Professional Documents

Culture Documents

Chapter 14 Exercise Solutions

Uploaded by

Carol RobinsonOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 14 Exercise Solutions

Uploaded by

Carol RobinsonCopyright:

Available Formats

Chapter 14 - Business Unit Performance Measurement

14

Business Unit Performance Measurement

Solutions to Review Questions

14-1.

Divisional income is relatively easy to compute because the data exist for financial

reporting purposes. It is related to firm profit, which is of interest to the shareholders. It

makes comparisons easier because it is a summary financial measure. Two

disadvantages are that it is difficult to compare divisions that are different sizes and it

does not include a measure of asset utilization.

14-2.

The basic computations are the same. Because divisional income is not reported, the

firm is free to specify certain accounting policies that might not be consistent with

GAAP. In addition, depending on the decision authority of the manager, some accounts

might be ignored or might be computed using firm-wide averages.

14-3.

ROI-type measures adjust for size. In addition, ROI measures adjust for asset usage.

14-4.

There are two common situations. First, managers might choose not to invest in

worthwhile projects because the ROI is less than the target, even though the net

present value is positive. Second, decisions made based on ROI depend on the current

level of ROI. If the ROI of a project is greater than the ROI of the unit without the

project, the project will increase ROI, regardless of how low it is.

14-5.

ROI is income divided by assets; residual income is income less a capital charge equal

to the cost of capital multiplied by the investment. Residual income is a dollar amount,

not a ratio. It subtracts a capital charge, equal to the cost of capital multiplied by the

assets used.

14-1

Chapter 14 - Business Unit Performance Measurement

EVA makes adjustments to income and investment to correct accounting calculations

that do not reflect the economics of the transaction. Typical examples are capitalizing

expenditures that common accounting practice would expense, such as advertising or

R&D expenditures.

14-7.

Use of net book value will result in the ROI rising as the net asset is reduced through

depreciation. This might be mitigated if ROI is based on gross book value. The problem

is most acute if all depreciable assets in the investment base are the same age.

14-8.

The danger is that you will ignore the interdependence of the business units. No

incentive is given to business unit managers to make them consider the effect of their

actions on other units.

14-2

Chapter 14 - Business Unit Performance Measurement

Solutions to Critical Analysis and Discussion Questions

14-9.

Here the managers are encouraged to include slack in the budget by underestimating

revenues and overestimating costs. The greater the slack, the greater is the division

managers bonus.

14-10.

By maximizing their own divisional income, managers might refuse to sell products to

each other, or might not share information about customers. This statement ignores

interdependencies among business units.

14-11.

Two problems usually arise here:

(a) The division might be encouraged to produce in volumes in excess of sales. In this

way, the fixed production costs would be deferred in inventory.

(b) There could be a great deal of game-playing over how costs are allocated since a

managers performance will depend in part on how few costs get charged to the

division. See the discussion in chapter 12 about allocating corporate costs.

These problems might be greater in new, growing industries than in mature industries

where the accounting and cash flows tend to be more similar.

14-12.

Residual income measures depend upon the rate chosen for charging a division for its

investments. Different rates can yield different residual income rankings. In addition,

residual income measures will tend to favor large divisions over smaller ones since the

measures are based on an absolute dollar value. ROI uses information easily available

from the accounting system.

14-13.

The reason the division manager has been delegated the authority to make investment

decisions is that he or she has better local knowledge of the investment opportunities.

Therefore, if the division manager does not identify the investment project, it is not clear

that the corporate staff will know it exists. If they do not know about the investment, they

cannot direct its adoption.

14-3

Chapter 14 - Business Unit Performance Measurement

Residual Income (RI) is defined as follows:

Investment center operating profits(Capital charge Investment center assets)

The capital charge is the minimum acceptable rate of return, which will likely be

greater than the companys cost of capital.

