Professional Documents

Culture Documents

Mock Test Paper 1

Uploaded by

adityanarang1470 ratings0% found this document useful (0 votes)

22 views0 pagesMock Test Paper 1

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMock Test Paper 1

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

22 views0 pagesMock Test Paper 1

Uploaded by

adityanarang147Mock Test Paper 1

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 0

1

Test Series: February, 2012

MOCK TEST PAPER 1

IPCC/PCC: GROUP II / GROUP I

PAPER 6/2: AUDITING AND ASSURANCE

Question No.1 is compulsory.

Attempt any five questions fromthe remaining six questions.

Time Allowed 3 Hours MaximumMarks 100

1. Give your comments and observations on the following

(a) In a system based audit, test checking approach provides a good base for the

auditor to form his opinion on the financial statement. (5 Marks)

(b) Auditor is responsible for expressing opinion on financial statements in statutory

audit. (5 Marks)

(c) The first auditors of Public Ltd, a Government company was appointed by the Board

of directors. (5 Marks)

(d) Doing a statutory audit is full of risk. Narrate the factors which cause the risk. (5 Marks)

2 (a) Discuss briefly the features of an effective system of internal control over wages

and salaries in a large factory. (8 Marks)

(b) With reference to Government Audit, what do you understand by Audit of

Commercial Accounts? (8 Marks)

3 (a) Megaworld Pvt Ltd. is a in the business of multiplex and restaurant. Restaurant is

adjoining to the multiplex. There has been a theft from ticket collection box. State

how as an auditor you would conduct the audit of Megaworld Pvt Ltd. (8 Marks)

(b) The management of Smita Limited suggested for quick completion of the statutory

audit that it would give its representation about the receivables in terms of their

recoverability. The management also acknowledged to the auditors that the

management would give their representation after scrutinizing all accounts diligently

and they own responsibility for any errors in these respects. It wanted auditors to

complete the audit checking all other important areas except receivables. The

auditor certified the account clearly indicating in his report the fact of reliance he

placed on representation of the management. Comment. (8 Marks)

4 (a) M/s. XYZ, a partnership firm, approaches you and enquires, whether it is necessary

for them, under any statute or otherwise, to get their accounts audited. You are

required to advise them, explaining briefly the advantages of audit of a partnership

firm. (8 Marks)

The Institute of Chartered Accountants of India

2

(b) SK Ltd. has fully computerised its accounting operations. The stock records are

maintained up to date with timely entries passed for all receipts and issues. The

company has hired a professional security agency which monitors and implements a

close vigilance over the operations of the company. As such, the company had

dispensed with the practice of taking stock of their inventories at the year end as in

their opinion the exercise is redundant, time consuming and intrusion to normal

functioning of the operations. (8 Marks)

5. As an auditor, comment on the following situation/statements:

(a) Government of India has appointed Mr. M, a retired Finance Director and a non-

practising member of the Institute of Chartered Accountants of India, as an auditor

to conduct special audit of ABC Ltd. on the ground that the company was not being

managed on sound business principles. The Managing Director of the company

contends that the appointment of Mr. M is not valid because he does not hold a

certificate of practice. (8 Marks)

(b) Sri & Company, a firm of Chartered Accountants was appointed as statutory

auditors of Aaradhana Company Ltd.. Aaradhana Company Ltd. holds 51 % shares

in Sarang Company Ltd.. Mr. Sri, one of the partners of Sri & Company, owed

` 1,500 as on the date of appointment to Sarang Company Ltd. for goods

purchased in normal course of business. (8 Marks)

6. Answer the following:

(a) AB Ltd. is a company in which 20% of the paid up share capital is held by a State

Government and 31% of the paid up share capital is held by a Government

Company. Who will appoint the auditor of AB Ltd? Also state other categories of

companies to which provision of section 619B is applicable. (8 Marks)

(b) State the matters which the statutory Auditor should look into before framing opinion

on accounts on finalisation of audit of accounts? Discuss over all audit approach.

(8 Marks)

7. Write short notes on any four of the following:

(a) Internal evidence and External evidence.

(b) Substantive Procedures

(c) Importance of Working Papers

(d) Reissue of redeemed debentures.

