Professional Documents

Culture Documents

Atm

Uploaded by

mirgasaraCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Atm

Uploaded by

mirgasaraCopyright:

Available Formats

Banking Journal, Volume 2 {Issue 2)

23

Perception of Bank Customers about Automated Teller Machine {ATM)

Service Quality

Amar Dhungel

Research-Fellow, Think Tank Foundation, Jorpati, Nepal

Associate, CSC and Company, Chartered Accountants

Email: amardhungel11@gmail.com

Banodita Acharya

Researcher, Think Tank Foundation, Jorpati, Nepal

Kshitiz Upadhyay-Dhungel

Director, Research and planning, Think Tank Foundation, Jorpati, Nepal

ABSTRACT

Banks are increasing their technology-based service options to remain competitive.

Automated Teller Nachine (ATN) is one of such services. Number of ATN

cardholders is increasing and is expected to increase at the increasing rate in future

in Nepal. As service providers all banks should know how their customers perceive

about the ATN facilities provided by them. However, research in this regard is rare

in Nepal and there is still a gap, which this study wishes to fulfill. This study is

conducted to draw a profile of urban ATN cardholders, know the level of their

awareness about ATN services, and identify the problems and prospects regarding

the use of ATN.

A semi-structured questionnaire was developed to collect data about the habits and

perceptions of the customers, after proper literature review. Data were analyzed

and presented in the tabularfgraphical form for easy understanding and elaboration

of the findings of this study. Based on the findings, some suggestions and

recommendation were made that could be useful for the banks.

First, the use of ATN is expected to increase at an increasing rate but banks should

explore potential for attracting those users not accustomed to use ATN. The cost of

ATN cards should be minimized for the mutual benefit of banks and their

customers, especially in the wake of cheque clearing charges due to establishment

of private cheque clearing company. Other problems in the use of ATN services and

concerns of the customers should be solved as well as customers' satisfaction

should be at the heart of any solutions proposed by the banks in this regard.

Possibility of depositing money at ATN machines and probability of scope of use of

ATN cards such as for shopping etc should be explored for enhancing the business

of banks.

INTRODUCTION AND BACKGROUND OF THE STUDY

Excellence in quality has become an imperative for organizational sustainability in

this competitive and fast moving world (Lewis et al., 199+). On top of that, the

changing customers" perception of quality poses unique challenges. Nanagement of

Banking Journal, Volume 2 {Issue 2)

24

customer orientation and service quality is the most effective means of building a

trust and competitive position in service industries like banks (Athanassopoulos,

2000). Any customer of this era including bank customer is more oriented to the

ease, reliability, and faster services. They want autonomy in transactions, so they

prefer self-service delivery systems (Khan, 2010).

!n 2008, Bill Gates announced that "banking is essential, banks are not." This

announcement from a great information technology business icon means that the

traditional bank branch is going to vanish in order to be surrogated by electronic

banking which continues to attract new users (Baten and Kamil, 2010). The

development of information and telecommunication technologies has enabled

organizations to provide superior services for customers" satisfaction (Surjadjaja et

al 2003). Banks are increasing their technology-based services options to remain

competitive. ATN facilities are one of such services.

An ATN is a computerized telecommunication device that provides the customer of

a financial institution with financial transaction facility without the need for a human

clerk or bank teller. !t was first developed by De la Rue in 1967 in United Kingdom

(Abdulwahab, 2010). Cards (debit or ATN) otherwise known as "Plastic money" is

widely used by the consumers all around the world. They provide convenience and

safety to the consumers. They are a good substitute of cash and cheque. !t saves

the time and inconvenience of going to the bank for cash withdrawals. !t is enough

for the cash holder to carry only card with herfhim while shopping, travelling, etc.

The introduction of the ATN cards brought up dramatic changes in withdrawing

money in Nepal also. The country has witnessed a rapid growth in banking

transaction with the introduction and diffusion of information and

telecommunication technologies in its banking sector. Baten and Kamil mentioned

in their paper that, in Nepal, ATNs are the most popular electronic delivery channel

for banking services (Baten and Kamil, 2010). Number of ATN cardholders is

increasing and is expected to increase much more in Nepal (Bhatta, 2011).

Therefore, as a service provider all banks should know how the consumer perceives

about the ATN facilities provided them. However, research in this regard is rare in

Nepal and there is still a gap, which this study wishes to fulfill. This study is

conducted to know the perception about ATN services, their advantages and

disadvantages, and the areas of customers inconvenience while using ATN card and

services. The objective of the study is outlined below:

1. To draw a profile of urban ATN cardholders;

2. To find the level of awareness about the ATN facility among consumers;

3. To identify prospects and problems concerning the use of ATN;

+. To provide necessary suggestions and recommendation to the banks regarding

the future of ATN and things to keep in mind for future development in this

regard.

MATERIALS AND METHODS

Survey tool: A self-designed semi-structured questionnaire was developed to

collect data about the habits and perceptions of the bank customers, after proper

literature review. The questionnaire was distributed to around 200 persons. The

Banking Journal, Volume 2 {Issue 2)

25

data was collected by contacting people door to door in Jorpati vDC, Kathmandu,

Nepal. Each alternate home was chosen for distributing the printed questionnaire.

Naximum of two persons were contacted from a single house, whosoever is

available on the day of visit. !n case of illiterate respondents, the first author

himself filled the questionnaire on their behalf. The questionnaire has two

components. First section is to collect the demographic information of the

respondents and the second section to enquire about respondent's perception

about ATN and some other related information.

Survey population: The study was conducted in Jorpati vDC, Kathmandu, Nepal.

Sample size: Questionnaire was distributed to a total of 201 participants. Out of

that 150 participants filled and submitted the questionnaire (Response rate 75).

Consent: Objective of the research was explained to the respondents and their

consent was taken for the participation. They were free to not to submit back the

questionnaire.

Limitation of the study

1. Study cannot authenticate the validity of response obtained from respondents.

2. This study assumes that the individuals who respond to this survey are truthful.

3. !n Nepalese environment, the customer is not willing to share genuine

information.

