Professional Documents

Culture Documents

Annual Report of Maruti Suzuki India

Uploaded by

janurag1993Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annual Report of Maruti Suzuki India

Uploaded by

janurag1993Copyright:

Available Formats

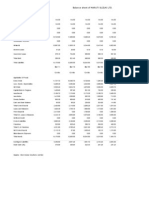

Balance Sheet of Maruti Suzuki India

------------------- in Rs. Cr. ------------------Mar '12

Mar '11

Mar '10

Mar '09

Mar '08

12 mths

12 mths

12 mths

12 mths

12 mths

Total Share Capital

Equity Share Capital

Share Application Money

Preference Share Capital

Reserves

Revaluation Reserves

Networth

144.50

144.50

0.00

0.00

15,042.90

0.00

15,187.40

144.50

144.50

0.00

0.00

13,723.00

0.00

13,867.50

144.50

144.50

0.00

0.00

11,690.60

0.00

11,835.10

144.50

144.50

0.00

0.00

9,200.40

0.00

9,344.90

144.50

144.50

0.00

0.00

8,270.90

0.00

8,415.40

Secured Loans

Unsecured Loans

Total Debt

Total Liabilities

0.00

1,078.30

1,078.30

16,265.70

Mar '12

31.20

278.10

309.30

14,176.80

Mar '11

26.50

794.90

821.40

12,656.50

Mar '10

0.10

698.80

698.90

10,043.80

Mar '09

0.10

900.10

900.20

9,315.60

Mar '08

12 mths

12 mths

12 mths

12 mths

12 mths

14,734.70

7,214.00

7,520.70

11,737.70

6,208.30

5,529.40

10,406.70

5,382.00

5,024.70

8,720.60

4,649.80

4,070.80

7,285.30

3,988.80

3,296.50

Capital Work in Progress

Investments

1,406.30

6,147.40

1,428.60

5,106.70

387.60

7,176.60

861.30

3,173.30

736.30

5,180.70

Inventories

Sundry Debtors

Cash and Bank Balance

Total Current Assets

Loans and Advances

Fixed Deposits

Total CA, Loans & Advances

Deffered Credit

Current Liabilities

Provisions

Total CL & Provisions

Net Current Assets

1,796.50

937.60

1,776.10

4,510.20

2,140.10

660.00

7,310.30

0.00

5,420.50

698.50

6,119.00

1,191.30

1,415.00

893.30

95.50

2,403.80

1,626.30

2,413.00

6,443.10

0.00

3,805.20

525.80

4,331.00

2,112.10

1,208.80

809.90

98.20

2,116.90

1,739.10

0.00

3,856.00

0.00

3,160.00

628.40

3,788.40

67.60

902.30

918.90

239.00

2,060.20

1,809.80

1,700.00

5,570.00

0.00

3,250.90

380.70

3,631.60

1,938.40

1,038.00

655.50

324.00

2,017.50

1,173.00

0.00

3,190.50

0.00

2,718.90

369.50

3,088.40

102.10

0.00

16,265.70

0.00

14,176.80

0.00

12,656.50

0.00

10,043.80

0.00

9,315.60

5,925.90

525.68

5,450.60

479.99

3,657.20

409.65

1,901.70

323.45

2,734.20

291.28

Sources Of Funds

Application Of Funds

Gross Block

Less: Accum. Depreciation

Net Block

Miscellaneous Expenses

Total Assets

Contingent Liabilities

Book Value (Rs)

