Professional Documents

Culture Documents

Grasim

Uploaded by

Bhavini UnadkatOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Grasim

Uploaded by

Bhavini UnadkatCopyright:

Available Formats

o o o o o o o o o o o o o o o o o

Home Company About ICR Subscribe Advertise Print Online Feedback Our Publications Construction World India CW Interiors Construction World Gulf Infrastructure Today Project Reporter Projects Info Equipment India Power Today Construction Tenders Property 200 CW Property Today Project Reporter Digest PRQ InfraNews Indian Cement Review Partners Cement News

Request a quote / free information from our Advertisers

Advertise

Here

[300

600

pixels]

Forecast January

2013 2013

ICR examines and studies the cement, concrete, concrete equipment sector for the coming year. The study was done basically to comprehend and analyse the current state of each sector. Also, ICR bring to you the opinions of dealers, who know the real pulse of the market. The first half of the year 2012 of the cement industry witnessed a sluggish demand and almost the other half felt the cost pressure. In the states like Andhra Pradesh, the year ended on a discouraging note since the prices dipped further by Rs 40-45. However as per the Working Committee report on cement industry suggests that the Government of India plans to increase its investment in infrastructure to US $ 1 trillion in the Twelfth Five Year Plan (2012-17) as compared to US $ 514 billion expected to be spent on infrastructure development under the Eleventh Five Year Plan (2007-12). Further, infrastructure projects such as the dedicated freight corridors, upgraded and new airports and ports are expected to enhance the scale of economic activity, leading to a substantial increase in cement demand. Housing sector and road also provide significant opportunities. The cement demand is likely to be sensitive to the growth in these sectors and also the policy initiatives. Further, capacity addition in cement would continue to be preferably front loaded. It may be desirable to create some excess capacity rather than operate with shortages or supply bottlenecks. Keeping in view the factors responsible for the increasing demand for the sector and the assumptions mentioned below, four lines of projection in the demand for cement up to next 25 years (2027) have been given. The annual average growth in the demand, production and installed capacity of the cement during the period could be within the range of 10-11.75 per cent. The production of cement would be sensitive to the GDP growth and the growth of sectors which are major users of cement. A step up in demand of these sectors could provide some stimulus to the cement sector as well. Assumptions

Base line growth from 2014-15 is kept at assumed GDP growth, or an elasticity of 1.0. The growth is expected to increase by 1 per cent above the base line in scenario 2 assuming NH and SH to be initially covered. In scenario 3, assuming a further increase in growth by 0.5 per cent and in scenario 4 growth is scaled up further by 0.25 per cent. Base Growth kept a little lower than GDP growth in first three years because of pickup in demand may take some time. With all the three expectations being met, growth improves to 10.75 per cent or with an assumed elasticity of roughly 1.2, as against observed elasticity of 1.07 during 12th Plan and further to 11.75 per cent in the next 10 years. Elasticity tapers off to 1.175. 12 The Task Force for the 11th Plan for the Cement sector also mentioned that the concrete roads, besides providing an excellent surface, enjoy a lower life cycle cost. In the current scenario, however, concrete roads enjoy an initial cost advantage as well. 2012 a mixed bag The year 2012 for the cement industry was full of controversies. Be it the issue of catelisation, wherein the 11 cement giants were penalised with a mammoth amount of Rs 6,304 crore or the reduction in prices of cement by the end or the year. The cement market was volatile and slowed signs of improvement. The acquisition of Calcom in the beginning of the year and Adhunik in September 2012 by Dalmia proved that consolidation remains the key for the cement business. By the end of the year they increased their stake in Calcom by 26 per cent. Expressing his opinion on the market scenario in the year 2012, Jagdeep Verma, Head- Business Consulting, Holtec Consulting said, The good news was that cement consumption grew by 8 per cent, despite a slowdown in GDP growth. Retail prices too increased by an average 6-7 per cent over the last year, though there were large price fluctuations in some states and key consumption centres on account of consumptionsupply imbalances. The price increase enabled most producers to offset the increased cost of inputs, significant offenders being fuel and logistics. He further explained the negative side of the sector. On the flip side, industry sentiment was adversely affected, not only by the penalty proposed by the Competition Commission of India, but also by general economic sluggishness, the current prevalence of market surplus, high