+. Although samples were collected purposively, the efforts are made to enhance

the quality of research for increasing its generalization for wider set of

population.

RESULTS AND DISCUSSION

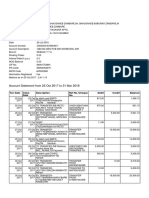

This study was conducted in Jorpati vDC, a sub-urban population in Kathmandu,

capital of Nepal. A total of 150 participants filled the questionnaire and returned

(response rate of 75). The demographic of the respondents is shown in Table (1).

Out of 150 respondents, 11+ possess ATN card (76). The study has wide range

of respondents. They belong to age from 18 to 72 years, married and unmarried,

and male and females. They are having different occupations from students to

service-holders, and self-employed to retired persons. The sample has non-earning

respondents to respondents having income greater than Nepalese Rupees six

hundred thousand per year. Twenty seven percent of the respondents do not wish

to disclose their income. Few of them seem to be from higher income groups while

other seems to be low income (based on Authors perception during data collection).

Banking Journal, Volume 2 {Issue 2)

26

Table 1: Demographics of the respondents

Parameters Number Of Respondents {%)

Have ATN Cards 11+ (76)

Nale Narried +9 (33)

Unmarried 13 (9)

Female Narried 35 (23)

Unmarried 53 (35)

Education Undergraduate +6 (31)

Graduate 60 (+0)

Post Graduate 27 (18)

vocational Degree 13 (9)

!lliterate + (3)

Age Less than 20 18 (12)

21-30 71 (+7)

31-+0 27 (18)

+1-50 21 (1+)

51-60 10 (7)

60 And Above 3 (2)

Occupation Homemaker 9 (6)

Service 61 (+1)

Self Employed +8 (32)

Retired 5 (3)

Student 27 (18)

Per Year !ncome Less Than 1 Lakh 32 (21)

One-Four Lakh +7 (31)

Four-Six Lakh 8 (5)

Nore than Six Lakh 7 (5)

Yet To Nake Noney 15 (10)

Do Not Disclose +1 (27)

Figure (1) shows 90 of the respondents in the age group 21-30 years have at

least one ATN with them while persons at higher age, that is, above 50 years of

age uses it less commonly. Of the respondents of age group 31-+0 years of age

81 have ATN. Wan et al. from their study in Hong Kong showed that age has

significant effect on pattern of use of technology-based services (Wan et al., 2005).

Usually youth prefer to use technology-based and innovative service delivery

channel like ATNs. People of higher age group are reluctant in using ATNs because

of perceived risk of failure, complexities, lack of knowledge, lack of awareness

program by the banks, and security reasons (Noutinho, 1992).

Banking Journal, Volume 2 {Issue 2)

27

Figure 1: Age-wise distribution of the participants having and not-having

ATM Cards

Table (2) depicts the age wise distribution of the ATN users. The person belonging

to age 21-+0 years (group 21-30 years and 31-+0 years) uses ATN more

commonly. This shows that the younger generations are using ATN more

commonly and banks should focus on their demand and orientation while deciding

about such facilities. Older generations are more reluctant to use ATN (Nutinho,

1992). However, for growing the business banks should come up with some

schemes that may attract these groups of people (old-aged) to use ATN.

Table 2: Distribution of respondents havingJnot having ATM among

different age group

Age Number of respondents Number having ATM card { % )*

Less than 20 18 8 (++ )

21-30 71 6+ (90)

31-+0 27 22 (81)

+1-50 21 1+ (67)

51-60 10 5 (50)

Above 60 3 1(33)

* Percentage represents the percent of respondents having ATN

Figure (2) shows that the service holders are the one who is using ATN mostly.

Service holders are the regular earners so are using ATN mostly. Homemakers and

retired persons use the ATN less often respectively. The study also found that even

the students, having less income as well as irregular income, are using ATN more

than above two groups. This may shot the potential for ATN's future.

Banking Journal, Volume 2 {Issue 2)

2S

Figure 2: Occupation-wise distribution of the participants having and not-

having ATM Cards

Table (3) shows that service holders are the one who is using ATN mostly followed

by self-employed. Service holders (85) followed by self employed (79) are the

group who is using ATN mostly. Retired persons use ATN service least. Sixty

percent of retired person do not use ATN. This shows the reluctance of retired

person to use ATN. Nutinho argued that old age persons are reluctant to use ATN

due to technical complexities and security reasons or may be due to fear of failure

(Nutinho, 1992) may be due to the fact that during their service time they were

using cheques as ATN services came late in Nepal and are still comfortable with

cheques than the ATN services.

Table 3: Distribution of respondents among different occupational group

Occupation Number of

respondents

Number of respondents

having ATM card {%)*

Home maker 9 5 (56)

Service 61 52 (85)

Self employed +8 38 (79)

Retired 5 2 (+0)

Student 27 17 (63)

* Percentage represents the percent of respondents having ATN

Among ATN users, high numbers of people were under-graduate and graduate

(Table +) but if we observe the percentage of ATN users among each group on

table +, we can see that 85 of post-graduate respondent uses ATN whilst

relatively less percentage of graduate and undergraduate uses ATN. The "r" value,

coefficient of correlation between education level and percentage of respondent

having ATN at that level was found to be +0.85, that is, highly positive correlation

was found among these variables which means as educational status increases, the

tendency of using ATN increases.

Banking Journal, Volume 2 {Issue 2)

29

Table 4: Distribution of respondents among different educational level

Education Number of

respondents

Number of respondents

having ATM card {%)*

Correlation coefficient

{r)

!lliterate + 1 (25) + 0.85

Schooling only 13 9 (69)

Undergraduate +6 3+ (7+)

Graduate 60 +7 (78)

Postgraduate 27 23 (85)

* Percentage represents the percent of respondents having ATN

Figure (3) give the information about ATN users in different income groups. The

person having income from four to six Lakh Nepalese rupees uses ATN more

frequently. Even respondents falling on group "! am yet to make money" use ATN

(67). They usually are college students and they are comfortable using ATN. Nay

be certain provision for students like students discount on ATN charges and

surcharges may enhances their ATN-uses and increase the banks deposit and

transaction. !n Nepal, many students stay at Kathmandu, the capital and education

hub for their study, but their parents are staying on other parts of Nepal. Parents

can deposit the money on the account of their children from their own town and

their wards can withdraw it from their nearby ATN-vendor. This has become

possible due to ABBS (Any Branch Banking Services) provided by the banks and

shows that technological advancement can enhance the business of the banks.