Profit & Loss account of Maruti Suzuki India

------------------- in Rs. Cr. ------------------Mar '12

Mar '11

Mar '10

Mar '09

Mar '08

12 mths

12 mths

12 mths

12 mths

12 mths

Sales Turnover

Excise Duty

Net Sales

Other Income

Stock Adjustments

Total Income

Expenditure

39,495.30

3,937.10

35,558.20

366.20

160.10

36,084.50

40,865.50

4,304.00

36,561.50

784.60

73.20

37,419.30

32,174.10

2,856.40

29,317.70

662.00

200.90

30,180.60

23,381.50

2,652.10

20,729.40

491.70

-356.60

20,864.50

21,200.40

3,133.60

18,066.80

494.00

336.30

18,897.10

Raw Materials

Power & Fuel Cost

Employee Cost

Other Manufacturing Expenses

Selling and Admin Expenses

Miscellaneous Expenses

Preoperative Exp Capitalised

Total Expenses

28,330.60

229.50

843.80

1,856.20

1,209.29

272.32

-42.70

32,699.01

Mar '12

28,880.00

210.20

703.60

1,949.40

1,153.87

289.73

-25.70

33,161.10

Mar '11

22,636.30

216.60

545.60

1,061.60

1,032.17

201.73

0.00

25,694.00

Mar '10

15,983.20

193.60

471.10

716.10

817.66

236.84

-22.30

18,396.20

Mar '09

13,958.30

147.30

356.20

523.30

521.48

287.62

-19.80

15,774.40

Mar '08

12 mths

12 mths

12 mths

12 mths

12 mths

Operating Profit

3,019.29

3,473.60

3,824.60

1,976.60

2,628.70

PBDIT

Interest

PBDT

Depreciation

Other Written Off

Profit Before Tax

Extra-ordinary items

PBT (Post Extra-ord Items)

Tax

Reported Net Profit

3,385.49

55.20

3,330.29

1,138.40

0.00

2,191.89

109.10

2,300.99

511.00

1,635.20

4,258.20

24.40

4,233.80

1,013.50

0.00

3,220.30

18.90

3,239.20

820.20

2,288.60

4,486.60

33.50

4,453.10

825.00

0.00

3,628.10

51.10

3,679.20

1,094.90

2,497.60

2,468.30

51.00

2,417.30

706.50

0.00

1,710.80

37.90

1,748.70

457.10

1,218.70

3,122.70

59.60

3,063.10

568.20

0.00

2,494.90

76.60

2,571.50

763.30

1,730.80

Total Value Addition

Preference Dividend

Equity Dividend

Corporate Dividend Tax

Per share data (annualised)

4,368.40

0.00

216.70

35.10

4,281.10

0.00

216.70

35.10

3,057.70

0.00

173.30

28.80

2,413.00

0.00

101.10

17.20

1,816.10

0.00

144.50

24.80

Shares in issue (lakhs)

Earning Per Share (Rs)

2,889.10

56.60

2,889.10

79.21

2,889.10

86.45

2,889.10

42.18

2,889.10

59.91

150.00

525.68

150.00

479.99

120.00

409.65

70.00

323.45

100.00

291.28

Income

Equity Dividend (%)

Book Value (Rs)

Key Financial Ratios of Maruti Suzuki India

Mar '12

Mar '11

Mar '10

Mar '09

Mar '08

5.00

7.50

99.15

1,230.77

520.68

--

5.00

7.50

115.72

1,265.50

474.32

--

5.00

6.00

129.38

1,014.77

403.82

--

5.00

3.50

65.89

717.50

318.45

--

5.00

5.00

88.31

625.34

286.28

--

8.05

4.79

4.85

7.69

7.69

4.53

4.53

13.52

10.76

10.75

525.68

525.68

14.48

9.14

6.24

6.37

8.69

8.69

6.13

6.13

21.69

16.50

16.08

479.99

479.99

21.74

12.74

9.73

9.93

10.78

10.78

8.34

8.34

27.89

21.10

20.29

409.65

409.65

28.80

9.18

5.62

5.77

9.13

9.13

5.72

5.72

17.37

13.04

13.23

323.45

323.45

17.48

14.12

10.70

10.97

11.79

11.79

9.34

9.34

26.18

20.56

19.20

291.28

291.28

27.35

1.02

0.89

0.07

--

1.47

1.14

0.02

0.02

0.91

0.68

0.07

0.04

1.51

1.26

0.07

0.07

0.91

0.66

0.11

0.06

Interest Cover

Total Debt to Owners Fund

Financial Charges Coverage Ratio

Financial Charges Coverage Ratio Post Tax

Management Efficiency Ratios

39.85

0.07

60.47

51.25

126.04

0.02

167.58

136.33

105.39

0.07

130.02

100.18

34.21

0.07

48.06

38.75

40.93

0.11

50.46

39.57

Inventory Turnover Ratio

Debtors Turnover Ratio

Investments Turnover Ratio

Fixed Assets Turnover Ratio

Total Assets Turnover Ratio

Asset Turnover Ratio

22.80

38.84

22.80

2.46

2.22

--

33.33

42.93

33.33

3.13

2.59

2.73

30.47

33.92

30.47

2.82

2.32

2.58

30.46

26.33

30.46

2.38

2.06

2.14

22.93

25.76

22.93

2.48

1.94

2.48

Average Raw Material Holding

Average Finished Goods Held

Number of Days In Working Capital

Profit & Loss Account Ratios

13.36

7.46

12.06

10.01

4.56

20.80

10.66

5.35

0.83

13.21

3.17

33.66

9.33

12.49

2.03

Material Cost Composition

79.67

78.99

77.21

77.10

77.25

Investment Valuation Ratios

Face Value

Dividend Per Share

Operating Profit Per Share (Rs)

