Professional Documents

Culture Documents

Shipping Newsletter Week48

Uploaded by

murphycj25Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Shipping Newsletter Week48

Uploaded by

murphycj25Copyright:

Available Formats

Capital Link Shipping Weekly Markets Report

Monday, December 5, 2011 (Week 48)

IN THE NEWS

Latest Company News 13th Annual Investor Forum - Greece A New Beginning Select Dividend Paying Shipping Stocks Weekly China Update

CAPITAL MARKETS DATA

Currencies, Commodities & Indices Shipping Equities - Weekly Review Weekly Trading Statistics, by Knight Capital Shipping Bonds - Weekly Review, by Knight Capital Dry Bulk Market - Weekly Highlights, by Intermodal Shipbrokers Weekly Tanker Market Opinion, by Poten & Partners Weekly Freight Rate & Asset Trends, by Intermodal Shipbrokers Container Market - Weekly Highlights, by Braemar Seascope S&P Secondhand, Newbuilding & Demolition Markets, by Golden Destiny Forward Freight Agreements - FFAs, by SSY Futures

SHIPPING MARKETS

TERMS OF USE & DISCLAIMER CONTENT CONTRIBUTORS

Capital Link Shipping

...Linking Shipping and Investors Across the Globe

Capital Link is a New York-based Advisory, Investor Relations and Financial Communications firm. Capitalizing on our in-depth knowledge of the shipping industry and capital markets, Capital Link has made a strategic commitment to the shipping industry becoming the largest provider of Investor Relations and Financial Communications services to international shipping companies listed on the US and European Exchanges. Capital Link's headquarters are in New York with a presence in London and Athens.

Operating more like a boutique investment bank rather than a traditional Investor Relations firm, our objective is to assist our clients enhance long term shareholder value and achieve proper valuation through their positioning in the investment community. We assist them to determine their objectives, establish the proper investor outreach strategies, generate a recurring information flow, identify the proper investor and analyst target groups and gather investor and analyst feedback and related market intelligence information while keeping track of their peer group. Also, to enhance their profile in the financial and trade media.

Investor Relations & Financial Advisory

In our effort to enhance the information flow to the investment community and contribute to improving investor knowledge of shipping, Capital Link has undertaken a series of initiatives beyond the traditional scope of its investor relations activity, such as:

A web based resource that provides information on the major shipping and stock market indices, as well as on all shipping stocks. It also features an earnings and conference call calendar, industry reports from major industry participants and interviews with CEOs, analysts and other market participants.

www.CapitalLinkShipping.com

Capital Link Shipping Weekly Markets Report

Weekly distribution to an extensive audience in the US & European shipping, financial and investment communities with updates on the shipping markets, the stock market and listed company news.

www.CapitalLinkWebinars.com

Sector Forums & Webinars: Regularly, we organize panel discussions among CEOs, analysts, bankers and shipping industry participants on the developments in the various shipping sectors (containers, dry bulk, tankers) and on other topics of interest (such as Raising Equity in Shipping Today, Scrapping, etc).

In New York, Athens and London bringing together investors, bankers, financial advisors, listed companies CEOs, analysts, and shipping industry participants.

Capital Link Investor Shipping Forums

Capital Link Maritime Indices: Capital Link developed and maintains a series of stock market maritime indices which track the performance of U.S. listed shipping stocks (CL maritime Index, CL Dry Bulk Index, CL Tanker Index, CL Container Index, CL LNG/LPG Index, CL Mixed Fleet Index, CL Shipping MLP Index Bloomberg page: CPLI. The Indices are also distributed through the Reuters Newswires and are available on Factset.

Capital Link - New York - London - Athens

www.MaritimeIndices.com

New York - 230 Park Avenue, Suite 1536, New York, NY, 10169 Tel.: +1 212 661 7566 Fax: +1 212 661 7526 London - Longcroft House,2-8 Victoria Avenue, London, EC2M 4NS, U.K Tel. +44(0) 203 206 1320 Fax. +44(0) 203 206 1321 Athens - 40, Agiou Konstantinou Str, Suite A 5, 151-24 Athens, Greece Tel. +30 210 6109 800 Fax +30 210 6109 801

www.capitallink.com www.capitallinkforum.com

Capital Link Shipping Weekly Markets Report

Monday, December 5, 2011 (Week 48)

IN THE NEWS

Tsakos Energy Navigation to Host Investor and Analyst Day in New York City on December 9, 2011 Tsakos Energy Navigation Limited (NYSE: TNP) announced that the Company will host an Investor and Analyst Day on Friday, December 9, 2011 at 1:00 pm ET in New York City to discuss the Companys recent developments and prospects, as well as the tanker shipping market outlook. The event, which is for investors and analysts, will feature a presentation by the Companys President and Chief Executive Officer, Nikolas P. Tsakos, followed by a question and answer session. Pre-registration is required to attend the event. Please contact Capital Link at 212-661-7566 or by email at ten@capitallink.com. Transocean Announces Pricing of Senior Notes Transocean Ltd. (NYSE: RIG) announced that its wholly-owned subsidiary, Transocean Inc., priced a public offering of $1.0 billion of 5.050% Senior Notes due 2016, issued at a price of 99.906% of the principal amount, $1.2 billion of 6.375% Senior Notes due 2021, issued at a price of 99.946% of the principal amount, and $300 million of 7.350% Senior Notes due 2041, issued at a price of 99.996% of the principal amount (together, the Senior Notes). Transocean Ltd. will fully and unconditionally guarantee the Senior Notes. The offering is expected to close on December 5, 2011, subject to the satisfaction of customary closing conditions. Thursday, Dec 1, 2011 Scorpio Tankers Inc. Prices Public Offering of Its Common Stock Scorpio Tankers Inc. (NYSE: STNG) announced that it has priced its public offering of 7,000,000 shares of its common stock, par value $0.01 per share, at $5.50 per share. An aggregate of 700,000 shares was allocated, at the direction of the Company, to a member of the Lolli-Ghetti family, of which Scorpio Tankers Inc.s Chairman and Chief Executive Officer is a member, subject to a customary underwriters lockup agreement. The offering is expected to close on December 6, 2011. The Company has granted the underwriters a 30-day option to purchase an additional 1,050,000 shares of its common stock, which was exercised in full. Navios Maritime Partners L.P. to Present at the Wells Fargo Pipeline, MLP and E&P, Services and Utility Conference Navios Maritime Partners L.P. (NYSE: NMM) announced that members of its management team will be presenting at the Wells Fargo Pipeline, MLP and E&P, Services and Utility Conference in New York City on Tuesday, December 6, 2011 at 1:40pm local time. A link to the live (and then archived) webcast of Navios Partners speech along with a PDF of the presentation will be available on the Navios Partners website, www.navios-mlp.com, under the Investor Relations section.

Latest Company News

Tuesday, Nov 29, 2011 Transocean Announces Pricing of Share Offering Transocean Ltd. (NYSE: RIG) announced that it has priced its previously-announced public offering of 26,000,000 of its shares at a public offering price of U.S. $40.50 per share, or 37.32 Swiss francs per share at an exchange rate of 0.9215 Swiss francs per U.S. $1.00. Transocean granted the underwriters a 30-day option to purchase up to an additional 3,900,000 shares at the public offering price (less the underwriting discount) solely to cover overallotments, if any. Net proceeds to Transocean from the sale of the 26,000,000 shares, after underwriting discounts, estimated offering expenses and the Swiss Federal Issuance Stamp Tax (Emissionsabgabe), will be approximately U.S. $1,008 million. Transocean intends to use the net proceeds from this offering to partially refinance its acquisition of Aker Drilling ASA, which was initially financed through the use of available cash and the assumption of Akers outstanding debt. Wednesday, Nov 30, 2011 Global Ship Lease Obtains Loan-to-Value Waiver Global Ship Lease, Inc. (NYSE:GSL) announced that it had today entered into an agreement with its lenders to waive until November 30, 2012 the requirement under its credit facility to conduct loan-to-value tests. The credit facility requires that loan-tovalue, which is the ratio of outstanding borrowings under the credit facility to the aggregate charter-free market value of the secured vessels, cannot exceed 75%. Due to the current downturn in the containership market and consequent impact on vessel values, the Company previously anticipated that loan-to-value would exceed 75% at the scheduled test date of November 30, 2011. Accordingly, the Company engaged its lenders to waive the loan-to-value requirement. Scorpio Tankers Inc. Announces Public Offering of 7,000,000 Shares of Its Common Stock Scorpio Tankers Inc. (NYSE: STNG) announced that it intends to offer and sell 7,000,000 shares of its common stock in an underwritten public offering. The purpose of the offering is to enable the Company to fund the acquisition of two 52,000 dwt newbuilding tankers that it is currently negotiating to have constructed at Hyundai Mipo Dockyard Co. Ltd. of South Korea. The proceeds of the offering are expected to be used to partially repay outstanding indebtedness under the Companys 2010 Revolving Credit Facility with Nordea Bank Finland plc (the 2010 Revolving Credit Facility) and for general corporate purposes. The Company intends to re-draw all or a portion of the amount available under the 2010 Revolving Credit Facility to fund the acquisitions described above. Morgan Stanley & Co. LLC is acting as the sole bookrunning manager in the offering.

Page 3

Capital Link Shipping Weekly Markets Report

Monday, December 5, 2011 (Week 48)

IN THE NEWS

Friday, Dec 2, 2011 TBS International Reaches Agreement With Banks to Extend Forbearance TBS International plc (NASDAQ: TBSI) previously announced in September 2011 that, with the agreement of the requisite lenders under its various financing facilities, it would not make certain principal payments due on its financing facilities for the period through December 15, 2011. Today the Company is announcing that it has reached agreements in principle with its lenders to restructure the Companys debt. To permit documentation of the agreements in principle, the lenders have agreed to an extension of the forbearance period through February 15, 2012. The agreements in principle, subject to final documentation and approvals, provide for the continued operation of the Companys business under current management, continued timely payment in full of all trade creditors, satisfaction of the claims of certain lenders, restructuring of the terms of debt held by the Companys key lenders and no residual value for the existing common and preferred stock.

