Professional Documents

Culture Documents

Pivot Table Practice Test

Uploaded by

Shakthivel K ShakthiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pivot Table Practice Test

Uploaded by

Shakthivel K ShakthiCopyright:

Available Formats

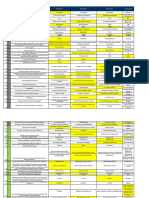

S.

No

Question

Ans Option 1

Ans Option 2 2. Perils are risks that policyholders will die before a specified date and hazards are factors which could influence that risk. 2. Real needs are actual needs and perceived needs are based on a clients thoughts and desires.

1. Perils are medical factors How are perils and hazards normally which influence the risk of distinguished under term insurance dying and hazards are lifestyle policies? activities which influence the risk of dying. In the context of financial planning, how is the difference between real needs and perceived needs best described? 1. Real needs are financial needs and perceived needs are non-financial needs.

If a person is concentrating more on health plan and retirement plan then 1. Young unmarried at which stage of life is he in. The Institute of insurance and risk management along with insurance education does what more

2. Young married

1. Regulation

2. Redressal

If the client does not wish to proceed 1. Insist on taking the product with the recommendations right at the right away moment the agent should Suresh has adequate reserve capital with him and he wishes to protect his income, moreover he feels that if he 1. Term Insurance Plan does not die then he would need the amount. What type of plan should he opt for? A claim was paid in a policy and it was advertised in the newspaper also. This indicates that the policy was.

2. Should ask for the reason for not going with the recommendation

2. Endowment plan

1. It was assigned.

2. It was paid up.

An indemnity bond was signed in a policy when the claim was paid. This 1. It was lost. indicates that the policy was. Manish and Manisha is a married couple with one child. They want to plan for savings, child 1. Marriage. education/marriage and their retirement and protection of income. Which should be their lowest priority? While calculating HLV along with future income, no of years of work, increments in salary what is also to be taken in to account? If RBI increases the interest rates then what will be the effect on share prices.

2. It was paid up.

2. Savings.

10

1. Inflation.

2. Interest.

11

1. Shares will be more attractive.

2. Shares will be less attractive.

12

Vishal and sandeep applied for a health plan in XYZ Life Insurance 1. Sandeep has taken another Company. Vishal is asked to undergo policy from XYZ Life Insurance 2. Vishal is older than Sandeep a medical checkup but Sandeep is Company not asked to do so. What will be most possible reason? During fact finding, What will be the next step after Identifying clients need What is purpose of investing money in debt mutual fund? Mr. shailsh has an endowment policy with 30 years policy term, he has paid for eight years. The sum assured Rs.8,00,000/- and accumulated bonus Rs.60,000/-. What is the paid up value? What is the similarity between Recurring Deposits & cumulative deposits in a bank Mrs. Sheela received some amount out of her husbands death. In such a situation what will be her prime focus? 1. Quantify clients need 1. Easy access 2. Priorities Clients Need 2. Fixed income

13 14

15

1. 213333

2. 229333

16

1. Guarantees

2. Taxation

17

1. Savings

2. Insurance

18

Mr. Kunal used to participate in Car race. While taking up the Insurance 1. Physical hazard policy he disclosed this information. What kind of hazard does it refers to Which of the following falls under voidable contract? Law of large numbers is worked out by which of the following? 1. Misrepresentation 1. Pooling of risk

2. Fraudulent representation

19 20

2. Lack of insurable interest 2. Maintaining insurable interest

21

If a client wants to compare between all financial products then the best 1. Individual agent person he can approach is If a person want to maintain emergency funds the best place is a bank or 1. Equity market

2. Corporate agent

22

2. ULIP

23

During a fact finding process the need analyzed were income replacement and childrens 1. Do the fact finding exercise 2. Insist with the client to take a education. But the customer insists again term plan on only a child plan for the time being and asks the agent to give him a child plan. The agent should. If a case is already before the consumer forum, then the 1. Give a recommendation ombudsman should If the sum assured remains the same, what will be impact of net 1. It rises premium if the age of the policyholder increases 2. Give a joint decision with the consumer forum

24

25

2. It falls

26

What is the advantage of converting 1. Liquidity physical gold assets to gold ETFs. For which of the following reasons, the underwriter should ask beyond agents confidential report.

2. More gold in value

27

1. Physical Hazard

2. Moral Hazard

28

After doing the need analysis of the client, the agent advised the client to opt for TROP product. But the client 1. Enquire about the refusal refused. According to ethical from the client business practices what will the agent do ? Generally insurance companies do not hold the premium in case of a fraud or misrepresentation. However, 1. Fraudulent claim due to which of the following circumstances the insurer can retain the premium of the policyholder According to IRDA agents code of conduct, what is the best method of showing the amount of commission earned by the advisor

2. Suggest an alternative plan

29

2. Indisputability clause

30

1. Signed copy of sales illustration

2. Brochure

31

With pooling of risks an insurance company pools the premium collected from several individuals to insure them against similar risks. At 1. Under no circumstances what circumstances will the insurance companies pool the risk of a life insurance and health insurance together? In case the customer has stopped making payment for the premium of the policy. What are the two most important things required in order to reinstate the policy? If the customer has invested money in a pension plan from company A and buys an annuity from company B, what is the nature of transaction?

2. Under conditions of the reinsurer

32

1. Reinstatement Fee and Proof of continuing good health

2. Premium cheque and health declaration

33

1. Life Long Annuity

2. Open Market

34

If a policy holder buys a policy from 1. Same for all policies sold by 2. Same for all policies sold by the the advisor and lodges a complaint, it advisor advisor except corporate clients should be treated as : An investor holds a wide range of shares. If the Reserve Bank of India announces a series of significant interest rate increases, the prices of these shares are most likely to

35

1. Become volatile

2. Decrease

36

In life insurance business if a person is working in calculating premium 1. institutes of actuaries of rates of insurance products, then he India is mostly likely a member of In a life insurance policy it is later found that the person doesnt have 1. expired insurable interest then the contract is If both parents of proposer died in their thirties due to heart attack what 1. Insurable hazard is the kind of peril or hazard the proposer has? Raunak earns 80,000 per month as salary. He has taken a House loan of Rs. 500000. What will be the 1. Rs. 32000 per month maximum amount of EMI that can be charged by the Bank to recover the loan amount? Frequent switching is not advisable in ULIP plan because it increase According to insurance terminology which of the following is correct? 1. Investment Risk 1. Lung cancer is a hazard whereas smoking is a peril

2. insurance institute of India

37

2. reviewed

38

2. moral hazard

39

2. Rs. 24000 per month

40

2. Risk of death 2. Smoking is a hazard and lung cancer is a peril

41

42

An insurance agent sold two policies to two different persons having the same policy term. He declares the 1. Risk profile of both the commission to each of them. The policyholder are different commission of one of the policy is more than the other. What should be the reasons for this difference? Open market option under Annuity policy would extend which of the following benefit? Akash is an Unmarried person and employed with company ABC and drawing a handsome salary. He has no liabilities. What kind of plan can be suggested to him? 1. Ensure Better annuity rate

2. Age of both the candidate are different

43

2. Increase in the range

44

1. Money Back

2. Term Plan

45

46 47 48

What should an agent do in order to understand the mental state of client 1. Fact finding in respect to his investments in saving products 1. Premium plus interest Net premium is equal to earning 1. The premium collected & Pooling of risk in insurance means deposited in a pool Principle of utmost good faith will operate in existing policy 1. Every time premium is paid

2. Consulting the clients parents 2. Risk premium plus interest earning 2. All similar risks are pooled together 2. If the policy has lapsed and it has to be revived.

49

Both the parties to a contract must agree and understand the same thing 1. Consideration. and in the same sense which is called

2. Legality of an object.

50 51 52

In case of life insurance, Insurable interest must exist With this type of deposit the bank pays the principal and the total interest at the end of the term. The Premium on all riders put together should not exceed How riders will help the customer in life insurance?

