Professional Documents

Culture Documents

Energy Outlook 2030 Fact Sheet

Uploaded by

Cesario GillasOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Energy Outlook 2030 Fact Sheet

Uploaded by

Cesario GillasCopyright:

Available Formats

BP Energy Outlook 2030

Fact Sheet

Global energy consumption in 2030 is 36% higher than 2011 with virtually all (93%) the growth in non-OECD countries and more than half coming from India and China.

World energy demand will be about 36% higher in 2030 with India and China accounting for half the growth while inputs to power generation account for nearly 60% of the growth. Global energy intensity in 2030 is almost half (46%) of what it was in 1990 and 31% lower than 2011. EU energy consumption is more or less back to where it was in 1995. High prices and technological advances have unlocked vast unconventional resources in the US. Despite above ground factors the global resource potential suggests measured growth elsewhere. Tight oil will account for 9% of global supplies while shale gas will reach 16% of the world total by 2030. North America will dominate output accounting for 72% of tight oil/shale gas supplies in 2030. The US will produce 99% of its energy needs by 2030, up from a low point of 70% in 2005. Around 2015 China will overtake the US to become the worlds biggest energy importer. Russia remains the largest net exporter of energy and in 2030 its net exports meet 4.3% of world energy demand. Europe will remain the worlds largest importer of natural gas. By 2030, 70% of emissions are coming from the non-OECD, although per capita emissions in the non-OECD are still less than half the OECD level. Total carbon emissions will increase by 26%. Oil and other liquids remain the slowest growing fuel in our outlook, with demand up by just 0.8% p.a., reaching 104 Mb/d (+16) by 2030. Demand is driven by non-OECD transport. The US, Russia, and Saudi Arabia will supply over a third of global liquids for the remainder of the outlook. The 2011 level of Call on OPEC isnt reached again until 2021. Natural gas will be the fastest growing fossil fuel at 2% p.a., reaching 456 Bcf/d (+144) by 2030. By volume, growth is greatest in power (+56 Bcf/d) and industry (+54 Bcf/d). Non-OECD accounts for 76% of the rise in gas demand and 74% of output growth. LNG supply grows twice as fast as total output and Australia overtakes Qatar as the top LNG supplier. Nearly all the growth in coal demand comes from just two countries, China and India, which will jointly account for 65% of total demand in 2030. India overtakes US as 2nd largest consumer. China overtakes the US as the biggest nuclear producer with its share of the world total rising from 3% in 2011 to 30% in 2030. Hydros share of power generation falls slightly to 14%. Renewables (including biofuels) account for 6% of total demand in 2030 and grow 7 .6% p.a. By 2030, 11% of world electricity is from renewable sources, up from just 4% in 2011.

www.bp.com/energyoutlook

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Air Conditioning SystemsDocument47 pagesAir Conditioning SystemsCesario GillasNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- 1LAC000003 DistTrHandbookDocument92 pages1LAC000003 DistTrHandbookkastanis_3No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- An Energy Benchmarking Model Based On Artificial Neural Network Method With A Case Example For Tropical ClimatesDocument17 pagesAn Energy Benchmarking Model Based On Artificial Neural Network Method With A Case Example For Tropical ClimatesCesario GillasNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- AC Motors, Motor Control and Motor ProtectionDocument25 pagesAC Motors, Motor Control and Motor Protectionwira eka0% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Electric Motors Whitepaper PDFDocument8 pagesElectric Motors Whitepaper PDFCesario GillasNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- AC SystemsDocument140 pagesAC SystemsCesario GillasNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Capito Loses ToDocument52 pagesCapito Loses ToCesario GillasNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Trading System Based On ANNDocument45 pagesA Trading System Based On ANNCesario GillasNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Modeling and Analysis of Energy Data: State-Of-The-Art and Practical Results From An Application ScenarioDocument9 pagesModeling and Analysis of Energy Data: State-Of-The-Art and Practical Results From An Application ScenarioCesario GillasNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Industrial Energy Audit Using Data Mining Model Web ApplicationDocument6 pagesIndustrial Energy Audit Using Data Mining Model Web ApplicationCesario GillasNo ratings yet

- Churn Prediction in Telecommunications Using MiningMartDocument2 pagesChurn Prediction in Telecommunications Using MiningMartcmanoj6No ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- DM BiDocument16 pagesDM BiCesario GillasNo ratings yet

- DM BiDocument16 pagesDM BiCesario GillasNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Multi JerarquicoDocument23 pagesMulti JerarquicoCesario GillasNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Green3 PDFDocument1 pageGreen3 PDFCesario GillasNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Statcom ReferenciaDocument7 pagesStatcom ReferenciaCesario GillasNo ratings yet

- Eija Er 1022Document10 pagesEija Er 1022Anikendu MaitraNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Modelo MotorDocument7 pagesModelo MotorCesario GillasNo ratings yet

- Tesis Multiobjetivos PDFDocument207 pagesTesis Multiobjetivos PDFCesario GillasNo ratings yet

- Statcom Static Synchronous Compensator: Theory, Modeling, ApplicationsDocument7 pagesStatcom Static Synchronous Compensator: Theory, Modeling, ApplicationsCesario GillasNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- HARMO1Document3 pagesHARMO1Cesario GillasNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- FuzzyLogicinAppliances PDFDocument10 pagesFuzzyLogicinAppliances PDFCesario GillasNo ratings yet