borrowing rates/ poor liquidity conditions in user segments, difficulties faced in land acquisition/ procuring environmental clearances and ambivalent perceptions regarding the emerging politico-economic scenario. All this manifested itself in a reining in of capacity addition initiatives. Firms with high costs pressures are opening up to M&A possibilities and PE funding in order to smoothen their cash flow obligations. However Prakash Raja, the Committee Member of Cement Dealers Stockist Association feels that on one hand where there was a hike in cement prices, on the other hand, the demand that showed signs of pick up never really caught on, which brought a lot of volatility in the market. We have seen cement companies, which have been region specific for almost decades, now venturing out in hunt for newer markets. Consequently, a mini price war was witnessed this year. In fact the rates are still far from being stable. Since many construction companies do not utilise input Value Added Tax (VAT) credit, they prefer buying material against C-form, ensuring concessional rate of Central Sales Tax (CST) and consequently, lowering of input costs. This has made it worthwhile for the new market seeking companies to do business across states, without really breaking the bank. The slump has impacted their business in a threefold manner. Jugal Raja, Kings Trade Links said that the slump has a threefold effect on the dealers. Higher borrowing costs, higher prices of cement and elongation of credit period offered to the buyers are the three negatives that have ensured that most of our revenues are literally wiped out. To illustrate, if we take the cement price hike on a smoothened average basis to be Rs.40, the cost of borrowings rise at 2.5-3 per cent per annum and the elongation of credit period on an average by 40-60 days, the income remaining constant, one can imagine the impact on the margins. Given the slow down and overall sluggishness, lowering volumes have made this worse than it looks. Many dealers have been raising their voice against the stagnant commission and pass-on since the last 5 years. Although the prices of cement have risen, the absolute value of dealers pass-on has been kept constant by the manufacturers, citing growth in volumes to be enough to compensate the dealers. Now that there is slow down, there is a strong case for the hike in dealers margins, albeit only at the manufacturers discretion. Even the concrete equipment sector witnessed severe disappointment.

Anand Sundaresan, Managing Director, Schwing Stetter said that the entire industry went through a bad phase and the concrete equipment industry was no exception to that which led to drop in their numbers. Talking about the percentage in slouch he said,It will be very difficult to talk about by what percentage has our business gone down since the Finance Minister is also trying his level best to improve the sector by introducing new policies which might work out and we might be in a better position. Recently Lucky Cement, Pakistans largest cement manufacturer was keen on setting up a cement plant in India. Generally cements from Pakistan are said to be of a cheaper rate and of a better quality. But Jugal Raja, Dealer, Kings Trade Links believes that India being the second largest producer of cement in the world is producing almost three times the total output of the third largest producer Iran. We firmly believe there is no case, be it quality or affordability that makes our economy open up to such imports, more so when such notorious activities have been unearthed. If the pricing is so enticing, there must be a reason for it. We see it and its high time the end users as well as the authorities see it. This may sound like a very Nationalist and even slightly jingoistic view, but imagine where cement companies from South of India are finding it difficult in terms of costs to move the material to areas such as Mumbai at Rs 270 per bag, how would it be a profitable affair for an economy such as Pakistan which is surviving on external aid to push it from longer distances at Rs 220 per bag. Challenges With the mismatch of demand and supply faced by the cement industry is expected to encounter with a lot of challenges, which will further impact all the related industries. According to Sundaresan, the major challenge faced by the equipment manufacturing sector is substantial increase in input costs due to a hike in commodity prices, increase in interest rates, increase in employee and power costs and almost an increase of 25 per cent in the dollar exchange rate between April 2011 and average exchange rate in the year 2012. Whilst Verma feels that the cement industry will face a series of challenges like dwindling natural resources, cost reduction, optimisation of logistics, acute shortage of domestic coal and the increase in costs and gestation period. Shortage of natural resources is a serious cause of

concern. Among these, limestone, fossil fuel and water, if not conserved, could definitely inhibit the long term growth of the industry. The onus of conservation, till now, has generally been technology-based and, therefore, largely driven by equipment suppliers. Wasteful practices need much higher attention and cement producers must pick up the baton on directly arresting these in the course of normal operations. He further said that the life of limestone reserves being limited to the next 40 years or so, initiatives to use poorer grades appear imminent; despite conventional wisdom, high quality limestone imports are, possibly, inevitable. Cost reduction will be another issue which is expected to dominate the upcoming two to three fiscals. The biggest costs in cement business are energy and logistics, thus adequate attention has, only been recently directed at one of the largest components of delivered cost, viz. input and output freight. Given the acute shortage of domestic coal and the increase in costs in imported coal, alternate fuels would continue to receive enhanced attention and could provide 7-10 per cent of the total thermal fuel requirements by FY 2015-16. The usage of gas, especially in plants enjoying logistical proximity to gas resources, could well become a reality. While Greenfield plants would setup captive power plants to ensure reliable power supply, the existing plans would consider use of alternative fuels and also installation of Waste Heat Recovery systems to keep costs under control Verma further explained, An analysis of the components of the final delivered cost of cement shows that 40 per cent is constituted by production costs, 25 per cent by the transport costs of inputs and outputs and 35 per cent by direct and indirect taxes. Optimisation of transportation logistics, spanning modes, nodes and routes, is thus an area deserving a higher degree of focused attention. The potential for reducing costs in non-equipment related domains, e.g. material inventories, consumable consumption rates and tariffs, financial expenses, etc. has still not been adequately harnessed. Also with the pre-project activities, such as land acquisition and statutory clearances, being expected to consume more time, the gestation period in the future is likely to be in the range of 5-7 years. Industry players could attempt to bring down actual construction time by employing more steel in civil engineering structures. According to SN Subrahmanyan, Member of the Board and Sr. EVP (Infrastructure & Construction), L&T Construction, the cement equipmeny