(e) Cut-off procedure. (4 4 =16 Marks)

The Institute of Chartered Accountants of India

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Positive AttitudeDocument31 pagesPositive Attitudeadityanarang147No ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Gandhian PhaseDocument1 pageGandhian Phaseadityanarang147No ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Corrigendum SSC JR Engineer PostsDocument1 pageCorrigendum SSC JR Engineer Postsadityanarang147No ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

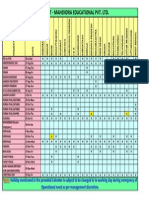

- Holiday List - Mahendra Educational Pvt. LTDDocument1 pageHoliday List - Mahendra Educational Pvt. LTDadityanarang147No ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Sample Question Paper1 JE (Electrical) NE04Document13 pagesSample Question Paper1 JE (Electrical) NE04sanjeevNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- PSMART Download Confirm Digital GoodDocument1 pagePSMART Download Confirm Digital GoodLee ChorneyNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- ManiaaDocument3 pagesManiaaadityanarang147No ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Timeline of Indian History (Ancient To Modern)Document16 pagesTimeline of Indian History (Ancient To Modern)adityanarang147No ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Gandhian PhaseDocument1 pageGandhian Phaseadityanarang147No ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Major Political PhilosophiesDocument7 pagesMajor Political Philosophiesadityanarang147No ratings yet

- Union Budget 2015-16 IndiaDocument4 pagesUnion Budget 2015-16 Indiaadityanarang147No ratings yet

- List of Various CommitteesDocument4 pagesList of Various Committeesadityanarang147No ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- SPL - Advt.52-15 Web CellDocument34 pagesSPL - Advt.52-15 Web CellSaurabh ChoudhariNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- YASR Model PaperDocument2 pagesYASR Model PaperPrakash Kumar SenNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Railwayss ChapterDocument13 pagesRailwayss Chapteradityanarang147No ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- General Hindi Mains MPPSC 2010Document12 pagesGeneral Hindi Mains MPPSC 2010devraj22No ratings yet

- Writing an AbstractDocument1 pageWriting an AbstractChantal Neryett Cordoba DelisserNo ratings yet

- Welcome To RBI - Recruitment of AssistantDocument2 pagesWelcome To RBI - Recruitment of Assistantadityanarang147No ratings yet

- Anova BiometryDocument33 pagesAnova Biometryadityanarang147No ratings yet

- Barc Oces-15Document1 pageBarc Oces-15vsmishra1992No ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- BotanyDocument43 pagesBotanyadityanarang147No ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- GATE ME Solved Question Paper 2010Document12 pagesGATE ME Solved Question Paper 2010anjaiah_19945No ratings yet

- Craft maintenance evaluation and RCM analysis inputsDocument1 pageCraft maintenance evaluation and RCM analysis inputsadityanarang147No ratings yet

- Upsc - Ies Syllabus - General AbilityDocument1 pageUpsc - Ies Syllabus - General Abilityadityanarang147No ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Web Advt No. 52 UpdatedDocument8 pagesWeb Advt No. 52 Updateddeepaksisodia1076No ratings yet

- IntroductiontocncmachinesDocument46 pagesIntroductiontocncmachinesadityanarang147No ratings yet

- Syllabus For IES: Indian Engineering Services ExaminationDocument2 pagesSyllabus For IES: Indian Engineering Services Examinationadityanarang147No ratings yet

- Paper Template Formatting GuideDocument3 pagesPaper Template Formatting GuideShrinivas Saptalakar0% (1)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- NOTICEMPPGCLDocument3 pagesNOTICEMPPGCLadityanarang147No ratings yet

- 08 Sony FailureMechanism PHMConfDocument6 pages08 Sony FailureMechanism PHMConfadityanarang147No ratings yet

- 7a Initial PetitionDocument105 pages7a Initial PetitionAnna Burnham100% (1)

- Roxas Vs Court of Appeals GR 127876Document22 pagesRoxas Vs Court of Appeals GR 127876Anonymous geq9k8oQyONo ratings yet

- Cases Arts. 152 To 1267Document62 pagesCases Arts. 152 To 1267Nikki BarenaNo ratings yet

- Notes For Persons Regards To Article 2 of The Civil CodeDocument109 pagesNotes For Persons Regards To Article 2 of The Civil CodeJay CruzNo ratings yet

- LAND OWNERSHIP CASEDocument6 pagesLAND OWNERSHIP CASEMariel D. PortilloNo ratings yet

- Lista de Responsables de Las Firmas Bolivianas Vinculadas Con El Caso Panamá PapersDocument3 pagesLista de Responsables de Las Firmas Bolivianas Vinculadas Con El Caso Panamá PapersLos Tiempos DigitalNo ratings yet

- GST Registration CertificateDocument3 pagesGST Registration CertificateAccounts West India GlobalNo ratings yet

- Standard Contract For Kenya (Architect and Employer)Document52 pagesStandard Contract For Kenya (Architect and Employer)Jim Taubitz100% (2)

- AlterEgo CaliforniaLawyerNov2008Document4 pagesAlterEgo CaliforniaLawyerNov2008Victor LopezNo ratings yet

- MySQL V Progress SoftwareDocument11 pagesMySQL V Progress SoftwarepropertyintangibleNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Republic vs. Tupaz (G.r. No. 197335)Document1 pageRepublic vs. Tupaz (G.r. No. 197335)Alljun Serenado100% (2)

- Deed of Waiver of RightsDocument2 pagesDeed of Waiver of RightsAnna Ray Eleanor De Guia100% (3)