Economic value added (EVA) is defined as follows:

After-tax (adjusted) operating profits(Cost of capital Capital employed (adjusted))

Comparison:

Investment center operating profits (in the RI formula) can be equated to after-tax

operating profits (in the EVA formula). Investment center assets can be equated to

capital employed. However, the capital charge is not the same as the cost of capital.

The capital charge is the companys minimum acceptable rate of return, and the cost

of capital is the weighted average cost of the companys debt and equity. While it is

possible that these percentages might be the same for a given company, the terms

clearly have different meanings.

More important, EVA calculations adjust the income and capital numbers from the

accounting, or book, numbers to reflect basic differences between economic results

and accounting measurements.

Therefore, although the two methodsRI and EVAhave many similarities, they

are not typically identical.

14-15.

The problem with using the same measure of performance for managers at all levels in

an organization is that managers responsibilities and decision rights differ. For

example, a plant manager might not have the authority to choose where to produce or

what equipment to use. EVA, however, evaluates the manager on how well he or she

uses assets.

14-16.

If the division can rent and the rent does not have to be capitalized for inclusion in the

investment base, the residual income will increase so long as the income from the asset

exceeds the lease payment. If EVA is used, and if these types of transactions are

common, an adjustment will be made to income and assets to treat the leases as if they

are capital leases, even if the company treats the leases as operating leases for

financial reporting purposes.

14-4

Chapter 14 - Business Unit Performance Measurement

ROI does not take the time value of money into account; it is computed based on

annual results. The cost of capital is a measure that does consider the time value of

money. The ROI can be high or low in any one period, while the cost of capital and the

present value of the investment consider return over the life of the investment.

Differences between ROI and the cost of capital are common when assets have

different lives or are purchased at different times. Since the two measures are not

comparable, trying to relate the two will not be meaningful.

14-18.

Residual income divided by divisional assets is just ROI minus the cost of capital (see

below). Therefore, while the measure allows a comparison among divisions, it suffers

from the same problems as ROI.

Residual income

Assets

Income

Assets

Cost of capital x Assets

Assets

= ROI Cost of capital

14-5

Chapter 14 - Business Unit Performance Measurement

Solutions to Exercises

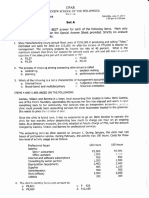

14-19. (10 min.)

Compute Divisional Income: Eastern Merchants.

Operating Income

(thousands)

Eastern

Western

Revenue ............................................................

$1,200.0

$3,800.0

Cost of sales ......................................................769.5

1,900.0

Gross margin ..................................................

$ 430.5

$1,900.0

Allocated corporate overhead ............................ 72.0

228.0

Other general and administration.......................158.5

1,100.0

Operating income ..............................................

$ 200.0

$572.0

Comments:

1. Divisional income is greater in Western.

2. The gross margin percentage is higher in Western.

3. The operating margin is greater in Eastern.

4. Corporate overhead appears to be allocated on the basis of revenues (6% in both

divisions).

Ratio

Calculation

Eastern

Gross Margin percentage ...................................

(Gross margin Sales)

35.88%

Operating margin ................................................

(Operating income Sales) 16.67

14-6

Western

50.00%

15.05

Chapter 14 - Business Unit Performance Measurement

14-20. (10 min.) Compute Divisional Income: Eastern Merchants.

Operating Income

(thousands)

Eastern

Western

Revenue .............................................................

$1,200.0 $2,800.0

Cost of sales.......................................................

769.5 1,400.0

Gross margin ......................................................

$ 430.5 $1,400.0

Allocated corporate overhead.............................

90.0

210.0

Other general and administration .......................

158.5

1,100.0

Operating income ...............................................

$ 182.0

$90.0

Comments:

In addition to the comments for exercise 14-19, nothing changed in Eastern Division.

However, because sales fell in Western Division, the reported divisional income for

Eastern went down. Corporate overhead is allocated on the basis of relative revenues,

not absolute revenues. Thus, the performance of the Eastern Division is affected by the

results in the Western Division.

Ratio

Calculation

Eastern Western

Gross Margin percentage ...................................