1. At inception of policy 1. Traditional deposits

2. Not needed 2. Recurring deposits

1. 10% of the premium on the 2. 20% of the premium on the base policy base policy 1. allows policyholders to customize their insurance cover with additional benefits 2. rider is like a clause

53

54

In Daily hospitalization cash benefit scheme,

2. The insurance company may 1. The daily amount paid is pay an additional amount on a fixed and will never be more or daily basis if the insured is less than the cost of actual admitted to the Intensive Care treatment. Unit (ICU). 1. 1/3rd of the accumulation fund 2. 1/4th of the accumulation fund

55

A lump sum withdrawal allowed as commutation in pension plans is

56

Customer has opted for a 5 yrs guaranteed annuity option. What will happen to annuity, if the customer 1. paid up to 75 Yrs survives for 5 years after the end of guarantee period? In term insurance if Critical illness rider claim happens then what will happen to existing policy What is the main objective of taking the life insurance policy? If person consumes alcohol- what is the type of hazard? Group Insurance can be taken in following relationship Where one can approach in case of dispute? Life insurance is the most important for which age group Where annually increasing flexible premiums operate under a life insurance policy, what rate of increase will generally apply?

2. annuity will be continued for next 5 Years

57

1. CI benefit will cease

2. CI benefit reduced from existing sum assured 2. Savings 2. Physical 2. husband-wife 2. Consumer Forum 2. Pre- retirement

58 59 60 61 62

1. Tax benefit 1. Moral 1. employee- employer 1. IRDA 1. Young

63

1. 2.5%

2. 3.0%

64

Kamal is willing to pay 60000/- per annum for his ULIP policy. What 1. 1 lacs should be the SA in case he wants to avail the tax benefits? The regulations issued by the IRDA, require that the decision on the proposal must be conveyed to the proposer within Family floater health Insurance plan covers According to IRDA guidelines, how long does an insurance company have to complete its investigation of a claim? 1. 15 days of receiving the proposal 1. All members of a Family

2. 3 lacs

65

2. 20 days of receiving the proposal 2. Husband and Wife only

66

67

1. 30 days

2. 90 days

68

How the Daily hospitalization cash benefit will provide benefits to policyholder who is hospitalized? Who is a regulator, supervisor and monetary authority of the financial system in India? Indisputability clause can be enforced by the insurance company during the To ensure that the premiums are paid out of a legitimate source of funds cash is accepted If there is no claim in a year than what will be the benefit to the customer as NO CLAIM BONUS

1. Entire charges are refunded.

2. Entire charges less bed charges will be paid

69

1. IRDA

2. SEBI

70

1. First five years of policy

2. First Two years of policy

71

1. Up to 50000 1. Discount in next year premium

2. Up to 99990 2. Increase in Sum Assured next year 2. 21 year old 2. 2 months 2. 30 lakhs

72

73 74 75

An individual is said to be competent 1. 18 year old to enter into a contract if they are Maximum time for investigation in disputed claim? The Ombudsmans powers are restricted to insurance contracts of value not exceeding? 1. 1 month 1. 50 lakhs

76

In which section of Policy document, Information about the location of the 1. Operative clause insurance Ombudsman had written? In Cumulative bank deposit the interest that in normally compounded 1. Monthly on what basis. The premium for accidental death benefit rider must not exceed

2. Attestation

77

2. Quarterly

78

1. 15% of base policy premium 2. 25% of base policy premium

79

If the annual premium for a plan is 32000 and a frequency loading of 4% 1. 8000 is added in a quarterly premium what is the amount that needs to be paid. What amount of insurable interest does an individual have in his own 1. 20,000 life? Ombudsman passes an award within 1. 1 month which time If the license of an agent has been disqualified by a designated authority 1. 2013 in 2010 then the person can apply for a license in which year. Under the hospital care rider what is 1. 10% of the sum assured the payout made If the agent recommends the client to terminate an endowment plan and 1. Switching take a whole life in order to earn higher commission its termed as

2. 8320

80 81

2. 50,000 2. 2 months

82

2. 2015

83

2. Specified amount multiplied by the number of days the policyholder is hospitalized

84

2. Doing a financial planning

85

Mr. Denny is married and has 2 children and his parents are alive. He 1. Denny has taken a family floater plan. Under the plan who all will be covered. Amit has taken a G-Sec and has parted with it mid way as he required 1. Discounted Value the money with the intention of not getting the interest. What will he get? If bonus is given under a plan the additional premium added is known as Nomination can be in favor of how many people? 1. Loading 1. One person

2. Denny and his wife

86

2. Principle amount

87 88

2. Investment 2. Two persons

89

Suresh is suffering from Asthma and the policy is been done on joint life 1. Joint life policy basis and the need for nomination under the plan will be as What key impact will the agent have in low persistency Within how many days will the underwriter needs to inform the policyholder regarding the status of the policy. Certificate from the village panchayat What is the maximum sum assured under a micro insurance Varun wishes to pursue a career in insurance and wishes to be in a department which calculates the level of premium. In which department should he join? If Naresh wishes to take the tax benefit of the full premium paid which is 60000, what amount of sum assured should he avail in a ULIP plan. Ashish is looking at different plans of insurance for protection at the lowest premium. Which is the best plan for him? The insurance act of 1938 created which of these. Ashu is an illiterate person and his proposal form was filled by Nishu, then what is the additional requirement to be taken along with the documents. 1. Increase more business

2. Not Possible

90

2. Increase in the agents earning

91

1. 10 days 1. Will be considered as standard age proof 1. 10000

2. 15 days 2. Will be considered as non standard age proof 2. 25000

92 93

94

1. Actuary

2. Underwriter

95

1. 2 lacs

2. 3 lacs

96

1. Term plan

2. Endowment plan

97

1. IRDA

2. Tariff Advisory Committee

98

1. The policy needs to be advertised in the newspaper.

2. Nishu has to sign an indemnity bond.

99

Harshs policy matured, however he was paid only 25% of the sum insured in spite of all his premiums 1. Term plan. been paid on time. This indicates that his policy is a

2. Endowment plan.

100

The Authority of COPA is limited to what amount at the district level.

1. 10,00,000.

2. 20,00,000.

In case of a term plan the maximum 101 premium of the accidental rider can 1. 100% of basic premium. be. In case of a term plan the maximum 102 premium of the accidental rider can 1. 100% of basic premium. be. 103 With reference to the principle of 1. Insurance contract. indemnity a life insurance policy is a.

2. 50% of basic premium.

2. 50% of basic premium.

2. Indemnity contract.

In the personal statement, Harish 104 declares that he consumes alcohol twice every week. This is a 105

1. Moral hazard.

2. Moral peril.

Micro insurance is made specifically 1. High income. for people from. The reduction in the benefit 106 1. Charges. illustration shows what. If Insurable interest does not exists at the time of inception of the life 107 1. Voidable insurance policy then, life insurance contract is 108 If a contract is signed by a 15 years old boy, this contract will be If a life insurance policy is issued with a lien, it will be mention in 1. Null and void

2. Middle class. 2. Mortality.

2. Invalid

2. Invalid

109

1. Proviso

2. Schedule

Available Loan amount under a life 110 Insurance policy is generally based on 111 De- tarrification is a process by which pricing of Insurance

1. Total paid premium

2. Sum Assured

1. Rises

2. Decreases 2. Those Insurer who did not created Insurance Ombudsman System 2. IRDA 2. To be an active link between Global market & Indian Life Insurance Industry

As per Regulation for protection of Policyholders interest 2002 (IRDA), 112 Which insurer will have a grievance redressal System Which body has created a call 113 center for logging a complaint 114 What is the key function of NIA

1. Some Specific Insurer

1. Life Insurance Council 1. Provide suggestion for Premium calculation

After maturity In a Unit Linked Life Insurance Policy, customer does not get received Maturity in a lump sum. 115 1. He has switched his fund What is the possibility of receiving it in installments if it is not a annuity plan Gautam wants to purchase a Kisan 116 Vikas Patra. What is the most suitable place to purchase it

2. He has opted for Settlement option

1. Bank

2. Insurance Company

Anand received post taxation 5% return on his fixed deposit in a bank. 117 If his net return is 3%, what can be the reason During Fact finding, rating is 118 mentioned 3. This Indicates Raunak wants to purchase a cheapest plan which can provide 119 financial security to his dependent. Which plan should be offered For tax Saving Someone wants to 120 fixed deposit in bank. What duration is required for it? 121 Incase of presumption of death

1. Administrative charge

2. Inflation

1. Risk apatite of client

2. His future aspiration

1. Term Plan

2. Term Plan with return of premium

1. 3 years 1. Not necessary to pay premium until court decree

2. 5 years 2. Necessary to pay premium until court decree 2. Convertible plan

If insured gets the two advance payment in the 5yrs and in the 122 1. Money back policy maturity he gets rest of sum assured. What type of policy it is 1. Insurance broker is Which is correct in relation to represents insurance buyer 123 Insurance Broker? and remunerated by the insurance company

2. Insurance broker is represents insurance buyer and remunerated by the Client

Shailesh and ankit want to retire in the age of 65yrs. But shailesh pays 2. Shaileshs income is more than 124 1. Shailesh is older than ankit. more monthly payment than ankit for Ankits income same amount of policy. Why? 125 What will be lien amount in 3rd year 1. It is higher as compared to the 4th year of lien. 1. One year 1. Health Insurance 2. Decrease

Within how many years a complaint 126 can be made through consumer protection act. In which plan weekly premium 127 payments are accepted.

