Professional Documents

Culture Documents

Chapter 1: Introduction: Eugene Bala Influence of Beta On The Price of Equity and The Cost Capital

Uploaded by

Mano_Bili89Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 1: Introduction: Eugene Bala Influence of Beta On The Price of Equity and The Cost Capital

Uploaded by

Mano_Bili89Copyright:

Available Formats

Eugene Bala

Influence of Beta on the Price of Equity and the Cost Capital

Summary

Chapter 1: Introduction Chapter 2: Estimating the Cost of Capital Chapter 3: Beta Estimates page 6 Chapter 4: Managerial Implications Annexes ! output

page 2 page 4

page 13

page 14 page 22

"ata ets

12#16#13

!age: 1

Eugene Bala

Influence of Beta on the Price of Equity and the Cost Capital

Chapter 1

Introduction

$he "o% &ones industrial a'erage( the %orld)s most %idel* follo%ed indicator of stoc+ mar+et health( ,ro+e through the 1-(--- le'el for the first time on March 1.( 1///0 ome in'estors( mostl* small1time pla*ers( attached great significance to the de'elopment0 $en thousand2 $hat)s a lot of 3eros( %hich translates into a lot of %ealth0 $he real significance of 1-(--- is ) that)s eas* to sa* and has fi'e digits instead of four) said financial anal*sts0 4hich in'estment is more profita,le and %hich is ris+ier5 A stoc+)s expected return( its di'idend *ield plus expected price appreciation( is related to ris+0 6is+ a'erse in'estors must ,e compensated %ith higher expected returns for ,earing ris+0 7ne source of ris+ is the financial ris+ incurred ,* shareholders in a firm %hich has de,t in its capital structure0 Meeting its financial strateg* for a firm is em,ar+ing onl* on pro8ects that increase shareholder 'alues0 $hus( the expected rate of return on these pro8ects should ,e e9ual or greater to the cost of capital0 $he compan*)s cost of capital is directl* related to its financial le'erage and its impact on the cost of e9uit*0 Changes in interest rates( go'ernment spending( monetar* polic*( oil prices( foreign exchange rates and other macroeconomic factors affect all companies and the returns on all stoc+0 6is+ depends on exposure to macroeconomic e'ents and can ,e measured as the sensiti'it* of a stoc+)s return to fluctuations in returns on the mar+et portfolio0 "ominant practices in estimating companies) cost of capital are the 4ACC method0 $he CA!M model( %hich relies on ,eta estimates and the return on the mar+et portfolio( is used in order to determine the cost of e9uit*0 $heor* dictates that the return on mar+et portfolio is an uno,ser'a,le portfolio consisting of all ris+* assets( including human capital and other nontraded assets( in proportion to their importance in %orld %ealth0 Beta pro'iders use a 'ariet* of stoc+ mar+et indices as proxies for the mar+et portfolio on the argument that stoc+ mar+ets trade claims on a

12#16#13

!age: 2

Eugene Bala

Influence of Beta on the Price of Equity and the Cost Capital

sufficientl* %ide arra* of assets to ,e ade9uate surrogates for the uno,ser'a,le mar+et portfolio0 :o% ,eta is estimated and ho% it impacts the cost of e9uit*( respecti'el* the cost of capital is critical for managers to understand0 In the follo%ing sections of this paper it is presented the relationship ,et%een ,etas and the cost of capital( the regression model and assumptions allo%ing to estimate ,etas as %ell as t%o regressions for t%o different stoc+s and a su,se9uent anal*sis of the impact of using different indices as return on the mar+et proxies on the 'alue of the ,eta0 Included to this document is a dis+ette containing the data sets that ha'e ,een used for statistical anal*sis0

12#16#13

!age: 3

Eugene Bala

Influence of Beta on the Price of Equity and the Cost Capital

Chapter 2

Estimating the Cost of Capital

The Weighted-Average Cost of Capital

A standard method of expressing a compan*)s cost of capital is the %eighted1 a'erage of the cost of indi'idual resources of capital emplo*ed ;4ACC<: WACC !Wde"t # !$-t%&de"t% ' !Wpreferred # &preferred% ' !Wequity #

&equity% (1) %here : = 4 t > component cost of capital > %eight of each component as percent of total capital > marginal corporate tax rate

?inance theor* offers se'eral important o,ser'ations %hen estimating a compan*)s 4ACC0 ?irst( the capital costs appearing in the e9uation should ,e current costs reflecting current financial mar+et conditions( not historical( sun+ costs0 In essence( the costs should e9ual the in'estors) anticipated internal rate of return on future cash flo%s associated %ith each form of capital0 econd( the %eights appearing in the e9uation should ,e mar+et %eights( not historical %eights ,ased on often ar,itrar* out1dated ,oo+ 'alues0 $hird( the cost of de,t should ,e after corporate tax( reflecting the ,enefits of the tax deducti,ilit* of interest0