(Gross margin Sales)

35.88% 50.00%

Operating margin ................................................

(Operating income Sales) 15.17

3.21

14-21. (10 min.)

Compute Residual Income and ROI: TL Division.

a.

$1,800,000,000

= 12.5% (ROI)

$14,400,000,000

b.

$1,800,000,000 (.08 $14,400,000,000) = $648,000,000 (Residual Income)

14-7

Chapter 14 - Business Unit Performance Measurement

14-22. (25 min.)

ROI Versus Residual Income.

Annual income = $252,000 ($720,000 4 years) = $72,000

Year

1

2

3

4

a

Investment

Base

$720,000a

540,000

360,000

180,000

(a)

RI

$72,000 Base

10.0%

13.3

20.0

40.0

(b)

Residual Income

$72,000 (15% x Base)

($36,000)

(9,000)

18,000

45,000

Base decreases by annual depreciation of $180,000.

14-23. (10 min.) Compare Alternative Measures of Division Performance:

Solomons Company.

a. Using return on investment measures:

*North:

$7,000,000

= 25%

$28,000,000

South:

$39,000,000

= 15%

$260,000,000

b. Using EVA:

North: $7,000,000 (10% x $28,000,000) = $4,200,000

*South: $39,000,000 (10% x $260,000,000) = $13,000,000

c. Using ROI, the comparison is not affected by the cost of capital; the cost of capital

serves only as a benchmark against which to judge ROI.

For EVA, the comparison is affected.

*North: $7,000,000 (20% x $28,000,000) = $1,400,000

South: $39,000,000 (20% x $260,000,000) = ($13,000,000)

*Indicates division with better performance.

14-8

Chapter 14 - Business Unit Performance Measurement

14-24. (10 min.)

Impact of New Asset on Performance Measures: Ocean Division.

a. ROI before:

$780,000

= 20%

$3,900,000

b. ROI after:

$780,000 + $55,500a

= 18.3%

$3,900,000 + $675,000

a

$55,500 = $168,000 ($675,000 6 years)

14-25. (10 min.)

Impact Of Leasing On Performance Measures.

With the lease, the incremental income is the operating cash flow minus the lease

payment or $20,000 = $168,000 $148,000.

The new ROI is:

$780,000 + $20,000

= 20.5%

$3,900,000

14-26. (15 min.)

Residual Income Measures And New Project Consideration.

a. $780,000 (.15 $3,900,000) = $195,000

b. $195,000 + $168,000 ($675,000 6 years)

.15 ($675,000) = $149,250

or

$780,000 + $168,000 ($675,000 6 years) .15 ($3,900,000 + $675,000)

= $149,250

c. $195,000 + $168,000 $148,000 = $215,000

or

($780,000 + $168,000 $148,000) (.15 $3,900,000)= $215,000

14-9

Chapter 14 - Business Unit Performance Measurement

14-27. (20 min.) Impact of New Asset on Performance Measures: Noonan

Division.

a. ROI before disposal:

$330,000

= 15%

$2,200,000

b. ROI after disposal:

$330,000 $28,000

= 15.1%

$2,200,000 $200,000

c. Residual income before disposal:

$330,000 0.12 x $2,200,000

= $66,000

d. Residual income after disposal:

($330,000 $28,000) 0.12 x ($2,200,000 $200,000) = $62,000

14-28. (20 min.) Impact of New Asset on Performance Measures: Noonan

Division.

a. ROI before disposal:

$330,000

= 16.5%

$2,000,000

b. ROI after disposal:

$330,000 $28,000

$2,000,000

= 15.1%

c. Residual income before disposal:

$330,000 0.12 x $2,000,000

= $90,000

d. Residual income after disposal:

($330,000 $28,000) 0.12 x ($2,000,000) = $62,000

14-10

Chapter 14 - Business Unit Performance Measurement

14-29. (25 min.) Compare Historical Cost, Net Book Value To Gross Book Value:

Caribbean Division.

