Professional Documents

Culture Documents

Law

Uploaded by

15986Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Law

Uploaded by

15986Copyright:

Available Formats

Incorporation of Company: Advantages and Disadvantages The word company has no strictly technical or legal meaning.

In the terms of the Companies Act, a company means a company formed and registered under the Companies Act. In common law a company is a legal person or legal entity separate from, and capable of surviving beyond the lives of, its members.[4] Like any juristic person, a company is legally an entity apart from its members, capable of rights and duties of its own, and endowed with the potential of perpetual succession.[5] But the company is not merely a legal institution. It is rather a legal device for the attainment of any social or economic end and to a large extent publicly and socially responsible. It is, therefore, a combined political, social, economic and legal institution.[6] Thus the term has been variously described. It is a means of co-operation in the conduct of an enterprise.......[7]. Corporate device is one form of associated enerprise.[8] It is an intricate, centralised, economic administrative structure run by professional managers who hire capital from the investor.[9] In a practical way, a company means a company of certain persons registered under the Companies Act. Two or more persons who are desirous of carrying on joint business enterprises, have the choice of either forming a company or a partnership. Partnership is a suitable device for a small scale business which can be financed and managed by a small group of partners who take personal interest and there is mutual trust and confidence among them. But where the enterprise requires a rather greater mobilisation of capital which the resoursces of a few persons cannot provide, the formation of a company would be better, as this is the only form of business organistion which offers the privilege of limiting personal

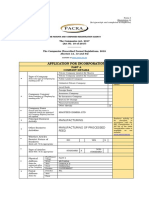

liability for bussiness debts. Accordingly, the company has become the most dominant form of business organisation.[10] One of the best assessments in reference to`companies in the context of the modern economies is enshrined in the following words: Companies abound in the national economy. Ranging from the small family or partnership concern to the faceless multinational corporaition, they provide the structure framework of the modern industrial society. Procedure for Registration of a Corporation Incorporation of Companies in India and setting up of branch offices of foreign corporations in India are regulated by the Companies Act, 1956. The Companies Act of 1956 sets down rules and regulations for the establishment of both public and private companies in India. For the purpose of incorporation in India under the Companies Act, 1956, the first step for the formation of a company is the approval of the name by the Registrar of Companies (hereinafter referred as ROC) in the State/Union Territory in which the company will maintain its registered office. This approval is subject to certain conditions. For instance, there should not be an existing company by the same name. Further, the last words in the name are required to be "Private Ltd." in the case of a private company and "Limited" in the case of a Public Company. Foreign companies engaged in manufacturing and trading activities are permitted by the Reserve Bank of India to open its branch offices in India. Application for permission to open a branch, a project office or liaison office is made via the Reserve Bank of India by submitting form FNC-5 to the Foreign Investment and Technology Transfer Department of

the Reserve Bank of India. For opening a project or site office, application may be made on Form FNC-10 to the regional offices of the Reserve Bank of India. A foreign investor need not have a local partner, whether or not the foreigner wants to hold full equity of the company. The portion of the equity thus not held by the foreign investor can be offered to the public. The ROC generally informs the applicant within seven days from the date of submission of the application, whether or not any of the names applied for is available. Once a name is approved, it is valid for a period of six months, within which time Memorandum of Association and Articles of Association together with miscellaneous documents are required to be filed. A company is formed by registering the Memorandum and Articles of Association with the Registrar of Companies. After the duly stamped Memorandum of Association and Articles of Association, documents and forms are filed and the filing duly fees are paid, the ROC scrutinizes the documents and, if necessary, instructs the authorized person to make necessary corrections. The ROC will give the certificate of incorporation after the required documents are presented along with the requisite registration fee, (Annexure A) which is scaled according to the share capital of the company, which will be stated in its Memorandum of association. In case the Memorandum and Articles is to be signed by any of the promoters out side India, then the signatures are required to be made in the presence of Consul of India at the Indian Consulate. Minimum number of Directors and shareholders: 1. For incorporating a Private Limited Company a minimum of two directors are required and minimum two shareholders.