Therefore, banks can explore this area for enhancing their business.

Figure 3: Income-wise distribution of the respondents for having and not-

having ATM Cards

Only 27 of the respondents use ATN several times in a week (more frequently)

and 12 uses it very rarely or less often (Figure +). This means that some person

having ATN do not use it much or has not used it even once. Usually many banks

to attract custom

the common one. So, as an offer, customers or accou

for first year

use it. Either banks h

disseminating knowledge about its use (method of us

rules and regulation

these services only to the prospective cust

Figure 4: Frequency of ATM use by respondents

Similarly, Figure (5) gives the respondents opinion

respondents

transactions

discussed later on,

11 are undetermined may be because they are using b

cards in different occasions

the total respondents around 72

find it comfortable, it may be due to different tec

discussed later

whilst 67 find the service reliable. According to K

service quality and customer satisfaction, the reli

services accurately at all times and is one of

satisfaction. He further elaborates it as: ATN users

quantity and right quality of services at all the t

also prefer accurate billing of their accounts.

guard to be present at ATN vendor for security whil

We can see that at several ATN

since most of the customer

addressed by the banks

to attract customer (deposit) gives different facilities, among them

the common one. So, as an offer, customers or accou

for first year. So, it showed that the

. Either banks has to encourage such person to use ATN services by

disseminating knowledge about its use (method of us

rules and regulation, etc) or

these services only to the prospective cust

Figure 4: Frequency of ATM use by respondents

Similarly, Figure (5) gives the respondents opinion

respondents, about 73

s. This may be because they like it

discussed later on, but 16 do not prefer

11 are undetermined may be because they are using b

cards in different occasions

the total respondents around 72

find it comfortable, it may be due to different tec

discussed later. Also, 23

whilst 67 find the service reliable. According to K

service quality and customer satisfaction, the reli

services accurately at all times and is one of

satisfaction. He further elaborates it as: ATN users

quantity and right quality of services at all the t

also prefer accurate billing of their accounts.

guard to be present at ATN vendor for security whil

We can see that at several ATN

most of the customer

by the banks.

er (deposit) gives different facilities, among them

the common one. So, as an offer, customers or accou

. So, it showed that the person

as to encourage such person to use ATN services by

disseminating knowledge about its use (method of us

etc) or may minimize their costs and resources by providing

these services only to the prospective cust

Figure 4: Frequency of ATM use by respondents

Similarly, Figure (5) gives the respondents opinion

prefer ATN banking to the traditional method of

. This may be because they like it

but 16 do not prefer

11 are undetermined may be because they are using b

cards in different occasions or since these

the total respondents around 72 find ATN operation comfortable but 19 do not

find it comfortable, it may be due to different tec

Also, 23 expressed that they

whilst 67 find the service reliable. According to K

service quality and customer satisfaction, the reli

services accurately at all times and is one of

satisfaction. He further elaborates it as: ATN users

quantity and right quality of services at all the t

also prefer accurate billing of their accounts.

guard to be present at ATN vendor for security whil

We can see that at several ATN vendor

most of the customer wish that

30

er (deposit) gives different facilities, among them

the common one. So, as an offer, customers or accou

person receives ATN

as to encourage such person to use ATN services by

disseminating knowledge about its use (method of using, advantages, precaution,

may minimize their costs and resources by providing

these services only to the prospective customers who are willing to use it

Figure 4: Frequency of ATM use by respondents

Similarly, Figure (5) gives the respondents opinion about ATN

prefer ATN banking to the traditional method of

. This may be because they like it due to several reasons that will be

but 16 do not prefer ATN because they prefer cheques, and

11 are undetermined may be because they are using b

these two instruments

find ATN operation comfortable but 19 do not

find it comfortable, it may be due to different technical problems

that they do not

whilst 67 find the service reliable. According to Khan (2010) in his study on ATN

service quality and customer satisfaction, the reliability means providing promised

services accurately at all times and is one of the major components of customer

satisfaction. He further elaborates it as: ATN users

quantity and right quality of services at all the times, as promised by banks. They

also prefer accurate billing of their accounts. Of the tota

guard to be present at ATN vendor for security while 31 say they

endors, guards are not present all the time

wish that guards be present

Banking Journal, Volume

er (deposit) gives different facilities, among them ATN facilities is

the common one. So, as an offer, customers or account holders get ATN for free

ATN cards may not necessarily

as to encourage such person to use ATN services by

disseminating knowledge about its use (method of using, advantages, precaution,

may minimize their costs and resources by providing

omers who are willing to use it

about ATN services.

prefer ATN banking to the traditional method of

due to several reasons that will be

because they prefer cheques, and

11 are undetermined may be because they are using both cheques and ATN

two instruments have different use.

find ATN operation comfortable but 19 do not

hnical problems that will also be

do not find ATN service reliable

han (2010) in his study on ATN

ability means providing promised

the major components of customer

satisfaction. He further elaborates it as: ATN users want to receive the right

imes, as promised by banks. They

the total respondents 65

guard to be present at ATN vendor for security while 31 say they

guards are not present all the time

be present, this issue

Banking Journal, Volume 2 {Issue 2

er (deposit) gives different facilities, among them ATN facilities is

nt holders get ATN for free

cards may not necessarily

as to encourage such person to use ATN services by

ing, advantages, precaution,

may minimize their costs and resources by providing

omers who are willing to use it.