The Cost of Equity - the Capital Assets Pricing (odel

$he presence of de,t in a firm)s capital structure has an impact on the ris+ ,orne ,* its shareholders0 In the a,sence of de,t( shareholders are su,8ected onl* to ,asic ,usiness or operating ris+0 $his ,usiness ris+ is determined ,* factors such as the 'olatilit* of a firm)s sales and its le'el of operating le'erage0 As compensation for incurring ,usiness ris+( in'estors re9uire a premium in excess of the return the* could earn on a ris+less securit* such as a $reasur* ,ill0 $hus( in the a,sence of financial le'erage a stoc+)s expected return can ,e thought of as the ris+1 free rate plus a premium for ,usiness ris+:

12#16#13

!age: 4

Eugene Bala

Influence of Beta on the Price of Equity and the Cost Capital

E#pected return (2)

)is*-free rate ' )is* premium

$he ris+ premium consists of a premium for ,usiness ris+ and a premium for financial ris+0 $hus( the relation can ,e expressed as E#pected return )is*-free rate ' Business ris* premium ' +inancial ris* premium (3) $he capital assets pricing model ;CA!M< is an idealised representation of the manner in %hich capital mar+ets price securities and there,* determines expected returns0 ince CA!M models the ris+#expected return trade1off in the capital mar+ets( it can ,e used to determine the impact of financial le'erage on expected returns0 In CA!M( s*stematic ;or mar+et1related< ris+ is the onl* ris+ rele'ant in the pricing of securities and the determination of expected returns0 Beta( %hich facilitates the estimation of the stoc+)s expected return0 In general the return on the stoc+( %hich corresponds to the cost of e9uit* in ;1< and ;2< can ,e expressed as : )s (4) %here : 6s 6f 6m > stoc+)s expected return > ris+ free rate > return on the mar+et )f ' Beta ! )m - )f% *stematic ris+ is measured ,* Beta0 CA!M pro'ides a measure of a stoc+)s ris+ premium emplo*ing

12#16#13

!age: @

Eugene Bala

Influence of Beta on the Price of Equity and the Cost Capital

Chapter 3

Beta Estimates, (easuring (ar*et )is*

)egression model

?inance theor* calls for a for%ard1loo+ing ,eta( one reflecting in'estors) uncertaint* a,out the future cash flo%s to e9uit*0 Because for%ard1loo+ing ,etas are uno,ser'a,le( practitioners are forced to rel* on proxies of 'arious +inds0 Most often this in'ol'es using ,eta estimates deri'ed from historical data and pu,lished ,* such sources as Bloom,erg and tandard A !oors0 $he usual methodolog* is to estimate ,eta as the slope coefficient of the mar+et model of returns0 $he regression e9uation is: )it > Alphai B Betai ;)mt< ;@< %here : 6it > return on stoc+ i in time period ;e0g0 %ee+( month< t0 $his is the dependent 'aria,le( as it is predicted ,* the 'ariation of the independent 'aria,le0 6mt > return on the mar+et portfolio in period t $his is the independent 'aria,le as it used to ma+e a prediction on the dependent 'aria,le0 Alphai > Betai > regression constant for stoc+ I ;the intercept< ,eta for stoc+ I ;the slope<

Sample si-e - Practical Compromises

$he use of this e9uation ;@< to estimate ,eta relies on historical data0 $he data that has ,een do%nloaded from "atastream and su,se9uentl* anal*sed( represents the return on stoc+( respecti'el* the return on the mar+et portfolio0 $he time span used for estimating the ,eta is: 10 t%o *ear of %ee+l* periods ,asis ;1-4 paired 'alues< and 20 fi'e *ear of monthl* periods ,asis ;6- paired 'alues< $he names of the companies in each sample are presented in annexes0

12#16#13

!age: 6

Eugene Bala

Influence of Beta on the Price of Equity and the Cost Capital

.ne /ull 0ypothethis

$he null h*pothethis is that there is no relationship ,et%een the mar+et return( reflected ,* the index used as prox*( and the return on the stoc+ i0

T1o regressions

$he regression e9uation ;@< implies that the return on stoc+ and the return on the mar+et portfolio 'ar* together( the* are correlated0 ome stoc+s are less affected ,* mar+et fluctuations than others are0 In'estment managers tal+ a,out )defensi'e) and )aggressi'e) stoc+s0 "efensi'e stoc+s are not 'er* sensiti'e to mar+et fluctuations and their ,etas are lo%0 In contrast( aggressi'e stoc+ amplif* an* mar+et mo'ement and their ,etas are high0 $o illustrate this relationship( t%o regressions ha'e ,een ,uilt for : 10 the 4alt "isne* Compan* 20 the Cnis*s Corporation As proxies for the mar+et ha'e ,een retained: $he "o% &ones 1 as the 4alt "isne* Compan* is one of the 3- largest companies ;,lue chips< listed on the DE E0 $he tandard A !oors @-- index has ,een retained as prox* for the mar+et portfolio0 +irst regression $he ! output is presented in Annexe 1 to 40 ?or monthly o,ser'ations of the return on the 4alt "isne* Compan*) stoc+0 $he null h*pothethis has ,een re8ected as ignif ? F -0-@0 $he correlation coefficient is 0@/ if "o% &ones is the independent 'aria,le0 $he correlation coefficient is 0@3 if A!@-- is the independent 'aria,le0 $hat indicates a strong correlation ,et%een the return on the mar+et and the return on stoc+0 ?urthermore( the 'alue of ig $ F -0-@ sho%s that the independent 'aria,le( %hich is the mar+et return( is significant0

12#16#13

!age: .