2. For incorporating a Public Limited Company a minimum of three directors are required and minimum seven subscribers. Thereafter, a Certificate of Incorporation is issued by the ROC, from which date the company comes in to existence. It takes about one to two weeks from the date of filing Memorandum of Association and Articles of Association to receive a Certificate of Incorporation. A private company can commence business on receipt of its certificate of incorporation. A public company has the option of inviting the public for subscription to its share capital. Accordingly, the company has to issue a prospectus, which provides information about the company to potential investors. The Companies Act specifies the information to be contained in the prospectus. The prospectus has to be filed with the ROC before it can be issued to the public. In case the company decides not to approach the public for the necessary capital and obtains it privately, it can file a statement in lieu of prospectus with the ROC. On fulfillment of these requirements, the ROC issues a Certificate of Commencement of business to the public company. The company can commence business immediately after it receives this certificate. To sum up, a company is formed by registering the Memorandum and Articles of Association with the Registrar of Companies of the State in which the main office of the proposed company would be located. After the duly stamped Memorandum of Association and Articles of Association, documents and forms are filed and the filing fees are duly paid, the ROC scrutinizes the documents and, if necessary, instructs the authorized person to make necessary corrections. The ROC grants the certificate of incorporation after the required documents are presented along with the requisite registration fee, which is scaled according

to the share capital of the company, as stated in its Memorandum. Thereafter, a Certificate of Incorporation is issued by the ROC and the company officially comes in to existence w.e.f the date shown on this certificate. It usually takes one to two weeks from the date of filing Memorandum of Association and Articles of Association to receive a Certificate of Incorporation. As a recent development in incorporation procedures, various forms and applications under Companies Act, 1956 and the Rules and Regulations are being facilitated through e-filing which is projected by Ministry of Company Affairs. Advantages of Incoroporation Incorporation offers certain advantages to a company as compared with all other kinds of business organizations. They are: Independent corporate existence- the outstanding feature of a company is its independent corporate existence. By registration under the Companies Act, a company becomes vested with corporate personality, which is independent of, and distinct from its members. A company is a legal person. The decision of the House of Lords in Salomon v. Salomon & Co. Ltd. (1897 AC 22) is an authority on this principle: One S incorporated a company to take over his personal business of manufacturing shoes and boots. The seven subscribers to the memorandum were all his family members, each taking only one share. The Board of Directors composed of S as managing director and his four sons. The business was transferred to the company at 40,000 pounds. S took 20,000 shares of 1 pound each n debentures worth 10,000 pounds. Within a year the company came to be wound up and the state if affairs was

like this: Assets- 6,000 pounds; Liabilities- Debenture creditors-10,000 pounds, Unsecured creditors- 7,000 pounds. It was argued on behalf of the unsecured creditors that, though the co was incorporated, it never had an independent existence. It was S himself trading under another name, but the House of Lords held Salomon & Co. Ltd. must be regarded as a separate person from S. Limited liability- limitation of liability is another major advantage of incorporation. The company, being a separate entity, leading its own business life, the members are not liable for its debts. The liability of members is limited by shares; each member is bound to pay the nominal value of shares held by them and his liability ends there. Perpetual succession- An incorporated company never dies. Members may come and go, but the company will go on forever. During the war all the members of a private company, while in general meeting, were killed by a bomb. But the company survived, not even a hydrogen bomb could have destroyed it (K/9 Meat Supplies (Guildford) Ltd., Re, 1966 (3) All E.R. 320). Common seal- Since a company has no physical existence, it must act through its agents and all such contracts entered into by such agents must be under the seal of the company. The common seal acts as the official seal of the company. Transferable shares- when joint stock companies were established the great object was that the shares should be capable of being easily transferred. Sec 82 gives expression to this principle by providing that the shares or other interest of any

member shall be movable property, transferable in the manner provided by the articles of the company. Separate property- The property of an incorporated company is vested in the corporate body. The company is capable of holding and enjoying property in its own name. No members, not even all the members, can claim ownership of any asset of companys assets. Capacity for suits- A company can sue and be sued in its own name. The names of managerial members need not be impleaded. Professional management- A company is capable of attracting professional managers. It is due to the fact that being attached to the management of the company gives them the status of business or executive class. Disadvantages of Incorporation 1. Lifting of corporate veil- though for all purposes of law a company is regarded as a separate entity it is sometimes necessary to look at the persons behind the corporate veil. a. Determination of character- The House of Lords in Daimler Co Ltd. v. Continental Tyre and Rubber Co., held that a company though registered in England would assume an enemy character if the persons in de facto control of the company are residents of an enemy country.