services. Of the total

prefer ATN banking to the traditional method of financial

due to several reasons that will be

because they prefer cheques, and

oth cheques and ATN

have different use. Of

find ATN operation comfortable but 19 do not

that will also be

find ATN service reliable

han (2010) in his study on ATN

ability means providing promised

the major components of customer

want to receive the right

imes, as promised by banks. They

l respondents 65 want

e 31 say they do not prefer it

guards are not present all the time b

issue needs to be

ssue 2)

ATN facilities is

nt holders get ATN for free

cards may not necessarily

as to encourage such person to use ATN services by

ing, advantages, precaution,

may minimize their costs and resources by providing

the total

financial

due to several reasons that will be

because they prefer cheques, and

oth cheques and ATN

Of

find ATN operation comfortable but 19 do not

that will also be

find ATN service reliable

han (2010) in his study on ATN

ability means providing promised

the major components of customer

want to receive the right

imes, as promised by banks. They

want

do not prefer it.

but

needs to be

Figure 5: Respondents opinion regarding ATM use

Figure (6) shows that 5

different banks and 76 have at least one ATN card

they have more t

topic for study in our context.

have more than one cards and that the market for AT

bright.

Figure 6: Distributi

Cards

Of the total respondents 72

transaction while using an ATN not owned by the ban

Figure 5: Respondents opinion regarding ATM use

Figure (6) shows that 5 of respondent have more than three

different banks and 76 have at least one ATN card

they have more than one card is beyond the scope of study, but

topic for study in our context.

have more than one cards and that the market for AT

Figure 6: Distribution of respondents according to the number of ATM

total respondents 72

transaction while using an ATN not owned by the ban

Figure 5: Respondents opinion regarding ATM use

of respondent have more than three

different banks and 76 have at least one ATN card

han one card is beyond the scope of study, but

topic for study in our context. But at least it shows that customers are willing to

have more than one cards and that the market for AT

on of respondents according to the number of ATM

total respondents 72 were aware of the charges need to be paid per

transaction while using an ATN not owned by the ban

31

Figure 5: Respondents opinion regarding ATM use

of respondent have more than three

different banks and 76 have at least one ATN card with them. The analysis why

han one card is beyond the scope of study, but

But at least it shows that customers are willing to

have more than one cards and that the market for AT

on of respondents according to the number of ATM

were aware of the charges need to be paid per

transaction while using an ATN not owned by the ban

Banking Journal, Volume

Figure 5: Respondents opinion regarding ATM use

of respondent have more than three

different banks and 76 have at least one ATN card with them. The analysis why

han one card is beyond the scope of study, but could be

But at least it shows that customers are willing to

have more than one cards and that the market for ATN growth is expected to be

on of respondents according to the number of ATM

were aware of the charges need to be paid per

transaction while using an ATN not owned by the bank, while 23 were unaware

Banking Journal, Volume 2 {Issue 2

of respondent have more than three ATN cards of

with them. The analysis why

could be a good

But at least it shows that customers are willing to

N growth is expected to be

on of respondents according to the number of ATM

were aware of the charges need to be paid per

k, while 23 were unaware

ssue 2)

ATN cards of

with them. The analysis why

a good

But at least it shows that customers are willing to

N growth is expected to be

on of respondents according to the number of ATM

were aware of the charges need to be paid per

k, while 23 were unaware

Banking Journal, Volume 2 {Issue 2)

32

of about the charges, 5 of the respondents did not disclose their opinion in this

regard (Figure 7). Bhatta (2010) in his study in Nepal has shown that greater than

50 of the respondent of his study were unaware about the Cost and Service

Charges for the use of ATN services. The price or charges and surcharges are

essential aspects of customer satisfaction also. !t affects the customers' perception

of ATN service quality (Surjadjaja et al., 2003; !qbal et al., 2003). The higher

charges give an impression of injustice and non-competitiveness and monopoly of

service providers and may lead to switching of service provider bank (Nboma,

2006; Colgate and Hedge, 2001).

Figure 7: Knowledge about service-charges of ATM services

!n Figure (8), the problem regarding ATN services has been presented. Around half

of the respondents have at least faced the lack of one or more of the ATN facilities

at the time of need frequently, and 35 have faced the problem of trapping of

their card by ATN vendor machine. False debiting and the time consuming process

of correcting the problem of false debiting in part of customer is one of the major

discomfort faced by ATN users in our study and also the major concern shown by

them. Several other problems have been presented and these are the points where

bankers should focus on to remain competitive among themselves and enhance the

quality of service provided by them. Again, around 31 of the respondents said

they had complained to the bank regarding problem of ATN service to which only

22 of the respondents complain was promptly addressed. This shows that bank

customer rarely complain about the problems although bank are found to responds

promptly on the customers' complains. Such response should go up to 100 if the

banks are concerned about customer satisfaction and motives of remaining

competitive. Some previous researchers also found that the customers always

prefer to resolve their complains expeditiously (Karajaluoto et al., 2002). Several

other studies also have shown that responsiveness is crucial to sustain service

quality and facilitates in building long

and customers (Long and Nc Nellon, 200+; Bauer et al

Figure S: Distribution of the respondents

discomfort regarding ATM Servic

The advantages of ATN

presented in Table (5)

network among other banks are the major advantages

customers. Lucy

enhance operations and customer satisfaction in ter

adds value in terms of speedy handling of voluminou

services were unable to handle efficiently.

closed in non

to the customers. !t would have been better if the

opening the ATN twenty four hours per day and seven

Table 5: Respondents perception regarding advantage

Responses

Easy transaction

Time saving

Safety and portable

Networking with other

Others

Lucy (2006

technological and processing failures. Somewhat simi

respondents regarding disadvantages. The disadvanta

perceived by the respondents are presen

of proper services, long queues,

of the major disadvantages quoted by the respondents.

quality and facilitates in building long

and customers (Long and Nc Nellon, 200+; Bauer et al

Figure S: Distribution of the respondents

discomfort regarding ATM Servic

The advantages of ATN

presented in Table (5). Ease

network among other banks are the major advantages

customers. Lucy (2006) from h

enhance operations and customer satisfaction in ter

adds value in terms of speedy handling of voluminou

services were unable to handle efficiently.