- .JTGL ::K L : R.A. No. 6758, As AnlendedDocument6 pages.JTGL ::K L : R.A. No. 6758, As AnlendedBryan Gai Taguiam IdmilaoNo ratings yet

- Admiralty Report - HistoryDocument14 pagesAdmiralty Report - HistoryRushid Jay Samortin SanconNo ratings yet

- Grimm Estate SettlementDocument2 pagesGrimm Estate SettlementLenvicElicerLesiguesNo ratings yet

- Cabuay V MalvarDocument2 pagesCabuay V MalvarJeffrey EndrinalNo ratings yet

- Deed of Absolute SaleDocument5 pagesDeed of Absolute SaleViva Fatima Ligan100% (1)

- LTD Digest 3Document3 pagesLTD Digest 3Fernando BayadNo ratings yet

- OMB FARA FormDocument7 pagesOMB FARA FormTitle IV-D Man with a planNo ratings yet

- Answer To Succession Samplex 1Document3 pagesAnswer To Succession Samplex 1Ansis Villalon PornillosNo ratings yet

- Republic of The Philippines v. La Orden de P.P. Benedictinos de Filipinos, G.R. No. L-12792Document2 pagesRepublic of The Philippines v. La Orden de P.P. Benedictinos de Filipinos, G.R. No. L-12792AkiNiHandiongNo ratings yet

- Eastern Shipping Lines v. CA DigestDocument4 pagesEastern Shipping Lines v. CA DigestYsmaelNo ratings yet

- Comedk and Uni-Gauge Uget 2022Document3 pagesComedk and Uni-Gauge Uget 2022raman dalalNo ratings yet

- Error CodesDocument2 pagesError CodesAbdul IrshathNo ratings yet

- Syllabus - ATAP 2nd Semester 2019-2020Document8 pagesSyllabus - ATAP 2nd Semester 2019-2020gongsilog100% (1)

- Leave and Licence AgreementDocument3 pagesLeave and Licence AgreementGuru Surya Prabhakar100% (1)

- RP Vs Javier DigestDocument4 pagesRP Vs Javier DigestErrol TortolaNo ratings yet

- ISO 9001 2008 Certificate Expires 2018 NEWDocument2 pagesISO 9001 2008 Certificate Expires 2018 NEWDavid TomlinsonNo ratings yet

- Dissolution Deed.Document2 pagesDissolution Deed.Jatinder SandhuNo ratings yet

- Unlawful Detainer Case Position PaperDocument5 pagesUnlawful Detainer Case Position PaperBurn-Cindy AbadNo ratings yet

- Coloring Book for Adults & Grown Ups : An Easy & Quick Guide to Mastering Coloring for Stress Relieving Relaxation & Health Today!: The Stress Relieving Adult Coloring PagesFrom EverandColoring Book for Adults & Grown Ups : An Easy & Quick Guide to Mastering Coloring for Stress Relieving Relaxation & Health Today!: The Stress Relieving Adult Coloring PagesRating: 2 out of 5 stars2/5 (12)

- Creative Abstract Watercolor: The beginner's guide to expressive and imaginative paintingFrom EverandCreative Abstract Watercolor: The beginner's guide to expressive and imaginative paintingNo ratings yet

- Art Models Ginger040: Figure Drawing Pose ReferenceFrom EverandArt Models Ginger040: Figure Drawing Pose ReferenceRating: 4 out of 5 stars4/5 (5)

- One Zentangle a Day: A 6-Week Course in Creative Drawing for Relaxation, Inspiration, and FunFrom EverandOne Zentangle a Day: A 6-Week Course in Creative Drawing for Relaxation, Inspiration, and FunRating: 4 out of 5 stars4/5 (25)

- The Everything Art Handbook: A Comprehensive Guide to More Than 100 Art Techniques and Tools of the TradeFrom EverandThe Everything Art Handbook: A Comprehensive Guide to More Than 100 Art Techniques and Tools of the TradeNo ratings yet

- Sharpie Art Workshop: Techniques & Ideas for Transforming Your WorldFrom EverandSharpie Art Workshop: Techniques & Ideas for Transforming Your WorldRating: 3 out of 5 stars3/5 (16)

- Portrait Painting in Oil: 10 Step by Step Guides from Old Masters: Learn to Paint Portraits via Detailed Oil Painting DemonstrationsFrom EverandPortrait Painting in Oil: 10 Step by Step Guides from Old Masters: Learn to Paint Portraits via Detailed Oil Painting DemonstrationsRating: 4.5 out of 5 stars4.5/5 (3)

- Celestial Watercolor: Learn to Paint the Zodiac Constellations and Seasonal Night SkiesFrom EverandCelestial Watercolor: Learn to Paint the Zodiac Constellations and Seasonal Night SkiesRating: 3.5 out of 5 stars3.5/5 (6)