Professional Documents

Culture Documents

Federal Jurisdiction Tax Question Answeredfedjurisdiction

Uploaded by

rhouse_10 ratings0% found this document useful (0 votes)

73 views2 pagesFEDERAL JURISDICTION TAX QUESTION ANSWERED 2001 WL 306496 87 A.F.T.R.2d 2001-1233, 2001-1 USTC P 50.366 (cite as: 00-CV-2293-j (lsp)) JONES, district judge, granted Defendant's motion to dismiss for lack of subject matter jurisdiction. Because section 2201 (a) of the Declaratory Judgment Act expressly denies

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFEDERAL JURISDICTION TAX QUESTION ANSWERED 2001 WL 306496 87 A.F.T.R.2d 2001-1233, 2001-1 USTC P 50.366 (cite as: 00-CV-2293-j (lsp)) JONES, district judge, granted Defendant's motion to dismiss for lack of subject matter jurisdiction. Because section 2201 (a) of the Declaratory Judgment Act expressly denies

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

73 views2 pagesFederal Jurisdiction Tax Question Answeredfedjurisdiction

Uploaded by

rhouse_1FEDERAL JURISDICTION TAX QUESTION ANSWERED 2001 WL 306496 87 A.F.T.R.2d 2001-1233, 2001-1 USTC P 50.366 (cite as: 00-CV-2293-j (lsp)) JONES, district judge, granted Defendant's motion to dismiss for lack of subject matter jurisdiction. Because section 2201 (a) of the Declaratory Judgment Act expressly denies

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

We Support the Victims of the lith 2001 Attacks.

God Bless America. Snow yovr svpport ar.d Dor.ate to a Cnarity

For information on the (IRS) "in rem Complaint forms" and material click on John and Marlin in

t he Menu Bar above. This will take you to the public Site were sample forms and information on how

to order the various kits.(Audio and Video). Due to communications out of our control we are no

longer able to supply Tapes of the Seminars. sorry for this inconvience.

If you would like to sign up for members login j ust click on Login Signup. If you only wish to be on

the E-Mail List just click on Listserver. Please remember that if you sign up for Listserver the system will

not allow you to sign up for Members Login. If you sign up for members Login you will also be placed

on the E-Mail List.

FEDERAL JURISDICTION TAX QUESTION ANSWERED

2001 WL 306496

87 A.F.T.R.2d 2001-1233, 2001-1 USTC P 50.366

(Cite as: 2001 WL 306496 (S.D.Cal.))

United States District Court , S.D. California.

Matthew A. FOGEL. Plaintiff.

v.

UNITED STATES of America. Defendant.

No. 00-CV-2293-J (LSP). \

Feb. 6. 2001 .

EXHIBIT 38

ORDER GRANTING DEFENDANT'S MOTION TO DISMISS WITH PREJUDICE

JONES, District J.

'' 1 This matter comes before the Court on the United States OF America's Motion to Dismiss for lack of

- -y subj ect matter jurisdiction and failure to state a claim upon which relief can be granted. Because section

2201 (a) of the Declaratory Judgment Act [FN1] expressly denies federal courts subject matter

juri sdiction over requests for declaratory judgments in federal tax matters. the Government's motion to

dismiss for lack of subject matter jurisdiction is GRANTED with prejudice. Because the Court lacks

jurisdiction, Defendant's motion to dismiss for failure to state a claim upon which relief may be granted

is DENIED as MOOT.

FNl. 28 U.S.C. 2201(a) (2001) .

BACKGROUND

Plaintiff, Matthew A. Fogel, was born in New York and has paid taxes in the United States for several

years. (Compi.PP 6, 10.) On November 14,2000, Mr. Fogel, in propria persona. filed a complai nt

against the United States of America. alleging "fraud. slavery and involuntary servitude in the

application of the Collective Entity Rule. " (Compl. at 1.) Plaint iff claims that obtaining a Social Security

Number from the government amount s to a contractual relationship with the United States and that

paying taxes i s voluntary under that contractual relationship. Plaintiff further alleges that because he

born "within the boundaries of the United States" he is not a "person" or "taxpayer" within the

meaning of the United States tax code and thus, his social security "contract" is void. (Compi.PP 10-13.)