Net Operating Profit Per Share (Rs)

Free Reserves Per Share (Rs)

Bonus in Equity Capital

Profitability Ratios

Operating Profit Margin(%)

Profit Before Interest And Tax Margin(%)

Gross Profit Margin(%)

Cash Profit Margin(%)

Adjusted Cash Margin(%)

Net Profit Margin(%)

Adjusted Net Profit Margin(%)

Return On Capital Employed(%)

Return On Net Worth(%)

Adjusted Return on Net Worth(%)

Return on Assets Excluding Revaluations

Return on Assets Including Revaluations

Return on Long Term Funds(%)

Liquidity And Solvency Ratios

Current Ratio

Quick Ratio

Debt Equity Ratio

Long Term Debt Equity Ratio

Debt Coverage Ratios

Imported Composition of Raw Materials Consumed

Selling Distribution Cost Composition

Expenses as Composition of Total Sales

Cash Flow Indicator Ratios

10.60

2.80

10.38

11.99

2.62

9.56

12.89

3.12

15.49

11.70

3.56

7.24

10.84

3.10

4.10

Dividend Payout Ratio Net Profit

Dividend Payout Ratio Cash Profit

Earning Retention Ratio

Cash Earning Retention Ratio

AdjustedCash Flow Times

15.39

9.07

84.59

90.92

0.39

11.00

7.62

88.72

92.24

0.10

8.09

6.08

91.59

93.74

0.25

9.70

6.14

90.44

93.92

0.36

9.78

7.36

89.53

92.25

0.41

Mar '12

Mar '11

Mar '10

Mar '09

Mar '08

56.60

525.68

79.21

479.99

86.45

409.65

42.18

323.45

59.91

291.28

Earnings Per Share

Book Value

You might also like

- in Rs. Cr.Document16 pagesin Rs. Cr.Dinesh SinghNo ratings yet

- Balance Sheet of Maruti Suzuki IndiaDocument20 pagesBalance Sheet of Maruti Suzuki IndiaprabhuduttadashNo ratings yet

- 2021-2024 (4 Year) Planner (Printable Version)From Everand2021-2024 (4 Year) Planner (Printable Version)Rating: 5 out of 5 stars5/5 (1)

- Balance Sheet 29Document15 pagesBalance Sheet 29Jasleen KaurNo ratings yet

- Balance Sheet of MARUTI SUZUKI LTD.: Dion Global Solutions LimitedDocument1 pageBalance Sheet of MARUTI SUZUKI LTD.: Dion Global Solutions LimitedShem KharbithaiNo ratings yet

- Maruti Suzuki India Balance Sheet Analysis 2007-2011Document2 pagesMaruti Suzuki India Balance Sheet Analysis 2007-2011bandhhathNo ratings yet

- Hero Motocorp Financial Data 2008-13Document10 pagesHero Motocorp Financial Data 2008-13vijayvvr91No ratings yet

- Tata Motors Standalone Balanve SheetDocument4 pagesTata Motors Standalone Balanve SheetJohn MathewNo ratings yet

- Valuation - HDILDocument21 pagesValuation - HDILronak5787No ratings yet

- Balance Sheet of Axis BankDocument8 pagesBalance Sheet of Axis BankKushal GuptaNo ratings yet

- Kingfisher Airlines Balance Sheet AnalysisDocument3 pagesKingfisher Airlines Balance Sheet AnalysisShashank MadimaneNo ratings yet

- Balance Sheet of WiproDocument3 pagesBalance Sheet of Wiproishit9No ratings yet

- Portfolio AssignmentDocument19 pagesPortfolio AssignmentHARSHINI KudiaNo ratings yet

- MacBook battery recall approval sheetDocument256 pagesMacBook battery recall approval sheetRajmaniNo ratings yet

- Balance Sheet of Indian Oil CorporationDocument4 pagesBalance Sheet of Indian Oil CorporationPradipna LodhNo ratings yet

- Standalone Balance Sheet - in Rs. Cr.Document20 pagesStandalone Balance Sheet - in Rs. Cr.ramansutharNo ratings yet