2. Two years 2. Group Insurance

One person wants to take term plan for 20 lakh and wants to take ADB 1. Needs to take experts 128 rider, he is not sure of how much sum suggestion assured he needs to take for ADB rider. What is your suggestion? 129 Basing on which criteria the 1. Address of the agent qualification of Agent is determined?

2. Equal to base cover

2. Domicile status

Which tax rate is applicable, in case 130 of Client pays the premium of 5000/- 1. Nil and suffers illness before maturity? A customer surrenders his policy on Feb 2010 As per Agents code of 131 conduct, an agent can get a new 1. 2011 policy from this customer from Feb which year If we hold 100 units in gold ETF, It 132 means that how much grams we 1. 5 or 10 grams have in physical

2. 10%

2. 2012

2. 10 or 15 grams

133 134

In case of life insurance, the insurable interest should exist Pooling of insurance applies to

1. At the time of taking the policy 1. all types insurance

2. At the time of claim 2. All types of insurance except Motor insurance

Insurance companies are required to honor the awards passed by the 135 1. 10 days Insurance Ombudsman within how may days If IRDA is unable to discharge its 136 functions or duties, Central Government An elderly person wants to use tax efficient investment and invests in 137 senior citizen saving scheme. Its the impact in his taxation What are the benefits to the 138 policyholder Under Surgical care rider?

2. 15 days

1. Has the power to supersede 2. Has the power to supersede the the IRDA by issuing IRDA by issuing a bill in notification. parliament 1. He will get tax benefit up to 2. He will get tax benefit up to 25% 5000 1. Number of days admitted in 2. Number of days admitted in hospital & surgery expenses in hospital & surgery expenses in full partial 2. Need to add that hospital as TPA

Health insurance policy holder takes treatment in a hospital which doesnt 1. Need to spend and Get 139 have cashless facility. How the policy claim from the insurer holder will get benefited During financial planning session if the agent finds out the following needs, which one should be given 140 the top priority. Needs: Income protection, Childs education, marriage and emergency funds. 141 142 143

1. Childs education

2. Marriage

National insurance academy has the 1. Calculating premium following main functions Health insurance rider and critical illness rider in classified under Pure risk is classified under 1. Life and non life respectively 1. Economic risk

2. Interact with the government 2. Both life insurance 2. Speculative risk

If a valid claim is delayed by the insurer then the interest for the same 144 will have to be paid by the insurance 1. 10 days after how many days from the date of admission of the claim? 145 As per IRDA regulations IGMS should be mandatory set up by 1. Only by few selected insurers

2. 20days

2. Only by non life

If a customer has mentioned he is a drinker in the proposal form, the 146 insurance company can exclude this 1. Provisio hazard and mention it in which part of the policy document? When can an insurance company 147 give more than 35% first year commission? 1. When the insurance company is in the first 10 years of operation

2. Endorsements

2. If the agent has worked with the company for more than 5 years

When should an agent disclose the 148 commission which he will earn from the product which he is going to sell

1. When the customer asks him

2. After the fact finding process

In a pension plan illustration what 149 are the parts which shows the benefit 1. Insurance coverage for an annuitant. Mr. shailsh has an endowment policy with 30 years policy term, he has paid for eight years. The sum assured Rs.8,00,000/- and 150 1. 213333 & 273333 accumulated bonus Rs.60,000/-. What is the paid up value if bonus accumulated and if not bonus accumulated? The consequences of these risks which will affect specific individuals or 151 1. Pure risk local communities in nature is called as 152 What is the disadvantage to the insurer in case the persistency falls 1. Lower profits

2. Annuity part

2. 213333 & 229333

2. Financial risk

2. Higher profits

For the customer whose claim has been refused by the company, the three places where he/she should 153 follow up are Ombudsman, IRDA Customer Grievance Cell and .. If a policy with premium of Rs 5000 has matured, how much will be 154 deducted when the maturity claim arises When a person is investing in Debt 155 Mutual Fund, what is the primary objective

1. Consumer Forum

2. COPA

1. Nil

2. 1%

1. Good Returns

2. Regular Income

If the employer has insurable interest 156 in the life of an employee, what kind 1. Surety insurance of policy is this? In the sales illustration, the reduction 157 of the actual benefit amount is mainly 1. Commission due to deduction of The concept of indemnity is based 158 on the key principle that policyholders 1. Insuring existing losses. should be prevented from 159 The client of reinsurer are 1. Insurance companies

2. Keyman Insurance

2. Charges

2. Making false insurance claims.

2. Banks

A customer gets periodic benefits without any claim and then when he 160 dies during the term of the policy, his 1. Endowment nominees gets the sum insured. What type of policy is this ?

2. Term

For assessing the risk of a group health insurance policy, which of the 161 following information is the most critical According to Insurance Brokers Association of India, what is the most 162 appropriate relationship between Insurer and Broker? 163 A low persistency ratio for the insurance company means that:

1. Group lifestyle

2. Employees

1. Insurance broker represent 2. The client represent the broker the client and the insurer and the insurer remunerate the remunerate the broker broker 1. The customers are satisfied 2. The company is acquiring more with the products business and new customers

For annuity plans, before receiving regular/periodic annuity payments, the individual can make a lump sum 164 withdrawal. This is known as commutation. Up to what proportion of the accumulated fund can be withdrawn? What is the stipulated time frame within which an insurer is supposed 165 to respond after receiving any communication from its policyholders? For an insurance agent, a low 166 persistency ratio means :

1. The entire fund can be withdrawn

2. Only half of the fund can be withdrawn

1. 24 hours

2. 1 day

1. Loss of renewal commission 2. High client satisfaction

The proposer can withdraw from the contract, if they disagree with the 1. 15 days from the date of 2. 20 days from the date of receipt 167 terms and conditions of the Policy, receipt of the policy document of the policy document within a free look-in period of 168 169 In the case of life insurance, insurable interest should exist In which of the following plan remaining part of the Sum Assured is paid on maturity? Rakesh wants to buy a policy primarily for Risk Cover but at the end of the term he wants to get at least some return. Under which policy he will get these benefits Payment/Investments in Kishan Vikash Patra under post office schemes is done Prashant buys an Endowment Plan with a sum assured of Re. 100000 and wants to make use of tax benefit under the policy for whole SA. How much premium would help him avail this benefit Under the IRDA guidelines for Claim settlement, any queries or additional documents can asked from the claimant within Law of Large number helps the insures to 1. At the inception of the policy 2. At the time of a claim 1. Endowment Plan 2. Convertible Plan

170

1. Endowment plan

2. ROP plan

171

1. Regularly with no fixed term 2. Lump Sum with no fixed term

172

1. Less than 10000

2. More than 10000

173

1. 5 days from the receipt

2. 10 days from the receipt

174

1. Calculate the premium

2. Increase the profitability

A person with a criminal background 175 due to Financial fraud would come 1. Physical under which hazard 176 177 178 Whose signature is required on attestation of the policy? What is the ceiling of tax exemption under 80 c. What is the limit of tax benefit that can be availed of under Section 80C.? Mr. Shyam is having 9 year old child. Which product is not to be given priority? Mr. Raj is married and having 2 children. Which plan can he take that can cover his whole family? Which is the best option to manage risk? What is the major reason for self employed to take insurance. What is the major reason for conducting fact finding exercise? 1. Agent 1. 1 lakh 1. 75K

2. Moral

2. Policy holder 2. 1.5 lakhs 2. 1L

179

1. Health plan

2. Child Plan

180 181 182 183

1. Health Insurance 1. Retain 1. Save Tax 1. Need analysis

2. Family floater 2. Transfer 2. Fluctuating income 2. Understand about company

If 5% bonus is given every year then for a SA of 1 lakh, what will be the 184 1. 60000 payout after 15 years in a simple revisionary bonus system? 185 186 The guidelines for annual assumed growth rate are given by Pricing element is done by 1. Life Insurance Council 1. IRDA 1. Inspection by IRDA

2. 75000

2. IRDA 2. Insurance Company 2. Audit by Finance Ministry

AML Program of every insurer to 187 include _______________, apart from Procedure, Training and audit. 188 Payment of premiums by cash cannot exceed ____________ .