closed in non-banking hours or during holidays, it creates some t

to the customers. !t would have been better if the

opening the ATN twenty four hours per day and seven

Table 5: Respondents perception regarding advantage

Responses

Easy transaction

Time saving

Safety and portable

Networking with other Banks

2006) also established that the level of satisfaction is

technological and processing failures. Somewhat simi

respondents regarding disadvantages. The disadvanta

perceived by the respondents are presen

of proper services, long queues,

the major disadvantages quoted by the respondents.

quality and facilitates in building long-

and customers (Long and Nc Nellon, 200+; Bauer et al

Figure S: Distribution of the respondents

discomfort regarding ATM Service

service of banks as perceived by the respondents ar

. Ease of transaction, sav

network among other banks are the major advantages

from her study in Tanzania established

enhance operations and customer satisfaction in ter

adds value in terms of speedy handling of voluminou

services were unable to handle efficiently.

banking hours or during holidays, it creates some t

to the customers. !t would have been better if the

opening the ATN twenty four hours per day and seven

Table 5: Respondents perception regarding advantage

Banks

also established that the level of satisfaction is

technological and processing failures. Somewhat simi

respondents regarding disadvantages. The disadvanta

perceived by the respondents are presen

of proper services, long queues, limit of transaction, unnecessary charges are

the major disadvantages quoted by the respondents.

33

-term relationship between service provider

and customers (Long and Nc Nellon, 200+; Bauer et al., 2006).

Figure S: Distribution of the respondents" opinion according to areas of

service of banks as perceived by the respondents ar

transaction, saving of time, safety and portability

network among other banks are the major advantages

er study in Tanzania established

enhance operations and customer satisfaction in terms of flexibility of time. !t also

adds value in terms of speedy handling of voluminous transactions which t

services were unable to handle efficiently. But since at present several ATNs were

banking hours or during holidays, it creates some t

to the customers. !t would have been better if the banks explore the possibilit

opening the ATN twenty four hours per day and seven days per week.

Table 5: Respondents perception regarding advantage

also established that the level of satisfaction is

technological and processing failures. Somewhat simi

respondents regarding disadvantages. The disadvanta

perceived by the respondents are presented in Table (6).

imit of transaction, unnecessary charges are

the major disadvantages quoted by the respondents.

Banking Journal, Volume

term relationship between service provider

and customers (Long and Nc Nellon, 200+; Bauer et al., 2006).

opinion according to areas of

service of banks as perceived by the respondents ar

ing of time, safety and portability

network among other banks are the major advantages of ATN, as perceived by the

er study in Tanzania established that ATN services

enhance operations and customer satisfaction in terms of flexibility of time. !t also

adds value in terms of speedy handling of voluminous transactions which t

But since at present several ATNs were

banking hours or during holidays, it creates some type of discomfort

to the customers. !t would have been better if the banks explore the possibilit

opening the ATN twenty four hours per day and seven days per week.

Table 5: Respondents perception regarding advantages of ATM use

Number of Respondents

also established that the level of satisfaction is

technological and processing failures. Somewhat similar is the responses of our

respondents regarding disadvantages. The disadvantages of ATN services as

ted in Table (6). Technical difficulties, lack

imit of transaction, unnecessary charges are

the major disadvantages quoted by the respondents. !t can be seen

Banking Journal, Volume 2 {Issue 2

term relationship between service provider

opinion according to areas of

service of banks as perceived by the respondents are

ing of time, safety and portability

perceived by the

that ATN services

ms of flexibility of time. !t also

s transactions which traditional

But since at present several ATNs were

banking hours or during holidays, it creates some type of discomfort

banks explore the possibility of

days per week.

s of ATM use

Number of Respondents

+7

2+

21

also established that the level of satisfaction is reduced by

lar is the responses of our

ges of ATN services as

Technical difficulties, lack

imit of transaction, unnecessary charges are some

!t can be seen from the

ssue 2)

term relationship between service provider

opinion according to areas of

service of banks as perceived by the respondents are

ing of time, safety and portability,

perceived by the

that ATN services

ms of flexibility of time. !t also

raditional

But since at present several ATNs were

ype of discomfort

y of

Number of Respondents

+7

2+

21

2

+

reduced by

lar is the responses of our

ges of ATN services as

Technical difficulties, lack

some

from the

Banking Journal, Volume 2 {Issue 2)

34

table that the customers has perception that the bank is charging unnecessary

charges like charges for statement, transaction charges with other network , yearly

charges, etc to the ATN users. Some of the study has established that the

perception of customer that the service delivery mode is expensive and insecure

creates customer dissatisfaction (Lucy, 2006).

Cost and service charges is one of the areas where lots of work needs to be done.

One of the study by Humphrey et al. (2003) in 12 European countries established

that the ratio of operating cost of providing banking services to total assets has

decreased considerably because of electronic payments and use of ATNs. However,

one of the previous studies by the same author in 199+ has shown that ATNs have

not reduced banks' costs. Humphrey and vale (200+) have stated that the shift to

electronic based payments led to remarkable cost savings. As there is remarkable

cost saving as shown by majority of studies, ultimately the consumer will get

benefit and have to spend less time and money for each transaction. !n context of

Nepal, due to electronic cheque clearing initiated by Nepal clearing House Pvt. Ltd.

and the service charge associated with it, the cost of using cheque is certain to

increase in future, because the service and technology charges of electronic cheque

clearing will ultimately be passed on to the end users. On top of it, hassles in the

use of cheques will reduce its use. Hence, it will become not only easy but also

cheap to use ATN cards in the future and upgrading its quality is a must for banks,

at least for competitive necessity if not for competitive advantages. However, from

our respondents it seems that bankers have failed to convince their customer that

ATN service is cheaper for costumer than the use of cheques or any other means of

transaction. At present ATN cost seem to be very high although cheques are

usually provided free of charge till now.