Year 1

a. Net Book Value

b. Gross Book Value

($15,000,000 $6,000,000)

($60,000,000 $6,000,000)

($15,000,000 $6,000,000)

$60,000,000

$9,000,000

$54,000,000

Year 2

Year 3

$9,000,000

= 15%

$60,000,000

($15,000,000 $6,000,000)

[$60,000,000 (2 x $6,000,000)]

($15,000,000 $6,000,000)

$60,000,000

$9,000,000

= $48,000,000 = 18.8%

$9,000,000

= $60,000,000 = 15%

($15,000,000 $6,000,000)

[$60,000,000 (3 x $6,000,000)]

($15,000,000 $6,000,000)

$60,000,000

Year 4

= 16.7%

$9,000,000

= 21.4%

$42,000,000

($15,000,000 $6,000,000)

[$60,000,000 (4 x $6,000,000)]

=

$9,000,000

= 25.0%

$36,000,000

14-11

$9,000,000

= 15%

$60,000,000

($15,000,000 $6,000,000)

$60,000,000

=

$9,000,000

$60,000,000

= 15%

Chapter 14 - Business Unit Performance Measurement

14-30. (25 min.) Compare ROI Using Net Book And Gross Book Values:

Caribbean Division.

a. Net Book Value

Year 1

($15,000,000 $6,000,000)

$60,000,000

=

Year 2

= 15.0%

$9,000,000

$54,000,000

= 16.7%

($15,000,000 $6,000,000)

[$60,000,000 (2 x$6,000,000)]

=

Year 4

$9,000,000

$60,000,000

($15,000,000 $6,000,000)

($60,000,000 $6,000,000)

=

Year 3

b. Gross Book Value

$9,000,000

$48,000,000

= 18.8%

($15,000,000 $6,000,000)

[$60,000,000 (3 x$6,000,000)]

=

$9,000,000

$42,000,000

= 21.4%

($15,000,000 $6,000,000)

$60,000,000

=

$9,000,000

= 15%

$60,000,000

($15,000,000 $6,000,000)

$60,000,000

=

$9,000,000

= 15%

$60,000,000

($15,000,000 $6,000,000)

$60,000,000

=

$9,000,000

= 15%

$60,000,000

($15,000,000 $6,000,000)

$60,000,000

=

$9,000,000

= 15%

$60,000,000

c. Of course, there is no change under the gross book value method. With the net

method, both alternatives (using end-of-year asset values versus beginning-of-year

values) show the same trend of rising ROIs as the assets depreciate. This is to be

expected. The end-of-year value is the next years beginning-of-year value.

14-12

Chapter 14 - Business Unit Performance Measurement

14-31. (30 min.)

Compare Current Cost To Historical Cost: Caribbean Division.

Parts c and d can be solved easier if one first sets up a table showing the change in value of the depreciable assets.

(1)

(2)

(3)

Yearly

Gross Depreciable

Depreciation

Total Depreciation

[col. (1) x 25%]

(1) (Years of life 4 years)

Asset Valuea

Year 1

$24,000,000 x 1.1 = $26,400,000

$6,600,000

$26,400,000 x 1/4 = $6,600,000

Year 2

$26,400,000 x 1.1 = $29,040,000

$7,260,000

$29,040,000 x 2/4 = $14,520,000

Year 3

$29,040,000 x 1.1 = $31,944,000

$7,986,000

$31,944,000 x 3/4 = $23,958,000

Year 4

$31,944,000 x 1.1 = $35,138,400

$8,784,600

$35,138,400 x 4/4 = $35,138,400

a Start

with gross assets = $60,000,000 $36,000,000 salvage value = $24,000,000.

14-13

Chapter 14 - Business Unit Performance Measurement

14-31. (continued)

Year 1

a.

