Professional Documents

Culture Documents

Pryor Company Receives Net Proceeds of

Uploaded by

Aulia HidayatiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pryor Company Receives Net Proceeds of

Uploaded by

Aulia HidayatiCopyright:

Available Formats

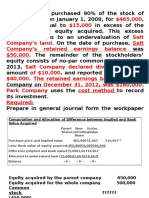

Pryor Company receives net proceeds of $42,000 on the sale of stock investments that cost $39,500.

This transaction will result in reporting in the income statement a: gain of $2,500 under "Other revenues and gains." Assume that Horicon Corp acquired 25% of the common stock of Sheboygan Corp. on January 1, 2011, for $300,000. During 2011 Sheboygan Corp. reported net income of $160,000 and paid total dividends of $60,000. If Horicon uses the equity method to account for its investment, the balance in the investment account on December 31, 2011, will be: $325,000. Using the information in question 6, what entry would Horicon make to record the receipt of the dividend from Sheboygan? Debit Cash and credit Stock Investment Net income is $132,000, accounts payable increased $10,000 during the year, inventory decreased $6,000 during the year, and accounts receivable increased $12,000 during the year. Under the indirect method, how much is net cash provided by operations? Net cash provided by operating activities is computed by adjusting net income for the changes in the three current asset/current liability accounts listed. An increase in accounts payable and a decrease in inventory are added to net income and an increase in accounts receivable is subtracted from net income. The result is: $132,000 + $10,000 + $6,000 - $12,000 = $136,000.

1. Journalize the 2009 transactions and post to the account Stock Investments July 1 Received $1 per share semiannual cash dividend on Pine Co. common stock. Dr Cash $5,000 Cr Dividend revenue/income $5,000 Aug. 1 Received $0.50 per share cash dividend on Hurst Co. common stock. Dr Cash $1,000 Cr Dividend revenue $1,000 Sept. 1 Sold 1,500 shares of Pine Co. common stock for cash at $8 per share, less brokerage fees of $300 Dr Cash $11,700 Dr Loss on sale of investments $1,800 Cr Stock Investments $13,500 (1,500 x cost of $9) Oct. 1 Sold 800 shares of Hurst Co. common stock for cash at $33 per share, less brokerage fees of $500 Dr Cash $25,900 Cr Stock investments $$24,000 ($800 x cost of $30) Cr Gain on sale of investments $1,900 Nov. 1 Received $1 per share cash dividend on Scott Co. common stock. Dr Cash $1,500

Cr Dividend revenue $1,500 Dec. 15 Received $0.50 per share cash dividend on Hurst Co. common stock Dr CAsh $600 Cr Dividend revenue $600 (1,200 shares x $0.50) Dec. 31 Received $1 per share semiannual cash dividend on Pine Co. common stock Dr Cash $3,500 Cr Dividend $3,500 2. Prepare the adjusting entry at December 31, 2009, to show the securities at fair value. The stock should be classified as available-for-sale securities .......... .......... ........... .......Fair value .......... Cost Hurst Co. $32 x 1,200 = $38,400; ..........$36,000 Pine Co. $8 x 3,500 = $28,000; .............$31,500 Scott Co. $18 x 1,500 = $27,000; ..........$30,000 Totals .......... .......... ........$93,400 .......... .$97,500 <== loss of $4,100 Dr Fair value loss in OCI $4,100 (taken to AFS reserve in equity) Cr AFS Stock investments $4,100 3. Show the balance sheet presentation of the investments at December 31, 2009. At this date, Ramey Associates has common stock $1,500,000 and retained earnings $1,000,000 Non-current assets AFS securities $93,400 Stockholders' equity Common stock $1,500,000 AFS reserve ($4,100) Retained earnings $1,000,000 Total $2,495,900

Here are comparative balance sheets for Taguchi Company. TAGUCHI COMPANY Comparative Balance Sheets December 31 Assets 2011 2010