Around 38 respondents of our study mentioned various technical problems faced by

them and it seems to be major disadvantages of ATN. Among the Technical

problems: Trapping of the card, frequent out of service messages, machine not

properly functioning, no back up during load-shedding, system problem and

software problem, were the major technical problems mentioned. Several studies

have shown that technical complexities and lack of knowledge are the major

disadvantages of the ATN (Bhatta, 2010; Lucy, 2006; Khan, 2010). Besides above

problems, the researcher has grouped the disadvantages (mentioned by customers)

like short expiry date, blocking not done through SNSfphone, minimum balance

withheld, some banks having no network with other banks, and so on as "lack of

proper services". These are the area where the bankers should take care of to

satisfy their customers. Nany responses regarding disadvantages were there in less

frequency and are grouped under "others", but some pertinent issue has also been

raised which are to be mentioned here as: "rumor of loss of money", "misuse by

fraudsters in banking system itself", "intruder can enter during transaction", "cannot

deposit money through ATN", "not in convenient place", "no security guards" are

some of the important and pertinent comments made by the respondents. These

area also needs focus by the banks. Apart from many disadvantages similar to our

research, a study by Lucy (2006) focused that the ATN service provided in Tanzania

has not considered the people with disabilities such as blindness and people in

Banking Journal, Volume 2 {Issue 2)

35

wheel chair which negates the role of self-serving customers. Similar is the case in

Nepal too.

Table 6: Respondents perception regarding disadvantages of ATM use:

Responses Number of Respondents

Technical difficulties and problems 38

Lack of proper service 19

Long queue 15

Limit on transaction 1+

Unnecessary charge 5

Others 28

CONCLUSION AND RECOMMENDATION

To sum up, this study provides the demographic details of ATN users in one of the

sub-urban areas in the Kathmandu district, the capital of Nepal. Najority of the

people in the selected area preferred ATN service to branch banking, which shows

that there is a need of expanding the establishment of ATN vendor machine to

include several more areas. Younger generations and educated people are more

comfortable using ATN while older generations are reluctant to ATN use and are

comfortable with traditional method of branch banking. So, it also gives the picture

of customers' perception about using newer technology like ATN, their perceived

usefulness, their perceived risks, and inconvenience they face while using the ATN.

Depending upon age, occupation, income, and other demographics this research

found that a certain group of users are more used to the ATN services and some

other groups are not. Such as we can see from our research that educated, high

income, young, service holders are the majority using ATN but opposite to it less

educate, less income, old, retired and home makers are using ATN services less.

So, it is recommended that banks should develop a strategy to motivate non-users

through awareness, education, demonstrating the function of ATN through

personalized services and through other means.

Nost of the respondents have faced technical problems and have reported several

technical problems like trapping of the card, out of service machines, machines not

properly functioning, no back up during load-shedding, system problem and

software problems. Besides, short expiry date, regular renewal and charges for

renewal, blocking not done through SNSfphone when ATN card is lost, withheld of

minimum balance, some banks having no network with other banks are also some

issues of concern. These are the area where the bankers should take care of to

satisfy their customers. Besides, although not raised by many respondents due to

lack of knowledge of such facilities, but the possibility of ATN machines where

deposits could also be done as found in some developed countries as well as that

used by some banks in the past should be explored and the problem, if any, in

implementing this should be solved with stakeholders. !t has been learnt that due

to the quality of currency notes, direct deposit of cash has not been possible, if

show the Nepal Rastra Bank (NRB), the central bank, should solve this problem in

order to promote use of technology in the banking sector.

Banking Journal, Volume 2 {Issue 2)

36

One of the major issues is also related to cost. Since by the use of ATN, customers

are using less of the cheques, that means reduced cost of printing cheques, banks

should give a second think to waive the yearly cost of possessing an ATN card. This

will also send positive message to the NRB, in the time when the attitude of NRB

and the relationship between NRB and banks are like the competitors, in the sense

that NRB is trying its best to reduce the costs associated with depositing the money

that are the major source of fund for the banks from which they earn their profits.

Besides, due to the establishment of electronic clearing of cheques through the

newly established company in the initiation of NBA and NRB, it is highly like that the

customers are required to pay for cheque transactions. Hence, from the economic

perspective also the use of ATN cards will be cheaper, especially for those

customers who have to withdraw cash frequently and that also for the personal

use. Banks could think of better alternatives to reduce the cost burden for both

them and their customers. One of the alternatives is to make ATN a way of living:

that is making its use for more and more activities. For instance, use of ATN cards

for shopping could be helpful and some agreements between banks and businesses

may be helpful. !t may also reduce the cost for customers and is beneficial for

banks since more transactions were made through them (formal means) as well as

for businesses since they could have peace of mind for safety of their money and

reduced possibility of fraud by employees.

At last, this study being a first study in Nepal regarding ATN and is a preliminary

one, we recommend further studies to be carried out to examine the factors that

influence customers (ATN users) satisfaction. Nore systematic empirical study is

needed to establish the predictors of ATN service quality of banks and to examine

the extent to which it enhances or diminishes these variables in our context.

ACKNOWLEDGEMENTS

This research is partially funded by Research Grant [NBAfBPC RG#3(B)| provided to

the first author by Banking Promotion Committee, Nepal Bankers Association.

Authors would also like to thank the Think Tank Foundation, Jorpati, Nepal for their

technical and academic support.

REFERENCES

Abdulwahab, L. 2010. Studies on e-transaction using the technology of automatic

teller machine by bank customer in north-west geographical zone of

Nigeria. Bayero Journal of Pure and Applied Sciences, volume 3 (1): Pp. 1-

5.

Athanassopoulos, A. 2000. Customer satisfaction cues to support market

segmentation and explain switching behavior. Journal of Business

Research, volume +7 (3): Pp. 191-207.

Baten, N. A. 2010. E-banking of economical prospects in Bangladesh. Journal of

!nternet Banking and Commerce, volume 15 (2): Pp. 1-10.

Bauer, H. H., T. Falk, and N. Hammerschmidt. 2006. A transaction process-based

approach for capturing service quality in online shopping. Journal of

Business Research, volume 59: Pp. 866-875.