Plaintiff now seeks a declaratory judgment which provides him with "non-taxpayer" status and rescinds

all "contracts" between him and the United States. (Compl. at 3.)

DISCUSSION

I. Subject Matter Jurisdiction

A. Standard of Review

[

Under Federal Rule of Civil Procedure 12(b)(1), a motion to dismiss for lack of subject matter J

"" jurisdiction may be properly granted if the plaintiff does not meet its burden in establishing that the

court has such jurisdiction. Because federal courts are courts of limited jurisdiction, the plaintiff must

demonstrate that the court has been authorized to preside over the case either by statute or the

constitution. See W{!J.y x _(oastaiCorg, 503 U.S. 131, 136-37 (1992). Whenever it appears that the

court lacks subject matter jurisdiction, the court is obligated to dismiss the action. Fed.R.Civ.P. 12(h)

(3) .In a suit against the United States, a 12(b)(l) motion is proper when sovereign immunity has not

been waived. See Mf,Carth'i_v. Uojted StatgJ. 850 F .2d 558, 560 (9th Cir.1988). "[A] waiver cannot be

implied but must be unequivocally expressed." States y_,j{j_n_g! 395 U.S. 1,4 (1969).

B. Analysis

[

The government's motion to dismiss for lack of subject matter jurisdiction must be granted pursuant to]

28 U.S.C. 2201 (a), which expressly declares an exception to federal. court jurisdiction in controversies

"with respect to Federal taxes" when the plaintiff requests declaratory relief. See Hughes v. Unitec

States, 953 F.2d 531, 536-37 (9th Cir.1991) (where the real issue in the case is whether the plaintiff must

pay taxes, the court lacks subject matter jurisdiction under 2201). Because Plaintiff has requested a

declaratory judgment fmding that he is a "non-taxpayer" and is not required to file taxes in the United

States, this Court lacks subject matter jurisdiction and is obligated to grant the United States' motion to

dismiss.

* 2 Furthermore, even if Plaintiffs claim validly invoked federal question jurisdiction under 28 U.S.C.

1331, he has failed to demonstrate that the United States has given consent to be sued and thereby

waived its sovereign immunity, a requirement that must be met before this Court may preside over

such a case. See flnitefii.@Jes v. Palm, 494 U.S. 596,608 (1990) . Section 1331 itself does not contain a

waiver of sovereign immunity. See Kester v. Caf71pb_gfb 652 F.2d 13 (9th Cir.1981) . Because the Plaintiff

has failed to establish that the United States has waved its sovereign immunity, there is undeniably no

for subject matter jurisdiction in this case. [FN2]

FN2. Plaintiff filed an untimely opposition motion for summary judgment on January 25, 2001. In it he

asserts that the United States is not sovereign to him, thus no waiver is necessary. Plaintiffs failure to

recognize the U.S. as his sovereign does not obliterate the doctrine of sovereign immunity.

\, CONCLUSION

Based on the foregoing, Defendant's Motion to Dismiss for lack of subject matter jurisdiction is]

GRANTED with prejudice pursuant to section 2201 (a) of Declaratory Judgment Act. The Defendant's

Motion to Dismiss for failure to state a claim upon which relief may be granted is DENIED as MOOT.

Plaint iffs Motion for Summary Judgment is also DENIED as MOOT. The Clerk of the Court is

ORDERED to close this file.

IT IS SO ORDERED.