Cash $73,000 $22,000 Accounts receivable 85,000 76,000 Inventories 170,000 189,000 Land 75,000 100,000 Equipment 260,000 200,000 Accumulated depreciation (66,000) (32,000) Total $597,000 $555,000 Liabilities and Stockholders' Equity Accounts payable $39,000 $47,000 Bonds payable 150,000 200,000 Common stock ($1 par) 216,000 174,000 Retained earnings 192,000 134,000 Total $597,000 $555,000 Additional information: 1. Net income for 2011 was $103,000. 2. Cash dividends of $45,000 were declared and paid. 3. Bonds payable amounting to $50,000 were redeemed for cash $50,000. 4. Common stock was issued for $42,000 cash. 5. No equipment was sold during 2011, but land was sold at cost. Are you looking for cash flow. Indirect method Operating Activities 103,000 Net Income + 34,000 Depreciation (66,000 - 32,000) - 9,000 increase in A/R + 19,000 decrease in inventory - 8,000 decrease in A/P = $139,000 cash flow from operating activities Investing Activities + 25,000 sale of land - 60,000 equipment purchase = - $35,000 cash flow from investing activities Financing Activities - 45,000 dividends - 50,000 redemption of bonds + 42,000 stock issue = - $53,000 cash flow from financing activities

139,000 - 35,000 - 53,000 = $51,000 total cash flow 22,000 beginning cash balance + 51,000 = 73,000 ending cash balance

You might also like

- Please: Solutions Guide: This Is Meant As A Solutions GuideDocument12 pagesPlease: Solutions Guide: This Is Meant As A Solutions GuideEkta Saraswat Vig0% (1)

- Chapter 10 and 11 HWDocument4 pagesChapter 10 and 11 HWkanielafinNo ratings yet

- Accounting HW Chapter 15Document4 pagesAccounting HW Chapter 15chiaraar88No ratings yet

- ACC 291 Week 4 ProblemsDocument8 pagesACC 291 Week 4 ProblemsGrace N Demara BooneNo ratings yet

- Problem Sets Finacc Chapter 9Document19 pagesProblem Sets Finacc Chapter 9Reg LagartejaNo ratings yet

- AC 551 Final ExamDocument2 pagesAC 551 Final ExamNatasha Declan100% (2)

- Bab 3 - Soal-Soal No. 4 SD 10Document4 pagesBab 3 - Soal-Soal No. 4 SD 10Vanni LimNo ratings yet

- CH 16Document3 pagesCH 16vivienNo ratings yet

- Accounting II Chapters 12, 13, 14 ReviewDocument10 pagesAccounting II Chapters 12, 13, 14 ReviewJacKFrost1889No ratings yet

- Review Sw4tgession 5 TEXTDocument9 pagesReview Sw4tgession 5 TEXTMelissa WhiteNo ratings yet

- CH 11 Exam PracticeDocument20 pagesCH 11 Exam PracticeSvetlanaNo ratings yet

- ch4 Solution21Document25 pagesch4 Solution21Melinda Amelia0% (1)

- Raihan Rohadatul Aisy 205154055 3B-AC: 1. Bow's Percentage Ownership in Tre 2. GoodwillDocument16 pagesRaihan Rohadatul Aisy 205154055 3B-AC: 1. Bow's Percentage Ownership in Tre 2. GoodwillRaihan Rohadatul 'AisyNo ratings yet

- 6Document5 pages6Carlo ParasNo ratings yet

- Stock Dividend: Date of PaymentDocument6 pagesStock Dividend: Date of PaymentmercyvienhoNo ratings yet

- Chapter 4Document25 pagesChapter 4Anonymous XOv12G67% (3)

- 7Document4 pages7Carlo ParasNo ratings yet

- Translation Exposure Problems ModuleDocument7 pagesTranslation Exposure Problems ModuleAlissa BarnesNo ratings yet

- Soal Latihan 2Document4 pagesSoal Latihan 2Fradila Ayu NabilaNo ratings yet

- AP Lecture SW SheDocument23 pagesAP Lecture SW SheMary Dale Joie BocalaNo ratings yet

- Advanced Financial Accounting and ReportingDocument5 pagesAdvanced Financial Accounting and Reportingaccounting prob100% (1)

- Quiz 2 Chpts 3 4Document14 pagesQuiz 2 Chpts 3 4Jayden Galing100% (1)

- Kuis UTS Genap Lab AKM II DoskoDocument4 pagesKuis UTS Genap Lab AKM II DoskoYokka FebriolaNo ratings yet

- Akl Multiple ChocieDocument6 pagesAkl Multiple ChocieggeumNo ratings yet

- Problem Sets Finacc Chapter 9Document19 pagesProblem Sets Finacc Chapter 9Reg Lagarteja100% (1)

- Intermediate Accounting CH 14 HWDocument5 pagesIntermediate Accounting CH 14 HWBreanna WolfordNo ratings yet