Eugene Bala

Influence of Beta on the Price of Equity and the Cost Capital

$he predicti'e po%er of the regression is 03@ ;"o% &ones<( respecti'el* 02G ; A!< $herefore the regression is considered to ,e significant0

If 2o1 3ones represents the prox* of the mar+et return then the regression e9uation is: )t Beta -4567898 ' $45:9;$6 < )mt $45: ;6<

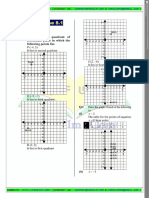

Exhibit 1 : Normal P-P Plot of DISNEY

1.00

. !

Ex#e$ted Cum Prob

.!0

."!

0.00 0.00

."!

.!0

. !

1.00

Observed Cum Prob

and is graphicall* represented in Exhi,it 10

If the S=P >55 represents the

prox* of the mar+et return then the regression e9uation is : )t Beta -4;58:$5 ' $45;;;7; < )mt $45; ;.<

?or 1ee*ly o,ser'ations of the return on the 4alt "isne* Compan*) stoc+: $he null h*pothethis has ,een re8ected as ignif ? F -0-@0 $he correlation coefficient is 04/ if "o% &ones is the independent 'aria,le0

12#16#13

!age: G

Eugene Bala

Influence of Beta on the Price of Equity and the Cost Capital

$he correlation coefficient is 04. if A!@-- is the independent 'aria,le0 $hat indicates a strong correlation ,et%een the return on the mar+et and the return on stoc+0 is: )t Beta 4$959:6 ' 46>9:78 < )mt ;G< 46> ?urthermore( the 'alue of ig $ F -0-@ sho%s that the independent 'aria,le( %hich is the mar+et return( is significant0 $he predicti'e po%er of the regression is 024 ;"o% &ones<( respecti'el* 022 ; A!< $herefore the regression is considered to ,e significant0

If 2o1 3ones represents the prox* of the mar+et return then the regression e9uation

and is graphicall* represented in Exhi,it 20

Exhibit ": Normal P-P Plot of DISNEY

1.00

. !

Ex#e$ted Cum Prob

.!0

."!

0.00 0.00

."!

.!0

. !

1.00

Observed Cum Prob

12#16#13

!age: /

Eugene Bala

Influence of Beta on the Price of Equity and the Cost Capital

If the S=P >55 represents the prox* of the mar+et return then the regression e9uation is : )t Beta 4595>:5 ' 46;75?> < )mt ;/< 469

Second regression $he ! output is presented in Annexe @ and 60 ?or monthly o,ser'ations of the return on the Cnis*s Corporation) stoc+0 $he null h*pothethis has ,een re8ected as ignif ? F -0-@0 $he correlation coefficient is 0@3 %ith A!@-- as independent 'aria,le0 $hat indicates a strong correlation ,et%een the return on the mar+et and the return on stoc+0 ?urthermore( the 'alue of ig $ F -0-@ sho%s that the independent 'aria,le( %hich is the mar+et return( is significant0 $he predicti'e po%er of the regression is 02G ; A!< $herefore the regression is considered to ,e significant0

Exhibit %: Normal P-P Plot of &NISYS

1.00

. !

.!0

Ex#e$ted Cum Prob

."!

0.00 0.00

."!

.!0

. !

1.00

Observed Cum Prob

12#16#13

!age: 1-

Eugene Bala

Influence of Beta on the Price of Equity and the Cost Capital

$he regression e9uation is : )t Beta -$489>$59 ' ;496$>87 < )mt ;496 ;1-<

and is graphicall* represented in Exhi,it 30 ?or 1ee*ly o,ser'ations of the return on the Cnis*s Corporation) stoc+: $he null h*pothethis has ,een re8ected as ignif ? F -0-@0 $he correlation coefficient is 04G %ith A!@-- as independent 'aria,le0 $hat indicates a strong correlation ,et%een the return on the mar+et and the return on stoc+0 ?urthermore( the 'alue of ig $ F -0-@ sho%s that the independent 'aria,le( %hich is the mar+et return( is significant0 $he predicti'e po%er of the regression is 023 ; A!< $herefore the regression is considered to ,e significant0

$he regression e9uation is : )t Beta $4$7?$96 ' $49$9687 < )mt $49$ ;11<

and is graphicall* represented in Exhi,it 40

12#16#13

!age: 11

Eugene Bala

Influence of Beta on the Price of Equity and the Cost Capital

Exhibit ':Normal P-P Plot of &NISYS

1.00

. !

.!0

Ex#e$ted Cum Prob

."!

0.00 0.00

."!

.!0

. !