Latest Company News

Safe Bulkers, Inc. Announces a Two-Year Time Charter With a Forward Delivery Date in August of 2013 for a Kamsarmax Class Vessel Safe Bulkers, Inc. (the Company) (NYSE: SB) announced that it has entered into a new period time charter for the Pedhoulas Trader, a 82,300 dwt Kamsarmax class vessel, for a duration of 23 to 25 months, with a forward delivery date in August of 2013, at a gross daily charter rate linked to the Baltic Panamax Index (BPI) plus a premium of 6.5%. Dr. Loukas Barmparis, President of the Company, said: This new two-year time charter increases our charter coverage for 2013 and onwards and strengthens our relationships with our charterers. At the same time we maintain exposure in the spot market which could prove beneficial in case of spot charter market appreciation after 2013.

Page 4

CAPITAL LINK FORUM

13 Investor Forum

th Annual

- Greece

Wednesday, December 7, 2011 - Metropolitan Club, 1 E 60th St., New York City

UNDER THE AUSPICES OF THE MINISTRY OF FINANCE OF THE HELLENIC REPUBLIC

KEYNOTE SPEAKER:

Introductory Remarks by

IN COOPERATION WITH: MORNING SESSIONS: GREECE - A NEW BEGINNING

European Sovereign Debt - Developments & Outlook Greeces Economic Adjustment Program: The Restructuring of State-Owned Enterprises Privatization Program The Legal Aspects of the Upcoming Privatization Program Hellenic Exchanges & the Greek Stock Market Investment Opportunities for Foreign Investors in the Greek Stock Market Restructuring as an Investment Opportunity Telecommunications Banking Sector Gaming & Sports Betting

President & Editor-inChief, The Huffington Post Media Group

Ms. Arianna Hufngton

Vice Chairman of Global Banking, Citi Keynote Speech by

Mr. Jay Collins

Deputy Prime Minister & Minister of Finance of the Hellenic Republic (Via webcast)

REGISTER NOW

REQUEST 1X1 MEETING

Prof. Evangelos Venizelos

AFTERNOON SESSIONS: 5TH ANNUAL GLOBAL SHIPPING MARKETS ROUNDTABLE

The Global Energy & Tanker Shipping Markets The Global Commodities & Dry Bulk Shipping Markets The Global Container Shipping Markets Analyst Panel

LEAD SPONSORS

GLOBAL GOLD SPONSORS

GRAND SPONSOR

VIEW AGENDA SPONSORSHIP INQUIRY MEDIA INQUIRY

For more information, call (212) 661-7566 or email Eleni Bej at ebej@capitallink.com.

CORPORATE SPONSORS

SUPPORTING SPONSOR

SUPPORTING ORGANIZATIONS

MEDIA PARTNERS

ABOUT THE SHIPPING MAN

When restless New York City hedge fund manager Robert Fairchild watches the Baltic Dry Cargo Index plunge 97%, registering an all-time high and a 25-year low within the span of just six months, he decides to buy a ship. Immediately fantasizing about naming a vessel after his wife, carrying a string of worry beads and being able to introduce himself as a shipowner at his upcoming college reunion, Fairchild immediately embarks on an odyssey into the most exclusive, glamorous and high stakes business in the world. From pirates off the coast of Somalia, to Wall Street investment bankers to Greek and Norwegian shipping magnates, the education of Robert Fairchild is an expensive one. In the end, he loses his hedge fund, but he gains a life - as a Shipping Man. Part fast paced financial thriller, part ship finance text book, The Shipping Man is 310 pages of required reading for anyone with an interest in capital formation for shipping.

Available at

Capital Link Shipping Weekly Markets Report

Monday, December 5, 2011 (Week 48)

IN THE NEWS

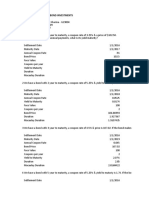

Select Dividend Paying Shipping Stocks

Company Name Ticker Quarterly Dividend Annualized Dividend Last Closing Price (DEC-2, 2011) $10.05 $11.70 Annualized Dividend Yield Containers Box Ships Inc Costamare Inc Dry Bulk Globus Maritime Limited Navios Maritime Holdings Inc Navios Maritime Partners Safe Bulkers Inc Star Bulk Carriers Corp Tankers Capital Product Partners Lp Navios Maritime Acquisition Corp Tsakos Energy Navigation Ltd Mixed Fleet Euroseas Ltd London Listed Companies (Great British Pence) Goldenport Holdings ESEA Ticker $0.07 2010 Total Dividend 5.40 $0.28 Last Closing Price (DEC-2, 2011) 72.00 $2.71 Annualized Dividend Yield 7.50% 10.33% CPLP NNA TNP $0.2325 $0.05 $0.15 $0.93 $0.20 $0.60 $5.90 $2.75 $5.13 15.76% 7.27% 11.70% GLBS NM NMM SB SBLK $0.16 $0.06 $0.44 $0.15 $0.05 $0.64 $0.24 $1.76 $0.60 $0.20 $3.75 $3.90 $15.42 $6.10 $1.11 17.07% 6.15% 11.41% 9.84% 18.02% TEU CMRE $0.15 $0.27 * $0.60 $1.08 5.97% 9.23%

GPRT

*Board approved an eight percent (8%) dividend increase, beginning with the third quarter 2011 dividend, raising the quarterly dividend from $0.25 to $0.27 per common share.

Get your message across to 36,000 weekly recipients around the globe

Join a select group of shipping & financial industrys advertisers by promoting your brand with Capital Links Shipping Weekly Markets Report.

For additional advertising information and a media kit, please contact/email: Nicolas Bornozis at +1 212 661-7566, forum@capitallink.com

Page 7

Capital Link Shipping Weekly Markets Report

Monday, December 5, 2011 (Week 48)

IN THE NEWS

Oil & Gas As 2012 is the second year of the 12th Five-Year Plan, the acceleration of the construction of major national pipeline projects will boost the demand for steel pipes. The oil and gas pipe sector was hard hit by the suspension of global oil and gas projects in 2010. In 2011, the demand for steel pipes picked up steadily as the construction of a number of major national oil and gas pipeline projects in the PRC resumed. Earnings of steel pipe manufacturers have also shown signs of bottoming out. The Chinese government plans to expand its total length of oil and gas pipelines at a CAGR of 14% in the coming five years, translating into 5mn tonnes of steel pipes demand each year. Being the second year of the 12th FiveYear Plan, major projects blueprinted such as the Third and Fourth West to East Gas Pipeline and domestic section of Sino-Myanmar Pipe Network will commence construction in 2012. Meanwhile, regional pipeline network will also be expanded significantly to meet the energy needs of economic development and to increase the penetration of natural gas consumption. Coal Thermal coal prices at major ports around Bohai Sea edged down further in the week ending November 30, marking its third consecutive week of declines. The latest Bohai-Rim Steam-Coal Price Index, or BSPI, indicates that the average price of thermal coal with calorific value of 5500 Kcal/kg dropped to CNY 847 per tonne, down CNY 3 per tonne from a week earlier. At Qinhuangdao port, the price of 4500 kilocalories per kilogram thermal coal came to CNY 635-645, decreasing CNY 5 per tonne as compared to the previous week. The continuous fall in thermal coal price was mainly attributed to the high levels of inventory at power plants and main ports despite of the favorable factors that may somewhat stimulate the market demand, such as increasing coal consumption in winter season. The thermal coal market was hurt again by rumors that the National Development and Reform Commission would put a cap on spot coal prices. It was reported that the NDRC ordered, in a statement released recently that benchmark spot prices with a heating value of 5,500 kilocalories per kilogram to be capped at CNY 800 per tonne. NDRC recently announced temporary price control on thermal coal along with tariff hikes for electricity. The specific price control measures include limiting the increase of 2012 key contract coal price to no more than 5%, capping the spot thermal coal price at Rmb800/ton for 5,500kcal/kg-grade coal at major ports in the Bohai Bay since 1 January 2012 and cutting the local government surcharges on coal producers. The price gap is supposed to be no big shock for coal producers while the nod for hike in 2012 contract coal price may help narrow spot-contract spread.

Weekly China Update

Major Economic Indicators

The Peoples Bank of China (PBOC) announced a 50bp cut in the required reserve ratio (RRR) for all banks on Nov. 30, effective 5 December 2011. Between January 2010 and June 2011, the RRR was raised 12 times, an aggregate 600bp increase that produced a record-high RRR of 21.5%. Chinas large banks will see their ratio reduced to 21% while the ratio for other banks will fall to 19%. After a series of RRR and interest rate hikes in 2011, economic indicators are now showing signs of softening. The PBOC is growing concerned about economic downside risk given that Novembers PMI is likely to remain below 50 due to the slowdown in manufacturing. An RRR cut just before Novembers CPI is published implies prices in China are finally under control. With exports and prices now falling, economic growth will take priority over inflation. Chinas Central Economic Working Conference will convene in early December. One issue will surely be how to maintain stable, healthy growth by fostering domestic demand and economic restructuring. Chinas first official step towards easing credit will probably be to alleviate market risk premium, which would lead to a re-rating of certain stocks and sectors that suffered heavily from credit tightening and default risk. These would include banking, property, materials and construction-related sectors. Formerly rising foreign reserves have begun to decline, going from over US$150.0b in each of the first two quarters of the year to only US$4.2b in 3Q11. Hot money from 1H11 is now withdrawing and credit in the domestic market is still tight. With inflation finally under control, RRR was bound to be cut. Steel Weak Chinese demand has pulled down the price of Iron Ore by 11% to $130.80 a ton, lowest since November 8. The industrial activity of China which has been affected by the ongoing uncertainties in the global economy and it was visible on the Chinese Manufacturing data. According to data from the China Iron and Steel Association, the average daily output of crude steel stood at 1.66 million tons (mt) over November 11-20, unchanged from the previous 10 days, reported The Business Standard The overall consumption of iron ore is likely to remain low as the buying activities from Chinese mills are to remain under pressure until December-end due to poor demand from construction sectors. Chinas manufacturing sector recorded the weakest performance since the global recession eased in 2009, indicating the Europes crisis weighs on the worlds second-largest economy. The iron ore inventories at 25 major Chinese sea ports stood at 100.87 million metric tons (tonnes) on November 28, down 990,000 tonnes, or 0.97 per cent, from the proceeding week, according to the Xinhua-China Iron Ore Price Index (Xinhua-China IOP Index). The index, compiled through thorough research and analysis of 25 selected major sea ports, shows that the price index for iron ore imports of 63.5 per cent purity grade reached 145 points on November 28, down 8 point from a week earlier, while that for iron ore imports of 58 per cent purity grade declined 7 point to 117 points.