1. Rs. 1, 00,000

2. Rs. 50,000

Ravi was expecting a claim amount of Rs. 12, 00,000 from insurer. But it 189 was rejected. He feels that it is 1. National Commission repudiated on wrong reasons. Which consumer forum can he approach? Under section 80C the maximum tax deduction that can be gained for 190 1. Rs. 75,000 premium paid is _______ in a financial year. Vijay received his policy bond on 11th June, 201 Due to some personal 1. No, as 15 days period is 191 problems he has decided to cancel over the policy on 8th July, 201 Can he cancel or return the policy? Naresh is married and his daughter 192 Sneha is 3 years old. Which plan can 1. Term & Children Plan he take?

2. District Level

2. Rs. 1, 10,000

2. Yes, as it is within 1 year

2. Annuity Plan

Vinay doesnt want to take insurance on himself. He feels that his family will survive with the funds available in 193 1. Transfer the bank and monthly rentals received from village. This comes under Risk ______ Naveen, aged 32 years, has taken money back plan. He is a teacher by profession. Naveen referred Prasad to Ram. Prasad is also teacher. Ram 1. Yes, as Naveen and Ram 194 who is an agent advised Prasad to are of same age. take money back plan as he is of same age (33 years). Is it the right advice? Why? Ajay has bought an endowment insurance plan with a cover of Rs. 10, 00,000 for a term of 15 years. Ajay 195 1. Normal died after 4 years. Insurance company will not treat this claim as ________ claim. Rajesh is 34 years old and having 2 sons, Vineeth and Sumith. The level 196 1. Middle Level of risk appetite, Rajesh belongs is _______. 197 198 What is the minimum Sum Assured allowed for Micro Insurance? 1. 5000

2. Control

2. No, customers needs are different

2. Fraudulent

2. Top Level

2. 10000 2. 30 Days 2. 10 Lakhs

How many days does the Free Look 1. 15 days Period last? The Ombudsmans powers are 199 restricted to insurance contracts of 1. 1Lakh what value? Under current regulations what is the 200 maximum stake that the Foreign 1. 48% Partner in Insurance Company hold? 201 What does MDRT Stand for? 202 Where would you have to go if you wanted to buy a Kisan Vikas Patra? 1. Million Dollar Round Table 1. Any Nationalized Bank

2. 50%

2. Major Double Rupees Tag 2. Insurance Company

203 204

What is the limit of tax benefit that 1. 50,000/can be availed of under Section 80C? Ombudsman has to give his decision 1. 15 Days within how many days?

2. 15,000/2. 30 Days

In a case, the underwriter felt that the risk associated with the person 205 would decrease with time, then he would accept the case with

1. A clause

2. A Lien

A person suffering from lung cancer 206 is a smoker. Here smoking can be 1. Peril termed as Which of the following is a Non 207 1. PAN Card Standard Age Proof

2. Hazard 2. Certificate of Baptism

Venu, aged, 32, had a Insurance cover of 10, 00,000/- . He was approached by an advisor who made some analysis and told him that his 208 Insurance need is higher than 10, 1. Churning 00,000 and suggested that he surrenders the existing policy and buys a new one. This is an example of If the recommendation of the agent 209 has been rejected by the client, the agent should: Which of the following is true 210 regarding Family Floater Health Insurance Plan? In what proportion is the cover in a Family Floater Plan shared? To identify suitable products their 212 main features and their tax treatments is the role of: 211 213 In Cumulative Deposits the interest is normally compounded in a The rider which is given by the Insurance company pays for the treatment costs in the event of hospitalization of the insured person is called Age proof submitted from Village Panchayat is: Mr. X is married with wife, 2 children and aged parents Health premium is allowed for Maximum Life cover As per AML regulation, it allows cash premium not over than Bank interest is accumulated _____ controls monetary system in India 1. Ask the client to fill the proposal form

2. Proposing

2. Find out the reasons for refusal

1. A Family Floater Plan is the 2. Only self and spouse can be same as a Individual Plan covered in this plan 1. 25% each 1. Agent 2. 15% each 2. Insured

1. Annually

2. Semi Annually

214

1. Critical Illness Rider

2. Hospitalization Care Rider

215 216 217 218 219 220 221

1. Standard and accepted 1. X only 1. 20 times annual salary 1. Rs.20000 1. Monthly 1. RBI

2. Not standard but accept 2. X with wife 2. 500000 2. Rs.25000 2. Yearly 2. IRDA

Hospitalization rider has the following 1. Person receives fixed amt 2. Person receives an amount benefit: daily for no of days in hospital equal to the expense.

Total annual premium Rs 32000 222 quarterly loading done 4 %. Hence actual quarterly premium will be License of an agent was withdrawn 223 in June 2010 due to malpractice. He can reapply for his license in 224 225 226 227 A Professional insurance market carries.. Insurance Market divided into What is Bancassurance? The Risk contains.

1. 7680

2. 9320

1. 2015

2. 2014

1. Need Based Selling 1. Endowment and Money Back Insurance 1. Giving insurance policies to Banks. 1. Peril and Hazard

2. Product Based Selling 2. Life and General (non-life) Insurance 2. Selling insurance policies through Banks. 2. Level

228 229 230

Grouping the similar risks by Insurance Company is called as. The function of Insurance works on.. A contract comes into existence when

1. Grouping of Risk 1. Risk Transfer 1. One party makes an offer which the other party accepts unconditionally.

2. Risk Grading 2. Risk avoid 2. One party makes an offer which the other party put extra conditions.

Mr. Kumars wife is suffering from blood cancer. Doctors lost their hope on her live. Mr. Kumar would like to 231 take Life Insurance policy on wifes 1. Anti Money Laundry name in order to get monitory benefit. Insurance company rejects this proposal on the grounds of. Under this situation may leads to 232 breach of the duty of utmost good faith. 233 234 Principle of Indemnity denotes.. 1. Non disclosure of material facts. 1. Insurance can not be used to make a profit 1. Facts of common knowledge 1. Advertisements. 1. Number of years premium paid.

2. Legality of object or purpose

2. Concealment of a material fact 2. Insurance should not taken by high risk people. 2. Facts of law 2. Proposal form.

The principle of utmost good faith is not applicable to What is the main source for 235 insurance company to get information of proposer? What are the factors involved in 236 calculating Surrender Value of the Policy? What are the different types of 237 Assignments?

2. Number of premiums payable.

1. Full Assignment and Partial 2. Conditional and Absolute Assignment Assignment.

Mr. Kumar is taken one life insurance policy with ABC Company. 1. He can not do any thing, 238 But he is not satisfied with the policy because be received the benefits. What Mr. Kumar can do policy bond. under this situation? 239 Moral Hazard reflects the . 240 241 Income replacement methods equates Human Life Value (HLV) to Agent will be called as.. 1. Intentions and attitude of Proposer. 1. Future value of Present earnings. 1. Primary Underwriter

2. He can file a complaint against insurance company in court.

2. Habits and Hobbies of Proposer. 2. Present value of future earnings. 2. Main Underwriter

Mr. Rajesh has taken policy from ABC insurance company for Rs. 500000 Sum Assured by paying Rs. 242 50,000 premium per year. Company declared 5% Simple Reversionary bonus, what is bonus amount? 243 244 245 246 247 The two basic elements of most life insurance plans are Term Insurance Plan will give. Low risk products give.. Who will maintain Mutual Fund Schemes? Which is the primary saving need among all saving needs?