industry is also going through alot of changes. The current focus is on savings in energy consumption and emission control methods, with stringent pollution control norms which are tightened day by day and the introduction of PAT (Perform, Achieve and Trade) scheme. Cement manufacturers are expected to operate their plant in optimised conditions all the time. Power availability is also a key factor that affects cement plant operations. Clients are looking for equipment which reduces energy, fuel consumption, and effective utilisation of waste heat. Due to this trend waste heat recovery systems and alternate fuel firing systems have become common requirements in cement plant tenders. Regarding future trends: In India Municipal Waste Firing (MWF) in cement plants is an area with great potential but still underutilised. The reason for that is nonhomogeneity and lack of continuous availability of the wastes. This irregularity creates fluctuations in the cement process and causes undesirable emission levels, increase in energy consumption patterns and also affects clinker quality. Every state should have waste collection centres to ensure continuous supply of wastes to cement plants. Substantial research is required to develop municipal waste firing systems suitable for Indian conditions considering mode of transport and hygiene. Existing designs are predominantly based on western country municipal wastes, but the wastes generated in western countries are quite different from the municipal wastes generated in Indian cities due to cultural differences. This change in type of waste impacts the system performance and firing rate. Availability of municipal waste is also inconsistent in India. If flexible firing systems are developed then Municipal wastes can be substituted for fossil fuels by 20-30 per cent. Currently cement plants are able to substitute only 5-15 per cent of waste for fuel fired in the system due to above said reasons. We believe with increasing coal prices and non-availability of power may encourage more cement plant clients to prefer municipal waste firing systems in the near future. Government intervention With over 200 major construction projects pending in India, the entire construction industry is suffering with losses. First and the f oremost, the government should push investment in infrastructure projects, and bring in whatever policies changes that are necessary to speed this up and make it investment friendly, said Sundaresan. The other hindrance faced by the

industry is most road contractors talk about land acquisitions as one of the major bottlenecks for speedy completion of projects. Definitely, this issue has to be addressed, which is pending for quite some time. Coming to the equipment industry he commented, Concerning the equipment industry, the government should bring in similar kind of sops like what was done during the budget 2009, i.e., reduction in excise duty for capital equipments. In addition to that, we have other usual grievances like abolition of entry tax, GST, Uniform Tax Policy, etc. Even the dealers are of the opinion that the Government needs to clearances to the pending projects. We require only one support and that is the clearing of proposed and further issuance of quality projects which will help build a new India. The money injected will churn into the economy fastest through this route as we have witnessed in the past. To supplement this, we believe India has a top-notch infrastructure funding mechanism in the form of multiple lending institutions. Perhaps, easing of certain eligibility criteria will do a host of good. He further added, Maybe, a different, more ambitious projects centric version of IDFC is the need of the hour. Also, as mentioned earlier, there is disparity among VAT and concessional rate of CST for end-users not utilising input VAT to pay output VAT. This disparity should be mitigated with the introduction of GST as early as possible. At a general level, the industry would like stable economic policies and lowering of interest rates leading to positive growth sentiments and increase in GDP, GFCF and thereby construction related investment. This would enable the industry to systematically plan its capacity expansions and focus on ways to meet cement demand. At an industry level, cogent policies to own mines and coals blocks, as also those associated with land acquisition, would be desired. This would facilitate ease of setting up cement plants within acceptable gestation periods, generate acceptable returns to stakeholders and keep debt related cash outflows lowin turn downward inflowing cement prices. According to Verma, A regulatory body to ensure adherence to India Standards by all concrete producers (commercial and captive) would help the industry to ensure quality concrete is made available to all end users. With such an intervention, the industry could then further educate its customers on concrete production and usage. Malpractices followed by small-scale concrete producers would come to an end and prices narrow