Page 8

Capital Link Shipping Weekly Markets Report

Monday, December 5, 2011 (Week 48)

IN THE NEWS

Weekly China Update

Shipping Indices

Shanghai Containerized Freight Index closed at 868.31 for the week ended December 2, losing 1.22% week-on-week. China Coastal Bulk Freight Index fell 1.04% to 1154.35 for the same period.

Page 9

Capital Link Shipping Weekly Markets Report

Week ending Friday, December 2, 2011

Monday, December 5, 2011 (Week 48)

CAPITAL MARKETS DATA

Currencies, Commodities & Indices

KEY CURRENCY RATES Rate 3-Month LIBOR 10-Yr US Treas. Yield USD/EUR USD/GBP USD/JPY USD/CNY Current Price 0.5283 2.0418 0.7462 0.6411 77.8800 6.3431 Price Last Week 0.5181 1.9635 0.7552 0.6478 77.6700 6.3840 % Change 1.97% 3.99% -1.19% -1.03% 0.27% -0.64% PRECIOUS METALS Current Price Gold Silver Platinum Copper Palladium 1,750.45 33.38 1,556.50 358.50 643.95 Price Last Week 1,714.95 32.16 1,560.50 328.40 572.20 % Change 2.07% 3.79% -0.26% 9.17% 12.54% YTD %Chg 23.78% 8.77% -12.04% -19.17% -19.16% 52 Week High $1,921.15 $49.79 $1,916.75 $457.70 $851.00 52 Wk Low $1,308.25 $26.07 $1,432.50 $302.00 $541.70 YTD %Chg 74.48% -38.80% -0.35% -0.74% -4.71% -3.91% 52 Week High 0.5393 3.3190 0.7766 0.6545 85.5300 6.6800 52 Wk Low 0.2844 2.3833 0.6694 0.5972 75.3800 6.3190

KEY AGRICULTURAL & CONSUMER COMMODITIES Current Price Corn Soybeans Wheat Cocoa Coffee Cotton Sugar #11 595.25 1,135.75 625.50 2,228.00 229.55 91.84 23.45 Price Last Week 590.00 1,106.50 589.00 2,381.00 232.55 90.87 22.90 % Change 0.89% 2.64% 6.20% -6.43% -1.29% 1.07% 2.40% KEY FUTURES Commodities Gas Oil WTI Crude Natural Gas Heating Oil Gasoline RBOB Current Price 946.25 101.02 3.59 299.25 262.95 Price Last Week 929.75 96.77 3.54 292.73 244.89 % Change 1.77% 4.39% 1.41% 2.23% 7.37% YTD %Chg 19.44% 10.25% -22.46% 16.95% 8.17% 52 Week High $1,056.75 $115.22 $4.98 $341.99 $303.63 52 Wk Low $785.50 $75.36 $3.29 $253.95 $235.00 YTD %Chg -4.07% -17.64% -22.35% -26.59% -4.55% -35.41% -26.99% 52 Week High $789.00 $1,474.25 $994.75 $3,620.00 $313.15 $134.62 $30.60 52 Wk Low $526.00 $1,102.75 $586.00 $2,211.00 $194.50 $87.00 $20.36

Page 10

Capital Link Shipping Weekly Markets Report

Monday, December 5, 2011 (Week 48)

CAPITAL MARKETS DATA

Currencies, Commodities & Indices

MAJOR INDICES Index Dow Jones Dow Jones Transp. NASDAQ NASDAQ Transp. S&P 500 Russell 2000 Index Amex Oil Index FTSE 100 Index Symbol INDU TRAN CCMP CTRN SPX RTY XOI UKX Close 12,019.42 4,946.67 2,626.93 2,170.87 1,244.28 735.02 1,224.77 5,552.29 Last Week 11,231.78 4,533.44 2,441.51 2,032.07 1,158.67 666.16 1,114.30 5,164.65 % Change 7.01% 9.12% 7.59% 6.83% 7.39% 10.34% 9.91% 7.51% YTD % Change 2.99% -4.41% -2.40% -16.52% -2.17% -7.96% -0.08% -7.68% 3-Jan-11 11,444.61 4,693.59 2,532.41 2,151.96 1,199.38 714.63 1,148.91 5,246.99

CAPITAL LINK MARITIME INDICES Index Capital Link Maritime Index Tanker Index Drybulk Index Container Index LNG/LPG Index Mixed Fleet Index MLP Index Symbol CLMI CLTI CLDBI CLCI CLLG CLMFI CLMLP 2-December-11 2,120.65 1,948.92 639.36 862.64 3,733.80 1,109.56 2,718.48 25-November-11 1,945.50 1,862.61 587.31 871.00 3,389.29 1,042.56 2,567.67 BALTIC INDICES Index Baltic Dry Index Baltic Capesize Index Baltic Panamax Index Baltic Supramax Index Baltic Handysize Index Baltic Dirty Tanker Index Baltic Clean Tanker Index Symbol BDIY BCIY BPIY BSI BHSI BDTI BCTI 2-December-11 1,866 3,409 1,701 1,335 623 776 726 25-November-11 1,807 3,049 1,794 1,380 639 782 705 % Change 3.27% 11.81% -5.18% -3.26% -2.50% -0.77% 2.98% 4-Jan-11 1,693 2,285 1,798 1,421 807 842 635 YTD % Change 10.22% 49.19% -5.39% -6.05% -22.80% -7.84% 14.33% % Change 9.00% 4.63% 8.86% -0.96% 10.16% 6.43% 5.87% 3-Jan-11 2,031.89 2,355.67 894.91 2,182.51 3,004.87 1,943.64 2,963.32 YTD % Change 4.37% -17.27% -28.56% -60.48% 24.26% -42.91% -8.26%

Page 11

Capital Link Shipping Weekly Markets Report

Monday, December 5, 2011 (Week 48)

CAPITAL MARKETS DATA

Shipping Equities: The Week in Review

SHIPPING EQUITIES OUTPERFORMED THE BROADER MARKET LNG/LPG STOCKS THE BEST PERFORMERS During last week, shipping equities outperformed the broader market, with the Capital Link Maritime Index (CLMI), a composite index of all US listed shipping stocks increased 9.00% compared to the S&P 500 climbing 7.39%, and the Dow Jones Industrial Average (DJII) gaining 7.01%. Year-to-date, the CLMI has increased 4.37% versus a gain of 2.99% for the DJII and a loss of 2.17% for the S&P 500. The broader markets showed strong gains as the ECB increased access to US dollar funding for European banks. LNG/LPG stocks performed the best during last week, with the Capital Link LNG/LPG Index gained 10.16%, compared to the gains of 8.86% for Capital Link Dry Bulk Index, 6.43% for Capital Link Mixed Fleet Index, 5.87 for Capital Link MLP Index, 4.63% for Capital Link Tanker Index, and a loss of 0.96 % for Capital Link Container Index. Year-to-date, the best performing sector has been LNG/LPG stocks, with the Capital Link LNG/LPG Index gaining 24.26%, followed by Capital Link MLP Index losing 8.26% and Capital Link Tanker Index sliding 17.27%. The top three largest weekly trading gainers are Navios Maritime Holdings (NM), Excel Maritime (EXM), and Global Ship Lease (GSL), with stock prices increasing 21.50%, 18.79% and 18.38%, respectively. During last week, dry bulk stocks outperformed the physical shipping market, as the Baltic Dry Index (BDI) increased 3.27% compared to a gain of 8.86% for the Capital Link Dry Bulk Index. Year-to-date, the BDI has gained 10.22% compared to a loss of 28.56% for the Capital Link Dry Bulk Index. Capesize rates ended up higher last week, with strong chartering activity in both the Atlantic and Pacific, while the rates of the smaller vessels remained weak by overcapacity. London Listed Friday Price Last % YTD 52 Week 52 Week 1 Month

Companies (GBp) Hellenic Carriers Ltd Goldenport Holdings Ticker HCL GPRT Close Week Change %Chg High Low

41.50 44.00 -5.68% -46.45% 81.00 39.50 8,052.13 Tanker stocks outperformed the physical tanker shipping market during last week as well, with the Baltic Tanker Index (BDTI) losing 72.00 72.25 -0.35% Dirty -38.20% 122.25 69.00 11,582.97 0.77% and the Baltic Clean Tanker Index (BCTI) increasing 2.98% compared to a gain of 4.63% for the Capital Link Tanker Index. Year1 Month Friday Last % YTD 52 Week 52 Week Milan Listed Company (Euro) Ticker to-date, the BDTI has slipped 7.84% and the BCTI has gained 14.33%, while the Capital LinkPrice Tanker Index has lost 17.27%. Brent Crude Average Close Week Change %Chg High Low Volume Oil gained 1.14% for the week, and 17.49% year-to-date. VLCC rates continue to benefit from a seasonal upswing in demand, and the dAmico International Shipping DIS 0.45 0.40 12.50% -54.54% 1.03 0.40 N/A Suezmax market becomes firmer after the Thanksgiving holiday.

Average Volume

The Trading Statistics supplied by Knight Capital provide details of the trading performance of each shipping stock and analyze the Nautilus Marine Acquisition Corp NMAR 9.53 9.50 0.32% 0.00% 9.58 9.40 N/A markets trading momentum and trends for the week and year-to-date. Nautilus Marine Acquisition The objective of the Capital Link Maritime Indices is to enable investors, as well as all shipping market participants, to better track the performance of listed shipping stocks individually, by sector or as an industry. Performance can be compared to other individual shipping stocks, to their sector, to the broader market, as well as to the physical underlying shipping markets or other commodities. The Indices currently focus only on companies listed on US Exchanges providing a homogeneous universe. They are calculated daily and are based on the market capitalization weighting of the stocks in each index. In terms of historical data, the indices go back to January 1, 2005, thereby providing investors with significant historical performance. There are seven indices in total; the Capital Link Maritime Index comprised of all 50 listed shipping stocks, and six Sector Indices, the CL Dry Bulk Index, the CL Tanker Index, the CL Container Index, the CL LNG / LPG Index, the CL Mixed Fleet Index and the CL Maritime MLP Index. The Index values are updated daily after the market close and can be accessed at www.CapitalLinkShipping.com or at or www.MaritimeIndices.com. They can also be found through the Bloomberg page CPLI and Reuters.