END OF DOCUMENT

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- 0010a Kill Them With Paper WorkDocument21 pages0010a Kill Them With Paper Workrhouse_191% (11)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Notes On Public International Law (Orig)Document41 pagesNotes On Public International Law (Orig)Stewart Paul Tolosa Torre100% (1)

- 1 - Instructions - Enforcement ProcessDocument5 pages1 - Instructions - Enforcement Processrhouse_1No ratings yet

- William Cooper HOTT Facts Expose of IRS Fraudulent RacketeeringDocument272 pagesWilliam Cooper HOTT Facts Expose of IRS Fraudulent Racketeeringrhouse_1No ratings yet

- LegalBasisForTermNRAlien PDFDocument0 pagesLegalBasisForTermNRAlien PDFmatador13thNo ratings yet

- 0001 Cheryl Wiker-Affirmation of National-As Amended 05.19.2014 PDFDocument4 pages0001 Cheryl Wiker-Affirmation of National-As Amended 05.19.2014 PDFrhouse_1No ratings yet

- 0001 When You Are BornDocument3 pages0001 When You Are Bornrhouse_1100% (2)

- 0005c SamplebDocument1 page0005c Samplebrhouse_1No ratings yet

- Federalist Papers 15Document1 pageFederalist Papers 15rhouse_1No ratings yet

- DwightAvis-TaxVoluntaryDocument3 pagesDwightAvis-TaxVoluntaryrhouse_1No ratings yet

- 26 USC6013 GDocument1 page26 USC6013 Grhouse_1No ratings yet

- Definition VoluntaryDocument1 pageDefinition Voluntaryrhouse_1No ratings yet

- 0005b SampleaDocument1 page0005b Samplearhouse_1No ratings yet

- Federalist Papers 15Document1 pageFederalist Papers 15rhouse_1No ratings yet

- Avis Testimony Feb 53Document3 pagesAvis Testimony Feb 53rhouse_1No ratings yet

- 26CFR1 871-1Document1 page26CFR1 871-1rhouse_1No ratings yet

- Eye of The Eagle Volume 1 Number 5Document12 pagesEye of The Eagle Volume 1 Number 5rhouse_1No ratings yet

- 0002a Legisl Intent 16thaDocument3 pages0002a Legisl Intent 16tharhouse_1No ratings yet

- 0002a Legisl Intent 16thaDocument3 pages0002a Legisl Intent 16tharhouse_1No ratings yet

- CDP Hearing RequestDocument4 pagesCDP Hearing Requestrhouse_1No ratings yet

- Power Authority Power PointDocument7 pagesPower Authority Power Pointrhouse_1No ratings yet

- Steps To Terminate IRS 668 Notice of LienDocument10 pagesSteps To Terminate IRS 668 Notice of Lienrhouse_1100% (3)

- Jurisdiction Is The Key FactorDocument6 pagesJurisdiction Is The Key Factorrhouse_1100% (1)

- Notary Verifies SignaturesDocument1 pageNotary Verifies Signaturesrhouse_1No ratings yet

- Modern Money Mechanics ExplainedDocument50 pagesModern Money Mechanics ExplainedHarold AponteNo ratings yet

- Gov Exists in Two FormsDocument2 pagesGov Exists in Two Formsrhouse_1100% (1)

- First Estate Comprehensive DiagramDocument1 pageFirst Estate Comprehensive Diagramrhouse_1No ratings yet

- 9b Corp Political Society - PsDocument52 pages9b Corp Political Society - Psrhouse_1No ratings yet

- 9 Natural Order - PsDocument53 pages9 Natural Order - Psrhouse_1100% (1)

- Treatise SovereigntyDocument46 pagesTreatise Sovereignty1 watchman100% (1)

- EPA Civil ServiceDocument27 pagesEPA Civil ServiceTiff DizonNo ratings yet

- Jacobson Vs MassachussetsDocument4 pagesJacobson Vs MassachussetsAngelGemp100% (1)

- The Second Amendment Doesnt Say What You Think It Does Mother JonesDocument7 pagesThe Second Amendment Doesnt Say What You Think It Does Mother Jonesapi-319773246No ratings yet

- Appsc Group-Ii Services: Paper - I: General StudiesDocument1 pageAppsc Group-Ii Services: Paper - I: General StudiesRavi V PotluriNo ratings yet

- Civic Education JSS 3Document4 pagesCivic Education JSS 3Miriam FolorunshoNo ratings yet

- Philtread Workers Union V ConfesorDocument2 pagesPhiltread Workers Union V ConfesorMarc Virtucio100% (1)