Historical Cost

Net Book Value

($16,500,000 $6,000,000)

($60,000,000 $6,000,000)

=

Year 2

($18,150,000 $6,000,000)

[$60,000,000 (2 x $6,000,000)]

=

Year 3

$12,150,000

= 25.3%

$48,000,000

($19,965,000 $6,000,000)

[$60,000,000 (3 x $6,000,000)]

=

Year 4

$10,500,000

= 19.4%

$54,000,000

$13,965,000

= 33.3%

$42,000,000

($21,961,500 $6,000,000)

[$60,000,000 (4 x $6,000,000)]

=

$15,961,500

= 44.3%

$36,000,000

14-14

b.

Historical Cost

Gross Book Value

($16,500,000 $6,000,000)

$60,000,000

=

$10,500,000

= 17.5%

$60,000,000

($18,150,000 $6,000,000)

$60,000,000

=

$12,150,000

= 20.3%

$60,000,000

($19,965,000 $6,000,000)

$60,000,000

=

$13,965,000

= 23.3%

$60,000,000

($21,961,500 $6,000,000)

$60,000,000

=

$15,961,500

= 26.6%

$60,000,000

Chapter 14 - Business Unit Performance Measurement

14-31. (continued)

Year 1

c.

Current Cost

Net Book Value

($16,500,000 $6,600,000)

($66,000,000 $6,600,000)

=

Year 2

$10,890,000

= 18.8%

$58,080,000

$10,890,000

= 15.0%

$72,600,000

($19,965,000 $7,986,000)

$79,860,000

$11,979,000

= 21.4%

$55,902,000

($21,961,500 $8,784,600)

[$87,846,000 $35,138,400]

=

$9,900,000

= 15.0%

$66,000,000

($18,150,000 $7,260,000)

$72,600,000

($19,965,000 $7,986,000)

[$79,860,000 $23,958,000]

=

Year 4

$9,900,000

= 16.7%

$59,400,000

($18,150,000 $7,260,000)

[$72,600,000 $14,520,000]

=

Year 3

d.

Current Cost

Gross Book Value

($16,500,000 $6,600,000)

$66,000,000

$11,979,000

= 15.0%

$79,860,000

($21,961,500 $8,784,600)

$87,846,000

$13,176,900

= 25%

$52,707,600

14-15

$13,176,900

= 15.0%

$87,846,000

Chapter 14 - Business Unit Performance Measurement

14-32. (25 min.) Effects Of Current Cost On Performance Measures: Upper

Division.

a.

ROI

Year 1:

$225,000 (.25 x $600,000)

$600,000

$75,000

= 12.5%

$600,000

Year 2:

$255,000 (.25 x $600,000)

$600,000

$105,000

= 17.5%

$600,000

Year 3:

$285,000 (.25 x $600,000)

$600,000

$135,000

= 22.5%

$600,000

Year 4:

$300,000 (.25 x $600,000)

$600,000

$150,000

= 25.0%

$600,000

b.

ROI

Year 1:

$225,000 (.25 x $600,000)

$600,000

$75,000

= 12.5%

$600,000

Year 2:

$255,000 (.25 x $660,000)

$660,000

$90,000

= 13.6%

$660,000

Year 3:

$285,000 (.25 x $726,000)

$726,000

$103,500

= 14.3%

$726,000

Year 4:

$300,000 (.25 x $798,600)

$798,600

$100,350

= 12.6%

$798,600

14-16

You might also like

- Expected and Required Returns Answer: C Diff: MDocument6 pagesExpected and Required Returns Answer: C Diff: MLopez, Azzia M.No ratings yet

- Accounting For Business Combinations: Multiple ChoiceDocument19 pagesAccounting For Business Combinations: Multiple Choicehassan nassereddineNo ratings yet

- 2011-02-03 230149 ClarkupholsteryDocument5 pages2011-02-03 230149 ClarkupholsteryJesus Cardenas100% (1)

- Solved ExercisesDocument9 pagesSolved ExercisesKyle BroflovskiNo ratings yet

- AIS Chapter 7Document2 pagesAIS Chapter 7Rosana CabuslayNo ratings yet

- WRITTEN ACTIVITY 6: Inventory ManagementDocument4 pagesWRITTEN ACTIVITY 6: Inventory ManagementDaena NicodemusNo ratings yet