Corp Warrants NMARW 0.30 0.41 -26.83% -25.00% 0.53 0.30 N/A MARITIME INDEX DAILY COMPARISON CHARTS (YTD)*

Blank Check Companies

Ticker

Friday Close

Price Last Week

% Change

YTD %Chg

52 Week High

52 Week Low

1 Month Average

1.10 1.00 0.90 0.80 0.70

*SOURCE: BLOOMBERG CAPITAL LINK TANKER INDEX DAILY COMPARISON CHARTS (YTD)*

Capital Link Maritime Index S&P 500

Russell 2000

1.90 1.70 1.50 1.30 1.10 0.90 0.70 0.50

*SOURCE: BLOOMBERG CAPITAL LINK DRY BULK INDEX DAILY COMPARISON CHARTS (YTD)*

Capital Link Tanker Index Baltic Clean Tanker Index Baltic Dirty Tanker Index

1.55 1.40 1.25 1.10 0.95 0.80 0.65 0.50 0.35

*SOURCE: BLOOMBERG

Capital Link Drybulk Index Baltic Dry Index

Page 12

Capital Link Shipping Weekly Markets Report

Monday, December 5, 2011 (Week 48)

CAPITAL MARKETS DATA

% Change 15.03% 4.83% 12.56% 5.36% 19.39% -21.79% 9.67% -5.06% 21.50% 14.22% 0.47% 2.18% -5.04% -9.02% -30.00% % Change 5.65% 3.15% -12.09% 10.14% 4.17% -0.42% -32.07% 1.94% -5.36% 4.52% 3.86% 4.11% 12.73% 3.85% % Change -1.86% 1.39% 0.60% -2.24% 18.38% -1.04% % Change 12.61% 3.12% 6.45% 7.37% % Change -4.91% 6.48% -9.72% 4.20% 6.12% Page 13 YTD %Chg -51.63% -34.93% -51.66% -76.35% -65.56% -83.73% -47.69% -61.46% -28.18% -21.92% -78.13% -31.31% -80.90% -59.04% -90.38% YTD %Chg -56.95% -38.61% -83.40% -88.29% -32.10% -54.55% -85.30% -72.17% -48.74% -0.22% -17.21% -69.87% -91.35% -49.06% YTD %Chg -8.64% -18.69% -14.32% -68.52% -56.63% -19.48% YTD %Chg 185.91% 18.27% -51.35% -12.79% YTD %Chg -29.24% -31.25% -74.00% -52.31% -75.70% 52 Week High $11.79 $12.95 $6.21 $5.39 $6.17 $4.08 $15.65 $13.59 $5.99 $21.56 $3.66 $9.78 $16.35 $3.09 $4.39 52 Week High $12.92 $11.39 $5.19 $27.76 $4.55 $26.80 $1.54 $38.32 $12.18 $31.50 $37.93 $12.99 $7.70 $11.18 52 Week High $12.00 $18.48 $7.87 $15.50 $7.75 $21.33 52 Week High $44.26 $29.74 $8.80 $41.50 52 Week High $5.28 $25.80 $3.88 $23.07 $11.60 52 Week Low $3.64 $6.59 $1.75 $1.04 $1.63 $0.56 $4.15 $3.26 $2.88 $11.06 $0.66 $5.28 $2.61 $1.00 $0.21 52 Week Low $3.19 $4.85 $0.74 $2.52 $2.50 $11.58 $0.13 $9.79 $4.69 $22.01 $20.67 $3.48 $0.54 $4.84 52 Week Low $6.44 $10.93 $2.65 $4.58 $1.62 $10.21 52 Week Low $13.77 $22.41 $3.40 $28.61 52 Week Low $2.53 $14.65 $0.53 $9.20 $1.00 1 Month Average Volume 106,077 430,959 5,158,809 594,743 528,088 8,679 613,495 22,548 484,207 307,423 260,127 94,350 4,770 210,480 62,477 1 Month Average Volume 282,500 268,157 685,031 3,112,585 43,458 505,578 42,889 876,120 205,024 159,791 337,561 550,561 44,696 135,494 1 Month Average Volume 118,455 69,996 33,196 70,736 67,627 336,289 1 Month Average Volume 563,285 67,615 28,696 387,552 1 Month Average Volume 25,177 138,180 975 652,020 10,732

Shipping Equities

Dry Bulk Baltic Trading Ltd Diana Shipping Inc DryShips Inc Eagle Bulk Shipping Inc Excel Maritime Carriers FreeSeas Inc Genco Shipping Globus Maritime Navios Maritime Hldgs Navios Maritime Ptns Paragon Shipping Inc Safe Bulkers Inc Seanergy Maritime Hldg Star Bulk Carriers Corp TBS International PLC Tankers Aegean Marine Petrol Capital Product Ptns DHT Holdings Inc Frontline Ltd Navios Maritime Acq. Nordic American Tanker Omega Navigation Ent. Overseas Shipholding Scorpio Tankers Inc Teekay Corp Teekay Offshore Ptns Teekay Tankers Ltd Torm A/S Tsakos Energy Nav. Containers Box Ships Inc Costamare Inc Danaos Corp Diana Containerships Global Ship Lease Inc Seaspan Corp LNG/LPG Golar LNG Ltd Golar LNG Partners LP StealthGas Inc Teekay LNG Partners Mixed Fleet Euroseas Ltd Knightsbridge Tankers NewLead Holdings Ltd Ship Finance Intl TOP Ships Inc Ticker BALT DSX DRYS EGLE EXM FREE GNK GLBS NM NMM PRGN SB SHIP SBLK TBSI Ticker ANW CPLP DHT FRO NNA NAT ONAVQ.PK OSG STNG TOO TK TNK TRMD TNP Ticker TEU CMRE DAC DCIX GSL SSW Ticker GLNG GMLP GASS TGP Ticker ESEA VLCCF NEWL SFL TOPS Friday Close $5.05 $7.60 $2.42 $1.18 $1.97 $0.61 $7.60 $3.75 $3.90 $15.42 $0.75 $6.10 $2.75 $1.11 $0.28 Friday Close $4.49 $5.90 $0.80 $3.04 $2.75 $11.95 $0.20 $9.98 $5.30 $27.75 $27.46 $3.80 $0.62 $5.13 Friday Close $10.05 $11.70 $3.35 $4.80 $2.19 $10.50 Friday Close $43.66 $29.39 $3.96 $33.20 Friday Close $2.71 $15.60 $0.65 $10.42 $2.60 Prev. Week Close $4.39 $7.25 $2.15 $1.12 $1.65 $0.78 $6.93 $3.95 $3.21 $13.50 $0.75 $5.97 $2.90 $1.22 $0.40 Price Last Week $4.25 $5.72 $0.91 $2.76 $2.64 $12.00 $0.29 $9.79 $5.60 $26.55 $26.44 $3.65 $0.55 $4.94 Price Last Week $10.24 $11.54 $3.33 $4.91 $1.85 $10.61 Price Last Week $38.77 $28.50 $3.72 $30.92 Price Last Week $2.85 $14.65 $0.72 $10.00 $2.45

Diana Containerships Global Ship Lease Inc Seaspan Corp LNG/LPG

Capital Link Shipping Friday Price Last Weekly Markets Report Ticker

GLNG GMLP GASS TGP Close $43.66 $29.39 $3.96 $33.20

DCIX GSL SSW

$4.80 $2.19 $10.50

$4.91 $1.85 $10.61

-2.24% 18.38% -1.04% % Change 12.61% 3.12% 6.45% 7.37% % Change -4.91% 6.48% -9.72% 4.20% 6.12% % Change -5.68% -0.35%

-68.52% -56.63% -19.48% YTD %Chg 185.91% 18.27% -51.35% -12.79% YTD %Chg -29.24% -31.25% -74.00% -52.31% -75.70% YTD %Chg -46.45% -38.20% YTD %Chg -54.54%

$15.50 $7.75 $21.33 52 Week High $44.26 $29.74 $8.80 $41.50

Monday, December 5, 2011 (Week 48)

$4.58 $1.62 $10.21

70,736 67,627 336,289

Golar LNG Ltd Golar LNG Partners LP StealthGas Inc Teekay LNG Partners Mixed Fleet

Shipping Equities

Ticker ESEA VLCCF NEWL SFL TOPS Ticker HCL GPRT Friday Close $2.71 $15.60 $0.65 $10.42 $2.60 Friday Close 41.50 72.00 Ticker DIS Ticker NMAR NMARW

Week $38.77 $28.50 $3.72 $30.92

CAPITAL MARKETS DATA

52 Week Low $13.77 $22.41 $3.40 $28.61

1 Month Average Volume 563,285 67,615 28,696 387,552

Euroseas Ltd Knightsbridge Tankers NewLead Holdings Ltd Ship Finance Intl TOP Ships Inc London Listed Companies (GBp) Hellenic Carriers Ltd Goldenport Holdings

Price Last Week $2.85 $14.65 $0.72 $10.00 $2.45 Price Last Week 44.00 72.25

52 Week High $5.28 $25.80 $3.88 $23.07 $11.60 52 Week High 81.00 122.25

52 Week Low $2.53 $14.65 $0.53 $9.20 $1.00 52 Week Low 39.50 69.00

1 Month Average Volume 25,177 138,180 975 652,020 10,732 1 Month Average Volume 8,052.13 11,582.97 1 Month Average Volume N/A 1 Month Average N/A N/A

Milan Listed Company (Euro) dAmico International Shipping Blank Check Companies Nautilus Marine Acquisition Corp Nautilus Marine Acquisition Corp Warrants

Friday Close 0.45 Friday Close 9.53 0.30

Price Last Week 0.40 Price Last Week 9.50 0.41

% Change 12.50% % Change 0.32% -26.83%

52 Week High 1.03

52 Week Low 0.40 52 Week Low 9.40 0.30

YTD %Chg 0.00% -25.00%

52 Week High 9.58 0.53

MARITIME INDEX DAILY COMPARISON CHARTS (YTD)*

1.10 1.00 0.90 0.80 0.70

Capital Link Shipping

*SOURCE: BLOOMBERG CAPITAL LINK TANKER INDEX DAILY COMPARISON CHARTS (YTD)*

Capital Link Maritime Index S&P 500

Russell 2000

Capital 1.90 Link 1.70 Tanker Index 1.50 Baltic 1.30 Clean 1.10 Tanker 0.90 Index Track all U.S. & European listed Shipping companies and access: earnings Baltic 0.70 & conference call calendar, media interviews, press releases, news, blogs, Dirty 0.50

stock prices/charts & presentations Visit CapitalLinkShipping.com

Tanker Index

*SOURCE: BLOOMBERG

CAPITAL LINK DRY BULK INDEX DAILY COMPARISON CHARTS (YTD)*

Page 14

1.55

Capital Link Shipping Weekly Markets Report

Monday, December 5, 2011 (Week 48)