b. For benefit of revenue- The separate existence of a company may be disregarded when the only purpose for which it appears to have been formed is the evasion of taxes. Sir Dinshaw Maneckjee, Re / Commissioner of Income Tax v. Meenakshi Mills Ltd. c. Fraud or improper conduct- In Gilford Motor Co v. Horne, a company was restrained from acting when its principal shareholder was bound by a restraint covenant and had incorporated a company only to escape the restraint. d. Agency or Trust or Government company- The separate existence of a company may be ignored when it is being used as an agent or trustee. In State of UP v. Renusagar Power Co, it was held that a power generating unit created by a company for its exclusive supply was not regarded as a separate entity for the purpose of excise. e. Under statutory provisions- The Act sometimes imposes personal liability on persons behind the veil in some instances like, where business is carried on beyond six months after the knowledge that the membership of company has gone below statutory minimum(sec 45), when contract is made by misdescribing the name of the company(sec 147), when business is carried on only to defraud creditors(sec 542). 2. Formality and expense- Incorporation is a very expensive affair. It requires a number of formalities to be complied with both as to the formation and administration of affairs.

3. Company not a citizen- In State Trading Corporation of India v. CTO, the SC held that a company though a legal person is not a citizen neither under the provisions of the Constitution nor under the Citizenship Act.

Pre-incorporation Contracts Sometimes contracts are made on behalf of a company even before it is duly incorporated. These are called as pre-incorporation contracts. Two consenting parties are necessary to a contract, whereas a company before incorporation is a non-entity. Therefore, following are the effects of pre-incorporation contracts. Company cannot be sued on pre-incorporation contracts- A company, when it comes into existence, cannot be sued on pre-incorporation contracts. In English and Colonial Produce Co, Re, a solicitor on the request of promoters prepared a companys documents and spent time and money in getting it registered. But the company was not held to be bound to pay for those services and expenses. Company cannot sue on pre-incorporation contracts- A company cannot by adoption or ratification obtain the benefit of a contract made on its behalf before the company came into existence. In Natal Land and Colonization Co v. Pauline Colliery Syndicate, the promoters of a proposed company obtained an agreement from a landlord that he would grant lease of coal mining rights to the company. The company could not, after incorporation, enforce this contract.

Agents may incur personal liability- The agents who contract for a proposed company may sometimes incur personal liability. In Kelner v. Baxter, the promoters of a projected hotel company purchased wine from the plaintiff on behalf of the company. The company came into being but, before paying the price went into liquidation. They were held personally liable to the plaintiff. Ratification of a pre-incorporation contract- So far as the company is concerned it is neither bound by nor can have the benefit of a pre-incorporation contract. But this is subject to the provisions of the Specific Relief Act, 1963. Section 15 of the Act provides that where the promoters of a company have made a contract before its incorporation for the purposes of the company, and if the contract is warranted by the terms of incorporation, the company may adopt and enforce it. In Vali Pattabhirama Rao v. Ramanuja Ginning and Rice Factory, a promoter of a company acquired a leasehold interest for it. He held it for sometime for a partnership firm, converted the firm into a company which adopted the lease. The lessor was held bound to the company under the lease. Section 19 of the Specific Relief Act provides that the other party can also enforce the contract if the company has adopted it after incorporation and the contract is within the terms of incorporation.

Conclusion As soon as a company is incorporated, whether public or private limited, it becomes a juristic person. It has its own name and property. It is a separate legal entity distinct from its members who incorporate it. A company does its business through its Directors. The directors are also called the ears, eyes and hands of the company. The directors of a company are in fiduciary position. On the one hand they run the company as its owner (Policy maker) and on the other hand they are merely a servant of the company and take remuneration. They are entitled to do any work on behalf of the company, what a company can do in ordinary course of business. There are certain items for which Board is not empowered to do. Such items are done by the company in general meeting. Any action done by the directors in the ordinary course of business are treated as done by the Company. But wrong done by the Directors (criminal action ) are the responsibility of the Directors and not the responsibility of the Company.

You might also like

- Khelshi LakhamsiDocument1 pageKhelshi Lakhamsi15986No ratings yet

- State Quarantine Rules for Domestic TravelersDocument16 pagesState Quarantine Rules for Domestic TravelersRahul SNo ratings yet

- State Quarantine Rules for Domestic TravelersDocument16 pagesState Quarantine Rules for Domestic TravelersRahul SNo ratings yet

- Places Names11Document2 pagesPlaces Names1115986No ratings yet

- Places Names'kerelaDocument1 pagePlaces Names'kerela15986No ratings yet

- New Microsoft Word DocumentDocument6 pagesNew Microsoft Word Document15986No ratings yet