down within an acceptable band. This could impel more cement producers to forward integrate into the RMC industry and serve their customers better. Also for the dealers logistics remains the biggest challenge for the year 2013. Mumbai, (which is considered a separate region altogether, giving exclusivity to this market, separate from the rest of the Western region) has the threshold logistical permissibility of 750,000- 800,000 metric tonne a month. With rising demand in satellite areas and the ambitious projects waiting in the flanks, there is consensus that this constraint be dealt with. Same goes for Bangalore and even for some up and coming tier-two cities such as Mangalore and Bhopal, where demand has been robust. Another challenge that the industry faces is really something which is not in control of the industry, viz, the log-jam of various projects, both private and state/central funded. This log-jam is expected to be cleared out before the last budget of the UPA-2 on a populist count. Be that as it may be, the opportunity for the cement industry is huge, considering that the Indian growth story is still very much intact. Forecast 2013 Most of the industries related to cement are expecting a sluggish year ahead. For the concrete equipment industry the year is expected to grow marginally. Even though the government is bringing in a lot of policy reforms and steps for improving the economic growth, the award of contracts will take some time. Besides that, concreting comes at a much later stage, i.e. after excavation or earth moving. Therefore, for the concreting equipment industry, I feel 2013 will be a flat year or it will be with a marginal growth, said Anand. To combat the same the company is all set to launch new equipment in the upcoming bCIndia 2013. Cement consumption is expected to sustain in the range of 8-9 per cent, taking estimated cement consumption in FY 2013 from around 260 mio t to 280-285 mio t in FY 2014. Due to public perceptions of high cement prices, cement demand (not to be mistaken with consumption) would remain unfulfilled. Producing affordable cement without compromising the quantum (not per cent) of EBIDTA is possibly the one major initiative that would possibly dwarf all other initiatives. This would necessitate the harnessing of technology, amending operating practices and modifying customer mindsets. The net effect could be significant increase in customer base and consequentially

a mini-explosion in the size of the cement market pie. There is also a strong likelihood of players announcing greenfield capacity additions, in order to ensure plants are operational by the time cement consumption overtakes capacity (FY 2018). Possible pre-conditions for these announcements to be translated into action would include a lowering of interest rates and expeditious action on statutory clearances. The likelihood of PE Firms playing a higher role to fund the cash-strapped companies would increase. M&A activities are also likely to accelerate, particularly with larger cement players having an opportunity to acquire plants under financial pressures. Capacities would most probably exchange ownership if the agreed valuation is in the range of USD 145-165/ t. On the technology front, efforts to utilise Alternative Fuels and install Waste Heat Recovery are initiatives which are likely to become much more widespread. For the dealers the summer of 2013 is touted to be the start of the new bull run for the entire infra space. With both, the Holcim group (ACC and Ambuja) and Aditya Birla group (Ultratech) having the right arsenal in place in the form of increased capacities, and with the other upcoming brands, the total tally of consumption in cement will see a huge pick up owing to moderated base of last two years. There were times when demand would be so high that companies were compelled to allocate the total arrivals in preference of consumer loyalty and buying patterns. We believe that wont happen in the next bull run since the easing of logistical situation backed by the expansion of capacity has taken place since then. Thus only time will show that if the industry will regain its old pace or will deteriorate further. CEMENT The word Cement has come from the Roman word Opus Caementicium. In general, theword cement means binder- a substance, which when gets set and hardens, binds itself independently with other substances. Joseph Aspdin, a British stonemason, invented cement way back in 1824.(Portland Cement Association 2010) INTRODUCTION TO THE INDIAN CEMENT INDUSTRY In 1914, the first licensed cement-manufacturing unit in India was set-up by the IndiaCement Company Ltd. With the boom in the economy-growth rate of India,

the cement industryis seeing a great future. India has now become the second largest cement producer in the worldafter China, with a total capacity of 151.2 Million Tones, contributed by around 125 large and300 mini cement plants. Further growth in the Indian cement industry is expected in the comingyears. It is expected that by FY12, the cement production capacity will rise upto 262.61 MillionTones.The cement industry in India is dominated by around 20 companies, some of the major Cement players in India

Porters 5 FORCES FRAMEWORK 1. RIVALRY AMONG EXISTING PLAYERS (High) The Indian cement industry has large number of cement producers thus making it a lowconcentration market. The four biggest cement players in the Indian cement industry are:1 . A C C L t d 2 . G r a s i m C e m e n t 3 . A m b u j a C e m e n t 4 . U l t r a t e c h C e m e n t The market share of the abovementioned four companies accounts to 39.80% currently. It is believed that if these four companies do not increase their market share in the coming years, thentheir combined share could drop to 34%. The share of mid-large players (like Shree Cement,Madras Cement, India Cement) will remain about 36%, small players (like My Home IndustriesLtd, Orient, Binani) will hold about 24%, and new players (like Reliance, Murli Agro, JSWCement) will account for 6% of the marketWith focus on capacity addition, many small/medium players have been able to capture moremarket share and consolidate their position in the industry in the last two years. Market share of top five individual companies taken together show a decline to a level of 44.3% in FY09 from46.3% in FY08(Bharat Book Bureau 2004).