Bhatta, K. P. 2011. Customer behavior and preference: a survey report. Banking

Journal, volume 1 (1): Pp. 63-7+.

Banking Journal, Volume 2 {Issue 2)

37

Colgate, N. and R. Hedge. 2001. An investigation into the switching process in retail

banking services. !nternational Journal of Bank Narketing, volume 19 (5):

Pp. 201-212.

Humphrey, D. and B. vale. 200+. Scale economies, bank mergers, and electronic

payments: a spline function approach. Journal of Banking and Finance,

volume 28: Pp. 1671-1696.

Humphrey, D., N. Willesson, G. Bergendahl, and T. Lindblom. 2003. Cost savings

from electronic payments and ATNs in Europe. Working Paper No. 03-16,

Federal Reserve Bank of Philadelphia, USA.

!qbal, Z., R. verma, and R. Baran. 2003. Understanding customer choices and

preference in transaction-based e-services. Journal of Service Research,

volume 6: Pp. 51-65.

Karjaluoto, H., N. Nattila, and T. Pento. 2002. Electronic banking in Finland:

customer belief and reactions to new delivery channel. Journal of Financial

Service Narketing, volume 6 (+): Pp. 3+6-361.

Khan, N. A. 2010. An empirical study of automated teller machine service quality

and customer satisfaction in Pakistani banks. European Journal of Social

Sciences, volume 13 (3): Pp. 333-3+3.

Lewis, B. R., J. Orledge, and v. Nitchell. 199+. Service quality: students'

assessments of banks and societies. !nternational Journal of Bank

Narketing, volume 2 (+): Pp. 3-12.

Long, N. and C. NcNellon. 200+. Exploring the determinants of retail service quality

on the internet. Journal of Services Narketing, volume 18 (1): Pp. 78-90.

Lucy, N. N. 2006. ATN and customer satisfaction: a case of banking industry in

Tanzania. The African Journal of Finance and Nanagement, volume 15 (1).

Noutinho, L. 1992. Customer satisfaction measurement: prolonged satisfactions

with ATNs. !nternational Journal of Bank Narketing, volume 10 (7): Pp. 30-

37.

Singh, S. K. 2009. !mpact of ATN on customer satisfaction (a comparative study of

SB!, !C!C!, 8 HDFC bank). Business !ntelligence Journal, volume 2 (2): Pp. 276-

287.

Surjadjaja, H., S. Ghosh, and J. Anthony. 2003. Determining and assessing the

determinants of e-service operations. Nanaging Service Quality, volume 13

(1): Pp. 39-53.

Wan, W. W. N., C. L. Luk, and C. W. C. Chow. 2005. Customer's adoption of

banking channels in Hongkong. !nternational Journal of Bank Narketing,

volume 23 (3): Pp. 255-272.

Banking Journal, Volume 2 {Issue 2)

3S

APPENDIX

Questionnaire

Surname: Age: Gender: Narital status:

Education: a) Undergraduate b)Graduate c)Postgraduate d)Other

occupational degree

Occupation: a) Homemaker b) Service c) Self employed d) Retired e)

Student

Per year income group:

a) Less than one lakh per annum

b) One lakh to 3 lakh per annum

c) Four to 6 lakh per annum

d) Nore than 6 lakh per annum

e) ! am yet to make money

f) Don't want to disclose

1. Do you already have an Automated teller machine (ATN) card?

2. For how many account do you have ATN?

a. one

b. two

c. three

d. more

3. Do you prefer ATN to branch banking?

+. !s operating on ATN comfortable?

5. Can you access ATN at any location?

6. How often do you use an ATN?

a. Several times in a week

b. Once a week

c. Once a month

d. Twice a month

e. Less often

f. Other (specify)

7. Do you find it necessary for a guard to be present in ATN post?

8. Are you aware of the feesfcharges you need to pay while using an ATN not owned by your bank?

9. Do you find the charges for ATN affordable?

10. What are the inconvenience you have encountered while using an ATN

a. Long queues

b. Limit on daily withdrawal

c. Difficulty in inserting card

d. Not being able to read from the screen

e. The slip provided is unreadable

f. Others

g. None

11. Do you find ATN transaction reliable?

12. Did your ATN machine ever trap your card during transaction?

13. Has it happened that your ATN machine could not provide you the service when you needed?

1+. Did your ATN machine ever debit your account without actually giving physical cash?

15. Have you ever complained about ATN machine to your bank?

16. !f yes, has your complain been promptly addressed?

17. !f not using ATN, what factor can motivate you to use such instrument?

18. What problem do you face while using ATN?

19. Please list the Advantages of ATN

20. Please list the Disadvantages of ATN

You might also like

- RD NotesDocument2 pagesRD NotesmirgasaraNo ratings yet

- FAO Fisheries & Aquaculture - National Aquaculture Sector Overview - NepalDocument10 pagesFAO Fisheries & Aquaculture - National Aquaculture Sector Overview - NepalmirgasaraNo ratings yet

- Writing ReportsDocument89 pagesWriting ReportsmirgasaraNo ratings yet

- New Microsoft Word DocumentDocument6 pagesNew Microsoft Word DocumentmirgasaraNo ratings yet

- New Microsoft Word DocumentDocument2 pagesNew Microsoft Word DocumentmirgasaraNo ratings yet

- Capital MarketDocument15 pagesCapital MarketmirgasaraNo ratings yet

- New Microsoft Word DocumentDocument2 pagesNew Microsoft Word DocumentmirgasaraNo ratings yet

- New Microsoft Word DocumentDocument1 pageNew Microsoft Word DocumentmirgasaraNo ratings yet

- Notes of Port Folio ManagemntDocument3 pagesNotes of Port Folio ManagemntmirgasaraNo ratings yet

- The Phillips Curve: Geoff RileyDocument2 pagesThe Phillips Curve: Geoff RileymirgasaraNo ratings yet

- Sample LettersDocument15 pagesSample LettersStephanie Michelle TanNo ratings yet