1.00

Observed Cum Prob

12#16#13

!age: 12

Eugene Bala

Influence of Beta on the Price of Equity and the Cost Capital

Beta estimates

$he different 'alues resulting from the use of different return on the mar+et proxies ;$a,le 1< indicates that : 4hen using "o% &ones as return on the mar+et prox* for a compan* %hich is in the "o% &ones) pool the 'alue of ,eta is a,o'e 1( as for an aggressi'e stoc+0 4hen using A!@-- as return on the mar+et prox* for a compan* %hich is in the "o% &ones) pool the 'alue of ,eta is under 1( as for a defensi'e stoc+0 As a result( it is possi,le to assess the 'aria,ilit* of the return on the stoc+ ,* comparing %ith a larger population of companies ,* using the A! @--0 In this case the 4alt "isne* Compan* seems to ,e a defensi'e stoc+ %hen compared to the o'erall mar+et0 4hen compared to its specific pool of ),lue chip) companies the same stoc+ appears to ,e slightl* aggressi'e ,ecause the companies in the "o% &ones pool are less ris+ier than those in the o'erall mar+et and perform differentl*0 4hen using %ee+l* o,ser'ations 's monthl* o,ser'ations the 'alue of ,etas for ,oth companies are smaller as the* ma* introduce some irrele'ant information( li+e unchanged return on stoc+ and#or the mar+et portfolio0 De'ertheless it increases the si3e of the sample and thus ( the relia,ilit* of the estimate0

Ta"le $ Compan* Mar+et Index Beta Monthl* o,s0 $45: 46> ;496 4ee+l* o,s0 $45; 469 $49$

Walt 2isney 2o1 3ones Company S=P>55 @nisys Corp4 S=P>55 2o1 3ones vs S=P >55

In the light of the results o,tained pre'iousl*( it seems that each of the t%o companies come from a different population of companies more or less ris+*0 In order to assess %hether these assumption is true the follo%ing test of means has ,een made : $%o samples each of 3- companies ha'e ,een esta,lished :

12#16#13

!age: 13

Eugene Bala

Influence of Beta on the Price of Equity and the Cost Capital

one contains all the ,lue chips companies in the "o% &ones) pool the second one contains other companies in the A! @-- pool0

$he null h*pothethis : the companies in ,oth samples come from the same population0 Instead of doing a regression for each compan* in the samples( ,eta estimates from the Bloom,erg pro'ider ha'e ,een considered0 If the null h*pothesis is correct then all these companies should respond more or less in the same manner to the 'ariations of the return on the mar+et portfolio0

As the ! the 21$ail

output for a t1test for independent samples in Annexe . indicates(

ig F -0-@( thus the null h*pothesis is re8ected0 In other %ords( the t%o A! @-- pool

samples do not come from the same population0 :o%e'er( the 3- companies in the "o% &ones pool ha'e ,een ta+en out( %ithout replacement( from the ),lue chips)0 %hen the second sample has ,een created pic+ing all other compan* excepting a

12#16#13

!age: 14

Eugene Bala

Influence of Beta on the Price of Equity and the Cost Capital

Chapter 4

Implications for (anagers

4hen using the C!AM model ,eta estimates directl* influence the magnitude of the compan*)s cost of e9uit* and indirectl*( as indicated in the pre'ious sections( the cost of capital0 Bigger the ,eta harder the compan* has to )%or+) for the mone* that it gets from in'estors and pa* a premium for the ris+ that the* ha'e ta+en0 ?irms recognise a certain am,iguit* in an* cost num,er and are %illing to li'e %ith approximation0 De'ertheless it is critical for managers to understand %hat underlies ,eta estimates and( as a result( use the most appropriate 'alue that se'eral pro'iders ma* offer0 In addition to rel*ing on historical data( use of this e9uation ;@< to estimate ,eta re9uires a num,er of practical compromises( each of %hich can materiall* affect the results0 10 Increasing the num,er of time periods used in the estimation ma* impro'e the statistical relia,ilit* of the estimate ,ut ris+s the inclusion of stale( irrele'ant information0 20 hortening the o,ser'ation period from monthl* to %ee+l* or dail* increases the si3e of the sample ,ut ma* *ield o,ser'ations that are not normall* distri,uted and ma* introduce un%anted random noise0 30 Choice of the mar+et index0 Beta pro'iders use a 'ariet* of stoc+ mar+et indices as proxies for the mar+et portfolio on the argument that stoc+ mar+ets trade claims on a sufficientl* %ide arra* of assets to ,e ade9uate surrogates for the uno,ser'a,le mar+et portfolio0 !art of the "o% &ones index)s appeal is its simplicit*: it includes 3- of the ,iggest corporate names on the planet( such as Mc"onalds)s Corp0( 4alt "isne*( IBM( 4al1Mart tores Inc0( ,ut the* represent onl* 2- percent of C mar+et)s total 'alue0 A much ,roader measure is the tandard H !oors @--( %hose stoc+s represent a,out ./ per cent of the mar+et 'alue0 $herefore it is ,etter that the ,etas should ,e estimated ta+ing into account the A! @-- indice as prox* for the return on the mar+et portfolio0 Also managers must ,e a%are of the impact that the time inter'al of

12#16#13

!age: 1@

Eugene Bala

Influence of Beta on the Price of Equity and the Cost Capital

o,ser'ations ha'e on the 'alue of ,eta( as indicated in ta,le 1( and accordingl* ad8ust it0

12#16#13

!age: 16

Eugene Bala

Influence of Beta on the Price of Equity and the Cost Capital

Annexes 1

SPSS .utput for The Walt 2isney Company

(onthly ."servations - 2o1

Mean "I "74&M D of Cases > td "e' Ia,el 10@44 10@26.0346 40-4.