CAPITAL MARKETS DATA

Weekly Trading Statistics

Custom Statistics Prepared Weekly for Capital Link Shipping BROAD MARKET

Percent Change of Major Indexes for the Week Ending Friday, December 2, 2011

Name Russell 2000 Index Dow Jones Transportation Index Russell 3000 Index Nasdaq Composite Index Russell 1000 Index S&P 500 Index Nasdaq-100 Index Dow Jones Industrial Average Index Nasdasq Transportation Index Russell 2000 Index Symbol RUT TRAN RUA COMPX RUI SPX NDX INDU TRANX RUT Close 734.91 4946.83 736.27 2626.93 687.44 1244.28 2302.04 12019.35 2170.87 734.91 Net Gain 68.75 413.39 52.42 185.42 47.63 85.61 151.16 787.57 138.80 68.75 Percent Gain 10.32% 9.12% 7.67% 7.59% 7.44% 7.39% 7.03% 7.01% 6.83% 10.32%

Index Data: INDU (Dow Jones Industrial Average Index. The INDU closed today at 12,019.35 for a weekly gain of 787.57 pts (+7.0120%). The high of the week was 12,146.68 while the low was 11,232.47 (close = 86.07% of high/low range). The INDU closed 7.03% from its 52 week high (12,928.45) and 15.99% from its 52 week low (10,362.26).

INDU Important Moving Averages

50 Day: 11,596.98 100 Day: 11,586.09 200 Day: 11,946.18

SHIPPING INDUSTRY DATA (50 Companies)

Moving Averages

45.45% closed > 10D Moving Average. 27.27% closed > 50D Moving Average. 27.27% closed > 100D Moving Average. 6.82% closed > 200D Moving Average

Top Upside Momentum (Issues with the greatest 100 day upside momentum*)

Symbol Close TOPS GLNG ALEX TOO TK 2.6 43.66 44.4 27.75 27.44 Weekly % Change 6.12% 12.61% 33.90% 4.52% 3.78% 50-Day % Change 68.83% 36.52% 19.48% 10.56% 16.92%

Top Downside Momentum (Issues with the greatest 100 day downward momentum*)

Symbol Close TBSI FRO TRMD DHT OSG FREE NEWL TNK SFL EGLE 0.28 3.03 0.62 0.8 9.98 0.61 0.65 3.8 10.42 1.18 Weekly % Change -30.00% 9.78% 12.73% -12.09% 1.94% -21.79% -9.72% 4.11% 4.20% 5.36% 50-Day % Change -67.44% -43.68% -55.40% -62.09% -33.38% -27.38% -13.33% -24.45% -18.47% -30.99%

*Momentum: (100D % change) + 1.5*(50D % change) + 2.0*(10D % change) for each stock then sort group in descending order and report the top 10.

*Momentum: (100D % change) + 1.5*(50D % change) + 2.0*(10D % change) for each stock - sort names that have a negative value in ascending order - report the top 10.

Page 16

Capital Link Shipping Weekly Markets Report

Monday, December 5, 2011 (Week 48)

CAPITAL MARKETS DATA

Top Consecutive Lower Closes

Symbol Close Down Streak CPLP DCIX ESEA OSG SHIP STNG TEU 5.9 4.8 2.71 9.98 2.75 5.3 10.05 -2 -2 -2 -2 -2 -2 -4

Weekly Trading Statistics

Top Consecutive Higher Closes

Symbol ALEX GSL TOPS NMM Close Up Streak 44.4 2.19 2.6 15.42 5 3 3 2

Top Largest Weekly Trading Gains

Symbol ALEX NM EXM GSL BALT NMM TRMD GLNG DRYS FRO Close One Week Ago 33.16 3.21 1.65 1.85 4.39 13.5 0.55 38.77 2.15 2.76 Friday Close 44.4 3.9 1.96 2.19 5.05 15.42 0.62 43.66 2.42 3.03 Net % Change Change 11.24 33.90% 0.69 21.50% 0.31 18.79% 0.34 18.38% 0.66 15.03% 1.92 14.22% 0.07 12.73% 4.89 12.61% 0.27 12.56% 0.27 9.78% TBSI FREE DHT NEWL SBLK STNG SHIP GLBS ESEA TEU

Top Largest Weekly Trading Losses

Symbol Close One Week Ago 0.4 0.78 0.91 0.72 1.22 5.6 2.9 3.95 2.78 10.24 Friday Close 0.28 0.61 0.8 0.65 1.11 5.3 2.75 3.75 2.71 10.05 Net Change -0.12 -0.17 -0.11 -0.07 -0.11 -0.30 -0.15 -0.20 -0.07 -0.19 % Change -30.00% -21.79% -12.09% -9.72% -9.02% -5.36% -5.17% -5.06% -2.52% -1.86%

Top Largest Monthly Trading Gains (A month has

been standardized to 20 trading days) Prior Friday Net Symbol % Change Close Close Change TEU ALEX GLNG TOO TK GMLP NM TGP 8.63 41.68 41.27 26.24 25.95 28.11 3.82 32.94 10.05 44.4 43.66 27.75 27.44 29.39 3.9 33.2 1.42 2.72 2.39 1.51 1.49 1.28 0.08 0.26 16.45% 6.53% 5.79% 5.75% 5.74% 4.55% 2.09% 0.79%

Top Largest Monthly Trading*Losses (A month has

Symbol TBSI TRMD DHT FRO SFL FREE EXM OSG TNK EGLE

been standardized to 20 trading days) Prior Net % Friday Close Close Change Change 0.73 1.15 1.47 4.93 14.38 0.8 2.55 12.77 4.84 1.48 0.28 0.62 0.8 3.03 10.42 0.61 1.96 9.98 3.8 1.18 52W Low 9.79 10.06 11.34 4.84 14.62 4.44 0.74 0.56 2.47 10.59 -0.45 -61.64% -0.53 -46.09% -0.67 -45.58% -1.90 -38.54% -3.96 -27.54% -0.19 -23.75% -0.59 -23.14% -2.79 -21.85% -1.04 -21.49% -0.30 -20.27% % Away 1.94% 4.42% 5.29% 5.79% 6.67% 8.11% 8.11% 8.93% 9.88% 10.04%

Stocks Nearest to 52-Week Highs

Symbol GMLP GLNG TOO TEU TGP ALEX NMM TK NM SB 52W High 29.74 44.26 29.89 11.45 39.41 54.36 20.00 36.75 5.82 9.18 % Away -1.18% -1.36% -7.17% -12.26% -15.76% -18.32% -22.90% -25.33% -32.98% -33.54%

Stocks Nearest To 52-Week Lows

Symbol OSG SSW NAT TNP VLCCF DCIX DHT FREE ESEA CMRE

Page 17

Capital Link Shipping Weekly Markets Report

Monday, December 5, 2011 (Week 48)

CAPITAL MARKETS DATA

Weekly Trading Statistics

Top Stocks with Highest Weekly Volume Run Rate* > 1

Symbol STNG ALEX SFL NNA TBSI TEU SSW GSL Close 5.3 44.4 10.42 2.81 0.28 10.05 10.5 2.19 Net % Change -5.36% 33.90% 4.20% 6.44% -30.00% -1.86% -1.04% 18.38% Run Rate 5.7370 2.8201 2.6332 2.2596 2.2425 1.6517 1.4710 1.3183

*The Volume Run Rate is calculated by dividing the current week's volume by the average volume over the last 20 weeks. For example, a run rate of 2.0 means the stock traded twice its average volume. Top Year-To-Date Gainers

Symbol GLNG GMLP ALEX TOO YTD Gain % 200.28% 18.27% 14.11% 7.18%

Top Year-To-Date Decliners

Symbol TRMD TBSI FRO FREE DHT SHIP PRGN EGLE TOPS NEWL YTD Decline % -91.13% -90.34% -87.90% -83.69% -81.18% -80.07% -77.81% -76.31% -76.15% -71.98%

ANW - Aegean Marine Petroleum Network Inc; BALT - Baltic Trading Ltd; CPLP - Capital Product Partners LP; CMRE- Costamere, Inc.; DAC - Danaos Corp; DCIX Diana Containerships; DHT - DHT Maritime Inc; DRYS DryShips Inc; DSX - Diana Shipping Inc; EGLE - Eagle Bulk Shipping Inc; ESEA - Euroseas Ltd; EXM - Excel Maritime Carriers Ltd; FREE FreeSeas; FRO - Frontline Ltd; GASS - StealthGas Inc; GLBS Globus Maritime Limited ; GLNG - Golar LNG Ltd; GMLP Golar LNG Partners; GNK - Genco Shipping & Trading Ltd; GSL - Global Ship Lease Inc; NAT - Nordic American Tanker Shipping; NEWL - NewLead Holdings Ltd; NM - Navios Maritime Holdings Inc; NMM - Navios Maritime Partners LP; NNA - Navios Maritime Acquisition Corp; OSG - Overseas Shipholding Group Inc; PRGN - Paragon Shipping Inc; SB - Safe Bulkers Inc; SBLK - Star Bulk Carriers Corp; SFL Ship Finance International Ltd; SHIP - Seanergy Maritime Holdings Corp; SSW - Seaspan Corp; STNG - Scorpio Tankers Inc; TBSI - TBS International Ltd; TEU Box Ships Inc; TGP - Teekay LNG Partners LP; TK - Teekay Corp; TNK - Teekay Tankers Ltd; TNP - Tsakos Energy Navigation Ltd; TOO - Teekay Offshore Partners LP; TOPS - TOP Ships Inc; TRMD - D/S Torm A/S; VLCCF - Knightsbridge Tankers Ltd Notes These symbols were ignored in some analysis (i.e. 200 day moving average) due to the lack of historical data: GMLP and TEU. DISCLAIMER This communication has been prepared by Knight Equity Markets, L.P. The information set forth above has been compiled from third party sources believed by Knight to be reliable, but Knight does not represent or warrant its accuracy, completeness or timeliness of the information and Knight, and its affiliates, are not responsible for losses or damages arising out of errors or omissions, delays in the receipt of this information, or any actions taken in reliance thereon. The information provided herein is not intended to provide a sufficient or partial basis on which to make an investment decision. The communication is for your general information only and is not an offer or solicitation to buy or sell any security or product. Knight and its affiliates most likely make a market in the securities mentioned in this document. Historical price(s) or value(s) are as of the date and, if applicable, time indicated. Knight does not accept any responsibility to update any information contained in this communication. Knight and/or its affiliates, officers, directors and employees, including persons involved in the preparation or issuance of this material, may, from time to time, have long or short positions in, or buy or sell (on a principal basis or otherwise) the securities mentioned in this communication which may be inconsistent with the views expressed herein. Questions regarding the information presented herein or a request for a copy of this document should be referred to your Knight representative. Copyright 2011 Knight Equity Markets, L.P. Member NASD/SIPC. All rights reserved.