1. Rs. 2500/-

2. Rs. 25000/-

1. Guaranteed Benefit and Non-guaranteed Benefit. 1. Only Death Benefit. 1. High Returns 1. Mutual Fund Management Societies 1. Insurance

2. Interest Benefit and Bonus Benefit. 2. Only Maturity Benefit. 2. Low Returns 2. Mutual Fund Management Systems. 2. Purchasing House

Mr. Rao has Rs. 10, 00,000 cash with him. He would like to use this amount for his daughters marriage which is going to happen with in Nine 248 1. Insurance months. He would like to get some returns from this money in these 9 months period. What is the best option to park his money? Which of the following product not 249 comes under Section 80 ( C ), income tax act 196

2. Shares

1. National Saving Certificates. 2. Equity Linked Saving Schemes.

Mr. Suresh purchase one pension plan and accumulated Rs. 9,00,000 amount in his pension fund. He would 250 like to utilize commutation benefit 1. Rs. 3, 00,000/before taking pension. What is amount Mr. Suresh can withdraw as commutation? Customer has to pay the amount in regular intervals to create purchase 251 price or Pension Fund. We call this phase as.. Some Health Plans will give 252 coverage for family members also. We will call these plans as..

2. Rs. 4, 50,000/-

1. Collection Phase.

2. Accumulation Phase

1. Family Health Insurance Plans

2. Total Protection Policies.

Mr. Hitesh would like to get health coverage along with Life Insurance. 1. Taking Life Insurance plan 253 What are the options available to Mr. with Critical Illness Rider. Hitesh to fulfill his need with a little cost? Mr. Govind, Advisor with ABC life insurance company find out one client is seeking solutions for health 254 1. Young Unmarried. care and inheritance planning. Which main life stage he most likely to fall into? Which type of questioning is very 255 useful to gather information from 1. Closed Ended Questions clients? 256 257 258 259 Perceived needs are those. Need analysis involves identifying 1. Short term needs.

2. Taking Health Plan, Insurance Plan separately.

2. Young married with children.

2. Open Ended Questions. 2. Imagined to be important by Advisor.

1. Financial provision to meet 2. Capacity to pay the premiums predictable and unpredictable in future. needs. 2. Proof of identity 2. Renewal Commission.

Which is the not part of KYC norms? 1. Photographs Remuneration to Agents includes 1. First Year Commission

Mr. Gayaram, Advisor who advised the customer to close the old policy and take new one. But new policy 260 does not have any extra benefits but it will give more commission to Mr. Gayaram. This is called as An insurance agent is intermediary between. What is the factor which has 262 influence on persistency? What is meant by a claim under 263 insurance policy? 261 264 Who will take the initiation to settle the maturity claim process? Which is the right statement regarding claim enquiry? A missing person will be presumed to be dead only after. Which is the 2nd stage in Money Laundering? What is the maximum stake can foreign company has in one insurance company in India? Who controls and regulate the rates, advantages, terms and conditions that may be offered by insurers in the respect of general insurance business. How many ombudsmen offices located in India? What the name of department that is established by IRDA to deal with customer complaints? Ethics can be defined as 25

1. Switching

2. Churning

1. Client and Insurance Company 1. Role of Agent 1. A demand to fulfill the policyholders obligations. 1. Client 1. The insurance company makes enquire only on death claims. 1. Three years 1. Layering 1. 74%

2. Insurance Company and IRDA 2. Product Design. 2. A demand to fulfill the insurers obligations. 2. IRDA 2. The insurance company makes enquire on maturity claims only. 2. Five years. 2. Placement 2. 26%

265

266 267 268

269

1. Insurance Regulatory and Development Authority.

2. Reserve Bank of India.

270 271

1. 10 1. Customer Complaint Department (CCD)

2. 12 2. Customer Grievance Department (CGD)

272 273

1. Those values we commonly 2. Behavior that is based upon the hold to be good and right. moral judgments of an individual 1. Over selling of Insurance policies. 2. Under selling of Insurance policies.

Mr. Mahesh is a software engineer. He has taken a term insurance for 274 Rs. 30,000,00/- for 30 years. This is an example for----------------275

1. Risk retention

2. Risk transfer

Which of the following do not include 1. individual agents the channel of indirect marketing? In an insurance contract the insurable 1. claim interest needs to be at the time of .... 1. a family history of heart disease 1. physical values of assets

2. bancassurance

276 277

2. revival 2. a person working in a chemical factory 2. economic values of assets

Which of the following can be an example of moral hazard? The business of Insurance is 278 connected with................

Human beings need life insurance because.................. In an insurance contract 280 'consideraton' means........ Life insurance the risk is determined 281 on the basis of .......... 279 282 283 284

1. death is certain 1. proposal form 1. future data

2. death is uncertain 2. Advisors confidential report 2. past data 2. employee-employer 2. only proposer

Where do you not find insurable 1. surety-co surety interest in the following options......... The principle of utmost good faith applies to........... When an illiterate person wants to have a policy..... 1. only insurers

1. an impression of the left 2. an impression of the left thumb thumb is taken and third party is taken and the advisor has to has to attest it attest it

Mr.Shanth has taken an endowment policy of 15 years with ABC insurance company. He has paid premium for 4 years and he could not 1. The policy will be renewed 285 pay premium for 5th and 6th year. In on the existing terms and the 7th year he approaches the conditions. company to renew the policy. Now which of the following options will apply to him? Which of the following statement is 286 not true in connection with nomination? Which of the following statements in 287 correct in connection with assignment? 1. The life insured can nominate one or more than one person as nominees. 1. Assignee cannot make fresh nomination in the policy

2. Mr. Shanth cannot renew the policy

2. Nomination can be done either at the time the policy is bought or later. 2. The assignor need not be major at the time of assignment.

Mr. Shanth has taken an endowment policy of 20 years. He has paid 1. Mr. Shanth will not be 288 premium for 10 years and now the granted any loan policy is in force. At this point of time can Shanth take loan? As per the IRDA regulations the 289 decisions on the proposal must to convey to the proposer within...... 290

2. Mr. Shanth can take loan which should be certain percentage of the surrender value of the policy.

1. 10 days

2. 15 days

The underwriter can get the required 1. Proposal form. information about the proposer in..... 1. moral hazard 1. the risk associated might increase 1. a unit linked policy

2. renewal receipt

Mr. Ramesh works in a mining 291 company. So he is exposed to.............. Lien is imposed on a policy when 292 underwriter feels that...... The income of an individual can be 293 protected with the help of.........

2. physical hazard 2. the risk associated might decrease 2. a term life policy

Mr. Shanth has got a pure endowment policy for 30 years for the 294 1. when he dies sum assured of Rs. 75,000,00/-. It can be paid to him...... 295 The disposable income means......

2. when he survives the term

1. the surplus amount that can 2. the amount that can be paid be invested towards one's EMIs

Mr. Shanth is in his early 20s and 296 has just started earning. His risk 1. high appetite is expected to be..... Which of the following ways is easier 297 for a person to take a saving 1. through individual agents product? Flexibility like partial withdrawal and 298 taking premium holidays is possible 1. Fixed deposits with.... Mr. Rajgopal has invested some money. He has been informed clearly about the tenure, interest rate and 299 1. Life Insurance method of payment of interest at the inception of the investment itself. His investment may be in..... 300 In 'Daily hospitalization cash benefit plan'......

2. low

2. through internet

2. Unit linked Insurance plans

2. Mutual fund

1. all the expense incurred will 2. Some percentage of the be reimbursed by the expense will be reimbursed by the insurance company insurance company 1. The rider waives future premiums in the event of the disability or death of the policy holder. 2. This rider is ideal for helping to prevent a policy lapsing due to non-payment of premiums due to death or disability

Which of the following is not a 301 feature of WOP rider? Mr. Ramakant is 35 years old. He has bought retirement plan for 20 302 years. This type of pension plan is known as..................