Jaria,le;s< Entered on tep Dum,er 100 "74&M 0@/122 034/@4 033G32 @0/.@32

Multiple 6 6 9uare tandard Error

Ad8usted 6 9uare

Anal*sis of Jariance "? 6egression 6esidual ?> 1 @G um of 9uares 11120G1G31 2-.-0G@./G ignif ? > 0---Mean 9uare 11120G1G31 3@0.-44@

31016.@-

111111111111111111 Jaria,les in the E9uation 111111111111111111 Jaria,le "74&M ;Constant< B 10-.321G 10-G6434 EB 01/223. 0G24G.4 Beta 0@/121G $ @0@G3 101-@ ig $ 0---0/16/

12#16#13

!age: 1.

Eugene Bala

Influence of Beta on the Price of Equity and the Cost Capital

Annexes 2

SPSS .utput for The Walt 2isney Company

(onthly ."servations - S=P>55

Mean "I !@--M D of Cases > Multiple 6 6 9uare Ad8usted 6 9uare tandard Error 10@44 10.11 60@2/@1 02G-3G 026./. 602G4/@ td "e' Ia,el .0346 30G-@

Anal*sis of Jariance "? 6egression 6esidual ?> 1 @G um of 9uares G/2064334 22/10-32/@ ignif ? > 0---Mean 9uare G/2064334 3/0@--@.

220@/G24

111111111111111111 Jaria,les in the E9uation 111111111111111111 Jaria,le !@--M ;Constant< B 10-22262 102-4.1EB 021@-43 Beta 0@2/@1$ 40.@4 ig $ 0---10230G1/1

0G/-/21

12#16#13

!age: 1G

Eugene Bala

Influence of Beta on the Price of Equity and the Cost Capital

Annexes 3

SPSS .utput for The Walt 2isney Company

Wee*ly ."servations - 2o1

Mean "I "74&4 03G/ 03-3 td "e' Ia,el 403@2 204G@

D of Cases > 1-4 Multiple 6 6 9uare Ad8usted 6 9uare tandard Error Anal*sis of Jariance "? 6egression 6esidual ?> 310./1/G 1 1-2 um of 9uares 46304.4G1 14G60//241 Mean 9uare 46304.4G1 140@.G36 04G.4. 023.62 023-1@ 30G1G16

ignif ? > 0----

111111111111111111 Jaria,les in the E9uation 111111111111111111 Jaria,le "74&4 ;Constant< B 0G@3.64 013-3.G EB 01@141/ Beta 04G.46@ $ ig $

@063G 0---0346 0.3-3

03..2-4

12#16#13

!age: 1/

Eugene Bala

Influence of Beta on the Price of Equity and the Cost Capital

Annexes 4

SPSS .utput for The Walt 2isney Company

Wee*ly ."servations - S=P>55

Mean "I !@--4 Multiple 6 6 9uare Ad8usted 6 9uare tandard Error Anal*sis of Jariance "? 6egression 6esidual ?> 1 1-2 um of 9uares 4220/-6G/ 1@2.0@6-34 ignif ? > 0---Mean 9uare 4220/-6G/ 140/.6-G 03G/ 0434 td "e' Ia,el 403@2 204@3 046@64 0216G2 02-/1@ 30G6/G/

2G023GG2

111111111111111111 Jaria,les in the E9uation 111111111111111111 Jaria,le !@--4 ;Constant< B 0G26-/@ 0-3-@.EB 01@@4@6 03G@42. Beta 046@643 $ ig $

@0314 0---0-./ 0/36/

12#16#13

!age: 2-

Eugene Bala

Influence of Beta on the Price of Equity and the Cost Capital

Annexes @

SPSS .utput for The @nisys Corp4

(onthly ."servations - S=P>55

Mean CI !@--M td "e' Ia,el

2064- 160-21 10.11 30G-@

Multiple 6 6 9uare Ad8usted 6 9uare tandard Error Anal*sis of Jariance "? 6egression 6esidual ?> 1 @G

0@6@6031//03-G1G 13032@/2

um of 9uares 4G440.4G/. 1-2//06@243 ignif ? > 0----

Mean 9uare 4G440.4G/. 1..0@G-21

2.02G2-3

111111111111111111 Jaria,les in the E9uation 111111111111111111 Jaria,le !@--M ;Constant< B 203G1@46 11043@1-3 EB 04@@/@4 10GG/-12 Beta 0@6@6-$ @0223 10.6ig $ 0---04@-@