- CSR 1Document2 pagesCSR 1Muhammed HanasNo ratings yet

- Places Names'kerelaDocument1 pagePlaces Names'kerela15986No ratings yet

- Places Names'kerelaDocument1 pagePlaces Names'kerela15986No ratings yet

- OnlineDocument57 pagesOnline15986No ratings yet

- Places Names'kerelaDocument1 pagePlaces Names'kerela15986No ratings yet

- The Companies Act 1956Document17 pagesThe Companies Act 195615986No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 2019 Form Mag FeedDocument9 pages2019 Form Mag FeedJosephine Kawayo100% (1)

- Medplus Health Services Limited DRHPDocument355 pagesMedplus Health Services Limited DRHPYash GuptaNo ratings yet

- CRD Foods PVT LTDDocument15 pagesCRD Foods PVT LTDsanju kumarNo ratings yet

- Company Law BirthDocument12 pagesCompany Law BirtharunasghNo ratings yet

- Secura Group Limited 2 PDFDocument12 pagesSecura Group Limited 2 PDFInvest StockNo ratings yet

- Memorandum of AssociationDocument2 pagesMemorandum of AssociationRohit NegiNo ratings yet

- AccountsDocument8 pagesAccountsAlveena UsmanNo ratings yet

- Memorandum of AssociationDocument21 pagesMemorandum of AssociationRehaanNo ratings yet

- Ch-2 Memorandum and Articles: Constitutional Documents of CoDocument90 pagesCh-2 Memorandum and Articles: Constitutional Documents of CoAhmad MalikNo ratings yet

- Camel Audio Acquired by AppleDocument4 pagesCamel Audio Acquired by AppleMacRumorsNo ratings yet

- GENERAL GUIDELINES - PETRONAS License Registration Applications v11.0 (10 Jun 2021)Document11 pagesGENERAL GUIDELINES - PETRONAS License Registration Applications v11.0 (10 Jun 2021)Aziema OthmanNo ratings yet

- Newinc 2022-11-28Document10 pagesNewinc 2022-11-28DeltaNo ratings yet

- Universiti Tunku Abdul Rahman May 2021 Trimester Ukml1013/Ubml1013 Corporate and Business LawDocument14 pagesUniversiti Tunku Abdul Rahman May 2021 Trimester Ukml1013/Ubml1013 Corporate and Business LawAngela Lai100% (1)

- Agreement Loan LendersDocument15 pagesAgreement Loan LendersSrikanth Reddy MettuNo ratings yet

- Company Veil and Corporate PersonalityDocument50 pagesCompany Veil and Corporate PersonalityAbhishekMittalNo ratings yet

- Memorandum of Association Key DetailsDocument2 pagesMemorandum of Association Key DetailspratikpatilpNo ratings yet

- MOA and AOA For ScribdDocument82 pagesMOA and AOA For ScribdJasmine BothelloNo ratings yet

- Companies Act 1994 Final PDFDocument7 pagesCompanies Act 1994 Final PDFCryptic LollNo ratings yet

- Unit 1 Company Law Unit 1 Company LawDocument40 pagesUnit 1 Company Law Unit 1 Company LawRanjan BaradurNo ratings yet

- Myanmar Company Law SummaryDocument10 pagesMyanmar Company Law SummaryKen NgoNo ratings yet

- Modes of Company IncorporationDocument5 pagesModes of Company IncorporationAmit KainthNo ratings yet

- Legal Aspects of BusinessDocument16 pagesLegal Aspects of BusinessArvindNo ratings yet

- Company Law EssentialsDocument30 pagesCompany Law EssentialsTumwesigyeNo ratings yet

- An Analysis of Company IncorporationDocument17 pagesAn Analysis of Company IncorporationSunita YadavNo ratings yet

- Project On Transfer and Transmission of SharesDocument45 pagesProject On Transfer and Transmission of SharesRajviPatel50% (4)

- Company Law Bus 323Document156 pagesCompany Law Bus 323David ONo ratings yet

- Corporate Structure FormationDocument22 pagesCorporate Structure FormationSHASHANK RAJ RP100% (2)

- Mercari Asia Limited: The Companies Act, 1994Document12 pagesMercari Asia Limited: The Companies Act, 1994Atiqur SobhanNo ratings yet

- Articles of Association and Its AlterationDocument5 pagesArticles of Association and Its AlterationSiddharth RajNo ratings yet

- Set Up Your Non Profit in Uganda With A Company Limited by Guarantee StructureDocument3 pagesSet Up Your Non Profit in Uganda With A Company Limited by Guarantee Structurewasswa isaac jeff0% (1)