- Latihan Soal Chapter 5 SD 7Document6 pagesLatihan Soal Chapter 5 SD 7Andy warholNo ratings yet

- Crown Corporation Stockholders' Equity PracticeDocument3 pagesCrown Corporation Stockholders' Equity PracticeMeraj Ali100% (1)

- Reading 18 Understanding Income StatementsDocument109 pagesReading 18 Understanding Income StatementsNeerajNo ratings yet

- Be16 P16 2aDocument7 pagesBe16 P16 2aLisa Hammerle ClarkNo ratings yet

- Chapter 14 Review ProblemsDocument6 pagesChapter 14 Review ProblemsMaya HamdyNo ratings yet

- Tarea 3 ParcialDocument13 pagesTarea 3 ParcialMIGUEL ANGEL AGUIRRE VILLANo ratings yet

- (A) Reproduce The Retained Earnings Account For 2012. Solution: Retained Earnings AccountDocument5 pages(A) Reproduce The Retained Earnings Account For 2012. Solution: Retained Earnings AccountQasim KhanNo ratings yet

- Problem Sets Solutions 1 Accounting Statements and Cash FlowDocument5 pagesProblem Sets Solutions 1 Accounting Statements and Cash FlowYaoyin Bonnie ChenNo ratings yet

- Last Assignment (Najeeb)Document7 pagesLast Assignment (Najeeb)Najeeb KhanNo ratings yet

- Chapter 15 SolutionsDocument6 pagesChapter 15 SolutionshappysparkyNo ratings yet

- Tugas Kelompok ke-3 Minggu 8 Case StudyDocument3 pagesTugas Kelompok ke-3 Minggu 8 Case StudyIden PratamaNo ratings yet

- Final TestDocument85 pagesFinal TestRobin MehtaNo ratings yet

- Ac550 FinalDocument4 pagesAc550 FinalGil SuarezNo ratings yet

- Ak 2Document12 pagesAk 2nikenapNo ratings yet

- Practices in Financial Accounting Exercise Corporation/EquityDocument4 pagesPractices in Financial Accounting Exercise Corporation/EquityMOHAMAD ASYRAF BIN AZHARNo ratings yet

- Assignment 4 FA 03062021 102154pmDocument3 pagesAssignment 4 FA 03062021 102154pmMuhammad ArhamNo ratings yet

- Chapter 2 NotesDocument6 pagesChapter 2 NotesZain ZaighamNo ratings yet

- QuizDocument14 pagesQuizYusuf Khan0% (3)

- Advance Accounting Week 2 Homework 1Document3 pagesAdvance Accounting Week 2 Homework 1Nabila Nur IzzaNo ratings yet

- Task AccountingDocument2 pagesTask AccountingQudsia BanoNo ratings yet

- Final Exam: Cpa Exam Questions & Additional ExercisesDocument24 pagesFinal Exam: Cpa Exam Questions & Additional Exercisessino akoNo ratings yet

- Evaluate Earnings Per ShareDocument1 pageEvaluate Earnings Per ShareSivakumar KanchirajuNo ratings yet

- 2024 Becker CPA Financial (FAR) Mock Exam QuestionsDocument19 pages2024 Becker CPA Financial (FAR) Mock Exam QuestionscraigsappletreeNo ratings yet

- Soal Latihan 2 AKL 2ADocument3 pagesSoal Latihan 2 AKL 2ARyza DyandraNo ratings yet

- Practice Quiz - Chap1Document7 pagesPractice Quiz - Chap1Nada MuchoNo ratings yet

- Hope College of Business, Science and Technology Faculty of Business Department of Accounting and Finance Advanced Accounting AssignmentDocument6 pagesHope College of Business, Science and Technology Faculty of Business Department of Accounting and Finance Advanced Accounting AssignmentShumebeza BaylleNo ratings yet

- Dilutive Securities and Earnings Per Share: Learning ObjectivesDocument35 pagesDilutive Securities and Earnings Per Share: Learning ObjectivesAntony OjowiNo ratings yet

- Chapter 4 Problem 32Document9 pagesChapter 4 Problem 32morgan.bertoneNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Finance Fundamentals for Nonprofits: Building Capacity and SustainabilityFrom EverandFinance Fundamentals for Nonprofits: Building Capacity and SustainabilityNo ratings yet

- Microeconomics Chapter 1 OverviewDocument18 pagesMicroeconomics Chapter 1 OverviewSiambeNo ratings yet