12#16#13

!age: 21

Eugene Bala

Influence of Beta on the Price of Equity and the Cost Capital

Annexes 6

SPSS .utput for The @nisys Corp4

Wee*ly ."servations - S=P>55

Mean CI !@--4 Multiple 6 6 9uare Ad8usted 6 9uare tandard Error 10.@6 0446 td "e' Ia,el 60.32 20462 04G-43 023-G1 02232@0/332G

Anal*sis of Jariance "? 6egression 6esidual ?> 1 1-1 um of 9uares 1-660/4363@@@0@./@4 ignif ? > 0---Mean 9uare 1-660/4363@02-3.6

3-03-.66

111111111111111111 Jaria,les in the E9uation 111111111111111111 Jaria,le !@--4 ;Constant< B 10313G46 1016/13G EB 023G6@4 0@/424. Beta 04G-431 $ ig $

@0@-@ 0---10/6. 0-@1/

12#16#13

!age: 22

Eugene Bala

Influence of Beta on the Price of Equity and the Cost Capital

Annexes .

SPSS .utput for the Test of (eans

t-tests for Independent Samples of I/2EA

Dum,er Jaria,le BE$A ID"EK 1 ID"EK 2 330/4G102@2. 031@ 02/4 0-@G 0-@4 of Cases Mean " E of Mean 11111111111111111111111111111111111111111111111111111111111111111111111

11111111111111111111111111111111111111111111111111111111111111111111111 Mean "ifference > 103-4. Ie'ene)s $est for E9ualit* of Jariances: ?> 0-12 !> 0/12

t1test for E9ualit* of Means Jariances t1'alue E9ual Cne9ual 130G. 130G. df @G @.0.2 21$ail ig 0--0--E of "iff 0-./ 0-./

/@L CI for "iff ;10462( 1014.< ;10462( 1014.<

1111111111111111111111111111111111111111111111111111111111111111111111111111111

1111111111111111111111111111111111111111111111111111111111111111111111111111111

12#16#13

!age: 23

Eugene Bala

Influence of Beta on the Price of Equity and the Cost Capital

Annexe G

"etadBm4sa v

+ield

month sp@--m do%8m mcd dis ch' xon gm genel u+ intc aap dd pg +o ip %mt utx cat s ald e+ good*ear mr+ h%p mmm mo 8n8 c t axp ,a 8pm

2escription

tandard A !oors monthl* "o% &ones monthl* Mc"onald)s Corporation $he 4alt "isne* Co0 Che'ron Corp0 Exxon Corp0 Meneral Motors Corp0 Meneral Electric Co0 Cnion Car,ide Corp0 Intel Business Machines Corp0 Alcoa Inc0 "u !ont de Demours !rocter A Mam,le Co0 Coca1Cola Co0 International !aper Co0 4al1Mart tores Inc0 Cnited $echnologies Corp0 Caterpillar Inc0 ears( 6oe,uc+ H Co0 Allied ignal Inc0 Eastman =oda+ Co0 Mood*ear $ire A 6u,,er Co0 Merc+ A Co0( Inc0 :e%lett1!ac+ard Co0 Minnesota Mining A M?M Co0 !hilip Morris Companies Inc0 &ohnson A &ohnson Citigroup Inc0 A$A$ Corp0 American Express Co0 Boeing Co0 &! Morgan A Co0

12#16#13

!age: 24

Eugene Bala

Influence of Beta on the Price of Equity and the Cost Capital

Annexe /

"etadB14s av

+ield

%ee+ sp@--m do%8% mcd dis ch' xon gm genel u+ intc aap dd pg +o ip %mt utx cat s ald e+ good*ear mr+ h%p mmm mo 8n8 c t axp ,a 8pm

2escription

tandard A !oors %ee+l* "o% &ones %ee+l* Mc"onald)s Corporation $he 4alt "isne* Co0 Che'ron Corp0 Exxon Corp0 Meneral Motors Corp0 Meneral Electric Co0 Cnion Car,ide Corp0 Intel Business Machines Corp0 Alcoa Inc0 "u !ont de Demours !rocter A Mam,le Co0 Coca1Cola Co0 International !aper Co0 4al1Mart tores Inc0 Cnited $echnologies Corp0 Caterpillar Inc0 ears( 6oe,uc+ H Co0 Allied ignal Inc0 Eastman =oda+ Co0 Mood*ear $ire A 6u,,er Co0 Merc+ A Co0( Inc0 :e%lett1!ac+ard Co0 Minnesota Mining A M?M Co0 !hilip Morris Companies Inc0 &ohnson A &ohnson Citigroup Inc0 A$A$ Corp0 American Express Co0 Boeing Co0 &! Morgan A Co0

12#16#13

!age: 2@

Eugene Bala

Influence of Beta on the Price of Equity and the Cost Capital

Annexe 1-

"etasp>55m4sa v

+ield

month sp@--m amr ntrs lu' mar 8cp mas fm* hon lnc uis ,c cs cof ccl cd ctx cen cha cm, c, ci csco ccu cl 8ci rn, p+n d( $$r see