Page 18

The following are the 44 members of this group: Symbol Name: ALEX - Alexander & Baldwin Inc;

Capital Link Shipping Weekly Markets Report

Monday, December 5, 2011 (Week 48)

CAPITAL MARKETS DATA

Contributed by

Shipping Bonds

Month to date high yield deal volume is $0.000 billion in 0 deals. The year to date high yield deal volume is $252.152 billion in 539 deals. Yesterday, the S&P/LSTA Leveraged Loan 100 gained 6 basis points, to close at 90.53. The current default rate by number of issuers is 0.62% for November, versus 0.92% for October. Data from Lipper FMI reported an outflow from HY funds of $1 billion for the week ended Nov. 30th. Marine Subsea bondholders gave the Company consent to amend their 9% bonds due in 2019 for a restructuring. Holders will receive $59 million in cash and the principal amount on the bonds will be reduced by $75 million, originally $246 million were issued. This week Moodys cut Ship Finance Internationals rating from B1 to Ba3 and the Company is on negative watch. The is primarily due to the deteriorated liquidity position of Ship Finances counterparty Frontline.

Page 19

Capital Link Shipping Weekly Markets Report

Monday, December 5, 2011 (Week 48)

CAPITAL MARKETS DATA

Contributed by

Shipping Bonds

Page 20

Knight Corporate Access is an unbiased service for issuers to connect with institutional investors. Through a combination of strategic investor introductions, thought leadership initiatives and market insight, Knight can help strengthen and diversify a companys investor base.

Knight is the leading source of off-exchange liquidity in U.S. equities and has a greater share volume than any U.S. exchange.

For additional information, please contact:

Sandy Reddin

phone 212-455-9255 email SReddin@knight.com www.knight.com

September 2010 Knight Capital Group, Inc. All rights reserved. Knight Equity Markets, L.P. and Knight Capital Markets LLC are off-exchange liquidity providers and members of FINRA and SIPC. To learn about Knight Capital Group, Inc. (NYSE Euronext: KCG) go to knight.com.

Capital Link Shipping Weekly Markets Report

Monday, December 5, 2011 (Week 48)

SHIPPING MARKETS

Dry Bulk Market - Weekly Highlights

Thanks to a once again firming Capesize market, the Baltic Index Contributed by was able to witness an overall week-on-week closing on Friday with a 3.3% gain. This rise in Capesize rates seems to have mainly Intermodal been on sentiment rather than on actual market fundamentals, as Intermodal Shipbrokers Co. not only was there an overall drop in reported activity for a second 17th km Ethniki Odos Athens-Lamia & 3 Agrambelis Street, week in a row, but we also witnessed an overall drop in demand 145 64 N. Kifisia, of both iron ore and coal. The rest of the size segments on the Athens - Greece other hand witnessed a considerable drop as the tonnage lists which have gathered in both basins were greatly outnumbering Phone: +30 210 6293300 the few inquiries circulating in the market. Panamaxes witnessed Website: www.intermodal.gr the largest drops, despite an increase in activity seen mid-week. Things were similar in the Supras, with the drop in rates closely following that of the Panamaxes, although position lists looked to be improved as we enter in the new week and if demand holds at these levels we could see an improvement in freight levels within the next couple of days. Fairly quiet conditions for Handies in both basins causing a considerable drop in rates as demand started to drift sideways while tonnage lists increased considerably.

Baltic Indices / Dry Bulk Spot Rates

BDI BCI BPI BSI BHSI Week 48 02/12/11 Index 1,866 3,409 1,701 1,335 623 $29,359 $13,586 $13,956 $/day Week 47 25/11/11 Index 1,807 3,049 1,794 1,380 639 $25,851 $14,332 $14,431 $9,073 $/day 3.3% 11.8% -5.2% -3.3% -2.5% % Point Diff 59 360 -93 -45 -16 2011 Avg Index 1,528 2,153 1,750 1,387 726 2010 Avg Index 2,758 3,480 3,115 2,148 1,124

Things werent looking much rosier on the demand side as reports of falling prices emerged for most of the major dry bulk commodities. With reports coming out of a slowing in Chinese demand for steel, iron ore prices declined by more than 10 per cent in the past week according to data published by the Steel Index. At the same time the Coal market continued on its downward slide, with both Indonesian and Chinese coal prices dropping considerably on lack of demand while at the same time many commodity traders seem to be holding back interest in anticipation of even lower prices to come.

3,500 3,000 2,500

Index

Baltic Dry

160 140 120 100 80 60 40 20 0

5,000 4,000

Index

Capesize

25 20

no. Fixtures

no. Fixtures

2,000 1,500 1,000 500

3,000 2,000 1,000

15 10 5 0

p The Baltic Dry Index closed on Friday the 2nd of December at 1,866 points with a weekly gain of 59 points or 3.3% over previous

weeks closing. (Last Fridays the 25th of November closing value was recorded at 1,807 points).

CAPESIZE MARKET - p The Baltic Cape Index closed on Friday the 2nd of December at 3,409 points with a weekly gain of 360 points. For this week we monitor a 11.8% change on a

week-on-week comparison, as Last Fridays the 25th of November closing value was 3,049 points). It is worth noting that the annual average of 2011 for the Cape Index is currently calculated at 2,153 points, while the average for the year 2010 was 3,480 points.

Page 22

Capital Link Shipping Weekly Markets Report

Monday, December 5, 2011 (Week 48)

SHIPPING MARKETS

No. of Fixtures 45 40 Period Charter $10,357 $12,842 Highest Fixture $26,500 $35,000 Lowest Fixture $2,000 $9,000 Trip Charter $13,493 $16,240

Dry Bulk Market - Weekly Highlights

Week this week last week Week this week last week No. of Fixtures 4 6 Period Charter $0 $17,900 Highest Fixture $25,000 $28,000 Lowest Fixture $19,900 $17,000 Trip Charter $21,438 $23,070 Week this week last week Week this week last week

For Week 48 we have recorded a total of 4 timecharter fixtures in the Capesize sector, 0 for period charter averaging $0 per day, while 4 trip charters were reported this week with a daily average of $21,438 per day. This weeks fixture that received the lowest daily hire was the M/V CAPE SPENCER, 169092 dwt, built 2010, dely Fukuyama 30 Nov, redely Singapore-Japan, $19900, Noble, for a 2 laden legs 1st Newcastle/Lazaro Cardenas 2900$ improved from last week, and the fixture with the highest daily hire was the M/V ANANGEL VISION, 171810 dwt, built 2007, dely retro Shanghai 24 Nov , redely N.China, $25000, E.On, for a trip via Richards Bay -3000$ reduced from last week. The BCI is showing a 11.8% increase on a weekly comparison, a 17.3% increase on a 1 month basis, a 14.6% increase on a 3 month basis, a 75.8% increase on a 6 month basis and a 14.3% increase on a 12 month basis.

For Week 48 we have recorded a total of 45 timecharter fixtures in the Panamax sector, 7 for period charter averaging $10,357 per day, while 38 trip charters were reported this week with a daily average of $13,493 per day. The daily earnings differential for the Panamaxes, that we calculate from all this weeks reported fixtures, i.e. the difference between the lowest and highest reported fixture for this week was reduced, and this weeks fixture that received the lowest daily hire was the M/V GENCO SURPRISE, 72495 dwt, built 1998, dely Singapore 28 Nov/3 Dec , redely Turkey, $2000, Efe, for a trip via Richards Bay -7000$ reduced from last week, and the fixture with the highest daily hire was the M/V DARYA MOTI, 80545 dwt, built 2010, dely Ghent spot , redely China, $26500, Medmar, for a trip via Finland -8500$ reduced from last week. The BPI is showing a -5.2% loss on a weekly comparison, a -10.0% loss on a 1 month basis, a 4.4% increase on a 3 month basis, a -5.0% loss on a 6 month basis and a -28.6% loss on a 12 month basis.

Panamax

4,000

100 90 80 70 60 50 40 30 20 10 0

2,500 2,000

Index

no. Fixtures

Supramax

50 45 40 35 30 25 20 15 10 5 0

Index

3,000

no Fixtures

2,000

1,500 1,000 500

1,000

PANAMAX MARKET - q The Baltic Panamax Index closed on Friday the 2nd of December with a loss at 1,701 points having lost -93 points on a weekly comparison. It is worth noting that last Fridays the 25th of November saw the Panamax index close at 1,794 points. The week-on-week change for the Panamax index is calculated to be -5.2%, while the yearly average for the Baltic Panamax Index for this running year is calculated at 1,750 points while the average for 2010 was 3,115 points.

SUPRAMAX & HANDYMAX MARKET - q The Baltic Supramax Index closed on Friday the 2nd of December at 1,335 points down with a weekly loss of -45 points or -3.3% . The Baltic Supramax index on a weekly comparison is with a downward trend as last Fridays the 25th of November closing value was 1,380 points. The annual average of the BSI is recorded at 1,387 points while the average for 2010 was 2,148 points.

Page 23

Capital Link Shipping Weekly Markets Report

Monday, December 5, 2011 (Week 48)

SHIPPING MARKETS

HANDYSIZE MARKET - q The Baltic Handysize Index closed on Friday the 2nd of December with a downward trend at 623 points with a weekly loss of -16 points and a percentage change of -2.5%. It is noted that last Fridays the 25th of November closing value was 639 points and the average for 2011 is calculated at 726 points while the average for 2010 was 1,124 points.