- Balance Sheet of Maruti Suzuki IndiaDocument415 pagesBalance Sheet of Maruti Suzuki IndiaMahesh VaiShnavNo ratings yet

- 2007 MFI BenchmarksDocument42 pages2007 MFI BenchmarksVũ TrangNo ratings yet

- Sources of Funds: Balance Sheet of Infosys Co - LTDDocument3 pagesSources of Funds: Balance Sheet of Infosys Co - LTDParul SharmaNo ratings yet

- QuanticoDocument6 pagesQuantico19EBKCS082 PIYUSHLATTANo ratings yet

- Horizontal Analysis Balance Sheet Profit & Loss Key RatiosDocument18 pagesHorizontal Analysis Balance Sheet Profit & Loss Key Ratiosvinayjain221No ratings yet

- Balance Sheet of Tata MotorsDocument10 pagesBalance Sheet of Tata Motorssarvesh.bhartiNo ratings yet

- Computer Aided Design OffsetDocument9 pagesComputer Aided Design OffsetmohbNo ratings yet

- Computer Aided Design OffsetDocument9 pagesComputer Aided Design OffsetMohamed BarakatNo ratings yet

- CUSCANODocument3 pagesCUSCANOwilfredo espinozaNo ratings yet

- Adani PowerDocument17 pagesAdani Powerनिशांत मित्तलNo ratings yet

- Copia de Desglose TEBCADocument3 pagesCopia de Desglose TEBCAcoralrlNo ratings yet

- Balance Sheet of ICICI Bank: - in Rs. Cr.Document10 pagesBalance Sheet of ICICI Bank: - in Rs. Cr.teslinbaby2No ratings yet

- Accounting Books ASDC 88Document199 pagesAccounting Books ASDC 88Rodel, Jr BaldemorNo ratings yet

- Balance Sheet of Idea CellularDocument4 pagesBalance Sheet of Idea CellularJohn NewmanNo ratings yet

- Essar SteelDocument10 pagesEssar Steelchin2dabgarNo ratings yet

- Maruti-SuzukiDocument20 pagesMaruti-Suzukihena02071% (7)

- Balance Sheet of Kingfisher AirlinesDocument1 pageBalance Sheet of Kingfisher AirlinesRohit KumarNo ratings yet

- ASHIK'sDocument17 pagesASHIK'smohammedaashik.f2022No ratings yet

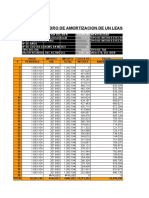

- Leasing financiero cuadro amortizaciónDocument4 pagesLeasing financiero cuadro amortizaciónGR YanaNo ratings yet

- Maruti Suzuki India Ltd: A Financial Analysis PresentationDocument20 pagesMaruti Suzuki India Ltd: A Financial Analysis PresentationSushant TanejaNo ratings yet

- Daily Stock Watch: MondayDocument9 pagesDaily Stock Watch: MondayRandora LkNo ratings yet

- Financial Statements For Indian Overseas Bank (8789430) Annual Income Statement of IobDocument20 pagesFinancial Statements For Indian Overseas Bank (8789430) Annual Income Statement of Iob10pec002No ratings yet

- ESPESORESDocument9 pagesESPESORESTIPAZONo ratings yet

- Term PaperDocument9 pagesTerm Paperkavya surapureddy100% (1)

- Manila Standard Today - Business Daily Stocks Review (December 4, 2012)Document1 pageManila Standard Today - Business Daily Stocks Review (December 4, 2012)Manila Standard TodayNo ratings yet

- SureshDocument2 pagesSureshARVIND MEENANo ratings yet

- Masterat NetDocument23 pagesMasterat NetGombos TimeaNo ratings yet

- US Internal Revenue Service: 2004p1212 Sect I-Iii TablesDocument133 pagesUS Internal Revenue Service: 2004p1212 Sect I-Iii TablesIRSNo ratings yet

- Balance Sheet of Bharat Petroleum CorporationDocument4 pagesBalance Sheet of Bharat Petroleum CorporationPradipna LodhNo ratings yet

- Reliance Industries: Previous YearsDocument6 pagesReliance Industries: Previous YearsSweta ChakravartyNo ratings yet

- Er Stress Strain-13!01!2023Document412 pagesEr Stress Strain-13!01!2023Jaswant Singh ChauhanNo ratings yet

- Produksi Tanaman Florikultura (Hias)Document2 pagesProduksi Tanaman Florikultura (Hias)taslimNo ratings yet