1. immediate annuity

2. life annuity

Mr. Ranga has taken Critical Illness Rider. In which of the following 1. When Mr. Ranga dies due 303 scenarios the insurance company will to critical illness pay him...... The younger the age of an 304 individual..............their liabilities will be. Mr. Ramachandra's son Mr. Bharat has just employed as a software engineer, daughter Anusha has got 305 married. Now Mr. Ramachandra is free from his burden. So Mr. Ramachandra is now in the ...................stage. Mr. Vinodh has lot of inconvenience to reach office every day. So he 306 wants to buy an expensive car when he will have sufficient fund. Here Mr. Vinodh's need is............. 307 Fact finding enables the insurance advisor to identify the............. During the recommendation stage the advisor needs to...... As per the IRDA circular an insurance agent....... 1. the lower

2. When Mr. Ranga is diagnosed a critical illness

2. the higher

1. Pre-retirement stage

2. Post retirement stage

1. Real need

2. Perceived need

1. clients financial need 1. recommend the products that best meet the client's needs 1. need not disclose the amount of commission

2. clients personal problems 2. recommend to wait some days to invest 2. need to disclose the amount of commission

308

309

For an insurance advisor churning is.............practice According to IRDA regulations the maximum percentage of first year 311 commission to be paid to an insurance advisor is............. In the case of agent's death, the 312 commission payable will be paid to......... 310 Mr. Chintamani has taken a policy from ABC Company on 2nd March 313 2010, but unfortunately he died on 18th August 201 His death claim is considered as.......... 314

1. good

2. bad

1. 30 %

2. 35%

1. his legal heirs

2. to his nominee

1. Normal death claim

2. Early death claim

Detailed Investigation will be 1. Maturity claims triggered in case of...... In insurance, if a person is not heard 315 for .......years his is presumed to be 1. 5 years dead. 316 In the process of settling maturity claims.... Issuance of a license to a person has been stipulated in................Act

2. All death claims 2. 6 years

1. the company will wait until 2. the process is initiated by the the claimant comes to office to company well in advance of the demand the claim maturity date 1. Section 43 of the Insurance 2. Section 42 of the Insurance Act Act 1939 1938 1. 50% 1. 1956 1. policyholders 2. 25% 2. 1999 2. shareholders

317

The foreign direct Investment (FDI) 318 in Indian Insurance Industry is allowed up to..... The Insurance Institute of India (III) 319 was formed in..... The insurance ombudsman has been 320 appointed to protect the interest of....... The charges were not fully disclosed 321 to the customers" is a common complaint against..... Mr. Sharma is a newly recruited insurance advisor. To meet his month target he explains only the good 322 points of newly launched plan to his customer. Here Mr. Sharma's behavior is............ The code of conduct has been 323 prescribed in India by........... Which one of the following is 324 possible in retaining the risk? 325 326 327

1. IRDA

2. Agents

1. ethical

2. unethical

1. IRDA 1. Retaining the ownership in the policy

2. Insurance Council 2. Not possible as life has many risks. 2. At an early age 2. The risk retained person 's family

The timing of death is uncertain, so 1. At the time of uncertainty when one should take life insurance? Insurance Protects which of the following? What does the mortality tables contains ? 1. The life of the person paying compensation

1. Tables of death occurring in 2. Tables of details of various various circumstances probabilities of death

Mr. Guptha is recently detected with 1. Time of death is uncertain, 328 lung cancer. He would like to take an so insurance can be given insurance. What is your suggestion? On 6th August there was a typhoon. Mr.Augustin who had insurance died in typhoon. Now 329 how will the insurance company will categories this particular risk ?

2. Only lung is affected so health insurance can be given.

1. Under the category of Pure 2. Under the category of peril risk risk

Mr.Akash filled the proposal form but before submitting to the company he discussed with the agent that he is 1. Consideration in the 330 not sure whether he can pay for 15 contract years . This attitude affects which part of the contract? 331 Agent who is a licensed intermediary 1. A legal person to act on is actually is ? behalf of the re-insurer

2. Capacity to contract

2. B.A legal person to act on behalf of the insurer

Mr.Karan who has to go to abroad for 6 months on an official work 1. The insurable interest decides to leave his car with his 332 between the car and jim is friend Mr. Jim. What will be the valid for 6 months validity of the insurable interest in this case ? Mr. Varun who won a multi chain company would like to take an 333 insurance. What will be the best option for him from the following ? Mr. Josh was filling the proposal form but as his mother was sitting beside him, even though he drinks 334 and smokes he ticked NO in smoking & drinking column of proposal form. This indicates ? 1. He can take Surety insurance

2. The insurable interest between the car and karan is valid for 6 months

2. He can take Business Partner insurance

1. He has breached the nondisclosure of the fact

2. He has breached the company by concealing the facts

Mr.Feroz has taken policy for critical illness worth Rs.1 lakh in health policy. He also has a term plan worth 1. claim of critical illness and 2. claim of hospital charge Rs Rs.10 lakhs. Mr.Feroz was 335 10 lakh from term policy will be 20,000 and 1 lakh for death will be hospitalized after he was detected settled settled with cancer .Unfortunately he died after 3 days of treatment. How the claim will be settled? Mrs.Shwetha has taken a loan from her policy. Later stage she neither 1. Policy will be surrendered 336 paid back neither the loan nor she by the insurer paid the premium for a very long time. What will happen to her policy?

2. Policy will be surrendered by the nominee

Mr. Manish has a money back policy and a whole life policy. He is planning to take some loan from both the 337 policies as he was regularly paying the premium. What is your suggestion? Which of the following information 338 does not appear in the First Premium Receipt?

1. He regularly pays premium 2. He can surrender whole life so he can take loan from both policy and can take loan from the policies Money back policy

1. method and frequency of premium payment

2. Date of commencement of last premium

Mr.Santhosh working as a head master who is around 52 years had requested for an Insurance cover for 2. B. Moral hazard, as he is 52 Rs.1 crore. He insisted that his 1. A . Physical hazard, as he is 339 years old and wife is not the brothers son should be the nominee old nominee not his wife. Underwriter will verify this case for which one of the following: Mr.Feroz has applied for an insurance cover of Rs.4 crores. The 340 Company will accept or reject the proposal only after confirming from one of the following agencies.

1. Financial Inspection agencies

2. Specialized inspection agencies

The responsibility for classification 341 and analysis of the proposal form lies 1. Risk Analysis Department with whom? 342 In underwriting the economic value of 1. The occupation of the the person is determined by what? person

2. Classification of Risk Department 2. The financial history of his family

Mr. Vinu got a job recently, he cant afford to pay to pay the higher premium as of now but in future once 1. Convertible Endowment 343 he settles down with his job he can plan pay higher premium. Which one will be the best plan? Mr. Kumar decides that his 344 employees should have SSS scheme. What type of plan is SSS?

2. Convertible Term plan

1. Salary saving Life plan

2. Not a specific plan

The concept of Risk diversification is 345 applicable in which of the following 1. Mutual Fund instrument ? Ajay bought a share for Rs.110 and 346 he sold when it was Rs.630.What had happened to his share? Which of the following cant be 347 ducted under section 80 c from taxable income? Which official body decides to 348 increase the interest rates? Who act as an intermediary by 349 offering a trading platform for buying and selling of shares? Chap-6

2. Risk Diversified Insurance

1. Capital Appreciation

2. Capital Profit

1. Pension Funds 1. Central bank of India

2. Public Provident Fund 2. Reserve bank of India

1. Bombay Share exchange

2. Bombay Stock exchange

350

Which one of the following cannot be 1. Blindness covered under Critical illness rider?

2. Paraplegia

Mr. Yash has taken an annuity on 25th August 201The benefit of the 351 plan will start from 25th August 201 What type of annuity plan is this? Mr.Rohith wants to have a health insurance plan for his family and for 352 his aged parents. which will be the best plan for him ? 353 In what situation Waiting Period is applicable in a health insurance? Which are the two primary needs of any customer in any point of life?

1. Guaranteed period annuity

2. Life annuity

1. Group Family health insurance plan

2. Family health insurance plan

1. Immediate care

2. Medical examinations

354

1. Investment and retirement

2. Investment and Protection

Mr. Raj has taken a policy of 15 year term. He has paid the premium for 9 years. But now unfortunately he has 1. Converting the policy to 355 lost his job. He is unable to pay the Term policy premium. What can be the best solution from the following ? In which of the following an agent will 356 collect the customers Personal data, 1. Fact Finding Sheet professional data and financial data Mr.Mohith, an agent was explaining to his customer the guaranteed 357 benefits of the product. Which one of 1. Fact Finding document the following documents he would have used to explain the same?

2. Converting the policy to Paid up

2. Advisor Confidential Sheet

2. B.KYC document

Mr.Harsha an agent wants do a thorough Fact Finding for his client to Mr.Kishan who is a business man. 1. Clients Profits and 358 Which of the following information will Withdrawals from business be helpful to know about the earnings and Expense of Kishan? 359 360 Which one of the section deals with the licensing of an agent? Which one of the following factor does not help in the Persistency ?

2. Clients Expense statement

1. Section 42 of the insurance 2. Section 42 of the insurance act act 1938 1936 1. Regular reminders about the premium to the customer 2. Flexibility of Premium payment to the customer 2. Benefit illustration of unit linked product

In which one of the following 1. Customer Statement of the 361 statement an agents commission will product be disclosed to the customer ?