- G.R. No. 120265 September 18, 1995: Title: Aquino vs. ComelecDocument3 pagesG.R. No. 120265 September 18, 1995: Title: Aquino vs. ComelecRowell Ian Gana-anNo ratings yet

- The Punjab Commission On The Status of Women Act 2014 PDFDocument7 pagesThe Punjab Commission On The Status of Women Act 2014 PDFPhdf MultanNo ratings yet

- Law of Freedom Bond 00 HurdDocument676 pagesLaw of Freedom Bond 00 HurdJesse Faulkner100% (1)

- Florida Commission On Human Relations, Records RequestDocument29 pagesFlorida Commission On Human Relations, Records RequestNeil GillespieNo ratings yet

- FREEDOM OF SPEECH in MalaysiaDocument13 pagesFREEDOM OF SPEECH in MalaysiaazieraNo ratings yet

- Knights of Rizal VS., DMCI Homes, Inc., Et Al., GR 213948 18 April 2017 - Digest For BunsoDocument3 pagesKnights of Rizal VS., DMCI Homes, Inc., Et Al., GR 213948 18 April 2017 - Digest For BunsoAldrinmarkquintanaNo ratings yet

- R.K.Sabharwal CaseDocument7 pagesR.K.Sabharwal CaseVigneshwar Raju PrathikantamNo ratings yet

- Boracay Landowners Supreme Court Ruling on Positive Government Act for Land ClassificationDocument17 pagesBoracay Landowners Supreme Court Ruling on Positive Government Act for Land ClassificationJamey SimpsonNo ratings yet

- Admin Law Reading: Delegation, Separation of Powers, Agency PowersDocument3 pagesAdmin Law Reading: Delegation, Separation of Powers, Agency PowersCalagui Tejano Glenda JaygeeNo ratings yet

- Set 7 Admin Law CasesDocument118 pagesSet 7 Admin Law CasesTammy YahNo ratings yet

- 205 Public International LawDocument159 pages205 Public International Lawbhatt.net.in100% (1)

- 001 2005 Administrative LawDocument22 pages001 2005 Administrative LawTrisha TayaNo ratings yet

- Jamie Alberto Torres Soto v. City of Aurora, Et Al.Document36 pagesJamie Alberto Torres Soto v. City of Aurora, Et Al.Michael_Lee_Roberts100% (3)

- Amendment To BylawsDocument3 pagesAmendment To BylawsBrianNo ratings yet

- LEGAL-ASPECTSDocument2 pagesLEGAL-ASPECTSJasmin KumarNo ratings yet

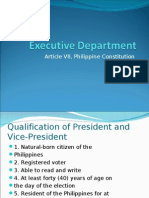

- Article VII, Philippine ConstitutionDocument47 pagesArticle VII, Philippine ConstitutionDiaz Ragu100% (4)

- Philippine Citizenship RequirementsDocument21 pagesPhilippine Citizenship RequirementsiamparalegalNo ratings yet

- Answer Guidance For Chapter 17 Practice Questions: Baskind, Osborne, & Roach: Commerical Law 2 EditionDocument2 pagesAnswer Guidance For Chapter 17 Practice Questions: Baskind, Osborne, & Roach: Commerical Law 2 Editionkks8070No ratings yet

- Property Continuous Outline2Document63 pagesProperty Continuous Outline2maxNo ratings yet

- How A Bill Becomes A Law (Ms. López's Example) : Chain-of-Events Graphic OrganizerDocument2 pagesHow A Bill Becomes A Law (Ms. López's Example) : Chain-of-Events Graphic Organizerapi-501092376No ratings yet

- Dew v. Curry - Document No. 5Document2 pagesDew v. Curry - Document No. 5Justia.comNo ratings yet

- Free The Nipple OrderDocument12 pagesFree The Nipple OrderMichael_Lee_Roberts67% (3)

- Labo Jr. vs. ComelecDocument14 pagesLabo Jr. vs. ComelecShannin MaeNo ratings yet