2escription

tandard A !oors monthl* AM6 Corp0 Dorthern $rust outh%est Air Mariott Intl &C !enne* Co0 Masco Corp0 ?red Ma*er Inc0 :one*%ell Inc0 Iincoln Datl0 Corp0 Cnis*s Corp0 Bruns%ic+ Corp0 Ca,letron *stem Cap 7ne ?inl0 Carni'al Corp0 Cendant Corp0 Centex Corp0 Ceridian Corp0 Champion Intl0 Chase Manhattan Corp0 Chu,, Corp0 Cigna Corp0 Cisco *stems0 Clear Channel Colgate !almoli'e &ohnson Controls 6epu,lic DE Corp0 !er+in1Elmer "ollar Meneral Countr*%ide Cred0 ealed Air Corp0

12#16#13

!age: 26

Eugene Bala

Influence of Beta on the Price of Equity and the Cost Capital

Annexe 11

"etasp>5514sa v

+ield

%ee+ sp@--m amr ntrs lu' mar 8cp mas fm* hon lnc uis ,c cs cof ccl cd ctx cen cha cm, c, ci csco ccu cl 8ci rn, p+n d( $$r see

2escription

tandard A !oors %ee+l* AM6 Corp0 Dorthern $rust outh%est Air Mariott Intl &C !enne* Co0 Masco Corp0 ?red Ma*er Inc0 :one*%ell Inc0 Iincoln Datl0 Corp0 Cnis*s Corp0 Bruns%ic+ Corp0 Ca,letron *stem Cap 7ne ?inl0 Carni'al Corp0 Cendant Corp0 Centex Corp0 Ceridian Corp0 Champion Intl0 Chase Manhattan Corp0 Chu,, Corp0 Cigna Corp0 Cisco *stems0 Clear Channel Colgate !almoli'e &ohnson Controls 6epu,lic DE Corp0 !er+in1Elmer "ollar Meneral Countr*%ide Cred0 ealed Air Corp0

12#16#13

!age: 2.

Eugene Bala

Influence of Beta on the Price of Equity and the Cost Capital

Annexe 11

Beta954sav

+ield

Cn* Index Beta

2escription

Dame of the compan* 11 "o% &ones pool 21 A! @-- pool ,eta pro'ided ,* Bloom,erg

12#16#13

!age: 2G

Eugene Bala

Influence of Beta on the Price of Equity and the Cost Capital

Annexe 12

)eferences

6 Miammarino 6 Bruner( = M Eades( 6 :arris( 6 :iggins

)?undamentals of Corporate ?inance)

)Best !ractices in Estimating the Cost of Capital: ur'e* and *nthesis)

12#16#13

!age: 2/

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Saturdays G9Document1 pageSaturdays G9Mano_Bili89No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Cultural Web Questions - Interview PendingDocument1 pageCultural Web Questions - Interview PendingMano_Bili89No ratings yet

- SampleDocument4 pagesSampleMano_Bili89No ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Chapter No. 3: Worked Solutions Class Discussion (Actual and Approximated Values) Journal Writing (Page 67)Document19 pagesChapter No. 3: Worked Solutions Class Discussion (Actual and Approximated Values) Journal Writing (Page 67)Mano_Bili89No ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Case Study For BusinessDocument1 pageCase Study For BusinessMano_Bili89No ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Subjective Type: MathematicsDocument2 pagesSubjective Type: MathematicsMano_Bili89No ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grade CalculatorDocument7 pagesGrade CalculatorMano_Bili89No ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- 7115 - s18 - in - 22 Business StudiesDocument4 pages7115 - s18 - in - 22 Business StudiesMano_Bili89No ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- TOWS MatricesDocument2 pagesTOWS MatricesMano_Bili89No ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- O Level Case Study BSDocument2 pagesO Level Case Study BSMano_Bili89No ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Case Study For BusinessDocument1 pageCase Study For BusinessMano_Bili89No ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- I Am A MuslimDocument66 pagesI Am A MuslimMano_Bili89No ratings yet

- Teachers Handbook 2015 16Document43 pagesTeachers Handbook 2015 16Mano_Bili89No ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Revision QuizDocument1 pageRevision QuizMano_Bili89No ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- CHP 10, 9th Math DefinitionsDocument1 pageCHP 10, 9th Math DefinitionsMano_Bili89No ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Business Studies WorkSheetDocument1 pageBusiness Studies WorkSheetMano_Bili89100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- 9th Math, CH 8, Theory, IntroductionDocument1 page9th Math, CH 8, Theory, IntroductionMano_Bili89No ratings yet

- CH 10Document1 pageCH 10Mano_Bili89No ratings yet

- G 9 DifinitionsDocument1 pageG 9 DifinitionsMano_Bili89No ratings yet

- Solutions For Math Grade 9thDocument6 pagesSolutions For Math Grade 9thMano_Bili89No ratings yet

- Patterns and Sequences RAGDocument3 pagesPatterns and Sequences RAGJolina Mae NatuelNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Sample Form LobneDocument2 pagesSample Form LobneMano_Bili89No ratings yet

- Masnoon DuainDocument1 pageMasnoon DuainMano_Bili89No ratings yet

- Chapter 3 Definantions 9th MathDocument1 pageChapter 3 Definantions 9th MathMano_Bili89No ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- CH 10Document1 pageCH 10Mano_Bili89No ratings yet