Mr. David an agent had helped Mr. Srinivasan to take an endowment policy on Feb 200As srinivasan was finding it difficult to pay the premium, 362 1. Churning of the policy Mr. David had advised him to surrender this policy and to apply for a lower premium policy. This is called as ? Mr. sham had taken a term plan in 2008 . He died of cancer in 20 Investigation about his death 363 1. Claim will be rejected revealed that he was deducted cancer in 200What will happen to his death claim? 364 Which regulations take care of the settlement of claims ? 1. Protection of Policy holder Interests regulation 2002

2. Surrendering the policy

2. Claim will be settled as Cancer was not deducted in 2008

2. IRDA claim protection regulation 2002

Mr.Baskar had taken a Term plan for a sum assured of Rs. 7 lakhs. He 2. Total 4 lakhs will be paid as also has an ADB rider worth Rs. 4 1. Total 7 lakhs will be paid as 365 death had happened due to car lakhs. Unfortunately Baskar died in a death had taken place accident car accident. How much will be the death claim settlement? Mr.Sampath has taken a policy on January 10th 2006 for a term of 12 1. Eligible for claim as the years. Due to financial instability he 366 premium was paid from 2006 discontinued to pay the premium to Dec 2010. from 201 He died on August 13th 201 What will happen to his death claim ? 367 Which of the following team represents the members of GBIC ? 1. Representatives from all insurance companies

2. Not eligible for Claim settlement

2. Representatives from all government bodies

Which council among the following focus on creating a positive image of 368 the insurance industry and would 1. Life insurance council also like to enhance the Consumers confidence on the same ? Mr.Varun taken up his agency in July 5th 200 His lost his IRDA license 369 while travelling. His agency has also expired. What is the solution for Mr.Varun ? If any consumer is dissatisfied with the customer care cell of any 370 insurance company to whom they can escalate their grievances. 1. Need to complete 25 hours of practical training and paying Rs.50 for the issuance of duplicate license

2. Consumer insurance council

2. Need to complete 50 hours of practical training and paying Rs.100 for the issuance of duplicate license

1. Nodal officer

2. Grievance call center

Which is the Regulation that insists that all the insurance companies should provide the information about 1. Policyholder grievance 371 the insurance ombudsman of that Regulation region while sending the policy documents.

2. Policyholders Protection regulation

Mrs. Hansa an agent, has planned to sell maximum products within a short 1. It will benefit both the 372 span of time by giving maximum company and the customer rebates to the customer to complete the contest target of the company.

2. Reputation of the company will be high due to offers to the customer

Mr.Raghav is an expert in fact finding .Mr.Raghav helps his brother in his job by sharing the information 1. Raghav will be promoted to 373 2. Raghav will be terminated of his clients after the fact finding he the next level does to procure insurance. What will be the outcome ? The concept of need based selling involves E-sales refers to sales of insurance 375 products through Rahul is a licensed insurance agent. 376 As agent he must carry out his role in accordance with 374 377 Life insurance company determine the level of risk based on 1. Selling what company wish 2. Selling what adviser wish to to sell. sell. 1. Insurance brokers. 1. Companys code of conduct. 1. Future expenses. 2. Bancassurance. 2. IRDA Acts code of conduct.

2. Claim experiences.

Ram works in a Fire cracker factory. 378 He stocks the cracker in his house. 1. Speculative. He runs which type of risk. 379 1. Using the same pool for In Insurance terms, pooling of risk is paying claims of car & life insurance. A contract exists between insurer and proposer when 1. A proposal has been accepted by insurer.

2. Particular.

2. Using different pool for paying claims of life insurance. 2. A policy document has been stamped by insurer.

380

Rakesh purchased a life insurance policy. While writing a proposal form he hide that he practices mountaineering. Sadly he died in an 381 accident while climbing Mount Everest. The insurers rejected the claim.What is the reason for rejection?

1. Innocent misrepresentation. 2. Fraudulent misrepresentation.

Shamsher has a health insurance policy of ` 1, 00,000 individually and from his company for ` 2, 00,000. He falls sick and got hospitalized. His hospital bill ran to ` 50,000. He 382 1. Indemnity contract. claimed this amount from his individual policy. Also, he placed the request with his company for group policy claim, which was rejected. The reason for rejection is. Payment of premium and sum assured are laid down in An insurance contract commences 384 when 383 1. Heading of policy document. 1. Quotation is signed by proposer.

2. Value contract.

2. Proviso of policy. 2. First Premium Receipt is issued.

385

When is premium considered / deemed to be paid?

1. When insured writes a cheque in favor of insurer.

2. When cheque amount is deposited in insurer account.

Ram Lal is an insurance policyholder. He has recently shifted his home from New Delhi to Noida. 386 1. Terms & Condition. He wants the address to be changed. This change in policy document will be effective through? Lalu Yadav is having a saving plan with 20 years tenure. He has paid 5 387 annual premiums but due to financial 1. Acquires surrender value. crisis is unable to make future premium. His policy How assignment distinguishes itself from nomination? When an underwriter may consider Moral Hazard? Level Premium is calculated based on MPL abbreviates 1. Nomination does not transfer the title while assignment does. 1. An individual is proposing SA 15 times his annual income. 1. Risk Premium. 1. Minimum Possible Loss.

2. Preamble.

2. Contract comes to an end.

388

2. Nomination transfers the title while assignment does not. 2. Insurance is taken out by an individual with dependents. 2. Net Premium. 2. Major Possible Loss. 2. Assignment.

389 390 391

What is generally considered as a 392 substitute to charging a high premium 1. Clause. for a high risk? Manmohan has recently purchased a house worth ` 50, 00,000 on loan. 393 1. Endowment Plan. Which insurance product you as an adviser will suggest? To avail the income tax benefit at 394 investment stage, premium should be 1. 10% of S1. maximum 395 The savings needs of a particular individual is majorly determined by 1. Amount of disposable income.

2. Money Back Plan.

2. 20% of SA.

2. Current assets.

For his investment need, Ravi has parked funds in equity. The returns 396 from this form of investment can be categorized as While calculating the expected returns from investments and 397 savings, an individual should make provisions for Vijay, aged 30 years and married, is the sole bread winner for his family. 398 He is saving enough with banks.As an agent, which need you prioritize first?

1. High Risk.

2. Low Risk.

1. Taxation only.

2. Inflation only.

1. Retirement need.

2. Tax planning need.

The Central Bank has recently 399 announced the decrease in interest rates. The prices of bonds are

1. Likely to increase.

2. Likely to decrease.

Rohit is working as sales manager with an FMCG company. His job requires him to travel across states. 1. To purchase an accidental 2. To purchase a health plan He is planning of covering his 400 rider with a savings insurance along with a savings insurance additional risk involved while plan. plan. travelling and a savings plan. What suggestion would you give him as an agent? The general need for purchasing a health insurance plan at an early age 1. The premium decreases 401 results from which of the following with increasing age. factors? The life expectancy in India is constantly improving and is well 402 above 60 years. This also brings along challenges. These challenges can be covered through

2. The premium remains constant with increasing age.

1. Equity.

2. Bank fixed deposits.

Anand has purchased a pension plan which is nearing completion of accumulation phase. He is in need of 1. 1/5th of accumulated 403 finances to make down payment of amount. car he wants to purchase. At the end of accumulation phase how much he can make tax free withdrawal?

2. 1/3rd of accumulated amount.

During the fact finding session as an 1. Prioritize, Identify & 404 agent you should follow which one of Quantify Needs. the following process?

2. Identify, Quantify & Prioritize Needs.

As an adviser why is it essential for 1. Individuals understand their 2. Individuals have same financial 405 you to carry out the financial planning real needs and can prioritize needs at different stages of the life exercise with the prospective clients? them. cycle. After undertaking financial planning exercise, the prospective client said that he does not have funds for 406 investments. To resolve this query, which skill of an agent would be tested? 407 408 409 The objective of Fact Finding is to To explain the benefits of a product, the insurance adviser should The agents duties and responsibilities ends

1. Objection handling skills.

2. Listening skills.

1. Gather Clients Information only. 1. Provide the product brochure to the client. 1. When the clients policy is issued.

2. Identify only the clients needs. 2. Provide Benefit illustration documents to client. 2. When the clients needs have been established.