- Strategic Management Assessment Task 8: Market ResearchDocument4 pagesStrategic Management Assessment Task 8: Market ResearchJes Reel100% (1)

- Capital Budgeting DecisionsDocument9 pagesCapital Budgeting DecisionsMarcel BermudezNo ratings yet

- Kingfisher School of Business and Finance: 2 Semester A.Y. 2020-2021Document5 pagesKingfisher School of Business and Finance: 2 Semester A.Y. 2020-2021NCTNo ratings yet

- B. Revising The Estimated Life of Equipment From 10 Years To 8 YearsDocument4 pagesB. Revising The Estimated Life of Equipment From 10 Years To 8 YearssilviabelemNo ratings yet

- MAS 7 Exercises For UploadDocument9 pagesMAS 7 Exercises For UploadChristine Joy Duterte RemorozaNo ratings yet

- Chapter 13 - AnswerDocument36 pagesChapter 13 - Answerlooter198No ratings yet

- Cash and RecDocument30 pagesCash and RecChiara OlivoNo ratings yet

- Father's Retirement Savings GoalDocument2 pagesFather's Retirement Savings GoalEngr Fizza AkbarNo ratings yet

- Theories Chapter 1Document16 pagesTheories Chapter 1Farhana GuiandalNo ratings yet

- Chapter 9Document10 pagesChapter 9Caleb John SenadosNo ratings yet

- BLT 2012 Final Pre-Board April 21Document17 pagesBLT 2012 Final Pre-Board April 21Lester AguinaldoNo ratings yet

- Auditing I: Chapter 8 (Audit Sampling: An Overview and Application To Tests of Controls)Document22 pagesAuditing I: Chapter 8 (Audit Sampling: An Overview and Application To Tests of Controls)CrystalNo ratings yet

- CH 03 Sample QsDocument6 pagesCH 03 Sample QsSourovNo ratings yet

- Practicequestions Mt3a 625Document25 pagesPracticequestions Mt3a 625sonkhiemNo ratings yet

- Ho3 Cash and Marketable Securities ManagementDocument3 pagesHo3 Cash and Marketable Securities ManagementMae ShoppNo ratings yet

- Chap 006Document285 pagesChap 006Jessica Cola86% (7)

- Strategic business analysis questionsDocument11 pagesStrategic business analysis questionsLyka DiarosNo ratings yet

- Mixed PDFDocument8 pagesMixed PDFChris Tian FlorendoNo ratings yet

- Test Bank Fin Man 3Document2 pagesTest Bank Fin Man 3Phillip RamosNo ratings yet

- Financial Management Act1108 Practice SetsDocument7 pagesFinancial Management Act1108 Practice SetsKaren TaccabanNo ratings yet

- 3 - Discussion - Joint Products and ByproductsDocument2 pages3 - Discussion - Joint Products and ByproductsCharles TuazonNo ratings yet

- TB Chapter05Document79 pagesTB Chapter05Yusairah Benito DomatoNo ratings yet

- 4 Responsibility and Transfer Pricing Part 1Document10 pages4 Responsibility and Transfer Pricing Part 1Riz CanoyNo ratings yet

- InTax Quiz 1Document7 pagesInTax Quiz 1ElleNo ratings yet

- Prelims Ms1Document6 pagesPrelims Ms1ALMA MORENANo ratings yet

- Linear Programming Problems ExplainedDocument12 pagesLinear Programming Problems ExplainedThea BacsaNo ratings yet

- The Expenditure Cycle: Purchases and Cash Disbursements ProceduresDocument4 pagesThe Expenditure Cycle: Purchases and Cash Disbursements ProceduresAnne Rose EncinaNo ratings yet

- SEATWORKDocument4 pagesSEATWORKMarc MagbalonNo ratings yet

- Math 006B - Module 4 HypothesisDocument4 pagesMath 006B - Module 4 Hypothesisaey de guzmanNo ratings yet