INDIAN CEMENT INDUSTRY LIFE CYCLE Looking at the current scenario, the Indian cement industry is at its growth stage. With asmany as four new foreign players having entered the Indian cement market and two-threeexpected to come in the near future, the competition is expected to get tougher. The Indiancement industry has witnessed a phenomenal capacity addition to the tune of about 52 milliontonnes in the last two financial years which

accounted for about 24% of the industrys capacityof 218 million tonnes at the end of FY09. In the last two financial years, the cement industry hasregistered a double-digit growth in capacity addition compared to moderate growth of 37%registered during period FY 03-07.Apart from large multi national cement companies entering the Indian industry, thenational players may have to face further competition from imported cement. Till date, import of cement in India is not allowed, but to check the price rise and control the increasing demand,Government of India is planning to start cement trading with countries like Pakistan, etc. 13

Scenario 1: The future of Indian Cement Industry is expected to see more of global cement players enteringthe market. The growth of Indian cement industry has been very impressive in the last 6 yearsFY03-09 and is expected to improve in the future, thus attracting big global cement giants toenter the business. As a result, I feel in the coming 10 years many Indian small cementcompanies will either sell off their cement business or will enter into a joint venture with theglobal players like Lafarge, Holcim etc. There is no doubt that in another decade, India will become the leading cement producing country in the world, with global and new local players(like Reliance Cementation) fighting for their market share. Scenario 2: As per 2008 records, there is only 5-6% use of Ready Mix Concrete in India, which is far lesser than developed countries like Japan and U.S.A where RMC is being used in almost 70-80% of construction.Looking at the current situation, since setting up a RMC plant is not huge capital intensive, a lotsmall business entrepreneurs are setting up their own private RMCs. Currently, they are facing alot difficulties in running them due to high shortage of cement in India. Inspite of havingcontracts with cement manufacturers, they are not getting the regular supply.Future, in India, seems to be of branded Ready Mix Concrete business, where cementmanufacturers set up their own RMC plants. They will not have raw material shortage sincecompanies can create reserves for their own RMCs, which will give them more realization thanselling just cement bags. A lot of companies like Ultratech Cement, Lafarge Cement etc. havealready moved into the RMC segment as well. Scenario 3: I assume that in the next 10 years, Indian Cement industry will witness a drastic change, which ithas never seen in the past. I feel that, like OPEC dominates the oil market of the world, Indiancement manufacturers will also form a group to dominate the cement marketing, distribution andmost importantly prices (Cartelization) in order to fight the upcoming foreign competition in thecountry. 14

Thus, according to me, SCENARIO 2 seems to be most promising for the future. Infrastructurecompanies always want to finish off their projects as soon as possible, they would also prefer buying RMC instead of following the old method. Therefore, future of the cement industry ismore likely to shift to Ready Mix Concrete. It is very difficult for new foreign players to enter the market, as the existing cement payers will definitely and very strongly resist their entry; thusruling out scenario 1. Scenario 3 is unlikely to occur because Cartelization is illegal, against theconsumers and shall be resisted strongly by the Government

INDIAN CEMENT INDUSTRY: CAN ULTRATECH BE THE NEXT MARKET LEADER?

Student Contributors:Arjun R Kannan, Debabrata Ghosh, Manaw Mohan, Priyank Dutt Dwivedi, Rahul Raj Jain

This article analyzes UltraTech's present position in the market and its strategies to enhance its presence in the cement industry. An industry analysis followed by the resource based view of UltraTech highlights UltraTech's strengths and areas of improvement. Thereafter, a financial comparison of UltraTech with its main competitor ACC provides an insight into its cost structure. Through in depth analysis, this article seeks to provide specific recommendations on what UltraTech must do in order to achieve market leadership.

