade or *usiness/ In addition, not onl" must t4e ta&pa"er meet t4e *usiness test, 4e must su*stantiall" pro)e *" e)idence or records t4e deductions claimed under t4e la$, ot4er$ise, t4e same $ill *e disallo$ed/ 24e mere allegation o% t4e ta&pa"er t4at an item o% e&pense is ordinar" and necessar" does not justi%" its deduction/ ;rdinaril", an e&pense $ill *e considered Knecessar"K $4ere t4e e&penditure is appropriate and 4elp%ul in t4e de)elopment o% t4e ta&pa"erKs *usiness/ It is Kordinar"K $4en it connotes a pa"ment $4ic4 is normal in relation to t4e *usiness o% t4e ta&pa"er and t4e surrounding circumstances/ 24e term Kordinar"K does not require t4at t4e pa"ments *e 4a*itual or normal in t4e sense t4at t4e same ta&pa"er $ill 4a)e to ma=e t4em o%ten? t4e pa"ment ma" *e unique or nonFrecurring to t4e