- FINALS - Theory of AccountsDocument8 pagesFINALS - Theory of AccountsAngela ViernesNo ratings yet

- All in CupDocument11 pagesAll in CupRosemarie Qui0% (1)

- Acctg11finalsq2andq3answerkey PDF FreeDocument17 pagesAcctg11finalsq2andq3answerkey PDF FreeMichael Brian TorresNo ratings yet

- TB Chapter12Document33 pagesTB Chapter12CGNo ratings yet

- Quizlet - SOM CH 8Document25 pagesQuizlet - SOM CH 8Bob KaneNo ratings yet

- CMA Exam Review - Part 2 AssessmentDocument66 pagesCMA Exam Review - Part 2 AssessmentAlyssa PilapilNo ratings yet

- Negotiable Instrument (Part III) M.CDocument6 pagesNegotiable Instrument (Part III) M.Csad nuNo ratings yet

- Hilton 2222Document70 pagesHilton 2222Dianne Garcia RicamaraNo ratings yet

- Chapter 1: Flexible Budgeting and The Management of Overhead and Support Activity Costs Answer KeyDocument33 pagesChapter 1: Flexible Budgeting and The Management of Overhead and Support Activity Costs Answer KeyRafaelDelaCruz50% (2)

- Question Bank - Management Accounting-1Document5 pagesQuestion Bank - Management Accounting-1Neel Kapoor50% (2)

- Cabrera Chapter 01 - AnswerDocument3 pagesCabrera Chapter 01 - AnswerAlyssa100% (1)

- Fin 4 WC FinancingDocument2 pagesFin 4 WC FinancingHumphrey OdchigueNo ratings yet

- Long Problems For Prelim'S Product: Case 1Document7 pagesLong Problems For Prelim'S Product: Case 1Mae AstovezaNo ratings yet

- Mas Test Bank QuestionDocument3 pagesMas Test Bank QuestionEricka CalaNo ratings yet

- UntitledDocument20 pagesUntitledapriljoyguiawanNo ratings yet

- (Fingerprints Group) 2011 CIMA Global Business Challenge ReportDocument23 pages(Fingerprints Group) 2011 CIMA Global Business Challenge Reportcrazyfrog1991No ratings yet

- PINTO - Razmen R. (MASECO MT EXAM)Document4 pagesPINTO - Razmen R. (MASECO MT EXAM)Razmen Ramirez PintoNo ratings yet

- Chapter 14 Exercise SolutionsDocument16 pagesChapter 14 Exercise Solutionstira sunday100% (1)

- Hilton7e SM CH13Document50 pagesHilton7e SM CH13VivekRaptorNo ratings yet

- Hilton Chapter 13 SolutionsDocument71 pagesHilton Chapter 13 SolutionsSharkManLazersNo ratings yet

- Ellah F. Gedalanon BSA-IV: Return On Investment (ROI)Document2 pagesEllah F. Gedalanon BSA-IV: Return On Investment (ROI)Ellah GedalanonNo ratings yet

- Summary PERFORMANCE MEASUREMENT IN DECENTRALIZED ORGANIZATIONSDocument9 pagesSummary PERFORMANCE MEASUREMENT IN DECENTRALIZED ORGANIZATIONSliaNo ratings yet

- Investment Centers and Transfer Pricing: Answers To Review QuestionsDocument45 pagesInvestment Centers and Transfer Pricing: Answers To Review QuestionsShey INFTNo ratings yet

- Dinda Putri Novanti - Summary Measuring and Controlling Asset EmployedDocument5 pagesDinda Putri Novanti - Summary Measuring and Controlling Asset EmployedDinda Putri NovantiNo ratings yet

- Class 2-1 - Capital Structure 1Document2 pagesClass 2-1 - Capital Structure 1Anna KucherukNo ratings yet

- 07 Valuation DCF Analysis Guide PDFDocument123 pages07 Valuation DCF Analysis Guide PDFParas BholaNo ratings yet