- Frequency response analysis resultsDocument4 pagesFrequency response analysis resultsMartinus PutraNo ratings yet

- Chettinad Cement Balance Sheet and Financial Ratios Over 5 YearsDocument10 pagesChettinad Cement Balance Sheet and Financial Ratios Over 5 YearsvmktptNo ratings yet

- Power Bin TotalDocument78 pagesPower Bin Totalpk7muneebNo ratings yet

- Balance Sheet of Sun Pharmaceutical IndustriesDocument2 pagesBalance Sheet of Sun Pharmaceutical IndustriesVivek ShahNo ratings yet

- Art275 1Document1 pageArt275 1Sutapa PawarNo ratings yet

- Bảng QDocument2 pagesBảng QĐông TàNo ratings yet

- Sales Report-Modern Trade 2023Document26 pagesSales Report-Modern Trade 2023jdgregorio2023No ratings yet

- BlanchingDocument22 pagesBlanchingAdrianna MichelleNo ratings yet

- 1B UskDocument36 pages1B UskIqbal MaulanaNo ratings yet

- Open Interest AnalysisDocument24 pagesOpen Interest AnalysisSanthosh Kumar0% (2)

- Fundamentals of The Legal Environment of BusinessDocument25 pagesFundamentals of The Legal Environment of BusinessRahul Dhiman100% (1)

- Rational Unified Process, Introduction To UMLDocument38 pagesRational Unified Process, Introduction To UMLjanurag1993No ratings yet

- The Parable of The PipelineDocument8 pagesThe Parable of The PipelineAtlasVending100% (21)

- Advance TaxDocument6 pagesAdvance Taxjanurag1993No ratings yet

- Research and Work By: Hector N. Echegoyen Oliver Scheck Gowri ShankarDocument60 pagesResearch and Work By: Hector N. Echegoyen Oliver Scheck Gowri ShankarabdiazizNo ratings yet

- Programming Languages For Compressing GraphicsDocument48 pagesProgramming Languages For Compressing Graphicsjanurag1993No ratings yet

- Kubasek ppt09Document47 pagesKubasek ppt09janurag1993No ratings yet

- Foreign Direct InvestmentDocument3 pagesForeign Direct Investmentjanurag1993No ratings yet

- 7Document6 pages7Sourav B BorahNo ratings yet

- Data Communication and NetworkingDocument52 pagesData Communication and Networkingjanurag1993100% (1)

- Exam Management System NotesDocument24 pagesExam Management System Notesjanurag1993No ratings yet

- MVC 4Document35 pagesMVC 4janurag1993No ratings yet

- Case Study of MarketingDocument10 pagesCase Study of Marketingnishantchhabra0% (1)

- css3 Cheat SheetDocument5 pagescss3 Cheat Sheetapi-242944016100% (1)

- Rupees To PaisaDocument2 pagesRupees To Paisajanurag1993No ratings yet

- Rational Unified ProcessDocument52 pagesRational Unified Processjanurag1993100% (1)

- L5 TreesDocument22 pagesL5 Treesjanurag1993No ratings yet

- Whats NewDocument30 pagesWhats Newjanurag1993No ratings yet

- Our For-Impact Culture CodeDocument73 pagesOur For-Impact Culture Codejanurag1993No ratings yet

- Data Communication and NetworkingDocument52 pagesData Communication and Networkingjanurag1993100% (1)

- Rupees To PaisaDocument2 pagesRupees To Paisajanurag1993No ratings yet

- Dcap313 Lab On Computer GraphicsDocument128 pagesDcap313 Lab On Computer Graphicsjanurag1993No ratings yet

- Programming Languages For Compressing GraphicsDocument48 pagesProgramming Languages For Compressing Graphicsjanurag1993No ratings yet

- Inventory ManagementDocument9 pagesInventory Managementjanurag1993No ratings yet

- Marketingprojectanshumandutta215111070 13379316418327 Phpapp02 120525024822 Phpapp02Document21 pagesMarketingprojectanshumandutta215111070 13379316418327 Phpapp02 120525024822 Phpapp02janurag1993No ratings yet

- What is Program Design Language? Explained in Plain EnglishDocument1 pageWhat is Program Design Language? Explained in Plain Englishjanurag1993No ratings yet

- Kubasek ppt09Document47 pagesKubasek ppt09janurag1993No ratings yet

- L5 TreesDocument22 pagesL5 Treesjanurag1993No ratings yet

- Coca Cola & Pepsi Marketing MixDocument11 pagesCoca Cola & Pepsi Marketing MixSmpasha PashaNo ratings yet