Week this week last week Week this week last week No. of Fixtures 4 6 Period Charter $0 $7,900 Highest Fixture $15,000 $15,000 Lowest Fixture $6,500 $4,000 Trip Charter $9,625 $7,620

Dry Bulk Market - Weekly Highlights

Week this week last week Week this week last week No. of Fixtures 27 16 Period Charter $11,275 $10,750 Highest Fixture $34,500 $34,500 Lowest Fixture $5,000 $6,000 Trip Charter $13,359 $13,500

For Week 48 we have recorded a total of 27 timecharter fixtures in the Supramax & Handymax sector, 4 for period charter averaging $11,275 per day, while 23 trip charters were reported this week with a daily average of $13,359 per day. The minimum vs maximum daily rate differential as analyzed from our fixtures database was overall improved and from the reported fixtures we see that this weeks fixture that received the lowest daily hire was the M/V MARYLAKI, 58470 dwt, built 2010, dely Xingang spot , redely India, $5000, Siva, for a trip via Indonesia -1000$ reduced from last week, and the fixture with the highest daily hire was the M/V CHRISTINA L, 50380 dwt, built 2003, dely Mobile early Dec , redely China intention pet coke, $34500, Chart Not Rep, for a trip 0$ improved from last week. The BSI is showing a -3.3% loss on a weekly comparison, a -10.2% loss on a 1 month basis, a -3.2% loss on a 3 month basis, a -7.0% loss on a 6 month basis and a -16.2% loss on a 12 month basis.

For Week 48 we have recorded a total of 4 timecharter fixtures in the Handysize sector, 0 for period charter averaging $0 per day, while 8 trip charters were reported this week with a daily average of $9,625 per day. The minimum vs maximum daily rate differential as analyzed from our fixtures database was overall reduced and this weeks fixture that received the lowest daily hire was the M/V AMYNTOR, 28326 dwt, built 2009, dely Taichung prompt, redely SingaporeJapan, $6500, Chart Not Rep, for a trip via New Zealand int logs 2500$ improved from last week and the fixture with the highest daily hire was the M/V B HANDY, 31440 dwt, built 2011, dely retro Port Said 26 Nov, redely US Gulf, $10000, WBC, for a trip via Black Sea -5000$ reduced from last week. The BHI is showing a -2.5% change on a weekly comparison, a -17.4% loss on a 1 month basis, a -7.0% loss on a 3 month basis, a -18.6% loss on a 6 month basis and a -23.7% loss on a 12 month basis.

1,250

Handysize

18 16 14 12 10 8 6 4 2 0

1,000

Index

no. Fixtures

750

500

All Baltic Dry Indices, 1 day, 1week , 1 month, 3 months, 6 months and 12 months % changes based on last Fridays closing figures.

INDEX 1 DAY 1 WEEK 1 MONTH 3 MONTHS 6 MONTHS 1 YEAR

BDI BCI BPI BSI BHI

0.2% 0.7% -0.5% -0.9% -0.2%

3.3% 11.8% -5.2% -3.3% -2.5%

0.4% 17.3% -10.0% -10.2% -17.4%

7.2% 14.6% 4.4% -3.2% -7.0%

25.3% 75.8% -5.0% -7.0% -18.6%

-13.9% 14.3% -28.6% -16.2% -23.7%

Page 24

Capital Link Shipping Weekly Markets Report

Monday, December 5, 2011 (Week 48)

SHIPPING MARKETS

Tanker Market - Weekly Highlights

USG crude imports to fall?

Last month, plans were announced to reverse the direction of the Seaway pipeline in order to offer gulf refiners easier access to WTI crude. The pipeline presently transports crude from Freeport, Texas, to Cushing, Oklahoma where NYMEX-traded WTI crude is settled. A buildup of inventories at Cushing tank farms and the inability to easily move crude from there this year depressed WTI prices and significantly widened the gap between WTI and Brent contracts. According to Seaways operators, reversed service could commence by 2Q12 with an initial capacity of 150,000 b/d with subsequent upgrades boosting capacity up to 400,000 b/d by early 2013. For gulf-area refineries, access to the pipelines Freeport terminus (via existing area pipeline networks) bodes well for the recent surge export demand for refined products. For the tanker sector, the implications are mixed. For the MR sector, further gulf product exports will augment demand, offsetting fleet growth and allowing for a further progression into the recovery stage. For crude tankers, however, any decline in demand for crude shipments to one of the worlds busiest hubs could further harm the already undermined recovery. Indeed, this seems to be the consensus among industry participants but on the issue of which crude tanker sector would likely take the biggest hit, opinion is divided.

Contributed by

Charles R. Weber Company, Inc.

Charles R. Weber Company, Inc. Greenwich Office Park One, Greenwich CT 06831 Phone: 203 629-2300 Website: www.crweber.com

(activity on the Middle East-US gulf route has risen 40% from 2010 to-date). Given prevailing pricing structures and economies of scale, the Middle East-US gulf route is unlikely to see a decrease in duty. Indeed, the 40% y/y gain which has been realized comes despite rising US production and despite the rise in deliveries from the Caribbean. The prospective shuttering of 770,000 b/d refining capacity will likely see West African producers seek new buyers from their crude in Asia rather than increase West African crude to the US. Accordingly, this leaves the Caribbean originating routes as the most vulnerable to the boost in WTI crude supplies reaching the US gulf by the Seaway reversal. Spot Rates VLCC TD1 TD2 TD3 TD4 TD15 SUEZMAX TD5 TD6 AFRAMAX TD7 TD9 TD19 PANAMAX TD10 TD12 CPP TC2 TC3 TC4 TC LR2 TC5 LR1 CONT>TA CBS>USAC SPOR>JPN AG>JPN AG>JPN 37,000 MT 38,000 MT 30,000 MT 75,000 MT 55,000 MT 155.0 155.0 157.5 105.0 125.0 $7,300 $8,700 $3,800 $10,900 $8,800 CBS>USAC CONT>TA 50,000 MT 55,000 MT 125.0 117.5 $6,600 $6,400 N.SEA>UKC CBS>USG TRK>MED 80,000 MT 70,000 MT 80,000 MT 95.0 100.0 85.0 $10,700 $3,700 $2,000 WAFR>USAC B.SEA>MED 130,000 MT 135,000 MT 82.5 80.0 $18,600 $13,600 AG>USG AG>SPORE AG>JPN WAFR>USG WAFR>CHINA 280,000 MT 260,000 MT 260,000 MT 260,000 MT 260,000 MT 38.0 58.0 58.0 60.0 60.0 Trade Cargo WS TCE $/day -$1,100 $19,600 $21,400 $19,700 $19,400

Data: C R Weber; Graphic: John M. Kulukundis This year, loading points in the Caribbean overtook those in West Africa to collectively account for the largest share of crude spot market deliveries to the US gulf accounting for 28% of the total. In part, this was due to a decline in demand for more expensive Brent-linked West African crude grades, and pricing discounts from Middle East producers for crude delivered to points in the West

Page 25

Capital Link Shipping Weekly Markets Report

Monday, December 5, 2011 (Week 48)

SHIPPING MARKETS

directions holding at ws60 (though untested). Although prompter dates may well command a premium, ballast units will likely prohibit any gains for further forward dates, with rates thus likely to remain unchanged. Tighter positions in the Caribbean have allowed Caribbean-Singapore rates to hold at $4.15m; with little change to the supply dynamics, rates on this route are unlikely to change during the week ahead. Suezmax The Atlantic Suezmax market commenced this week at ws80 on the TD5 benchmark route with a negative bias, before a mid-week replacement fixture at ws87.5 raised hopes that this level would prove repeatable. However, with fresh inquiry trailing off towards end-week, the market corrected to the low/mid ws80swhere it concluded. Continued quiet could see a further decline towards the high ws70s at the start of the upcoming week. Aframax A buildup of tonnage in the Caribbean Aframax market saw a significant correction in rates this week. The TD9 benchmark commenced at ws120 and concluded at ws100. Owners are now quite keen to stabilize rates and will likely resist further losses. However, with supply still outweighing demand, a measure of patience by charterers during the week ahead may see the market break below the ws100 level by a couple of points. Panamax The Caribbean Panamax market lacked a clear direction for much of the week, with rates trading in the mid-high ws120s on the TD10D benchmark. As of the end of the week, however, this remains sufficient tonnage relative to demand including some prompt units. Failing an uptick in activity, rates may decline towards the ws120 level during the week ahead. CPP The Caribbean MR market was largely flat this week with limited inquiry and rates holding around the ws160 level on the TC3 benchmark. Assessments at the close of the week declined to ws155; however, resistance by owners and steady inquiry saw this level prove unsustainable. During the week ahead, rates should remain around the ws160 level. USG exports were supported by the continued arbitrage opportunity on the trans-Atlantic USG-TA route. However, with the Caribbean and European markets offering similar returns, owners had no incentive to chose one market over the other. Accordingly, the premium charters have frequently found themselves paying for owners to move cargoes into a weaker European market continued to diminish, with USG-TA rates easing 5-points to conclude at ws110. The European MR market gained 7.5 points this week to conclude at ws155 on the TC2 benchmark route. Though sentiment remains bullish, further upward pressure might incentivize owners with units coming free on the US/Canada Atlantic coast to ballast across the Atlantic rather than towards the Caribbean/USG area, ultimately capping gains.