- Barrick Gold Corporation: GradeDocument5 pagesBarrick Gold Corporation: Gradederek_2010No ratings yet

- Tutorial 2 Discount Rate WACC AfterDocument12 pagesTutorial 2 Discount Rate WACC AfteroussemNo ratings yet

- FIN 534 Homework Chapter 9Document3 pagesFIN 534 Homework Chapter 9Jenna KiragisNo ratings yet

- Accounting Textbook Solutions - 69Document19 pagesAccounting Textbook Solutions - 69acc-expertNo ratings yet

- Business ValuationDocument24 pagesBusiness ValuationMota Tess TheressaNo ratings yet

- CFA Research Challenge Regional Final 2017 Dhaka - Team Fourth EchelonDocument24 pagesCFA Research Challenge Regional Final 2017 Dhaka - Team Fourth EchelonTarek MusannaNo ratings yet

- HEC Curriculum Business EducationDocument65 pagesHEC Curriculum Business EducationtheahmerNo ratings yet

- Management Notes EnglishDocument73 pagesManagement Notes Englishnitinpancholi1995No ratings yet

- Branding Challenges and StrategiesDocument15 pagesBranding Challenges and StrategiesAditee ZalteNo ratings yet

- Warner Body WorksDocument35 pagesWarner Body WorksPadam Shrestha50% (4)

- Finance Module 6 Long-Term FinancingDocument5 pagesFinance Module 6 Long-Term FinancingKJ JonesNo ratings yet

- Nike Case AnalysisDocument9 pagesNike Case AnalysistimbulmanaluNo ratings yet

- Diploma: in Treasury ManagementDocument45 pagesDiploma: in Treasury ManagementJewelyn C. Espares-Ciocon100% (1)

- Financial analysis of American Chemical Corporation plant acquisitionDocument9 pagesFinancial analysis of American Chemical Corporation plant acquisitionBenNo ratings yet

- Trilochan@xlri - Ac.in: Standardized Outline For CoursesDocument5 pagesTrilochan@xlri - Ac.in: Standardized Outline For CoursesAtul AnandNo ratings yet

- Financial Management Syllabus ExplainedDocument202 pagesFinancial Management Syllabus ExplainedSandeep KulshresthaNo ratings yet

- FM AssignmentDocument4 pagesFM AssignmentIsyfi SyifaaNo ratings yet

- TBChap 012Document88 pagesTBChap 012Dylan BarronNo ratings yet

- Optimal capital structure for HormelDocument17 pagesOptimal capital structure for HormelMehmet IsbilenNo ratings yet

- HBS Case Map for Smart, Megginson, and Gitman: Corporate FinanceDocument23 pagesHBS Case Map for Smart, Megginson, and Gitman: Corporate FinanceVidya ChokkalingamNo ratings yet

- Landmark Facility Solution Excel WorkingsDocument22 pagesLandmark Facility Solution Excel Workingsalka murarka27% (33)

- Irman Boyle - PFAN Matchmaking and Bank PartnershipsDocument17 pagesIrman Boyle - PFAN Matchmaking and Bank PartnershipsAsia Clean Energy ForumNo ratings yet

- Capital Structure Capital StructureDocument34 pagesCapital Structure Capital StructureREEN RIO100% (1)

- Using the CAPM for capital budgetingDocument5 pagesUsing the CAPM for capital budgetingangel guarinNo ratings yet

- 208 BDocument10 pages208 BXulian ChanNo ratings yet

- Case Analysis: American Home Products CorporationDocument3 pagesCase Analysis: American Home Products CorporationYanbin CaoNo ratings yet

- Gagan Deep Sharma Department of Management Studies BBSB Engineering College Fatehgarh Sahib, PunjabDocument29 pagesGagan Deep Sharma Department of Management Studies BBSB Engineering College Fatehgarh Sahib, PunjabAbdul Motaleb SaikiaNo ratings yet