Cement demand in India has increased due to the increasing expenditure by the Indian government in infrastructure. As a result, the participation of larger companies in the sector has also increased. There are a total of 125 large cement plants and more than 300 small cement plants operating in the country presently. The cement industry is a homogenous industry with similar nature of raw materials, rising power costs, similar manufacturing and processing units. The nature of the product makes it difficult for any player to differentiate in order to corner a large share of the market. This leads to low margins and makes the industry unattractive. On 17 June 2003, the Aditya Birla Group (ABG) acquired management control of L&T Cement and renamed it UltraTech. The acquisition brought in new competitive dynamics. The company has since grown rapidly. It is currently the second largest cement producer and is third in terms of profitability.

The Cement Industry

The cement industry is an interesting one to analyze as on one hand the similarity of raw materials and processing units makes differentiation difficult, while on the other hand large companies are acquiring smaller ones, changing industry dynamics. Competitors: The Indian cement industry has a large number of fragmented firms. There is also a dearth of new players as incumbents have already procured key raw material sources, like

limestone reserves on long-term leases. Further, large firms are continuously consolidating by acquiring smaller ones that find it difficult to attain minimum efficient scale of production. Product: Cement is a bulk commodity and a low value product. It is sold in 50 kg packs as OPC grade 33, 43, and 53. It is used in all construction activities as a primary constituent of concrete. Due to similar raw material inputs and production processes, there is no significant differentiation in the cement produced across firms. Environmental Issues: Greenhouse gas emissions from cement manufacturing pose a serious environmental threat. Currently, the cement industry generates 5% of India's total carbon-dioxide emissions.2 With stringent emission norms, the production process needs to be made environmentally sustainable. The cost of implementing new production processes that help reduce emissions can be offset by trading certified emission reductions (CERs). CERs are a component of national and international emissions trading schemes, implemented through Clean Development Mechanism (CDM) projects, in an attempt to mitigate global warming. 3 Credits obtained through implementation of such projects can be traded in international markets. Having studied the cement industry and identified the main issues facing the firms, we engage in an in depth analysis of the firm's resources to identify the sources of sustainable competitive advantage

UltraTech's Sources of Competitive Advantage

4,5

The key players in the cement market are Holcim Group, Lafarge Group, ACC and J K Cement. ABG that possessed the Grasim cement unit acquired management control of L&T cement in the year 2003. The acquisition of L&T Cement (later named as UltraTech) turned the group into one of the largest players in the market. Value chain analysis helps in identifying sources of competitive advantage in a systematic manner, and thus we use this framework. The cement industry value chain comprises (1) sourcing of raw materials and fuel from quarries and mines (2) the manufacturing process, and (3) distribution of the product to the markets. The sources of competitive advantage identified for UltraTech are: UltraTech's capabilities in identifying, and leasing, higher quality raw material quarries results in significant cost savings for them. Sourcing of Raw Materials: UltraTech's greatest strength is its raw material sourcing. Limestone quarries are usually leased from the government on a long-term basis (usually at least 25-30 years). UltraTech's capabilities in identifying, and leasing, higher quality raw material quarries results in significant cost savings for them. This source of long-term competitive advantage is due to their people skills which aid in identifying the sources and their terms of leasing which lock in these resources for the long term. Clearly, this resource is valuable and rare. Fuel used in Manufacturing Process: The manufacturing process offers no distinct competitive advantage to UltraTech or its largest competitor ACC, though ACC enjoys lower fuel cost. However, this is not sustainable, and since UltraTech has already started switching to coal, ACC's advantage is likely to be neutralized in the near future.

Financial and Human resource advantage: UltraTech, being a part of the Aditya Birla Group, has access to the deep pockets of its promoters, as well as human capital of the highest quality. While financial resources may be rare and inimitable, non-substitutability is debatable. Evidence suggests that in the long term others like the Holcim group can match the financial resources of ABG.6 Higher quality of human capital might be more valuable in the long run, and given their astute knowledge of the Indian market, ABG might be able to leverage this resource better than their foreign counterparts. A final point to note is that UltraTech has higher operating leverage than ACC. This by itself is neither a source of competitive advantage nor a disadvantage. In the long run, the gains during the 'up' years will be smoothened by the 'down' years of the cement cycle.