When client declines the recommendation by the insurance 410 adviser even after resolving the concerns, the adviser should Under what circumstances the 411 surrender of a policy should be recommended by the agent? 412 413 What key benefit high persistency ratios have on insurance adviser? Insurer will not pay the claim unless

1. Persuade the client to purchase the policy.

2. Should ask for reference who might be interested in financial planning. 2. When a client is holding a product having good value for money. 2. Less renewal income. 2. The nominee makes a demand.

1. When a client have been sold the right solution. 1. High renewal income. 1. The policyholder makes a demand.

Aman has taken a term plan for 20 years. In the 3rd year he suffered financial crisis due to which he was 2. This condition is excluded in the 414 unable to pay premium within grace 1. The policy was not in force. policy. period and died after 1 month. The nominee files a claim and is rejected because When a policy is lost, insurance 415 company take utmost care while settling maturity claims because What key event is most likely to 416 make an insurance contract not a valid contract? 417 Under Married Womens Property Act, 1874 a policyholder is 1. The claim may not be genuine. 1. The circumstances are legitimate. 1. The Life Assured. 2. The policy may be pledged. 2. Representation of facts by the policyholders is true. 2. The beneficiaries.

Who has the authority in insurance 418 company to issue/cancel the agents license

1. Insurance Company.

2. Designated Person.

Which organization was formed with 1. Institute of Actuaries of 419 purpose to promote insurance Indi1. education and training in India? A client demands the information on the current status of a policy 420 1. 10 Days. indicating accrued bonus. The insurer should provide communication within To ensure that the customers 421 complaints are handled effectively, IRDA has established 1. Integrated Grievance Management System.

2. National Insurance Academy.

2. 15 days.

2. Internal Grievance Redressal Cell of the Insurer.

Amit & Rashmi are newly married. Both are working couple. They want to invest their savings of 100,000 annually to build corpus to make 1. Ruining the long term 422 down payment for their house 5 years reputation of company. from now. An adviser sold than a unit link product to meet their requirement. This may result in

2. Opportunity of new business for adviser.

Shankar, an adviser, sold a term insurance policy and unit-linked insurance policy (ULIP) to Amar, the 1. Underselling of insurance 423 client, who is unmarried and has no policies. dependent. Consequently, Shankars action can be termed as 424 Insurance business is classified into three main types: 1. Life, Non life, Micro Insurance.

2. Churning.

2. Life, Non Life, Miscellaneous

Amit is looking for term insurance 425 plan for protection of his family, he is 1. Property Insurance advised to approach to: Insured can contact to seek the 426 resolution of grievances they have against insurer to IRDA through: An Insurance company pools the premium collected from several 427 Individual to insure them against similar risk is called:

2. Life Insurance

1.Complaint@gov.ird1.in

2.insurancecomplaints@irda.gov.i n

1. Pure Risk

2. Pooling of Risk

Which of the following Risk is associated with those events which 428 1. Pure Risk. are not in control of an individual and also no possibility of making profit: which of the following refres to 429 specific event which might cause a loss ... 1. Peril

2. Particular Risk.

2. Hazard

Manish took a loan from Pankaj of Rs.10 lac, Pankaj transferred his Insurance policy to Manish of Rs.10 430 lac as a security with the agreement 1. Loan assignment Of when Loan is fully paid, policy title will be revert back to name of Manish is called: Rakesh has bought an Endowment, 431 Money back, Term & Annuity Plan he 1. Endowment Plan would like to avail Loan from: On foreclosure, if Death claim arises before the payment of the surrender 432 1. Nominee value, the payment would be payable to: To prove ones identity in accordance with KYC process, the customer 433 1. An Age Proof needs to submit following document excluding .? 434 Life Insurance also known as: 1. Value Contract.

2. Conditional Assignment

2. Term Plan

2. Legal heir of life Assured

2. An Identity Proof

2. Indemnity

Which clause lays down the mutual obligation of the parties regarding, 435 1. Lien Clause Payment of Premium by Life assured & payment of Sum Assured by

2. Opertaive Clause

Gaurav is working in MNC at the age of 32 bought an Endowment Plan. He had nominated his 1 year old daughter Saanvi, but not able to get 436 1. Nominee only the Signature of her appointee due to unavailability of his spouse .after 5 year. He died in road accident, now claim money would be payable to: Parvesh bought a policy an endowment plan but after one year 1. Indisputability Clause 437 insurer. Found he had Aorta Surgery (Section 45) apply .now which will apply by insurer: Jyoti is submitting is copy of permanents account number card as 438 1. Non Standard Age Proof age proof for buying an money back plan .her age consider as a Which one of the following bonuses 439 is given by insurer as an incentive to 1. Simple Revisionary bonus the insured to for long term: Ramesh bought an endowment plan 440 for tern year he pays the same Amount in every year is called: 441 Which one of the following is not source of information about the

2. Legal heir of the life assured

2.Principal of Indemnity apply

2. Standard Age proof

2. Compound Revisionary bonus

1. Gross Premium

2. Level Premium

1. Proposal Form

2. Insurance agent

Manish being a sole earning member of his family not insured himself But 442 1. Physical Hazard looking for insurance for his son who is student .there is possibility of 443 In Group insurance plans contract of 1. Master Policy holder & insurance between ? insurer Which option is not correct with regard to joint life insurance plan? 1. Plan offer insurance coverage for two person in one policy 1. Post office

2. Moral Hazard

2. Employer & Employee 2. This plan is ideal for brother & sister. 2.Bank

444

445 Time deposit account is issued by: Pankaj want to save tax over and above the deduction allowed under 446 section 80C of the income tax act 1961, which allow deduction from taxable income

1. Corporate Bond

2. Infrastructure Bond

In which of the following Bank pays the Interest on the deposits fund on 447 1. Saving Deposit monthly /quarterly /half yearly/ yearly basis as chosen by depositor fund: Mukesh buys shares at lower price and sold at higher price, the 448 Difference between the two prices is known as:

2.Cumlative deposit

1. Dividend Income

2. Captial Appreciation

Ans Option 3

Ans Option 4

Correct Answer

4. Perils are factors which could 3. Perils are factors which influence an insured event affect the risk being insured occurring and hazards are the and hazards are the size of the actual events which will trigger a risk being insured. payout 3. Real needs are identified by the insurance agent and perceived needs are identified by the client. 4. Real needs are needs which satisfy an objective and perceived needs are needs which do not satisfy an objective.

3. Young married with Kids

4. Pre retirement

3. Research

4. Repository

3. Should ask for a future date from the client

4. Should review once again

3. Return of premium plan

4. Pension plan

3. It was lost.

4. It was surrendered.

3. It was lapsed.

4. It was surrendered.

3. Education.

4. Protection.

3. Discount rate

4. Compounding.

3. Fixed deposits will be more attractive.

4. Fixed deposits will be less attractive.

3. Sandeep is earning more then Vishal

4. Vishal is working in a MNC

3. Recommending Product 3. Tax Benefits

4. Fill up the proposal form 4. Liquidity

1 4

3. 273333

4. 293333

3. Tenure

4. Lock in periods

3. Investment management

4. Planning for pension

3. Moral hazard

4. Peril

3. Fraud 3. With utmost good faith

4. None of the above 4. Randomness

1 1

3. Bank

4. Broker

3. Debt mutual fund

4. FD

3. Give a child plan and revisit the client on a later date

4. Give the lead to another agent

3. Dismiss the case

4. Give an award.

3. It remains constant

4. Gross premiums increases

3. Purity

4. More conversion value

3. SA is too high

4. Pure Risk

3. Pass on to the superior

4. Pass on to the other agent

3. Redressal procedure

4. Pending decision from Ombudsman

3.Hand written declaration by agent

4.Verbal communication to customer

3. As directed by actuary

4. As per company policy

3. Only health certificate

4. Premium cheque with arrears

3. Reinsuring Annuity

4. deferred Annuity

3.Only for policy for which complaint has been given

4.None applicable

3. Increase

4. Remain unchanged

3. Charted institute of insurance

4. Insurance institute of risk management

3. Void

4. Valid

3. non insurable hazard

4. Physical hazard

3. Rs. 40000 per month

4. Rs. 48000 per month

3. Uncertainty of return 3. Lung cancer is a peril and smoking is a moral hazard

4. Chances of lapse 4. Smoking is a moral hazard whereas lung cancer is a peril.