- Arbitrage Pricing TheoryDocument13 pagesArbitrage Pricing TheoryWassim Hadji Basher83% (6)

- Quark StoreReceipt PDFDocument1 pageQuark StoreReceipt PDFandrew234edwardNo ratings yet

- Aspeon Sparkling Water, Inc. Capital Structure Policy: Case 10Document16 pagesAspeon Sparkling Water, Inc. Capital Structure Policy: Case 10Alla LiNo ratings yet

- FM Project Report On Zee EntertainmentDocument9 pagesFM Project Report On Zee EntertainmentKumar RohitNo ratings yet

- PDF Proposed Public Market and Transportation Terminal Compress 1 PDFDocument108 pagesPDF Proposed Public Market and Transportation Terminal Compress 1 PDFFello KimNo ratings yet

- Sales Related Marketing PoliciesDocument18 pagesSales Related Marketing Policiesswatimaheshwari0889100% (1)

- Ar T.C Om: EadingDocument8 pagesAr T.C Om: Eadingarun1974No ratings yet

- Bai Tap Chap 7-8Document3 pagesBai Tap Chap 7-8SonNo ratings yet

- Futuresave 62785064660: Summary in Botswana Pula BWPDocument4 pagesFuturesave 62785064660: Summary in Botswana Pula BWPSnr Berel ShepherdNo ratings yet

- Video Title: From Problem Definition To Decision MakingDocument3 pagesVideo Title: From Problem Definition To Decision MakingArun SharmaNo ratings yet

- MCQ'S: Deflation Inflation Recession None of The AboveDocument18 pagesMCQ'S: Deflation Inflation Recession None of The Abovesushainkapoor photoNo ratings yet

- Examples of Fast-Moving Consumer Goods: DiscountsDocument3 pagesExamples of Fast-Moving Consumer Goods: Discountstejaswi mhatreNo ratings yet

- Real Estate Economics: Augusto B. Agosto, Enp, Rea, RebDocument13 pagesReal Estate Economics: Augusto B. Agosto, Enp, Rea, RebAppraiser Philippines100% (4)

- It Implementations and Strategic Alignment of Air AsiaDocument5 pagesIt Implementations and Strategic Alignment of Air AsiaManish SharmaNo ratings yet

- The Economic Times: Jessil Ummer C.ADocument12 pagesThe Economic Times: Jessil Ummer C.AjessilcaNo ratings yet

- 2021 02 Kantar Aldi US Five SlidesDocument8 pages2021 02 Kantar Aldi US Five SlidesEvenwatercanburnNo ratings yet

- Margin Table For Standard and Pro Accounts: ForexDocument18 pagesMargin Table For Standard and Pro Accounts: ForexKenny GayakpaNo ratings yet

- Infolink Uiversity College Dilla Campus Department of Accountig & FinanceDocument4 pagesInfolink Uiversity College Dilla Campus Department of Accountig & FinanceKanbiro OrkaidoNo ratings yet

- One Stock CrorepatiDocument27 pagesOne Stock Crorepatigedosi50% (10)

- EN - Slide C3-KTVM-21 - 22 (SV)Document21 pagesEN - Slide C3-KTVM-21 - 22 (SV)Nguyễn Mỹ ChâuNo ratings yet

- Consumer Behaviour Allen Solly QuesDocument4 pagesConsumer Behaviour Allen Solly QuesSangeeta RaniNo ratings yet

- Business ProposalDocument6 pagesBusiness ProposalErms Delos Santos BurgosNo ratings yet

- Chapter 7 LeveragingDocument32 pagesChapter 7 LeveragingPA NDANo ratings yet

- Berk DeMarzo cf5 PPT 11 AccessibleDocument140 pagesBerk DeMarzo cf5 PPT 11 Accessibleshehry .CNo ratings yet

- Vanraj Case StudyDocument5 pagesVanraj Case StudyrohitdhallNo ratings yet

- Ferrari IPO Valuation Using DCF MethodDocument11 pagesFerrari IPO Valuation Using DCF MethodThe Brain Dump PH100% (1)

- GE3Document16 pagesGE3Aries C. GavinoNo ratings yet

- GFBSM Event BrochureDocument11 pagesGFBSM Event Brochurealoksemail2011No ratings yet

- Decision MakingDocument9 pagesDecision MakingTalhaFarrukhNo ratings yet