- Green1 PDFDocument14 pagesGreen1 PDFCesario GillasNo ratings yet

- Green2 PDFDocument8 pagesGreen2 PDFCesario GillasNo ratings yet

- Gestion EnergiaDocument4 pagesGestion EnergiaCesario GillasNo ratings yet

- BP Energy Outlook 2030: India InsightsDocument1 pageBP Energy Outlook 2030: India InsightsCesario GillasNo ratings yet

- 20.documento TecnicoDocument4 pages20.documento TecnicoCesario GillasNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Trading System Based On ANNDocument45 pagesA Trading System Based On ANNCesario GillasNo ratings yet

- Buen Dato HomerDocument14 pagesBuen Dato HomerCesario GillasNo ratings yet

- BP Energy Outlook 2030: Europe InsightsDocument1 pageBP Energy Outlook 2030: Europe InsightsCesario GillasNo ratings yet

- Heat Engines Vol 2 Chapter 3 PDFDocument23 pagesHeat Engines Vol 2 Chapter 3 PDFtarunNo ratings yet

- Analysis of Corona Discharge and Earth Fault 0N 33Kv OverheadlineDocument3 pagesAnalysis of Corona Discharge and Earth Fault 0N 33Kv Overheadlinem.a.hadiNo ratings yet

- Impulse and MomentumDocument23 pagesImpulse and MomentumGabriel RamosNo ratings yet

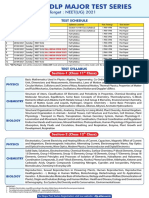

- DLP Major Test Series: Target: NEET (UG) 2021Document1 pageDLP Major Test Series: Target: NEET (UG) 2021Ankit singh TomarNo ratings yet

- Dokumen - Tips Saacke Boiler House Log Book Saacke Boiler House Log Book Saacke Service ContractDocument8 pagesDokumen - Tips Saacke Boiler House Log Book Saacke Boiler House Log Book Saacke Service Contractgeo3tripNo ratings yet

- Methonal Process and EconomicsDocument34 pagesMethonal Process and EconomicsravisankarpaladiNo ratings yet

- Tripp Lite Apsint612Document12 pagesTripp Lite Apsint612samsogoyeNo ratings yet

- DynamoDocument6 pagesDynamoFabian Hernandez HernandezNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- FMEA AssignmentDocument3 pagesFMEA AssignmentFebrizalNo ratings yet

- 1SEAPs Energy Review Energy Baseline and EnPI SOGESCADocument36 pages1SEAPs Energy Review Energy Baseline and EnPI SOGESCAdeniz ümit bayraktutarNo ratings yet

- 6 Ultratech Reddipalayam PDFDocument25 pages6 Ultratech Reddipalayam PDFbulentbulutNo ratings yet

- Aircraft Engine Electrical SystemsDocument19 pagesAircraft Engine Electrical SystemsRickchinoNo ratings yet

- Water Heater 15 Gallon (Manuf. Ruud) (Model - PEP15-1)Document1 pageWater Heater 15 Gallon (Manuf. Ruud) (Model - PEP15-1)Ahmed GhreebNo ratings yet

- Electronics Lab Reports: Sir Muhammad ArifDocument11 pagesElectronics Lab Reports: Sir Muhammad ArifMuhammad SadiqNo ratings yet

- Eaton Power Xpert 9395 High Performance Datasheet BR153048ENDocument2 pagesEaton Power Xpert 9395 High Performance Datasheet BR153048ENHector TroselNo ratings yet

- Online Ups With Iso Ld1000 2000t-070917Document2 pagesOnline Ups With Iso Ld1000 2000t-070917NaviNo ratings yet

- Electrical Engineering Mastery Test 2 REE Pre-Board ExamDocument18 pagesElectrical Engineering Mastery Test 2 REE Pre-Board ExamRogelio Jr. Dela CruzNo ratings yet

- Back UPS - BX2200MI MSDocument3 pagesBack UPS - BX2200MI MSHans SiddhārtaNo ratings yet

- En E1zm, E1z1Document3 pagesEn E1zm, E1z1retrueke1170No ratings yet

- KRL Questions of Previous ExamsDocument4 pagesKRL Questions of Previous ExamsAqmam HaiderNo ratings yet

- ME - M-Series and P-Series Catalog - 05-2021Document176 pagesME - M-Series and P-Series Catalog - 05-2021harry HendersonNo ratings yet

- Chemistry LOsDocument44 pagesChemistry LOsYoussef samehNo ratings yet

- Ethanol As Gas Turbine FuelDocument2 pagesEthanol As Gas Turbine FuelAnand Kumar100% (1)

- Megneto TherapyDocument15 pagesMegneto TherapyedcanalNo ratings yet

- Prediction and Tips STPM Physics 2010Document4 pagesPrediction and Tips STPM Physics 2010HenryChan_YSNo ratings yet

- VS P.S Pumping Edwards & Zuck Full Page 10.12.06Document41 pagesVS P.S Pumping Edwards & Zuck Full Page 10.12.06persaudchrisNo ratings yet

- Lubricant Market Statistics 2023 Q1 ED1Document22 pagesLubricant Market Statistics 2023 Q1 ED1Dharshan MylvaganamNo ratings yet

- C1000D6 Data SheetDocument3 pagesC1000D6 Data SheetCyril TEMATAHOTOANo ratings yet

- API 598 Valves Inspection and TestingDocument457 pagesAPI 598 Valves Inspection and TestingSenthamizhselvan SelvanNo ratings yet

- UFGS Solar Panel SpecificationDocument39 pagesUFGS Solar Panel Specificationvisal097No ratings yet