Time Charter Rates $/day (theoretical) VLCC Suezmax Aframax Panamax MR VLCC

1 Year $16,500 $17,000 $13,000 $13,500 $14,000

3 Years $25,000 $21,000 $17,000 $15,000 $14,500

5 Years $31,000 $22,750 $18,500 $17,000 $16,000

Following the slower pace of activity observed in the VLCC market last week owing in equal parts to the short work week in the US and a pause before a more aggressive progression into the December program the market rebounded this week. For their part, Middle East rates rose last week into the high ws60s on benchmark routes to the Far East, before the market quiet saw a correction to the high ws50s early this week. Ultimately, the market reached equilibrium at the ws60 level on those routes, where it has now remained through to weeks end. Whilst rates have little risk of downside through the remainder of December, hopes that a fresh rally is eminent are dissipating, with at least 20 excess units now projected for December. This view is apparently shared by FFA traders, with the December TD3 contract trading at ws60. There were 22 Middle East fixtures reported this week; 21 for discharge in the East and one in the West. South Korea led the Eastbound discharge profile with 5 fixtures reported. Reports indicate that South Korean refiners are keen to increase Fuel Oil production in anticipation of strong demand and to prevent the regional run on supplies which was experienced this past January. Last December, some 15 VLCCs loaded cargoes bound for South Korea. An estimated 17 VLCCs will likely load December cargoes for delivery in South Korea this year, including 10 already covered. Rates to the East declined 8.6 points, w/w, to an average of ws58.7. TCEs in this direction shed $11,100/day, w/w, to average $21,600/ day this week. Westbound rates lost 4.13 points, w/w, to average ws38 with corresponding TCEs losing $3,900/day at an average of -$400/day. Triangulated Westbound trade earnings declined $10,000/day, w/w, to average $21,600/day. To-date, some 78 December Middle East cargoes have been covered, leaving a further 50 as likely remaining. Against this, over 70 units are projected to be available by end-December. Although evident of the level of overcapacity which remains in the sector, rate downside remains unlikely. During the coming week, industry holiday parties in the US and UK will likely see limited activity, which sets expectations for a busier week thereafter as charterers rush to cover the requirements ahead of the holidays. Rising bunker prices and expectations for a robust January program will also contribute to bullish sentiments by owners. Accordingly, rates to the East will likely hold near the ws60 and Westbound rates around the ws38 level. In the Atlantic basin, a rapid rally in rates for Suezmaxes generated fresh interest in the VLCC co-load alternative, allowing some upward pressure to materialize for the larger class for which few units were available for early dates. Concrete movements in rates, however, have yet to be observed with ex-West Africa rates in both

Page 26

Capital Link Shipping Weekly Markets Report

Monday, December 5, 2011 (Week 48)

SHIPPING MARKETS

December 2, 2011

Weekly Tanker Market Opinion

The Brazilian Kickoff

Contributed by

On Wednesday, November 30th the Council on Foreign Relations Poten & Partners, Inc. Kickoff held the Rio de Janeiro Investment Conference in New York City to discuss prospects for Brazilian growth and the role of foreign 805 Third Avenue investment in Brazils rapidly growing economy. Much of the New York, NY 10022 n Wednesday, November 30th theon Council on Foreign held the Rio de Janeiro Investment discussion centered challenges andRelations opportunities in the Brazilian sector, will prospects be pivotal the countrys economic Phone: (212) 230-2000 onference energy in New York City which to discuss for in Brazilian growth and the role of foreign tanker demand to move Brazilian crude oil volumes has been largest for Suezmax vessels, Website: www.poten.com prospects. Development of the. Much enormous oil discoveries inGrowth in nvestment in Brazils rapidly growing economy of the crude discussion centered on challenges and which have carried approximately two-thirds of reported spot volumes out of the country 2011 year Brazils pre-salt basins could help to bring the countrys output to pportunities in the Brazilian energy sector, which will be pivotal in the countrys economic up to a projected 8 million barrels per day (mbd) by 2020. Thisto date. About 80% of these Suezmax volumes are being sent to US Gulf refiners. However long haul rospects. Development of thewould enormous crude discoveries Brazils pre -salt basins could help to Asian demand centers has also grown as Brazils export capacity increases. Trade trade on VLCCs production level easily putoil Brazil in the in top five of producing to2020. India and the Far East has accounted for 15 of the 16 Brazilian VLCC spot fixtures reported this o bring thecountries, countrys output to up to a projected 8 million barrels per day4.5 (mbd) by This with export capacity expected to be around mbd year. of Brazil over the same time. The technological challenges of developing roduction level would easily put Brazil in the top five of producing countries, with export capacity could somewhat offset erosion of VLCC demand resulting from decreased US import requirements. Additionally, as crude oil reserves have led some express skepticism about the xpected tothese be around 4.5 mbd over the same to time. The technological challenges ofIndian developing refiners have been sourcing heavy crude oil from Brazil, and China is likely to ramp up imports achievability of Brazils ambitious targets. However, there is no barrels are sent to Asian refiners, these same producers of refined of Brazilian oil as more barrels become available. This increasing frequency of long haul trade out of hese reserves have led some to express skepticism about the achievability of Brazils ambitious denying the massive potential for incremental growth in Brazilian petroleum are increasingly sending diesel back to Brazil to bridge could somewhat offset erosion of VLCC demand resulting from decreased US import argets. However, there is no which denying massive potential for incremental growth in the Brazilian countrys domestic supply gaps. crude oil supply, is the bound to further amplify the importance ofBrazil requirements. Additionally, as crude oil barrels are sent to Asian refiners, these same producers of rude oil supply, which is bound to further amplify thedemand. importance of Atlantic Basin trades in global Atlantic Basin trades in global tanker refined petroleum are increasingly sending diesel back to Brazil to bridge the countrys domestic While Brazils growing pains have been relatively mild compared anker demand. togaps. other countries faced with such a sudden resource bounty, it Brazil had long been a net importer of crude oil. Significantsupply has notgrowing been pains immune from the tendency of domestic downstream increases in production over the past decade as a result of staterazil had long been a net importer of crude oil. Significant increases in production over the past While Brazils have been relatively mild compared to other countries faced with such infrastructure to lag requirements. The staggering economic growth efforts and foreign investment have changed ecade as adirected result of exploration state-directed exploration efforts and foreign investment have changed this a sudden resource bounty, it has not been immune from the tendency of domestic downstream seen in Brazil has significantly raised the nations demand for this position. Crude oil production has risen at an average annualinfrastructure osition. Crude oil production has risen at an average annual rate of about 80 kbd since 2001 and to lag requirements. The staggering economic growth seen in Brazil has significantly transportation fuels, particularly diesel and ethanol. Additionally, rate of about 80 kbd since 2001 and currently stands at about 2.20raised the nations demand for transportation fuels, particularly diesel and ethanol. Additionally, urrently stands atBrazil about became 2.20 mbd.self-sufficient Brazil became self-sufficient from a net balance perspective in the because country was long dependent on crude oil imports, mbd. from a net balance perspective because the country was long dependent on crude oil imports, much of Brazils existing refining 006 and has able to further expand crude export capacity the past five years. much This has of Brazils existing refining capacity is designed to process inbeen 2006 and has been able tooil further expandover crude oil export capacity is designed to process crude oil slates of lighter quality than what it now produces. This has crude oil slates of lighter quality than what it now produces. This has capacity over the past five years. This as has led to a ed to a corresponding rise in tanker spot fixture activity, illustrated incorresponding the graph below. necessitated the continued import of light crude oil from producers in West Africa, and to a lesser necessitated the continued import of light crude oil from producers rise in tanker spot fixture activity, as illustrated in the graph below. extent, the Arabian Gulf. in West Africa, and to a lesser extent, the Arabian Gulf. Dirty Fixtures Loading Brazil - 2001 - 2011 YTD

90 80 70

No. Fixtures

Reported Spot Fixture Volumes into Brazil by Load Zone Past 12 Months

2400 2200

Crude Oil Production (kbd)

4.5 4.0 Reported Spot Volumes (mMT) 3.5 3.0 2.5 2.0 1.5 1.0 0.5 0.0 Arabian Gulf & Red Sea Caribbean EC South America Far East & UK Continent & Southeast Asia Med South Asia West Africa United States

60 50 40 30 20 10 0 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011

2000 1800 1600 1400 1200 1000

VLCC

Suezmax

Aframax

Crude Oil Production

Source: Poten & Partners

Crude Oil

Refined Product

Brazil currently imports about 20% of its total crude oil requirements, amounting to about 400 kbd. Brazil of currently imports about 20% its total to crude oil requirements, The volume foreign crude oil coming into Brazilof is expected decrease over time as lighter preamounting to about kbd. projects The volume of foreign crude oil arch@poten.com NEW YORK LOto NDON PERTH ATHENS OUSTON SINGAPORE GUANGZHOU are developed and 400 new refining able to process heavier oil come onstream. Growth in tanker demand move Brazilian crudeHoil volumes hassalt reserves coming into Brazil is expected to to decrease over time as lighter Brazils planned refinery expansions are expected add nearly 1 mbd of new capacity by 2017. been largest for Suezmax vessels, which have carried approximately

Source: Poten & Partners, BP Statistical Review of World Energy (2011)

pre-salt reserves are developed and new refining projects able two-thirds of reported spot volumes out of the country 2011 year to to process heavier oil come onstream. Brazils planned refinery date. About 80% of these Suezmax volumes are being Email: sent tankerresearch@poten.com to US expansions are NEW YORK LONDON HOUSTON expected to add PERTH nearlyATHENS 1 mbd of new SINGAPORE capacity Gulf refiners. However long haul trade on VLCCs to Asian demand by 2017. However, until this balance is struck it is likely that the centers has also grown as Brazils export capacity increases. Trade country will have to continue importing both product and light crude to India and the Far East has accounted for 15 of the 16 Brazilian oil even as it sends its domestically produced barrels abroad. VLCC spot fixtures reported this year. The complexity of Brazils petroleum trade flows and the offtake Indian refiners have been sourcing heavy crude oil from Brazil, and China is likely to ramp up imports of Brazilian oil as more barrels become available. This increasing frequency of long haul trade out

GUANGZH

opportunities it presents west of Suez is likely to be a boon for tanker owners, even more so if refiners in China and India become hungrier for Brazilian crude.

Page 27

Capital Link Shipping Weekly Markets Report

Monday, December 5, 2011 (Week 48)

SHIPPING MARKETS

Weekly Freight Rate & Asset Trends

FREIGHT RATES

Week 48

Contributed by

WEEK48 - 2011

Intermodal

%

-2% -5% 8% 7% 0% 6% 5% 0% 0% -6% 5% 1% 3% 3% -2% -2% -2%

Tanker Spot Rates

Vessel 265k 280k 260k 130k 130k 130k 80k 80k 80k 70k 75k Clean 55k 37K 30K Dirty 55K 55K 50k Routes AG-JAPAN AG-USG WAF-USG MED-MED WAF-USAC AG-CHINA AG-EAST MED-MED UKC-UKC CARIBS-USG AG-JAPAN AG-JAPAN UKC-USAC MED-MED UKC-USG MED-USG CARIBS-USAC WS points

59 38 65 80 83 85 115 83 95 115 103 127 155 175 120 120 128

Week 47 $/day

26,637 5,524 29,529 15,637 16,634 13,650 11,707 6,114 11,958 13,046 3,341 6,324 7,507 19,698 9,568 8,305 9,297

2011 $/day