UltraTech V/s ACC - A Financial Analysis

7,8

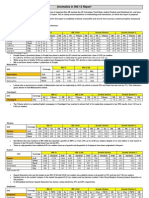

The objective of this financial analysis is to identify specific advantages enjoyed by UltraTech visa-vis its major competitor ACC, their relative magnitude and sustainability. The last few years of this decade have been good for cement companies as prices have remained high, and hence profits have been good.9 In the same period, UltraTech and ACC have shown the same trends of increasing sales growth and capacity utilization although UltraTech has done marginally better, and succeeded in closing the gap with its rival. In a post-mature industry such as cements, first movers' advantage in terms of differentiated products is easily negated thereby necessitating the need for Ultratech to establish itself as a cost leader. The cement industry is a "post-mature" industry - an old industry where change is slow and marginal, first movers' advantage in terms of differentiated products is minimal and any advantage is likely to be fleeting and parity would be restored soon enough. In such an industry, the only way for UltraTech to be the number one is to be a cost leader. Thus, it is imperative to analyze the cost advantages, which ACC and UltraTech have relative to the each other. A detailed analysis of the cost structure (Exhibit 1) reveals stark differences between ACC and UltraTech in raw material and power costs. A comparison of raw material costs showed that UltraTech had a huge advantage (nearly double) over ACC due to greater access to better quality quarries. For the same quantity of cement produced, UltraTech spent less on mining, and got better quality limestone, than ACC. A comparison of power costs revealed a different picture with ACC enjoying a cost advantage over UltraTech. This is due to the higher cost of Naphtha and Fuel Oil based Power Plants used by UltraTech (in addition to coal fired plants) while ACC used only coal based plants. UltraTech wanted to spread the risks of prices and availability of fuel, but the strategy backfired as coal remained a much cheaper alternative (detailed cost breakups shown in Exhibit 1).

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Transport Management MCQ Question BankDocument7 pagesTransport Management MCQ Question BankDEBABRATA BANERJEE71% (17)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Tagros Notice Toi Surat 14Document1 pageTagros Notice Toi Surat 14Bhavini UnadkatNo ratings yet

- Baroda Dairy (Prom)Document22 pagesBaroda Dairy (Prom)Bhavini UnadkatNo ratings yet

- Tagros Toi Notice Ad 14Document1 pageTagros Toi Notice Ad 14Bhavini UnadkatNo ratings yet

- Tagros Toi Notice Ad 14Document1 pageTagros Toi Notice Ad 14Bhavini UnadkatNo ratings yet

- Lions School Toi Ad 14Document1 pageLions School Toi Ad 14Bhavini UnadkatNo ratings yet

- Gujarat Guardian Ltd Tender Notice for TransportersDocument1 pageGujarat Guardian Ltd Tender Notice for TransportersBhavini UnadkatNo ratings yet

- Comparative Analysis of The Home Loan of Sbi in Bharuch: Prepared byDocument14 pagesComparative Analysis of The Home Loan of Sbi in Bharuch: Prepared byBhavini UnadkatNo ratings yet

- Lions School Toi Ad 14Document1 pageLions School Toi Ad 14Bhavini UnadkatNo ratings yet

- Tagros Notice Toi Surat 14Document1 pageTagros Notice Toi Surat 14Bhavini UnadkatNo ratings yet

- PI Science - 14x31Document1 pagePI Science - 14x31Bhavini UnadkatNo ratings yet

- Marketing at Mcdonald'S: CareersDocument6 pagesMarketing at Mcdonald'S: CareersSakib Hossain100% (1)

- Science of Self RealizationDocument343 pagesScience of Self Realizationapi-3699487100% (1)

- Tagros Notice Toi Surat 14Document1 pageTagros Notice Toi Surat 14Bhavini UnadkatNo ratings yet

- Gujarat Guardian Ltd Tender Notice for TransportersDocument1 pageGujarat Guardian Ltd Tender Notice for TransportersBhavini UnadkatNo ratings yet

- Dainik Bhaskar World Water Day 2014 Special FeatureDocument1 pageDainik Bhaskar World Water Day 2014 Special FeatureBhavini UnadkatNo ratings yet

- Solar ClientsDocument5 pagesSolar ClientsBhavini UnadkatNo ratings yet

- Marketing at Mcdonald'S: CareersDocument6 pagesMarketing at Mcdonald'S: CareersSakib Hossain100% (1)

- Plot No. A-14, Milan Complex, Sanand Chowkadi, Bavla Road, Sarkhej, Ahmedabad Gujarat, IndiaDocument2 pagesPlot No. A-14, Milan Complex, Sanand Chowkadi, Bavla Road, Sarkhej, Ahmedabad Gujarat, IndiaBhavini UnadkatNo ratings yet

- Marketing at Mcdonald'S: CareersDocument6 pagesMarketing at Mcdonald'S: CareersSakib Hossain100% (1)

- Apollo Group ProfileDocument1 pageApollo Group ProfileBhavini UnadkatNo ratings yet

- EcoDocument2 pagesEcoBhavini UnadkatNo ratings yet

- Anomaly in IRS 13 ReportDocument5 pagesAnomaly in IRS 13 ReportBhavini UnadkatNo ratings yet