- FuneralDocument3 pagesFuneralMano_Bili89No ratings yet

- BiographyDocument1 pageBiographyMano_Bili89No ratings yet

- Slides WorkDocument2 pagesSlides WorkMano_Bili89No ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Lost A Friend - PoemDocument2 pagesLost A Friend - PoemMano_Bili89No ratings yet

- PoemDocument1 pagePoemMano_Bili89No ratings yet

- Mock Test 19 Paper 1 - EngDocument12 pagesMock Test 19 Paper 1 - Enghiu chingNo ratings yet

- QuiChap012 PDFDocument108 pagesQuiChap012 PDFIvan YaoNo ratings yet

- Econ Final SolutionDocument4 pagesEcon Final SolutionKebonaNo ratings yet

- Syllabus GipeDocument68 pagesSyllabus GipeadityaNo ratings yet

- Course Outline M. Com Part 1 BZU, MultanDocument5 pagesCourse Outline M. Com Part 1 BZU, MultanabidnaeemkhokherNo ratings yet

- SME LoanDocument42 pagesSME LoanRafidul IslamNo ratings yet

- Dr. Ram Manohar Lohiya National Law University Lucknow: Monetary Policy of The Reserve Bank of India: An AnalysisDocument17 pagesDr. Ram Manohar Lohiya National Law University Lucknow: Monetary Policy of The Reserve Bank of India: An AnalysisGarima ParakhNo ratings yet

- Indonesia'S Economic Crisis: Contagion and Fundamentals: The Developing Economies, XL-2 (June 2002) : 135-51Document17 pagesIndonesia'S Economic Crisis: Contagion and Fundamentals: The Developing Economies, XL-2 (June 2002) : 135-51betalaksonoNo ratings yet

- Economics Cheat Sheet: by ViaDocument6 pagesEconomics Cheat Sheet: by ViaAnaze_hNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Pas 29 Financial Reporting in Hyperinflationary EconomiesDocument2 pagesPas 29 Financial Reporting in Hyperinflationary EconomiesLlyana paula SuyuNo ratings yet

- INTRODUCTION-WPS OfficeDocument2 pagesINTRODUCTION-WPS OfficeSabaNo ratings yet

- Macroeconomics Course Outline - Fall 2020Document10 pagesMacroeconomics Course Outline - Fall 2020Syeda WasqaNo ratings yet

- Group 2 - Fiscal PolicyDocument24 pagesGroup 2 - Fiscal PolicyJune MadriagaNo ratings yet

- Economics: Case Fair OsterDocument29 pagesEconomics: Case Fair OsterGear Arellano IINo ratings yet

- Globalization and International LinkagesDocument26 pagesGlobalization and International Linkageskelompok msdm28No ratings yet

- The Impact To The Malaysian EconomyDocument2 pagesThe Impact To The Malaysian Economyladybug lyxxNo ratings yet

- Chapter 3Document22 pagesChapter 3Akash JainNo ratings yet

- Rwanda Employment JobsDocument107 pagesRwanda Employment JobsAbdifatah Ali MohamedNo ratings yet

- Macro Tut 8Document7 pagesMacro Tut 8Nguyễn Hữu HoàngNo ratings yet

- 2 - Islamic Macroeconomics - ConsumptionDocument41 pages2 - Islamic Macroeconomics - ConsumptionFirman GallanNo ratings yet

- The Financial System, Financial Regulation and Central Bank Policy (PDFDrive)Document424 pagesThe Financial System, Financial Regulation and Central Bank Policy (PDFDrive)cuong3cao-501831100% (1)

- Dynamic Macro Basic Macro Frameworks Summer 2016 1Document90 pagesDynamic Macro Basic Macro Frameworks Summer 2016 1Mandar Priya PhatakNo ratings yet

- Kakatiya Univ Ma Syllabus PDFDocument39 pagesKakatiya Univ Ma Syllabus PDFDari ThangkhiewNo ratings yet

- Economics, Arab World Edition: R. Glenn Hubbard, Anthony Patrick O'Brien, Amany El AnshasyDocument35 pagesEconomics, Arab World Edition: R. Glenn Hubbard, Anthony Patrick O'Brien, Amany El Anshasysara fariedNo ratings yet

- Bretton Wood SystemDocument2 pagesBretton Wood SystemXulqarnain SaqlainiNo ratings yet

- 5 Phases of A Business CycleDocument5 pages5 Phases of A Business CycleValerie CoNo ratings yet

- FIN-444 Assignment-1: Submitted ToDocument9 pagesFIN-444 Assignment-1: Submitted ToMehrab Jami Aumit 1812818630No ratings yet

- Economics Text BooksDocument4 pagesEconomics Text BooksKevin Andrew100% (1)

- Practice Problems 9-2-11Document3 pagesPractice Problems 9-2-11Adel KamalNo ratings yet

- Egypt Balance of PaymentDocument7 pagesEgypt Balance of PaymentBram DirgantaraNo ratings yet