- Notes of Port Folio ManagemntDocument3 pagesNotes of Port Folio ManagemntmirgasaraNo ratings yet

- LCDocument5 pagesLCmirgasaraNo ratings yet

- Lewin Model of Change ManagementDocument3 pagesLewin Model of Change ManagementIla Mehrotra AnandNo ratings yet

- New Microsoft Word DocumentDocument7 pagesNew Microsoft Word DocumentmirgasaraNo ratings yet

- New Microsoft Word DocumentDocument1 pageNew Microsoft Word DocumentmirgasaraNo ratings yet

- New Microsoft Word DocumentDocument2 pagesNew Microsoft Word DocumentmirgasaraNo ratings yet

- New Microsoft Word DocumentDocument20 pagesNew Microsoft Word DocumentmirgasaraNo ratings yet

- New Microsoft Word DocumentDocument1 pageNew Microsoft Word DocumentmirgasaraNo ratings yet

- Notes of Port Folio ManagemntDocument3 pagesNotes of Port Folio ManagemntmirgasaraNo ratings yet

- Checklist For AustraliaDocument2 pagesChecklist For AustraliamirgasaraNo ratings yet

- Capital Rationing ConceptDocument2 pagesCapital Rationing ConceptAdhikari SumanNo ratings yet

- Customer Reln MGMTDocument1 pageCustomer Reln MGMTmirgasaraNo ratings yet

- SAARC NRI Feestructure 2013Document2 pagesSAARC NRI Feestructure 2013mirgasaraNo ratings yet

- White HouseDocument7 pagesWhite HousemirgasaraNo ratings yet

- Notes of Port Folio ManagemntDocument3 pagesNotes of Port Folio ManagemntmirgasaraNo ratings yet

- Checklist For AustraliaDocument2 pagesChecklist For AustraliamirgasaraNo ratings yet

- New Microsoft Office Word DocumentDocument3 pagesNew Microsoft Office Word DocumentmirgasaraNo ratings yet

- Quiz Knowledge 883464lDocument5 pagesQuiz Knowledge 883464lnikhiltembhare_60052No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Invitation For Bids: Office of The Bargarh Municipal Council: BargarhDocument3 pagesInvitation For Bids: Office of The Bargarh Municipal Council: BargarhANJANI KUMAR SRIWASNo ratings yet

- Section 14 Unab Rid Dged Written VersionDocument17 pagesSection 14 Unab Rid Dged Written VersionPrashant TrivediNo ratings yet

- James Mercier Hearing Panel DecisionDocument10 pagesJames Mercier Hearing Panel DecisionAlexa HuffmanNo ratings yet

- List of Designated Travel AgenciesDocument2 pagesList of Designated Travel AgenciesRappler100% (3)

- Week 1-5Document2 pagesWeek 1-5Or Gio100% (1)

- Elizabeth Wangui Wangoo Theory For InclusionDocument81 pagesElizabeth Wangui Wangoo Theory For Inclusionliemuel100% (1)

- BG To Be Issued by A Local Foreign Bank of The Required Country (Counter Guarantee Issuance)Document3 pagesBG To Be Issued by A Local Foreign Bank of The Required Country (Counter Guarantee Issuance)TicketReelNo ratings yet

- Job VacanciesDocument48 pagesJob VacanciesHijo del DuqueNo ratings yet

- Regarding PaymentDocument2 pagesRegarding Paymentbab1235No ratings yet

- Financial StatemnetDocument23 pagesFinancial Statemnetmelaniekudo100% (1)

- Gafta 49Document4 pagesGafta 49tinhcoonlineNo ratings yet

- Frias v. San Diego-SisonDocument2 pagesFrias v. San Diego-SisonJakeDanduanNo ratings yet

- Share-Capital AccountingDocument18 pagesShare-Capital AccountingcociorvanmiriamNo ratings yet

- Average Due Date and Account CurrentDocument80 pagesAverage Due Date and Account CurrentShynaNo ratings yet

- LQ 1 - Set B SolutionDocument14 pagesLQ 1 - Set B SolutionRyan Joseph Agluba Dimacali100% (1)

- Most Important One Liner Questions and Answers, September 2021 (Part-1)Document10 pagesMost Important One Liner Questions and Answers, September 2021 (Part-1)Anushmi JainNo ratings yet

- XML As Global Payment File PDFDocument24 pagesXML As Global Payment File PDFVenkat MadhuNo ratings yet

- Basic Finance ExercisesDocument3 pagesBasic Finance ExerciseskunheiNo ratings yet

- Senate Hearing, 112TH Congress - The Financial Stability Oversight Council Annual Report To CongressDocument278 pagesSenate Hearing, 112TH Congress - The Financial Stability Oversight Council Annual Report To CongressScribd Government DocsNo ratings yet

- 2015 CFE Honour Roll EnglishDocument1 page2015 CFE Honour Roll Englishsanjay_k87No ratings yet

- United India Insurance Company Limited: WWW - Uiic.co - inDocument2 pagesUnited India Insurance Company Limited: WWW - Uiic.co - inGulshan Datta0% (1)

- Elizabeth Pineda FT BDocument24 pagesElizabeth Pineda FT Bapi-285910404No ratings yet

- Wa0025Document8 pagesWa0025SachinZambareNo ratings yet

- ch04 PDFDocument100 pagesch04 PDFChang Chan ChongNo ratings yet

- Inco Terms in Supply Chain ManagementDocument22 pagesInco Terms in Supply Chain ManagementFoshan E-MartNo ratings yet

- EXIMDocument28 pagesEXIMmgurunathanNo ratings yet

- Union BankDocument2 pagesUnion Bankvignesh ACSNo ratings yet

- Case 4, BF - Goodrich WorksheetDocument1 pageCase 4, BF - Goodrich Worksheetisgigles157100% (2)

- Sonali Bank Loan CalculationDocument7 pagesSonali Bank Loan CalculationEngineering EntertainmentNo ratings yet

- CIR Vs LincolnDocument2 pagesCIR Vs LincolnAmee Bagtang-dapingNo ratings yet