- Science of Self RealizationDocument343 pagesScience of Self Realizationapi-3699487100% (1)

- Dainik Bhaskar - Main Edition: 1 Inside Color 400 2 Inside Color 200 3 Inside Color 160Document3 pagesDainik Bhaskar - Main Edition: 1 Inside Color 400 2 Inside Color 200 3 Inside Color 160Bhavini UnadkatNo ratings yet

- New Updated ResumeDocument2 pagesNew Updated ResumeBhavini UnadkatNo ratings yet

- Demand and Supply Analysis: UNIT - 2Document39 pagesDemand and Supply Analysis: UNIT - 2Deepak SrivastavaNo ratings yet

- Russian Exports DADocument23 pagesRussian Exports DACarolineNo ratings yet

- Hostelworld - Booking Reference - Shamik ChatterjeeDocument3 pagesHostelworld - Booking Reference - Shamik ChatterjeeNehaNo ratings yet

- 01 - Arquitectura en AfricaDocument44 pages01 - Arquitectura en AfricaINFRAESTRUCTURA TARAPOTONo ratings yet

- EU4Innovation Position PaperDocument2 pagesEU4Innovation Position PaperEaP CSFNo ratings yet

- GVK Airport Mumbai Bidding ProcessDocument25 pagesGVK Airport Mumbai Bidding ProcessRakesh RaushanNo ratings yet

- CBSE Class 11 Business Studies Sample Paper 2013Document2 pagesCBSE Class 11 Business Studies Sample Paper 2013Arun RohillaNo ratings yet

- Letter Compendium NO NOA ENDocument9 pagesLetter Compendium NO NOA ENBoban TrpevskiNo ratings yet

- 10th US History - Globalization - WorksheetDocument2 pages10th US History - Globalization - Worksheetangelicamiaot2No ratings yet

- Stock Market Crashes in BangladeshDocument54 pagesStock Market Crashes in BangladeshkheloomnaaNo ratings yet

- Dairy Milk in FranceDocument3 pagesDairy Milk in FrancemeanestNo ratings yet

- ICAI JournalDocument121 pagesICAI Journalamitkhera786No ratings yet

- Mcdonalds Swot and PestleDocument8 pagesMcdonalds Swot and PestleSmruti Ranjan Dora100% (2)

- Bank Reconciliation StatementDocument14 pagesBank Reconciliation StatementBharathi RajuNo ratings yet

- Boney Hector D'cruz (Am - Ar.u3com08013) - Final ProjectDocument63 pagesBoney Hector D'cruz (Am - Ar.u3com08013) - Final ProjectShinu ChandradasNo ratings yet

- Chapter 3Document50 pagesChapter 3wudineh debebeNo ratings yet

- NNN Bank Report Q1 2019Document3 pagesNNN Bank Report Q1 2019netleaseNo ratings yet

- Inma Bank LC FormDocument4 pagesInma Bank LC FormMohammed Hammad RizviNo ratings yet

- L7 - Slides Part 1 and 2Document18 pagesL7 - Slides Part 1 and 2zhongxu zhaoNo ratings yet

- Presentattion of L & TDocument18 pagesPresentattion of L & TNeha NNo ratings yet

- Risk Assessment What Work Excavation Work With Help of JCB Location PM Warehouse Area Contractor Company-Aalanna Project PVT LTDDocument2 pagesRisk Assessment What Work Excavation Work With Help of JCB Location PM Warehouse Area Contractor Company-Aalanna Project PVT LTDhemant yadav0% (1)

- JATMA Tyre Industry 2020Document32 pagesJATMA Tyre Industry 2020ChanduSaiHemanthNo ratings yet

- Vadimpopei 2907Document1 pageVadimpopei 2907Natalia DotencoNo ratings yet

- An American Depositary ReceiptDocument7 pagesAn American Depositary ReceiptAnil PujarNo ratings yet

- Seq 23 0464 0Document5 pagesSeq 23 0464 0AbdEl-Rahman AbdEl-NasserNo ratings yet

- Diagonal Leap Spread Portfolio StrategyDocument17 pagesDiagonal Leap Spread Portfolio StrategyFernando ColomerNo ratings yet

- The Ultimate Guide to Calculating Customer Lifetime Value (LTVDocument2 pagesThe Ultimate Guide to Calculating Customer Lifetime Value (LTVSangram PatilNo ratings yet

- DeNovo Quarterly Q2 2016Document48 pagesDeNovo Quarterly Q2 2016CrowdfundInsiderNo ratings yet

- MTFDocument2 pagesMTFchiragNo ratings yet