- Java Programming Language Features ExplainedDocument27 pagesJava Programming Language Features ExplainedNhan NguyenNo ratings yet

- Group Handling - Pre Registration Activity: Submited To-Submitted byDocument12 pagesGroup Handling - Pre Registration Activity: Submited To-Submitted byharshal kushwahNo ratings yet

- Final Revised ResearchDocument35 pagesFinal Revised ResearchRia Joy SanchezNo ratings yet

- Bakhtar University: Graduate School of Business AdministrationDocument3 pagesBakhtar University: Graduate School of Business AdministrationIhsanulhaqnooriNo ratings yet

- Postmodern Dystopian Fiction: An Analysis of Bradbury's Fahrenheit 451' Maria AnwarDocument4 pagesPostmodern Dystopian Fiction: An Analysis of Bradbury's Fahrenheit 451' Maria AnwarAbdennour MaafaNo ratings yet

- Basic Unix Commands: Cat - List A FileDocument3 pagesBasic Unix Commands: Cat - List A Filekathir_tkNo ratings yet

- Insecticide Mode of Action Classification GuideDocument6 pagesInsecticide Mode of Action Classification GuideJose Natividad Flores MayoriNo ratings yet

- Portfolio HistoryDocument8 pagesPortfolio Historyshubham singhNo ratings yet

- English Literature RevisionDocument61 pagesEnglish Literature RevisionAlex Cobain Glinwood100% (1)

- Credit Suisse AI ResearchDocument38 pagesCredit Suisse AI ResearchGianca DevinaNo ratings yet

- A Comparative Look at Jamaican Creole and Guyanese CreoleDocument18 pagesA Comparative Look at Jamaican Creole and Guyanese CreoleShivana Allen100% (3)

- Engaged Listening Worksheet 3 - 24Document3 pagesEngaged Listening Worksheet 3 - 24John BennettNo ratings yet

- Aspartame Literature ReviewDocument10 pagesAspartame Literature Reviewapi-272556824No ratings yet

- Burton Gershfield Oral History TranscriptDocument36 pagesBurton Gershfield Oral History TranscriptAnonymous rdyFWm9No ratings yet

- Ferret Fiasco: Archie Carr IIIDocument8 pagesFerret Fiasco: Archie Carr IIIArchie Carr III100% (1)

- 2020 Non Student Candidates For PCL BoardDocument13 pages2020 Non Student Candidates For PCL BoardPeoples College of LawNo ratings yet

- FIN 1050 - Final ExamDocument6 pagesFIN 1050 - Final ExamKathi100% (1)

- Homologation Form Number 5714 Group 1Document28 pagesHomologation Form Number 5714 Group 1ImadNo ratings yet

- AIX For System Administrators - AdaptersDocument2 pagesAIX For System Administrators - Adaptersdanielvp21No ratings yet

- 04 - JTC Template On Project ProposalDocument10 pages04 - JTC Template On Project Proposalbakelm alqamisNo ratings yet

- New Member OrientationDocument41 pagesNew Member OrientationM.NASIRNo ratings yet

- Method Statement Soil NailedDocument2 pagesMethod Statement Soil NailedFa DylaNo ratings yet

- BiblicalDocument413 pagesBiblicalMichael DiazNo ratings yet

- Grade 4 Science Quiz Bee QuestionsDocument3 pagesGrade 4 Science Quiz Bee QuestionsCecille Guillermo78% (9)

- Managing Remuneration MCQDocument5 pagesManaging Remuneration MCQlol100% (1)

- RITL 2007 (Full Text)Document366 pagesRITL 2007 (Full Text)Institutul de Istorie și Teorie LiterarăNo ratings yet

- Q3 Week 7 Day 2Document23 pagesQ3 Week 7 Day 2Ran MarNo ratings yet

- Death and DickinsonDocument12 pagesDeath and DickinsonHarshita Sohal100% (1)

- Bach Invention No9 in F Minor - pdf845725625Document2 pagesBach Invention No9 in F Minor - pdf845725625ArocatrumpetNo ratings yet

- Zeal Study 10th English Synonym Unit 1 - 7Document24 pagesZeal Study 10th English Synonym Unit 1 - 7viaanenterprises2008No ratings yet

- Dukic WarehouselayoutsDocument14 pagesDukic Warehouselayoutsrohitkamath7No ratings yet